We propose that G20 countries build a robust upstream policy and institutional framework for delivering on sustainable infrastructure. Specifically, such a framework should include coherent growth strategies and well-articulated investment plans, comprehensive infrastructure plans, a sound project prioritization framework, and procurement policies that integrate sustainability criteria. Additionally, G20 countries should work with Development Finance Institutions (DFIs) to build sound platforms to bring together all relevant stakeholders to help attract and evaluate investments in sustainable infrastructure.

Challenge

Infrastructure has been a central agenda item of the G20 due to its key role for economic growth and development. The efforts of the G20 in 2018 focused on mobilizing infrastructure financing such as through the Roadmap to Developing Infrastructure as an Asset Class. Despite the cruciality of scaling up financing, equal attention is required to ensure the quality of infrastructure investments given their large economic, social, and environmental impacts. In addition to locking in green house gas emission patterns for decades, infrastructure can degrade natural lands, drive deforestation (thus accentuating climate change), place greater demands on water resources, and contribute to the deterioration of ecosystem services. Managing these impacts while scaling up investments is the central challenge of infrastructure investments. In the Amazon, 95% of all deforestation occurs within 5.5 kilometers of a legal or illegal road. For example, new roads in central Africa have been linked to a loss of two-thirds of all forest elephants (i) . Development trends for energy, mining, agriculture and urban expansion could cumulatively impact 20 percent of remaining natural lands globally, doubling the extent of land converted in Latin America and tripling it in Africa (ii).

The social impacts of poorly planned infrastructure projects also threaten sustainable development. Some infrastructure projects have an adverse impact people by not providing access and benefit sharing of infrastructure projects, and and can entail re-locating large populations of people from their homelands. Indirectly, losses in ecosystem services can threaten their livehiloods and trigger social conflict. In a study of social conflict around infrastructure projects in Latin America, the Inter-American Development Bank found that degradation of ecosystems tied to local livelihoods was responsible for 72 percent of all the cases of social conflict around such projects. Not only is social inclusiveness paramount because it is a pillar of the SDGs, but infrastructure projects that are not inclusive can be very costly. The same IDB study of 200 social conflict effected infrastructure projects, found that 198 of them were eventualy closed (36) or faced significant delays (162) (iii).

Getting infrastructure investments right is challenging because of their inherent characteristics. Infrastructure investments are long-term and require large upfront investments, but generate cash flows after many years. They are subject to high risks, especially in the initial phases. Infrastructure investments are typically complex, involving many parties. This makes infrastructure investments vulnerable to policy and political risks and requires appropriate regulation, since they are often natural monopolies such as in transport, water, and power distribution. Spillover effects and positive externalities and social benefits of the investment may be large but difficult to measure, and negative externalities also. Consequently, markets alone cannot provide effective and sustainable infrastructure services.

Development Finance Institutions (DFIs) such as the multilateral development banks (MDBs) and national and sub-regional development banks are thus essential for helping to steer private sector financing into infrastructure, and infrastructure finance in general toward broader SDGs. However, DFIs deploy a wide variety of environment and social criteria in their infrastructure investment planning, with some attempting to calibrate their project selection and design toward social and environmental outcomes and others deferring such frameworks to host country systems. Recent work has shown that the lack of common goals and approaches may be leading to an expansion of environmentally and socially impactful projects with those DFI’s that have not calibrated their infrastructure planning in a sustainable manner (iv).

To tackle these challenges, sound upstream policy and institutional frameworks and platforms for project preparation are essential. A robust policy and institutional framework enables increased infrastructure investment as well as ensures high quality projects. Platforms for project preparation contribute to scaling up the delivery of sustainable infrastructure through providing bankable and sustainable projects. Despite this importance, they have received less attention compared to financing. This brief proposes G20 countries build a more systematic and integrated upstream policy and institutional framework and platforms for delivering on sustainable infrastructure

Proposal

1. Revamp the upstream policy and institutional foundation to deliver on sustainable infrastructure

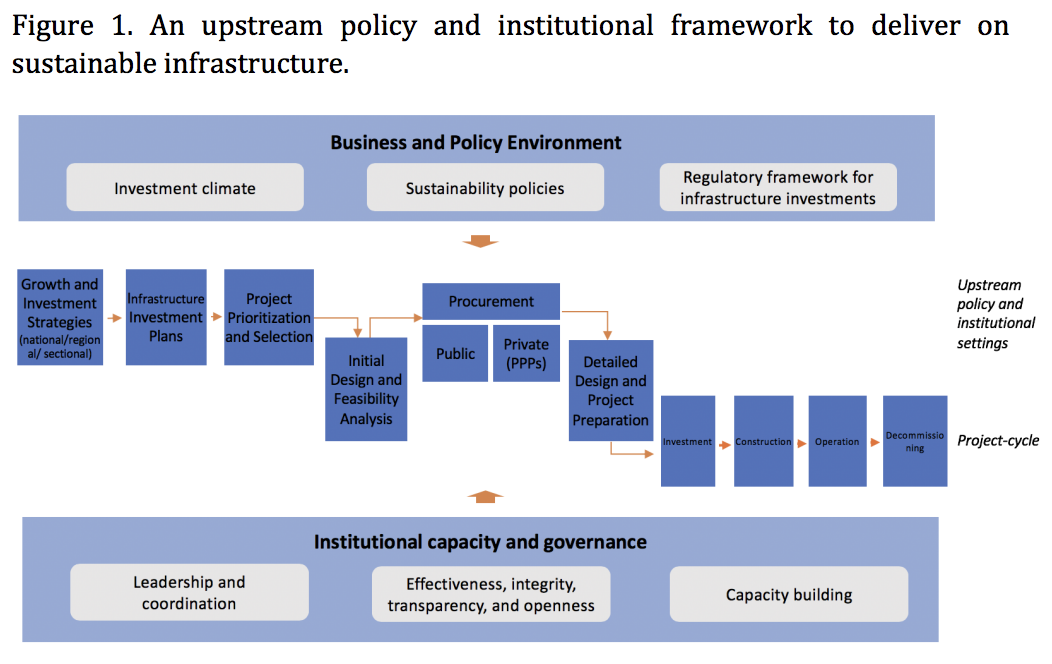

The policy and institutional underpinnings for delivering on infrastructure projects are complex, encompassing upstream planning and project prioritization, sound frameworks for procurement and public-private partnerships, institutional capacities and governance, and sound business and policy environment (Figure 1). Meeting the sustainable infrastructure challenge requires moving decision making upstream to integrate policy objectives across sectors and to optimize for social, economic and environmental outcomes. Each element of upstream policy and institutional planning should incorporate sustainability to ensure quality of projects.

This upstream planning approach, encompassing spatial planning, offers multiple benefits, including the potential to accelerate the project review and approval process, reduce the risks of conflict and litigation, and facilitate offset design and implementation.v The aforementioned IADB study of forty years‘ worth of infrastructure investments found that lack of upfront planning to anticipate and address social and environmental impacts, usually around local communities‘ access to natural resources, was a major driver of infrastructurerelated conflict, often resulting in substantial delays and costs.vi Conversely, a recent analysis of the potential hydropower buildout of the Magdalena River in Colombia found that optimizing the potential investment portfolio for sustainability by screening out the most socially and environmentally damaging projects had the financial effect of nearly doubling the internal rate of return on investment-worthy projects while holding capital expenditures and energy generation constant. vii By saving time and money, upstream planning can de-risk infrastructure investments and increase project value— while improving outcomes for preservation of natural capital and ecosystem services. viii In addition, upstream planning can identify opportunities for natural infrastructure to take the place of traditional built solutions. For instance, natural infrastructure, or hybrid solutions that combine natural and “gray” infrastructure (such as seawalls, dams, levees and wastewater systems), is often the most cost-effective option for reducing flood risk while delivering a host of other benefits such as improved water quality, healthier fish and wildlife habitat, enhanced aesthetics, recreational opportunities and quality of life. (ix)

Despite the utility of these upstream approaches, many countries do not have a sound, credible, and integrated policy and institutional framework for sustainable infrastructure. Although numerous policies and institutions exist, their quality varies greatly among countries; they often poorly integrate sustainability objectives, and they are often not well-coordinated to avoid conflicts among sectors. Most countries do not have coherent growth strategies or well-articulated investment plans that recognize the imperative for greater sustainability and resilience. Upstream spatial and landscape-scale planning is essential to optimize the deployment of physical and natural capital (x) , yet it is rarely undertaken in a systemmatic way by governments.

Many countries have infrastructure plans, but the quality of the plans also varies greatly. Project pipelines or guidelines for the appraisal of infrastructure projects are missing in many infrastructure plans. Procurement policies only partially address sustainability criteria, and many governments face challenges to implement sustainable procurement policies such as the perception that green products and services are more expensive than non-green ones, public officials‘ lack of technical knowledge; and the absence of legislation and monitoring mechanisms to evaluate the performances of green procurement system. (xi)

The failure to address environmental and social risks at the start of the project cycle threatens project sustainability, performance goals and financial return (xii). This results in smaller pipelines of projects and unnecessary depletion of natural capital (the world’s stock of natural resources). At the project level, Environmental Impact Assessment (EIA) is the primary tool for governments to review sustainability components of major projects, but here too, accountability is often weak, the assessment is too late in the project cycle, and mitigation requirements are not required or not enforced. Lacking the information from upstream planning processes, EIA can not effectively address long-term and cumulative impacts.

Policy proposals for the G20:

1) G20 countries should establish coherent growth strategies and wellarticulated investment plans, which integrate sustainable development objectives, and should coordinate them with other sustainability strategies and policies such as Nationally Determined Contributions (NDCs) and biodiversity commitments. This requires a whole-ofgovernment approach with integrated and coherent strategies and frameworks of action. At present there is a fragmentation of efforts with finance ministers often focused on the growth agenda, development and line ministers on the SDGs or on specific sectors, and environment ministers on climate and/or other environmental issues.

2) In alignment with growth strategies and investment plans, G20 countries should build comprehensive infrastructure plans including core elements such as long-term vision and goals, credible pipeline of projects, and the roles of public and private sector. These plans should include spatial planning at a strategic scale to identify and resolve potential points of conflict between development and critical natural capital.

3) To ensure the selection of sustainable projects, G20 countries should establish a sound project prioritization framework, which includes all the dimensions of sustainability—economic and financial, ecological and climate resilience, social, and institutional sustainability—as preselected criteria for evaluation of projects. A well-articulated methodology should be developed for evidence-based evaluation of projects in terms of effectiveness, sustainability, and feasibility.

4) G20 countries should better integrate all the dimensions of sustainability into their regulatory framework for procurement. The laws, regulations, processes, and institutional responsibilities related to procurement need to be developed, implemented, and managed to ensure both efficiency and sustainability of infrastructure projects ar rhe same time as good governance, integrity and transparency.

2. Scale up project delivery through platforms

Better institutional structures are required to scale up and enhance the quality of projects at global, regional and national levels. Platforms, at the country and global level, will be essential to bring together all relevant stakeholders and help attract investments in sustainable infrastructure. With government buyin, platforms can be catalytic agents of change helping move beyond project-byproject approaches and really take efforts to scale. They can ensure a shared understanding of what is meant by sustainable infrastructure; on how to tackle policy and institutional impediments with shared tools and benchmarks in key areas of action; and on setting up common platforms to scale-up project preparation with adherence to high quality standards. A shared understanding of sustainable infrastructure is a base for building platforms. It would enable a more concerted approach by providing clear goals for projects and helping to identify key actions at each stage of the project cycle to bring together various stakeholder groups in a concerted and coordinated way. Many approaches have been taken to develop a shared definition of sustainable infrastructure, but the concept of sustainable infrastructure is still not clearly understood or agreed among stakeholders. Multiple approaches to quality of infrastructure have even created some confusion and have been a barrier to attract investments.

Recent years have seen increasing number of standards and tools to quantify and assess the sustainability of infrastructure for instance, through high-level principles, safeguards and good practices, reporting guidelines, database and benchmarking, and infrastructure sustainability rating systems. Infrastructure sustainability rating systems specifically focus on infrastructure, providing a comprehensive set of indicators. However, these rating systems have some gaps in addressing sustainability, especially economic and financial sustainability, and the use of them tend to be limited to the country where they were developed and neighboring areas rather than being global (xiii).

In order to develop bankable, investment-ready projects, numerous project preparation facilities (PPFs) have been created, but their contributions to the progress in infrastructure investment have been modest. Many PPFs do not have a clear and long-term strategy, and distribute their funds without systemic prioritization (xiv). They rarely leverage private sector expertise to improve project development, and rely on public funds rather than developing a sound mechanism to recover expenses.

An effort to fill this gap led to the creation of SOURCE, a joint global initiative for advanced project preparation. SOURCE is a global platform for national and sub-national governments to help prepare their infrastructure projects. It enables all the stakeholders including MDBs, DFIs, investors, consultancy, contractors, and lenders to work together under the common goal of bridging project preparation and development requirements of the public and private sectors. After two years of operation, SOURCE currently hosts the preparation of 256 infrastructure projects covering all the areas of infrastructure investments, and supports about 2,100 users across 47 countries, having provided 82 trainings in different countries.

Policy proposals for the G20:

1) The G20 should work with MDBs and other stakeholders to reach an agreement on a common understanding of sustainable infrastructure. Building on existing work, the Brookings Institution, the Inter-American Development Bank, Harvard University, the Public-Private Infrastructure Advisory Facility (PPIAF) and The Nature Conservancy have been developing a common framework for sustainable infrastructure including the definition and attributes of sustainable infrastructure (xv). This work can be used as a basis for wider discussion among the G20 and stakeholders to reach a broad agreement on what is sustainable infrastructure.

2) G20 countries should work with multilateral and regional and national development banks to create global sustainable project preparation and guarantee facilities that are managed at the country level, anchored by multilateral, regional and national development banks (xvi) The regional and multilateral development finance institutions would provide technical assistance to enable countries to conduct cross-sectoral and large-scale infrastructure planning. The project development fund would be used to help national development banks search for potential sustainable projects, scale up existing ones and promote a project pipeline, to monitor the development and impact of projects, and to minimize the risks involved in sustainable investments.

3) The G20 should work with the MDBs to reform and streamline PPFs. PPFs should have a clear strategy, which enables an optimal allocation of resources to support project preparation, and should build a sustainable financing model, which recovers a significant portion of their costs from project owners.

4) G20 countries should work with MDBs and other stakeholders to ensure the best operationalization of standards and tools and to ensure that infrastructure scaling is calibrated toward our common social and environmental development goals. Existing standards and tools need to be improved with better incorporation of sustainability attributes, and the use of them should be expanded.

5) G20 countries should establish mechanisms for monitoring, transparency and accountability to ensure that project execution goes as planned. Indicators, monitoring, and performance requirements, combined with digital technologies, should be further developed and applied to ensure that the end product delivers the outcomes that were planned.

REFERENCES

i Laurance W.F. Burgues I. Roads to riches or ruin? Science. 2017; 358: 442-444; Barber C.P. et al. Roads, deforestation, and the mitigating effect of protected areas in the Amazon.Biol. Conserv. 2014; 177: 203-209.

ii Oakleaf JR, Kennedy CM, Baruch-Mordo S, West PC, Gerber JS, Jarvis L, et al. (2015). A World at Risk : Aggregating Development Trends to Forecast Global Habitat Conversion. PLoS ONE 10(10) : e0138334. https://doi.org/10.1371/journal.pone.0138334

iii Inter-American Development Bank (2018), Four Decades of Infrastructure Related Conflicts in Latin America and the Caribbean, Washington, Inter-American Development Bank.

iv Ray, et al. 2018.

v McKenney B.A., Krueger L.I., Kiesecker J.M., Thompson J.F. (2016). Blueprints for a Greener Footprint Sustainable Development at a Landscape Scale. World Economic Forum.

vi Watkins G, Mueller S-U, Meller H, Ramirez MC, Serebrisky T., and Georgoulias A. (2017). Lessons From 4 Decades of Infrastructure Project Related Conflicts in Latin America and the Caribbean. Inter-Americal Development Bank : Washington D.C.

vii Opperman, J., J. Hartmann, J. Raepple, H. Angarita, P. Beames., E. Chapin, R. Geressu, G. Grill, J. Harou, A. Hurford, D. Kammen, R. Kelman, E. Martin, T. Martins, R. Peters, C. Rogéliz, and R. Shirley. (2017). The Power of Rivers : A Business Case. The Nature Conservancy : Washington, D.C.

viii High Level Expert Group on Sustainable Finance (2018). Financing a sustainable European economy.

ix The Nature Conservancy (2015). Urban Coastal Resilience : Valuing Nature’s Role. July 2015 :1-205. https://www.nature.org/media/newyork/urban-coastal-resilience.pdf; Narayan S, Beck MW, Wilson P, et al. (2017). Coastal Wetlands and Flood Damage Reduction. Using Risk Industry-Based Models to Assess Natural Defenses in the Northeastern USA. Scientific Reports 7: 9463.

x A.C. Barros, B. McKenney, A. Bhattacharya, B. Nofal, C. Nobre, K. Gallagher, L. Krueger and T. Lovejoy. (2019) .Sustainable Infrastructure to Secure the Natural Capital of the Amazon. T20 Japan 2019 Task Force Four Policy Brief. https://t20japan.org/policy-briefsustainable-infrastructure-to-secure-the-natural-capital-of-the-amazon/

xi OECD. (2015). Smart Procurement : Going Green – Better Practices for Green Procurement, GOV/ PGC/ETH (2014)1/REV1 ; and Nofal, Beatriz (2017). Compras Publicas y Desarrollo Productivo, in, Los Futuros del Mercosur, Inter-American Development Bank, INTAL, pages 68-81, https://publications.iadb.org/handle/11319/8172

xii Watkins, 2017.

xiii Bhattacharya, A., Contreras, C., and Jeong. M., forthcoming. Defining a Common Framework for Sustainable Infrastructure. Brookings, Inter-American Development Bank, and Public-Private Infrastructure Advisory Facility. Washington, DC.

xiv World Economic Forum. (2015). Africa Strategic Infrastructure Initiative : A Principled Approach to Infrastructure Project Preparation Facilities.

xv Bhattacharya, A., Contreras, C., and Jeong. M., forthcoming. Defining a Common Framework for Sustainable Infrastructure. Brookings, Inter-American Development Bank, and Public-Private Infrastructure Advisory Facility. Washington, DC. ; IDB and Brookings.(2019). Attributes and Framework for Sustainable Infrastructure. InterAmerical Development Bank and Global Economy and Development at Brookings: Washington D.C.

xvi Studart, R. and Gallagher, G. forthcoming. Guaranteeing sustainable infrastructure. Journal of International Economics.