E-commerce has been growing rapidly in recent years, supported by the development of new digital technologies, improvements in logistics and distribution services and changes in consumer preferences. During 2020, e-commerce further accelerated because of national lockdowns. Digital trade helped to underpin economic activity during the pandemic, permitting companies and households to buy goods and services online. Looking forward, the prospects for e-commerce to support economic recovery and global trade growth depend on addressing several challenges, including putting in place a multilateral framework to facilitate digital trade and e-commerce and supporting access and delivery in e-commerce markets for all firms, independent of size or location.

Ongoing World Trade Organization (WTO) negotiations on e-commerce and WTO agreements on trade in services and trade facilitation provide a basis for defining a set of common, agreed principles. G20 member states can give new impetus to e-commerce by agreeing to facilitate cross-border data flows, removing policies that discriminate against small firms and small consignments, and launching initiatives to support the inclusion of innovative small and medium enterprises (SMEs) in global digital trade markets.

Challenge

The digitalization of business activities and more broadly digital transformation of the economy is reflected in an increasing share of goods and services being sold online: in 2019, about 1.5 billion people shopped online. Preliminary evidence suggests that cross-border e-commerce became even more important during the pandemic, triggered by national lockdowns (+26% on 2019 according to preliminary estimates of the Digital Observatory of Politecnico di Milano), with online shopping as a share of global retail rising from 13% in 2019 to 17% in 2020.

The pandemic has also underlined the divides that still characterize the world in terms of country readiness to engage in and benefit from e-commerce. Like previous technological revolutions, the digital transformation can bring very significant benefits, but they will not materialize automatically. The outcome depends on policies, regulations and measures undertaken at both national and international levels to build the capabilities needed for countries to deal with technological changes and disruptions.

If the appropriate conditions are in place, the diffusion of digital technologies can help to reduce trade costs by speeding up customs clearance procedures, increasing the efficiency of logistics and lowering costs of communication and contract enforcement. Research has shown that trade costs for online trade are lower than for offline trade (Lendle et al., 2016). Digital technologies that exploit ICT networks and connectivity can improve access of small and medium enterprises (SMEs) to foreign markets and international supply chains by reducing information asymmetries between buyers and sellers and substantially lowering shipping and regulatory compliance costs (Bai, Chen and Yi Xu, 2020; Lanz et al., 2018).

E-commerce opportunities depend on access to, and the quality of, prevailing ICT networks and digital infrastructure, hard and soft. Regulatory regimes or the absence of effective regulation may reduce market access opportunities, impede product innovation or give rise to transactions costs that disproportionately affect SMEs. These may be associated with public policies such as taxes or product regulations or reflect the operation of key intermediaries such as logistics providers and dominant market platforms. Many of the relevant policy areas are addressed by World Trade Organization (WTO) agreements and/or are the subject of ongoing negotiations among WTO members, notably the joint statement initiatives on e-commerce and on MSMEs (WTO, 2018).

INTERNATIONAL REGULATION OF CROSS-BORDER E-COMMERCE

The rapid development of digital markets was not accompanied by a similar evolution of regulation to support e-commerce, especially at the international level. Digital trade is still characterized in several areas by a regulatory vacuum. Regulations in this area cover very different issues, from consumer protection, to contract enforcement and payment provision, to privacy issues related to the data collected in the process. In many of these areas national legislation, habits and sensitivities are very different.

The multilateral agreements governing trade in goods (GATT), services (GATS), and intellectual property (TRIPS) provide some shared principles governing policies affecting the products both goods and services exchanged across borders using e-commerce platforms, ICT networks and the services of logistics providers and distributors. However, important questions including differentiation between digital services and goods and defining what constitutes crossing physical borders for online transactions remain to be resolved, reflecting the fact that the GATS was negotiated before the rise of e-commerce and the advent of digitalization. The lack of a multilateral framework for e-commerce and related cross-border data flows, processing and storage increases trade costs for firms, especially SMEs, in accessing foreign markets.

Ongoing plurilateral negotiations on e-commerce policies offer the prospect of filling this gap (Ismail, 2020) by multilateralizing elements of e-commerce-related provisions that have been agreed in Regional Trade Agreements (there are currently 84 such agreements that include e-commerce provisions). Over 80 WTO members are currently negotiating trade rules on electronic commerce (e-commerce) under the so-called Joint Statement Initiative (JSI) launched in 2019. These WTO members seek to make progress in advance of the 12th WTO ministerial conference to be held 30 November to 3 December 2021. During the latest round of negotiations held in February 2021 some progress was achieved (e.g., on regulating spam emailing), raising expectations that a positive conclusion could be reached before the Ministerial Conference. These negotiations are particularly complicated as the ultimate goal is to strike a balance between (often) opposing interests: not only between public and private actors, but also between different economies, which often have different social preferences and priorities in this field, and between developed and developing countries. The latter often are in a disadvantaged position because of a digital divide, both in terms of available infrastructure and skills.

INTERNATIONAL REGULATION OF ACCESS AND DELIVERY IN E-COMMERCE MARKETS

In the case of purchases of physical goods, in order for an electronic transaction to be completed, there is a need to deliver products in due time and in good condition, the necessity to allow restitutions, to provide efficient means of payment, and so on. These “last-mile” services impact significantly on the quality of the purchase and on the final price of the transaction. In most countries, services related to the logistics process connected to e-commerce transactions are highly regulated, and in some cases foreign firms do not have much control over the non-digital part of cross-border e-commerce. This situation creates obstacles to the development of international e-commerce, with a disproportional impact on smaller firms that depend on intermediaries providing logistics.

INTERNATIONAL REGULATION OF COMPETITION IN E-COMMERCE MARKETS

Digital technologies tend to display very strong economies of scale and network economies, that favour market concentration. In addition to the concentration of digital platforms and marketplaces, delivery issues also tend to favour market concentration and reduce competition. The result might be the loss of efficiency gains on the consumers’ side, the reduction of margins on the producers’ side and the loss of some of the advantages and efficiencies that can be gained through e-commerce.

The emergence of dominant e-commerce platforms (marketplaces) leads to concerns over potential abuse of market power. In 2020, digital trade flows heavily depended on six marketplaces that represent 58% of world e-commerce sales (Taobao.com 15%, owned by Alibaba Group; Tmall.com 14%; Amazon 13%; JD.com 9%; Pinduoduo 4%). The European market is dominated by Amazon and eBay, with the former hosting 70% of European enterprises. The pandemic led to a further increase of market power by these platforms: for instance in the US it has been estimated that the market share of the ten biggest digital platforms at national level increased in 2020 from 54% to 60%. The increasingly broad diffusion of such platforms provides a key avenue for the smallest companies to internationalize, but at the same time the market power of dominant platform providers could impinge on access of SMEs.

Tax considerations need also to be dealt with, as existing tax frameworks are another element reinforcing market power of digital MNCs (Bloch and Demange, 2020). The debate about introducing an international digital services tax (i.e. a universal tax rate on the revenues generated by the major digital multinationals) has been revised after the US Treasury Secretary, Janet Yellen, at the virtual meeting of G20 Finance Ministers in February 2021, supported the proposal to introduce a global minimum tax on corporate profits, and removed a crucial veto dropping their traditional insistence for a safe harbour for digital companies. Indeed, in the meeting held in early June 2021, finance leaders from the G7 countries agreed to back a new global minimum tax rate of at least 15% that companies would have to pay regardless of where they locate their headquarters. The agreement would also impose an additional tax on some of the largest digital multinational companies, potentially forcing global businesses to pay taxes to countries based on where their goods or services are sold, regardless of whether they have a physical presence in that nation. This initial agreement was further discussed at the G20 meeting in Venice in early July 2021, and it will be brought to the G20 meeting in October in Rome to befinalized, and possibly extended. In fact, also in early July, 130 countries signed a joint statement expressing support to the initiative and inviting to continue the negotiations within the OECD framework. This could be the first step leading to more common ground and a progressive harmonization of taxes in an industry that remains scarcely regulated.

The business model underlying digital platforms is characterized by high up-front sunk costs and low marginal costs, which provide conditions that benefit incumbent players in the market through economies of scale, thus leading to high market concentration. Moreover, such companies also have a firm control on personal and financial data of their users and customers, potentially adding to an already unbalanced market structure. Overall, these features establish entry barriers and tend to reduce competition, disadvantaging smaller businesses, and need to be addressed in order to create a better regulated environment, which would be able to promote competition, foster technology innovation and safeguard consumers’ rights.

The forgoing suggests supporting further growth in international e-commerce calls for:

1. Creating a stronger common regulatory framework for cross-border e-commerce that seeks to lower the trade costs associated with differences in national regulations pertaining to data privacy and consumer protection.

2. Assuring data access, as this is critical for success in digital markets. This is a complex issue to deal with, involving difficult trade-offs between privacy and transparency, efficiency and market exploitation. Research suggests focusing on policies that discriminate against foreign providers or that give rise to high fixed costs have the largest negative effect on trade and should be prioritized as a trade issue.

3. Addressing the risk of high market concentration and reduced competition at different stages of the value chain. While e-commerce and digital markets represent an important opportunity to reach foreign markets especially for SMEs, if rules for access are set by big corporations dominating e-commerce through large platforms, for many small enterprises there could be additional hurdles to increase their presence in global, digital markets.

Proposal

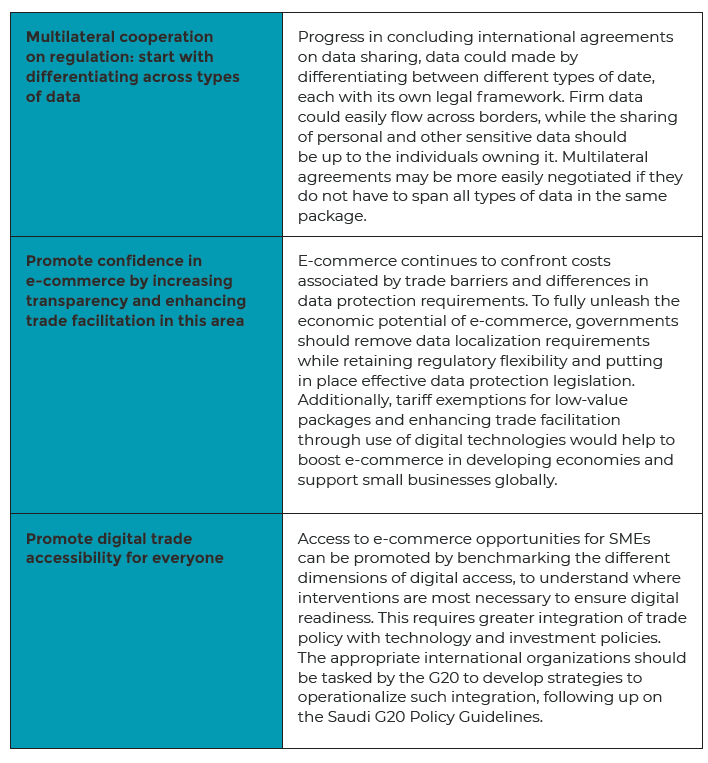

MULTILATERAL COOPERATION ON REGULATION: START WITH DIFFERENTIATING ACROSS TYPES OF DATA

Electronic transactions and the data generated in e-commerce transactions involve at least three groups of players: the individual purchasing firm or consumer, who provides the raw data, and uses the processed data; the selling firm, which processes the raw inputs from the consumer, and usually controls such data; and the state, which monitors and regulates the data used by the first two groups. Therefore, any regulatory framework must take into account these different interests, which often result in conflicting priorities, with the individual advocating privacy protection, the firm promoting unhindered data flow, the state focusing on the security implications. Effective regulation needs to strike a balance between the clashing interests of different stakeholders. Currently, existing national regulatory regimes differ in determining this balance. In the European Union (EU), the General Data Protection Regulation (GDPR) prioritizes the need to safeguard the privacy of users, and recognizes “protection of natural persons in relation to the processing of personal data” as “a fundamental right” (European Commission, https://ec.europa.eu/info/law/law-topic/data-protection_en). The United States tends to put the commercial interests of firms first, as reflected in the 1996 Telecommunication Act, which notes that it aims to “promote competition and reduce regulation in order to secure lower prices and higher quality services …” (https://www.congress.gov/104/plaws/publ104/PLAW-104publ104.pdf). National security concerns are often cited to justify restrictions on cross-border data flows, as in the case of China’s 2017 Cybersecurity Law, which imposed several restrictions aiming to safeguard cyber security, protect cyberspace sovereignty and national security. Such different priorities are difficult to reconcile in a common multilateral framework.

The challenge to data policy for digital trade relates mainly to personal data. Firms can manage corporate data for commercial ends if the data are allowed to flow between jurisdictions, but individuals often do not have the same oversight and control. As a result, governments have sought to protect personal data, but this has also erected barriers to participation in digital trade.

A possible solution lies in differentiating data by type and adopting differential regulation: firm data (f-data), official personal data (o-data), privy personal data (p-data), and collective personal data (c-data) (see Snower, Twomey and Farrell [2020] for the typology for personal data):

- f-data is owned and controlled by firms, who can choose to share it or not (e.g. patterns in sales in different markets)

- o-data is created and authenticated by the state but controlled by people (e.g. a passport number)

- c-data is shared within a well-defined group governed by certain rules (e.g. aggregated data from banking cooperatives)

- p-data is created by people, either directly through first-order p-data (e.g. photos put online) or indirectly through second-order p-data (e.g. location data from smartphones)

f-data should be allowed to flow freely both within and across economies, if firms are willing to allow this, following corporate agreements between parties. o-data, c-data and p-data should be in the hands of people, who can decide whether to share it (and on what terms), or not. o-data would likely not be shared; c-data would be shared to achieve certain objectives; and p-data might be shared depending on compensation (financial or non-financial). Differentiating data by type in this way can provide a big step forward to creating interoperable frameworks on data flow governance, as governments can more easily agree on protocols related to certain types of data. The G20 could encourage the adoption of this taxonomy, which could be further expanded and defined.

PROMOTE CONFIDENCE IN E-COMMERCE BY INCREASING TRANSPARENCY AND ENHANCING TRADE FACILITATION IN THIS AREA

Regulation of e-commerce to attain domestic non-economic objectives should be distinguished from measures that are intended to restrict cross-border e-commerce. Examples include data localization requirements, local commercial presence or residency requirements for firms or the use of local infrastructure or technology requirements for data storage. While such requirements could potentially affect all service sectors, e-commerce is especially vulnerable as it is often detached from traditional brick-and mortar establishments.

It is important to underline that the current framework seems too tightly connected to GATS and the trade in services system. Negotiations to regulate and at the same time open digital markets should follow a different framework. Localization in services, when not used as disguised protectionism, is required as a form of quality control and customer’s safety; however in the case of digital trade, the customer should be protected in different ways.

The policy of data localization requires that firms offering data-driven services, a process that also collects user data in electronic transactions, store their acquired data on servers that are physically located within the regulating country. Governments justify this policy as a necessary means of protecting the data of residents from foreign use and manipulation, with implications for network reliability and national security. Opponents see it as a form of trade protectionism, forcing the development of computing capacity within the regulating countries and raising barriers to efficient international provision of data services. Evidence and theory favour the protectionist interpretation, suggesting that data localization amounts to a costly barrier to trade (Bauer et al., 2014; Chen, Hua and Maskus, 2021). Because data can be readily transmitted, efficiency supports permitting firms to store them where there are greatest cost advantages, including from economies of scale in concentrated locations. The fact that data may be stored abroad does not prevent regulatory authorities from requiring that data collected within their borders be used and transmitted subject to privacy rules and norms. Transparency on one side and vigilance on the other can both be applied to improve trust and enable domestic regulators to approve the foreign processes, without introducing protectionist measures. A better approach would be to preclude localization requirements in return for national regulatory flexibility in data use. Governments should pursue a policy of mutual recognition to encourage this flexibility, subject to some minimum floors in data protection. This form of policy coordination, although not easy to realize due to concerns about information asymmetry, should still be easier to achieve than uniformity, and, combined with the absence of protectionist data localization requirements, offers the best avenue for building a globalized and efficient data-driven economy.

Consumer protection needs to be included in laws that govern e-commerce. Only about half (56%) of countries have adopted consumer protection legislation as part of e-commerce legislation (UNCTAD, 2020a), which represents the lowest uptake of the four core e-commerce legislations (e-transactions, data protection and privacy, cybercrime, and consumer protection). Perceptions (or reality) of risk to consumers of engaging in digital trade is often what is holding back growth of SMEs in e-commerce, with issues of trust paramount on people’s minds (UNCTAD, 2020b). Policy-makers should therefore ensure that consumer protection legislation is both enacted and enforced to boost confidence in e-commerce.

The potentially high level of fragmentation and customization of e-commerce can open unique opportunities to expand markets for all countries, including developing countries and least-developed countries, as well as by small businesses. A truly open digital market can reduce market concentration. In order to achieve this, many bureaucratic obstacles must be overcome. Within the current negotiations, progress was made in small groups on issues such as e-signatures and authentication, paperless trading, and customs duties on electronic transmissions, all areas in which cutting red tape can help.

In order to help smaller firms to improve their ability to exploit digital trade opportunities, an important set of proposals relate to the theme of trade facilitation, specifically aimed at facilitating the delivery of small shipments direct to consumers. This can be done first of all by introducing a common de minimis value for single package imports, a threshold for low value goods below which customs duties or taxes will not be collected, and simplified customs clearance procedures for these types of deliveries. Also fundamental for this type of trade is enhanced trade facilitation through the use of technology for the release and clearance of goods, and provision of supportive services such as digital payments that integrate new technologies such as blockchain and AI) (Sotelo and Fan, 2020). An amendment or addendum to the WTO’s Trade Facilitation Agreement (TFA) could be considered that maps different technologies to trade facilitation provisions, encouraging both uptake of these technologies and capacity building/technical assistance for developing economies to do so. In particular, more disclosure and better information on the performance of logistics services would help to identify priority areas for action.

PROMOTE DIGITAL TRADE ACCESSIBILITY FOR EVERYONE

Another important way to increase competition in digital markets is to ensure that digital technologies and e-commerce is accessible to everyone, everywhere (all consumers and all types of firms). In this respect, capacity building to expand digital access is fundamental, especially for developing economies. Capacity building includes targeted assistance to ensure that MSMEs can get online and expand their business through e-commerce, for example through the development of specific digital skills. The question is where should each economy direct its efforts, given that each may be at a different starting point in terms of digital capacity of SMEs?

Policy-makers can sequence and prioritize SME digital capacity building by benchmarking how their economy is doing relative using, for instance, the OECD’s Going Digital Toolkit. This includes seven dimensions (Access, Market openness, Use, Innovation, Jobs, Society, Trust, and Growth & Well-being) and within each dimension a number of indicators. Some of these are clearly fundamental to track and support SME digital trade capacity. For instance, according to the OECD Digital Toolkit, the share of small business making e-commerce sales in the last 12 months, the share of internet users who purchased online in the last 12 months, the share of businesses using broadband, and the percentage of consumers that report they do not purchase online due to either security concerns or concerns related to returning products. The priority challenges and bottlenecks holding back SMEs from plugging into digital trade opportunities can thus be discerned economy-by-economy, and proactively addressed. Policy-makers may therefore wish to undertake a review of their SME digital readiness using this tool and identify specific actions to climb up the rankings where they are currently low.

In addition, improvements in digital infrastructure could be leveraged by a reduction (or elimination) of customs duties for digital products and electronic transmissions to ensure that customs duties do not impede the supply of digital products (whether classified as goods or services). A way forward could involve integrating trade policy, investment policy, and technology policy (Zhan, 2021). This can be operationalized at the country level by launching ‘Facilitation 2.0’ projects, which aim to understand the interrelations between trade, investment, technology, and e-commerce, and how policies and measures need to embrace and address those interlinkages (WEF, 2020).

The G20 should task international organizations (including the OECD, WBG, UNCTAD) to work on a set of policy options and recommendations to integrate trade, investment, and technology policy with a view to supporting the growth of SMEs through new digital trade opportunities. These recommendations could build on the G20 Policy Guidelines on Boosting MSMEs international competitiveness approved last year by G20 during the Saudi Presidency. Such a menu of actions could then be used to inform Facilitation 2.0 projects, which should be launched at the national level by each G20 economy. This would be in the interest of all G20 economies, as they seek to boost employment and growth of the smallest firms, but which comprise the largest number of enterprises. In the digital era, it is important to leave no SME behind.

Summary of policy recommendations

REFERENCES

Bai J, Chen M, Yi Xu D (2020). Search and information frictions on global e-commerce platforms: evidence from AliExpress. VoxEU-CEPR. https://voxeu.org/article/search-and-information-frictions-global-e-commerce-platforms, accessed 25 July 2021

Bauer M, Lee-Makiyama H, van der Marel E, Verschelde B (2014). The costs of data localisation: Friendly fire on economic recovery. ECIPE Occasional Paper no 3/2014

Bloch F, Demange G (2020). Profit-split ting rules and the taxation of multinational digital platforms: comparing strategies. VoxEU-CEPR. https://voxeu.org/article/profit-splitting-rules-and-taxation-multinational-digital-platforms accessed 25 July 2021

Chen Y, Hua X, Maskus KE (2021). International protection of consumer data. University of Colorado working paper

Ismail Y (2020). E-commerce in the World Trade Organization – history and latest developments in the negotiations under the joint statement. International Institute for Sustainable Development.

Lanz R, Lundquist K, Mansio G, Maurer A, Teh R (2018). E-commerce and developing country-SME participation in global value chains. Staff Working Paper ERSD-2018-13

Lendle A, Olarreaga M, Schropp S, Vézina P-L (2016). There goes gravity: eBay and the death of distance. The Economic Journal, 126(591):406-441

OECD (Organisation for Economic Co-operation and Development) (n.d.). Going digital toolkit. https://goingdigital.oecd.org/, accessed 25 July 2021

Snower D, Twomey P, Farrell M (2020). Revisiting digital governance. Social Macroeconomics Working Paper Series (SM-WP-2020-003), Oxford University, September. https://www.bsg.ox.ac.uk/sites/default/files/2020-10/SM-WP-2020-003%20Revisiting%20digital%20governance_0.pdf accessed 25 July 2021

Sotelo J, Fan Z (2020). Mapping TradeTech: Trade in the fourth industrial revolution. World Economic Forum. December. https://www3.weforum.org/docs/WEF_Mapping_TradeTech_2020.pdf accessed 25 July 2021

UNCTAD (United Nations Conference on Trade and Development) (2020a). Online consumer protection legislation worldwide. https://unctad.org/page/online-consumer-protection-legislation-worldwide accessed 25 July 2021

UNCTAD (United Nations Conference on Trade and Development) (2020b). Summary of adoption of e-commerce legislation worldwide. https://unctad.org/topic/ecommerce-and-digital-economy/ecommerce-law-reform/summary-adoption-e-commerce-legislation-worldwide accessed 25 July 2021

WEF (World Economic Forum) (2020). Facilitation 2.0: Trade and Investment in the Digital Age, Insight Report, 4 November. https://www.weforum.org/reports/facilitation-2-0-trade-and-investment-in-thedigital-age accessed 25 July 2021

WTO (World Trade Organization) (2018). World Trade Report 2018: The Future of World Trade: How Digital Technologies Are Transforming Global Commerce. Geneva: WTO

Zhan JX (2021). GVC transformation and a new investment landscape in the 2020s: Driving forces, directions, and a forward-looking research and policy agenda. Journal of International Business Policy, 4: 206-220. https://link.springer.com/article/10.1057/s42214-020-00088-0 accessed 25 July 2021