As carbon dioxide (CO₂) emission reductions become increasingly urgent to counter climate change, many nations have announced net- zero emissions targets. Achieving a Net-Zero Economy (NZE) will require the total decarbonisation of electricity generation, massive expansion of low-carbon energy systems, and investment in net-zero carbon technologies. These adjustments must consider the existing energy, economic, and social development imperatives of advanced and developing countries, while encouraging regional cooperation. This brief assesses energy transition challenges for the Association of Southeast Asian Nations (ASEAN) and the Gulf Cooperation Council (GCC) and proposes new policy pathways toward an inclusive global net-zero economy.

Challenge

Since the ratification of the Paris Climate Accords in 2015, governments have made commitments to reduce greenhouse gas (GHG) emissions. Many nations in the Association of Southeast Asian Nations (ASEAN) and the Gulf Cooperation Council (GCC) have set economy-wide net-zero emission planning targets by 2040–2060 and have committed to ambitious investments in clean energy production and decarbonisation.

While supporting the speedy uptake of renewables as a part of Net-Zero Economy (NZE) targets is imperative, there is an urgent need to decarbonise fossil fuels without risking energy security or increasing existing economic development challenges. Against this backdrop, new frameworks, such as the Circular Carbon Economy (CCE), have been discussed at the G20 level since 2020. Although several options exist for the energy transition to a net-zero economy, there are substantial challenges, especially for developing and emerging economies.

Challenge 1: Meeting basic energy needs. Many least-developed and some upper-middle- income nations are still dealing with critical development issues, such as end-user access to clean energy, e.g., electricity, clean cooking, and pollution-free travel. These nations also have challenges in financing their energy transitions. Leapfrogging from large-scale fossil fuels is unrealistic, given heavy dependencies on affordable fuels and development imperatives. Meanwhile, adoption of modern renewable energy (RE) sources and other low-carbon energy technologies has been slow, marked by a lack of investment, public budget limitations, and investor hesitancy (Pigato et al. 2020; IRENA, 2021).

Challenge 2: High cost of RE related technologies and sustainable bioenergy. Despite decreasing costs for solar and wind, prices of other RE technologies, new energy resources, and carriers remain relatively high in developing countries, especially considering integration and implementation costs. Rapid deployment requires reducing barriers in trade and investment for RE products and services, while building local capacities (IPPC, 2018; ADB, 2021; IRENA, 2021). The cost of advanced biofuels, e.g., drop-in hydrotreated vegetable oil (HVO) and second-generation biofuels, also remains higher than fossil fuels. Land use changes and their negative impacts on food prices (Shrestha et al., 2019) and the environmental and social impacts of feedstock cultivation (German et al., 2011) are barriers to biofuel deployment, while the barriers for developing biomass co-firing for electricity and industry are market volatility from seasonal supplies and the rising costs of raw material collection, transportation, and handling.

Challenge 3: Energy security, green recovery, and geopolitics. The economic turmoil generated by COVID-19 has affected investment in the energy sector. Concerns about energy supplies and energy security are emerging, especially in low-income regions less able to absorb price increases. Global renewable energy capacity growth fell by 13 percent in 2020 (Eisen, 2021), the first drop in more than two decades. There was also a significant slowdown in renewable energy deployment. At the same time, the oil and gas industries have not been able to recover. Oil and gas industry investment in 2021 was 23 percent lower than pre- pandemic levels (IEF, 2021). High oil prices have not led to a significant increase in investment. The International Energy Agency (IEA, 2022), in its Stated Policies Scenarios (STEPS), estimated that expected oil and natural gas investment in 2022 would be about 25 percent below the annual level needed by 2030. Almost 90 percent of investment in these scenarios is to compensate for declining output at existing fields, rather than to meet extra demand. On carbon neutrality objectives, Bernes et al. (2022) said that natural gas might be the only fossil fuel to receive increased short-term investment, as it is a bridge between traditional hydrocarbons and renewable energy sources. Value creation is essential during the transition to more environmentally sustainable energy options. Developed regions have started to work on ‘green recovery’ packages to enable nations to build back cleaner societies while driving economic growth and job creation (UNEP, 2021). Organisations have also started their own green recovery plans aimed at emerging regions. However, the scope of those programmes is limited, and recovery efforts have been interrupted by geopolitical crises, such as the Ukraine, the Iranian nuclear negotiations, and internal issues in African, Middle East, and Latin American nations also affect the deployment of energy sources.

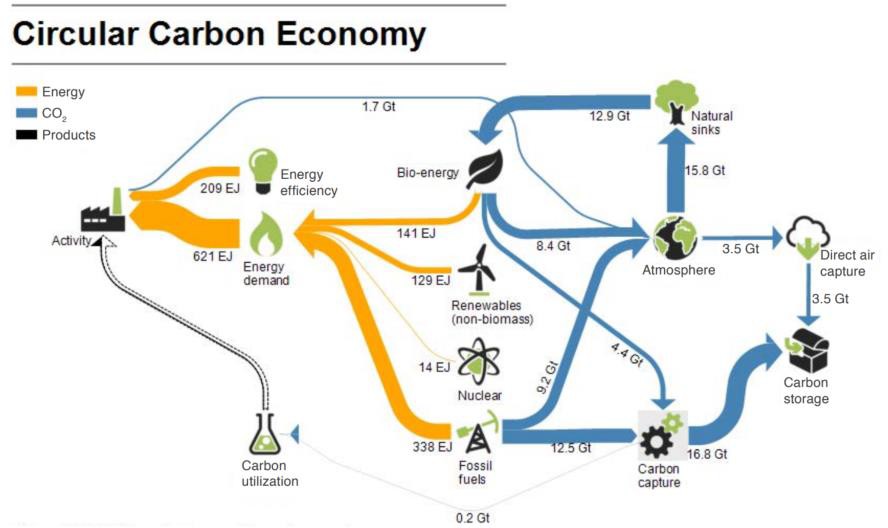

Challenge 4. High costs of several circular economy pathways. A circular low-carbon economy (Appendix 1 – Figure 1) offers a framework for managing and reducing emissions. It is a closed-loop system involving 4Rs: reduce, reuse, recycle, and remove. The G20, during the presidency of Saudi Arabia in 2020, adopted a CCE framework (Saudi G20 Presidency, 2020) to reduce global carbon footprints and achieve net-zero emissions. However, circular pathways remain costly and difficult to implement, underscoring the need for policy support.

Proposal

In view of these challenges, this brief proposes redirecting global strategies and regional cooperation pathways to an inclusive NZE strategy.

In 2019, two Group of 20 (G20) members, Saudi Arabia and Indonesia, were among the world’s biggest energy producing nations (fourth and eighth, respectively) and biggest energy consuming nations (eleventh and thirteenth, EIA, 2022). In recent years, Indonesia, as an ASEAN member, and Saudi Arabia, as a GCC member, have promoted renewable energy, CCE, and regional energy cooperation. The G20 should be a focal point for spurring inter-regional energy transition cooperation involving ASEAN and GCC, as represented by Indonesia and Saudi Arabia. The G20 has a role in initiating and establishing treaties, alliances, creating special bodies, and elaborating specific mechanisms.

The proposed specific net-zero emission pathways include establishing a monitoring and evaluation body to track the alignment of COVID-19 recovery actions with the 2015 Paris treaty, enhancing cross-region cooperation on CCE frameworks, improving access to electricity and energy connectivity, enforcing cross-regional cooperation to reduce the cost of energy transitions, and bringing economic resilience and energy security to emerging and developing countries.

These pathways have been translated into the following four proposals:

PROPOSAL 1: ESTABLISH A G20 – INITIATED MONITORING AND EVALUATION BODY TO TRACK HOW NATIONAL COVID -19 RECOVERY ACTIONS ALIGN WITH PARIS TREATY OBLIGATIONS.

The body would gather information on national plans, actions, and outcomes and disseminate this information on a user-friendly dashboard. This can build on the G20 Data Gaps Initiative, which aims to produce indices related to a low-carbon economy transition (Ducharme, 2022). Timely information on the current state of climate change, as well as on efforts to fight climate change, can guide G20 donor countries in targeting technology transfer and capacity building for the developing world.

Rationale:

- G20 members comprise about 90 percent of global gross domestic product (GDP) (Statista, 2022), and produce around 80 percent of greenhouse gas (GHG) emissions (OECD, 2021). As 80 percent of GHG emissions are energy-related CO2 emissions, decarbonisation of the energy system is fundamental to achieve the 2015 Paris treaty.

- G20 countries have increased their capacity to generate renewable energy by 3.78 times between 2000 and 2019 (IRENA, 2022). However, this investment has raised the proportion of green energy in the G20 energy supply to only 17.9 percent (BP, 2021).

- Energy transition faces challenges. Decarbonisation has been disrupted by global shocks like COVID-19 (Anbumozhi, Kalirajan, Yao, 2022). Many nations have responded to the virus by adopting economic recovery programmes intended to accelerate the transition to green energy and other actions. Fourteen G20 members responsible for 61 percent of global GHG emissions have announced their intention to meet net-zero targets by mid-century. For example, Germany pledged to achieve net-zero emissions by 2045, China and Indonesia to do so by 2060 (Climate Transparency, 2021), and India by 2070 (BBC, 2021). In the GCC, Saudi Arabia has pledged to reach net-zero by 2060 (Arab News, 2021), and the United Arab Emirates (UAE) by 2050 (Reuters, 2021)

- The G20 has adopted the Sustainable Recovery Tracker of the International Energy Agency (IEA) as its policy guidance, to measure how much public spending earmarked for the COVID-19 recovery has been directed to clean energy (IEA, 2021). In our view, the G20 should establish comprehensive policy guidance on climate actions by establishing a monitoring and evaluation body to track how individual G20 member COVID-19 recovery programs align with the fulfilment of Paris treaty obligations

PROPOSAL 2: SPUR LARGE- SCALE INNOVATION IN THE CIRCULAR LOW- CARBON ECONOMY BY FOCUSING ON VARIABLE AND VERSATILE RENEWABLE ENERGY SOURCES, CCUS, HYDROGEN, AND AMMONIA

Proposal 2a: Spur innovation in the circular low-carbon economy by:

- encouraging solar and wind energy, considering local innovation capacity for recycling and green financing, and strengthening local innovation capacity and participation in global networks to produce clean energy technologies;

- ensuring circular carbon pathways are fed by 4R technology inputs and prioritize circular carbon pathways in the G20;

- creating a cooperative research, development, and demonstration mechanism for the G20 to bring down the cost of circular pathways; and

- promoting the buildout of critical infrastructure through the G20 energy task force.

Rationale

- Circular low-carbon pathways in the energy sector include electrochemical and thermochemical pathways, which might be able to deliver deep emission reductions after displacing conventional energy production and consumption (Meys et al., 2021).

- Some low-carbon circular pathways (e.g., electrochemical carbon monoxide production, carbon cure concrete process) have lower production costs than current sales prices (Lee et. al., 2017) and could be prioritised for early market growth using the demand-pull mechanism.

- Carbon recycling of synthesis fuels is currently uneconomical.

- G20 governments can use public procurement policies to bolster early progress for the most successful 4R pathways.

- The G20 energy task force can seek to remove barriers to and promote investment in building onshore and offshore renewable electricity, transmission lines, electrolysers, and captured carbon transport and trade within and across national boundaries.

Proposal 2b: focus on bioenergy by:

- Realising a G20 agreement that commits to using sustainable bioenergy, e.g., bioenergy whose use does not trigger GHG emissions related to land-use change, and does not have an impact on air and water quality and biodiversity (IRENA, 2021). This is one of the important pathways in the energy transition to reach net-zero emission targets, especially in developing countries.

- Realising a G20-initiated treaty to facilitate development of sustainable bioenergy to help developing countries as part of a clean development mechanism, especially for developing second-generation bioethanol and green (drop-in) biofuels.

- Ensuring G20 cooperation promotes the sustainability of advanced biofuels and biomass co-firing via the CCE Platform and G20 Bioenergy Platform as a part of IEA’s Biofuture Platform. Risks to global food sources will be minimised by focusing G20 cooperation on stable bioenergy regulations, subsidies, blending mandates, technology transfer, financing support and incentives for GHG reduction.

Rationale

- Bioenergy is a leading form of renewable energy and an important part of an energy- secure and net-zero energy mix. Bioenergy should be part of a circular biobased economy (IEA Bioenergy, 2022).

- Sustainable bioenergy is essential for domestic and regional energy security, as the use of domestically produced biofuels can improve the self-sufficiency of countries with net energy imports and reduce the economic burden of importing crude oil for nations (IEA, 2019).

- Knowledge and technologies to produce advanced biofuels, such as drop-in hydrotreated vegetable oil (HVO) and second-generation biofuels, have been advancing in developed countries (IEA Bioenergy, 2021, UNCTAD, 2015) that set the

reference for sustainability and GHG lifecycle emissions, e.g., the Renewable Energy Directions in the European Union (EU) and the US Renewable Fuel Standard. Norway, the United Kingdom, and several EU countries, i.e., Denmark, Finland, France, Germany, and Italy, have enacted policies to facilitate advanced biofuel project delivery (IEA, 2020a). Though developing countries have abundant feedstocks, they are struggling to producing biomass in a sustainable way. Bioenergy policies should consider the effects on food supply chains. Avoiding a negative impact on prices, distribution, and food availability is a priority. Bioenergy technology deployment should focus on human priorities, alternatives such as bioenergy produced from waste or human residuals, and on reducing bioenergy dependence on vital food supplements.

Proposal 2c: Emphasise the deployment of clean hydrogen and ammonia along with support for CCUS through a G20 initiative, and by connecting developed and developing countries. The focus should be on market development for hydrogen and ammonia, as well as on reducing carbon emissions through CCE frameworks. Connections should:

- Promote CCUS technologies (e.g, direct air capture, conversion of capture into value- added products) as low-carbon and net negative emission technologies as a G20 cooperation project for technology transfer to developing countries,

- Promote international collaborations to develop a proven carbon sink capacity.

- Promote a hub-and-cluster business model by assigning risks to parties and reducing costs through shared infrastructure.

- Promote a platform for cooperation between nations and consolidating efforts to manage emissions in hard-to-abate industries.

- Harmonise standards for the large-scale deployment of hydrogen and improving the robustness of carbon accounting and verification methods for the hydrogen supply chain.

- Incubate cross-border public-private partnerships for CCS financing to establish risk- sharing mechanisms for CCS-ready projects, especially regarding financial/monetary and public/institutional related risks.

- Explore the use of carbon storage units in the international carbon trading system.

- Promote the use of CO2 in enhanced oil recovery (EOR) operations by sequestering large volumes of CO2 in hydrocarbon-bearing zones to help achieve net-zero targets.

- Help developing countries to understand, learn about, and tackle CCUS, e.g., through feasibility and cost-effectiveness studies, to reduce the knowledge gap between developed and developing countries.

Rationale

- Under the IEA’s (2021) business-as-usual (BAU) scenario, fossil fuels are forecast to remain the primary source for global power generation, totaling 25,000 terawatt-hours (TWh) by 2050. Hydrogen and ammonia have the potential to replace higher-carbon fuels in the future. Their use in combination with CCUS is essential for reducing GHG emissions.

- By 2030, hydrogen will be the key element of energy security (Han et al. 2020; IRENA, 2021). Hydrogen is a promising alternative to fossil fuels due to its physical characteristics, and may solve energy storage problems while reducing carbon emissions significantly. However, the overall prospects for cost reduction are promising only when the technologies can be deployed at scale. The cost efficiency level of electrolysis determines the cost of hydrogen, whereas carbon capture technology influences the production cost of blue hydrogen (Alatawi and Darandary, 2020). With the falling costs of renewable energy but the remaining high cost of transporting hydrogen, the emerging geopolitical map is likely to show growing regionalisation in energy relations.

- Cross-border trading of hydrogen will increase along with the rise of decarbonisation scenarios, including derivatives, notably ammonia. The need for investment to build infrastructure for hydrogen in the industry and transport sectors is also growing.

- CCUS technology is well proven and is an important technological option for reducing CO2 emissions in the energy sector and achieving the goal of net-zero emissions (IEA, 2020b), but further development of carbon-removal technology is required to reduce costs and create a sustainable value chain (Kimura et al., 2020). Developing countries have abundant potential for carbon storage but lack advanced technology. Support from the G20 and developed countries is needed to accelerate the adoption. CCUS demonstration projects at scale can often be conducted most cost-effectively through clusters of industrial partners, especially for integrating variable renewable energy (VRE).

- Knowledge and best practice sharing are key to improving the policy and regulatory frameworks to make progress in wider CCUS deployment. Such platforms can help improve the readiness of large-scale CCUS projects by facilitating the harmonisation of standards along the CCUS production chain, with special attention to storage site selection, storage site characterisation, environmental impact assessments, and long- term liability.

- Exploring the use of carbon storage units in a broader carbon trading system can improve the long-term sustainability of CCUS deployment. Pricing carbon storage units can provide additional incentives to commercialise and deploy CCS on a large scale (Zakkour and Heidug, 2019). Cross-regional trade to enable carbon capture in one

region and its subsequent storage and potential utilisation in another should be facilitated and incentivised. Such trade can be enabled under ESG frameworks to allow capital markets to innovate and develop novel funding and financing mechanisms.

- Major oil and gas enterprises can leverage their expertise in hydrocarbon exploration and production by sequestering carbon in oil-bearing reservoirs and get credits in the form of marginal ‘low-carbon’ oil production or carbon offsets.

PROPOSAL 3: REORIENT ELECTRICITY MARKETS TO ENCOURAGE COMPETITION AND AFFORDABILITY IN ABSORBING LOW CARBON – TRANSFORMATIVE SOLUTIONS FOR EMERGING AND DEVELOPING COUNTRIES, BY:

- Building an intergovernmental alliance that includes nations with liberalised electricity markets and a high penetration of renewables, especially from G20 members such as Canada, European Union member states, and the United Kingdom, as well as nations in ASEAN and the GCC that are aiming at increasing their renewable energy share in power generation. Renewable energy resources should include solar, wind, hydro, geothermal, and biomass. The alliance should be a platform for capacity building in progressing towards the liberalisation of electricity markets, developing strategies to stimulate penetration of renewables, reducing market distortions, monitoring, and evaluating energy market functioning. An alliance between G20 members and ASEAN and GCC nations should only be the start. The next phase should include nations from other regions.

Rationale:

- While most developing nations have implemented policies to subsidise electricity tariffs to improve affordability and access, such policies have budget implications. Stability, visibility, and reliability in transmission and distribution in those nations are affected by critical issues. Renewables-based electricity is usually limited, as feed-in tariffs require additional government spending.

- Most developed countries began to create reforms that focused on their market- oriented power sectors in 1990. The impact on electricity tariffs has been mixed in the industry sector (Liddle and Hasanov, 2022), or positive but limited only in the short term for households and firms (Necoechea-Porras et al., 2021). Nevertheless, (Necoechea- Porras et al., 2021) concluded that deregulation increased competition, opened up markets, and improved innovations, including the use of renewable electricity.

PROPOSAL 4: STRENGTHENING CROSS-REGIONAL COOPERATION TO REDUCE THE TOTAL COST OF THE ENERGY TRANSITION AT THE GLOBAL LEVEL AND BRING MUCH- NEEDED ECONOMIC RESILIENCE AND ENERGY SECURITY TO THE EMERGING AND DEVELOPING COUNTRIES

The ASEAN and GCC can set an example by: (a) establishing an ASEAN-GCC free trade and investment framework, with the aim of eliminating tariff and non-tariff barriers to trade flows of low-carbon technologies and services and increasing investment in new infrastructure for using hydrogen and CCUS in hard-to-abate sectors; (b) testing the feasibility of carbon-neutral approaches, for example carbon footprint standards and labelling for energy trade and carbon storage unit trade; (c) establishing CCE knowledge sharing facilities that emphasise the development of local innovation capabilities; and (d) improving energy security for both regions by enhancing downstream petrochemical integration and encouraging joint oil stockpiling in ASEAN with GCC crude exporters..

Rationale:

- Both regions have complementary aspects in energy trade and energy innovation. Over the past two decades, ASEAN and the GCC have collaborated in energy, agriculture, trade, and investment, laying the foundation for further cooperation in the global energy transition. A cooperative approach between ASEAN and the GCC in critical areas can set an example for G20 members to integrate their energy strategies and create new momentum for growth. The proposed ASEAN-GCC free trade and investment framework could also be used to shape assistance to non-G20 nations or organisations and improving south-south cooperation.

- The international economy and financial system remain distressed due to inflation and disruptions from COVID-19 and geopolitical conflicts. Weak international policymaking has led to a rise of protectionism in global trade and investment activities. Against the backdrop of growing renewable energy demand, higher inputs costs caused by tariff and non-tariff barriers may hamper the continued development of specialisation, skills, and innovation that are essential for maintaining competitiveness of global renewable energy production (National Board of Trade Sweden, 2020).

- In the absence of progress at the global multilateral level, regional trade agreements can play an increasingly important role in creating a new form of strategic trade policy, allowing regional cooperation to affect world supply chains by intervening in investment policies and international trade in a region’s interest. Prioritising climate considerations in the proposed ASEAN-GCC Free Trade and Investment Framework could help raise effectiveness while preserving the fairness of international climate action.

- Collaborative efforts in establishing a CCE knowledge centre as part of an ASEAN-GCC cooperation framework can help identify technologies at lower technology readiness levels that might benefit from targeted financing, thus aligning objectives and incentives for research centres and offering application opportunities for the private sector. This would accelerate the speed of development and deployment and the scaling up of commercialisation for such technologies.

- With the Regional Comprehensive Economic Partnership (RCEP) that entered into force on January 1, 2022, increased trade and logistics connectivity between RCEP members can be expected. An ASEAN-GCC joint effort in decarbonising logistics facilities, such as the provision of hydrogen for ports, highways, and railway in project planning and financial arrangements, can help improve carbon competitiveness in the logistics industry and the cost-effectiveness of hydrogen and CCUS financing.

- Despite attempts at decarbonisation, oil demand in ASEAN will increase, and import dependency will rise. Further integration along the petrochemical downstream has become prominent. Considering oil supply risks, oil stockpiling will continue to be necessary to address supply disruptions. International schemes like joint oil stockpiling between ASEAN and Middle East crude exporters or ticket stockpiling between ASEAN importing countries offer less expensive stockpiling options (ERIA, IEEJ, and KAPSARC, 2022).

References

Alatawi, H. and A. Darandary (2020), ’The Saudi Move into Hydrogen: A Paradigm Shift.’

KAPSARC Instant Insight, December 22.

Anbumozhi V, K Kalirajan and X Yao (2022). Rethinking Low-Carbon Green Growth in Asia in the Post Covid Word: Towards Net Zero Economy, Economic Research Institute for ASEAN and East Asia https://www.eria.org/publications/rethinking-asias-low-carbon- growth-in-the-post-covid-world-towards-a-net-zero-economy/ (Accessed 28 June, 2022)

ADB (2021) ‘Financing Clean Energy in Developing Asia’, Asian Development Bank, Manilla: June, https://dx.doi.org/10.22617/TCS210206-2 (accessed 22 April 2022)

Berns, M., R. Fitz, L. Holm, J. Webster, B. Winnike (2022) ‘How Institutional Investors See the Future of Oil and Gas’, Boston Consulting Group (BCG), January 6, https://www.bcg.com/publications/2022/how-investors-see-future-of-oil-gas (Accessed 13 June 2022)

BBC (2021) ‘COP26: India PM Narendra Modi pledges net zero by 2070’, November 21,

https://www.bbc.com/news/world-asia-india-59125143 (Accessed 13 June 2022)

BP (2021) ‘Statistical Review of World Energy 2021’ https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy- economics/statistical-review/bp-stats-review-2021-full-report.pdf (Accessed 13 April 2022)

Climate Transparency (2021) ‘The Climate Transparency Report 2021’, Annual G20 Report, https://www.climate-transparency.org/g20-climate-performance/g20report2021 (Accessed 13 April 2022)

Ducharme, L. (2022). Setting the Scene – The Need for a New Data Gaps Initiative. IMF. Retrieved 20 April 2022, from https://www.imf.org/en/News/Articles/2022/02/23/sp022322-setting-the-scene-the- need-for-a-new-data-gaps-initiative (accessed 20 April 2022)

EIA (2022) International – United States Energy Information Administration (EIA) https://www.eia.gov/international/rankings/world?pa=12&u=2&f=A&v=none&y=01 percent2F01 percent2F2019&ev=false (accessed 22 April 2022)

Eisen, J. B. (2021). ‘COVID-19’s Impact on Renewable Energy.’ University of Richmond,

School of Law.

ERIA, IEEJ and KAPSARC. 2022. ‘The Strategic and Economic Value of Joint Oil Stockpiling Arrangements for Middle East Exporters and ASEAN Importers.’ Forthcoming report.

Fouih, Y.E., Bouallou, C., 2013. Recycling of Carbon Dioxide to Produce Ethanol. Energy Procedia 37, 6679–6686. https://doi.org/10.1016/j.egypro.2013.06.600 (accessed 20

April 2022)

German, L., G. C. Schoneveld, and P. Pacheco (2011) ‘The social and environmental impacts of biofuel feedstock cultivation: evidence from multi-site research in the forest frontier. Ecology and Society 16(3): 24. https://dx.doi.org/10.5751/ES-04309-160324 (accessed 22 April 2022)

Han, P., Kimura, F., and Arima, J., 2020. ‘Potential Renewable Hydrogen from Curtailed Electricity to Decarbonize ASEAN’s Emissions: Policy Implications’ Sustainability 12, no. 24: 10560. https://doi.org/10.3390/su122410560 (Accessed 12 April 2022)

IEA (2019), Renewables 2019, International Energy Agency, Paris: October https://www.iea.org/reports/renewables-2019 (accessed 11 April 2022)

IEA (2020a) Tracking Transport Biofuels 2020, International Energy Agency, Paris: June https://www.iea.org/reports/tracking-transport-biofuels-2020-2 (accessed 11 April 2022)

IEA (2020b), CCUS in Clean Energy Transitions, IEA, Paris: September https://www.iea.org/reports/ccus-in-clean-energy-transitions (accessed 10 April 2022)

IEA (2021) ‘Renewables 2021: Analysis and Forecasts to 2026’, International Energy Agency, Paris: December, https://www.iea.org/reports/renewables-2021 (Accessed 13 April 2022)

IEA (2022) ‘World Energy Investment 2022’, International Energy Agency, Paris: June, https://iea.blob.core.windows.net/assets/db74ebb7-272f-4613-bdbd- a2e0922449e7/WorldEnergyInvestment2022.pdf (Accessed 29 June 2022)

IEA Bioenergy (2021) ‘IEA Bioenergy Countries’ Report – update 2021: Implementation of bioenergy in the IEA Bioenergy member countries’ https://www.ieabioenergy.com/wp- content/uploads/2021/11/CountriesReport2021_final.pdf (Accessed 11 April 2022)

IEA Bioenergy (2022) ‘What is IEA Bioenergy?’, https://www.ieabioenergy.com/about/#:~:text=Bioenergy percent20is percent20an percent20integral percent20part,and percent20reduced percent20greenhouse percent20gas percent20emissions. (Accessed 11 April 2022)

IEF (2021) ‘Deepening Underinvestment in Hydrocarbons Raises Spectre of Continued Price Shocks and Volatility.’ International Energy Forum (IEF). December 07, 2021. https://www.ief.org/news/deepening-underinvestment-in-hydrocarbons-raises-spectre- of-continued-price-shocks-and-volatility (accessed 11 April 2022)

IPCC (2018) ‘Global Warming of 1.5°C. An IPCC Special Report on the impacts of global warming of 1.5°C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty’ [Masson-Delmotte, V.,

P. Zhai, H.-O. Pörtner, D. Roberts, J. Skea, P.R. Shukla, A. Pirani, W. Moufouma-Okia, C. Péan, R. Pidcock, S. Connors, J.B.R. Matthews, Y. Chen, X. Zhou, M.I. Gomis, E. Lonnoy,

T. Maycock, M. Tignor, and T. Waterfield (eds.)]. In Press.

IRENA (2021), ‘World Energy Transitions Outlook: 1.5°C Pathway’, International Renewable Energy Agency, Abu Dhabi. https://irena.org/publications/2021/Jun/World-Energy- Transitions-Outlook (accessed 22 April 2022)

IRENA (2022) ‘World Energy Transitions Outlook: 1.5°C Pathway’, International Renewable Energy Agency, Abu Dhabi: March, https://www.irena.org/publications/2022/Mar/World- Energy-Transitions-Outlook-2022 (Accessed 13 April 2022)

Kimura, S., Shinchi, K., Kawagishi, S., Coulmas, U., 2020. ‘Study on the Potential for the

Promotion of Carbon Dioxide Capture, Utilisation, and Storage in ASEAN Countries:

Current Situation and Future Perspectives’ ERIA Research Project Report No 21. ERIA: Jakarta. https://www.eria.org/research/study-on-the-potential-for-promoting-carbon- dioxide-capture-utilisation-and-storage-ccus-in-asean-countries-vol-ii/ (Accessed 12 April 2022)

Lee, R. P, F. Keller, B. Meyer (2017). ‘A concept to support the transformation from a linear to circular carbon economy: net zero emissions, resource efficiency and conservation through a coupling of the energy, chemical and waste management sectors Clean Energy’, Volume 1, Issue 1, December 2017, Pages 102–113,

https://doi.org/10.1093/ce/zkx004 (Accessed 13 June 2022)

Liddle, B., F. Hasanov, (2022) ‘Industry electricity price and output elasticities for high- income and middle-income countries.’ Empirical Economy 62, 1293–1319. https://doi.org/10.1007/s00181-021-02053-z (Accessed 13 June 2022)

Mahdi, Wael. 2021. ‘Saudi Arabia to reach net zero carbon by 2060: Crown Prince Mohammed bin Salman.’ Arab News. October 23, 2022. https://www.arabnews.com/node/1953441/business-economy. (Accessed 21 April 2022)

Meys, R., A. Kätelhön, M. Bachmann, B. Winter, C. Zibunas, S. Suh, A. Bardow (2021) ‘Achieving net-zero greenhouse gas emission plastics by a circular carbon economy’ Science 374, 71-76. https://doi.org/10.1126/science.abg9853 (Accessed 13 April 2022)

Necoechea-Porras, P. D., A. López, J. C. Salazar-Elena (2021) ‘Deregulation in the Energy Sector and Its Economic Effects on the Power Sector: A Literature Review.’ Sustainability 2021, 13, 3429. https://doi.org/10.3390/su13063429 (Accessed 13 June 2022)

OECD (2021) ‘G20 economies are pricing more carbon emissions but stronger globally more coherent policy action is needed to meet climate goals, says OECD’, The Organization for Economic Cooperation and Development, 27 October, https://www.oecd.org/tax/g20- economies-are-pricing-more-carbon-emissions-but-stronger-globally-more-coherent- policy-action-is-needed-to-meet-climate-goals-says-oecd.htm#:~:text=G20 percent20economies percent20account percent20for percent20around,at percent2097 percent25 percent20of percent20emissions percent20priced. (Accessed 13 April 2022)

Pigato, M. A., S. J. Black, D. Dussaux, Z. Mao, M. McKenna, R. Rafaty, S. Touboul. (2020)

‘Technology Transfer and Innovation for Low-Carbon Development. International

Development in Focus’. Washington, DC: World Bank. doi:10.1596/978-1-4648-1500-3 (accessed 22 April 2022)

Pike, Christopher. 2021. ‘UAE launches plan to achieve net zero emissions by 2050.’ Reuters.

October 7, 2021. https://www.reuters.com/world/middle-east/uae-launches-plan-

achieve-net-zero-emissions-by-2050-2021-10-07/ (Accessed 21 April 2022)

Saudi G20 Presidency (2020) ‘G20 Promotes the Circular Carbon Economy (CCE)’ News provided by Saudi G20 Presidency at Cision PR Newswire, 20 October, https://www.prnewswire.com/ae/news–releases/g20-promotes-the-circular-carbon- economy-cce–829334922.html (accessed 12 April 2022)

Shrestha, D.S., B.D. Staab, J.A. Duffield, (2019) ‘Biofuel impact on food prices index and land use change’,Biomass and Bioenergy, Volume 124, Pages 43-53, ISSN 0961-9534, https://doi.org/10.1016/j.biombioe.2019.03.003 (accessed 22 April 2022)

Statista (2022) ‘G20 Statistics and Facts’, 29 March,

https://www.statista.com/topics/4037/g20-summit/ (Accessed 13 April 2022)

The National Board of Trade Sweden. 2020. ‘Trade Barriers to Goods and Services Important for Climate Action and opportunities for reform.’ https://www.kommerskollegium.se/globalassets/publikationer/rapporter/2020/trade- barriers-to-goods-and-services-important-for-climate-action_webb.pdf (accessed 12 April 2022)

UNCTAD (2015) ‘Second Generation Biofuel Markets: State of Play, Trade, and Developing Country Perspectives’ https://unctad.org/system/files/official- document/ditcted2015d8_en.pdf (Accessed 11 April 2022)

UNEP (2021) ‘Green Recovery.’ United Nations Environment Programme (UNEP). March 25,

2021. https://www.unep.org/resources/factsheet/green-recovery (accessed 11 April

2022)

Williams, E. (2019), ‘Achieving Climate Goals by Closing the Loop in a Circular Carbon Economy.’ KAPSARC Instant Insight. 6 November. https://www.kapsarc.org/research/publications/achieving-climate-goals-by-closing-the- loop-in-a-circular-carbon-economy/ (Accessed 21 April 2022)

Zakkour, Paul, and Wolfgang Heidug. 2019. ‘A Mechanism for CCS in the Post-Paris Era: Piloting Results-Based Finance and Supply Side Policy Under Article 6.’ KAPSARC Discussion Paper. Doi: 10.30573/KS–2019-DP52.

Appendix 1

Figure 1: Circular Carbon Economy

Source: Williams, 2019.