A version of this policy brief was first published by the Centre for International Governance Innovation, copyright 2018.

Economic Transformation

Economic history has always been in part the story of international competition for wealth…. The Industrial Revolution gave this competition a new focus — wealth through industrialization — and turned it into a chase. There was one leader, Britain, and all the rest were pursuers. The lead has since changed hands, but the pursuit goes on in what has become a race without a finishing line…. The rest can at best follow along and make the most of their capacities. But even these are far better off than those who are not even running. No one wants to stand still; most are convinced that they dare not. (Landes 1969, 538)

These lines, taken from David Landes’ landmark study of the first industrial revolution, published in 1969, apply just as aptly to the technological transformation currently under way. The question in the digital era is not whether to participate but how best to participate effectively. Central to this participation are the enabling conditions and supporting policies that governments create within which the application of technological advances to real-world problems, and the fruits from entrepreneurship, are maximized and distributed. This was the case during the first industrial revolution, when differing conditions in, for example, IP laws, the strength of guilds and laws relating to the ownership of land have been cited as explaining the relative success and failure of the first, early and late industrializers. In the post-World War II era, this discussion mutated into what came to be known as industrial policy, which, in its wider forms, goes beyond a focus on manufacturing to include “any type of selective intervention or government policy that attempts to alter the structure of production toward sectors that are expected to offer better prospects for economic growth than would occur in the absence of such intervention” (Pack and Saggi 2006, 267-68).

Challenge

Government policy has played an integral part in the process of technological change and economic growth throughout modern history. Its contours both shape and adapt to the nature of the particular transformation in play, so it is important to outline the stylized facts about the digital era.

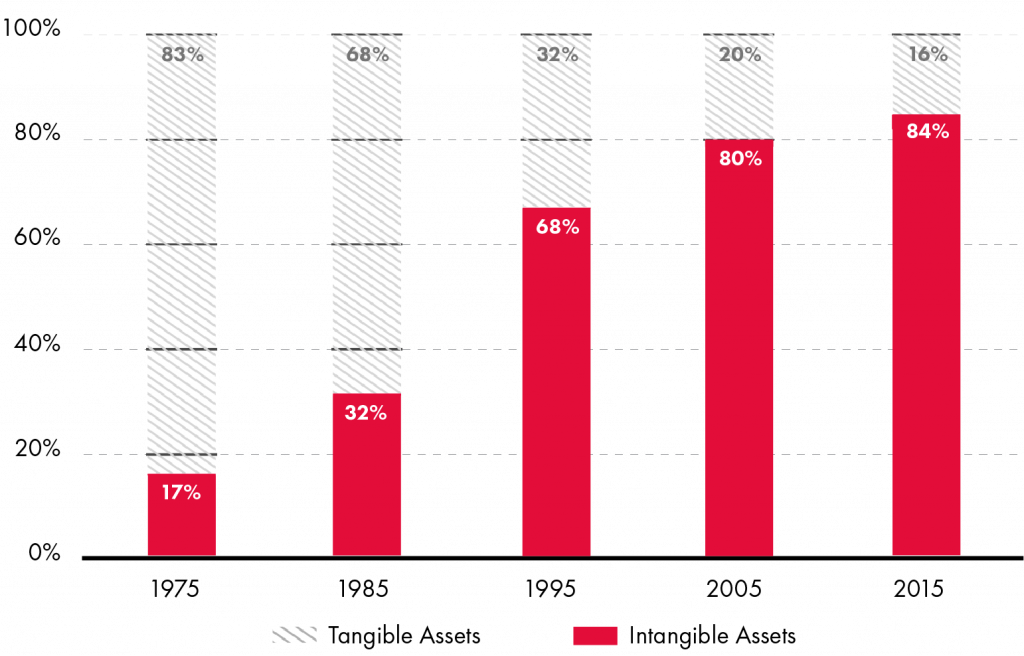

Central to the digital transformation is a shift toward intangibles. In their book with the telling title Capitalism Without Capital, Jonathan Haskel and Stian Westlake (2017) report that businesses in developed countries increasingly invest more in intangible assets (10 to 13 percent of GDP) than in tangible assets. The intangibles economy is driven by ideas, mostly proprietary ideas — i.e., IP. For an indicator of the importance of ideas in today’s economy, consider what has happened to companies comprising the Standard & Poor’s (S&P’s) 500. In 1975, one-sixth of the S&P 500 represented the value of intangibles; today the figure is five-sixths (see Figure 1). The market value of Apple, Amazon, Alphabet, Microsoft and Facebook is about US$4.2 trillion, with total tangible assets amounting to about five percent (US$225 billion) of that figure. Intangibles and IP are not the same thing — the former also comprises, for example, goodwill and brand recognition. But as an indicator of the relative decline of the value of physical assets and the rise of technological advancements and organizational change, the magnitude of the shift is telling.

The intangibles economy has some features that distinguish it from the conventional type of economy (see Breznitz 2016; Ciuriak 2018). It is characterized by high upfront costs and very low reproduction costs. It conveys a great advantage to first movers, particularly if the technology becomes an industry standard. This also means that primacy in this matter is a global geopolitical game. And economies of agglomeration are inherent in the production of IP, so existing innovation clusters have a head start over others still in the formative stage.

Robotics and artificial intelligence (AI) are other features of the intangibles economy. Even if the dire predictions of job losses from robotics and AI are not borne out, this much is clear — career trajectories and the nature of work are being transformed.

Figure 1: Shifting Tangible and Intangible Asset Ratios of S&P 500 Market Value, 1975–2015

Source: Ocean Tomo (2017).

Career changes are likely to become more frequent. Skills upgrading will become more important and multi-year upfront education programs less the norm (or more likely to be complemented by lifelong learning opportunities). At an extreme, the traditional firm-employee relationship might devolve into a series of simultaneous or sequential multiple contractual relationships between a worker and employer or between workers.

Although specific scenarios are unknown (and unknowable), two outcomes about this era are obvious. First, it will be driven by proprietary knowledge (IP). Second, this IP is generated within a few countries only, and by a very small number of individuals and firms. As a result, income and wealth distribution will worsen before it improves (eventually, if at all).

Thus, policy making in such a world must explicitly incorporate these features in its design and execution:

- high upfront costs, low to zero marginal costs;

- high risk of failure, but large rents accruing to success;

- rewards to strategic behaviour;

- kinetic job environments and labour markets; and

- rising inequality (spatial, economic and social).

Proposal

The Spectrum of Policy Responses

Supporting and Managing Innovation

The first three points above create near ideal conditions for which industrial policy — that is, the strategic use of government intervention in the economy — exists. Governments either actively “pick winners” — that is, the sectors, industries or firms that with direct government intervention are likely to be growth engines for the rest of the country — or, if they wish to leave it to the market to determine the “winners,” they support the sectors that the market yields as emergent via indirect and complementary policies.

Principal in these policies is a set of measures to promote the creation and use of IP (see Medhora et al. 2017). In the domestic arena, this includes such initiatives as creating patent collectives, using public procurement budgets to prioritize domestic small firms and start-ups, and ensuring that the IP generated in publicly funded universities is commercialized appropriately.

Underlying the effectiveness of these policies is a fundamental imbalance of interests between holders of IP and IP-exporting countries on the one hand, and consumers and IP-importing countries on the other. This tension will continue to play out in various fora, including plurilateral trade negotiations, multilaterally at the World Trade Organization/Agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS) (including and especially whether TRIPS should be refreshed) and in disputes over the extent to which national IP laws and their enforcement are compliant with international commitments. Governments separately and collectively will have to determine where to find the balance between the stimulus to innovate and the resulting economic gains that IP protection provides, and the losses to consumers and efficiency via higher prices and rent-seeking behaviour by firms granted such protection (although this is a bell curve, not an upwardly linear relationship).

Advanced technology firms accrue economic rent in two related ways: via the monopoly power granted by IP systems, and via first-mover advantage. The recent crises around “big data” firms have accelerated the trend to view them not as special but as natural monopolies. Viewed in this light, the policy responses may be designed accordingly. Competition/anti-trust policy can be used to curtail the market power of dominant firms (for example, à la breakup of the telecoms in many countries in the early 1980s; see Blit, St. Amand and Wajda 2018).

Macroeconomic Policy

The distinct characteristics of the digital economy also have implications for macroeconomic policy. Once it is recognized that intangibles constitute the new capital stock and that outputs are produced at near-zero marginal cost, consider, for example, the implication for the exchange rate, the standard equilibrating tool to maintain external payments balance. In a conventional economy dominated by trade in goods and services, with a positive and often upward sloping marginal cost curve, a depreciation/devaluation raises the domestic currency cost of imports and lowers the foreign currency cost of exports. With the usual caveat about the J-curve and Marshall-Lerner condition,[1] the deficit (surplus) in the balance of trade is thus lowered (raised). In an economy where IP stocks constitute a part of the economy, a depreciation/devaluation by lowering the foreign currency cost of IP, makes its acquisition more attractive to potential foreign buyers.

In this, as in other effects, the modern IP-based economy exhibits characteristics associated with rentier economies based on land and natural resources. The policy dilemma is a familiar one, for in these cases changes in the value of the currency pits the interests of “holders of stocks” (such as land) against those whose revenue depends on “flows” (such as manufactures). This does not diminish the importance of the exchange rate as a policy tool; rather, it highlights the importance of understanding the disaggregated and often long-term implications of such moves. In the digital economy, it places a renewed focus on foreign acquisitions policy to avoid predatory behaviour (where emerging threats to an existing monopoly are taken out before they reach their full potential) or to retain control of what used to be called the “commanding heights” of the economy.

To illustrate the point, technology entrepreneur and writer Ian Hogarth (2018) provides the example of DeepMind, the renowned AI lab headquartered in London, UK. At a critical point in its development, after it had established itself as a key player in AI but before its most groundbreaking work, DeepMind was acquired by Google in 2014 for £400 million. To be sure, Google brought finance and its in-house expertise to bear on what followed, and at the time of acquisition DeepMind was a pre-revenue start-up; however, Hogarth states:

I find it hard to believe that the UK would not be better off were DeepMind still an independent company. How much would Google sell DeepMind for today? $5 billion? $10 billion? $50 billion? It’s hard to imagine Google selling DeepMind to Amazon, or Tencent or Facebook at almost any price. With hindsight, would it have been better for the UK government to block this acquisition and help keep it independent? Even now, is there a case to be made for the UK to reverse this acquisition and buy DeepMind out of Google and reinstate it as some kind of independent entity?

The stock-flow dilemma puts foreign investment review and the structure of revenue-sharing agreements for high-tech firm acquisitions as a key consideration in policy design in the digital era.

Haskel and Westlake (2018) also posit implications for the conduct of monetary policy in the digital era, for three reasons. First, as national statistics currently under-report the new forms of investment in intangibles, policy makers do not have good information on the size and performance of the economy. Second, intangibles are less attractive as collateral to lenders than are physical assets that can be parcelled and sold off more easily. As a result, IP-based firms rely more on forms of finance such as equity and venture capital that are less sensitive to the short-term interest rate, the policy tool of choice for central bankers. Third, in a near-zero-marginal-cost economy, prices do not start increasing more quickly as the economy reaches capacity. Instead, the economy might be characterized by more firms each producing slightly differentiated products. The measured rate of inflation thus conveys different information than it does conventionally.

The uncertainty around the signals the economic statistics send and the transmission mechanism for monetary policy raises another issue. It is likely that in the face of radical technological change, in particular in the areas of machine learning and AI, we might enter a period of prolonged secular decline in prices. In such an environment, maintaining aggregate demand becomes important if a deflationary spiral is to be avoided. Initiatives that are currently seen as experimental or exceptional, such as a universal basic income scheme and “helicopter money,”[2] will enter the mainstream of the policy arsenal.

The rise of natural monopolies in the digital era also has implications for tax policy as the rent-driven profits of IP-centric firms must be monitored and taxed effectively. Although the trend in recent years has been toward consumption-based taxation and away from corporate taxation, the digital economy heralds an era that reverses this trend, with good reason. An interesting variant of this idea is Bill Gates’ proposal to tax the owners of robots (Delaney 2017). This is not a radical proposal, grounded as it is in the notion that in a rentier economy the source of rent (be it land or soft capital like IP) provides a rich, efficient and economically and socially justifiable basis to levy taxes. The focus on appropriate taxation of rents of what are large, powerful and agile multinational firms puts tax-base erosion and profit shifting[3] in focus and places a greater onus on cross-border tax cooperation.

Social Policy

A final set of policy considerations in the digital era relates specifically to the impact robotics and AI are likely to have on jobs and labour markets, described at the start of this policy brief. This has implications for a series of social policies (Medhora and Ossip 2018).

Support — in areas such as transport, child care, education and pensions — should move from “job centred” to “person centred.” Student loan programs, tax deductions for fees and learning, currently often related to the age or income level of the individual, might have to become universal. Barriers to re-skilling and public-private partnerships in learning will have to be removed. Limits on tax-free savings might give way altogether, while pension plans might go either entirely public or have total portability as a central feature. Indeed, a universal basic income scheme, mentioned above, may be the dominant form of social safety net, with public goods such as education and perhaps transport paid for by taxes on economic rents and wealth.

In sum, what is most striking about the policy issues raised in this policy brief is that they insinuate scenarios that are neither dystopian nor a panacea. They all evolve from methods and tools already in the policy arsenal. Large, important tracts of policy space remain uncovered, in particular in the technology-security-liberty nexus of issues, recently so eloquently raised by Henry Kissinger and Yuval Noah Harari.[4] But within the conventional macro-micro-institutional areas, policy responses in the digital era will have to be creative, yet grounded in history in equal measure.

Author’s Note

Earlier versions of this paper have benefited from discussions with Jim Balsillie and Bob Fay, and presentations at the Centre for the Study of Living Standards (Ottawa), the CIO Strategy Council (Ottawa) and Tsinghua University (Beijing).

Works Cited

Blit, Joël, Samantha St. Amand and Joanna Wajda. 2018. Automation and the Future of Work. CIGI Papers No. 174. Waterloo, ON: CIGI. www.cigionline.org/sites/default/files/ documents/Paper%20no.174lowres.pdf.

Breznitz, Dan. 2016. “New trade deals raise tricky questions about how countries pursue growth.” The Globe and Mail, December 3. www.theglobeandmail.com/report-on-business/rob-commentary/new-trade-deals-raise-tricky-questions-about-how-countries-pursue-growth/article33182470/.

Ciuriak, Dan. 2018. Rethinking Industrial Policy for the Data-driven Economy. CIGI Paper No. 192. Waterloo, ON: CIGI. www.cigionline.org/sites/default/files/ documents/Paper%20no.192web.pdf.

Delaney, Kevin J. 2017. “The robot that takes your job should pay taxes, says Bill Gates.” Quartz, February 17. https://qz.com/911968/ bill-gates-the-robot-that-takes-your-job-should-pay-taxes/?utm_source=qzfb.

Harari, Yuval Noah. 2018. “Why Technology Favors Tyranny.” The Atlantic (October). www.theatlantic.com/magazine/ archive/2018/10/yuval-noah-harari-technology-tyranny/568330/.

Haskel, Jonathan and Stian Westlake. 2017. Capitalism Without Capital: The Rise of the Intangible Economy. Princeton, NJ: Princeton University Press.

———. 2018. “Tough choices for central bankers in the modern age of intangibles.” The Times, August 18. www.thetimes.co.uk/article/ tough-choices-for-central-bankers-in-the-modern-age-of-intangibles-03fhrh6vz.

Hogarth, Ian. 2018. “AI Nationalism” (blog post), June 13. www.ianhogarth.com/ blog/2018/6/13/ai-nationalism.

Kissinger, Henry A. 2018. “How the Enlightenment Ends.” The Atlantic (June). www.theatlantic.com/ magazine/archive/2018/06/henry-kissinger-ai-could-mean-the-end-of-human-history/559124/.

Landes, David S. 1969. The Unbound Prometheus. Cambridge, UK: Cambridge University Press.

Medhora, Rohinton et al. 2017. New Thinking on Innovation. CIGI Special Report. Waterloo, ON: CIGI. www.cigionline.org/ publications/new-thinking-innovation.

Ocean Tomo. 2017. “Intangible Asset Market Value Study.” www.oceantomo.com/intangible-asset-market-value-study/.

Pack, Howard and Kamal Saggi. 2006. “Is There a Case for Industrial Policy? A Critical Survey.” World Bank Research Observer 21 (2): 267–97.

[1] The Marshall-Lerner condition is a mathematical statement that an exchange rate depreciation/devaluation will only improve the balance of trade if the absolute value of the sum of the elasticities of demand for imports and exports exceeds one. The J-curve is a special case of this verity. It refers to the phenomenon wherein under fixed-price contracts (which is how much trade occurs), the initial effect of a depreciation/devaluation on the balance of trade will be perverse, only improving in the medium to long term as these contracts come to an end and their successors reflect the new price structure of imports and exports caused by the exchange rate change.

[2] The digital-era equivalent is a “cash blast” to every individual’s bank account or e-payment system.

[3] See www.oecd.org/tax/beps/.

[4] The article titles are revealing. Kissinger’s is titled “How the Enlightenment Ends” and Harari’s is titled “Why Technology Favors Tyranny.”