International banking regulations are developed by a small group of financial regulators, largely from advanced economies. Off-the shelf adoption of these standards in developing countries, particularly low and lower-middle income countries, poses substantial costs and risks. Yet many regulators are pressing ahead with them nevertheless, partly due to concerns about reputation and competition. We explain why, in today’s world of globalised finance, regulators cannot simply ignore international standards, even if they are ill-suited to their regulatory environment. We propose ways that the international policy community can move from a minimalist ‘do no harm’ approach, to actively designing international standards that are genuinely useful for low and lower-middle income countries and support financial sector development.

Challenge

Challenge: International Banking Standards Pose Challenges for LMICs

Designed in the wake of the Global Financial Crisis, the Basel III reforms tighten capital requirements and introduce liquidity requirements and macroprudential tools. These reforms were agreed upon by the 28 members of the Basel Committee on Banking Supervision (hereafter ‘Basel Committee’), representing major advanced and emerging economies. Basel standards are designed to address financial risks emanating from large, complex banks with international operations.

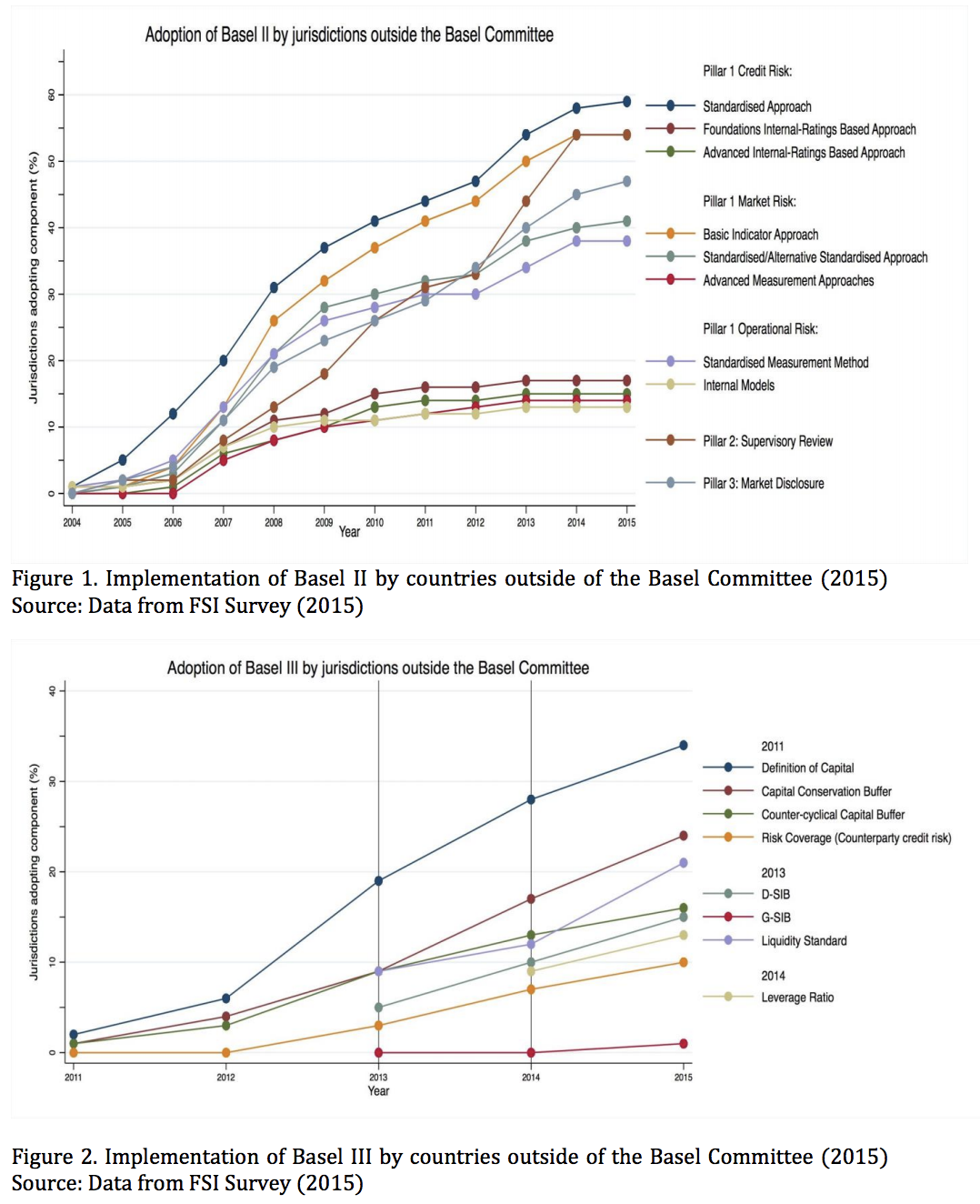

While in principle only member countries are obliged to adopt and implement Basel standards, many non-members are moving to implementing them. As at 2015, 90 out of 100 surveyed non-member jurisdictions were implementing, or preparing to implement, aspects of Basel II, while 81 were implementing, or preparing to implement, aspects of Basel III (FSI 2015). It is striking that regulators in many low- and lower-middle income countries (LMICs) are implementing international standards even though their jurisdictions feature simpler banking systems and different financial risk profiles.

Overall, the available evidence suggests that while there are strong arguments for strengthening the regulation of banks in LMICs, it is far from clear that the Basel standards are the most effective approach (Barth and Caprio 2018). The implementation of Basel II and III poses particular challenges for LMICs (1):

- Financial infrastructure gaps. Even the simpler components of Basel II and III presume a degree of financial development and the existence of infrastructure that is not in place in many LMICs. For instance, the standardised approach to credit risk under Basel II relies on credit rating agencies but many LMICs do not have national ratings agencies and the penetration of global ratings agencies is limited to the largest corporations.

- Poor match for financial stability threats. Basel II and III address financial risks that may be of little relevance in the simpler financial systems of LMICs, such as counterparty risk for derivatives exposures or liquidity mismatches arising from wholesale funding. Conversely, they may not adequately address key macroeconomic threats to financial stability in LMICs, such as volatility in crossborder capital flows and large swings in global commodity prices.

- Human and Financial Resource Constraints. Implementing Basel II and III imposes significant adjustment costs onto both banks and regulators. The costs derive not from regulatory stringency– capital requirements in most LMICs are higher than Basel III – but from the complexity of Basel rules. The implementation of the new global standards, exacerbates regulatory resource constraints that are already significant in many LMICs.

- Exacerbated information asymmetry. In many LMICs, remunerative differences and brain drain to the private sector already pose challenges for regulatory authorities. Information asymmetries may be exacerbated when the more complex elements of Basel II and III are implemented, widening the scope for regulatory arbitrage.

- Distorted regulatory agenda. Implementing Basel II and III may take scarce resources away from other priority tasks of the regulatory agency. Implementation of Basel II/III does not necessarily address underlying weaknesses in the regulatory system. As designed, international standards embody a complex regulatory regime, not necessarily a strong one.

- Deterioration of credit composition. Banks that implement Basel II and III may have an incentive to shift their portfolio away from sectors of the economy that are key for inclusive economic development. For instance, higher risk weights for loans to small and medium enterprises (SMEs) may not properly reflect the potential benefit of diversification away from a few large enterprises and may discourage financial inclusion.

Proposal

Why are regulators in many LMICs implementing international banking standards, despite the challenges they pose? What steps can be taken to ensure that international banking standards are genuinely useful for low and lowermiddle income countries and support financial sector development?

The political drivers of implementation

A recent research project we led, titled “Developing countries navigating global banking standards” combines cross-country panel analysis and in-depth case studies of eleven LMICs across Africa, Asia and Latin America. It examined the political economy of Basel II/III adoption and provides important insights into the factors that explain why or why not regulators in developing countries adopt and implement international regulatory standards.

Politicians and regulators in small developing countries, particularly those with nascent financial sectors, are often looking to attract international capital, maintain (or attain) investment grade ratings from international ratings agencies, and stay on good terms with international financial institutions like the IMF. Our research shows how this generates powerful reputational and competitive incentives that lead regulators to adopt international standards even when they are ill-suited to their local context. We find that regulators in developing countries do not merely adopt Basel II/III because these standards provide the optimal technical solution to financial stability risks in their jurisdictions.

Instead, regulatory decisions are also driven by concerns about reputation and competition (Jones 2019; Jones and Zeitz 2017).

We find that the following factors are important drivers of Basel II/III adoption in LMICs:

- Signaling to international investors. Incumbent politicians may adopt Basel standards in order to signal sophistication to foreign investors. For example, in Ghana, Rwanda, and Kenya, politicians have advocated the implementation of Basel II and III, and other international financial standards, as part of a drive to establish financial hubs in their countries.

- Reassuring host regulators. Banks headquartered in LMICs may endorse Basel II or III as part of an international expansion strategy, as they seek to reassure potential host regulators that they are wellregulated at home. We see this at work in Nigeria, where large domestic banks have championed Basel II/III adoption at home as they seek to expand abroad. Their fervour has been met with reluctance among regulators who fear that a rapid regulatory upgrade may put weaker local banks in jeopardy.

- Facilitating home-host supervision. Adopting international standards can facilitate cross-border coordination between supervisors. In Vietnam, for example, regulators were keen to adopt Basel standards as their country opened up to foreign banks, to ensure they had a ‘common language’ to facilitate the supervision of the foreign banks operating in their jurisdiction.

- Peer learning and peer pressure. Even while acknowledging the shortcomings of Basel II and III LMIC regulators often describe them as international ‘best practices’ or ‘the gold standard’ and there is strong peer pressure in international policy circles to adopt them. In the West African Economic and Monetary Union (WAEMU), for example, regulators at the supranational Banking Commission are planning an ambitious adoption of Basel II and III with the support and encouragement of technocratic peer networks and the IMF. Domestic banks however have limited cross-border exposure and show little enthusiasm for the regulator-driven embrace of Basel standards.

- Technical advice from the International Monetary Fund and the World Bank plays an important role in shaping the incentives for politicians and regulators in developing countries. While the Financial Stability Assessment Programmes (FSAPs) are designed to merely evaluate the regulatory environment of client countries against a much more basic set of so-called Basel Core Principles, we find evidence that Fund and the Bank motivate regulators in LMICs to engage in Basel II and III adoption, in some cases with explicit recommendations.

Steps regulators in LMICs can take

What steps can financial regulators in LMICs take to harness the prudential, reputational and competitive benefits of global banking standards, while avoiding the implementation risks and challenges associated with wholesale adoption?

Given the challenges and risks associated with implementing Basel II and III, regulators in LMICs face difficult choices and trade-offs. LMIC regulators are under pressure to adopt the full suite of international Basel standards in order to signal to regulators in other jurisdictions and to international investors that their banks are soundly regulated. Yet there are major challenges and risks associated with implementation.

Our research highlights specific ways that LMICs can tailor Basel implementation to their domestic circumstances:

- Consider the risks of an overly ambitious Basel II/III implementation. Prioritise key financial challenges and assess to what extent Basel implementation may exacerbate reliance on credit rating agencies, information asymmetry between regulators and banks, and the exclusion of economic sectors, including small and medium enterprises.

- Implement a selection of Basel components. Regulatory agencies outside the Basel Committee on Banking Supervision are not bound by its rules and not subject to peer review procedures. Regulators in the financial periphery can use this freedom to adapt global standards to meet domestic regulatory needs. Basel II and III are in practice compendia of different standards so regulators can select those components that are most desirable and feasible to implement. Components vary substantially in the amount of regulatory resources they require, both in the implementation and supervision phase. Regulators can identify domestic prudential needs and regulatory capabilities first and then assess the adequacy of each Basel II/III component in matching those needs given existing capacity constraints. Indeed, regulators in non-member countries are adopting Basel II and III in a highly selective manner. Regulators are more likely to adopt the simpler Basel II standardised approaches to credit, market and operational risk instead of much-disputed advanced approaches that rely on the use of internal models by banks (Figure 1). Similarly, simple components of Basel III such as the new definition of capital and the leverage ratio are more popular than complex requirements such as the liquidity ratios or the countercyclical buffer (Figure 2).

- Proportional rules implementation. Regulators can refrain from copying prudential requirements from the Basel II and III rulebook. They can use their intimate knowledge of the domestic financial system to write rules that match local circumstances better than the Basel template. In the Philippines for example, regulators have adjusted the risk-weights for small and medium enterprises to reduce the incentive of banks to move away from lending to these firms

- Adjust the perimeter of banking regulation. Regulators can adjust the perimeter of banking regulation, so that regulations that are aligned with international standards only apply to large internationally active banks, and simpler (although not necessarily less stringent) rules apply to small domestic banks. This approach is common in countries belonging to the Basel Committee (Castro Carvalho et al. 2017). In looking to modify international standards, regulators should tap into the wealth of knowledge among their peers. While regulators in many developing countries look first to international institutions for advice, they should also look to strengthen mechanisms for peer-to-peer learning.

Steps for the G20 and international policy community

While LMIC regulators can tailor the local adoption of global banking standards this is not straightforward – sifting through the full suite of international standards and adapting them to fit the local context is a painstaking and resource-intensive task. Rather than place the burden of adjustment on regulators in LMICs, who face the greatest resource constraints, the international community can take steps to ensure that international standards are designed in ways that support financial stability and financial sector development in LMICs.

The Financial Stability Board, World Bank, and IMF explicitly advise countries with limited international financial exposure and supervisory capacity constraints to “first focus on reforms to ensure compliance with the Basel Core Principles and only move to the more advanced capital standards at a pace tailored to their circumstances” (FSB, World Bank, and IMF 2011, 7). While this advice is well-intentioned, it fails to recognise the powerful reputational and competitive incentives that regulators in LMICs face to converge on international standards even when they are ill-suited to their national circumstances. Simply telling LMIC regulators, politicians and banks to ‘go slow’ on Basel II and III implementation leaves them without a way to credibly signal to international investors and other regulators that their banks are appropriately and effectively regulated. National regulators in LMICs often lack the resources to adapt global standards to national circumstances. Moreover, they face the risk having to explain to incumbent politicians why the adapted rules and regulations fall short of “global best practice”.

The core problem for LMICs is that their interests are not effectively represented when international standards are designed, and the international community provides little advice on how to adapt Basel standards for use in LMICs:

- Development prerogatives remain at the margins of regulatory debates at the Basel Committee. In the wake of the global financial crisis, there were calls for international standards to be simplified and to build proportionality into their design. But little has changed. The Basel Committee set up a Task Force on Simplicity and Comparability in 2012, and has implemented some of its recommendations, such as an output floor for risk weight calculations using internal models. But the Task Force paid no attention to implementation challenges faced by developing countries (BCBS 2013). There have been calls for the Basel Committee to build greater proportionality into the design of its standards. The Basel II Accord of 2004 included a so-called Simplified Standardized Approach to credit risk, a regulatory standard that was specifically designed with developing countries in mind. Unfortunately, the Basel Committee has not engaged in a revision of the standard in line with Basel III even though developing country comments in consultations consistently emphasized the costs of complexity (World Bank 2015). A recent proposal to simplify the Basel approach to market risk has also been criticized by developing country representatives as still excessively complex (BCBS 2017).

- LMICs are chronically under-represented in standard-setting. In 2009 the membership of the Basel Committee was expanded to incorporate representatives from ten emerging market economies of the G20. This opened up the prospect that international standards would be recalibrated to work in a wider range of contexts. Yet the incumbent network of well-resourced regulators from industrialized countries continues to dominate the regulatory debate (Chey 2016; Walter 2016). The Basel Consultative Group is tasked with facilitating dialogue between members and non-members, but few LMICs are chronically underrepresented, and the Group has little influence over the design of international standards. Hence, international standards are not designed with LMICs in mind. In the wake of the global financial crisis, the G20 asked standard- setting institutions to assess the implications of international financial standards for developing countries, and further open up decision-making processes. The Financial Stability Board created an internal workstream on the effects of regulatory reform on emerging market and developing economies (FSB et al., 2011) . It also established six Regional Consultative Groups but conversations with regulators give the impression that these Groups have little input into the design of international standards, functioning instead as fora for regulators to trouble-shoot implementation.

- Regulators in LMICs have little guidance for proportional Basel standards adoption and adaptation. Even though key stakeholders in the global regulatory community have endorsed the proportionality principle in global financial standards implementation, useful guidance for regulators in LMICs is still lacking. Existing publications have analysed proportional implementation of Basel III among advanced economies, looked at unintended consequences for emerging market G20 members, and offer advice on the Basel Core Principles. But guidance on how to approach proportional Basel II or III implementation from a development perspective has not been compiled systematically, although the BIS Financial Stability Institute has taken important preliminary steps in this direction (Castro Carvalho et al. 2017; Hohl et al. 2018).

- The International Financial Institutions do not provide consistent advice regarding Basel II or III implementation. The Financial Sector Assessment Programmes (FSAP) conducted by the Fund and the Bank assess the financial regulatory system of client countries. Our research shows that while assessors explicitly warn against hasty Basel II or III implementation in some LMICs, they encourage it explicitly or implicitly in others. The Bank and the Fund can do more to encourage a tailoring of global standards that safeguards financial stability, highlight positive cases of proportional or non-adoption of Basel II and III, and facilitate peer learning among developing countries.

To address these challenges, there are a series of steps that the G20 can take to ensure that the Basel Committee on Banking Supervision, Financial Stability Board, IMF and World Bank provide support to LMICs:

- Mandate the Basel Committee on Banking Standards to build in proportionality into the design of Basel standards. Instead of placing the burden of retrofitting complex international standards on regulatory agencies in LMICs, proportionality should be hardwired into international standards. International standards should be designed so that they can be readily adapted for use in a wide range of financial sectors, at all stages of development. Research by the BIS Financial Stability Institute (Hohl et al. 2018) should be expanded to obtain a clear understanding of proportionality in standards implementation This would enable LMICs to keep up with ‘international best practices’ in a manner that is genuinely aligned with their prudential regulatory needs. The mandate of the Basel Committee could be broadened beyond an exclusive focus on financial stability to recognise the importance of other objectives such as financial sector development and financial inclusion. Even bringing these in as secondary considerations would incentivize more careful analysis in international-standard setting (Jones and Knaack 2019). Rather than waiting to see whether standards generate adverse impacts on developing countries, the Basel Committee could undertake ex ante assessments.

- Open the standard-setting processes to more meaningful input from LMIC representatives. At a minimum the Basel Consultative Group should include representatives from LMICs; the Basel Consultative Group and the FSB’s Regional Consultative Groups could move away from the current top-down modus operandi of focusing on the implementation of global standards towards facilitating bottom-up proposals to influence their design.

- Improve the accountability of standard-setting bodies. A small multilateral organisation could be created to audit the Basel Committee, akin to auditor-generals in national jurisdictions or the Independent Evaluation Office of the IMF (Helleiner and Porter 2010). This would help ensure that the Basel Committee decisions robustly reflect the views of all members and consider implications for nonmembers.

- Prevent an ill-fated race to the top among LMICs towards maximum Basel II and III implementation by clarifying under which conditions proportional or non-implementation of specific Basel II and III components is recommended;

- Recognize the signalling function of Basel standards as a seal of regulatory quality and devise complementary methods to assess and communicate the quality of prudential financial regulation in LMICs;

- Engage in further research on the repercussions of Basel II/III implementation for credit allocation in the real economy and for financial inclusion. The Financial Stability Institute, IMF and World Bank could invest greater resources in analysing international financial standards from the perspective of LMICs, increasing their dialogue with regulators and making recommendations to the Basel Committee. Rather than focusing on ways to minimise the harm and challenges that international standards pose for developing countries, this research agenda should start from the question of what regulations are most needed in peripheral developing countries.

REFERENCES

• Barth, James R., and Gerard Caprio. 2018. “Regulation and Supervision in Financial Development.” In Handbook of Finance and Development, edited by Thorsten Beck and Ross Levine, 393–418. Edward Elgar Publishing. https://doi.org/10.4337/9781785360510.

• BCBS. 2013. “The Regulatory Framework: Balancing Risk Sensitivity, Simplicity and Comparability – Discussion Paper.” https://www.bis.org/publ/bcbs258.htm.

• ———. 2017. “Simplified Alternative to the Standardised Approach to Market Risk Capital Requirements.” • https://www.bis.org/bcbs/publ/d408.htm.

• Beck, Thorsten. 2018a. “Basel III & Emerging Markets: Effects on Capital Market Development and the Real Economy.” Center For Global Development (blog). May 2018. https://www.cgdev.org/blog/basel-iii-unintended-consequencesemerging-markets-and- developing-economies-part-5-effects.

• ———. 2018b. “Basel III and Emerging Markets and Developing Economies: Challenges on Infrastructure and SME Lending.” Center For Global Development (blog). May 2018. https://www.cgdev.org/blog/basel-iii-unintended-consequencesemerging-markets- developing-economies-part-iv-challenges.

• Beck, Thorsten, Samuel Maimbo, Issa Faye, and Thouraya Triki. 2011. Financing Africa: Through the Crisis and Beyond. Washington DC: World Bank. https://openknowledge.worldbank.org/handle/10986/2355.

• Castro Carvalho, Ana Paula, Stefan Hohl, Roland Raskopf, and Sabrina Ruhnau. 2017. “Proportionality in Banking Regulation: A CrossCountry Comparison.” FSI Insights 1. Financial Stability Institute. https://www.bis.org/fsi/publ/insights1.htm.

• Chey, Hyoung-kyu. 2016. “International Financial Standards and Emerging Economies since the Global Financial Crisis.” In Global Financial Governance Confronts the Rising Powers, edited by C. Randall Henning and Andrew Walter, 211–36. Waterloo: CIGI.

• FSB, IMF, and WB. 2011. “Financial Stability Issues in Emerging Market and Developing Economies: Report to the G20 Finance Ministers and Central Bank Governors.” Financial Stability Board, International Monetary Fund, World Bank,. https://siteresources.worldbank.org/EXTFINANCIALSECTOR/Resour ces/G20_Report_Finan cial_Stability_Issues_EMDEs.pdf.

• FSB, World Bank, and IMF. 2011. “Financial Stability Issues in Emerging Market and Developing Economies: Report to the G-20 Finance Ministers and Central Bank Governors,” October. https://openknowledge.worldbank.org/handle/10986/27274.

• FSI. 2015. “FSI Survey – Basel II, 2.5 and III Implementation.” BIS. https://www.bis.org/fsi/fsiop2015.pdf.

• Fuchs, Michael, Thomas Losse-Mueller, and Makaio Witte. 2013. “The Reform Agenda for Financial Regulation and Supervision in Africa.” In Financial Sector Development in Africa: Opportunities and Challenges, edited by Thorsten Beck and Samuel Munzele Maimbo. Washington DC: The World Bank.

• Gobat, Jeanne, Mamoru Yanase, and Joseph Maloney. 2014. “The Net Stable Funding Ratio: Impact and Issues for Consideration.” IMF Working Papers 14 (106): 1. https://doi.org/10.5089/9781498346498.001.

• Griffith-Jones, Stephany, and Ricardo Gottschalk, eds. 2016. Achieving Financial Stability and Growth in Africa. London: Routledge Taylor & Francis Group.

Helleiner, Eric, and Tony Porter. 2010. “Making Transnational Networks More Accountable.”

• Economics, Management, and Financial Markets 5: 158–73.

• Hohl, Stefan, Maria Cynthia Sison, Tomas Stastny, and Raihan Zamil. 2018. “The Basel Framework in 100 Jurisdictions: Implementation Status and Proportionality Practices,” November. https://www.bis.org/fsi/publ/insights11.htm.

• Jones, Emily, ed. 2019. The Politics of Banking Regulation in Developing Countries: Risk and Reputation. Oxford University Press.

• Jones, Emily, and Peter Knaack. 2019. “Global Financial Regulation: Shortcomings and Reform Options.” Global Policy, February. https://doi.org/10.1111/1758-5899.12656.

• Jones, Emily, and Alexandra O. Zeitz. 2017. “The Limits of Globalizing Basel Banking Standards.”

• Journal of Financial Regulation 3 (1): 89–124.

• Kasekende, L. A., Justine Bagyenda, and Martin Brownbridge. 2012. “Basel III and the Global Reform of Financial Regulation: How Should Africa Respond? A Bank Regulator’s Perspective.” Bank of Uganda Mimeo. https://www.academia.edu/download/45274158/Basel_III_and_the_ global_reform_of_finan20 160502-119586-11ggbhb.pdf.

• Kasekende, Louis A. 2015. “The Relevance of Global Reform of Bank Regulation: A Perspective from Africa.” Journal of African Development, no. 17: 1–20.

• Murinde, Victor, ed. 2012. Bank Regulatory Reforms in Africa. Palgrave Macmillan.

• Murinde, Victor, and Kupukile Mlambo. 2010. “DevelopmentOriented Financial Regulation.” University of Birmingham, African Economic Research Consortium, African Development Bank.

• Powell, Andrew. 2004. “Basel II and Developing Countries: Sailing through the Sea of Standards.” Policy Research Working Paper. World Bank.

• Rojas-Suarez, Liliana. 2018. “Basel III & Unintended Consequences for Emerging Markets and Developing Economies – Part 1: CrossBorder Spillover Effects.” Center For Global Development (blog). May 14, 2018. https://www.cgdev.org/blog/basel-iii-unintendedconsequences-emerging-markets-and-developing-economies-part-1- cross-border.

• Rojas-Suarez, Liliana, and Danial Muhammad. 2018. “Basel III & Unintended Consequences for Emerging Markets and Developing Economies – Part 2: Effects on Trade Finance.” Center For Global Development (blog). May 2018. https://www.cgdev.org/blog/baseliii-unintended- consequences-emerging-markets-and-developingeconomies-part-2-effects.

• Stephanou, Constantinos, and Juan Carlos Mendoza. 2005. “Credit Risk Measurement Under Basel II: An Overview and Implementation Issues for Developing Countries.” World Bank Policy Research Working Paper. Washington, DC: World Bank.

• Walter, Andrew. 2016. “Emerging Countries and Basel III: Why Is Engagement Still Low?” In Global Financial Governance Confronts the Rising Powers, edited by C. Randall Henning and Andrew Walter, 179–210. Waterloo: CIGI.

• World Bank. 2015. “World Bank Survey on the Proposed Revisions to the Basel II Standardised Approach for Credit Risk: Analysis of Survey Responses.” https://www.bis.org/bcbs/publ/comments/d307/wbsaor.pdf.