Addressing global investment gaps in infrastructure has been a consistent priority for the Group of Twenty (G20) over the last decade. This has culminated in the formulation of the G20 Quality Infrastructure Investment Principles (QII) in 2019, along with the convergence of the G20 priorities and the global development goals. However, multilateral development and environmental agendas have largely missed the multiplier effect of urbanization on rising challenges such as global warming or biodiversity losses, a decades-long trend which has only been accelerated by the delivery of new infrastructure since the last global financial crisis in 2007–2008. This policy brief calls for a breakthrough in the delivery of new infrastructure, determining that in the context of the COVID-19 crisis, any new policy choices should yield high socio-economic multipliers and enhance resilience. As a number of major global ecosystems are reaching a tipping point, such as those in the Amazonia and Arctic, the timing is critical. Therefore, the delivery of designated Quality and Sustainable Infrastructure Investment Principles (QS-II) should focus on shaping new technological and financial frontiers for critical infrastructure assets on land and at sea. Prioritizing time to market acceleration through innovative partnerships between public and private market players and mobilizing financial enablers, such as sustainable procurement, can help build an accountable pathway for large-scale change and mainstream nature-based solutions in global and regional infrastructure project pipelines.

Challenge

“Infrastructure for growth” investments have turned un-sustainable

In June 2020, as the COVID-19 pandemic unfolded across the globe, a fuel tank collapse in the Russian Great North made its way to international headlines. Thawing permafrost had ruined the foundations of the installation, which dumped its content in a nearby Arctic river. While weather reports from summer 2020 highlight record high temperatures in Arctic regions, scientific literature describes the large-scale transformation patterns of the Euro-Asian and North American permafrost regions (Pokrovsky, Kirpotin, and Malov 2020). As the effects on existing infrastructure become visible, global warming could also accelerate the development of new infrastructure and activities, with risks of further environmental impacts.

Meanwhile, a group of large global asset managers and investment funds officially warned the federal government of Brazil about the “negative systemic impacts” on their portfolios because of extensive burning in parts of the Amazonian forest. The global eco-systemic importance of the Amazonian forest is well-known. However, there is growing evidence that the shrinking of the tropical forestry cover is reaching a tipping point, risking a transformation into a savanna, with deforestation triggered by the development of new transportation or energy infrastructure (Lovejoy and Nobre 2019).

The transformation of very large habitats has consequences for the planning and maintenance of all infrastructure systems that are in those regions. The global expansion of infrastructure development (IMF 2014) has contributed to its exponential global impacts (Stockholm Resilience Center 2019; IPBES 2019). With cities becoming the nodes of integrated logistics, major continuous investments in interconnected systems, supply chains, and trade flows have contributed to economic growth and the overall reduction of poverty and hunger in the past three decades (Secchi and Riela 2019). However, the corresponding urbanization patterns have turned highly un-sustainable (McDonald et al. 2018).[1]

The existing apparatus of international agreements issued by the Rio Earth Summit of 1992 seems to no longer be suitable for their purpose when it comes to building a sustainable pathway for an urbanized planet (Buchoud 2020). The Conferences of the Parties (COPs) on Climate and Biodiversity can no longer ignore urbanization and the role of cities alongside national governments. The goal cannot be “greening” infrastructure investments standards or even investing more (Rozenberg and Fay 2019). It must be about changing priorities and reconsidering the very role of infrastructure for sustainable development and a healthy, rapidly urbanizing planet (GSDR 2019).[2]

The knowledge challenge: from “sustainable infrastructure” to “nature-based solutions”

With many ecosystems shrinking (Bartlett 2019), our urbanizing world needs more sustainable infrastructure (Bhattacharya et al. 2016; 2019a) and stronger valuation of nature-based solutions and ecosystem services (Bloomfield, McIntosh, and Lambin 2020).

- We refer to “sustainable infrastructure” as a built or natural solution that provides a service to the public in a manner. This service provides value across social, gender, environmental, resiliency, institutional, economic, and financial dimensions, and is aligned with environmental and developmental goals and based upon a full lifecycle approach (Global Leadership Academy 2020).

- We refer to “nature-based solutions” as a range of activities associated with the protection, management, and adaptive restoration of natural capital. This includes natural infrastructure, green or blue infrastructure, and integrated approaches that combine green and grey (or man-made) elements. Nature-based solutions can play alternative or complementary roles to grey infrastructures, help reduce investment and operation costs and generate additional co-benefits (Gomez-Baggethun et al. 2013; Kumar 2010; EEA and ETC/ULS 2015; EC 2015; World Forum on Natural Capital, n.d.).[3]

- Ecosystems, such as forests, wetlands, or coral reefs, can provide numerous benefits to humanity, also known as “ecosystem services” (Chaparro and Terradas 2010; Thiele et al. 2020). They are often designated as green or blue ecological infrastructure, and they are typically threatened by habitat conversion and land use change, pollution, and climate change.

Shaping the new frontiers of infrastructure investments

Even before the COVID-19 crisis, countries were facing significant gaps regarding their ability to deliver on Agenda 2030 promises and the Sustainable Development Goals’ 17 targets, which include investment needs in both new and old infrastructure in sectors (transport, energy, water, waste, construction, coastal protection, etc.).

Many gaps still exist in global welfare. More than half a billion people lack access to drinking water. Over a billion people live in slums, which lack basic services. More than 2.4 billion people lack improved sanitation facilities and 1 billion people live more than 2 km from an all-season road. However, the systemic environmental consequences of building millions more kilometers of new roads to support a more thorough access to economic opportunities, without properly assessing the global environmental costs will only further lock-in the global environmental and biodiversity crisis.[6] What is the point of developing new infrastructure assets that lock-in the growth of CO2 emissions and directly and indirectly scatter natural habitats, with short and long-term negative consequences on sustainability and growth? (Ahmed et al. 2013; Barber et al. 2014; Assunção, Braganca, and Araújo 2020).

In 2020, climate and environment concerns have ranked on top of long-term risk assessment surveys (Löw, 2019; WEF 2020). In this context, infrastructure investments are a multiplier of local impacts, a phenomenon accelerated by the absence of integrated infrastructure and urbanization governance at the global level. Shaping New Frontiers’ priorities might not be about going to Mars. It should be about shaping infrastructure systems that will Safeguard the Planet in light of the continuously increasing urbanization rate of the coming decades.[7] “Planetary boundaries, ecosystem services, and socio-economic dynamics have evolved into one common space” (Chevalier, Chamas, and Stagno 2020, 2), marked by the emergence of a highly transformative urban continuum (Buchoud et al. 2019).

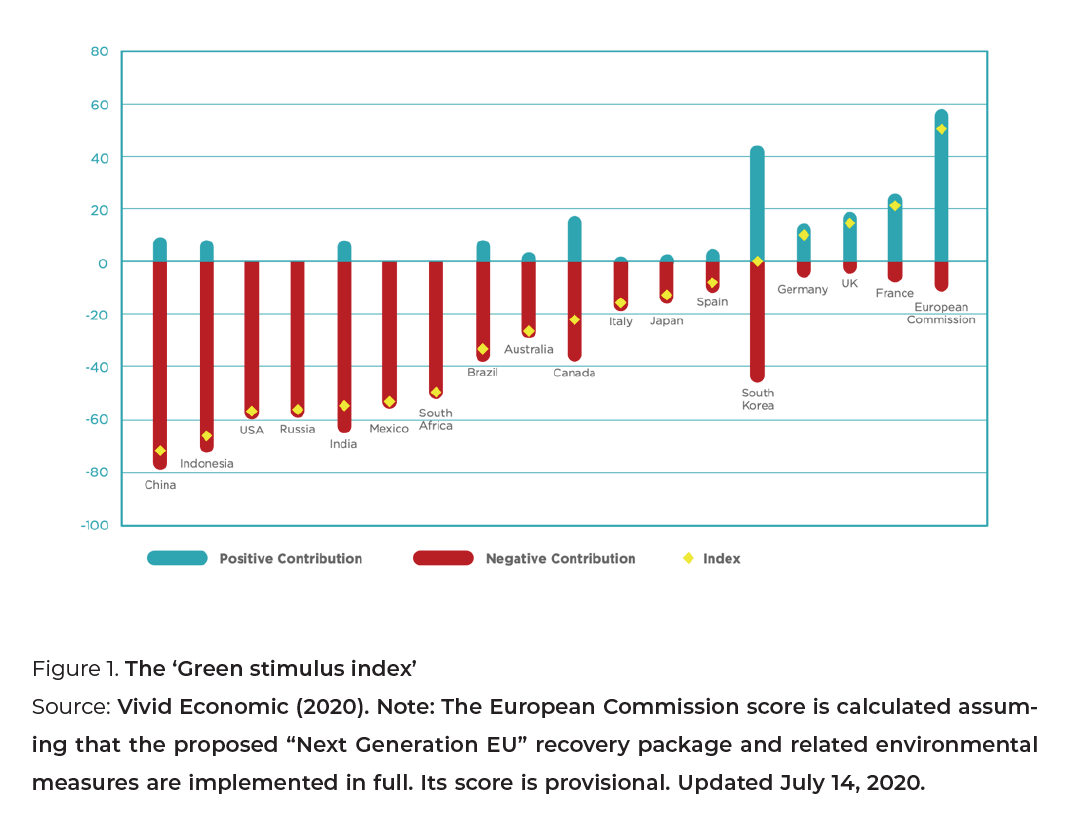

Addressing the complex interactions of socio-economic and environmental processes has been the new frontier of geo-science research for some time now (Häyhä and Franzese 2014). It must become the new horizon of policy-making for infrastructure investments, an issue that the G20 COVID-19 Recovery Action Plan cannot ignore. However, the G20 infrastructure approach must make the case for sustainable infrastructure and stimulus as “recovery” packages are weighted far more heavily toward business as usual investments, including in carbon-intensive sectors.[8]

In the first half of 2020, the COVID-19 pandemic has triggered a total of USD 18.4 trillion of fiscal and monetary support to the global economy—USD 10.4 trillion on fiscal and budgetary stimulus and $8 trillion on monetary support—equating to more than 20% of the total world GDP. These investments, along with the upcoming national, regional, or global recovery packages, must be linked to the preparation of the post2020 Global Biodiversity Framework ahead of the COP15 Biodiversity and the COP26 on Climate in 2021.

We believe that cooperation among Think 20 (T20) taskforces on climate and infrastructure investments should be further enhanced, with sustainable infrastructure investments serving as a bridge between the nationally determined contributions (NDCs) for the COP26 and the National Biodiversity Strategies and Action Plans (NBSAPs) for the COP15 (Hehmeyer et al. 2019).[9] We also call for the inclusion of nature-based solutions and ecosystem services within the NDCs, as a catalyst to simultaneously achieve the goals of multiple agreements, including the Agenda 2030, the Paris Agreement, and the post-2020 Global Biodiversity framework.

Proposal

Creating sustainable infrastructure in the context of 2020

Well-functioning infrastructure is crucial for any economy, but the world remains unable to deliver on the quantity and quality of investment needed. However, building sustainable infrastructure depends on international financial institutions (IFIs) and business groups’ understanding that only delivering more infrastructure without proper environmental assessments nurtures a system that is spiraling out of control. Over time, the G20 has incubated many infrastructure initiatives across major financial institutions and development banks. The current economic crisis highlights the outflows of capital from emerging countries and sharp declines in remittances to emerging and lower income countries. Meanwhile, the call for more private capital investments in job generating infrastructure projects has to be supplemented by a sustainable infrastructure approach. We cannot afford to lock-in more polluting technologies and inefficient capital (Bhattacharya et al. 2019b). Infrastructure investments can become a tool to “re-couple” growth with shared prosperity and welfare (de Miranda and Snower 2020).

To build change, we consider the reinforcement of the QII Principles to be a priority and an opportunity. Building on the joint OECD, The World Bank, and UNEP report (2018), the implementation of the QII Principles could generate more jobs, and be more sustainable, by reducing time to market in several infrastructures, as we propose below. Project preparation and capacity-building must also be prioritized, in particular by multilateral development banks, so that adequate human resources are deployed to turn investments into projects.

From the G20 Quality Infrastructure Investment (QII) principles to the G20 Quality and Sustainable Infrastructure (QS-II) principles

The QII principles regarding ecosystem preservation issues should be reinforced and, therefore, be explicitly supplemented by a sustainable infrastructure rationale to become the Quality and Sustainable Infrastructure Investment (QS-II) principles (Bhattacharya et al. 2019c). Issuing the QII principles was the first step in a long-term transition to another type of global infrastructure. Moving from the QII to the QS-II principles is the second step of the journey and it should start with:

- the inclusion of nature-based solutions as engineering and financial components of future infrastructure systems (Cohen-Shacham et al. 2016; Kabisch et al. 2016; Berensmann et al. 2017),

- the consideration of the role of cities and the impacts of infrastructure investments on urbanization by adopting a multi-sectoral systems approach, including wellbeing and health (Gomez-Baggethun and de Groot 2010; Van den Bosch and Sang 2017; Chevalier, Chamas, and Stagno 2020), and

- a review of how the private sector can contribute to shaping more sustainable infrastructure delivery, including a job-generating and resilience perspective in the COVID-19 crisis context (Phillips 2020), along with improved connectivity between the T20 and the Business 20 (B20) engagement groups.

Therefore, we recommend that the G20 Infrastructure Working Group (IWG) includes a systematic and multiscale review of nature-based solutions through the Infrastructure Cooperation Platform (ICP) with a focus on designated post-COVID-19 recovery initiatives.

Owing to the lack of a single or unified global go-to source that quantifies the economic value of and increasing need for investing in nature, we recommend using the World Bank Lifelines report as a proxy for the G20 IWG (Hallegatte, Rentschler, and Rozenberg, 2019). We further recommend conducting an assessment of the wider socio-economic benefits of nature-based solutions and ecosystem services, moving toward QS-II principles, and ensuring that nature-based solutions and ecosystem services are included in every stage of the infrastructure lifecycle.

Progress is especially critical for emerging markets and developing countries and cities, which are expected to see the most infrastructure investment and where environmental data to evaluate nature-based solutions and ecosystem services is most often lacking.

The urgency for action is even greater given the long lag time between the structuring, planning, design, procurement, and construction of infrastructure projects; realizing the results of this much-needed transition can take even longer (Depietri and McPhearson 2017; EIB 2018).

The QS-II principles as an accelerator of time to market policies on land and sea

Monetary and non-monetary valuation of the benefits of nature-based solutions and the development of performance indicators, standards, and technical and scientific reference models for nature-based solutions is necessary to systematize their implementation. Despite several institutional efforts to valuate ecosystem services generated by nature-based solutions, their practical application remains limited (Andreucci 2018).[10] Ecosystem services bring positive externalities but without adequate remuneration (Croci and Lucchitta 2018). They are used without direct, visible pricing for consumers, and price signals do not indicate the scarcity of natural capital from which the ecosystem services originate.

The implementation of the QS-II principles could be a game-changer in terms of including the valuation of natural capital in future critical infrastructure assets. Linear transport infrastructure and their rights of way, in particular roads, are a universal kind of infrastructure, which is present on all continents, in all regions, and bound to expand with an additional 3.0 to 4.7 million km by 2050, triggered by urban growth (Meijer et al. 2018).

The Horizon Europe 2020–2027 research program could serve as a global incubator for accelerating large-scale implementation of sustainable infrastructure solutions, with a focus on transportation networks (Rushe, Reimer, and Stichmann 2019).[11] We view innovative geo-engineering concepts, such as the Roads of the Anthropocene, as ways to maximize infrastructure investments spillover effects through nature-based solutions (Hautière and Bourquin 2017; Blanquart, Delaplace, and Gastineau 2020; Pearlmutter et al. 2020). For instance, Global Performance Contracts (GPC) should be signed by mobility corridors operators and investors to include linear transport infrastructure ecosystem dependencies in the projects’ financial rationale. In return for engaging in such contracts, operators could be entrusted with the adaptation of mobility networks.[12] Similar approaches could target much larger-scale projects, such as the Belt and Road Initiative (Ascensão et al. 2018; Lechner et al. 2018) as well as other cross-boundary infrastructure investments, in connection with G20 COVID-19 recovery investments and debt relief initiatives.

In addition to roads and other linear transportation infrastructure, coastal ecological infrastructure brings huge and multiple benefits, provided transaction costs for capturing them are lowered. (Hijdra, Woltjer and Arts 2014; O’Hogain and McCarton 2018).

The World Bank’s ProBlue Programme and the Asian Development Bank’s Action Plan for Healthy Oceans and Sustainable Blue Economies provide new avenues to support nature-based marine and freshwater infrastructure efforts. By combining a wider coastal landscape approach in the planning stages, sustainable marine and freshwater infrastructure projects can bring multiple partners and revenue streams into the project structure. Blended finance approaches can be used to address early stage transaction cost/risk challenges and capacity-building needs. Finding inspiration in the acceleration of time to market of carbon sequestration programs (SwissRe 2020), the protection of fragile coastal areas should become another priority of the G20 QS-II agenda, along with linear infrastructure. These ecosystems constitute the livelihood of over 1 billion urban dwellers; present a significant resource for global trade industries; and are essential to the climate resilience of coastal populations (alongside fisheries, tourism, and multiple additional benefits).

Climate adaptation, such as through wetland restoration; natural carbon sequestration, such as through mangrove and seagrass replanting; and the reuse of materials, such as through dredged materials for flood protection and regenerate concrete for quay walls and breakwaters, have been proven relevant in practice. This is the right time to mobilize sustainable finance facilities and enable change, including the representative organizations from the dredging industry sector, the maritime transportation sector, the port management sector, and their global constituents. Navigation infrastructure, such as ports and waterways, needs to adapt to rising sea levels and climate change in order to ensure long-term growth, and there is a considerable volume of work expected in this sector. A joint initiative by the T20 and the B20 to promote QS-II principles in this field could help connect short term and longer-term micro- and macro-economic rationales.

The sustainable infrastructure approach should also apply in support of deforestationfree infrastructure investment and development models (Lees et al. 2016; Finer et al. 2008; Costa et al. 2019).

We recommend that international funding supports deforestation-free development models, together with public and private commitments for reforestation and biodiversity regeneration. Further, such funding must include the formulation of sustainable infrastructure policies and guidelines for early territorial planning and social and environmental costs assessment (Chiavari et al. 2019).

A multiscale and ex-ante evaluation of nature-based solutions benefits compared with grey infrastructure benefits should become the new normal of infrastructure projects procurement procedures (Amsterdam Declaration 2015; Trase 2018). Additional increments of deforestation in priority areas—such as rainforests—that have been caused by infrastructure investments should be compensated or penalized by as much as three to five times the reforestation value, to be mandated and regulated at the national level (Barros et al. 2020). The role of multilateral development banks and development finance institutions as implementers of normative change is key, but change will only occur when it is being channeled throughout all value chains. Private players, from companies to individuals, will play a critical role (Watkins et al. 2017; Watkins et al. 2019).

Financial enablers of the QS-II principles

The acceleration of sectoral transformation and the mainstreaming of sustainable infrastructure projects should be supported by open and transparent procurement processes. This must follow regardless of whether investments are provided by the public sector, the private sector, or a combination of both, such as through publicprivate partnerships (PPPs).

The impetus to mobilize greater levels of private investment into sustainable infrastructure, especially in developing countries, is even more profound in the COVID-19 context. We recognize that the development of public procurement of nature-based infrastructure solutions (standalone or as part of built infrastructure) for public and/or private investments is still in an early stage. Thus, it requires political and institutional support, better incorporation into sectoral procurement regulations, changes in public accounting systems, capacity building of public procurement agencies, as well as greater knowledge and capacity in the private sector.[13] The promotion of tender evaluation methods that account for lifecycle cost savings and co-benefits delivered by nature-based infrastructure, as opposed to business-asusual infrastructure, is another area for changes in public procurement.

Sustainable public procurement, in particular the procurement of naturebased infrastructure, is key to implementing quality infrastructure. This is because a large share of public spending is allocated to infrastructure projects and because private investment in infrastructure must grow significantly to close the infrastructure investment and service gaps (Rozenberg and Fay 2018; Wuennenberg and Casier 2018).[14]

Payments for ecosystem services (PES) is a complementary way to approach financial mechanisms for achieving the QS-II principles (Davies and Schaafsma 2018). These are defined as a voluntary transaction between service users and service providers that are conditional on agreed rules of natural resource management for generating offsite services (Wunder 2015). They aim to stimulate the production of positive externalities, transforming them into marketable services that can be bought and sold on a market. In other words, PES introduces the economic value of ecosystem services in decision-making, which the QS-II principles aim at streamlining at a larger scale. Adaptation and resilience credits, as well as “biodiversity certificates,” could be good ways to accelerate a monetary approach to ecosystem preservation (Thiele et al. 2020). Locally, “livability improvement districts,” inspired by the concept of business improvement districts, could be efficient citizen-oriented tools, especially if combined with sustainable infrastructure global performance contracts.

Elements for the way forward

Many large regions and ecosystems around the globe are undergoing profound changes that affect the rest of the world. They could become priority targets to implement the QS-II principles, while rethinking the global environmental and development governance issued from the 1992 Rio Earth Summit, including a sustainable infrastructure rationale (Costanza et al. 2014).

Enhanced joint international programs in field research should be encouraged to complement existing data-based and remote observation. This would also bring science closer to local communities in these areas that often have harsh living conditions. Expanded research programs would provide a deeper understanding of environmental and climate implications in these regions (Frantzeskaki et al. 2019; GSDR 2019). They could bring additional benefits insofar as infrastructure investments can be made while considering the QS-II principles.

Finally, Arctic governance frameworks as a global role model and potential benchmark for pioneering transformations can be revisited. The governance of Arctic regions heretofore combines robust, legally binding international treaties that have been in place for several decades (Heininen, 2018; Antsygina, Heininen, and Komendantova-Amann 2020).[15] Unlike developed economies where there are more advanced regulatory and institutional frameworks applicable to a sovereign territory, and unlike developing countries where multilateral development banks and other development finance institutions play important support roles for governments to progress applicable regulatory and institutional frameworks, the Arctic is governed by treaty. As such, proactive revisiting of applicable Arctic regulations to ensure that infrastructure investments are sustainable, in line with the QS-II principles outlined in this policy brief, should be encouraged. This could also become a benchmark for future global environmental and development governance.[16]

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

Ahmed, Sadia E. Carlos Souza Jr, Julia Riberio, and Robert M. Ewers. 2013. “Temporal

Patterns of Road Network Development in the Brazilian Amazon.” Regional Environmental

Change 13: 927–37. https://doi.org/10.1007/s10113-012-0397-z.

Amsterdam Declaration. 2015. “Towards Eliminating Deforestation from Agricultural

Commodity Chains with European Countries.” ProTerra Foundation website, PDF.

Last updated December 7, 2015. https://www.proterrafoundation.org/wp-content/uploads/2017/07/AmsterdamDeclarationDeforestation26Agro-commoditychains.pdf.

Andreucci, Maria Beatrice. 2018. “Economic Valuation of Urban Green Infrastructure.

Principles and Evidence.” Economics and Policy of Energy and the Environment 0,

no. 2: 63–84. https://doi.org/10.3280/EFE2018-002004.

Antsygina, Ekaterina, Lassi Heininen, and Nadejda Komendantova-Amann. 2020. “A

Comparative Study on the Cooperation in the Arctic Ocean and the South China

Sea.” In The Arctic: Current Issues and Challenges, edited by O.S. Pokrovsky, S. N. Kirpotin,

and A. I. Malov. Hauppauge: Nova Science Publishers.

Assunção, Juliano J., Arthur Braganca, and Rafael Araújo. 2020. “The Environmental

Impacts of the Ferrogrão Railroad: An Ex-Ante Evaluation of Deforestation Risks.” Climate

Policy Initiative, Policy Brief. Last updated March 13, 2020. https://www.climatepolicyinitiative.org/publication/the-environmental-impacts-of-the-ferrograo-railroad.

Ascensão, Fernando, Lenore Fahrig, Anthony P. Clevenger, Richard T. Corlett, Jochen

A.G. Jaeger, William F. Laurance, and Henrique M. Pereira. 2018. “Environmental

Challenges for the Belt and Road Initiative.” Nature Sustainability 1: 206–9. https://doi.org/10.1038/s41893-018-0059-3.

Asian Development Bank Institute (ADBI). 2020. Building the Future of Quality Infrastructure.

ADBI Institute. https://www.adb.org/sites/default/files/publication/577031/adbi-building-future-quality-infrastructure.pdf.

Barber, Christopher P., Mark A. Cochrane, Carlos M. Souza Jr, and William F. Laurance.

2014. “Roads, Deforestation, and the Mitigating Effect of Protected Areas in the Amazon.”

Biological Conservation 177: 203–9. https://doi.org/10.1016/j.biocon.2014.07.004.

Bartlett, Ryan. 2019. Visioning Futures: Improving Infrastructure Planning by Accounting

for Nature’s Benefits in a Warming World. Washington, DC: WWF.

Barros, Ana Cristina, Bruce McKenney, Amar Bhattacharya, Beatriz Nofal, Carlos Nobre,

Kevin Gallagher, Linda Krueger, and Thomas Lovejoy. 2020. Sustainable Infrastructure

to Secure the Natural Capital of the Amazon, T20 Japan.

Berensmann, Kathrin, Ulrich Volz, Céline Bak, Amar Bhattacharya, Tian Huifang, Gerd

Leipold, Lawrence MacDonald, Hannah Schindler, Isabella Alloisio, Qingqing Yang.

2017. “Fostering sustainable global growth through green finance – what role for the

G20?” T20 Policy Brief. Last updated January 23, 2020. https://www.g20-insights.org/policy_briefs/fostering-sustainable-global-growth-green-finance-role-g20.

Bhattacharya, Amar, Joshua P. Meltzer, Jeremy Oppenheim, Zia Qureshi, and Nicholas

Stern. 2016. “Delivering on Sustainable Infrastructure for Better Development

and Better Climate.” Brookings Institute website, Report. Last updated December

23, 2016. https://www.brookings.edu/research/delivering-on-sustainable-infrastructure-for-better-development-and-better-climate.

Bhattacharya, Amar, Kevin P. Gallagher, Miquel Muñoz Cabré, Minji Jeong, and

Xinyue Ma. 2019a. Aligning G20 Infrastructure Investment with Climate Goals and

the 2030 Agenda. Foundations 20 Platform, a report to the G20. https://www.foundations-20.org/wp-content/uploads/2019/06/F20-report-to-the-G20-2019_Infrastrucutre-Investment.pdf.

Bhattacharya, Amar, Beatriz Nofal, Linda Krueger, Minji Jeong, and Kevin Gallager.

2019b. “Policy and Institutional Framework for Delivering on Sustainable Infrastructure.”

T20 Japan 2019. Policy Brief. Last updated May 9, 2019. https://t20japan.org/policy-brief-policy-institutional-framework-delivering-sustainable-infrastructure.

Bhattacharya, Amar, Cristina Contreras Casado, Minji Jeong, Amal-Lee Amin, Graham

G. Watkins, and Mariana C. Silva Zuniga. 2019c. Attributes and Framework for

Sustainable Infrastructure in Technical Note n° IDB-TN-01653. IDB Report. https://dx.doi.org/10.18235/0001723.

Blanquart, Corinne, Mathieu Delaplace, and Pascal Gastineau. 2020. What Can We

Say on the Wider Economic Impacts of Transportation Infrastructures? T20 Saudi

Arabia Task force 3. To be published, 2020.

Bloomfield, Laura S. P., Tyler L. McIntosh, and Eric F. Lambin. 2020. “Habitat Fragmentation,

Livelihood Behaviors, and Contact Between People and Nonhuman

Primates in Africa.” Landscape Ecology 35: 985–1000. https://doi.org/10.1007/s10980-020-00995-w.

Buchoud, Nicolas J. A. 2020. “Making the Case for G20 Action on Urbanization.” Global

Solutions, World Policy Forum website. Article. Accessed August 10, 2020. https://www.global-solutions-initiative.org/press-news/g20-action-urbanization-nicolas-buchoud.

Buchoud, Nicolas J. A., Ross Douglas, Pascal Gastineau, Martin Koning, David

Mangin, Philippe Poinset, Jean-François Silvain, and Hélène Soubelet. 2019. “The Infrastructure

Nexus. From the Future of Infrastructures to the Infrastructure of the

Future.” T20 Japan 2019. Policy Brief. Last updated March 31, 2019. https://t20japan.org/wp-content/uploads/2019/03/t20-japan-tf4-2-infrastructure-nexus-from-the-future-of-infrastructures-to-the-infrastructures-of-the-future.pdf.

Chaparro, Lydia, and Jaume Terradas. 2010. Ecosystem Service of Urban Forest. Technical

Report. https://doi.org/10.13140/RG.2.1.4013.9604.

Chevalier, Ophélie, Paula Chamas, and Daniel Stagno. 2020. Urban Health, Safety,

and Well-Being: Cities Enabling the Provision and Access of Ecosystem Services,

U20, 2020. To be published, 2020.

Chiavari, Joana, Ana Cristina Barros, Luiza Antonaccio, and Gabriel Cozendey., 2019.

“The Future of Infrastructure in Brazil: An Integrated Vision of Proposed Legislation

is Needed to Ensure Progress.” Climate Policy Initiative website, Report. Last updated

October 10, 2019. https://climatepolicyinitiative.org/publication/the-future-of-infrastructure-in-brazil-under-discussion.

Cohen-Shacham, Emmanuelle, Christine Janzen, Stewart Maginnis, and Gretchen

Walters. 2016. Nature-Based Solutions to Address Global Societal Challenges. Switzerland:

IUCN. https://doi.org/10.2305/IUCN.CH.2016.13.en.

Costa, Marcos H., Leonardo C. Fleck, Avery S. Cohn, Gabriel M. Abrahão, Paulo M.

Brando, Michael T. Coe, Rong Fu, et al. 2019. “Climate Risks to Amazon Agriculture

Suggest a Rationale to Conserve Local Ecosystems.” Frontiers in Ecology and the

Environment 17, no. 10: 584–90. https://doi.org/10.1002/fee.2124.

Costanza, Robert, Rudolf de Groot, Paul Sutton, Sander van der Ploeg, Sharolyn J. Anderson,

Ida Kubiszewski, Stephen Farber, et al. 2014. “Changes in the Global Value of

Ecosystem Services.” Global Environmental Change 26: 152–8. https://doi.org/10.1016/j.gloenvcha.2014.04.002.

Croci, Edoardo, and Benedetta Lucchitta. 2018. “Nature-Based Solutions (NBSs) for

Urban Resilience.” Economics and Policy of Energy and Environment 2, no. 2. https://doi.org/10.3280/EFE2018-002002.

Davies, Helen J., and Marije Schaafsma. 2018. Future Funding of Urban Forests-Time

to Move to a Beneficiary Pays Model? Presented at the World Forum on Urban Forests,

in Mantova, Italy. https://doi.org/10.13140/RG.2.2.28827.31528.

de Miranda, Katharina L., and Denis J. Snower. 2020. Recoupling Economic and Social

Progress, in G20 Insights, June 11, 2020, Last updated July 7, 2020, https://www.g20-insights.org/policy_briefs/recoupling-economic-and-social-progress.

Depietri, Yaella, and Timeon McPhearson. 2017. “Integrating the Grey, Green, and

Blue in Cities: Nature-Based Solutions for Climate Change Adaptation and Risk Reduction.”

In Nature-Based Solutions to Climate Change Adaptation in Urban Areas,

edited by Nadja Kabisch, Horst Korn, Jutta Stadler and Aletta Bonn. Switzerland:

Springer. https://doi.org/10.1007/978-3-319-56091-5_6.

European Environmental Agency (EEA) and European Topic Centre on Urban, Land,

and Soil Systems (ETC/ULS). 2015. Exploring Nature-Based Solutions: The Role of

Green Infrastructure in Mitigating the Impacts of Weather- and Climate Change-Related

Natural Hazards. Technical Report No 12/2015. https://www.eea.europa.eu/publications/exploring-nature-based-solutions-2014.

European Commission (EC): Directorate-General for Research and Innovation. 2015.

“Towards an EU Research and Innovation policy agenda for Nature-Based Solutions &

Re-Naturing Cities.” Final report of the Horizon 2020 expert group on ‘Nature-based

solutions and re-naturing cities’ EU Publications. https://op.europa.eu/en/publication-detail/-/publication/fb117980-d5aa-46df-8edc-af367cddc202.

European Investment Bank (EIB). 2018. Investing in Nature: Financing Conservation

and Nature-Based Solutions. Climate Adapt website. Practical guide, last updated

November 12, 2019. https://climate-adapt.eea.europa.eu/metadata/guidances/investing-in-nature-financing-conservation-and-nature-based-solutions.

Finer, Matt, Clinton N. Jenkins, Stuart L. Pimm, Brian Keane, and Carl Ross. 2008.

“Oil and Gas Projects in the Western Amazon: Threats to Wilderness, Biodiversity,

and Indigenous Peoples.” PloS One 3 no. 8: e2932. https://doi.org/10.1371/journal.pone.0002932.

Frantzeskaki, Niki, Timon McPhearson, Marcus J. Collier, Dave Kendal, Harriet Bulkeley,

Dumitru Adina, Claire Walsh, et al. 2019. “Nature-Based Solutions for Urban Climate

Change Adaptation: Linking Science, Policy, and Practice Communities for Evidence-

Based Decision-Making.” BioScience 69, no 6: 455–66. https://doi.org/10.1093/biosci/biz042.

G20. n.d. G20 Principles for Quality Infrastructure Investment. Ministry of Finance

website. Accessed August 10, 2020. https://www.mof.go.jp/english/international_policy/convention/g20/annex6_1.pdf.

Global Leadership Academy. 2020. The Solutions Lab: Scaling for Sustainable Infrastructure,

Global Solutions Initiative (GSI), GiZ., July 2020. https://www.we-do-change.org/the-action/the-solutions-lab-scaling-for-sustainable-infrastructure.

GSDR. 2019. The Future is Now: Science for Achieving Sustainable Development.

Global Sustainable Development Report (GSDR) 2019, United Nations. Last updated

April 6, 2020. https://sustainabledevelopment.un.org/gsdr2019.

Gómez-Baggethun, Erik, and Rudolf de Groot. 2010. “Natural Capital and Ecosystem

Services: The Ecological Foundation of Human Society.” In Ecosystem Services: Issues

in Environmental Science and Technology, edited by R. E. Hester, and R. M. Harrison,

105–21. Cambridge: Royal Society of Chemistry. https://doi.org/10.1039/9781849731058-00105.

Gomez-Baggethun, Erik, Asa Gren, David N. Barton, Johannes Langemeyer, Timon

McPhearson, Patrick O’Farrell, Erik Andersson, Zoé Hamstead, and Peleg Kremer.

2013. “Urban Ecosystem Services.” In Urbanization, Biodiversity and Ecosystem Services:

Challenges and Opportunities, edited by Thomas Elmqvist, Michael Fragkias,

Julie Goodness Burak Günerlap, Peter J. Marcotullio, Robert I. McDonald, Susan Parnell,

et al. Switzerland: Springer. https://doi.org/10.1007/978-94-007-7088-1_11.

Hallegatte, Stephanie, Jun Rentschler, and Julie Rozenberg. 2019. Lifelines: The Resilient

Infrastructure Opportunity. Sustainable Infrastructure, Washington, DC: World

Bank. https://doi.org/10.1596/978-1-4648-1430-3.

Hautière, Nicolas, and Frédéric Bourquin. 2017. “Instrumentation and Monitoring of

the Nextgen Road Infrastructure: Some Results and Perspectives from the R5G Project.”

In Proceedings of the 19th European Geosciences Union General Assembly; Apr

23–28 2017. https://ui.adsabs.harvard.edu/abs/2017EGUGA..1918874H/abstract.

Häyhä, Tiina and Paolo Franzese. 2014. Ecosystem Services Assessment: A Review

under an Ecological-Economic and Systems Perspective, in Ecological Modelling

289: 124–132.

Head, Peter, Ryan Bartlett, Steven Crosskey, Anuj Malhotra, and Rowan Palmer. 2020.

Policies and Implementation Guidelines for Data Driven, Integrated, Risk-based

Planning of Sustainable Infrastructure, T20 Saudi Arabia Taskforce 3, 2020. To be

published.

Hehmeyer, Abigail, Jacqueline Vogel, Shaun Martin, and Ryan Bartlett. 2019. Enhancing

Nationally Determined Contributions through Protected Areas. Last updated

May 23, 2019. Washington: WWF.

Heininen, Lassi. 2018. “Arctic Geopolitics from Classical to Critical Approach – Importance

of Immaterial Factors.” Geography, Environment, Sustainability 11 no. 1: 171–86.

https://doi.org/10.24057/2071-9388-2018-11-1-171-186.

Hijdra, Arjan, Johan Woltjer, and Jos Arts. 2014. “Value Creation in Capital Waterway

Projects: Application of a Transaction Cost and Transaction Benefit Framework for

the Miami River and the New Orleans Inner Harbour Navigation Canal.” Land Use

Policy 38: 91–103. https://doi.org/10.1016/j.landusepol.2013.10.024.

IMF. 2014. “Is it Time for an Infrastructure Push? The Macroeconomic Effects of Public

Investment.” In World Economic Outlook, October 2014: Legacies, Clouds, and

Uncertainties. Washington, DC: IMF. https://dx.doi.org/10.5089/9781498331555.081.

IPBES. 2019. “Summary for Policymakers of the Global Assessment Report on Biodiversity

and Ecosystem Services of the Intergovernmental Science-Policy Platform

on Biodiversity and Ecosystem Services.” S. Díaz, J. Settele, E. S. Brondízio, H. T. Ngo,

M. Guèze, J. Agard, A. Arneth et al. (eds). Bonn: Germany. https://ipbes.net/global-assessment.

Kabisch, Nadja, Niki Frantzeskaki, Stephan Pauleit, Sandra Naumann, McKenna

Davis, Martina Artmann, Dagmar Haase, et al. 2016. “Nature-Based Solutions to Climate

Change Mitigation and Adaptation in Urban Areas: Perspectives on Indicators,

Knowledge Gaps, Barriers, and Opportunities for Action.” Ecology and Society 21, no

2: 39. https://doi.org/10.5751/ES-08373-210239.

Kovarik, Jean-Bernard, Anne Aguilera, Fabio Antonialli, Jean-Claude Choen, Philippe

Gache, Eric Hsu, Katherine Kortum, et al. 2020. Evaluating Resilient Infrastructure

Systems, T20 Saudi Arabia Taskforce 3, 2020. To be published.

Kumar, Pushpam. 2010. The Economics of Ecosystems and Biodiversity: Ecological

and Economic Foundations. London: Routledge.

La Notte, Alessandra. 2018. “Accounting for the Ecosystem Services Generated by

Nature-Based Solutions to Measure Urban Resilience.” Economics and Policy of Energy

and the Environment 0, no. 2: 43–61. https://doi.org/10.3280/EFE2018-002003.

Laurance, William F. 2016. “The Global Road Building is Shattering Nature.” The

Conversation, article. December 18, 2016. https://theconversation.com/the-global-road-building-explosion-is-shattering-nature-70489.

Lechner, Alex, Mark Faith, Chan Ka Shun, and Ahimsa Campos-Arceiz. 2018. “Biodiversity

Conservation Should be a Core Value of China’s Belt and Road Initiative” Nature

Ecology & Evolution 2: 408–9. https://doi.org/10.1038/s41559-017-0452-8.

Lees, Alexander C., Carlos A. Peres, Philip M. Fearnside, Maurício Schneider, and Jansen

A. S. Zuanon. 2016. “Hydropower and the Future of Amazonian Biodiversity.” Biodiversity

and Conservation 25 no. 3, 451–66. https://doi.org/10.1007/s10531-016-1072-3.

Lovejoy, Thomas E., and Carlos Nobre. 2019. “Amazon Tipping Point: Last Chance for

Action.” Science Advances 5, no. 12: eaba2949. https://doi.org/10.1126/sciadv.aba2949.

Löw, Petra. 2019. “The Natural Disasters of 2018 in Figures.” Munich RE article. August

1, 2019. https://www.munichre.com/topics-online/en/climate-change-and-natural-disasters/natural-disasters/the-natural-disasters-of-2018-in-figures.html.

McDonald, Robert I, M’Lisa Colbert, Maike Hamann, Rohan Simkin, Brenna Walsh,

Fernando Ascensāo, Melissa Barton, et al. 2018. Nature in the Urban Century: A Global

Assessment of Where and How to Conserve Nature for Biodiversity and Human

Wellbeing. Stockholm: The Nature Conservancy.

Meijer, Johan R., Mark A. J. Huijbregts, Kees C. G. J. Schotten, and Aafke M. Schipper.

2018. “Global Patterns of Current and Future Road Infrastructure.” Environmental

Research Letters 13 no. 6. https://doi.org/10.1088/1748-9326/aabd42.

O’Hogain, Sean, and Liam McCarton. 2018. A Technology Portfolio of Nature Based

Solutions: Innovations in Water Management. Switzerland: Springer. https://doi.org/10.1007/978-3-319-73281-7.

OECD, The World Bank, and UNEP. 2018. Financing Climate Futures: Rethinking Infrastructure.

Paris: OECD Publishing. https://doi.org/10.1787/9789264308114-en.

Pearlmutter, David, Dimitra Theochari, Thomas Nehls, Pedro Pinho, Patrizia Prio, Alisa

Korolova, Spiros Papaefthimiou, et al. 2020. “Enhancing the Circular Economy

with Nature-Based Solutions in the Built Urban Environment: Green Building Materials,

Systems and Sites.” Blue-Green Systems 2, no. 1: 46–72. https://doi.org/10.2166/bgs.2019.928.

Phillips, Arjun. 2020. “Quality Infrastructure and Civil Society.” Heinrich Böll Stiftung

website. March 19, 2020. https://in.boell.org/en/2020/03/18/quality-infrastructure-and-civil-society.

Pokrovsky, Oleg S., Sergey N. Kirpotin, and Alexander I. Malov, eds. 2020. The Arctic:

Current Issues and Challenges. Hauppauge: Nova Science Publishers.

Rozenberg, Julie and Marianne Fay. 2018. How Much is Needed? Infrastructure Investments

for Sustainable Development, Washington: World Bank Group.

Rozenberg, Julie, and Marianne Fay. 2019. Beyond the Gap: How Countries Can Afford

the Infrastructure They Need while Protecting the Planet. Washington: World Bank

Group. https://doi.org/10.1596/978-1-4648-1363-4.

Rushe, Karsten, Mario Reimer, and Rico Stichmann. 2019. “Mapping and Assessing

Green Infrastructure Connectivity in European City Regions.” Sustainability, 11, no. 6:

1819. https://doi.org/10.3390/su11061819.

Secchi, Carlo, and Stefano Riela, eds. 2019. Infrastructure for Growth: How to Finance,

Develop, and Protect It. Italy: ISPI.

Stockholm Resilience Center. 2019. “Ten Years of Nine Planetary Boundaries.” Stockholm

Resilience Center website. https://www.stockholmresilience.org/research/research-news/2019-11-01-ten-years-of-nine-planetary-boundaries.html.

SwissRe. 2020. Special Feature: Locking it Up ‒ Carbon Removal and Insurance, June

4, 2020. https://www.swissre.com/institute/research/sonar/sonar2020/sonar2020-carbon-removal-insurance.html.

Thiele, Torsten, Gerard Alleng, Andreas Biermann, Emily Corwin, Stephen Crooks,

Philip Fieldhouse, Dorothée Herr, et al. 2020. Blue Infrastructure Finance: A New Approach,

Integrating Nature-Based Solutions for Coastal Resilience. IUCN Global Marine

and Polar Programme, concept report. https://bluenaturalcapital.org/wp2018/wp-content/uploads/2020/03/Blue-Infrastructure-Finance.pdf.

Trase. 2018. Zero-Deforestation Commitments and Brazilian Soy. Trase Yearbook

2018. https://yearbook2018.trase.earth.

Van den Bosch, Matilda, and Åna Ode Sang. 2017. “Urban Natural Environments as Nature-

Based Solutions for Improved Public Health. A Systematic Review of Reviews.”

Environmental Research 158: 373–84. https://doi.org/10.1016/j.envres.2017.05.040.

Vivid Economics, and Finance for Biodiversity Initiative. 2020. Green Stimulus Index:

An Assessment of the Orientation of COVID-19 Stimulus in relation to Climate

Change, Biodiversity and other Environmental Impacts. https://www.vivideconomics.com/wp-content/uploads/2020/06/200605-Green-Stimulus-Index-1.pdf.

Watkins, Graham George, Sven-Uwe Mueller, Hendrik Meller, Maria Cecilia Ramirez,

Tomás Serebrisky, and Andreas Georgoulias. 2017. Lessons from Four Decades of

Infrastructure Project-Related Conflicts in Latin America and the Caribbean, IDB.

https://doi.org/10.18235/0000803.

Watkins, Graham George, Mariana C. Silva Zuniga, Amanda Rycerz, Katie Dawkins,

John Firth, Val Kapos, Laura Canevari, et al. 2019. Nature-based Solutions: Scaling

Private Sector Uptake for Climate Resilient Infrastructure in Latin America and the

Caribbean, IDB. https://doi.org/10.18235/0002049.

World Economic Forum (WEF). 2020. Global Risks Report 2020. Last updated January

15, 2020. https://www.weforum.org/reports/the-global-risks-report-2020.

World Forum on Natural Capital. n.d. “What is Natural Capital?” Website. Accessed

August 10 2020. https://naturalcapitalforum.com/about.

Wuennenberg, Lauren, and Liesbeth Casier. 2018. Low-Carbon Innovation for Sustainable

Infrastructure: The Role of Public Procurement. IISD website, report.

https://www.iisd.org/publications/low-carbon-innovation-sustainable-infrastructure-role-public-procurement.

Wunder, Sven. 2015. “Revisiting the Concept of Payments for Environmental Services.”

Ecological Economics 117: 234–43. https://doi.org/10.1016/j.ecolecon.2014.08.016.

WWF. 2018. Living Planet Report—2018: Aiming Higher. Edited by M. Grooten and

Almond, R.E.A (eds). Switzerland: WWF.

Appendix

[1] . Urban growth has been directly responsible for the loss of 190,000 km2 of natural habitat between 1992–2000 and could threaten 290,000 km2 more by 2030, in addition to the fragmentation of natural habitats on a much wider extent. The amount of agricultural land needed to supply cities with food is estimated to be 36 times greater than the urban area it serves.

[2] . In the past 20 years, cities across the globe have advocated for greater recognition of their role in global politics, as exemplified by the creation of the Sustainable Development Goal 11 regarding cities or the launch of the Global Taskforce at the Habitat III summit in Quito in 2016. However, the reporting on the SDGs has largely remained in the hands of nations. The New Urban Agenda has had little impact on national legislation so far, and since the mid-2010s, new priorities have emerged. The Global Sustainable Development Report (GSDR) 2019 report has pointed out that conflicts and trade-offs between the SDGs had received too little attention. Similarly, the localization of the global environmental and development agendas is emerging as a concern. Finally, the global governance of infrastructure investments is disconnected from engagement led by cities.

[3] . The Amazon basin alone stores more than 120 billion tons of carbon; this is approximately 10 times more carbon than annual CO2 emissions globally (WWF 2018).

[4] QII principle 3.1 refers specifically to “ecosystem-based approaches.”

[5] . Investment costs to meet infrastructure-related SDGs in low- and middle-income countries are estimated to be 40% cheaper when incorporating system scale, integrated planning efforts. (Hallegatte, Rentschler, and Rozenberg 2019).

[6] . One km of legal, mapped road is generally supplemented by 3 km of illegal, unmapped roads in the Amazonian region and other similar areas around the globe (Barber et al. 2014; Laurance 2016).

[7] . Shaping New Frontiers and Safeguarding the Planet are two priorities of the G20 Saudi Arabia Presidency.

[8] . https://www.energypolicytracker.org/region/g20

[9] . More harmonized coordination of monitoring, data collection and reporting efforts across the G20 would also greatly improve the quality and accuracy of G20 countries to report on their NBSAPs, NDCs, and the SDGs.

[10] . System of Environmental-Economic Accounting Experimental Ecosystem Accounting (SEEA-EEA) adopted by United Nations Statistical Commission; Mapping and Assessment of Ecosystems and their Services (MAES) Urban developed by the European Joint Research Centre (JRC); etc.

[11] . This includes programs such as Urban GreenUP, ConnectingNature, NAIAD, UnaLab and Naturvation. France’s ITTECOP research program is dedicated to the development of knowledge concerning biodiversity and landscape issues linked with linear transport infrastructures. The European Commission has opened a call for proposals, which aims at supporting and coordinating actors in this area as part of Horizon Europe. See also the Think Nature Platform, an umbrella platform for all project on nature-based solutions funded by the former EU H2020 program.

[12] . Partnerships with a term of ten years between several consortia could bring together different stakeholders, such as concessionaire, energy, telecom, vehicle manufacturer companies, and NGOs. This would make it possible to identify pilot areas and test and develop the technical, financial, and societal validity of the Global Performance Contracts.

[13] . Some examples such as Municipal Natural Assets Initiative in Canada point to forerunner municipalities that have started adjusting their public accounting systems and procured NBS/nature-based infrastructure solutions. The work conducted by IUCN on establishing a global nature-based solutions standard might also inspire public procurement, though the bulk of the baseline work to measure and monitor performance and how to earmark cost savings and co-benefits from NBS/ES is yet to be conducted.

[14] . Sustainable public procurement can be defined as the delivery of value for money (VfM) to taxpayers across the lifecycle of procured goods, services, and assets.

[15] . The United Nations Convention on the Law of the Sea (UNCLOS) and its article 76 are the cornerstone of the management and the regulation of the arctic ocean. This is key, as sovereign rights for continental shelves include exclusive rights to exploitation and exploration of natural resources, scientific research, and construction of artificial islands and installations.

[16] . It should also be noted that the Arctic Council will be chaired by the Russian Federation in 2021, along with the Arctic Economic Council and the Forum of Arctic Coast-Guards.