Increased connectivity and the use of digital technology are unlocking innovative business models for trade and economic activities on the African continent. Yet, the real potential for large-scale job creation and inclusive growth lies in the diffusion of digital innovations from the lead firms to the rest of the economy. Social gaps in the use of digital services and spatial inequalities in digital infrastructure development are limiting this potential. This policy brief provides recommendations on mutually beneficial partnership opportunities for the Group of 20 (G20) and African stakeholders that promote: (i) regional and local approaches to the expansion of infrastructure; (ii) improved project preparation and alternative financing mechanisms and (iii) policy frameworks to promote local ecosystem development and diffuse innovation.

Challenge

In Africa, digital infrastructure is expanding fast. The fibre-optic network extended from 278,056 kilometers in 2009 to 1 million km in June 2019. However, challenges remain in closing the coverage and usage gaps, while addressing a rising demand for data usage per user.

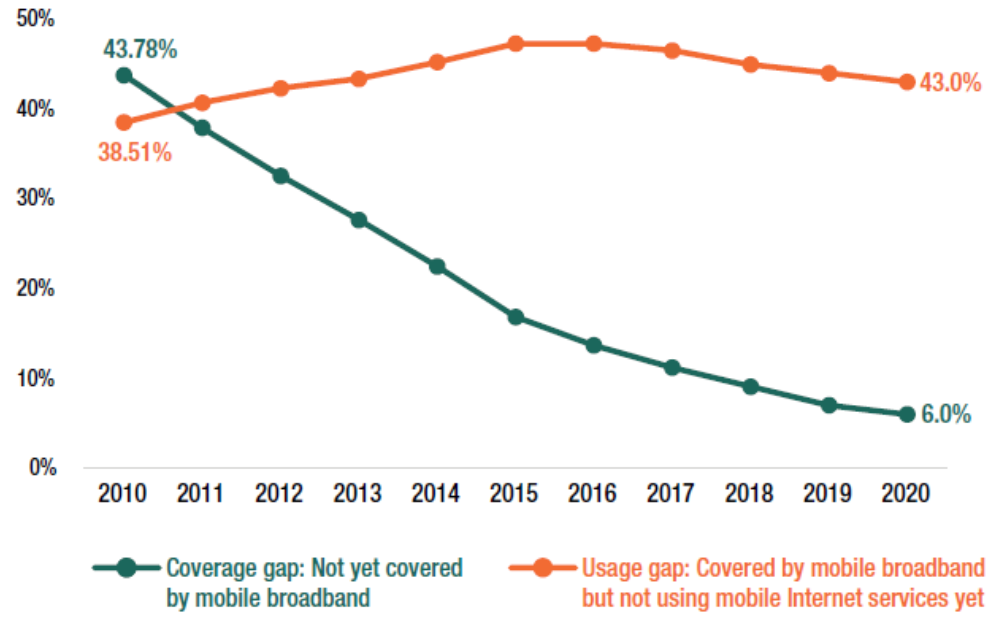

Figure 1. Evolution of gaps in global coverage and usage (in percentage of the global population)

The coverage gap is the most pronounced in Africa. Despite the steady expansion in digital broadband infrastructure in the last decade (Figure 1), nearly 600 million people – of which 300 million are in Africa – live in geographic areas that are too far from the broadband network. In 2019, only 35 percent of Africa’s intermediary cities were connected to the high‑speed terrestrial fibre‑optic network (AUC/OECD, 2021).

Connecting intermediary cities to the broadband network is commercially viable and can unlock high-potential regional supply chains. However, filling the coverage gap in less densely populated rural areas will require new technology solutions and innovative public-private alliances for investment (OECD, 2021). In Nigeria, for example, internet service providers (ISPs) find that extending service to rural areas via the terrestrial fibre-optic network is commercially unviable due to low commercial returns, higher maintenance costs, and the lack of reliable grid electricity supply (World Bank, 2019). The European Satellite operator SES, estimates that it will be difficult to connect about 30 percent of Africa’s rural population to the terrestrial fibre-optic networks in a cost-effective way (AU-EU DETF, 2019). The challenge for African governments lies in ensuring appropriate policies to encourage private-led investment in these remote areas.

A second challenge is to address the increasing demand for data usage. Humanity is at the beginning of a massive acceleration of demand for data usage on a global scale. Sub-Saharan Africa is expected to see the most growth in the demand for mobile broadband data usage, from 0.8 gigabytes per subscriber per month in 2020 to almost 7 GB in 2025 (GSMA, 2021b). The complexity and quantity of data being used by consumers means that cloud-based providers need data centres closer to target populations. This localisation process offers cost savings on connectivity and may facilitate sovereign control over data value chains. However, it will require additional investment in data centres and production of energy (Fung and Meinel, 2021). As of mid-2021, Africa had 97 data centres, which is less than 1 percent of total available global data centre capacity. Up to 700 new data centres are required to meet Africa’s rising demand for digital services (ACDA/ Xalam Analytics, 2021). Constraints on energy infrastructure (e.g. unreliable electrical grids) need to be addressed too.

While data centres and cloud services are generally financed by the private sector, public-sector financing to strengthen power supplies could stimulate further private investment in the digital sector (Williams and Bachiri, 2021).

A third challenge is to tackle the usage gap through agile policy measures and financing instruments. In 2020, more than 3.8 billion people worldwide were not using mobile internet at all, of which 88 percent live in geographic areas already covered by a mobile broadband network. Nine in 10 of those people facing usage gap were in developing countries. They face other barriers that prevent them from connecting, of which the most frequently reported ones were the cost of devices and data services, lack of literacy and digital skills, lack of relevant content, safety and security concerns and access to enablers (Cruz et al., 2021). Despite the significant drop in prices for data bundles, current prices of data services in 38 African countries should be halved to make 1 GB of mobile data affordable for 75 percent of their populations (AUC/OECD, 2021).

Proposal

The G20 has already initiated a number of efforts to support infrastructure development globally, and in Africa specifically.

- In 2014 the G20 established the Global Infrastructure Hub (GIH) as a knowledge-sharing platform to help implement the G20’s infrastructure agenda.

- The G20 Compact with Africa (CwA) was initiated in 2017 to promote private investment in Africa.

- And in 2019 the G20 Finance Ministers and Central Bank Governors endorsed new G20 Principles for Quality Infrastructure Investment, emphasising the importance of quality infrastructure investment.

This proposal aims to contribute to three perspectives of digital infrastructure investment:

(i) regional and local approaches to the expansion of infrastructure

(ii) improved project preparation and alternative financing mechanisms; and

(iii) policy frameworks to promote local ecosystem development and diffuse innovation.

I. Regional and local approaches to the expansion of infrastructure

Adopt a bottom-up approach to implementation: Implementing a regional approach requires not just the RECs, but a combination of different regional, national and even local actors necessary for infrastructure development. A number of issues must be addressed. First, parties must understand the type of infrastructure to be provided and identify the best arrangement to deliver it. Once identified, the jurisdiction of the regional authority delivering the infrastructure should match the location where the infrastructure will be delivered. And finally, parties must be willing to delegate national sovereignty to a regional authority to finance and oversee implementation. (ACET, 2021)

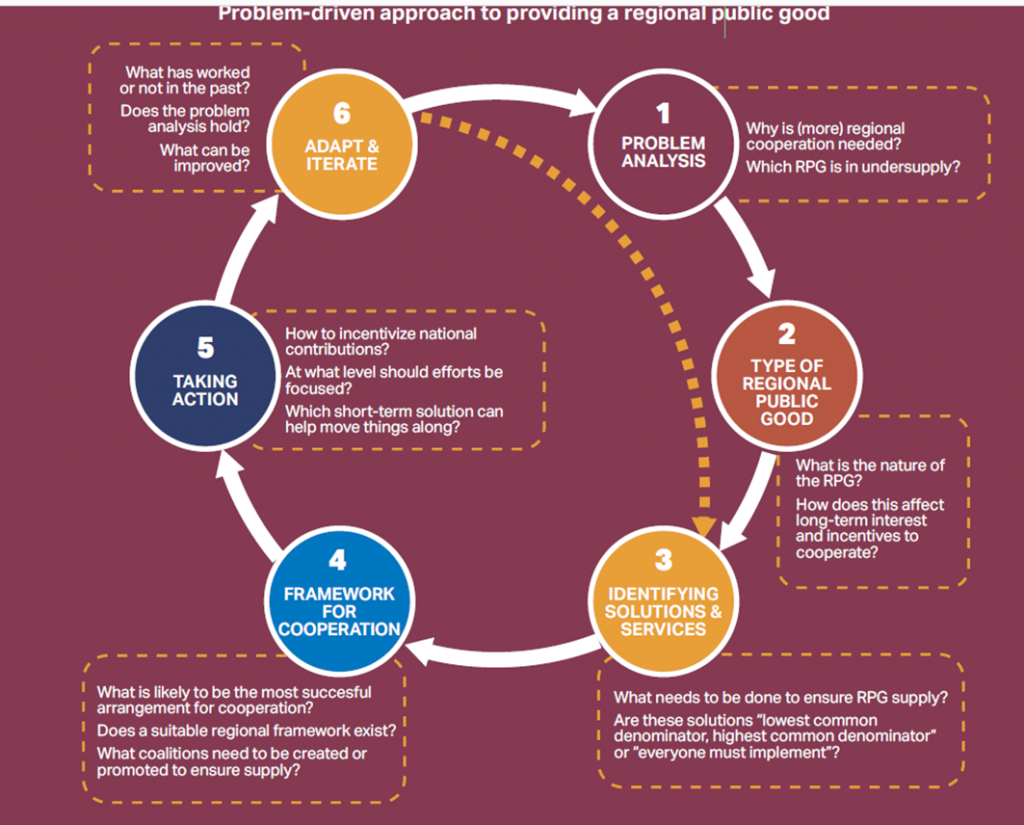

Traditionally strategies have been drafted at the continental/regional level with the expectation of a trickle-down effect at the national level. On many occasions, these strategies have seen limited success and demand reconsideration. They need to be complemented by a bottom-up approach that starts with identifying national problems with a regional reach; then assesses the interests of countries, the incentives of domestic stakeholders, and appropriate policies for the context (Figure 2). This approach will increase buy-in at the national level; build the capabilities of countries and organisations through repeated cycles of program implementation; and help countries adapt strategies that fit their local contexts. The Maputo Development Corridor is an example of such an approach, mixing high-level engagement with private sector engagement and wider initiatives (ACET, 2021).

Figure 2 Bottom-up approach to regional infrastructure initiatives

It is necessary to explore infrastructure-sharing models. Like energy and water infrastructure, several shared-ownership models could be explored for digital infrastructure at the regional level. While government-led regional agreements have had mixed success, private sector-led models have been more beneficial. At the government-to-government level, regional communities have pursued (i) bilateral agreements at fixed prices for power consumed; (ii) joint ownership/investment, which allocates a fixed percentage (e.g., the Senegal River Basin Development Organisation) and (iii) a regional market mechanism for regional electricity trade (e.g., Southern African Power Pool) (ACET, 2021).

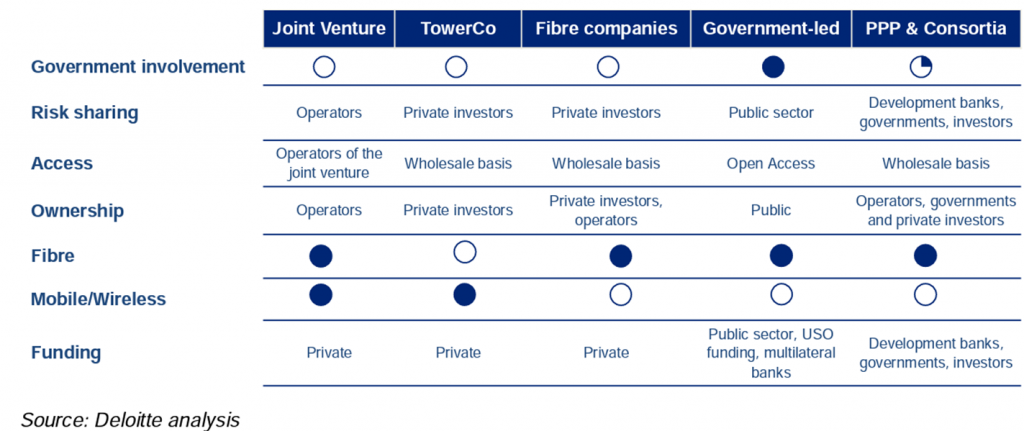

The benefits of infrastructure sharing are well known, including reduced barriers to entry which drives competition, better connectivity for customers, cost savings for all stakeholders, and revenue generation from rental/leasing for providers (Deloitte, ACP, 2015). In digital infrastructure, commercial sharing agreements may bring together multiple broadband providers operating in the same network to share risks and reduce costs (Figure 3). At the regional level, wholesale broadband services could be provided by private operators, a consortium of public and private actors, or regional authorities. Open access models may involve a larger broadband provider partnering with governments or smaller ISPs to provide middle to last mile access.

The European Union Common Union Toolbox for Connectivity is another example of a continental solution that focuses on streamlining permit-granting procedures for civil works, improving transparency, reinforcing the capabilities of single information points and expanding the right of access to existing physical infrastructure controlled by public sector bodies.

Figure 3: Characteristics of various commercial infrastructure-sharing models

Community-led infrastructure should be encouraged at the national level. Community and small and medium enterprise (SME)-led infrastructure initiatives are also being explored for rural areas that local operators do not see as commercially viable. This bottom-up approach offers many benefits including local control of how the network is used, increased attention to the needs of rural communities and marginalised people, lower costs, retention of profits within the community and an increased sense of agency for users.

Communities in Kenya, South Africa, Uganda, Mexico and Spain have piloted community-owned infrastructure solutions for last-mile access. Working in areas that are not viable for large operators, community-based ISPs can serve the needs of a smaller audience. Uganda’s Battery-Operated System for Community Outreach (BOSCO) is a nonprofit that was founded to end the isolation of people in internally displaced peoples (IDP) camps in Northern Uganda. BOSCO set up information and communications technology (ICT) centres that provided internet and Voice over Internet Protocol (VoIP) telephony with the help of solar-powered PCs. It also partnered with the Internet Society to construct network towers. The initiative has managed to establish 55 community ICT and development centres in rural areas of Aholi, Lango and West Nile. While BOSCO’s connectivity processes are funded by donors, it hopes to start selling internet access in the future and become a revenue source for the community.

Kenya’s Arid Lands Information Network (ALIN) in East Africa partnered with the Association for Progressive Communication (APC) to train teachers on Remote Area Community HotSpot for Education and Learning (RACHEL) in 2021. RACHEL is a portable plug and player server that stores educational websites and makes content available over any local wireless connection. Any device with a web browser can connect to RACHEL and it is designed for offline teachers and students and those with no internet access due to remote location. Additionally, the ALIN initiative ensures free access to information and basic digital training for all community members who are not familiar with ICT equipment such as computers and podcasting equipment. (ALIN, 2021)

In Algeria, Ghana, Kenya and Nigeria, the public sector has partnered with mobile telecom companies and telecommunications equipment providers to bring mobile broadband to rural populations. Benin, Ghana and Rwanda focus their Universal Service and Access Funds (USAFs) on skills-acquisition programs for women entrepreneurs. While 37 African countries have created USAFs, 46 percent of the funds collected, or US$ 408 million, were still unspent at the end of 2016 (Thakur, 2018).

II. Improved project preparation and alternative financing mechanisms

Local expertise in project preparation should be increased to develop investment-ready digital infrastructure projects that are attractive to the private sector. The African Union’s (AU) Programme for Infrastructure Development in Africa (PIDA) and the Smart Africa Alliance have initiated several projects to accelerate the development of infrastructure that can be expanded and scaled. However, governments’ capacities for project preparation are limited. On many occasions, government representatives find themselves negotiating infrastructure development deals and agreements without proper knowledge and the appropriate templates on project preparation. This adds to the length of the pre-development phase and sometimes it ultimately prevents governments from getting the best value for money. Additionally, without proper preparation or knowledge of infrastructure development, 80 percent of projects fail in the planning stages.

These efforts can be supported by building the capacity of government stakeholders in project preparation. To help overcome this challenge, AUDA-NEPAD provides early-stage project preparation support through the Service Delivery Mechanism, which puts in place institutional and project governance structures that can help to reduce the risks of corrupt practices. The Quality Infrastructure for Africa (QI4A) project, a partnership between AUDA-NEPAD, the African Center for Economic Transformation (ACET) and the OECD Development Centre seeks to address this issue through the development of a Community of Practice that facilitates peer-to-peer learning, and which provides industry-tested templates and examples to practitioners.

Private-sector incubators should be developed for scaling on-shore entrepreneurship and innovation. Developing an infrastructure project typically requires five inter-dependent processes to move forward, all the while reducing risk to capital. These include the developer’s own resource planning (time capability and capital), interactions with the government for permits, raising equity, raising debt and establishing commercial viability for the project in terms of construction, operations and revenue generation for the life of the project. The development timeline – which culminates in the financial close or start of construction – in the context of African projects usually takes two three times longer than comparable international projects. This is a function of all the challenges in an African context in running the five processes set out above.

Another effect of long project development lead-times is the loss of learning in development. With long development timelines, there is consequential lack of learning – learning between the public and private sectors, and within the multiple stakeholders that make up the private sector. This lack of learning leads to a dynamic of projects being delivered once-in-a-while or as one-offs. A persistent investment gap, a slower than desired deployment rate, and high tariffs of service are the outcomes of these challenges. Once successful projects have been delivered, it is critical that these lessons learned are shared and deployed for similar projects.

There is a need for a bottom-up and granular private sector capacity-building initiative in Africa, which incubates African start-ups and projects across the infrastructure space, and advocates for policy and capital interventions from the vantage point of these start-ups. The Africa Infrastructure Development Association (AfIDA), a non-profit association of leading investors, lenders and developers of private sector-led infrastructure in Africa, is promoting an incubator for African infrastructure start-ups, which can engage with and access the deep expertise, experience and capital represented in its membership to address this opportunity to create scale, speed and security in digital infrastructure deployment in Africa.

Creating repeatable models of investment, to promote speed and security of investment is essential. Infrastructure stakeholders have explored various opportunities to attract investment, and some emerging approaches in blended financing offer some opportunities for success. Blended finance, the strategic use of development finance for the mobilisation of additional finance, has been offered as a model to reduce perceived risks and improve returns for investors (ACET et al., 2019).

A database of new infrastructure projects maintained by the Project Finance and Infrastructure Journal (IJGlobal), indicates that foreign and local private finance are not being mobilised on a sufficiently large scale. A McKinsey & Company 2016 report estimated that institutional investors hold approximately $20 trillion in assets globally. Of the new projects reaching financial close in Sub-Saharan Africa (excluding South Africa), just 22 percent involved a private fixed income investor and only 15 percent were financed without co-financing from a public entity. Yet 77 percent of private finance was mobilised in middle-income countries (ACET et al., 2019).

Asset managers identified challenges including small deal sizes, securities denominated in local currency, lack of a credit rating, illiquid nature of the securities, cost, lack of a track record, unpredictable regulatory environment and an imbalance of risk and return (ACET et al., 2019). As African governments tackle these issues, three other models can be explored further:

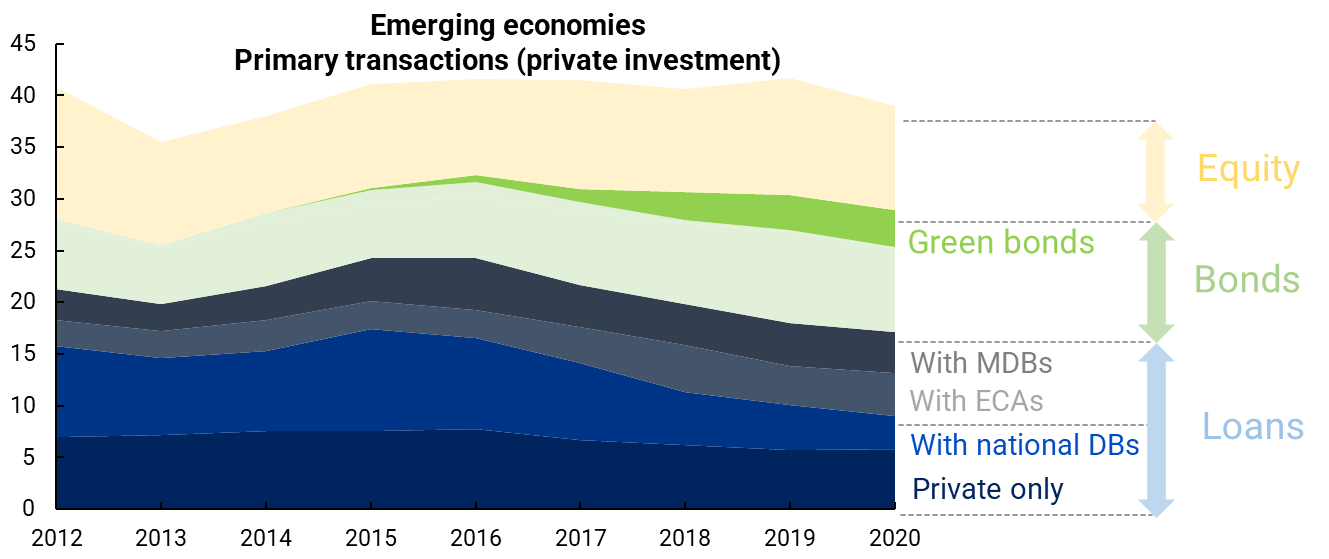

Green Bonds: In spite of these low levels of investment, one type of transaction – green bonds are growing (Figure 4). Green bonds allow governments to issue longer-term debt to reduce the maturity mismatch between project development timelines and borrowing timelines. The Chinese government, for example, established pilot zones to test them, and issued $192 million in green municipal special bonds. The bond generated high interest from investors and was oversubscribed 12 times (GIH, 2021).

Figure 4: Share of private investment transactions in emerging economies, 2012-2020

Source: Global Infrastructure Hub

Bundling: Another example of blended financing can be seen with Green Street Africa projects in energy. The company develops and aggregates portfolios of distributed solar projects for implementation by private independent power producers or ESCOs, which are financed with local capital markets solutions. It is a combination of a public-private partnership, bundling of portfolios of individual projects and guarantee-backed local-currency debt financing.

Grants: For smaller investments, some local government initiatives like ConnectME in Maine, awards grants for last-mile infrastructure, which are matched with funding from an ISP or a community.

III. Policy frameworks to promote local ecosystem development and diffuse innovation.

In Africa, the COVID-19 pandemic has reinforced the dynamics for digital entrepreneurship development, in terms of funding for start-ups (Maher et al., 2021), investment flows, communication infrastructure (Traoré et al., 2021), and mobile money transactions. This dynamic has created a new generation of local entrepreneurs who are leveraging digital technologies to deploy fast-growing business models. By the end of 2021, China had over 300 unicorns, India had 69, Indonesia had 11 and there were 23 in Latin America; but Africa saw the number of home-grown unicorns grow from just one in 2016 to seven in 2021 (Kene-Okafor, 2021). These innovative entrepreneurs need global business partners, conducive policy frameworks and a regional mindset to grow.

The G20 is well positioned to promote more action-oriented technology cooperation as new digital technologies are rapidly transforming the world (UNCTAD, 2018). Areas of particular importance include:

- Facilitating experience sharing around standards and regulatory practices that support local entrepreneurs, goods and capital and fair competition. With the fast-changing pace of technology, policymakers are faced with a multiplicity of standards and regulations on issues of data sovereignty and the data value chain and implementation of digital infrastructure (e.g., US, Chinese, EU data centre standards, the PIDA quality label, etc.). G20 members can facilitate global dialogues to promote a clear understanding on the pros/cons of various models. There is also an opportunity to further promote South-South cooperation and lessons learned from countries like India and Indonesia.

Advocating for the balancing of powers between data processors and countries where data is collected. With much of the world’s data being processed in a few countries, developing countries have limited control of how their data is collected, stored, processed and accessed. G20 countries can influence global dynamics by adopting and advocating for policies that give countries the ability to develop and control their own data value chains as they wish

Recommendations

Global investors, particularly from G20 nations, are recognising both the benefits of, and need for, digital infrastructure investment in Africa. African governments need to facilitate that investment in digital infrastructure, which is currently only 1.1 percent of GDP. Likewise, the international community needs to increase investment in digital infrastructure. In this regard, a September 2021 technical workshop organised by ACET on behalf of the G20 concluded that more emphasis was needed on the digital and green economies, as well as regional integration leveraging the Africa Free Trade Area.

The G20 Africa Advisory Group also endorsed a stronger focus on investment in digital infrastructure in October 2021, with the expectation that CwA countries will update policy matrices (with the support of the World Bank) addressing digital infrastructure, digital public platforms, digital financial services that allow people to transact online, a digital business environment that is conducive for SMEs, and building digital skills so that people can use and develop systems and applications.

The G20 can therefore take the lead in supporting investment in the digital economy starting with the proposed areas for development:

(i) Regional and local approaches to the expansion of infrastructure

- There should be greater efforts to align initiatives such as the G20 CwA, the Quality Infrastructure for Africa (QI4A) program, EU and Chinese investment schemes, and PIDA PAP2. By doing so, multiple stakeholders can more readily identify and crowd in local expertise. Additionally, closer alignment can lead to greater collaboration among global, African and national organisations and the private sector to address the most challenging bottlenecks to digital infrastructure investment.

- The G20 can facilitate emulation of collaborative solutions by supporting policy dialogue and experience sharing among developing countries that consider (i) bottom-up approaches to digital infrastructure projects, (ii) infrastructure sharing models and (iii) SME and community-led infrastructure at the national level

(ii) Improved project preparation and alternative financing mechanisms

- G20 countries, private sector partners and direct foreign investors can support capacity building of local expertise in project preparation to develop investment-ready digital infrastructure projects. This could include for example, the provision of ready to go templates (deal structuring e.g. PPP contracts, project concepts, TORs, etc.) towards the development of a knowledge-sharing platform for countries (QI4A Program).

- Promote and support the development of incubators for private sector infrastructure developers

- Facilitate training around repeatable models of investment and alternate financing instruments.

(iii) Policy frameworks to promote local ecosystem development and diffuse innovation

- Given the G20 CwA is pivoting towards digital infrastructure investment there is a unique window of opportunity for enhanced efforts between the CwA, the AfCFTA Secretariat, the AUC Commissioner for Infrastructure and Energy (which includes digital), PIDA and other African organisations. The collective voice of the G20 and CwA countries can facilitate experience sharing around standards and regulatory practices that support local entrepreneurs, goods and capital and fair competition.

- The G20 could support and promote incentives for responsible business conduct for lead platform companies. This includes advocating for the balancing of powers between data processors and countries where data is collected.

Partner Organisations

The African Center for Economic Transformation (ACET)

ACET is an economic policy institute supporting Africa’s long-term growth through transformation. Established in 2008 it produces research, policy advice and galvanises action for African countries to develop their economies, reduce poverty and improve livelihoods for all their people. Its vision is an economically transformed Africa within a generation; and its mission is to help governments and business deliver economic transformation that improves lives. It focuses on the “how-to” of policy reform, drawing on the best practices from within Africa and around the world to accelerate transformation. It does this by aligning its mission to three operating pillars that underpin all facets of its work and engagements, namely, informing transformation policy; supporting policymakers; and galvanising action.

The Africa Infrastructure Development Association (AfIDA)

AfIDA is an association of project developers that seeks to promote and enable project development activities in Africa, by creating an eco-system and platform that will foster continuous dialogue amongst its members, standardise project development template documents and serve as a policy advocacy platform for the industry, with a view to ensuring that more projects on the continent achieve bankability.

The OECD Development Centre

The OECD Development Centre has valuable experience in building policy dialogue or knowledge-sharing platforms across continents, including Africa. The centre’s strength is to broker discussions based on harmonised data and robust analysis. The diverse membership of the Development Centre (27 OECD and 29 non-OECD member countries, including 11 members from Africa) makes it a unique place, where developed and emerging economies exchange information on development trajectories and practices on an equal footing. The centre has gained legitimacy and importance within international organisations and development practitioners through its flagship economic regional reports and its longstanding policy dialogues on global value chains and productive transformation, natural resource-based development, migration and initiatives that promote youth employment, increase social protection as well as enhancing resource mobilisation and infrastructure development.

References

ADCA / Xalam Analytics (2021), “Growing Africa’s Data centre Ecosystem: An Assessment of Utility Requirements”, White Paper, African Actors of Data centre Association (ADCA), February, 2021, https://africadca.org/en/white-paper-growing-africas-data- centre-ecosystem-an-assessment-of-utility-requirements

ACET, ECDPM, OECD (2019), Strengthening the Local Dimension of Blended Finance: A review of the local approaches and instruments employed by Development Finance Organ isations (DFOs), September 2019.

ACET (2021), African Transformation Report 2021: Integrating to Transform, Accra, Ghana

Ariland Network (2021), “Enabling Access to ICTs”, https://www.alin.net/enabling_access_to_it.html

AU-EU Digital Economy Task Force (2019), New Africa-Europe Digital Economy Partnership:

Accelerating the Achievement of the Sustainable Development Goals, European Commission, Brussels.

AUC/OECD (2021), Africa’s Development Dynamics 2021: Digital Transformation for Quality Jobs, AUC, Addis Ababa/OECD Publishing, Paris, https://doi.org/10.1787/0a5c9314-en

Cruz, G. and M. Tiel Groenestege (2021), “Tackling digital disadvantage with people-centred policies”, in Development Co-operation Report 2021: Shaping a Just Digital Transformation, OECD Publishing, Paris, https://doi.org/10.1787/9ce8f762-en.

Fung, M. L., and C. Meinel (2021), “Clean-IT: policies to support sustainable digital technologies”, T20 policy brief, October 11, 2021, https://www.g20-insights.org/policy_briefs/clean-it-policies-to-support-sustainable-digital-technologies/

Global Infrastructure Hub (2021), “Green finance reforms to attract private capital to finance municipal infrastructure projects.” November 2021 https://www.gihub.org/emerging-funding-and-finance/case-studies/green-finance-reforms-to-attract-private-capital-to-finance-municipal-infrastructure-projects/

GSMA (2021a), “State of the Industry Report on Mobile Money London, UK, https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2021/03/GSMA_State-of-the-Industry-Report-on-Mobile-Money-2021_Full-report.pdf

GSMA (2021b), “Accelerating mobile internet adoption: Policy considerations to bridge the digital divide in low- and middle-income countries”, London, UK, https://www.gsma.com/mobilefordevelopment/wp-content/uploads/2021/05/Accelerating-Mobile-Internet-Adoption-Policy-Considerations.pdf

Google/ IFC (2020), “e-Conomy Africa 2020: Africa’s $180 billion Internet economy future”, International Finance Corporation (IFC) https://www.ifc.org/wps/wcm/connect/publications_ext_content/ifc_external_publication_site/publications_listing_page/google-e-conomy

Kene-Okafor, T. (2021) “African tech took centre stage in 2021”, TechCrunch Featured Article, published on December 30, 2021.

OECD (2021), “Bridging connectivity divides”, OECD Digital Economy Papers, No. 315, OECD Publishing, Paris, https://doi.org/10.1787/e38f5db7-en.

Thakur, D. (2018), Universal Service and Access Funds: An Untapped Resource to Close the Gender Digital Divide, Web Foundation, Washington, DC, https://webfoundation.org/docs/2018/03/Using-USAFs-to-Close-the-Gender-Digital-Divide-in-Africa.pdf

Traoré, B., J. Orozco and J. Velandia (2021), “Digital drivers of inclusive growth in Africa and Latin America and the Caribbean”, in Development Co-operation Report 2021: Shaping a Just Digital Transformation, OECD Publishing, Paris, https://doi.org/10.1787/2ef64dac-en

UNCTAD (2018), South-South Digital Cooperation: A Regional Integration Agenda, United Nations Conference on Trade and Development, Geneva, https://unctad.org/system/files/official-document/gdsecidc2018d1_en.pdf

Uganda Community Connectivity Network, https://boscouganda.com/who-we-are/

Williams, M. and O. Bachiri (2021), “Financing options for the future of digital”, in Development Co operation Report 2021: Shaping a Just Digital Transformation, OECD Publishing, Paris, https://doi.org/10.1787/122f062a-en.

World Bank (2019), Nigeria Digital Economy Diagnostic Report, World Bank, Washington, DC, https://hdl.handle.net/10986/32743

World Bank (2018), “Innovative Business Models for Expanding Fiber-Optic Networks and Closing the Access Gaps”, World Bank, Washington, DC, https://openknowledge.worldbank.org/handle/10986/31072