Advances in economic, social and governance (ESG) financing mechanisms, digital technologies, and policy regulations offer new possibilities to develop marine fuels compatible with the 2030 Sustainable Development Goals and net-zero ambitions. An incentive- compatible and sustainable global framework is proposed to reduce greenhouse gas (GHG) emissions in this hard-to-abate sector. In support of a sustainable energy transition, we highlight the promise of a worldwide circular economy approach that is underpinned by a robust digital infrastructure – where the value of avoided carbon is captured fully and reintroduced to the global financial and commodity markets. Such an inclusive and participatory energy transition would enhance the likelihood of an equitable post-Covid recovery in supply- chain diversification, while partially shielding the shipping industry from fuel and commodity volatility.

Challenge

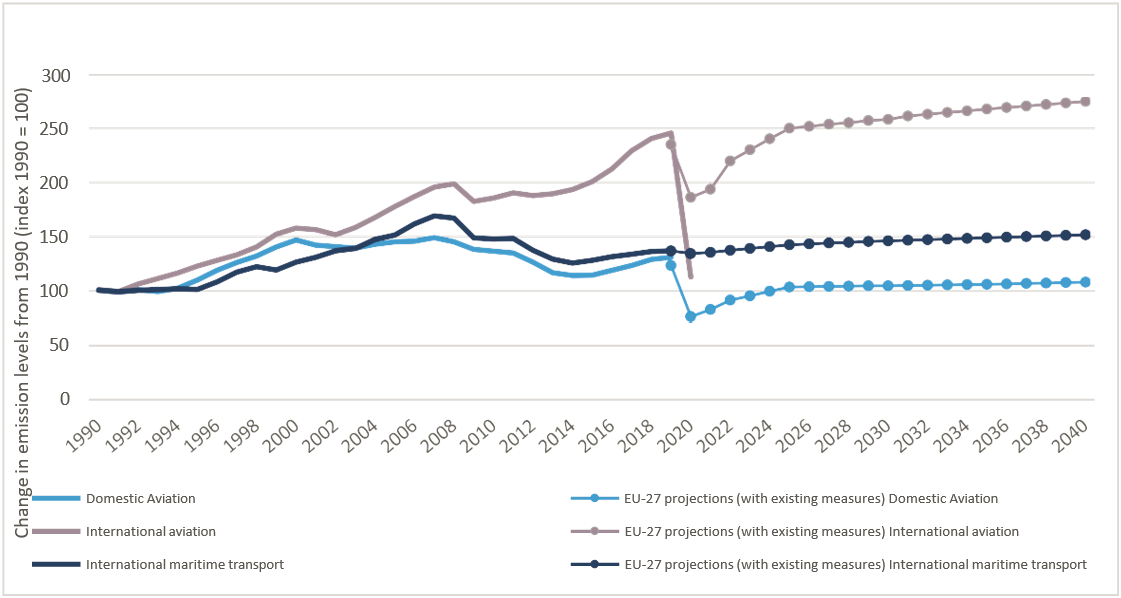

The trade and delivery of goods remain the backbone of the global economy, with marine shipping as the largest cargo transportation mode. Around 80 percent of the international trade in goods by volume (70 percent by value) are transported on marine shipping and are handled by the global port infrastructure (UNCTAD, 2018). Around 3 percent of annual global GHG emissions can be attributed to international shipping, along with 12 percent of sulphur dioxide (SOX), 13 percent of nitrogen oxide (NOx), and a substantial portion of black carbon (BC) emissions ( (IMO, 2020); (US EPA, 2022)). Over the past two decades, GHG emissions from international shipping and aviation have grown faster than other contributors (European Parliament, 2021). Figure 1 illustrates GHG emissions in Europe. Both sectors are projected to increase even with currently planned measures (EEA, 2021). Maritime shipping has proven to be one of the hardest-to-decarbonise sectors.

Figure 1: GHG emissions from transport in the European Union

Source: European Environment Agency and author’s analysis

Source: European Environment Agency and author’s analysis

Existing capital investments in the shipping industry, covering vessels and port infrastructure, are huge, long-term, and offer meager returns – often because of overcapacity and market competition (Bryant, 2021). As a result, low-cost maritime fuels, also called bunker fuels, are crucial to profitability. These fuels are derived from residues from the crude oil refining process, and generally yield increased emissions of carbon dioxide (CO2) and sulfur. High upfront capital costs, combined with the operational and financial legacies of the shipping industry, have emerged as significant impediments to decarbonisation, resulting in a sector has been slow to adopt low-carbon fuel options without substantial and persistent policy pushes.

The sustainable energy transition for marine fuels and related shipping and port infrastructure has broad implications for global trade stability and climate ambitions, reducing environmental pollution, and mitigating potentially irreparable damage to vulnerable ecosystems, like the polar icecaps. Marine fuels remain a critical area where progress can be made toward (i) GHG emissions reduction, (ii) emission mitigation and adaptation, (iii) ensuring the resilience of the global commodity and goods trade, and (iv) adopting circular economic frameworks to global marine transport by prudent use of fossil and low-carbon fuels, along with carbon capture and sequestration (CCS) to ensure the equitable distribution of benefits globally, as well as a sustainable and inclusive energy transition.

Currently available technologies make the decarbonisation of maritime shipping a distinct possibility by 2035 (International Transport Forum, 2018). The challenge will be to devise a comprehensive policy framework to motivate the industry to support the transition and the conversion of shipping fleets to cleaner, low-carbon fuels, such as liquified natural gas (LNG); green ammonia; synthetic fuels, like methanol, clean hydrogen, and fuel cells; and a mix of fuels, including wind and solar for vessels.

Increased policy support for clean and low-carbon fuels in Europe has signaled a significant willingness to make infrastructure investments and develop financing mechanisms. However, other parts of the world rely on carbon and emission-intensive fuels such as heavy fuel oil (HFO). Advances in fossil-fuel burning efficiencies, onboard carbon capture, and emissions mitigation could aid implementation of the energy transition.

Proposal

PROPOSAL 1:

Introduce fiscal incentives that reflect and enhance the value of avoided carbon in maritime transport using a Circular Carbon Economy (CCE) framework. Avoided carbon should be factored in, incentivised, and monetised as a tradeable commodity for markets where carbon is accounted for and taxed.

Rationale:

The maritime architecture, the international law of the sea, and the ease with which ships adopt flags of convenience give shipping companies ample opportunity to avoid regulation. As a result, shipping companies often follow the path of least resistance, with limited or delayed responses to environmental policies. While initiatives such as the Paris Memorandum of Understanding (2021) have helped standardise maritime tracking and port operations, compliance is voluntary. These initiatives have little leverage to change the behavior of corporations that are focused on profits.

Absent concrete incentives or enforcement, the current policy environment gives little impetus to the industry to transition to low-carbon operations. This is a fundamental problem, as research has shown that sustainable policy changes are possible only when incentives can prompt economic units to change their behavior.

The policy roadmap to achieve a sustainable energy transition can use market and non- market incentives to bolster the global energy transition (Adelman, 2000). Creating economic value via a circular economy for stakeholders is essential for curbing emissions and pollution policies. The creation of such value has proven to be instrumental in changing market sentiments (Bimonte, Romano, & Russolillo, 2021), securing buy-in from industry leaders (Dobni, Klassen, & Nelson, 2015), and fostering innovation (Kusi-Sarpong, Gupta, & Sarkis, 2018). Discussion on lowering emissions and pollution has highlighted two mechanisms: government intervention (through policy and mandates) and market mechanisms. Government policies often include tax incentives and exemptions, preferred procurement schemes, real estate grants, low-cost capital offered via state financial institutions, or similar fiscal interventions. These interventions are redistributive: the value created from an intervention is given as compensation to the “losers” of such an intervention or as a further incentive to compel desired behavior. Policy instruments tend to be blunt and are limited to the legal space in which governmental agencies can operate. The long-term credibility of these policies can also potentially come into question: If the market doubt a government’s commitment to a policy, e.g., if a change in government has the potential for a policy reversal, then market players will be less likely to support government mandates.

On the other hand, market-based mechanisms rely on price. The assumption is that markets can set the optimal price for a product or service. Every player in the value chain will be incentivised to improve processes to reducing deadweight costs. Putting a price on carbon is expected to incentivise market players to minimise emissions while relieving the policymakers from the need to impose a specific path of innovation or redistribute resources due to fiscal interventions. Still, various shortcomings in the pricing of carbon exist.

Our proposal of securitising the long-term benefits of decarbonising marine fuels builds on the two policy levers discussed above. We suggest that securitisation of future income flows from decarbonisation, along with operational and fiscal incentives, will speed the transition to a low-carbon global shipping industry. Financial securitisation of the returns from investments in transitioning can open a range of global possibilities. Such financial products could attract substantial interest from various international funds, increase interest in greening portfolios, and provide further impetus for global innovations for a sustainable transition. Investments in shipping offer a relatively stable long-term income stream (Marvest, 2022). The sustained nature of these payouts could create sufficient demand for this financial product, possibly as a hedging tool. This financial product would also help various funds become green to meet ESG standards.

The shipping industry is capital intensive; cash flow is often a major factor in ensuring a profitable returns. Hence, the major hurdle with abatement tends to be the first step, e.g., rationalising the investment financially. A proposed financial product must identify the needed upfront cash for ship operators to transition to low-carbon emitting fleets. Securitisation of carbon abatement and the integration of the resultant financial products into global markets is also expected to improve performance. Despite international governance mechanisms, such as the Paris Memorandum of Understanding, the “flag of convenience” nature of the shipping industry makes global coordination of policy a massive challenge. Such funds would necessitate transparency and operational accountability, adding another dimension to ESG compliance for the global economy. Finally, it is essential to note that ports can also securitise expected gains from offering low-carbon services. These gains can create low-carbon manufacturing and services industries around the ports through establishing clean energy hubs or hydrogen hubs.

PROPOSAL 2 :

Policy incentives to give operational and regulatory priority to operations using green marine fuels.

Rationale:

Switching the focus of regulatory incentives from ships to ports offers considerable leverage to policymakers. Decarbonising marine fuels will require a substantial investment in port infrastructure, featuring new shore facilities, fuel loading and unloading systems, transport system, and bunkering facilities for alternative fuels. National regulation and investment would be effective in ensuring such investments, possibly supplemented by global green funds.

Preferred access to ports, licensing, and other operational processes can incentivise ship owners to decarbonize while committing much less capital. Alternative fuels and renewable energy can deliver much of the required reductions. Advanced biofuels are already available, though in limited quantities. Gradually, they should be complemented by natural or synthetic fuels, such as methanol, ammonia, and hydrogen. Wind power could offer additional reductions. The first electric ships have been providing transport for short-distance routes. Technological measures to improve the energy efficiency of vessels could yield a substantial part of the needed emissions reductions. Market-mature options include, among other things, hull design improvements, air lubrication, and bulbous bows. Finally, operational measures such as ship speed reductions, smoother ship-port interfaces, and increased ship size could achieve further significant emission reductions.

PROPOSAL 3:

Continued policy support of technological innovations in petroleum-fuel upgrading at refineries, desulfurisation; engine technologies, onboard carbon and sulfur capture, black carbon, and NOx mitigation for making clean marine transport affordable to many resource- lean countries and until green options are fully available at a competitive cost and abundant supply.

Rationale:

Hydrogen utilised in fuel cells to power ships is widely believed to be the marine industry’s future (Herdzik, 2021). However, hydrogen production via green or low-carbon pathways is not expected to become cost-competitive in most parts of the world before 2030. Challenges associated with storage and transport may further delay widespread adaptation (Halff, 2017). During the transition, policymakers must continue to improve engine technologies with conventional liquid fuel options. All energy choices and technology options to mitigate GHG and pollution must be available to policymakers, especially those from the developing world. Desulfurisation (Guida, Jameel, Saxena, & Roberts, 2021) and carbon capture technologies (Ratcliffe & Rathi, 2021) are enabling technologies for achieving such goals (Vedachalam, Baquerizo, & Dalai, 2021); (Al Baroudi, Awoyomi, Patchigolla, Jonnalagadda, & Anthony, 2021). Some of these innovations are at a low technology readiness level (TRL), or there are significant cost barriers to their wide-scale commercialisation. Investments are needed in research and development for engine/fuel-cell innovations running on hydrogen (Turner, 2020), ammonia (Morlanes, et al., 2021), e-fuels (Ramirez, Sarathy, & Gascon, 2020), bio-fuels, and direct air capture (Chatterjee & Huang, 2020). R&D funding must continue to enhance fossil-based marine fuels during the transition period.

Furthermore, R&D in transitioning marine fuels may offer considerable positive externalities and high return in digital infrastructure, research, and engineering. The role of academic institutions shall become more prominent as an incubator of future technologies, while knowledge generated must not be lost or unused. Hence, strategic translation of academic research into industrial technologies and dissemination on a global scale will require a coordinated effort.

PROPOSAL 4:

Streamline R&D for carbon-free fuels (Ashrafi, Lister, & Gillen, 2022), digital transformation, related infrastructure, and engineering focused on the Fourth Industrial Revolution (4IR) to allow greening efforts to occur globally and in an expedited manner. The Internet of Things (IoT), artificial intelligence (AI), and cloud computing are backbone 4IR technologies that are critical to fostering a sustainable energy transition in the marine shipping industry and related infrastructure ( (Olsen & Tomlin, 2019); (Struck, 2020)).

Rationale:

Streamlining digital transformations and related infrastructure and engineering efforts is key to enabling a global transition of marine fuels. The digital financial infrastructure of the future is key to lowering the global shipping industry’s GHG emissions. Such infrastructure would provide the necessary information flow for certification, transparency, and performance management and hence lay the foundation for accountability. Advances in monitoring emissions would go hand in hand with digital verification and disseminating this data. In addition, deviations (intended or otherwise) from promised low-carbon bunkering must be automatically registered.

References

Adelman, I. (2000). Fifty Years of Economic Development: What have we learned? Retrieved from World Bank: https://documents1.worldbank.org/curated/en/625131468761704307/pdf/28737.pd f

Al Baroudi, H., Awoyomi, A., Patchigolla, K., Jonnalagadda, K., & Anthony, E. J. (2021, February 13). A review of large-scale CO2 shipping and marine emissions management for carbon capture, utilisation and storage. Retrieved from Applied Energy: https://www.sciencedirect.com/science/article/pii/S0306261921000684

Ashrafi, M., Lister, J., & Gillen, D. (2022, February 01). Toward a harmonisation of sustainability criteria for alternative marine fuels. Retrieved from Marine Transport Research: https://www.sciencedirect.com/science/article/pii/S2666822X2200003X

Bimonte, G., Romano, M. G., & Russolillo, M. (2021, September). Green Innovation and Competition: R&D Incentives in a Circular Economy. Retrieved from Games: https://ideas.repec.org/a/gam/jgames/v12y2021i3p68-d636545.html

Bryant, C. (2021, August 19). Container Shipping Earnings Now Rival Apple. It’s Not a Good Look. Retrieved from Bloomberg: https://www.bloomberg.com/opinion/articles/2021-08-19/container-shipping-is-making-a-killing-this-year-but-will-we-have-christmas

Chatterjee, S., & Huang, K.-W. (2020, July 03). Unrealistic energy and materials requirement for direct air capture in deep mitigation pathways. Retrieved from Nature Communications: https://www.nature.com/articles/s41467-020-17203-7

Dobni, C. B., Klassen, M., & Nelson, W. T. (2015, January 19). Innovation strategy in the US: top executives offer their views. Retrieved from Journal of Business Strategy: https://www.emerald.com/insight/content/doi/10.1108/JBS-12-2013-0115/full/html

EEA. (2021, November 18). Greenhouse gas emissions from transport in Europe. Retrieved from European Environment Agency: https://www.eea.europa.eu/ims/greenhouse-gas-emissions-from-transport

European Parliament. (2021, April 28). Emissions from planes and ships: facts and figures. Retrieved from European Parliament: https://www.europarl.europa.eu/news/en/headlines/society/20191129STO67756/emissions-from-planes-and-ships-facts-and-figures-infographic

Guida, P., Jameel, A., Saxena, S., & Roberts, W. L. (2021, April 29). Fundamental Aspects and Applications of Ultrasonically Induced Cavitation in Heavy Fuel Oil with a Focus on Deasphalting, Emulsions, and Oxidative Desulfurization. Retrieved from American Chemical Society: https://pubs.acs.org/doi/abs/10.1021/bk-2021-1379.ch010

Halff, A. (2017, August). Slow steaming to 2020:innovation and inertia in marine transport and fuels. Retrieved from Center on Global Energy Policy, Columbia – School of International and Public Affairs: https://energypolicy.columbia.edu/sites/default/files/SlowSteamingto2020Innovatio nandInertiainMarineTransportandFuels817.pdf

Herdzik, J. (2021, July 17). Decarbonization of Marine Fuels—The Future of Shipping.

Retrieved from Energies: https://mdpi-res.com/d_attachment/energies/energies-14- 04311/article_deploy/energies-14-04311.pdf

IMO. (2020). Fourth Greenhouse Gas Study 2020. Retrieved from International Maritime Organization: https://wwwcdn.imo.org/localresources/en/OurWork/Environment/Documents/Four th%20IMO%20GHG%20Study%202020%20-%20Full%20report%20and%20annexes.pdf

International Transport Forum. (2018, March 27). Decarbonising Maritime Transport: Pathways to sero-carbon shipping by 2035. Retrieved from ITF/OECD: https://www.itf-oecd.org/sites/default/files/docs/decarbonising-maritime-transport- 2035.pdf

Kusi-Sarpong, S., Gupta, H., & Sarkis, J. (2018, September 08). A supply chain sustainability innovation framework and evaluation methodology. Retrieved from International Journal of Production Research: https://www.tandfonline.com/doi/abs/10.1080/00207543.2018.1518607

Marvest. (2022). Long-term investments in shipping. Retrieved from Marvest: https://www.marvest.de/en/magazine/blog/long-term-investments-in-shipping/

Morlanes, N., Katikaneni, S. P., Paglieri, S. N., Harale, A., Solami, B., Sarathy, M. S., & Gascon, J. (2021, January 15). A technological roadmap to the ammonia energy economy: Current state and missing technologies. Retrieved from Chemical Engineering Journal: https://www.sciencedirect.com/science/article/pii/S1385894720334343

Olsen, T. L., & Tomlin, B. (2019, September 10). Industry 4.0: Opportunities and Challenges for Operations Management. Retrieved from Manufacturing and Service Operations Management: https://pubsonline.informs.org/doi/10.1287/msom.2019.0796

Ramirez, A., Sarathy, M. S., & Gascon, J. (2020, September). CO2 Derived E-Fuels: Research Trends, Misconceptions, and Future Directions. Retrieved from Trends in Chemistry: https://www.sciencedirect.com/science/article/abs/pii/S2589597420301751

Ratcliffe, V., & Rathi, A. (2021, June 30). Saudi Arabia Wants to Freeze Carbon to Cut Emissions From Power. Retrieved from Bloomberg: https://www.bloomberg.com/news/articles/2021-06-30/saudi-arabia-wants-to- freeze-carbon-to-cut-emissions-from-power

Struck, E. L. (2020, January 29). Digital transformation in the shipping industry : how Industry 4.0 is shaping the shipping industry? Retrieved from Universidade Católica Portuguesa: https://repositorio.ucp.pt/handle/10400.14/29650?locale=en

The Paris Memorandum of Understanding on Port State Control. (2021, January 01). Retrieved from Paris MoU on Port State Control: https://www.parismou.org/inspections-risk/library-faq/memorandum

Turner, J. (2020, February). Decarbonization of Transport: Synergies between Hydrogen and Alternative Engine Concepts. KAUST Research Conference: Transition to Low Carbon Mobility 2020. Thuwal, Riyadh, Saudi Arabia.

UNCTAD. (2018). Review of maritime transport. Retrieved from UNCTAD: https://unctad.org/webflyer/review-maritime-transport-2018

US EPA. (2022). Reducing Air Pollution from International Transportation. Retrieved from United States Environmental Protection Agency: https://www.epa.gov/international-cooperation/reducing-air-pollution-international-transportation

Vedachalam, S., Baquerizo, N., & Dalai, A. K. (2021, October 15). Review on impacts of low sulfur regulations on marine fuels and compliance options. Retrieved from Fuel: https://www.sciencedirect.com/science/article/pii/S0016236121021189