A fragmented global economy does not help to tackle global and local problems. Given the difficulties of the multilateral system to respond to new realities and to bring deeper rules (first-best policy), cooperation is needed and it is widely sought for under regional trade agreements (RTAs) (second-best policy). Shared rules are important in new trade areas related to new technologies and to the extension of global value chains (GVCs). The RTAs’ experience in dealing with these issues can be vital in multilateralising regulations and rules. This Policy Brief aims to examine briefly some positive aspects of selected RTAs that could support the multilateral system by strengthening GVCs (including through industrial policy tools), and the ongoing plurilateral processes at WTO level, by leveraging the G20 as an effective platform to foster dialogue among Member States.

Challenge

The risks of fragmentation in world markets have increased since the global economic crisis in 2009, hurting world trade. After the drop recorded in 2009, trade bounced back, but not quite on the same increasing trend. The reflections of geopolitical shifts in power balance exacerbated the fractures resulting from market failures, new types of barriers, and vulnerabilities in global supply chains. The multilateral system faces erosion when many advanced and emerging economies compete under inward-looking economic and industrial, and interventionist trade policies.

Nonetheless, most of the countries are aware that a fragmented economy does not help to tackle global and local problems, and therefore they need cooperation. The latter is sought for under RTAs to respond to new realities and to bring deeper rules, given the difficulties in multilateral system.

Considering the evidence in terms of regionalization in trade, we observe that in spite of the rapid increase in RTAs and in their depth, in many cases they did not result in dramatic increase in regional trade. Moreover , even though some of these RTAs are mega-regionals not necessarily confined to smaller regions, and have remained fairly open, they cannot provide global rules for all. Shared rules are important in new trade areas related for example to the development of new technologies and to the extension of GVCs. The RTAs’ experience in dealing with these issues can be vital in multilateralising regulations and rules in many areas.

Plurilateral negotiations stand out in recent years, notably the four Joint Statement Initiatives (JSIs) at the eleventh Ministerial Conference (MC11), dealing with electronic commerce, investment facilitation for development (IFD), services domestic regulation (SDR), and Micro, Small, Medium-sized Enterprises (MSMEs). Many WTO members look to plurilateral negotiations to “revitalize multilateralism” for new rules and trade liberalization. In addition to the progress at plurilateral level, WTO members (both developed and developing countries) are also engaged in RTAs. Some of these agreements feature deeper and more ambitious provisions than others. They explore new areas for regulation of trade and offer more flexible approaches to deepening provisions over time. RTAs and plurilaterals tend to be regarded as fragmenting the multilateral system, but we analyze the interaction between them to uncover that they can be helpful in uncovering best practices for reviving the multilateral system.

DEEP “REGIONAL TRADE AGREEMENTS” (RTAs)

Is regionalism on the rise?

The available data (see Annex) do not confirm that the slowdown in world trade (with the exception of trade in digital services) that has emerged since 2012 has been accompanied by increased regionalization. Even considering the intra-regional trade shares of the three most important areas (ASEAN + 3, EU-27 and North America), the picture does not change, displaying a constant or declining share of intra-regional trade. This is confirmed by considering other, better-suited indicators such as the trade intensity indices.

Trade within groups of countries with similar levels of development, or trade within GVCs (see the Annex), also show only weak signs of increased regionalization. Therefore, the potential issue of fragmented world markets does not seem to emerge from RTAs per se, but possibly because of other rapid changes occurring in world market, that might generate barriers between countries. In what follows, we examine how trade agreements and similar initiatives can be used to overcome some of these obstacles.

The case of Trade and Technology Council between EU and US as an example of deep integration pushed by technology

Despite recent trade tensions, the EU and the US have the largest and deepest bilateral trade and investment relationship in the world and have highly integrated economies accounting together for almost half of the world’s GDP, with total bilateral trade amounting to almost 1tn. € and bilateral FDI stocks over 4tn. € in 2020 (European Commission, 2021).

The improved political environment after Biden’s election as U.S. President paved the way to the establishment of a “Trade and Technology Council” (TTC), an initiative officially launched at the EU-US Summit in June 2021. With this new initiative the transatlantic partners aimed at enhancing the resilience of supply chains in key industries (Fasulo and Tentori 2021), promoting strategic autonomy through deepened co-operation in cutting-edge sectors, such as semiconductors and green technology, securing critical supply chains, aligning export controls, FDI screening mechanisms and technical standards (Bown and Malmström 2021).

While the TTC is not an attempt to revive TTIP, better coordination between EU and US strategies in trade appears helpful for any attempt to reactivate and seriously reform the WTO system. At the same time, such initiatives could lead to potentially dangerous fractures with other areas of the world, particularly after the economic shocks inflicted by the pandemic and the outbreak of the war in Ukraine (González 2022).

This adds to already existing frictions between the EU and the US with China, including tendencies to decouple such as a long-lasting tit-for-tat tariff dispute with the US (Blustein 2019) or the postponed ratification of the Comprehensive Agreement on Investment (CAI) signed with the EU in December 2020.

Therefore, the TTC presents both opportunities and challenges. On the one hand, this dialogue and cooperation mechanism can help strengthen supply chain linkages in some critical industries, and act as a platform for future cooperation with third parties, given the huge combined economic size of the US and EU, their advanced level of economic and technology specialization, and the EU’s leadership effort as a global standard setter. But on the other hand, the TTC is also seen as being directed at deepening transatlantic cooperation in a response against China’s trade practices. Transatlantic cooperation on sensitive technology issues could therefore lead to fractures with other key actors like China instead of promoting cooperation (van der Loo et. Al. 2021).

GVCs as example of the challenge: more trade participation but risk of more discrimination

The smooth functioning of cross-border production activities within GVCs calls for the regulation of behind-the-border policy areas, as GVCs might find obstacles in different standards and regulations even more than in traditional trade barriers, giving rise to a complementarity between GVCs and deep trade agreements (Laget et al., 2018). In a GVC context, RTAs and the multilateral trade system can complement each other because some policy areas can be more efficiently regulated within smaller groups of like-minded countries. WTO research (WTO, 2017) shows that deep RTAs boosts GVC integration and that undoing this depth is likely to hurt GVCs. Specific provisions in RTA’s matter differently according to countries’ characteristics and level of development.

But many important questions on the relationship between RTAs and GVCs remain open. One is on the content (or, equivalently, the efficient design) of deep RTAs; another is on the optimal choice of partners.

The evidence is not conclusive on the extent to which trade agreements foster GVCs. It could also be the other way around: countries that share a production chain have a stronger incentive to sign a trade agreement to facilitate exchanges within the GVC. Appropriate agreements between countries in these areas can give rise to a more efficient organization of production.

Regional initiatives and industrial policy

Another potential risk that might hinder the smooth flow of trade is the dependence on highly specialized inputs. The lion’s share of inputs into domestic production are sourced domestically or from a geographically diverse set of foreign suppliers (Flach et al., 2022; Lafrogne et al., 2021). Nevertheless, the supply of some strategic inputs is concentrated in a few supplying countries. Greater geographical diversification of these inputs could mitigate risks in GVCs.

For instance, bilateral European Union – US partnerships in energy supply, especially crude oil and natural gas, could limit excessive dependence of a number of European countries on imports from the Russian Federation. Similarly, excessive dependence of Europe and the US on semiconductor imports from a few Asian countries (mainly China, Chinese Taipei, Japan and South Korea) could be reduced by coordinated efforts to establish new production facilities elsewhere.

In most cases, greater geographical diversification of input supply would require going beyond closer regional integration. For instance, specific inputs may be available regionally only in very limited quantities. This suggests that initiatives for closer regional integration to strengthen the resilience of value chains should go together with strengthening the multilateral trading system. Moreover, sourcing inputs regionally (or in regional partnerships) is typically associated with high upfront costs, and risks driving up costs for client firms, e.g. because the establishment of new semiconductor production facilities in Europe and the United States will require large private and public investment.

Regional initiatives and investment policy

To improve supply chain resilience, companies have engaged in different strategies, resulting in alternative trajectories for GVCs and international production. Regionalization and diversification tend to go hand in hand, as alternatives to reshoring.

UNCTAD’s Investment Policy Framework for Sustainable Development sets out policy guidelines that could help maintain an open international investment environment. Some fundamental principles include transparent regulation of entry and establishment of foreign investors and non-discriminatory use of fiscal incentives to attract FDI.

A relevant example is provided by the Regional Comprehensive Economic Partnership (RCEP) agreement, signed in November 2020. The investment provisions in the agreement mostly consolidate existing market access as contained in myriad bilateral agreements. However, the trade disciplines and market-access commitments, especially on services and e-commerce are highly relevant for GVCs and market-seeking investment. RCEP is already an important FDI destination. It accounts for 16% of global FDI stock and more than 24% of flows. While global FDI has been stagnant for the last decade, the RCEP group has shown a consistent upward trend until 2019, and a limited drop in FDI in the region during the pandemic crisis (see UNCTAD, 2020b).

Intra-regional investment, at about 30% of total FDI in RCEP, has significant room for further growth. RCEP will have important implications for FDI and value chain development within and outside the group. Likely investment policy priorities for the partnership will include: (i) boosting investment in sustainable post-pandemic recovery; (ii) supporting resilience-seeking FDI, and (iii) promoting investment for development.

PLURILATERALISM AND MULTILATERALISM

In this part, we focus on plurilateral agreements to modernize the WTO. To succeed and support the multilateral system, these plurilaterals need to be inclusive and ambitious at the same time. Particularly developing countries are critical of plurilateral agreements because they supposedly lack inclusivity, restrict policy space, and distract from concluding the Doha Development Agenda. For other countries, plurilateral negotiations are not ambitious enough, in comparison to agreements (RTAs).

In order to investigate the twin-goal of achieving inclusivity and ambition, we analyze three Joint Statement Initiatives (JSIs) – namely services domestic regulation (SDR), electronic commerce (E-Commerce) and investment facilitation for development (IFD) – and compare them to RTAs We focus on RCEP, and the Pacific Alliance,[1] which contain participants with different levels of development and as such could provide best practices for plurilateral agreements. The part on e-commerce also includes best practices from the more ambitious CPTPP.

In a first step, we assess three key criteria: the JSI’s membership, scope as well as their special and differential treatment dimension (flexibilities) and compare them to the selected RTAs. Based on this analysis, the policy brief will recommend best practices on how to make plurilateral negotiations more inclusive and ambitious in the future. In addition, the policy brief will suggest a plurilateral reform agenda for the G20 under the Indonesian Presidency to support and accelerate inclusive WTO reform.

Membership

Plurilaterals are negotiated by sub-groups of like-minded WTO members and focus on specific issues, in which they share a particular interest. On average only about 40%of WTO members are participating in the various plurilaterals (Akman et.al. 2021).

Our analysis of membership of the three plurilaterals shows three distinct patterns (see, Figure 1): Firstly, high-income countries are the key participants[2], including 44 for SDR and 48 for E-commerce and IFD. Secondly, the number of upper-middle income countries is relatively evenly distributed across the three plurilaterals; 19 upper-middle income countries participate in the SDR agreement, 23 in the e-commerce and 29 in the IFD negotiations. Thirdly, the IFD negotiations attract the highest number of low and lower-middle income countries making it the most inclusive track, representing two thirds of the WTO membership. In contrast, only about half of the members participate in the e-commerce negotiations and 40%have concluded the SDR Agreement.

Figure 1: Participation of WTO members in plurilaterals according to income groups.

Source: Data collected by the authors

This variance of the participation in plurilateral initiatives can also be assessed when looking at regional patters. European and North American high-income countries are participating relatively evenly in the three plurilaterals. In contrast, the SDR agreement attracted the least number of other members, followed by the e-commerce negotiations and then the IFD negotiations. This difference is especially strong in Sub-Saharan Africa.

Services Domestic Regulation

The JSI on services domestic regulation (SDR) was successfully concluded in December 2021. The focus is on procedural issues, which cover transparency, legal certainty and predictability, and regulatory quality and facilitation issues. As such, the agreement is about good regulatory practices and not about market access, negotiations on which are covered separately under the General Agreement on Trade in Services (GATS) (WTO 2021).

The scope of the SDR Agreement and of RTAs like RCEP and the PA, which both also include developed as well as developing countries, are quite similar: RCEP establishes rules relating to regulatory transparency, efficiency, and trade facilitation. It also includes national treatment and MFN provisions and commitments that go beyond GATS (Australian Department of Foreign Affairs and Trade 2020). The PA includes rules relating to MFN, national treatment, more efficient national regulations, transparency measures, and enhanced legal certainty. The PA also breaks new ground by featuring treaty language on value chains in the form of both hard and soft law (Lopez, Munoz et al. 2017).

On market access, RCEP member chose positive or negative list approaches, while the PA members mainly tried to consolidate the degree of openness of their respective bilateral agreements. This has not necessarily led to more market opening but should be seen as a starting point.

Particularly the SDR Agreement and RCEP contain extensive flexibilities and (particularly the SDR Agreement) capacity-building mechanisms. The SDR agreement allows for a transitional period of seven years, while least developed countries (LDCs) are exempt. In addition, members are encouraged to provide technical assistance and capacity-building. RCEP also allows for flexibilities and differentiated commitments for developing country members. In addition, there is a six-year period to change from a positive to a negative list approach in services.

Investment Facilitation

Two thirds of the WTO’s members are currently engaged in negotiations on an IFD Agreement, aiming at finalizing the negotiations at the end of 2022. Like the SDR Agreement, the IFD Agreement aims at establishing good regulatory practices for FDI (Hoekman, 2021).

The IFD Agreement’s SDT provisions are more comprehensive and flexible compared to the SDR Agreement, which may be a result of the variance about the participating members.

RCEP includes an investment chapter with a dedicated section on investment facilitation, which follows existing ASEAN treaty-making practice (Schacherer, 2020). RCEP, like some other FTAs, furthermore, includes a transparency chapter. The investment facilitation section in the RCEP is best endeavour in nature and excluded from the scope of the dispute settlement chapter. The scope of the investment facilitation provisions in RCEP is like the WTO IFD Agreement, the latter, however, seeks to be far more comprehensive and binding. This shows that in investment facilitation, the IFD Agreement represents the international benchmark that will influence treaty-making on the bilateral and regional level.

Members of the Pacific Alliance are also seeking to facilitate investments in the region by starting initiatives to improve the investment climate. Furthermore, members are exchanging best practices on how to prevent investment disputes, which is an important means to retain investors.

By comparison, the IFD negotiations are more comprehensive than the investment facilitation provisions and initiatives of the RCEP and Pacific Alliance. Therefore, the IFD agreement, which is driven by developing countries, will become the benchmark for bilateral and regional investment facilitation agreements, including those pursued by the EU.[3]

E-commerce and digital trade

Despite the rising share of digital trade, due to difficulties faced at the multilateral level, WTO members have not yet achieved substantial disciplines on e-commerce, except for the moratorium on customs duties on electronic transmissions. In the absence of meaningful multilateral steps RTAs have been alternative avenues to regulate the area. Around one hundred RTAs exist with standalone chapters or having relevant provisions. Most agreements contain commitments in issues pertinent to market access; regulatory rules, and trade facilitation (Yeon, 2021). Despite developments in RTAs, WTO-based governance is vital largely because digitalization and e-commerce are “inherently global and borderless”, and fragmentation brings costs to businesses (Gao, 2022).

Plurilateral negotiations under the JSI on Trade-related Aspects of E-Commerce, adopted in 2017, provides another avenue. The JSI on e-commerce is expected to provide an “opt-in” accord to improve procedural and regulatory transparency and e-trade facilitation. Currently negotiated by 86 members that represent 93%of total trade flows (91% of services trade) and guided by the objective of achieving WTO-plus outcomes the JSI is framed around several themes including openness; trust; market access; and cross-cutting issues such as development and transparency. Small group meetings held can be helpful to extend convergence building process, and E-commerce Capacity Building Framework can offer technical assistance to developing countries in the e-commerce negotiations[4]. The decision at MC12 to maintain the current practice of not imposing customs duties on electronic transmissions until MC13 is positive. The G20 should work on the topic to help the WTO General Council to be able to extend it.

Yet, considering two major challenges the RTA experience can play a catalytic role to address knotty issues for the JSI and for multilateralization of the rules.

- Many developing countries do not take part in the negotiations largely due to trust, security, and capacity reasons (Akman, et.al. 2021).

- Differences among major players’ regulatory approaches to thorny issues like cross-border transfer of information (data flow), location of computing facilities, and privacy protection which surrounds the interests of developing economies.

The following RTAs including both developing and advanced economies with separate chapters can be illustrative for meaningful outcomes and lessons for JSI e-commerce.

RCEP devotes a chapter to e-commerce (Chapter 12), which aims at promoting e-commerce among parties, contributing to creating an environment of trust and confidence, and enhancing cooperation among member states (RCEP 2019) in accordance with the WTO Ministerial Decision taken at MC11 in 2017. However, in promoting cross-border electronic commerce, each Party is allowed to implement their own measures regarding the use or location of computing facilities to ensure security and confidentiality of communications. RCEP also includes several exceptions regarding data flows and data localization and is less stringent on non-discrimination. It recognizes that any Party may have its own regulatory requirements concerning transfer of information by electronic means. Parties cannot prevent cross-border transfer for the conduct of business; however, flexibilities are provided for some for a period of up to five years.

CPTTP regulates e-commerce in Chapter 14 which contains several issues[5]. CPTPP members have committed to allow service suppliers and investors to transfer information across borders as part of their business activities. They also agreed not to impose requirements to use or build local data centers to be able to conduct business in CPTPP territories.

Digital trade provisions in CPTPP are more ambitious compared to RCEP and PA even though many of their developing country members are the same, mainly because the CPTTP was initially driven by the US (withdrew subsequently)., RCEP diverges from CPTPP on provisions relevant to the location of computing facilities, protection of personal information, and dispute settlement. RCEP also has a much flexible approach by allowing Parties to impose national regulatory measures if they are non-discriminatory. Moreover, the RCEP chapter on e-commerce is not subject to Dispute Settlement rendering the provisions ineffective in terms of liberalizing cross-border digital trade and data flows. Though less ambitious, it seems that RCEP can be potential model in a plurilateral accord (Leblond, 2020) mainly because it gives more leeway for many developing countries. The practices in RTAs reflect that most developing countries face challenges in their digital commitments and refrain from ambitious approach. This can be related to their inadequate digital infrastructures, legal and institutional capacities, and digital skills (Yeon, 2021). It is also important to establish trust given controversial aspects of negotiations for the developing countries (Akman et.al. 2021). Divergent privacy regimes and rising compliance costs regarding critical data flow issues is another “source of concern” that need to be addressed (Drake-Brockman et.al. 2021).

Proposal

In order to support cooperation, the key following recommendations should be implemented:

- Unnecessary trade barriers (both tariffs and non-tariff measures) should be avoided, and strong engagement with the WTO and its rules must be preserved;

- Attention must be given to specific details of deep trade agreements, that can broaden the opportunities in terms of localization of parts of GVCs;

- More broadly, RTAs should be designed to avoid “fortress scenarios” but should rather tend to be inclusive and flexible to facilitate dialogue with third parties and to promote strengthened, non-competitive supply chains.

- G20 members as key players in global trade should scrutinize thoroughly the experiences, best-practices and flexibilities in RTAs that can shed light on multilateral and plurilateral negotiations.

Enhance resilience of GVCs

Investment policies, to create a balance between liberalization and resilience should encompass the following elements:

- New investment-development path. This involves, shifting strategic policy direction from a GVC-driven, segment-targeted export orientation towards a RVC (regional value chain)-based export expansion, with domestic industrial clustering to build linkages and resilience. In following the new path, countries should balance modern (open) industrial development policies with built-in national economic security and resilience mechanisms. Investment policies should be designed to maximize the benefits of attracting external know-how and technology to improve productive capacity and focused on promoting sectors that can support higher participation in GVCs.

- Promoting a business environment attractive to new investment activities and conducive to technology dissemination and sustainable development. An important component of the new ecosystem should be the modernization of infrastructure for digital, physical and institutional connectivity at regional and subregional levels.

- Building dynamic productive capacity, shifting the focus from narrow specialization to the expansion of the manufacturing base. Strengthening industrial clustering (including cooperatives of micro and SMEs for scale and scope of production) and retooling SEZs and science parks are viable approaches that match with MNE regionalization and diversification strategies. Such approaches can also help low-income countries to foster a resilient and inclusive economy by crowding in domestic micro and SMEs and facilitating backward linkages.

- Adapting investment promotion and facilitation in support of regional integration. This includes resetting priorities for investment promotion, targeting diverse investment activities and business functions, and facilitating green and digital investors, as well as impact investors, to promote investment in the SDGs.

Industrial Policy: making it as a tool for diversification and trade openness

When using industrial policy as a tool to foster diversification, it should be structured in a way that preserves a level-playing field for companies within and outside regional partnerships:

First, industrial policy should not underestimate the importance of horizontal instruments (e.g. sectoral regulation and technical standards, skills and knowledge provision, see Criscuolo et al., 2022a and 2022b).

Important synergies can be achieved at the regional or multilateral levels (e.g. on technical standards). By coordinating stakeholders on technical norms, technical standardisation allows the compatibility between actors and can generate positive externalities. For instance, the emergence of a regional and international green hydrogen market importantly hinges on the definition of international standards, e.g. guarantees of origin on the carbon emissions linked to hydrogen production or hydrogen purity (Cammeraat, Dechezleprêtre and Lalanne, 2022). Standardisation simultaneously occurs in partnerships and in multilateral standard setting organisations. Partnerships should be perceived as building blocks for the emergence of global solutions, rather than as tools to promote strategically domestic standards, which could prove technically suboptimal.

Second, industrial policy should prioritise addressing market failures, which can benefit trade partners. For instance, supporting the development and adoption of green technologies, including through subsidies, can foster the dissemination of these technologies and reduce carbon emissions, thereby potentially benefitting trade partners.

Third, industrial policy should not disadvantage foreign companies, especially in the areas of subsidies and public procurement. In fact, such a policy generally reduces competition and, consequently, innovation. On the contrary, coordination at the regional and multilateral levels should be used to avoid subsidy bidding wars. Finally, national security exemptions to non-discrimination principles should be used sparingly rather than as tool of industrial policy or trade protection.

Consider best-practices in RTAs to make plurilateral agreements more inclusive and ambitious

Focus on development aspects is key for the negotiation of inclusive plurilaterals

Plurilaterals can be a stepping-stone toward closer multilateral integration on issues where consensus is not yet in sight. However, in order to fulfil this goal, they need to be more inclusive. Members must find ways to accommodate diverse member interests, notably those of developing countries. Therefore, it is essential to provide trust and capacity building for developing and LDCs to take part more effectively in the process.

The IFD negotiations therefore adhere to the approach toward special and differential treatment (SDT), which was started in the TFA. This is a useful model to take the specific challenges of developing countries into account. In e-commerce, provisions allowing SDT for developing countries and LDCs can be helpful for inclusivity. However, provisions allowing long, or indefinite transition periods alone may not be effective unless coupled with capacity-building measures that address the deep causes of reluctance to make deeper commitments.

Capacity building is important

The JSI on SDR and RCEP allow for transitional periods to incorporate members with different stages of development. The JSI is the only one, which also addresses LDCs. It is also the only one dealing with the issue of building capacity to implement the agreement.

In e-commerce, most challenges in trade agreements are relevant to disparities pertinent to digital infrastructures, digital skills, data protection and security issues. Technical assistance programs like the E-Commerce Capacity Building Framework can be extended to develop institutional and technical infrastructures, and entrepreneurial capacities (especially for SMEs) to promote both inclusivity and ambition) in the JSI.

Rights to regulate need to be considered

Members of JSI on e-commerce must be assured of their rights to regulate cross-border data flow, protection of consumers, and personal information for public policy and public security purposes, however such objectives must not constitute unjustifiable and arbitrary discrimination or a disguised restriction to trade as provided in PA. To improve standards to mitigate market fragmentation associated with diverse approaches, JSI members should consider open dialogue and share best practices.

Keep plurilaterals open to avoid negative effects for outsider

Plurilateral agreements need to be inclusive, but they need to make sure at the same time that outside members are not negatively affected. This means that negotiations have to be conducted in a transparent manner and be open to new members at all stages. (Akman et.al. 2021).

Pragmatic approach in G20 could move forward to deepening

Increasing commitments in trade agreements and JSIs do not necessarily mean that the provisions are deepening. G20 should consider pragmatic approaches which support more ambitious outcomes. It can authorise the Trade and Investment Working Group (TIWG) to establish sub-groups to jointly work with the private sector, SMEs, and NGOs to discuss critical issues and work on deepening commitments. The PA for example breaks new ground by including best endeavour soft law commitments for digital trade and can be a starting point to explore the topic further with a view to developing fuller provisions in the future. A viable pragmatic approach operates smoothly if all G20 members take part in the JSI plurilaterals on SDR, IFD and e-commerce.

References

Akman, S., Berger, A., Botti, F., Draper, P., Freytag, A., Schmucker, C. (2021), “Boosting G20 Cooperation for WTO Reform: Leveraging the Full Potential of Plurilateral Initiatives”, T20 Italy Policy Brief, https://www.t20italy.org/2021/09/08/boosting-g20-cooperation-for-wto-reform-leveraging-the-full-potential-of-plurilateral-initiatives/

Blustein, P. (2019), “Schism – China, America and the Fracturing of the Global Trading System”, Center for International Governance Innovation.

Bown, C.P., Malmström, C. (2021), “What is the US-EU Trade and Technology Council? Five things you need to know”, PIIE.

Cammeraat, E., Dechezleprêtre, A., and Lalanne, G. (2022), “Innovation and industrial policies for green hydrogen“, OECD Science, Technology and Industry Policy Papers, No. 125, OECD Publishing, Paris.

Council of the European Union (2019), “Council Decision authorising the opening of negotiations with the United States of America for an agreement on the elimination of tariffs for industrial goods”

European Commission (2021), “EU-U.S. Relations – A Trillion-Euro Partnership”

Fasulo, F., Tentori, D. (2021), “Scambi Globali: Manovre USA-UE, nel mirino la Cina”, ISPI Commentary.

Flach, L., Gröschl, J., Steininger, M., Tetiund, F., Baur, A. (2021), Internationale Wertschöpfungsketten –Reformbedarf und Möglichkeiten, Ifo Institut.

González, A. (2022), “Problemas en las cadenas de suministro y creciente incertidumbre: cómo puede ayudar la OMC?”, Trade Thoughts from Geneva, WTO.

Hoekman, B. (2021), “From trade to investment facilitation: parallels and differences”,in Berger A, Sauvant KP (eds.), Investment Facilitation for Development: A Toolkit for Policymakers, Geneva: International Trade Centre, 28-42.

Iapadre, P. L. and Tajoli, L. (2014) “Emerging countries and trade regionalization. A network analysis”, Journal of Policy Modeling 36S, S89-S110.

Lafrogne-Joussier, R., Martin, J. and Mejean, I. (2021), “Supply Shocks in Supply Chains: Evidence from the Early Lockdown in China”, CEPR Discussion Paper No. DP16813,.

Laget, E., Osnago, A., Rocha, N., Ruta, M. (2018), “Deep Trade Agreements and Global Value Chains”, Policy Research Working Paper;No. 8491. World Bank.

Leblond, P. (2020), “Digital Trade: Is RCEP the WTO’s Future?”, CIGI Paper, November 23.

Lippoldt, D. (2022), “Regulating Digital Economy: Reflections on the Trade and Innovation Nexus”, CIGI Paper, February 14.

OECD (2019), “Measuring distortions in international markets: The semiconductor value chain”, OECD Trade Policy Papers, No. 234, OECD Publishing.

Schacherer, S. (2020), “Facilitating investment through IIAs: The case of the Regional Comprehensive Economic Partnership Agreement”, Columbia FDI Perspectives Perspectives on topical foreign direct investment issues No. 295 January 11.

UNCTAD (2020), “World Investment Report 2018: Investment and New Industrial Policies” New York and Geneva, United Nations.

UNCTAD (2020), “World Investment Report 2020: International Production Beyond the Pandemic”, New York and Geneva: United Nations.

UNCTAD (2020), “Global Investment Trend Monitor, No. 37: Special RCEP Agreement Edition” Geneva, Switzerland.

Van der Loo, G., Vandenbussche, T., Aktoudianakis, A. (2021), “The EU-US Trade and Technology Council: Mapping the Challenges and Opportunities for Transatlantic Cooperation on Trade, Climate and Digital”, Egmont Paper 113.

WTO (2017), “Global Value Chains Report”, Geneva, Switzerland.

Yeon, T.S. (2021), “Digital Commitments in ASEAN’s Free Trade Agreements”, ISEAS Perspective, No.163.

Appendix

Annex 1. Trends in trade and intra-regional trade agreements (RTAs)

Considering the 15 most important RTAs (Figure 1), the world merchandise trade share of their intra-regional flows, which had plateaued at 45% between 1999 and 2003, steadily decreased in the following decade, reaching a low of 36% in 2012. After a partial rebound in the following four years, this indicator has remained stable at around 39% since 2016.

Figure 1: Intra-regional trade of the main preferential trade agreements* as a percentage of world merchandise trade

*AMU, ASEAN +3, CAN, CACM, CARICOM, CEFTA, CIS, ECOWAS, ECCAS, EFTA, EU-28, GCC, MERCOSUR, NAFTA, SADC.

Source: UNCTAD, Merchandise: Intra-trade and extra-trade of country groups by product, annual – https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=24397

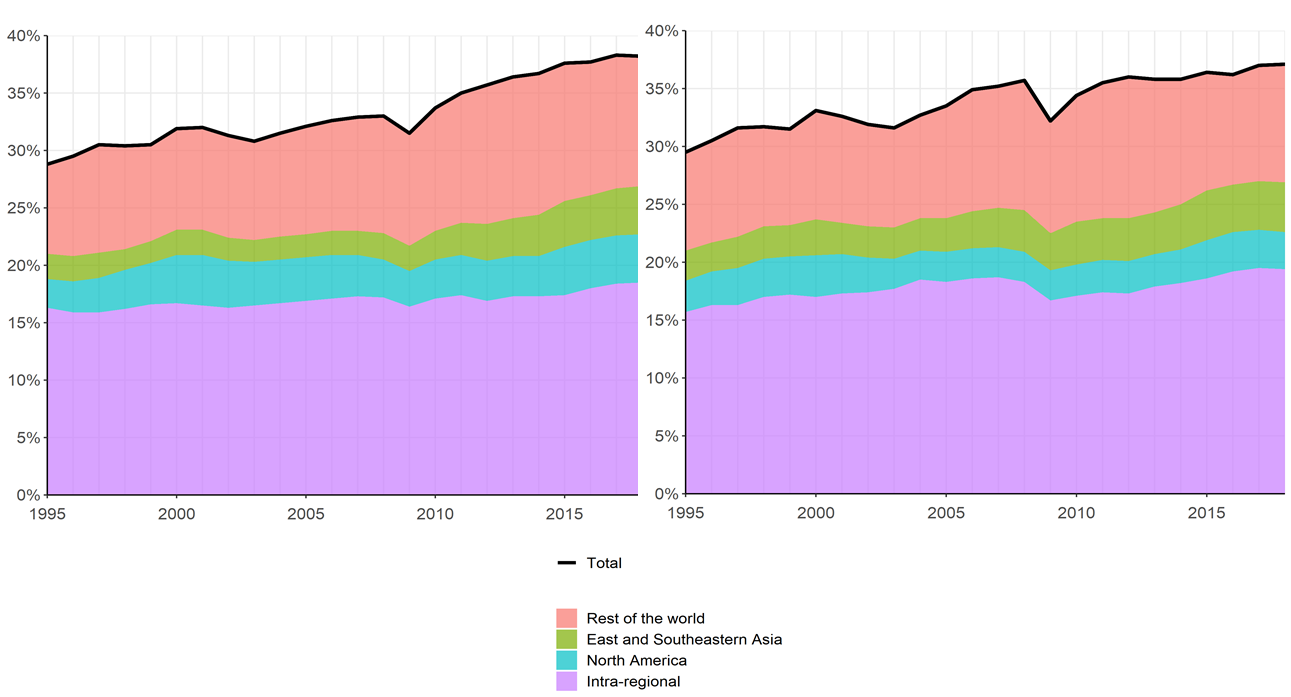

Considering separately the different regions (Figure 2), starting from a peak of 66% in 2004, this share has progressively decreased in the EU-28 dropping to a low of 59% in 2012 and remained fairly stable over the next decade. Its decline was even more pronounced in North America, from a high of 32% in 2000 to a low of 22% twenty years later. Only in the case of ASEAN + 3 the available data show a substantial stability of this indicator in the last two decades around 40%.

Figure 2: Intra-regional share of total merchandise trade

Source: UNCTAD, Merchandise: Intra-trade and extra-trade of country groups by product, annual – https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=24397

However, the intra-regional trade share is not an adequate indicator of the regionalization of trade, as it suffers from a pro-cyclical distortion: regions whose total trade tends to grow faster than the world average tend to show an increase in their intra-regional trade shares which does not necessarily reflect more intense regionalization. A better indicator is a trade intensity index, such as the revealed intra-regional trade preference index (Iapadre and Tajoli, 2014), which corrects for this bias. This indicator shows a notable downward trend for both ASEAN + 3 and North America between 2003 and 2020 and remains fairly stable only in the case of the EU-28 (Figure 3).

Figure 3: Revealed intra-regional trade preference index*

*Merchandise trade. See Iapadre and Tajoli (2014).

Source: UNCTAD, Merchandise: Intra-trade and extra-trade of country groups by product, annual – https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=24397

Partly similar results emerge when calculating intra-regional trade indicators for the two groups of “developed economies” and “emerging economies”, as defined in the UNCTAD trade database (Figures 4 and 5). The shares of intra-group merchandise trade have remained fairly stable for both groups over the past decade and the revealed intra-group trade preference index has increased slightly for developed economies only, but has shown a notable downward trend for emerging economies.

Figure 4: Intra-group share of total merchandise trade

Source: UNCTAD, Merchandise: Intra-trade and extra-trade of country groups by product, annual – https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=24397

Figure 5: Revealed intra-group trade preference index*

*Merchandise trade. See Iapadre and Tajoli (2014).

Source: UNCTAD, Merchandise: Intra-trade and extra-trade of country groups by product, annual – https://unctadstat.unctad.org/wds/TableViewer/tableView.aspx?ReportId=24397

In conclusion, the recent slowdown in world merchandise trade growth rate does not seem to be attributable to an increase in the relative costs of its extra-regional component, nor to the trade-creation and diversion effects of RTAs. Indeed, the growth of new RTAs notified to the WTO has been progressively declining over the past decade, as the most important regions are already covered by at least one of them.

What remains to be understood is the reason why the slowdown of international trade has been particularly noticeable in Asia. Since the mid-2000s, the trade-to-GDP ratio of China, India and other Asian emerging economies, including Indonesia, Malaysia, Philippines, Singapore and Thailand, has been falling significantly, reversing its previous upward trend. Rather than revealing a regionalization of the supply chains, these data seem to suggest their possible “domestication”, with several emerging Asian countries gradually becoming “normal” large economies, characterized by relatively lower degrees of trade openness.

Regionalization in Global Value Chains

The observed trend in regionalization does not change significantly when looking at trade in value added (TiVA) data, nowadays a widely used indicator of GVCs participation, with the manufacturing core of so-called “GVCs” having remained strongly regional. For example, in the case of euro area countries, over 80% of the foreign added value of domestic demand and gross exports originates from other euro area countries.

“Factory Europe” – as it is sometime named – has certainly been favoured by the high degree of integration of the European market but the degree of openness of the European production chain to non-European actors has been growing over time: the share of value-added produced within the EU shows a clear declining trend. European value-added has been substituted with value-added originating in the US, with the share reaching approximately 3%, but also from non-OECD economies, first of all China (about 1.6%), as well as other Asian countries such Cambodia or India. The share of value-added coming to the EU from Korea has also increased in the past decade, possibly consolidating in the years of the implementation of the bilateral Free Trade Agreement.

Value added exports of EU27 countries Value added imports of EU 27 countries

A. Value added exports/domestic value added (%) B. Value added imports / domestic final demand (%)

Figure 6: European integration has gone hand in hand with integration with non-EU countries

Note: Unweighted average of EU27 countries.

Source: OECD, Trade in Value Added (TiVA) Database, https://oe.cd/TiVA, February 2022.

- PA is a regional integration initiative established by Chile, Colombia, Mexico, and Peru in 2011, nevertheless it has over 60 observer countries from all continents. ↑

- EU countries are counted separately. ↑

- The EU is negotiating a Sustainable Investment Facilitation Agreement and has put forward a draft text that builds on many aspects of the IFD negotiations, see: https://trade.ec.europa.eu/doclib/press/index.cfm?id=2277 ↑

- See, “Co-conveners welcome good progress in e-commerce talks, launch capacity-building framework”, at https://www.wto.org/english/news_e/news22_e/jsec_13jun22_e.htm ↑

- These include, facilitation of trade, cross-border transfer of information, data localization barriers, customs duties, source code, privacy and consumer protection, cyber security, access to and use of internet and dispute settlement. ↑