Many international agricultural land investment projects are criticized because of their disrespect of land tenure rights, the few benefits they provide local populations, and the often displayed negative environmental impacts. The Group of 20 (G20) has recognized the need for more responsible land investments in targeted lower- and middle-income countries, but land deals remain opaque. This policy brief suggests the necessity of mandatory due diligence in global supply chains. As an important, quicker, and more feasible step, the G20 should commit to increasing transparency by (1) supporting transparency initiatives, (2) making contracts publicly available, and (3) encouraging companies to release relevant information. Open data can then be used by relevant stakeholders to hold investors accountable.

Challenge

Demand for agricultural land is continuously accelerating, and this is driven by a rising global population and changing food consumption patterns. This coincides with a shrinking natural resource base and increasing threats to ecosystems (Lambin and Meyfroidt 2011; Cotula 2012; Gerber, Nkonya, and von Braun 2014).

This increase in demand is reflected in the rise of international large-scale land transactions, particularly between 2008 and 2012. To date, the Land Matrix Initiative database has observed 1487 concluded land deals,[1] amounting to over 30 million hectares. G20 member states are involved in 20 million hectares of these deals as investors, and the most important investing G20 members are the European Union, the United States, and China. G20 countries are also among the target countries, in particular, Indonesia, Russia, Brazil, and Argentina, which host 11 million hectares.

For almost a decade, there has been a fierce debate around these international land investments, and many projects have attracted vocal criticism, in particular around the disrespect or absence of land tenure rights in targeted developing countries (Montilla Fernández 2017). Despite promises by investors and governments to foster rural development to improve agricultural productivity and create jobs, many projects have so far offered few benefits to local populations. Instead, they have been associated with negative environmental impacts, such as water stress or land-use changes that lead to threats to ecosystems and a loss of biodiversity (Anseeuw et al. 2012; Oberlack et al. 2015).

The G20 has recognized the need for more responsible land investments. In 2011, the G20 inter-agency working group on the “food security pillar of the G20 multi-year action plan on development” published a report on “Options for Promoting Responsible Investment in Agriculture” (IAWG 2011). Several UN-led guidelines and principles followed, specifically the Principles for Responsible Investment in Agriculture and Food Systems (RAI) and the Voluntary Guidelines on the Responsible Governance of Tenure (VGGT), both endorsed by the Committee on World Food Security (CFS).[2] These frameworks consider large-scale agricultural investments as an important factor for development and define characteristics that can transform these investments into “responsible” activities, which can help fight poverty and hunger, ensure decent work, and attain gender equality. The VGGT focus on land tenure governance, more generally, while the RAI Principles extend beyond land-based agricultural investments. The ten RAI principles require agricultural investments to improve food security and production, alleviate poverty, empower marginalized groups (such as women or youth), and acknowledge and adhere to the tenure of land, fisheries and forests, and access to water. Further, the RAI principles demand responsible investments to protect the environment and natural resources, recognize local culture and tradition, and promote inclusiveness of governance and accountability. The RAI and the VGGT are also referred to in the Annex to the G20 Leaders Declaration (2017a), which includes the “G20 Initiative for Rural Youth Employment.”

While this initiative focuses on creating rural employment opportunities, especially in Africa’s developing economies, it also called for increasing responsible investment and welcomed “the efforts to increase transparency around land-based investments by public or private national and foreign investors in developing countries.” Despite these declarations and individual efforts by some G20 member states to implement and promote the VGGT and the RAI principles (FAO/FIAN International 2017; Nolte, Chamberlain, and Giger 2016; Clapp 2017), few sustainable and responsible landbased agricultural investments have been implemented. The key challenge is thus to effectively implement these well-intentioned guidelines and principles to protect people’s land rights, ensure that economic benefits accrue locally, and limit environmental harm.

Proposal

More transparency in large-scale agricultural investments

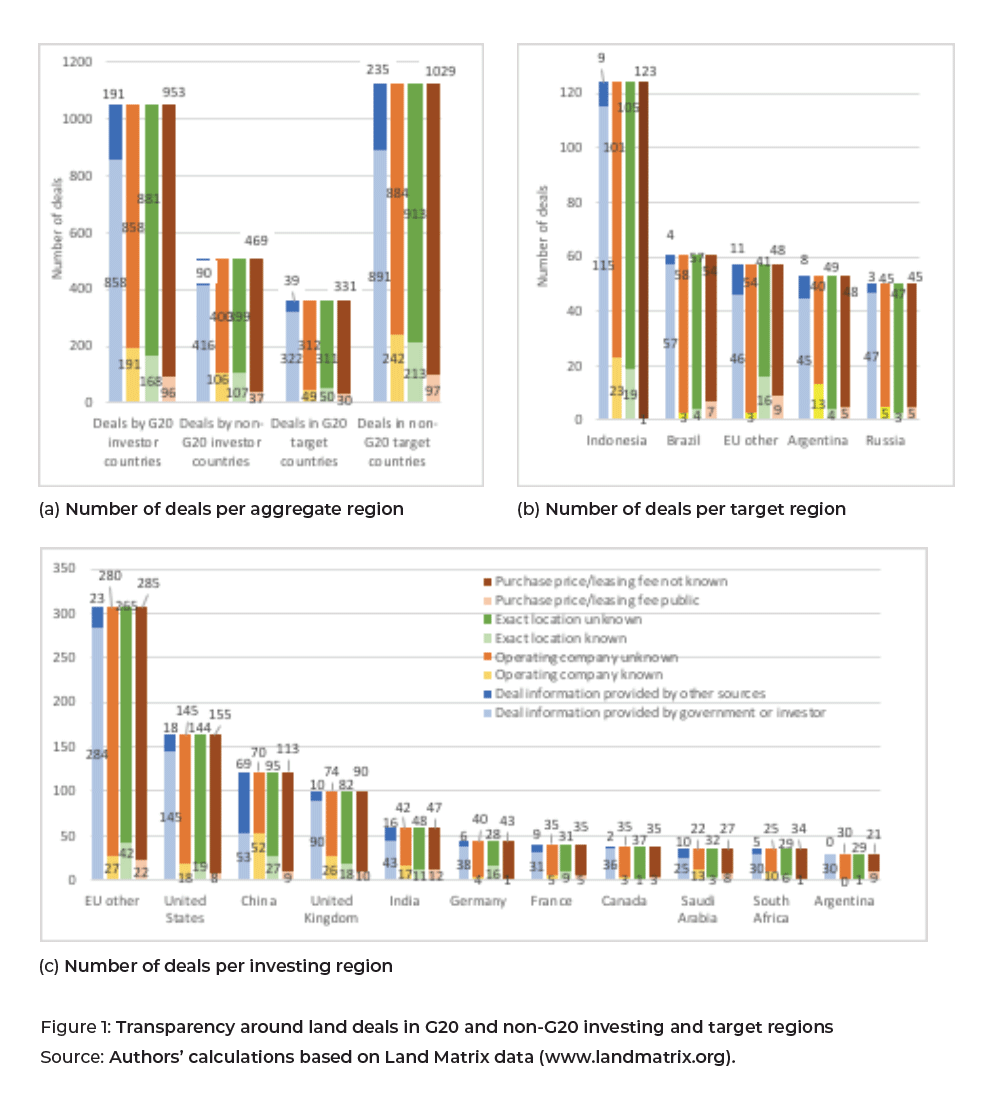

There is a clear need for reinforced efforts to increase transparency in large-scale agricultural investments. Ever since the discussion on “land grabs” by foreign investors emerged in the late 2000s, most of these large-scale land transactions have been referred to as opaque deals (Nolte, Chamberlain, and Giger 2016). Despite almost ten years of intense data collection efforts, the open database of the Land Matrix initiative (www.landmatrix.org), the leading transparency initiative with regard to land transactions, still lacks detailed information on many of the deals. These deals also include several investors from G20 member states. Figures 1 and 2 (in addition to Tables A1 and A2 in the Appendix) provide descriptive statistics on the availability of some of the key information in the Land Matrix database that would be necessary to monitor large-scale agricultural investments meaningfully. Note that the Land Matrix Initiative actively collects information from publicly available sources (such as the media, the Internet, research, contracts, and government and company websites). Land Matrix partner organizations contribute through field research, and the initiative additionally relies on a network of reporters (civil society organizations, researchers, and practitioners) to validate and collect additional information. Although the initiative’s resources are limited, the numbers in all the figures below (and in the corresponding Tables A1 and A2 in the Appendix) indicate transparency and the extent to which such information is readily accessible to an interested public. However, these data should be interpreted with caution as the data quality may vary considerably between regions and single countries.

Figure 1 (a) illustrates that transparency remains very low for the majority of largescale land deals in the agricultural sector. For most land deals in the Land Matrix database, there is some publicly accessible information provided by companies and governments. However, for less than 20% of the deals, the operating company is known, for only 15% of all G20 deals the exact location of land investment is communicated to the public, and less than 10% of investors publish the purchase price or leasing fee. Despite prior efforts by the G20, until today, G20 member states, on average, are no more transparent than non-G20 investing and target regions.

Figure 1 (b) illustrates that investments in some of the most relevant G20 target countries, especially in Indonesia, Russia, and Brazil, remain opaque. Specifically, the operating company and exact deal location are unknown in over 80% of the deals, and data on leasing/concession fees are typically not released. By contrast, China and other EU states (mostly investments in Romania for growing sunflowers) perform slightly better with respect to providing the location of the deal and publishing purchasing prices or leasing fees. However, in these cases, the operating companies are also typically unknown.

A similar picture is observed for G20 investor countries (see Figure 1 (c)). The United States and other EU countries (with EU other here mostly referring to Cyprus,[3] Romania, the Netherlands, and Luxemburg) do not only rank among the most important global investors but unfortunately also among the opaquest. In around 90% of their investments, the operating company, the exact location, and information on leasing or purchase fees are unknown. This holds with little variation also for the UK, Germany, France, and Canada. Chinese and Saudi Arabian foreign land deals stand out, as the operating company is known for about 40% of investments (India to a somewhat lesser extent). However, this is because the information on these deals is generated from a target country, that is, the data are sourced from non-official sources (see above). Very few deals that involve investors from Saudi Arabia can be precisely located, and investors from China hardly make available information on purchasing prices or leasing fees public.

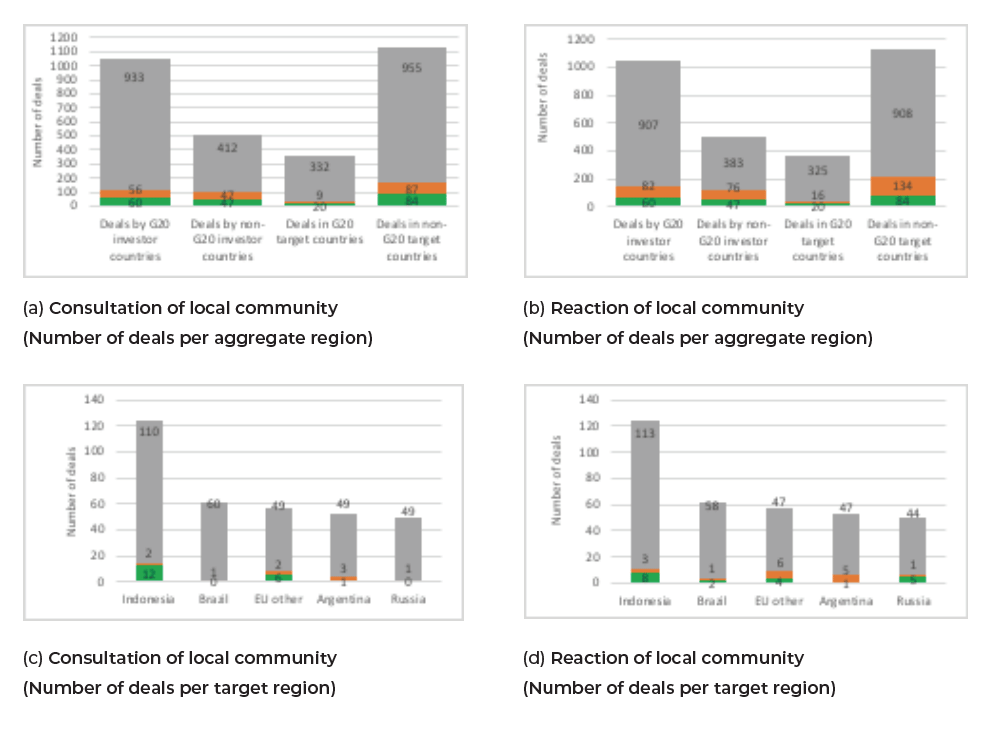

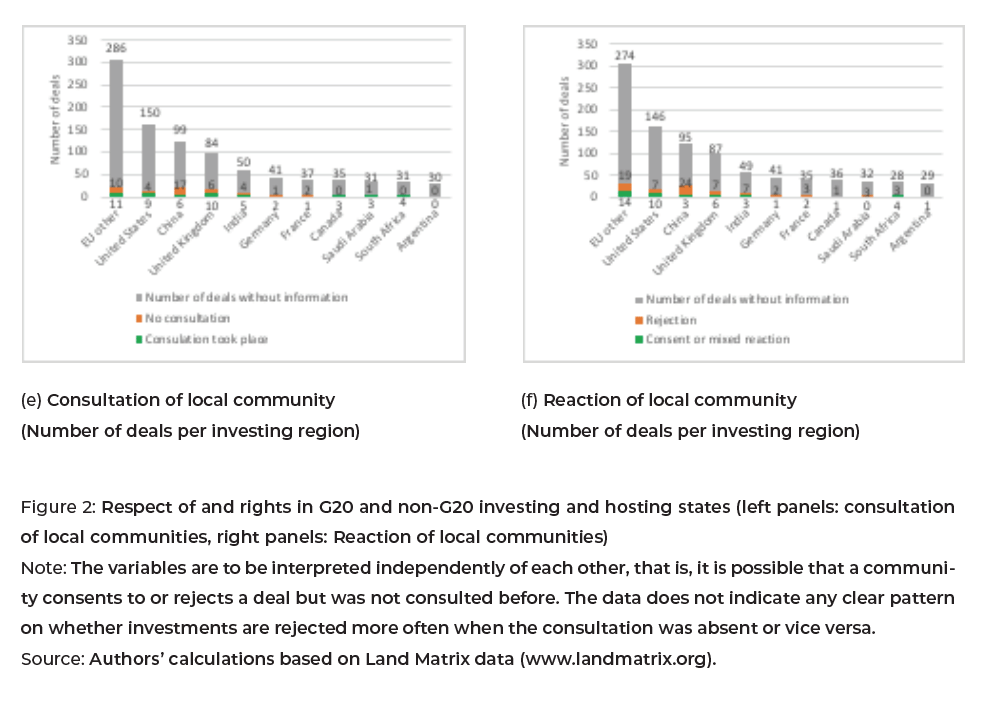

An even bleaker picture exhibits when analyzing land rights in large-scale land acquisitions (see Figure 2). The Land Matrix database provides information on two relevant aspects: first, whether the affected local communities are consulted before the deal is finalized; and, second, how the local communities react to the investment. The ratio of consultation to non-consultation and the ratio of positive (or mixed) to negative reaction of the communities is high in some countries and very low in others. It is most striking is that for 90% of the deals, there is no information on these two variables.

This lack of information means that the figures have to be interpreted with caution. It also underscores the need for more transparency around large-scale land investments. Note that for other relevant variables, for example, social and environmental impact assessments, there is even less reliable information in the database. Figure 2 (c) illustrates that deals located in Russia and Brazil especially lack information around consultation, and where information exists, consultation does not occur. Information around consultation and community reaction is slightly better in Indonesia and Eastern Europe. For example, for Indonesia, we can count 12 deals that involved consultation, in which eight communities gave consent.

Looking at differences between G20 investor countries (see Figure 2 (e) and (f)), the information is particularly scarce for Argentina, other EU countries, The United States, Canada, and Germany. For deals with information, Canadian, German, and South African investors—in addition to less relevant investing countries such as Turkey and Brazil—(almost) never consulted the local population beforehand. The data also indicate that for Saudi Arabian or Chinese investors, local communities—when asked—rejected the deals in all or most of the known cases, respectively.

These admittedly imperfect and partial statistics form the Land Matrix database confirm that there is a dearth of reliable information around the processes of large-scale agricultural investments in all G20 member states. Even basic information is often missing in these transactions, and there is almost no information on their impact. This lack of transparency, and the fact that available data points to persistent irresponsible and unsustainable land-based agricultural investments, leads to a set of policy proposals.

The G20 should work towards the inclusion of the mechanisms of human rights in global supply chains

Turning the current practices of large-scale agricultural investments into responsible and sustainable contributions to economic and social development that respect human rights and the environment requires fundamental changes in the conduct of business. Such changes are necessary to follow the principles laid out by the UN Guiding Principles on Business and Human Rights or the OECD Guidelines for Multinational Enterprises (United Nations 2011). We believe that the G20 should be the place where due diligence in global supply chains—beyond agriculture and large-scale land transactions—should be discussed. Considering the debates around and the emerging landscape of human rights due diligence mechanisms—including mandatory forms—in several G20 member states, the G20 should be reminded of and take more seriously the Leader’s declaration from the Hamburg 2017 summit: “In order to achieve sustainable and inclusive supply chains, we commit to fostering the implementation of labor, social and environmental standards and human rights in line with internationally recognized frameworks” (G20 2017b, 4). A starting point would be establishing a working group to gather information on the G20 countries that already practice human rights due diligence mechanisms in global supply chains. This would, in turn, permit the creation of common minimum standards in the long term. If finally adopted, the G20 could request international organizations to assist with their implementation.

The limited follow-up on these commitments since 2017[4] illustrates that the pathway to thorough and universal human rights due diligence in global business is likely to be long and rocky. This should not imply that multi-lateral coordination of these efforts should cease. However, as an important, intermediate, quicker, and more feasible step towards more sustainable and responsible agricultural investments, the G20 should commit to increasing transparency.[5] Change has to come quickly: Large-scale agricultural investment projects continue to ignore people’s land rights, threaten the rural livelihoods of smallholders, and cause environmental harm that will be very difficult to reverse. Some recent reports even suggest that the lock-down policies due to COVID-19 have accelerated the large-scale conversion of forests for agricultural purposes (Deutsche Welle 2020).

The G20 should take the lead in increasing transparency for large-scale agricultural investment projects in and by G20 member states

The G20 should provide a mandate to transparency initiatives to monitor the progress of G20 investors and target countries in implementing the guidelines for responsible agricultural investments. Specifically, we propose that project- and company-level information on large-scale agricultural projects should become publicly available on open data platforms, such as www.landmatrix.org, www.openlandcontracts.org, and www.globalforestwatch.org.

G20 should be the lead in the United Nations (VGGT and RAI principles) by imposing public entities to be fully transparent. Releasing information should be mandatory for investments and projects that receive public support (e.g., development finance) or public capital (e.g., public investment funds). Further, G20 governments should strongly encourage (private) projects and companies to release information. The information to be released should include:

- The main investors (foreign investors, potential domestic subsidiaries, and operating companies), including ownership structures (e.g., holdings, and investment funds).

- The (purchase or lease) contract, including the size of the land acquired and the location.

- Consultation processes (participating parties and main results).

- Information on the displacement of local people affected by the transaction.

- Project progress (land converted to the intended use, and the start of production).

The G20 should instruct the Meetings of Agricultural Chief Scientists of G20 States (MACS-G20) to coordinate a white paper on linking transparency initiatives to voluntary standards and certification schemes for key crops with the Roundtable on Sustainable Palm Oil (RSPO) and the Roundtable for Responsible Soy (RTRS). In the G20, this plays a particular role, as oil palm and soybeans make up more than one-tenth of all G20 land-based investments, and even more than one-third of all foreign landbased investments in G20 target countries.

Open data on large-scale land deals for agricultural purposes will have an impact on the sustainability of these investments and investor responsibility if the information can be used by relevant stakeholders, in particular, to hold investors to account. We, therefore, suggest that G20 member states should build a working group to support this capacity in intergovernmental organizations, financing institutions and donors, research organizations, and most importantly, in civil society organizations in target countries and communities.

The G20 needs to become a forum where due diligence in global supply chains—beyond agriculture and large-scale land transactions—should be discussed. We call on future G20 presidencies to put sustainable and responsible investment, trade, and supply chains on the agenda of the G20 Trade and Investment Working Group.

Acknowledgements

The authors of this policy brief acknowledge funding from the European Commission, the German Federal Ministry for Economic Cooperation and Development (BMZ), and the Swiss Agency for Development and Cooperation (SDC), which support and finance the Land Matrix Initiative.

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

Anseeuw, Ward, Mathieu Boche, Thomas Breu, Markus Giger, Jann Lay, Peter Messerli,

and Kerstin Nolte. 2012. “Transnational Land Deals for Agriculture in the Global

South.” Analytical Report based on the Land Matrix Database. Bern, Montpellier,

Hamburg. https://landmatrix.org/stay-informed/transnational-land-deals-agriculture-global-south-analytical-report-based-land-matrix-database.

Clapp, Jennifer. 2017. Responsibility to the Rescue? Governing Private Financial Investment

in Global Agriculture.” Agriculture and Human Values 34: 223–35. https://doi.org/10.1007/s10460-015-9678-8.

Cotula, Lorenzo. 2012. “The International Political Economy of the Global Land Rush:

A Critical Appraisal of Trends, Scale, Geography, and Drivers.” The Journal of Peasant

Studies 39 (3–4): 649–80. https://doi.org/10.1080/03066150.2012.674940.

Deutsche Welle. 2020. “WWF: Rainforest deforestation more than doubled under

cover of coronavirus.” Deutsche Welle, May 20, 2020. https://p.dw.com/p/3caZc.

FAO/FIAN International. 2017. “Putting the Voluntary Guidelines on Tenure into practice

– A Learning Guide For Civil Society Organizations.” Accessed March 18, 2020.

https://www.fao.org/3/a-i7763e.pdf.

G20. 2017a. “G20 Initiative for Rural Youth Employment.” 7/8 July 2017. Annex to the

G20 Leaders Declaration. https://www.g20germany.de/Content/DE/_Anlagen/G7_G20/2017-g20-rural-youth-employment-en___blob=publicationFile&v=4.pdf.

G20. 2017b. “Shaping an interconnected world.” G20 Leaders’ Declaration, Hamburg,

7/8 July 2017. https://www.bundesregierung.de/resource/blob/975254/422526/256c5ac1e16697df5fdbd09da5e 948e1/2017-07-08-abschlusserklaerung-g20-eng-data.pdf?download=1.

Gardner, Toby A., Magnus Benzie, Jan Börner, Elizabeth Dawkins, S. Fick, Rachel Garrett,

Javier Godar, et al. 2019. “Transparency and Sustainability in Global Commodity

Supply Chains.” World Development 121 (September): 163–77. https://doi.org/10.1016/j.worlddev.2018.05.025.

Gerber, Nicolas, Ephraim Nkonya, and Joachim von Braun. 2014. “Land Degradation,

Poverty and Marginality.” In Marginality edited by Joachim von Braun, and Franz

W. Gatzweiler, 181–202. Netherlands, Dordrecht: Springer. https://doi.org/10.1007/978-94-007-7061-4_12.

Inter-Agency Working Group (IAWG). 2011. “Options for Promoting Responsible Investment

in Agriculture.” Report to the High-Level Development Working Group.

Accessed December 02, 2019. https://unctad.org/sections/dite_dir/docs/diae_dir_2011-06_G20_en.pdf.

Lambin, Erik F., and Patrick Meyfroidt. 2011. “Global Land Use Change, Economic

Globalization, and the Looming Land Scarcity.” PNAS 108: 3465–472. https://doi.org/10.1073/pnas.1100480108.

Montilla Fernández, Luis Tomás. 2017. Large-Scale Land Investments in Least Developed

Countries: Legal Conflicts Between Investment and Human Rights Protection.

Netherlands, Dordrecht: Springer International Publishing. https://doi.org/10.1007/978-3-319-65280-1.

Nolte, Kerstin, Wytske Chamberlain, and Markus Giger. 2016. “International Land

Deals for Agriculture. Fresh insights from the Land Matrix: Analytical Report II.”

3906813274. https://doi.org/10.7892/boris.85304.

Oberlack, Christoph, Laura Tejada, Peter Messerli, Stephan Rist, and Markus Giger.

2016. “Sustainable Livelihoods in the Global Land Rush? Archetypes of Livelihood

Vulnerability and Sustainability Potentials.” Global Environmental Change 41: 153–71.

https://doi.org/10.1016/j.gloenvcha.2016.10.001.

OECD/UNIDO. 2019. “G20 Contribution to the 2030 Agenda. Progress and Way Forward.”

Accessed May 18, 2020. https://www.oecd.org/dev/OECD-UNDP-G20-SDG-Contribution-Report.pdf.

United Nations. 2011. “Guiding principles on business and human rights. Implementing

the United Nations ‘Protect, Respect, and Remedy’ Framework.” New York and

Geneva, 2011. Accessed May 18, 2020. https://www.ohchr.org/documents/publications/guidingprinciplesbusinesshr_en.pdf.

Appendix

[1] . These transactions are defined by the existence of a concluded contract to acquire more than 200 hectares of land through purchase, lease, or concession in a low- or middle-income country for agricultural purposes by a foreign actor between 2000 and today.

[2] . The CFS, established in 1974, is an intergovernmental body that serves as a forum in the United Nations System for review and follow-up of policies concerning world food security, including production and physical and economic access to food. It endorsed the RAI in 2014. The RAI principles build among other instruments on the VGGT, endorsed by the CFS in 2012.

[3] . The prominence of Cyprus as an investor country is due to the country hosting numerous companies and holdings that invest mainly in Eastern Europe (mostly Ukraine). Behind these investment vehicles are individuals and companies from various countries as well as multilateral investment banks, most notably the European Bank for Reconstruction and Development.

[4] . See, for example, the recent OECD/UNIDO (2019) report on the G20 contribution to the 2030 Agenda, where the issue of human rights due diligence hardly plays a role.

[5] . Transparency of large-scale land deals is a means to achieve more sustainable land-based investments; it is not an end. See Gardner et al. (2019), who thoroughly discuss the relationship between transparency and sustainability in global supply chains. We are well aware that transparency cannot be a substitute for effective governance mechanisms for the implementation of labor, social and environmental standards, and human rights in international investments and global supply chains.