Infrastructure investment is indispensable for green and inclusive recovery from the COVID-19 pandemic. However, public funding has been limited due to the use of funds for the immediate needs of COVID-19 recovery, and private investors have also reshaped their investment profile to address the difficult circumstances.

Many enablers for boosting economic growth through infrastructure development have been identified during the pandemic, and government intervention is needed to harness their benefits. Such intervention includes well-designed stimulus packages, innovative financing instruments and improvements in governance. This policy brief will discuss these factors and provide recommendations that policy makers can utilise to accelerate economic growth through infrastructure development.

Challenge

Sustainable and inclusive growth and development in many countries have been on track for a while. However, the coronavirus disease (COVID-19) pandemic poses cumulative challenges for sustaining livelihoods, healthcare systems, economic and social stability, and governance across the globe, nationally and locally. While public funds are limited and public and corporate debt levels are rising significantly, the demand for financial support is rising in multiple sectors, requiring policy makers to make difficult choices to cope with the health crisis and minimise its detrimental economic, social and developmental impacts.

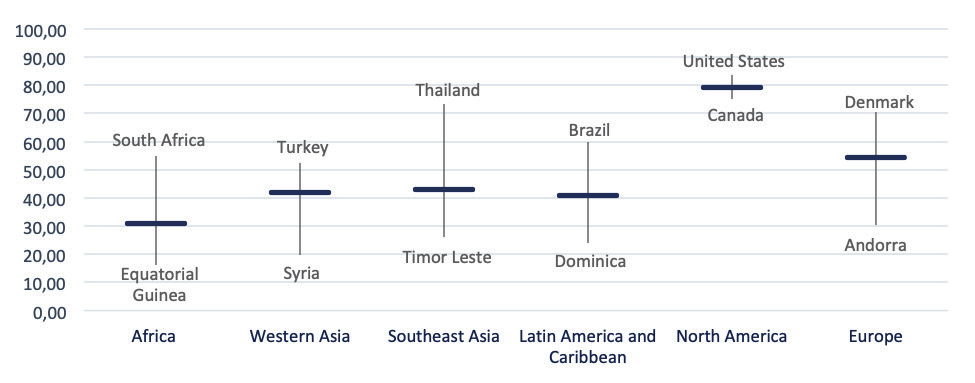

The COVID-19 pandemic has been a game-changer and has fundamentally transformed many aspects, such as doing business and activities. While the same traditional issues of climate change, such as subsidised or government-controlled energy prices,1 and technology will continue to present challenges as well as opportunities, this pandemic is creating greater challenges in our ideas and goals for how development can be sustainable, inclusive and resilient. Building infrastructure is essential to meet those needs. In many regions (e.g., in the Middle East, Africa, Latin America and Southeast Asia), the need for investment in public infrastructure remains high, while fiscal space remains limited. The global pandemic has shown that the existing healthcare infrastructure is lagging and is unprepared to deal with a health emergency (Figure 1).

Figure 1: Global Health Security Index Regional Averages

Note: The regional classification follows the one used by the Global Health Security Index (GHS), while Southeast Asia in the graph includes both Southeastern Asia and Southern Asia. The Global Health Security Index is a project of the Nuclear Threat Initiative and the Johns Hopkins Center for Health Security and was developed with the Economist Intelligence Unit. The average overall GHS Index score is 40.2 out of a possible 100. While high-income countries report an average score of 51.9, the index shows that collectively, international preparedness for epidemics and pandemics remains very weak

Source: Author’s elaboration based on data retrieved from the Global Health Security Index, https://www.ghsindex.org

It is time to reconsider seriously the priority of different types of infrastructure, the respective roles of the public and private sector in financing infrastructure investment and the governance in infrastructure development, for the following reasons.

First, there is a shift in the categories of the infrastructure needs of countries. Conventionally, essential infrastructure for water and sanitation, transportation and electricity has been crucial. The pandemic has made healthcare and telecommunications infrastructure essential. Activities such as agriculture and e-commerce are now equally important for livelihoods. This recognition will remain largely unchanged in the post-COVID-19 era.

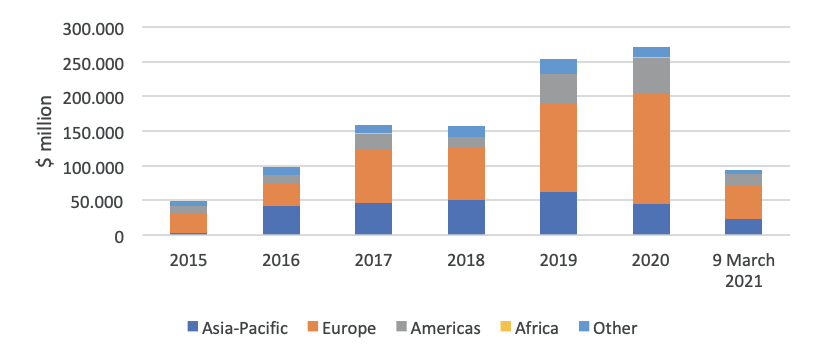

Furthermore, the United Nations (2020) pointed out that, shaken by the COVID-19 pandemic, the world is not on track to achieve the Sustainable Development Goals by 2030. In terms of climate change action, the world is still far from meeting its Paris Agreement target. There has been a rise in climate-related infrastructure projects, such as those for renewable energy. Green bond issuances are growing fast (Figure 2) and are expected to continue to grow in 2021 (Katz 2021). However, this rise is being surpassed by investment in fossil fuels. The situation has been exacerbated by the pandemic, which has led to countries diverting their funding to other sectors in an effort to make a quick recovery from the downturn due to the pandemic.

Figure 2. Green Bond Issuances

Source: BloombergNEF (2020)

Second, in the aftermath of the pandemic, public funds for financing infrastructure will be even more limited due to the enormous amount of public expenditure for the immediate needs of social security and economic recovery. The other sources, together with innovative schemes and mechanisms for financing, have accordingly assumed greater importance.

For years, the public sector has been the main financier for infrastructure with the support of multilateral development organisations. However, the increasingly unsustainable level of public debt has reduced the room for increasing public spending without risking governments’ international credit ratings across the world and lowand middle-income countries in particular. While public-private partnerships (PPPs) have been used for decades, there have been many cases of ineffective implementation and contract renegotiation and cancelation (Jooste and Scott, 2012). Mostly, the challenges come from the lack of bankable projects, market failures, agency failures including the lack of government capacity in designing a project and poor governance, legitimacy issues, and the loss of bargaining power to negotiate user charges or tariffs once a project finishes.

Third, infrastructure development is susceptible to corruption, especially if a project is not carefully designed and planned. For example, infrastructure with PPP financing usually involves many actors, and the role of the government in the scheme is unclear: whether it acts as a regulator, corrects market failure or is an active stakeholder. This composition sometimes causes a project to be characterised as a natural monopoly. Given the urgency of saving lives during the pandemic and maintaining the economy, it is important to accelerate infrastructure development, but hasty decision making and rough-and-ready designing and planning can further breed opportunities for corruption. A lack of transparency and time constraints can exacerbate the situation and lead to inefficiencies and delays in the completion of projects.

Proposal

Beyond the COVID-19 pandemic, infrastructure development is a key factor to ensure global stability through the accessibility of global public goods and connectivity, which should support local resilience. Therefore, this policy brief proposes three sets of solutions:

1.REPRIORITISATION

Governments across the world are now shaping their agendas and adapting to the “new normal”. Massive economic stimuli have been injected into economies for liquidity and stabilisation. According to an International Monetary Fund report (IMF, 2020), fiscal measures related to COVID-19 have reached almost 12 per cent of world GDP. Even though stimulus measures were projected to stabilise economies by boosting consumption and investment, they would result in the rise in public debt which has been made even surer by the declines in tax revenue and surge in social security expenditures during the pandemic. With the scarcity of resources, policy makers need to reconsider which type of stimulus is more effective and has less detrimental effects on the economy, while monitoring very closely whether the funds have been directed efficiently to the provision of public goods. The G20 can facilitate the support in this area, in term of policy options, knowledge management and effective monitoring. The output could be in the form of high-level principles and policy guidance on stimulus recovery package on COVID-19.

Global Infrastructure Hub (GIH, 2021) suggests that infrastructure investment should be included in mediumand long-term stimulus packages to drive economic recovery. It is estimated that the fiscal multipliers of public investment are higher than for other types of public spending. Based on 200 economic studies over 25 years, GIH estimates that the average fiscal multiplier is around 0.8 in 1 year and around 1.5 within 2-5 years. The multiplier is even larger during contractionary periods (around 1.6). Therefore, tunnelling the stimulus to the most urgent infrastructure projects for economic recovery growth is essential. Furthermore, Fernando and McKibbin (2021) predict, based on their cutting-edge macroeconomic model, that among several fiscal policy scenarios, an increase in infrastructure investment gives the most benefit because it increases both production capacity and effective aggregate demand.

While the G20 developed countries have issued their recovery packages, which include innovation, green growth and technological expansion, many developing countries are striving to be resilient by narrowing their fiscal gap through quantitative easing, tapping extra budgetary funds, and increasing revenue through new types of taxes or raising the rate of existing types of tax, such as fuel excise taxes (India) and VAT rate (Saudi Arabia), and imposed digital taxes on foreign firms (Indonesia) (IMF, 2020). Only a few developing countries have revisited their mediumand long-term prioritisation of infrastructure after COVID-19 or have reviewed the effectiveness of the current stimulus to ensure reaching the committed goals. It is timely for international organisations and multilateral development banks to provide guidance for countries on the choice of infrastructure priorities and in designing conducive policy measures.

Extreme behavioural changes in people during the pandemic should also be taken into consideration in infrastructure reprioritisation. While the use of public transport has declined at least in the short term, sharp increases in online shopping (e-commerce) and demand for delivery services have been observed, which causes pressure for countries to provide highspeed broadband connectivity as it is essential for remote working, online education and e-commerce. Furthermore, the emergency also pushes policy makers to prioritise healthcare and emergency services as well as power and water supplies, including sanitation and waste management.

In order to issue an effective infrastructure stimulus, a government should set the agenda and priorities for infrastructure projects. With the behavioural changes of people and changes in the norms of doing business, a government needs to reassess the infrastructure agenda and pipelines. In setting the agenda, governments should take short-, mediumand long-term needs and constraints into consideration.

In resetting the priorities, policy makers should consider and select the infrastructure that can accelerate deliveries in the supply chain, including medical deliveries, ensure there is sufficient budget and commitment to the plan, and ensure the projects will create high-quality jobs, enhance productivity and minimise inefficiencies and corruption.

While there are many types of infrastructure needing to be reprioritised due to the impact of the pandemic, this paper proposes that the following types of infrastructure development be accelerated and considered.

a. Social infrastructure

Even though social infrastructure is identified among the infrastructure needs (ADB, 2017), the COVID-19 pandemic has accelerated the current trend in social changes and brought about a new transformation in society. The output of social infrastructure is mainly services, but to be able to provide public services, governments need economic or physical infrastructure. Unlike electricity and telecommunications, social infrastructure is not built but is based on the staged planning by service providers to prepare for the future growth in demand and contains equipment within capital investment.

Even without COVID-19, Asia should have invested at least around $1.6 trillion-$1.7 trillion per year on social infrastructure. Some adjustments are needed in the investment of social infrastructure, especially for education, healthcare and public housing, due to the pandemic. The pandemic has increased the demand for investment in social infrastructure needs. Asia should invest an additional budget of almost 0.5%-1% of GDP (Hendriyetty, Boden and Takayama, 2021; Dartanto, 2021).

b. Sustainable infrastructure

Limiting global warming within 2.0⁰C above pre-industrial levels, with the greater ambition to limit it further to within 1.5⁰C above pre-industrial levels, is the cornerstone of the Paris Agreement. Sustainable infrastructure plays an important role in reaching this goal. Sustainable infrastructure not only refers to both fixed assets and institutions that enable and promote the greater use of renewable energy, but also greater energy storage, and infrastructure necessary for cleaner transportation, for biodiversity conservation and for the development of circular economy. Many countries are implementing national policies aiming to promote climate change mitigation and adaptation, including fiscal, financial, information and education, institutional support, strategic planning, regulatory and voluntary measures. Policies incentivising investment in sustainable infrastructure should be predictable over a long period of time, and hence require long-term commitments.

Long-term and predictable policies can help to mobilise private investments in sustainable infrastructure (OECD, 2020; World Bank, 2020), which are risky and require high upfront cost. Policies that demonstrate a government’s long-term commitment and are more predictable are more effective in promoting private investments in sustainable infrastructure than policies that do not require long-term government commitments and are less predictable (Azhgaliyeva, Kapsalyamova and Low, 2019). For the same reason feed-in tariffs have proven effective in promoting private investments in renewable energy projects. Other long-term and predictable policy instruments include, for example, subsidised loans and electricity market liberalisation. Such long-term and predictable policies allow renewable energy projects to receive long-term government support, while grants, subsidies and taxes usually do not require a long-term commitment from governments. The costs of such long-term policies can be higher than those of short-term policies, but it does not follow that the longer-term policies are less desirable, because their impact on private investments may be greater. Thus, it is important to differentiate shortand long-term policy support when conduct cost-benefit analysis for planed incentives for attracting private investment in sustainable infrastructure.

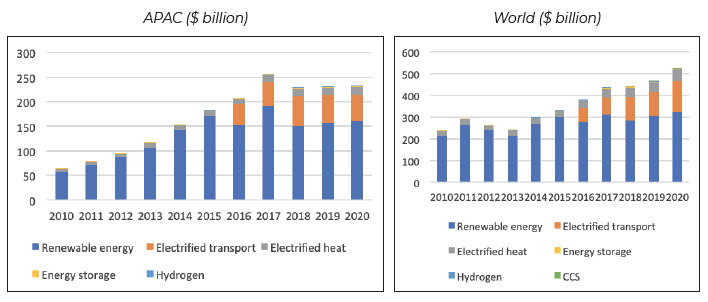

Although investment in energy transition has increased globally, it declined in Asia and the Pacific in recent years as the data in Figure 3 show. This means that Asia and the Pacific need more long-term and predictable policies to promote investments in energy transition. Such policies are more popular in developed countries and less popular in developing countries due to their high costs and the long-term commitment needed. The long-term commitment is still a major challenge for developing economy governments because of volatile government revenues. The situation warrants considerable further efforts to strengthen domestic resource mobilisation, in addition to support from the multilateral development banks.

Figure 3. Investments in Energy Transition Note: CCS = carbon capture and storage

Source: BloombergNEF (2020)

c. Digital infrastructure

COVID-19 has triggered drastic changes and shown that digitalisation and technology are critical for people’s resilience and business continuity. Digital technology (infrastructure) has helped people to connect amid the “social distancing” environment. Almost all aspects require digital connectivity, such as e-commerce, education (distance learning) and even medical services. According to Strusani and Houngbonon (2020), digital infrastructure is a physical infrastructure of connectivity. It includes the installation of cables undersea, underground and above ground; towers, data centres and satellites; wireless communication; and all equipment that can connect the world through the Internet. In regard to stimulus design, policy makers should consider all aspects to ensure that the Internet can be accessed by all. The change in consumer behaviour that COVID-19 has triggered may continue in the long term and expand online commerce even further. If governments fail to supply digital connectivity and services, there will be disruptions in supply chains, higher cost of operating due to organisational changes, and financial distress due to the shutdown of critical suppliers and distributors.

Those three types of infrastructure can be developed independently or integrated with each other depending on the needs and demand in the country. There are many examples of projects that combine digital and sustainable infrastructure, such as a service-oriented environment with cloud service, to facilitate green supply chains and promoting energy efficiency as well as healthcare systems and facilities (Hustada and Olsen, 2020).

2. NEW FINANCING MODELS

The pandemic forced the private sector to reduce their participation in infrastructure investment in light of rising debt levels and risks and to reduce their risk profile. Therefore, conventional financing models are possibly becoming less attractive for private investors when considering such long-term investments. New models, such as PPP financing schemes, infrastructure bonds, green bonds and revenue-based loans should be considered.

This policy brief therefore makes the following proposals.

a. New generation of PPP project-bond financing

Subsequent to the 2008 global financial crisis, stricter regulations on banks, including higher capital requirements, have not only reduced banks’ appetite to fund infrastructure projects by traditional debt but also reduced the internal rates of return for project developers, particularly in lower middle-income countries (LMICs). Since then, accessing institutional bond markets has become a viable alternative for funding infrastructure projects via dedicated project bonds2 that aim at reducing the cost of funding. However, because of the inherent high risk attached to infrastructure construction and performance, the market has remained small and largely underdeveloped, particularly in LMICs.

Ayadi (2021) proposes a PPP financing framework in the form of a PPP bond that decouples country and execution/performance risks. The bond structure relies on the underlying government assets (e.g., guarantees from governments and co-guarantees from international development institutions) to pay for the cost of the project and/or the cash flow that it could generate. The underlying debt, of whichever form, must be disclosed in a globally recognised registry, as argued in Ayadi and Avgouleas (2020), and the issuer must be fully independent from the government and the developer. The execution/performance risks, which are externalised from the bond structure, are under the responsibility of the project’s developers and associated construction companies. When the bond is issued and proceeds are raised for a specific project and escrowed in a project account for the benefit of the project, the use funds will be subjected to strict regulation (e.g., fund management agreement) and monitoring via a reputable independent audit firm that will be required under the prospectus of the bond to disclose periodically the progress of the projects to the investors and the co-guarantors. In case of non-performance of the executer, following two consecutive quarterly meetings with the appointed officials responsible to monitor the project progress on behalf of the government and the auditors, a predetermined prompt corrective action is implemented. In case of performance, the executor will be paid a portion of the margin in deferred consideration. This financing structure has the following benefits:1) it enhances predictability for the investors and reduces the reputational risks;2) it reduces the corruption and operational risks; and 3) it increases the certainty of execution.

b. Bonds for infrastructure investment

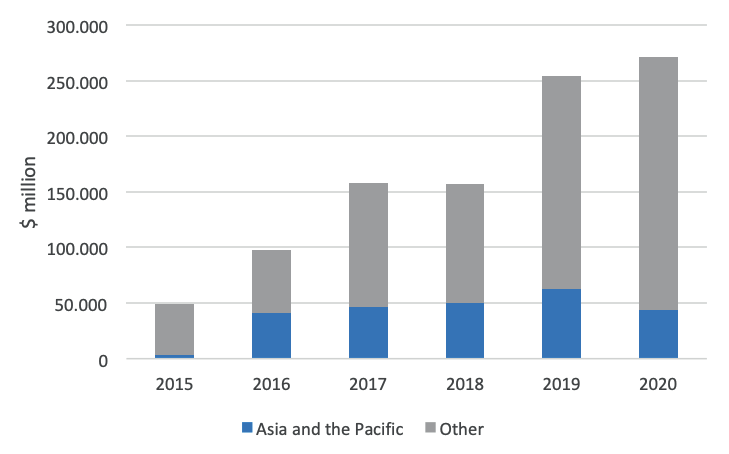

Green bonds. Green bonds are debt securities whose proceeds are used to fund environmental projects, including for climate change mitigation and adaptation. The financing of sustainable infrastructure using green bonds is growing fast. Annual issuances of green bonds around the world have grown rapidly, from $3.4 billion in 2012 to $271 billion in 2020. One-fifth of green bonds are issued in Asia and the Pacific (Figure 4). Therefore, unlike conventional bonds, green bonds finance projects with clear environmental benefits.

Figure 4. Green Bond Issuances in Asia and the Pacific and the Rest of the World ROW = rest of the world

Source: BloombergNEF (2020)

Two distinct challenges that have been found in the literature for issuers are the limited credit absorption capacity and the costs of meeting the green bond requirements. Third-party assurance providers are responsible for verifying the “green bond” status and monitoring the use of bond proceeds by issuers. The costs of obtaining a third-party opinion could range from $10,000 to $100,000. Policies that reduce the cost of labelling bonds “green” by covering the cost of the external review, such as green bond grants, have shown to be effective in promoting green bond issuances and listings (Azhgaliyeva, Kapoor and Liu, 2020).

However, green bonds do not necessarily bring environmental benefits. This is because the proceeds of green bonds can be used to fund “brown” projects, without clear environmental benefits, unless they are excluded from the green bond taxonomy (such as in EU TEGSF, 2020). Thus, green bond taxonomies should not only contain eligible projects but should also contain an exclusion list, at least covering fossil fuels, to eliminate brown projects. This is especially crucial for energy storage and transportation. Appropriate policy design is crucial for achieving a policy’s stipulated objectives, and these objectives must, therefore, be clearly defined before designing a green bond policy. National green bond taxonomies should be carefully developed to avoid the use of green bond proceeds for financing fossil fuel projects.

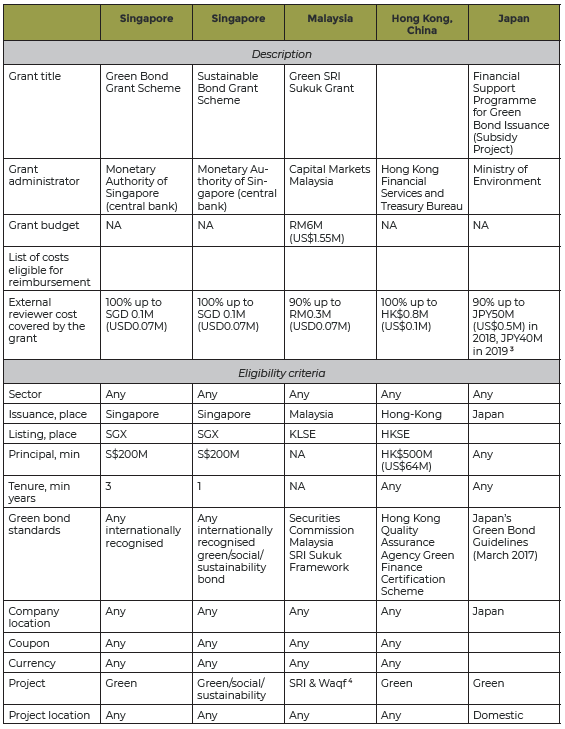

The “green” label is applicable not only to generic bonds but also to sukuk (Islamic bonds). In fact, green sukuk have been issued in major sukuk-issuing countries, i.e., Indonesia, the United Arab Emirates, Malaysia and Saudi Arabia. Also, policies incentivising green bonds, such as green bond grants and tax incentives as seen in Table 1 in the Appendix, have been successfully used to incentivise green sukuk.

Revenue-based loans. Revenue-based loans for infrastructure have been proposed to address concerns that infrastructure development requires enormous public funding that can create imbalances in government budgets. Many countries are exploring alternative solutions for infrastructure financing without putting further pressure on their budgets. One of the ideas is to create an investment instrument where the compensation is based on the performance of the infrastructure project considering the significant spillover effects created by it (Hyun, Nishizawa and Yoshino, 2008; Yoshino and Hendriyetty, 2021). However, there are some concerns for the lending instrument based on the infrastructure performance, such as the investment structure, risk exposure, term and the liability of issuers, even though the payment is based on performance (PWC, 2017). The recommendations for this mechanism are varied, such as establishing a trust or special purpose vehicle with independent and professional arrangement for asset securitisation, and the perpetual or extended maturity of the instrument. As the return on the investment will be based on the performance of the infrastructure (in this case, the spillover effects of the infrastructure), policy makers and construction companies should create conducive policies to encourage business in the areas adjacent to infrastructure projects. In such areas, small and medium-sized enterprises (SMEs) and startup businesses should be encouraged to start or expand operation (Yoshino, Hendriyetty and Lakhia, 2019). The Hometown Investment Trust Fund (HTITs) concept, which has been applied in Japan in the past, should be considered to help SMEs and startups to get financing and build their credit reputation (Yoshino, Hendriyetty and Taghizadeh-Hesary, 2020). The concept is similar to crowdfunding in many countries. Unlike common types of crowdfunding that are mostly in the informal sector, HTITs are supervised and registered as Type II Financial Instruments Business Operators under the Japan Financial Service Authority (Yoshino, Hendriyetty and Sioson, 2020).

3. GOVERNANCE AND TRANSPARENCY

PPP bonds to enforce transparency. As documented by Ayadi and Avgouleas (2020), there are fundamental weaknesses in the institutional and governance frameworks in debt issuance and recording by government entities in LMICs. These include, but are not restricted to, fragmented responsibilities and uncoordinated institutional arrangements, limited mandates where the legal framework for the coverage of public debt is narrow, and weak auditing capacity and disclosure to the market participants. Overall, the gaps stem from debt recording, monitoring, audit capacity and systematic links with the execution and performance of the infrastructure projects. In their paper, the authors advocated for increasing debt transparency by recording old and new debt issuances in a globally recognised, traceable repository powered by distributed ledger technology and systematically monitoring the debt proceeds to minimise the incidence of corruption and enhance accountability to taxpayers and citizens. Ayadi (forthcoming) emphasises that for infrastructure development using PPP bonds, transparency must be enforced via the regular (monthly) monitoring of the proceeds used to fund the projects by reputable third-party audit firms, which must be mandated to disclose the relevant information to the market under strict clauses in the prospectus. Such disclosure and monitoring will enhance the information available to the investors and the guarantors on the use of funds, and will ultimately reduce the financial and execution risks of the project.

Land trust for infrastructure governance. The highest risk for corruption in infrastructure development is in the procurement stage. Land procurement and land acquisition are delicate and complicated processes, especially for highway infrastructure. These issues sometimes cause stops or delays in the construction stage of infrastructure development, which can lead to substantial losses for investors and unpredicted changes in government plans.

Land mafias prevail in developing countries. They act as informal middlemen between the government/construction companies and the landowners. There is no written legal arrangement for them assigned by landowners. However, they ask extraordinarily high prices from construction companies or governments and report substantially lower price to landowners. They receive huge amounts of money as middlemen and leave the landowners feeling dissatisfied with the government for underestimating their land value.

A land trust is a legal and independent institution representing the landowners to the government and construction companies. As a legal institution, a land trust should fulfil the requirements of good corporate governance and promote transparency. With the assistance of the fast development of technology, a land trust can create a platform that can be accessed by the public for information on land prices in an area. This will reduce the potential for land mafias.

Moreover, the main objective of the land trust is to bridge the relationship between the government and landowners in cases where the government rents land for public infrastructure. For this function, the land trust institution will conduct an independent assessment of the value of the rent and collect it for the landowners. The rent payment can be calculated using the spillover effects of the tax revenue. In this scenario, landowners can retain the benefit of their land and enjoy the spillover effects created by the infrastructure built on it (Yoshino and Hendriyetty, 2021).

The main obstacle for countries to implement this concept that the regulation framework for land ownership, especially in developing countries, is unfavourable. For example, regulation cannot cover the long tenure of the contract for infrastructure, or create the independence and the professionality of the trust or institution to manage the rent. Nonetheless, with rapid urbanisation in many countries, the G20 and international organisations should consider this concept as an option for countries seeking to build smart and modern cities. The G20 can mandate multilateral development banks to develop guidance on the appropriate framework, and assist countries with a programme to help establish the concept.

CONCLUSION

This policy brief explained the challenges governments are facing for infrastructure investment during this economic contraction. The major challenges come from the slight changes in infrastructure priorities, financing gaps and governance. To address these challenges, this brief provides three approaches. Governments should: 1) include infrastructure investment in stimulus packages and rearrange the priorities of infrastructure based on the urgency of economic recovery; 2) increase private-sector participation in infrastructure by exploring many attractive financing instruments to fit investors’ appetites; and 3) enhance governance in infrastructure development by improving transparency and strengthening the monitoring process for accountability. To implement effective policies, governments need to consider their country’s characteristics and identify which areas are critical factors for economic recovery.

APPENDIX

Table 1. Comparison of Green Bond Grants

Note: NA not available; SRI Sustainable and Responsible Investment; SGX Singapore Stock Exchange;

KLSE Kuala Lumpur Stock Exchange; HKSE Hong Kong Stock Exchange

Source: Authors’ own based on information from official websites of the Government of the Hong Kong Special

Administrative Region, Monetary Authority of Singapore and Green Bond Issuance Promotion Platform (Japan)

Source: Azhgaliyeva, Kapoor and Liu (2020)

NOTES

1 Developing Asian economies spent about 2.5 per cent of GDP on average on subsidising oil, gas and coal in 2012 (ADB, 2016a). Subsidised energy prices not only consume public resources that could be devoted to financing the low-carbon transition (ADB, 2016b), and disincentivise investments in renewable energy production and efficient energy use; but also benefit the poor the least, while richer populations benefit the most due to their higher energy consumption (ADB, 2016a).

2 In a project bond, the issuer raises funds to finance a single indivisible large-scale capital investment project whose cash flows are the sole source to meet financial obligations and to provide returns to investors. In the case of a typical corporate borrower, the security is typically issued against the firm’s general credit, and the underlying assets consist of multiple sources of cash flows.

3 The upper limit of subsidies gradually decreases each fiscal year.

4 “Islamic endowment a voluntary and irrevocable endowment of Shariah-compliant assets for Shariah-compliant purposes” (Securities Commission Malaysia, 2019).

REFERENCES

Asian Development Bank (2016a), Fossil Fuel Subsidies in Asia: Trends, Impacts, and Reforms: Integrative Report, Mandaluyong City, Philippines, Asian Development Bank, https://www.adb.org/sites/default/files/publication/182255/fossil-fuel-subsidies-asia.pdf

Asian Development Bank (2016b), Asian Development Outlook 2016 Update. Meeting the Low-Carbon Growth Challenge, Mandaluyong City, Philippines, Asian Development Bank, https://www.adb.org/sites/default/files/publication/197141/ado2016-update.pdf

Asian Development Bank (ADB). 2017. Meeting Asia’s Infrastructure Needs. Manila

Ayadi, R. (2021), “Toward a New PPP Financing Framework of Infrastructure Development in Africa”, in EMEA Policy Papers

Ayadi, R.; and E. Avgouleas (2020), “Time to Implement a Techdriven Sovereign Debt Transparency Initiative: Concept, Design and Policy Actions”, in T20 Saudi Arabia Policy Brief: TF8 International Financial Architecture

Azhgaliyeva, D.; A. Kapoor; and Y. Liu (2020), “Green Bonds for Financing Renewable Energy and Energy Efficiency in South-East Asia: A Review of Policies”, in Journal of Sustainable Finance & Investment, Vol. 10, No. 2

Azhgaliyeva, D.; Z. Kapsalyamova; and L. Low (2019), “Implications of Fiscal and Financial Policies on Unlocking Green Finance and Green Investment”, in J. D. Sachs, W. T. Woo, N. Yoshino and F. Taghizadeh-Hesary, Handbook of Green Finance: Energy Security and Sustainable Development, Tokyo and Singapore, ADBI, Springer, pp. 427-457

BloombergNEF (2020), New Energy Outlook 2020, https://about.bnef.com/new-energy-outlook/

Dartanto, T. (2021), “Impact of COVID-19 on Social Infrastructure in Asia”, Conference presentation, 18-19 February, in Indonesia-Japan Policy Research Forum for Asia: Infrastructure, Technology and Finance for Sustainable and Inclusive Development in Asia beyond the Pandemic, p. 19

EU TEGSF (2020), Taxonomy: Final Report of the Technical Expert Group on Sustainable Finance, EU Technical Expert Group on Sustainable Finance, https://ec.europa.eu/info/sites/info/files/business_economy_euro/banking_and_finance/documents/200309-sustainable-finance-teg-final-report-taxonomy_en.pdf

Fernando, R.; and W. J. McKibbin (2021), “Macroeconomic Policy Adjustments Due to COVID-19: Scenario to 2025 with a Focus on Asia”, in ADBI Working Paper Series, No. 1219 (March), https://www.adb.org/sites/default/files/publication/684551/adbi-wp1219.pdf

GIH (2021), How Effective Is Public Infrastructure Investment in Supporting COVID-19 Economic Recovery Efforts?, Sydney, Australia, https://www.gihub.org/infrastructure-monitor/insights/fiscal-multipliereffect-of-infrastructure-investment/

Hendriyetty, N. S.; A. Boden; and K. Takayama (2021), “Social Infrastructure to Drive Sustainable Development in Asia beyond the Pandemic”, in Asia Pathways: The Blog of Asian Development Bank Institute, 14 June, https://www.asiapathways-adbi.org/2021/06/social-infrastructure-drive-sustainable-development-asia-beyond-pandemic/

Hustada, E.; and D. H. Olsen (2020), “Creating a Sustainable Digital Infrastructure: The Role of Service-Oriented Architecture”, in Procedia Computer Science, https://www.researchgate.net/publication/346989191_Creating_a_sustainable_digital_infrastructure_The_role_of_service-oriented_architecture

Hyun, S.; T. Nishizawa; and N. Yoshino (2008), “Exploring the Use of Revenue Bond for Infrastructure Financing in Asia”, in JBICI Discussion Papers (July)

IMF (2020), Fiscal Monitor: Policies for the Recovery, Washington DC

Jooste, S. F.; and W. R. Scott (2012), “The Public-Private Partnership Enabling Field: Evidence from Three Cases”, in Administration & Society, Vol. 44, No. 2, pp. 149-182

Katz, M. (2021), Green Bond Issuance Sets New Record in 2020, 2 February, https://www.ai-cio.com/news/green-bond-issuance-sets-new-record-2020/

OECD (2020), Compendium of Policy Good Practices for Quality Infrastructure Investment, Meeting of the OECD Council at Ministerial Level, 28-29 October 2020, https://www.oecd.org/mcm/2020/Compendium-CMIN-2020-3-EN.pdf

PWC (2017), Exploring Alternative Solutions to Infrastructure Financing: What You Need to Know

Strusani, D.; and G. V. Houngbonon (2020), “What COVID-19 Means for Digital Infrastructure in Emerging Markets”, in EM Compass in Emerging Markets (May), https://www.ifc.org/wps/wcm/connect/publications_ext_content/ifc_external_publication_site/publications_listing_page/what+covid+19+means+for+digital+infrastructure+in+emerging+markets

United Nations (2020), The Sustainable Development Goals Report 2020, https://unstats.un.org/sdgs/report/2020/The-Sustainable-Development-Goals-Report-2020.pdf

World Bank (2020), Renewable Energy: Evaluation of the World Bank Group’s Support for Electricity Supply from Renewable Energy Resources, 2000-2017, file:///C:/Users/DBT/Downloads/Renewable-Energy-Evaluation-of-the-World-Bank-Group-s-Support-for-Electricity-from-Renewable-Energy-Resources-2000-2017.pdf

Yoshino, N.; and N. Hendriyetty (2021), “Quality Infrastructure Investment in the Face of the COVID-19 Crisis: Sustainability, Profitability, and Demand versus Resilience”, in Policy Brief Saudi Arabia T20 Task Force 3: Infrastructure Investment and Financing

Yoshino, N.; N. S. Hendriyetty; and E. P. Sioson (2020), “Exploring Community-Based Financing Schemes to Finance Social Protection”, in ADBI Working Paper Series, No. 1105 (March), https://www.adb.org/sites/default/files/publication/575601/adbi-wp1105.pdf

Yoshino, N.; N. Hendriyetty; and S. Lakhia (2019), “Quality Infrastructure Investment: Ways to Increase the Rate of Return for Infrastructure Investments”, in T20 Japan Task Force 4: Economic Effects of Infrastructure Investment and Its Financing

Yoshino, N.; N. Hendriyetty; and F. Taghizadeh-Hesary (2020), “Economists’ Views on the Global Economy: How a Big Impact from Covid-19 on SME Finance & Infrastructure Maintenance Can Be Avoided”, in Japan Spotlight: The World Trade System with Covid-19 (July/August), pp. 64-67, https://www.jef.or.jp/journal/pdf/232nd_EVGE.pdf