We recommend the institution of a Global Citizen Income as a stepping stone toward fostering social, civil and political citizenship at the global level. We outline a gradual implementation roadmap and propose increased international aid, a mix of progressive global taxes and a carbon tax, to fund it. A Global Citizen Income would provide an automatic safety net against systemic shocks like COVID-19 and empower individuals starting, from the most vulnerable. We urge the G20 to take the lead in establishing a Global Citizenship Fund and a Convention for Global Citizenship under the aegis of the United Nations.

Challenge

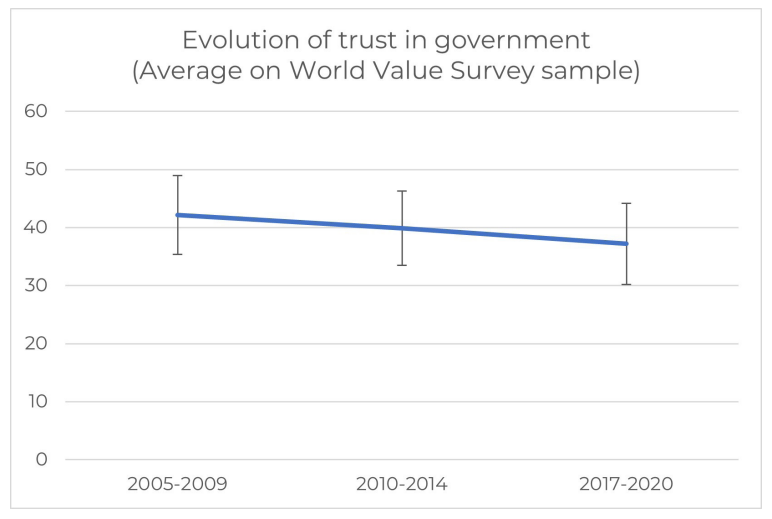

Growing inequalities in both income and wealth at the national level, accompanied by income stagnation for large swathes of the population even in rich countries (Alvaredo et al. 2018), have contributed to creating a general sense of disaffection towards democratic institutions. The persistence of high levels of inequality globally has dented the legitimacy of global institutions. According to the Edelman Trust Barometer (2021), covering 28 countries worldwide, governments are the least trusted societal leaders, among the seven categories considered. Perhaps more worryingly, people around the world have lost trust in their leaders but also in each other during 2020, with China recording the largest drop in trust. This recent fall in trust in governments compounds a negative trend in both High-Income Countries (HIC) and Low-Middle-Income Countries (LMIC) (Figure 1 and Appendix: Figure 4). Trust in international institutions, such as the IMF and the World Bank, is even lower than trust in national governments (Appendix: Figure 5).

Fig. 1 – Evolution of trust in governments (World Value Survey)

The COVID-19 pandemic has laid bare structural inequalities not only in economic outcomes, but also in preparedness for systemic crises. These two types of inequality have reinforced each other, so that the most socially and economically disadvantaged people are also those

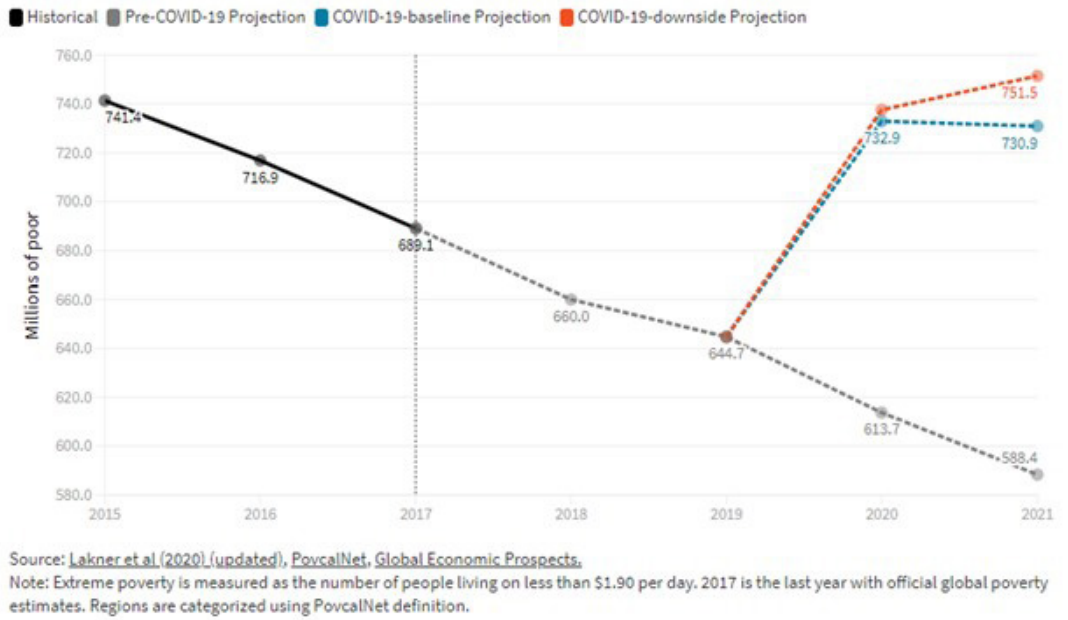

most exposed to the economic fallout and health threats from the pandemic (Egger et al. 2021; Bottan et al. 2020). This is the case both within countries and globally. The World Bank (2020) estimates that between 143 and 163 million people will become poor as an effect of the pandemic, thus reversing a trend of decreasing poverty that has lasted for several decades (Figure 2). The ILO (2020) estimates that 1.6 billion people living in LMIC (out of 2 billion people active in the informal economy) now find their livelihoods under threat because of COVID-19.

Fig. 2 – The impact of COVID-19 on global extreme poverty

This crisis calls for the establishment of safety nets against uninsurable events that can be deployed as quickly and effectively as possible, and the remediation of fundamental structural inequalities in economic outcomes and preparedness against risks. While HIC can finance safety nets through public debt, LMIC lack the “fiscal space” to do so (Hausmann 2020). With more than US$ 100 billion of financial capital having flowed out of LMIC in 2020, remittances having fallen by $100 billion, and oil and gas revenues plunging by 85%, LMIC are on brink of the worst debt crisis since 1982 (Eichengreen 2020). The initiatives taken by the G20 and the IMF to alleviate the LMIC debt burden (see Appendix) have been largely insufficient. At the intensive level, additional disposable resources are small in comparison with needs and are attached to “stigma effects” that make financing debt on markets more difficult. At the extensive level, many Middle-Income countries (MIC) are at high risk of default but are not included in these schemes. A moratorium on debt service payments similar to the one recently implemented by the G20 proved to be insufficient in the 1980s under the so-called Baker plan. There is no reason to believe that the situation is any better today if anything, it is worse. Safety nets are all the more needed because global crises of a different nature epidemic and environmental and of even greater gravity will hit societies in the future.

The G20 has repeatedly expressed its commitment to implementing global policies based on inclusiveness, consistent with the “no one left behind” principle (see points 22 and 24 of the Riyadh G20 final summit communiqué). Nevertheless, the gap between stated intentions and actions is wide, as the rise in poverty as a consequence of COVID shows. This is partly the result of the insufficiency of global-level redistribution.

If institutions fail to provide for their citizens in situations of crisis, it is not far-fetched to envisage a scenario of collapse of the social order both nationally and internationally. A new global social order should be based on a renewed sense of global citizenship.

Proposal

THE FOUNDATIONS OF A GLOBAL CITIZEN INCOME

We advocate the institution of a Global Citizen Income (GCI), funded by progressive international taxation and international aid, as an effective instrument to counter the challenges illustrated above. A Citizen Income (CI, also often called universal basic income) is a periodic cash payment unconditionally delivered to all, on an individual basis, without means-test or work requirement (Paine 2000; Meade 1995; van Parijs 1997; Straubhaar 2018). A GCI is a CI extended to all citizens of the world (Van Parijs and Vanderborght 2017). A basic income is a way to fulfil the widely shared idea that no one should be left without the means to live a dignified life, acknowledging that every human has an entitlement to receive a dividend from the exploitation of natural resources (Steiner 1994) and inherited infrastructures. It can thus also be justified as compensation from high carbon-emitting countries to low-carbon emitters. In addition to philosophical arguments, there are also economic, political and social arguments, which are reviewed in Grimalda et al. (2020).

WHAT TRANSFER LEVELS ARE APPROPRIATE?

Choosing the appropriate transfer level for a GCI is crucial. Too low a level will make it irrelevant. Too high a level may lead to perverse effects like labour supply reduction. An obvious candidate is the international poverty line set by the World Bank at PPP-$1.90. The use of one level only for international assessment has the advantage of having a single metric whereby all countries can be assessed with respect to poverty. Nevertheless, the World Bank also suggests considering four different poverty lines specific to the four income groups it identifies: PPP-$1.90 for Low-Income Countries (LIC); PPP-$3.20 for LMIC; PPP-$5.5 for High-Middle Income Countries (HMIC); PPP-$21.7 for HIC (Jolliffe and Prydz; 2021; Gentilini et al. 2019). Multiple poverty lines are adjustments that incorporate Amartya Sen’s idea of poverty as lack of capabilities. Accordingly, different baskets of goods and services are necessary in different countries to permit similar level of capabilities. These levels roughly correspond to transfers equal to a quarter of a country’s GDP within each income group. They are thus in line with the recommendation by Van Parijs and Vanderborght (2015).

Many cash transfer programmes have been tested, thanks to the diffusion of mobile money (Sury and Jack 2016). Beneficial effects have generally been found on a broad variety of outcomes, such as monetary poverty, education, health, nutrition, savings, employment and empowerment (Bastagli et al. 2016). Recent Randomized Control Trials (RCTs) conducted on unconditional cash transfers (UCTs) have made it possible to analyse specific aspects, such as the effects of transfer size. We can draw the following conclusions:

• Increasing the transfer size generally leads to statistically significant improvements in the outcome variable. Improvements tend to be slightly less than proportional, suggesting moderate decreasing returns to scale (Haushofer and Shapiro, 2016; Bastagli et al. 2016). McIntosh and Zeitlin (2021) explicitly test deviations from linearity in the variation of outcomes on transfer size, comparing small transfers (approximately PPP-$0.64 per day1111) with large transfers (PPP-$4.13 per day) in a UCT programme in Rwanda. They find only two deviations from linearity out of 24 outcomes. The large transfer was disproportionately more beneficial on house quality, but the small transfer was actually disproportionately more beneficial in reducing borrowing.

• Most UCTs have either insignificant or positive effects on labour supply. The only cases of negative effects on labour supply are for the elderly (Bastagli et al. 2016). In a recent study, though, McIntosh and Zeitlin (2020) find the tendency for labour supply to decrease for very high transfers (PPP-$8.88) in comparison to less large transfers (PPP- $4.80) in Rwanda.

• For very low transfers, effects are small but still positive. For instance, for transfers equal to PPP-$0.52, an index of financial health improved by 15.5% in comparison to the baseline in Colombia (Londoño-Vélez and Querubin 2021). One study finds negative, albeit statistically insignificant, effects on some outcomes for low transfers of PPP-$0.52 in Rwanda (McIntosh and Zeitlin 2021).

• The fear that money transferred to the poor will end up in “temptation goods”, e.g. alcohol and tobacco (Banerjee and Mullainathan 2010), appears unfounded (Evans and Popova 2014). On the contrary, UCT recipients seem eager to use the transfers on beneficial activities, such as paying off their debts.

• Egger et al. (2019) examined the community impacts of a UCT in Kenya, looking at joint effects for treated and non-treated households living in the same village. They find a fiscal multiplier effect of 2.5 for a programme worth 15% of local GDP (equivalent to PPP-$4.59) and minimal effects on inflation. The mechanism is demand-led, as UCTs increase demand for local consumption goods, which causes a rise in employment and wages, thus benefiting untreated households, too. Treated individuals also declare higher willingness to help fellow villagers.

STEP-1 GCI: TACKLING THE COVID-19 EMERGENCY

On the basis of the analysis of section 2, the PPP-$1.90 level appears sufficient to lead to positive significant effects on desirable outcomes such as consumption, health and savings in LIC and LMIC.

• We call for the urgent implementation of a GCI worth PPP-$1.90 in the poorest countries. We advise the G20 to cover as many LIC and LMIC as possible, using resources that can be mobilised in a relatively short time, based on existing commitments, debt relief, developments in international taxation, and tackling tax havens (see also Atkinson 2006).

National governments have already responded with an unprecedented expansion of cash transfers to combat the COVID-19 crisis. In 2020, 1.2 billion individuals received cash transfers as a form of aid, out of 1.8 billion individuals benefiting from some forms of aid (Gentilini et al. 2020). This proves the suitability of this instrument in crisis situations (Blofield et al. 2021; Blofield and Filgueira 2020).

Finding financial means to support the Step-1 GCI is of course difficult under economic contraction.

• Bringing ODA in line with the UN target: ODA by DAC countries, expressed on a grant-equivalent basis, amounted to US$ 161.2 billion (OECD 2021a). In spite of the rise in ODA over the last two decades, total ODA equalled 0.32% of DAC’s combined GNI, falling well short of the target of 0.70% of GNI set by the UN. Should the DAC countries as a group comply with this target, US$ 200 billion could be made available and devoted to funding the Step-1 GCI. This sum could be considerably larger if other countries that are not part of DAC, e.g. China, also contribute to this fund. Debt relief should be explicitly prioritised, given its prolonged beneficial effect in ensuring higher “fiscal space” in LMIC. We assume that $270bn may be obtained from this item.

• Tax on multinational corporations: Saez and Zucman (2021) propose a 0.02% tax on the stock value of large corporations, yielding about US$ 180 billion in revenues. The G20 has plans for a minimum tax on corporate profits, which is expected to yield a similar amount. We recommend that half of such tax receipts be devoted to funding the GCI, for a total of US$ 180 billion.

• Tackling tax havens: Although figures are highly speculative, tax havens have been estimated to collectively cost governments around US$ 600 billion a year in lost corporate tax revenues (Cobham and Janský 2018; Crivelli et al. 2015) and around US$ 200 billion for income tax losses for individuals (Zucman 2017), the latter being a conservative estimate (Henry 2016). Assuming the political will to tackle tax havens, it can be estimated that around US$ 200 billion may be recovered. We advocate that half of this amount be devoted to funding the GCI, for an amount of US$ 100 billion.

• Digital levy: For 2020, the worldwide value of online sales is estimated at US$ 4.2 trillion and is projected to surpass US$ 5.4 trillion by 2022. A moderate 1% tax on online shopping would generate around US$ 50 billion, an amount that would quickly increase as online shopping becomes more common.

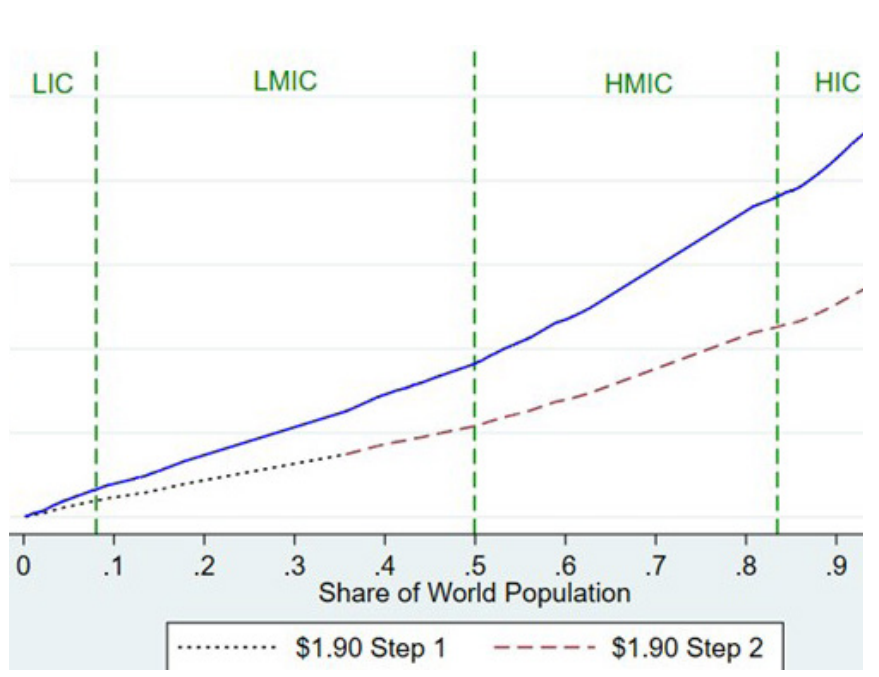

Although these figures are tentative, the resulting US$ 600 billion could be mobilised in a relatively short period of time, with political will, to fund a First-Step GCI. This sum equals around 0.75% of world GNI and would enable the payment of PPP-$1.90 to all people living in India and in all countries poorer than India (see Figure 3). This would mean that 2.67 billion people living in countries with per capita GNI of less than US$ 2,076 would be brought up to the poverty line.2222

G20 countries should take the lead in putting together the necessary legislative, political and financial means to establish a Global Citizenship Fund under the aegis of a newly created UN Convention for Global Citizenship. This Convention should be open to all countries willing to contribute, and should be charged with the task of managing the Global Citizenship Fund and setting up the pay-outs in different countries. This Convention could be similar in character to the existing COVAX facility providing access to vaccines to LMIC and may be open to philanthropic donations.

Fig. 3 – GCI Expenses relative to world population coverage

Note: Figure 3 plots the value of GCI transfers (as a percentage of world GNI) against the share of world population that would be covered. The black dotted line, the red dashed line and the solid blue line, represent the three steps of implementation of the GCI that we recommend. The three vertical lines identify thresholds for LIC, LMIC, HMIC and HIC, according to World Bank definitions. Coverage is computed assuming that all residents of a country falling below a certain GNI threshold receive the GCI. Source: Authors’ elaboration

STEP-2 GCI: EXTENDING COVERAGE TO THE FULL WORLD POPULATION

In his pioneering essay analysing the establishment of the notion of citizenship in England, Marshall (1963) distinguished three types of citizenship. Civil citizenship concerns individual freedom, liberty of movement, freedom of speech, thought and faith, and the right to property and justice. Political citizenship concerns the right to participate in the exercise of political power, either as a voter or as a candidate in elections. Social citizenship concerns the right to a minimum level of economic welfare and security. For Marshall, modern citizenship is the way in which communities harness market forces and allow for basic forms of equality. The state is its architect.

We draw two lessons from Marshall’s analysis. First, citizenship has been constructed in all the three domains. Before the Middle Ages, citizenship was virtually non-existent for most people under all the three domains, and gradually developed. Citizenship does not exist in natural form; rather it is the result of a political and social process. Second, the three domains of citizenship have developed sequentially rather than jointly.

We believe that citizenship may, and should, be constructed at the global level, similar to how it has been constructed at the national level. A GCI would arguably be a cornerstone for global social citizenship, as it would grant every individual, in each society at a given moment, the material set of resources that is necessary to lead a dignified life. Civil and political citizenship may follow suit, possibly driven by social citizenship. Given the scale of the current challenges facing humanity, constructing global citizenship is indispensable in conferring legitimacy to the political institutions that should combat such challenges.

• As a Second-Step GCI, to be implemented within a five to 10-year horizon from now, we recommend that the whole world population be covered by the PPP- $1.90 transfer.

On the basis of the RCT studies reviewed in section 2, this amount is likely to be small in MIC and close to irrelevant for most people in HIC, although still relevant for vulnerable people even in HIC. All the same, we believe that it is important to establish a principle of the global right to a minimum income. The funding should come from some of the sources reviewed in the next section. In this stage we encourage individual countries to “top up” the amount covered by the GCI out of national financial resources to fill the gap with the multiple thresholds indicated by the World Bank in section 2.

STEP-3 GCI: IMPROVING THE INTENSIVE MARGIN OF THE GCI

• As a third step for the GCI, we call for the universal increase of the GCI to the second level suggested by the World Bank, that is, PPP-$3.2.

According to the evidence reviewed in section 2, this level of UCT would remain beneficial for desirable outcomes, and the possible negative effects of reduced labour supply for large transfers would not yet appear.

The switch to this new level should occur as soon as newly created global taxation for the funding of the programme is implemented. The taxes we propose combat a set of global public bads and negative externalities: extreme wealth concentration, climate change, financial and economic instability.

- Global wealth tax. A wealth tax is an annual tax levied on the net wealth that a household (or an individual) owns above an exemption threshold. Wealth taxes at the national level are rarely used and do not cover more than 0.5% of total tax revenues (Figure 6). Nevertheless, a majority of the public in several countries support a wealth tax, the percentage ranging from 62% in Spain to 79% in Canada (Figure 7). Proposals to tax the super-rich internationally in particular at the EU level and globally have been made (Sachs et al. 2018; Landais et al. 2020). Personal wealth is often hidden in tax havens, so it is not easy to estimate the potential revenues (Tørsløv et al. 2018). According to Credit Suisse (2017), 36 million millionaires around the world in 2017 about 0.5% of the world population owned wealth worth US$ 128 trillion, while 2,208 billionaires owned wealth worth US$ 9.1 trillion (Sachs et al. 2018). Taxing the millionaires at 2% per year and billionaires at 3% in line with some of the above proposals would have raised US$ 2.65 trillion, equivalent to 3.3% of world GDP in 2017. Equivalent amounts may be expected to be raised for the future. National governments should be put in charge of levying taxes on their citizens if they are eligible for taxation. The revenues should then be transferred to the Global Citizenship Fund.

- Carbon tax: A global system of carbon taxation could raise around US$ 1.6 trillion per year between 2020 and 2030, i.e., around 1.9% of current world GDP (Jacob et al. 2016). Should a carbon tax be regressive in some countries, compensatory measures to the poor should be undertaken (Schwerhoff et al. 2017; Klenert et al. 2018).

- Tobin Tax: Taxing financial transactions worldwide, amounting to no less than US$ 12,000 trillion, at the rate of 0.1%, would generate around 7% of the world GDP as revenue even assuming that half of the tax base would be lost, due to either avoidance or evasion.

This set of taxes would be progressive in character, as it would weigh disproportionately on the richest, and would yield an overall financial capacity of around 12% of world GNI. The overall cost of the proposed GCI plan is US$ 4.25 trillion, equivalent to 5.22% of world GNI. The fiscal capacity of the above taxation is thus more than twice as much the financial requirement of a GCI. The slack may be allocated to other goals, in particular fostering investments to combat climate change, or to support the Sustainable Development Goals.

SHOULD THE GCI BE UNIVERSAL OR TARGETED AT THE POOR?

A common objection to a CI is that it benefits people who are not in need, thus decreasing the transfers that the really needy can receive. An alternative to universality is to target poor people through means-testing. Since means-testing is prone to evaluation errors, stigma effects and a lower than desired take-up rate, and since it also engenders poverty traps (Atkinson 2015), a trade-off exists between universality providing less to all and targeting providing more to the needy, but with a margin of error. It may be thought that means-testing is difficult in LMIC for people employed in the informal sector. However, proxy-means testing that is, means-testing based on observable characteristics of wealth, such as house construction materials have been proved to be both relatively effective and cheap in LMIC. Alternatives, like letting communities choose who is needy, have also been tested (Hanna and Olken 2018).

In our view, the main argument in favour of universality of transfers is not financial but rather related to the very idea of social cohesion that the GCI is designed to attain. Conditional programmes entrench divisions in the population, especially between people at the fringes of eligibility, and such divisions may beget social struggles that would make societies less rather than more cohesive. Such programmes generally trigger backlashes that, through political processes, keep these programmes insufficient and quasi-punitive, and block the creation of more generous programmes. Although research is still preliminary, negative psychological and even consumption effects have been recorded in people not receiving benefits in comparison to those receiving benefits in targeted programmes (Haushofer et al. 2019a; 2019b). It should be added that GCI should be accompanied by an increase in progressivity of income tax, so as to sterilise the beneficial effect on the rich (Tondani 2009; Francese and Prady 2018). In sum, we believe that the positive societal externalities of a GCI far exceed those of targeted programmes, and go beyond providing protection against risks, to offer real independence and empowerment.

ACKNOWLEDGEMENTS

We thank Selva Demiralp, Tommaso Faccio, Gabriel Felbermayr, Stefan Kooths, Gabriel Zucman for helpful discussion, and Leonie Heuer for great research assistance.

NOTES

1 RCTs vary a lot depending on length of intervention, frequency of transfers and transfer size. We have sought to make transfers comparable by dividing the total transfer handed out over the intervention by the length of the intervention, thus expressing it in transfer per day.

2 Countries may be ordered according to their HDI ranking, rather than their GNI ranking.

REFERENCES

Alvaredo F., L. Chancel, T. Piketty, E. Saez, and G. Zucman, (2018), “The elephant curve of global inequality and growth”, AEA Papers and Proceedings. vol. 108, May, pp. 103-08

Atkinson A.B., (2006), “Funding the Millennium Development Goals: a challenge for global public finance”, European Review, vol. 14, no. 4, p. 555

Atkinson A.B., (2015), Inequality, Cambridge MA, Harvard University Press.

Banerjee A. and S. Mullainathan, (2010), The shape of temptation: Implications for the economic lives of the poor, no. w15973, National Bureau of Economic Research

Banerjee A., M. Faye, A. Krueger, P. Niehaus, and T. Suri, (2020), Effects of a Universal Basic Income during the pandemic, Technical Report, UC San Diego, September

Bastagli F. et al., (2016), “Cash transfers: what does the evidence say”, A rigorous review of programme impact and the role of design and implementation features, London, ODI, vol. 1, no. 7

Blofield M., N. Lustig, and M. Trasberg, (2021), Social Protection During the Pandemic: Argentina, Brazil, Colombia, and Mexico

Blofield M. and F. Filgueira, (2020), COVID19 and Latin America: Social Impact, Policies and a Fiscal Case for an Emergency Social Protection Floor, CIPPEC Policy Brief, 2 April

Bottan N., B. Hoffmann, and D. Vera-Cossio, (2020), “The unequal impact of the coronavirus pandemic: Evidence from seventeen developing countries”, PloS one, vol. 15, no. 10, e0239797

Cobham A. and P. Janský, (2018), “Global Distribution of Revenue Loss from Corporate Tax Avoidance: Re-Estimation and Country Results”, Journal of International Development, vol. 30, no. 2, pp. 206-32

Credit Suisse, (2017), Global Wealth Report 2017, Zurich https://www.credit-suisse.com/corporate/en/research/research-institute/global-wealth-report.html

Crivelli E., A. Ruud A. de Mooij, and M. Keen, (2015), Base Erosion, Profit Shifting and Developing Countries, IMF Working Paper 15/118, International Monetary Fund, Washington, DC, May https://www.imf.org/en/Publications/WP/Issues/2016/12/31/Base-Erosion-Profit-Shifting-and-Developing-Countries-42973

Edelman Trust Barometer 2021. Accessed on 28.4.21 at https://www.edelman.com/trust/2021-trust-barometer

Egger D. et al., (2019), General equilibrium effects of cash transfers: experimental evidence from Kenya (No. w26600), National Bureau of Economic Research

Egger D. et al., (2021), “Falling living standards during the COVID-19 crisis: Quantitative evidence from nine developing countries”, Science advances, vol. 7, no. 6, eabe0997

Eichengreen B., (2020), “Managing the coming global debt crisis”, Project Syndicate, 13 May https://www.project-syndicate.org/commentary/managiing-coming-global-debt-crisis-by-barry-eichen-green-2020-05

Evans D.K. and A. Popova, (2014), Cash transfers and temptation goods: a review of global evidence, World Bank Group https://openknowledge.worldbank.org/handle/10986/18802

Francese M. and D. Prady, (2018), Universal basic income: debate and impact assessment, International Monetary Fund (IMF), Working Paper No. 18/273.

Gellner E. and J. Breuilly, (1983), Nations and Nationalism: New Perspectives on the Past, 1st ed., Ithaca, Cornell University Press

Gentilini U., M. Grosh, J. Rigolini, and R. Yemtsov (eds), (2019), Exploring universal basic income: A guide to navigating concepts, evidence, and practices, World Bank Publications

Gentilini U. et al., (2020), Social Protection and Jobs Responses to COVID-19: A Real-Time Review of Country Measures, World Bank Group, May https://openknowledge.worldbank.org/handle/10986/33635

Grimalda G. and N. Tänzer, (2018), Understanding and fostering social cohesion, T20 Task Force on Global Inequality and Social Cohesion https://www.g20-insights.org/policy_briefs/understanding-and-fostering-social-cohesion//

Grimalda G., F. Filgueira, M. Fleurbaey, and R. Lo Vuolo, (2020), Building global citizenship through global basic income and progressive global taxation, Policy brief – TF4 Social Cohesion and the State, T20 Saudi Arabia https://www.global-solutions-initiative.org/wp-content/uploads/g20-insights-uploads/2020/11/T20_TF4_PB6.pdf

Hanna R. and B.A. Olken, (2018), “Universal basic incomes versus targeted transfers: Anti-poverty programs in developing countries”, Journal of Economic Perspectives, vol. 32, no. 4, pp. 201-26

Haushofer J. and J. Shapiro, (2016), “The short-term impact of unconditional cash transfers to the poor: experimental evidence from Kenya”, The Quarterly Journal of Economics, vol. 131, no. 4, pp. 1973-2042

Haushofer J., M.I. Riis-Vestergaard, and J. Shapiro, (2019a), “Is there a social cost of randomization?”, Social Choice and Welfare, vol. 52, no. 4, pp. 709-39

Haushofer J., J. Reisinger, and J. Shapiro, (2019b), Is Your Gain My Pain? Effects of Relative Income and Inequality on Psychological Well-being, Working Paper

Hausman R., (2020), “Flattening the COVID-19 Curve in Developing Countries”, Project Syndicate https://tinyurl.com/saonqno

Henry J.S., (2016), “Taxing Tax Havens”, Foreign Affairs, 12 April https://www.foreignaffairs.com/articles/panama/2016-04-12/taxing-tax-havens

International Labour Organization (ILO), (2020), Social protection responses to the COVID-19 pandemic in developing countries, Social Protection Spotlight, May https://www.ilo.org/wcmsp5/groups/public/—ed_protect/—soc_sec/documents/publication/wcms_744612.pdf

Jacob M. et al., (2016). “Carbon Pricing Revenues Could Close Infrastructure Access Gaps”, World Development, vol. 84, pp. 254-65

Jolliffe D. and E.B. Prydz, (2021), „Societal poverty: A relative and relevant measure”, The World Bank Economic Review, vol. 35, no. 1, pp. 180-206

Klenert D. et al., (2018), “Making carbon pricing work for citizens”, Nature Climate Change, vol. 8, no. 8, pp. 669-77

Lakner C., D.G. Mahler, M. Negre, and E.B. Prydz, (2020), How Much Does Reducing Inequality Matter for Global Poverty?, Global Poverty Monitoring Technical Note 13, World Bank Document https://documents1.worldbank.org/curated/en/765601591733806023/pdf/How-Much-Does-Reducing-Inequality-Matter-for-Global-Poverty.pdf

Landais C., E. Saez, and G. Zucman, (2020), “A progressive European wealth tax to fund the European COVID response”, VoxEU https://voxeu.org/article/progressive-european-wealth-tax-fund-european-covid-response

Londoño-Vélez J. and P. Querubin, (2021), “The Impact of Emergency Cash Assistance in a Pandemic: Experimental Evidence from Colombia”, Review of Economics and Statistics, forthcoming

McIntosh C. and A. Zeitlin, (2020), “Using Household Grants to Benchmark the Cost Effectiveness of a USAID Workforce Readiness Program”, arXiv preprint arXiv:2009.01749

McIntosh C. and A. Zeitlin, (2021), “Cash versus Kind: Benchmarking a Child Nutrition Program against Unconditional Cash Transfers in Rwanda”, arXiv preprint arXiv:2106.00213

Meade J.E., (1995), Full Employment Regained?, vol. 61, Cambridge, Cambridge University Press

Organization for Economic Co-operation and Development (OECD), (2021a), COVID-19 spending helped to lift foreign aid to an all-time high in 2020, Paris https://www.oecd.org/dac/financing-sustainable-development/development-finance-data/ODA-2020-detailed-summary.pdf

Organization for Economic Co-operation and Development (OECD), (2021b), OECD Economic Outlook, Interim Report March 2021, OECD Publishing, Paris https://doi.org/10.1787/34bfd999-en

Paine T., (2000), Paine: Political Writings, Cambridge, Cambridge University Press

Parijs P.V., (1997), Real freedom for all: What (if anything) can justify capitalism?, OUP Catalogue

Sachs J. et al., (2018), Closing the SDG Budget Gap, Move Humanity and Sustainable Development Solutions Network https://movehumanity.org/wp-content/uploads/2018/10/FINAL-2018-10-18_Closing-the-SDG-Budget-Gap.pdf

Saez E. and G. Zucman, (2019), Progressive wealth taxation, Brookings Papers on Economic Activity

Saez E. and G. Zucman, (2021), A Wealth Tax on Corporations’ Stock, Economic Policy, Presented at the 73rd Economic Policy Panel Meeting https://www.economic-policy.org/wp-content/uploads/2021/04/9103_A-Wealth-Tax-on-Corporations-Stock.pdf

Schwerhoff G. et al., (2017), Policy options for a socially balanced climate policy, Policy brief, G20 Insights, T20 Task Force on Global Inequality and Social Cohesion, Germany

Shamshad A., U. Volz, M. Kramer, and S. Griffith-Jones, (2021), “The G20’s Missed Opportunity”, Project Syndicate, April https://www.project-syndicate.org/commentary/g20-debt-framework-must-go-further-byshamshad-akhtar-2-et-al-2021-04

Steiner H., (1994), An Essay on Rights, Oxford, Blackwell

Straubhaar T., (2018), Universal Basic Income – New Answer to New Questions for the German Welfare State in the 21st Century, CesIfo Forum, vol. 19, no. 3

Suri T. and W. Jack, (2016), “The long-run poverty and gender impacts of mobile money”, Science, vol. 354, no. 6317, pp. 1288-92

Tondani D., (2009), “Universal basic income and negative income tax: Two different ways of thinking redistribution”, The Journal of Socio-Economics, vol. 38, no. 2, pp. 246-55

Tørsløv T.R., L.S. Wier, and G. Zucman, (2018), The missing profits of nations, no. w24701, National Bureau of Economic Research

United Nations, (2020), Financing for Development in the Era of COVID-19 and Beyond Menu of Options for the Consideration of Heads of State and Government https://www.un.org/sites/un2.un.org/files/financing_for_development_covid19_part_ii_hosg.pdf

Van Parijs P. and Y. Vanderborght, (2015), “Basic income in a globalized economy”, in R. Hasmath (ed), Inclusive Growth, Development and Welfare Policy: A Critical Assessment, Routledge, pp. 229-48

World Bank, (2020), Poverty Overview https://www.worldbank.org/en/topic/poverty/overview#1

WVS time-series, (1981-2020), (2020), R. Inglehart, C. Haerpfer, A. Moreno, C. Welzel, K. Kizilova, J. Diez-Medrano, M. Lagos, P. Norris, E. Ponarin, and B. Puranen et al. (eds), World Values Survey: All Rounds – Country-Pooled Datafile, Madrid, Spain and Vienna, Austria, JD Systems Institute & WVSA Secretariat https://www.worldvaluessurvey.org/WVSDocumentationWVL.jsp

WVS wave 7 (2017-2020), (2020), C. Haerpfer, R. Inglehart, A. Moreno, C. Welzel, K. Kizilova, J. Diez-Medrano, M. Lagos, P. Norris, E. Ponarin, and B. Puranen et al. (eds), World Values Survey: Round Seven – Country-Pooled Datafile, Madrid, Spain & Vienna, Austria, JD Systems Institute & WVSA Secretariat, doi.org/10.14281/18241.1

Zucman G., (2017), “How Corporations and the Wealthy Avoid Taxes (and How to Stop Them)”, New York Times, 10 November https://gabriel-zucman.eu/how-corporations-avoid-taxes/