Although governments could protect against the economic devastation of future pandemics by requiring businesses to insure against pandemic-related risks, insurers do not currently offer that insurance. Even given sufficient actuarial data to set underwriting standards and rate tables, insurers are concerned that they lack sufficient capacity, as an industry, to cover pandemic-related risks, which are likely to occur worldwide and to be highly correlated. This Policy Brief examines how risk securitization could help insure those risks by utilizing the “deep pockets” of the global capital markets, which have a far greater risk-absorbing capacity than the global insurance markets.

1 This Policy Brief is based on and more fully developed in the author’s forthcoming article, “Insuring the ‘Uninsurable’: Catastrophe Bonds, Pandemics, and Risk Securitization”, Washington University Law Review, vol. 99, no. 3, 2022, also available at https://ssrn.com/abstract=3712534. The author is also co-authoring a related but more finance-focused article, “Risk Securitization and Insurance”, with Lori Medders, the Joseph F. Freeman Distinguished Professor of Insurance at Appalachian State University.

Challenge

Insurance is the tried-and-true strategy for protecting against infrequent but potentially devastating losses. In theory, governments could protect against the potential economic devastation of future pandemics by requiring businesses to insure against pandemic-related risks. In practice, though, insurers do not currently offer pandemic insurance. Although there appear to be sufficient statistical data to reliably set underwriting standards, 2 insurers fear their industry does not “have the capacity to [provide] coverage”. 3 Because a pandemic by definition is worldwide, the obligation of insurers to make payments under pandemic insurance would likely be highly correlated, creating losses that would overwhelm the insurance markets. Pandemics therefore are in the class of risks that are deemed “uninsurable,” at least by private markets. The challenge is to try to find an economically viable way to insure against pandemic-related risks.

Proposal

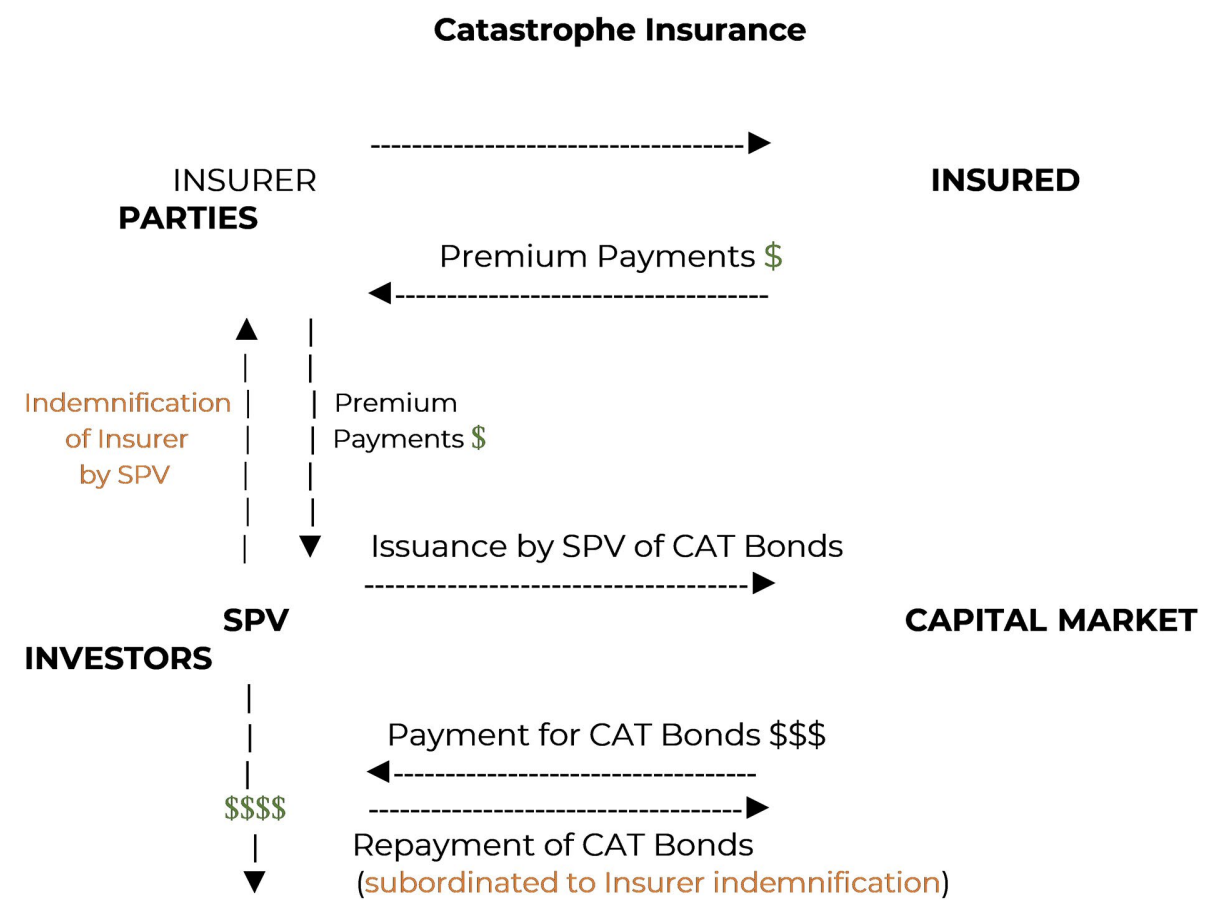

Risk securitization is a relatively recent and innovative private sector means of insuring certain otherwise “uninsurable” risks. Originally developed to respond to certain natural disasters including hurricanes and earthquakes, risk securitization has been used to hedge catastrophic risks that insurance and reinsurance markets may be incapable or unwilling to bear alone by allocating those risks to sophisticated global investors who choose to purchase catastrophe (“CAT”) bonds.

Schematically, a risk-securitization transaction would have the following representative elements.

CAT bonds should provide investors with a diversified return because natural catastrophes occur randomly and thus are not correlated with standard economic risks. That certainly is true for hurricanes, earthquakes, and other natural disasters that occur within a specific geographical region and within a specific period of time.

Like other natural disasters, pandemics occur randomly; they certainly are not caused, for example, by stock-market declines. Therefore, if there were no pandemic, there would be no correlation during the normal life of CAT bonds between their value and financial sector conditions. If there were a pandemic, there could well be a correlation.4 However, CAT investors explicitly bargain to take that risk: they agree to subordinate their right to repayment of the CAT bonds to the indemnification rights of pandemic insurers. Rating agency Standard & Poor’s even observes that the “COVID-19 pandemic has showcased the value of publicly traded CAT bonds to investors, offering a liquid asset class that [is] not correlated with the current volatile financial markets”.5

Precedents. Although there are numerous risk-securitization deals that provide hurricane and earthquake insurance, the only risk-securitization transaction that provides pandemic insurance is the Pandemic Emergency Financing Facility (“PEF”), arranged by the World Bank in 2017.6 The PEF was designed to help fund developing countries facing the risk of a pandemic. The thenWorld Bank Group President announced that the PEF created an entirely new market for pandemic risk insurance.7 Indeed, investor demand for the CAT bonds was strong, evidenced by the bond issue being oversubscribed by 200%.8 However, because the premiums for the PEF insurance were funded by donations, principally from Germany and Japan,9 it was not an arm’s length commercial project and thus it was not a valid market test.

Legal challenges. Many of the legal challenges to a successful pandemic risk-securitization transaction parallel the challenges of structuring traditional securitization transactions, and others involve issues of first impression. The latter include whether the SPV’s indemnification of the insurer, which resembles reinsurance, should require the SPV to be regulated as a reinsurer; whether requiring businesses to purchase pandemic insurance would raise constitutional or other legal challenges; and how the relative priority of any public-private risk sharing should be allocated. The article on which this Policy Brief is based analyzes these challenges in detail and explains how to resolve them.10

Economic challenges. The economic challenges center on developing a large enough market for CAT bonds to enable risk securitization to fund the level of pandemic insurance that businesses should be required to purchase.11

The market for CAT bonds is huge. US$ 9.1 billion of new CAT bonds were issued in 2018, and US$ 10.3 billion (a record high) were issued in 2017.12 Those numbers are small, however, compared to government bailout programs; the US government’s COVID-19 bailout program, for example, has been in the trillions. Developing a large enough market for CAT bonds to fund pandemic insurance will almost certainly require governments to purchase a significant amount of those bonds. How should that amount be calculated?

While pandemic insurance might be required to cover the full amount of a pandemic’s impact, the more critical and, given the scale of trying to cover a pandemic’s full impact, more pragmatic level would appear to be the amount of liquidity needed to help firms survive during a pandemic. That amount will depend in large part on the length of the pandemic and its impact on the ability of firms to continue operating during its continuance. As COVID-19 has shown, it is difficult ex ante to predict the length of a pandemic. Also, the impact on a firm’s ability to continue operating during a pandemic depends not only on the severity of the pandemic but also on the nature of the firm and applicable government public-safety measures.

Given these and other potentially indeterminate variables, this Policy Brief does not attempt to calculate the amount of liquidity that pandemic insurance should be required to cover. Rather, it looks in the first instance to pandemic insurance coverage numbers that others have proposed. The most notable example is the US$ 1.150 trillion program of pandemic business interruption insurance proposed by Chubb,13 the world’s largest publicly traded property-and-casualty insurance company.14 The discussion below uses that number, without necessarily implying it is correct.

Assuming that businesses should be required to purchase at least US$ 1.150 trillion of pandemic insurance, that same order of magnitude of CAT bonds would need to be issued to indemnify the providers of that insurance. The portion of those bonds that could be sold to capital market investors will depend, in part, on the credit rating of, and the interest rate payable on, those bonds. That, in turn, will depend on whether investors take a first-loss, second-loss, or pari passu position with respect to other bondholders, including the government. The interest rate will also depend on the premiums that businesses pay to insurers for the pandemic insurance, and thus the premiums that insurers pay to the SPVs for their indemnifications.

Given that range of variables, this Policy Brief does not purport to estimate the portion of those US$ 1.150 trillion of CAT bonds that capital market investors would purchase. In principle, such investors could purchase a significant portion. After all, the bond markets are estimated at more than ninety times that amount roughly US$ 106 trillion.15 And, even if capital market investors fail to purchase a significant portion of the contemplated CAT bonds, any portion they purchase would contribute to reducing the governments’ share of risk in controlling pandemic-related harm.

Assuming that governments purchase the shortfall between the amount of CAT bonds that would need to be issued to indemnify the insurers and the amount of those bonds that could be sold to capital market investors, how should their proportion of the risk be shared? For example, should a government’s priority in its purchased CAT bonds be pari passu with, or senior or subordinated to, the priority of CAT bonds purchased by capital market investors? The article on which this Policy Brief is based analyzes government risk sharing in detail and proposes analogous risk sharing precedents.16

As an alternative to purchasing CAT bonds to make up the capital market investment shortfall, governments might consider guaranteeing the CAT bonds to the extent necessary to motivate capital market investors to purchase all of the bonds, thereby obviating a shortfall.

A partial guarantee for example, covering only a set percentage (such as the first 10%) of losses on each bond might be sufficient to provide that motivation.17 Government risk sharing through a guarantee might be more politically acceptable because it would not require an initial outflow of funds. A guarantee might also be more politically acceptable because guarantors are influenced by “abstraction bias”, a type of cognitive bias. Unlike investors, they do not actually transfer their property at the time they make a guarantee. This can cause them to view their risk-taking more abstractly and to underestimate the risk, even after allowing for the fact that payment on a guarantee is a contingent obligation.18 Furthermore, there is a significant precedent for governments to offer guarantees in order to facilitate socially important projects.19

Proposal. This Policy Brief proposes, as a first step, a scaled-back pilot project that provides limited pandemic risk coverage as a real-world test of the risk-securitization concept. The World Bank’s PEF facility was itself a pilot project, although not a valid test20, to provide limited pandemic insurance in developing countries. The G20 might, for example, ask the Financial Stability Board, the Bank for International Settlements, the International Monetary Fund or even the World Bank, which may well have experienced people who will have learned from its first attempt to take the lead in implementing that real-world test. One or more G20 nations also might be interested in engaging in that test.

To implement the test, a nation could require a relatively limited number of firms at the outset, perhaps just global systemically important businesses to insure against pandemic-related risks. As this Policy Brief discusses, the amount of that insurance should be the amount of liquidity needed to help those firms survive during a pandemic, which will depend on various factors.21 Once that amount is determined, the same order of magnitude of CAT bonds would need to be issued to indemnify the providers of that insurance.

The providers of that insurance could be one or more insurers or reinsurers or even a government/multinational-sponsored catastrophe fund. Such (an) insurance provider(s) would set up a special purpose vehicle (SPV) to issue the CAT bonds. Although capital market investors might purchase the entire CAT-bond issuance, some government or multinational body should be prepared either to purchase any shortfall or to guarantee the CAT bonds to the extent necessary to motivate capital market investors to purchase all of those bonds.22

The theoretical import of this Policy Brief’s analysis goes beyond pandemic insurance to insuring against terrorism, riots, and other risks for which actuarial data are available but which exceed the capacity of private insurers. Investors should want to purchase CAT bonds covering these risks because they are not ordinarily correlated with standard economic risks.23

NOTES

1 This Policy Brief is based on and more fully developed in the author’s forthcoming article, “Insuring the ‘Uninsurable’: Catastrophe Bonds, Pandemics, and Risk Securitization”, Washington University Law Review, vol. 99, no. 3, 2022, also available at https://ssrn.com/abstract=3712534. The author is also co-authoring a related but more finance-focused article, “Risk Securitization and Insurance”, with Lori Medders, the Joseph F. Freeman Distinguished Professor of Insurance at Appalachian State University.

2 Risk-assessment firms such as Metabiota, Air Worldwide, Milliman, and RMS claim to “combine leading epidemiological, statistical and actuarial techniques to quantify [global] epidemic risks”. See https://metabiota.com/product. See also https://www.airworldwide.com/siteassets/Publications/Brochures/documents/AIR-Pandemic-Model; https://us.milliman.com/en/health/coronavirus-covid-19; and https://www.rms.com/blog/2020/02/04/the-coronavirus-outbreak-part-one-modeling-spotting.

3 E. Weinberger, “Chubb Pandemic Coverage Plan Exposes Industry Split”, Bloomberg Law, 14 July 2020, https://news.bloomberglaw.com/insurance/chubb-pandemic-coverage-planexposes-industry-split.

4 It should be noted that pandemic risk, unlike normal hurricane and earthquake risk, is also globally correlated. Presumably, PCAT investors would price in that correlated risk.

5 “S&P Global, Credit FAQ: In a Correlated Market, Catastrophe Bonds Stand Out”, 18 May 2020, https://www.spglobal.com/ratings/en/research/articles/200518-credit-faq-in-acorrelated-market-catastrophe-bonds-stand-out-11491720

6 See World Bank Press Release, https://www.worldbank.org/en/news/pressrelease/2017/06/28/world-bank-launches-first-ever-pandemic-bonds-to-support-500million-pandemic-emergency-financing-facility.

7 Id.

8 Id.

9 World Bank, “Pandemic Emergency Financing Facility (PEF): Operational Brief for Eligible Countrie”s, 3 February 2019, https://pubdocs.worldbank.org/en/134541557247094502/PEFOperational-Brief-Feb2019.pdf

10 See “Insuring the ‘Uninsurable’”, supra note 1.

11 Another challenge, which has been largely resolved, is how to assure that pandemic insurance can make timely payments given that a pandemic is a disaster in progress that

can come in successive waves through an extended period. The answer is to structure it as “parametric” insurance, which does not indemnify the actual loss but, instead, pays a preset amount upon the occurrence of the triggering event which is usually a catastrophic natural event. See, e.g., D. Brettler and T. Gosnear, “Parametric Insurance Fills Gaps Where Traditional Insurance Falls Short”, Insurance Journal, 9 January 2020, https://www. insurancejournal.com/news/international/2020/01/09/553850.htm

12 Insurance Information Institute, “Facts + Statistics: Catastrophe Bonds”, https://www.iii.org/fact-statistic/facts-statistics-catastrophe-bonds (reporting data from GC Securities, a division of MMC Securities Corp.).

13 Chubb, Pandemic Business Interruption Program Developed by Chubb 3, 8 July 2020.

14 See Chubb, https://www.chubb.com/us-en/about-chubb/

15 SIFMA, https://www.sifma.org/resources/research/research-quarterly-fixed-income-issuance-and-trading-second-quarter-2020/.

16 See “Insuring the ‘Uninsurable’”, supra note 1.

17 Cf. M.J. Rowan, et al., Rating Methodology, Moody’s, 6 August 2006, https://care-men-doza.nd.edu/assets/152347/loss-given-default-rating-methodology.pdf (discussing rating agency assessment of loss severity on corporate bonds).

18 See S.L. Schwarcz, “Regulating Financial Guarantors”, Harvard Business Law Review forthcoming, vol 11, no. 1, 2021 (examining how abstraction bias can distort the assessment of risk).

19 See “Insuring the ‘Uninsurable’”, supra note 1.

20 See supra note 9 and accompanying text.

21 See supra notes 12-14 and accompanying text.

22 See supra notes 15-19 and accompanying text.

23 Although there is a loose correlation insofar as war, terrorism, and riots could cause an economic decline, CAT-bond investors should bargain to take those risks. Distinguishing correlation from causation, the important point for CAT-bond investors is that an economic decline that could impair the value of their traditional investment portfolios would not ordinarily cause terrorism or riots that could impair the value of their CAT-bond investment portfolios.

REFERENCES

Brettler D. and T. Gosnear, “Parametric Insurance Fills Gaps Where Traditional Insurance Falls Short”, Insurance Journal, 9 January 2020 https://www.insurancejournal.com/news/international/2020/01/09/553850.htm

Chubb, Pandemic Business Interruption Program, 8 July 2020, https://www.chubb.com/us-en/about-chubb/pandemic-business-interruption-program.html

Chubb, https://www.chubb.com/us-en/about-chubb/

Insurance Information Institute, “Facts + Statistics: Catastrophe Bonds” https://www.iii.org/fact-statistic/facts-statistics-catastrophe-bonds

Rowan M.J. et al., Rating Methodology, Moody’s, 6 August 2006 https://care-men-doza.nd.edu/assets/152347/loss-given-default-rating-methodology.pdf

S&P Global, “Credit FAQ: In a Correlated Market, Catastrophe Bonds Stand Out”, 18 May 2020 https://www.spglobal.com/ratings/en/research/articles/200518-credit-faq-in-a-correlated-market-catastrophe-bonds-stand-out-11491720

Schwarcz S.L., “Regulating Financial Guarantors”, Harvard Business Law Review, vol. 11, no. 1, 2021, forthcoming

Schwarcz, S.L., “Insuring the ‘Uninsurable’: Catastrophe Bonds, Pandemics, and Risk Securitization”, Washington University Law Review, vol. 99, no. 3, 2022, forthcoming

Securities Industry and Financial Markets Association (SIFMA), https://www.sifma.org/resources/research/research-quarterly-fixed-income-issuance-and-trading-second-quarter-2020/

Weinberger, E., “Chubb Pandemic Coverage Plan Exposes Industry Split”, Bloomberg https://www.chubb.com/us-en/glaw.com/insurance/chubb-pandemic-coverage-plan-exposes-industry-split

World Bank, Press Release, 28 June 2017 https://www.worldbank.org/en/news/press-release/2017/06/28/world-bank-launches-first-ever-pandemic-bonds-to-support-500-million-pandemic-emergency-financing-facility

World Bank, Pandemic Emergency Financing Facility (PEF): Operational Brief for Eligible Countries, February 2019 https://pubdocs.worldbank.org/en/134541557247094502/PEF-Operational-Brief-Feb2019.pdf