We recommend the institution of a Global Universal Citizen Income. This is a periodic payment unconditionally delivered to all individuals worldwide, without means-test or work requirement, paid in cash or other appropriate forms. We recommend funding from newly established global taxes, including a tax on financial transactions, a wealth tax levied on the top 1 percent of the global wealth distribution and a carbon tax. The Global Citizen Income would provide an automatic safety net against sudden systemic shocks like COVID-19. It should be managed by a United Nations Convention. A Global Universal Basic Income fosters global social cohesion and regains trust and legitimacy toward international institutions such as the Group of 20 (G20).

Challenge

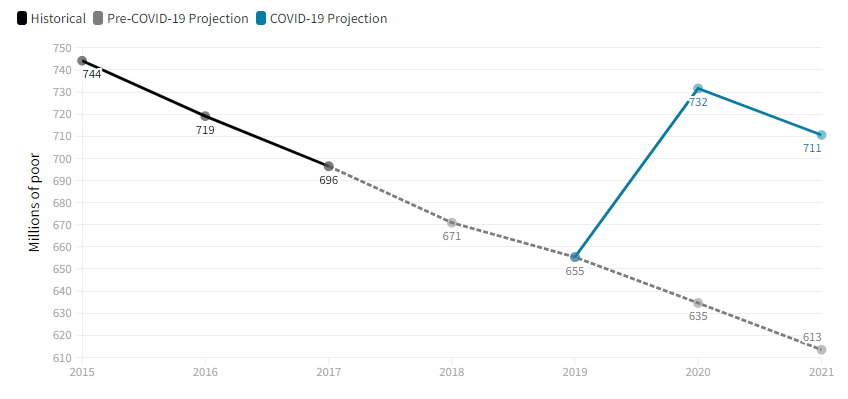

The COVID-19 pandemic has laid bare structural inequalities not only in economic outcomes (Chancel et al. 2021), but also in preparedness for systemic crises (Egger et al., 2021; Bottan et al., 2020). The World Bank (2021) estimates that around 100 million people have been thrown into poverty as an effect of the pandemic, reversing a decreasing trend that spanned several decades (Figure 1). Poverty was estimated to decrease in 2021, at the same rate as what would have occurred without the pandemic. This pattern may suggest that the pandemic shock will have a permanent effect on poverty. Importantly, the trend in estimated poverty reduction is not uniform, as poverty was estimated to increase by 2.7 percent in Africa in 2021 (Mahler et al., 2021). The International Labour Office (ILO) (2022) projects that total hours worked globally in 2022 will remain almost 2 percent below their pre-pandemic level when adjusted for population growth, corresponding to a decrease of 52 million full-time equivalent jobs. Global unemployment is projected to stand at 207 million in 2022, surpassing its 2019 level by approximately 21 million. The recovery has been faster for richer economies, owing largely to the higher vaccination rates and larger fiscal space than in low and middle-income countries, where between 42 percent and 82 percent of the population are not covered by any social protection schemes (Gentilini, 2018; Cichon, M., & Lanz, 2022).

Figure 1: The impact of COVID-19 on global extreme poverty

Source: Mahler et al. (2021).

Note: Extreme poverty is measured as the number of people living on less than US$1.90 per day; 2017 is the last year with official global poverty estimates.

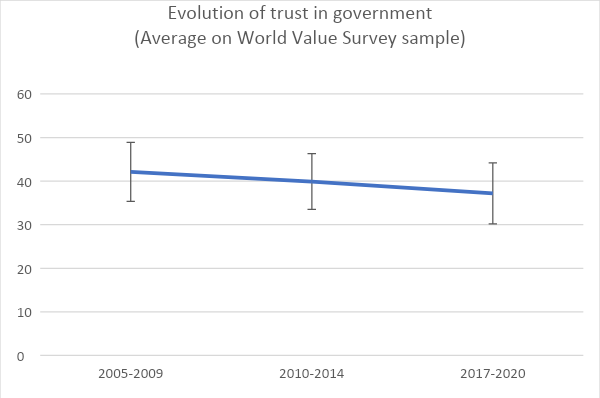

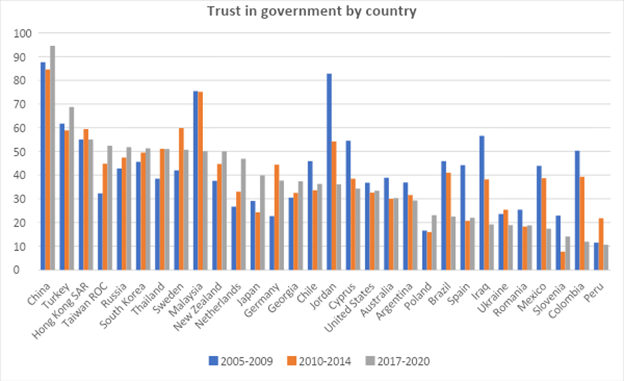

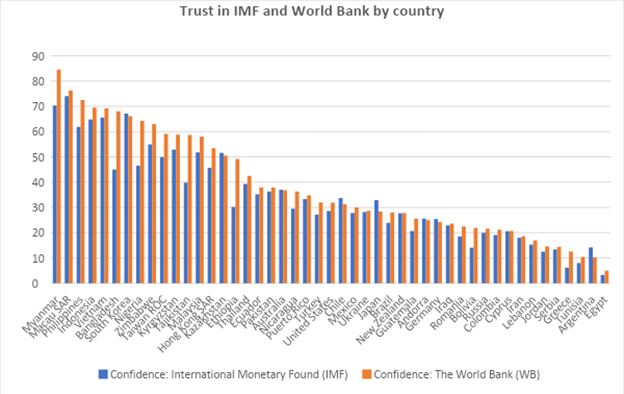

The setback caused by the pandemic has been accompanied by a growing sense of disaffection with democratic institutions. The Edelman Trust Barometer (2022), covering 28 countries worldwide, talks about distrust having now become the default emotion. Among the seven categories considered, governments are the least trusted societal leaders. This recent fall in trust in governments compounds a negative trend in both high-income countries (HIC) and low-middle-income countries (LMIC) (Figure 2 and Appendix: Figure 4). Trust in international institutions, such as the International Monetary Fund (IMF) and the World Bank, is even lower than trust in national governments (Appendix: Figure 5). Trust in democracy is also dwindling. The percentage of people saying that “having a strong leader who does not have to bother with parliament and elections” is a good thing has reached record levels (Grimalda et al., 2022).

Figure 2: Evolution of trust in governments (World Value Survey).

Note: The graph shows the (population-unweighted) average of the percentage of respondents who answered “a great deal” or “quite a lot” when asked how much confidence they have in the government in their nation’s capital, in the 30 countries included in the three last waves of the World Value Survey (WVS time-series, 1981-2020). See Appendix: Figure 4 for the country breakdown.

Finally, the Ukraine war is likely to lead to a further retreat of global governance. Such a retreat calls for the establishment of safety nets against uninsurable events that may be deployed as quickly and effectively as possible. This is all the more needed because extreme weather events and pandemics are becoming more likely because of climate change (International Panel on Climate Change, 2022).

Proposal

1. The foundations of a Global Citizen Income

We advocate the institution of a Global Citizen Income (GCI), funded by progressive international taxation and international aid, as an effective instrument to counter the challenges illustrated above. A Citizen Income (CI), also often called universal basic income (UBI), is a periodic cash payment unconditionally delivered to all, on an individual basis, without a means test or work requirements (Paine, 2000; Meade, 1995; van Parijs, 1997; Straubhaar, 2018). A GCI is a CI extended to all citizens of the world (Van Parijs and Vanderborght, 2017; Leinen and Bummel, 2018). A basic income is a way to fulfil the widely shared idea that no one should be left without the means to live a dignified life, acknowledging that every human is entitled to a dividend from the exploitation of natural resources (Steiner 1994) and inherited infrastructures. It can thus also be justified as compensation from high carbon-emitting countries to low-carbon emitters. In addition to philosophical arguments, there are also economic, political and social arguments, which are reviewed in Grimalda et al. (2020).

2. What transfer levels are appropriate?

The World Bank suggests four different poverty lines specific to the four income groups it identifies: purchasing power parity (PPP) of $1.90 for low-income countries (LIC); PPP $3.20 for LMICs; PPP $5.5 for high-middle-income countries (HMIC); PPP $21.7 for HICs (Jolliffe & Prydz; 2021; Gentilini et al., 2019). A large body of evidence has been gathered from randomised control trials on the impacts of cash transfers. Such trials relied on mobile money (Sury and Jack, 2016), which is also expected to limit the possibility of the embezzlement of aid funds from the institutions administering the programme. Grimalda et al. (2021) discuss the evidence in detail. The main conclusion is that cash transfers have a positive effect on a broad variety of outcomes, such as monetary poverty, education, health, nutrition, savings, employment and empowerment (Bastagli et al., 2016). No threshold effects seem to exist; that is, small transfers have small, positive impacts and transfer increases determine almost linear improvements in the outcome variables. Improvements tend to be slightly less than proportional, suggesting moderate, decreasing returns to scale (Haushofer & Shapiro, 2016; Bastagli et al., 2016).

3. Step-1 GCI: Tackling the COIVD-19 emergency

On the basis of the available evidence, the PPP $1.90 level appears sufficient to lead to positive significant effects on desirable outcomes such as consumption, health and savings in LICs and LMICs.

- We call for the urgent implementation of a GCI worth PPP $1.90 in the poorest countries. We advise the Group of 20 (G20) to cover as many LICs and LMICs as possible, using resources that can be mobilised in a relatively short time, based on existing commitments, debt relief, developments in international taxation and tackling tax havens (see also Atkinson, 2006).

National governments responded with an unprecedented expansion of cash transfers to combat the COVID-19 crisis. In 2020, 1.2 billion individuals received cash transfers as a form of aid, out of 1.8 billion individuals benefiting from some form of aid (Gentilini et al, 2020; Banerjee et al., 2020). This proves the suitability of this instrument in crisis situations (Blofield et al., 2021, Blofield and Filgueira, 2020).

We suggest the following means to fund the Step-1 GCI.

- Bringing official direct aid (ODA) in line with the UN target: ODA by developed advanced countries (DAC) amounted to $161.2 billion (OECD, 2021a), equivalent to 0.32 percent of DACs’ combined gross national income (GNI). Should DACs and China comply with the target of 0.70 percent of GNI set by the UN, $270 billion could be made available and devoted to funding the Step-1 GCI.

- Tax on multinational corporations: Saez and Zucman (2021) propose a 0.02 percent tax on the stock value of large corporations, yielding about $180 billion in revenues. The G20 has approved a minimum tax on corporate profits, which is expected to yield a similar amount. We recommend that half of such tax receipts be devoted to funding the GCI, for a total of $180 billion (Grimalda, 2022).

- Tackling tax havens: Although figures are highly speculative, tax havens have been estimated to collectively cost governments around $600 billion a year in lost corporate tax revenues (Cobham and Janský, 2018; Crivelli et al., 2015) and around $200 billion for income tax losses for individuals (Zucman, 2017) — the latter being a conservative estimate (Henry, 2016). Assuming the political will to tackle tax havens, it can be estimated that around $200 billion may be recovered. We advocate that half of this amount be devoted to funding the GCI, for an amount of $100 billion.

- Digital levy: For 2020, the worldwide value of online sales is estimated at $4.2 trillion and is projected to surpass $5.4 trillion by 2022. A moderate 1 percent tax on online shopping would generate around $50 billion, an amount that would quickly increase as online shopping becomes more common.

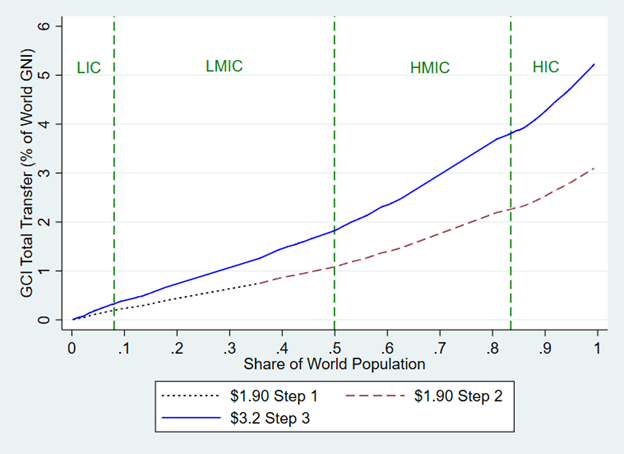

Although these figures are tentative, the resulting $600 billion could be mobilised in a relatively short period of time — depending on the political will — to fund a Step 1 GCI. This sum equals around 0.75 percent of world GNI and would enable the payment of PPP-$1.90 to all people living in India and in all countries poorer than India (see Figure 3). This would mean that 2.67 billion people living in countries with a per capita GNI of less than $2,076 would be brought up to the poverty line.

In the absence of a global fiscal authority, tax collection should be carried out by national governments. We envisage the institution of a Convention for Global Citizenship under the management of the UN. Given the goal of the GCI to foster global citizenship, we believe that the involvement of the UN is particularly important. National governments should transfer fiscal revenues to this convention, which will be in charge of delivering the cash transfers. The Global Citizen Fund may also be open to philanthropic donations. This convention may include national governments, non-governmental organisations (NGO) and other relevant bodies as observers or as consulting bodies. Nevertheless, we believe that it is important that the management of the convention is the responsibility of public international authorities. As for the delivery of the transfers, we envisage the Convention for Global Citizenship to act similarly to the World Food Programme (WFP). That is, we expect the UN body to have a direct “on the ground” capacity with logistical and administrative support from national governments. More details on the roadmap leading to the establishment and diffusion of the GCI may be found in the Appendix. We urge G20 countries to prepare the necessary legislative, political and financial means to establish such a Global Citizenship Fund.

Figure 3: GCI Expenses relative to world population coverage

Note: Figure 3 plots the value of GCI transfers (as a percentage of world GNI) against the share of the world population that would be covered. The black dotted line, the red dashed line and the solid blue line represent the three implementation steps of the GCI that we recommend. The three vertical lines identify thresholds for LICs, LMICs, HMICs and HICs, according to World Bank definitions. Coverage is computed assuming that all residents of a country falling below a certain GNI threshold receive the GCI.

Source: Authors’ elaboration

4. Step-2 and Step-3 GCI: Extending coverage to the full world population

- As a Step 2 GCI, we recommend that the whole world population be covered by the PPP $1.90 transfer.

On the basis of the randomised control trial (RCT) studies reviewed in section 2, this amount is likely to be small in LMICs and HMICs, and close to irrelevant for most people in HICs, although still relevant for vulnerable people even in HICs. All the same, we believe that it is important to establish a principle of the global right to a minimum income, which is conducive to fostering a sense of global citizenship (Grimalda et al., 2021). In this stage, we encourage individual countries to “top up” the amount covered by the GCI out of national financial resources to fill the gap with the multiple thresholds indicated by the World Bank in section 2. This move may also improve the efficiency of national government spending for what concerns their involvement in the administration of the programme (see previous section), now that spending would be financed by tax revenues rather than foreign aid. Governments will have to be more accountable to their own citizens than to aid donors (Devarajan, 2019).

- As a third step for the GCI, we call for the universal increase of the GCI to the second level suggested by the World Bank, that is, PPP $3.2.

The switch to this new level should occur as soon as newly created global taxation for the funding of the programme is implemented. The taxes we propose combat a set of global public bads and negative externalities: extreme wealth concentration, climate change, and financial and economic instability.

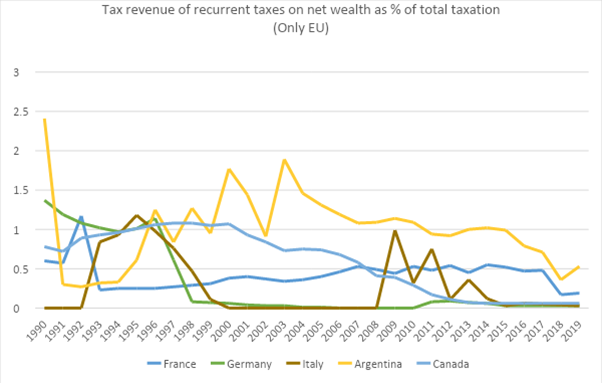

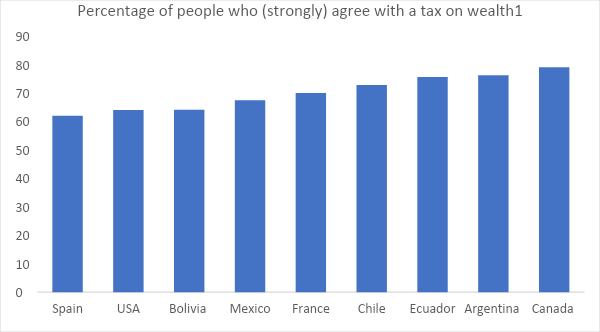

- Global wealth tax. A wealth tax is an annual tax levied on the net wealth that a household (or an individual) owns above an exemption threshold. Wealth taxes at the national level are rarely used and do not cover more than 0.5 percent of total tax revenues (Figure 6). Nevertheless, a majority of the public in several countries support a wealth tax, the percentage ranging from 62 percent in Spain to 79 percent in Canada (Figure 7). Proposals to tax the super-rich internationally – in particular at the European Union (EU) level – and globally have been made (Sachs et al., 2018; Landais et al., 2020). Personal wealth is often hidden in tax havens so it is not easy to estimate the potential revenues (Tørsløv et al., 2018). According to Credit Suisse (2017), 36 million millionaires around the world in 2017 — about 0.5 percent of the world population — owned wealth worth $128 trillion, while 2,208 billionaires owned wealth worth $9.1 trillion (Sachs et al., 2018). Taxing the millionaires at 2 percent per year and billionaires at 3percent – in line with some of the above proposals – would have raised $2.65 trillion, equivalent to 3.3 percent of world GDP in 2017. Equivalent amounts may be expected to be raised for the future. National governments should be put in charge of levying taxes on their citizens if they are eligible for taxation. The revenues should then be transferred to the Global Citizenship Fund.

- Carbon tax: A global system of carbon taxation could raise around $1.6 trillion per year between 2020 and 2030, or around 1.9 percent of current world GDP (Jacob et al., 2016). Should a carbon tax be regressive in some countries, compensatory measures to the poor should be undertaken (Schwerhoff et al., 2017; Klenert et al., 2018).

- Tobin Tax: Taxing financial transactions worldwide, amounting to no less than $12 quadrillion, at the rate of 0.1 percent, would generate around 7 percent of the world GDP as revenue —even assuming that half of the tax base would be lost due to either avoidance or evasion.

This set of taxes would be progressive in character, as it would weigh disproportionately on the richest and yield an overall financial capacity of around 12 percent of world GNI. The overall cost of the proposed GCI plan is $4.25 trillion, equivalent to 5.22 percent of world GNI. The fiscal capacity of the above taxation is thus more than twice the financial requirement of a GCI. The slack may be allocated to other goals; in particular, fostering investments to combat climate change or to support the Sustainable Development Goals (SDG).

5. Should the GCI be universal or targeted at the poor? Should it replace other welfare schemes?

A common objection to a CI is that it benefits people who are not in need, thus decreasing the transfers that the really needy can receive. An alternative to universality is to target poor people through means testing. Since means testing is prone to evaluation errors, stigma effects and a lower-than-desired take-up rate, and since it also engenders poverty traps (Atkinson, 2015), a trade-off exists between universality (providing less to all) and targeting (providing more to the needy), but with a margin of error. An important example comes from India’s social policy. India spent about 5 percent of its GDP on no less than 950 centrally administered welfare benefits schemes in 2016. These include subsidies for food, fertilizers, rural employment, other specific employment, crop insurance, student scholarships, etc (Government of India, 2017: 177). These add to a plethora of other state-run schemes. Although the goal of such schemes is not always to help the poor specifically, it would be expected that provinces with the highest share of the poor would receive the largest share of transfers. However, the opposite is true. An estimate of the exclusion error from 2011-12 suggests that between 40 percent and 65 percent of the bottom 40 percent of the population were excluded from subsidy schemes — although exclusion improved subsequently. The reason for such a misallocation has mainly to do with lower administrative capacity of the provinces where most poor are concentrated. Overall, the Indian government concluded its review with a mild encouragement for a UBI scheme, although the level of the transfer suggested was — in the words of Banerjee and Duflo (2019) — “ultra-basic”, as it amounted to roughly PPP $1.18.

One of the main advantages of a UBI in low-income countries like India is that it would reduce the costs associated with means testing and, if it replaced existing schemes, would eliminate the inefficiencies associated with the multitude of welfare schemes. The government of India’s (2017) review suggests that individuals may choose between the UBI or the in-kind programmes, and that non-deserving people (about 30 percent of the population) were selected out of the schemes through various easily implementable means, such as making the list of applicants public, thus exposing non-deserving people to social stigma, or using proxy means testing — that is, means testing based on observable characteristics of wealth, such as house construction materials (Hanna and Olken, 2018). Alternatively, the GCI should be accompanied by an increase in progressivity of income tax so as to sterilise the beneficial effect on the rich (Tondani, 2009; Francese and Prady, 2018). In the present proposal, the GCI would be funded through international taxation so that there would be no need for it to replace existing welfare schemes. It can be envisaged, nonetheless, that once the GCI was implemented, the need for alternative welfare schemes would be considerably reduced, thus allowing LICs and MICs to expand expenditures in other areas, such as public goods provision.

Another advantage of a GCI funded through global taxation is that it would permit foreign aid to directly reach the pockets of citizens in need, bypassing administrative and bureaucratic hurdles. This would be particularly beneficial for countries that have weak governance and are prone to corruption (Svensson, 2000; Acht et al., 2015; Pavlik and Young, 2021).

Acknowledgments

We thank Selva Demiralp, Tommaso Faccio, Gabriel Felbermayr, Stefan Kooths, Gabriel Zucman for helpful discussion, and Leonie Heuer for her great research assistance. We are also grateful to the T20 Task Force 5 co-chairs o for their valuable inputs.

References

Acht, M., Mahmoud, T. O., & Thiele, R. (2015). Corrupt governments do not receive more state-to-state aid: Governance and the delivery of foreign aid through non-state actors. Journal of Development Economics, 114, 20-33.

Atkinson, A. B. (2006). Funding the Millennium Development Goals: a challenge for global public finance. European Review, 14(4), 555.

Atkinson, A. B. (2015). Inequality. Harvard University Press.

Banerjee, A. V., & Duflo, E. (2019). Good economics for hard times. Public Affairs.

Banerjee, A., M. Faye, A. Krueger, P. Niehaus, and T. Suri, “Effects of a Universal Basic Income during the pandemic,” Technical Report, UC San Diego September 2020.

Bastagli, F., Hagen-Zanker, J., Harman, L., Barca, V., Sturge, G., Schmidt, T., & Pellerano, L. (2016). Cash transfers: what does the evidence say. A rigorous review of programme impact and the role of design and implementation features. London: ODI, 1(7).

Blofield, M., Lustig, N., and Trasberg, M. (2021). “Social Protection During the Pandemic: Argentina, Brazil, Colombia, and Mexico”,

Blofield, Merike and Fernando Filgueira (2020). COVID19 and Latin America: Social Impact, Policies and a Fiscal Case for an Emergency Social Protection Floor, (CIPPEC) Policy Brief April 2, 2020

Bottan, N., Hoffmann, B., & Vera-Cossio, D. (2020). The unequal impact of the coronavirus pandemic: Evidence from seventeen developing countries. PloS one, 15(10), e0239797.

Chancel, L., Piketty, T., Saez, E., Zucman, G. et al. (2022). World Inequality Report 2022, World Inequality Lab.

Cichon, M., & Lanz, H. (2022). Creating fiscal and policy space. A pragmatic two-pronged global implementation strategy for universal social protection. Geneva: Friedrich-Ebert-Stiftung, FES

Cobham, Alex, and Petr Janský. 2018. “Global Distribution of Revenue Loss from Corporate Tax Avoidance: Re-Estimation and Country Results.” Journal of International Development 30 (2): 206–32.

Credit Suisse, 2017. Global Wealth Report 2017. Zurich. Available: https://www.credit-suisse. com/corporate/en/research/research-institute/global-wealth-report.html.

Crivelli, Ernesto, Ruud A. de Mooij, and Michael Keen. 2015. “Base Erosion, Profit Shifting and Developing Countries.” IMF Working Paper 15/118, International Monetary Fund, Washington, DC.

Devarajan, S. (2019). How to use oil revenues efficiently. Institutions and macroeconomic policies in resource-rich Arab economies, 218-236.

Edelman Trust Barometer 2022. Accessed on 25.4.22 at https://www.edelman.com/trust/2022-trust-barometer .

Egger, D., Haushofer, J., Miguel, E., Niehaus, P., & Walker, M. W. (2019). General equilibrium effects of cash transfers: experimental evidence from Kenya (No. w26600). National Bureau of Economic Research.

Egger, D., Miguel, E., Warren, S. S., Shenoy, A., Collins, E., Karlan, D., … & Vernot, C. (2021). Falling living standards during the COVID-19 crisis: Quantitative evidence from nine developing countries. Science advances, 7(6), eabe0997.

Evans, D. K., & Popova, A. (2014). Cash transfers and temptation goods: a review of global evidence.

Francese, Maura, and Delphine Prady (2018). Universal basic income: debate and impact assessment. International Monetary Fund, Working Paper No. 18/273.

Gellner, Ernest and John Breuilly. 1983. Nations and Nationalism: New Perspectives on the Past, 1st ed. Ithaca: Cornell University Press.

Gentilini, U. (2018). What lessons for social protection from universal health coverage? World Bank blog, accessed on 25.4.22 at: https://blogs.worldbank.org/developmenttalk/what-lessons-social-protection-universal-health-coverage?cid=SHR_BlogSiteShare_EN_EXT

Gentilini, U., Grosh, M., Rigolini, J., & Yemtsov, R. (Eds.). (2019). Exploring universal basic income: A guide to navigating concepts, evidence, and practices. World Bank Publications.

Gentilini, Ugo, Mohamed Almenfi, Pamela Dale, John Blomquist, Harish Natarajan, Guillermo Galicia, Robert Palacios, and Vyjayanti Desai, “Social Protection and Jobs Responses to COVID-19: A Real-Time Review of Country Measures,” May 2020.

Government of India (2017). Economic Survey 2016-7. Retrieved from: https://www.indiabudget.gov.in/budget2017-2018/es2016-17/echapter.pdf on 10.7.22.

Grimalda G, Tänzer N, (2018). Understanding and fostering social cohesion. T20 Task Force on Global Inequality and Social Cohesion. https://www.g20-insights.org/Understanding and fostering social cohesion/

Grimalda G., Filgueira, F., Fleurbaey, Lo Vuolo, M. R. (2021). Building global citizenship through global basic income and progressive global taxation, Italy T20 Task Force on Social Cohesion and the State. Available: https://www.t20italy.org/2021/09/20/building-global-citizenship-through-a-global-citizen-income-and-progressive-global-taxation/

Grimalda, G., Murtin, F., Pipke, D., Putterman, L., & Sutter, M. (2022). The politicized pandemic: Ideological polarization and the behavioural response to COVID-19. MPI Collective Goods Discussion Paper, (2022/1).

Grimalda, Gianluca, Fernando Filgueira, Marc Fleurbaey, Rubén Lo Vuolo (2020). Building global citizenship through global basic income and progressive global taxation, Policy brief presented to T20 Saudi Arabia. Available at: https://www.global-solutions-initiative.org/wp-content/uploads/g20-insights-uploads/2020/11/T20_TF4_PB6.pdf

Grimalda, G. (2022). Establishing a Global Citizen Fund from Revenues of Global Taxation, Think7 Task Force on Social Cohesion, economic transformation and open societies

Hanna, R., & Olken, B. A. (2018). Universal basic incomes versus targeted transfers: Anti-poverty programs in developing countries. Journal of Economic Perspectives, 32(4), 201-26.

Haushofer, J., & Shapiro, J. (2016). The short-term impact of unconditional cash transfers to the poor: experimental evidence from Kenya. The Quarterly Journal of Economics, 131(4), 1973-2042.

Henry, James S. 2016. “Taxing Tax Havens.” Foreign Affairs, April 12.

ILO (2020) Social protection responses to the COVID-19 pandemic in developing countries, https://www.ilo.org/wcmsp5/groups/public/—ed_protect/—soc_sec/documents/publication/wcms_744612.pdf

International Labour Office (2022). World Employment and Social Outlook: Trends 2022. Geneva: International Labour Office Press..

International Panel on Climate Change (2022). Climate Change 2022: Impacts, Adaptation and Vulnerability, accessed on 25.4.22 at: https://www.ipcc.ch/report/sixth-assessment-report-working-group-ii/

Jacob, M. et al. (2016). “Carbon Pricing Revenues Could Close Infrastructure Access Gaps”, World Development Vol. 84, pp. 254–265.

Jolliffe, D., & Prydz, E. B. (2021). Societal poverty: A relative and relevant measure. The World Bank Economic Review, 35(1), 180-206.

Klenert, D., Mattauch, L., Combet, E., Edenhofer, O., Hepburn, C., Rafaty, R., & Stern, N. (2018). Making carbon pricing work for citizens. Nature Climate Change, 8(8), 669-677.

Landais, Camille, Emmanuel Saez, Gabriel Zucman (2020), A progressive European wealth tax to fund the European COVID response, https://voxeu.org/article/progressive-european-wealth-tax-fund-european-covid-response

Leinen, Jo, Bummel, Andreas (2018). A World Parliament: Governance and Democracy in the 21st Century, Democracy without Borders.

Mahler, D. G., Yonzan, N., Lakner, C., Aguilar, R. A. C., & Wu, H. (2021). Updated Estimates of the Impact of COVID-19 on Global Poverty: Turning the Corner on the Pandemic in 2021?. World Bank, 24. Accessed on 25.4.22: https://blogs.worldbank.org/opendata/updated-estimates-impact-covid-19-global-poverty-turning-corner-pandemic-2021

Meade, J. E. (1995). Full Employment Regained? (Vol. 61). Cambridge University Press.

OECD (2021a) COVID-19 spending helped to lift foreign aid to an all-time high in 2020. Accessed online on 28.4.21: https://www.oecd.org/dac/financing-sustainable-development/development-finance-data/ODA-2020-detailed-summary.pdf

OECD (2021b), OECD Economic Outlook, Interim Report March 2021, OECD Publishing, Paris, https://doi.org/10.1787/34bfd999-en.

Paine, T. (2000). Paine: Political Writings. Cambridge University Press.

Parijs, P. V. (1997). Real freedom for all: What (if anything) can justify capitalism? OUP Catalogue.

Pavlik, J. B., & Young, A. T. (2021). Sorting out the aid–corruption nexus. Journal of Institutional Economics, 1-17.

Sachs, Jeffrey, Vanessa Fajans-Turner, Taylor Smith, Cara Kennedy-Cuomo, Teresa Parejo, Siamak Sam Loni (2018). Closing the SDG Budget Gap Move Humanity: A Wealth and Justice Initiative of the UN Sustainable Development Solutions Network and Human Act, https://movehumanity.org/wp-content/uploads/2018/10/FINAL-2018-10-18_Closing-the-SDG-Budget-Gap.pdf

Saez, E., & Zucman, G. (2019). Progressive wealth taxation. Brookings Papers on Economic Activity.

Saez, E., & Zucman, G. (2021). A Wealth Tax on Corporations’ Stock. Economic Policy. Presented at the 73rd Economic Policy Panel Meeting. Accessed on 30.4.21 at: https://www.economic-policy.org/wp-content/uploads/2021/04/9103_A-Wealth-Tax-on-Corporations-Stock.pdf

Schwerhoff G, Dao Nguyen T, Edenhofer O, Grimalda G, Jakob M, Klenert D, Siegmeier J (2017). Policy options for a socially balanced climate policy. G20 Insights. T20 Task Force on Global Inequality and Social Cohesion.

Shamshad, A., Volz, U., Kramer, M., Griffith-Jones, S. (2021). The G20’s Missed Opportunity, Project Syndicate, accessed at: https://www.project-syndicate.org/commentary/g20-debt-framework-must-go-further-by-shamshad-akhtar-2-et-al-2021-04

Steiner, Hillel, 1994, An Essay on Rights, Oxford: Blackwell.

Straubhaar, T. (2018). Universal Basic Income – New Answer to New Questions for the German Welfare State in the 21st Century. CesIfo Forum, 19 (3).

Suri, T., & Jack, W. (2016). The long-run poverty and gender impacts of mobile money. Science, 354(6317), 1288-1292.

Svensson, J. (2000). Foreign aid and rent-seeking. Journal of international economics, 51(2), 437-461.

Tondani, D. (2009). Universal basic income and negative income tax: Two different ways of thinking redistribution. The Journal of Socio-Economics, 38(2), 246-255.

Tørsløv, T. R., Wier, L. S., & Zucman, G. (2018). The missing profits of nations (No. w24701). National Bureau of Economic Research.

United Nations (2020). Financing for Development in the Era of COVID-19 and Beyond Menu of Options for the Consideration of Heads of State and Government. Accessed on 30.4.21 at: https://www.un.org/sites/un2.un.org/files/financing_for_development_covid19_part_ii_hosg.pdf

Van Parijs, P., & Vanderborght, Y. (2015). Basic income in a globalized economy. Inclusive Growth, Development and Welfare Policy: A Critical Assessment, 229-48.

World Bank (2020) Poverty Overview. https://www.worldbank.org/en/topic/poverty/overview#1

WVS time-series (1981-2020): Inglehart, R., Haerpfer, C., Moreno, A., Welzel, C., Kizilova, K., Diez-Medrano J., M. Lagos, P. Norris, E. Ponarin & B. Puranen et al. (eds.). 2020. World Values Survey: All Rounds – Country-Pooled Datafile. Madrid, Spain & Vienna, Austria: JD Systems Institute & WVSA Secretariat [Version: https://www.worldvaluessurvey.org/WVSDocumentationWVL.jsp].

WVS wave 7 (2017-2020): Haerpfer, C., Inglehart, R., Moreno, A., Welzel, C., Kizilova, K., Diez-Medrano J., M. Lagos, P. Norris, E. Ponarin & B. Puranen et al. (eds.). 2020. World Values Survey: Round Seven – Country-Pooled Datafile. Madrid, Spain & Vienna, Austria: JD Systems Institute & WVSA Secretariat. doi.org/10.14281/18241.1

Zucman, Gabriel. 2017. “How Corporations and the Wealthy Evade Taxes.” New York Times, November 10.

Appendix

The G20 has repeatedly expressed its commitment to implementing global policies based on inclusiveness, consistent with the “no one left behind” principle (see points 22 and 24 of the Riyadh G20 final summit communiqué; points 1, 2 and 9 of the G20 Rome Leaders’ Declaration; and the call for safety nets in developing countries in the final T20 Italy communique, p.16). The institution of a GCI, therefore, appears in line with such commitments. The process to establish a GCI may be articulated in the following phases:

- Building consensus – at the political, social and economic level. We recommend the G20 to formally and explicitly express support for the institution of a GCI. The G20 could then invite the UN to create a special Convention for Global Citizenship to administer the programme. Various civil society movements have also advocated directly for the institution of a GCI (e.g., the Global Basic Income Foundation, the World Basic Income organization), or have campaigned for the implementation of global taxation, or to further environmental preservation and sustainability. We argue that the GCI could be set as a common goal for these movements, so that the support of a GCI gain momentum in the social and political domain.

- Establish the GCI within a “club” of countries. We envisage a set of countries, including those forming the G20, forming a “coalition of the willing”, under the aegis of the UN, to support and implement the programme. Such a coalition would agree to:

(a) implement international forms of taxation in at least one of the three domains illustrated in sections 3 and 4;

(b) transfer the relative revenues to the Convention for Global Citizenship.

(c) Assist the Convention in the implementation of the GCI in their jurisdiction.

- Extending the club. After the implementation of the GCI in the club, we envisage its extension to a broader – potentially universal – set of countries. For developed countries who did not subscribe to the GCI in the first place, the major direct incentive would be to comply with their voters’ demand to have the GCI established. The willingness to hold a positive reputation in the global arena might be sufficient for this purpose. Additional incentives may also be considered – such as the possibility of subscribing preferential trade agreements with the countries participating in the GCI. For developing countries, the obvious incentive would be to receive the GCI.

Figure 4: Trust in government by country

Note: The graph reports the percentage of respondents who answered ‘ A great deal’ or ‘Quite a lot’ when asked how much confidence they have in the government in their nation’s capital.

Source: World Value Survey (WVS time-series (1981-2020))

Figure 5: Trust in IMF and World Bank

Note: The graph reports the percentage of respondents who answered ‘ A great deal’ or ‘Quite a lot’ when asked how much confidence they have in the International Monetary Fund (IMF) and the World Bank (WB).

Source: World Value Survey (WVS wave 7, 2017-2020)

Figure 6: Revenues from recurrent taxes on net wealth (as percentage of GDP)

Source: OECD Global Revenue Statistics Data Set

Figure 7: Polls of support of wealth tax

Sources: The graph combines surveys conducted from different opinion pools, therefore answers are not strictly comparable. In particular the question asked in Spain was “People who own more than 8 million euros should pay an additional and temporary tax of 1% to fund recovery from COVID-19. (Agree) was commissioned by “Millionaires for Humanity” and commented by Oxfam (see https://www.oxfamintermon.org/es/nota-de-prensa/6-de-10-personas-a-favor-impuesto-ricos-financiar-recuperacion-covid-19/). The question asked in the US was “The very rich should contribute an extra share of their total wealth each year to support public program (Agree)”. The poll was run by Ipsos poll | Reuters (https://www.reuters.com/article/us-usa-election-inequality-poll-idUSKBN1Z9141/). The questions asked in Bolivia, Mexico, Ecuador, and Argentina was “Would the public support the tax on large fortunes? (Agree) and was run by CELAG (www.celag.org/encuestas-celag-america-latina-en-tiempos-de-pandemia/). The question asked in France was “The restoration of the Wealth Tax (ISF) is an effective measure to finance economic recovery. (Agree)” (see https: //elabe.fr/les-francais-prevoient-une-crise-economique/). The question asked in Canada was “Do you favor the idea of a 1% wealth tax on fortunes of $20 million or more? (Agree) (see: https: //www.huffingtonpost.ca/entry/wealth-tax-canada-poll_ca_5fb7ec50c5b625a2ae66dbda)