While financial technology (fintech) has enabled rapid economic growth and promoted financial inclusion around the world, it poses various risks in areas including the entire financial system, individual companies, consumers and supervisory authorities. The lack of a standardised framework to monitor fintech-related activities and products could cause cross-border regulatory arbitrage opportunities and may trigger serious economic losses from the failure of the financial system. Therefore, endeavours to mitigate these risks through international cooperation and in-depth discussion are necessary. As initial steps, we propose the standardisation of fintech data-collecting processes, drafting regulations for transactions of crypto-assets, mobile money services and peer-to-peer (P2P) lending, and finally promoting the establishment of an international supervisory framework.

Challenge

Financial technology (fintech) is rapidly evolving. Fintech collectively refers to innovative business models, industries and financial services that are newly emerging through the convergence of finance and information and communications technology (ICT). Technological applications had steadily been part of the development of finance in the past. However, their impacts were relatively fragmentary and indirect, whereas fintech today is bringing about a fundamental paradigm shift by replacing traditional financial transactions and creating new types of demand.

Cost reduction and prompt service provision through fintech have allowed individuals’ increased data sovereignty and alleviated the asymmetry of information between financial providers and consumers. In particular, digital innovations have contributed greatly to financial inclusion for low-income countries and financially underprivileged groups by expanding easy and fast data access. Additionally, the advancement of ICT companies into the financial industry has weakened the monopoly power of existing financial institutions and created a new competitive landscape. Several fintech platforms now handle financial transactions larger than those of major financial institutions. Non-financial institutions have also joined the industry to develop and sell personalised financial products.

Continuous technological progress is expected to stimulate innovation in the financial market and will help economic growth and promote financial inclusion. To this end, many countries increasingly support policies encouraging transformations in the financial sector through digitalisation.

As opportunities from fintech grow in content and scale, so do its pitfalls. The active expansion of fintech magnifies risk for the financial industry due to the following characteristics. First, fintech is highly dependent upon technology and large-scale data. Second, fintech is hugely linked with non-financial sectors. As the outsourcing of technology and data analysis increases, the use of digital platforms increases and, thus, blurs the boundary between the traditional finance and non-financial sectors. Third, there is intensified market concentration on a small number of IT service providers due to economies of scale and scope.

These characteristics may induce various risks for major economic players in the financial sector. Some of the main threats to financial stability are:

First, a systemic risk. Particularly with the expansion of new financial businesses by global platform companies such as Google, the possibility of market erosion and concentration is increasing. Any significant problem in one of these large platforms may trigger a paralysis of the entire financial system as in the case of traditional systemically important financial institutions (SIFIs).

Second, risks for individual companies. The heavy reliance on third-party IT providers increases possible exposure to cybercrime such as issues of data security, privacy, illicit money laundering and terrorist financing. This danger is heighted by the varied level of cyber security in individual companies.

Third, consumer risks. When a fintech company provides the simplest financial services for convenience only, the risk is likely to be passed onto consumers. For example, in the case of P2P lending, since fintech companies simply provide an intermediary function, investors run risks of incurring losses because they do not fully understand the likelihood of default.

Fourth, risks for the supervisory authority. As financial services show a trend of decentralisation, it has become difficult to manage or supervise market risks associated with emerging financial products in a timely manner with pre-existent monitoring systems.

In response to the risks listed above, different jurisdictions have proposed a variety of remedies. The World Bank (2020) classified each country’s fintech-related regulatory measure approaches into four categories: 1) “Wait and see” 2) “Test and learn” 3) “Innovation facilitators” and 4) “Regulatory sandboxes”. Of these, most countries are resorting to the innovation-facilitating policies which reflect a position of supporting innovation while pursuing preventive regulation. This is due to not only the fact that countries are not sufficiently aware of the problems of fintech, but also their preoccupation with international competitiveness without weakening their own innovative capabilities. The implementation of relatively stronger regulations may cause cross-border regulatory arbitrage, in which innovation companies move to other regions with less strict regulations. If this phenomenon continues, serious economic losses from the failure of the financial system similar to the global financial crisis of 2008 cannot be ruled out. Therefore, endeavours to mitigate these risks through international cooperation and discussion are necessary.

Proposal

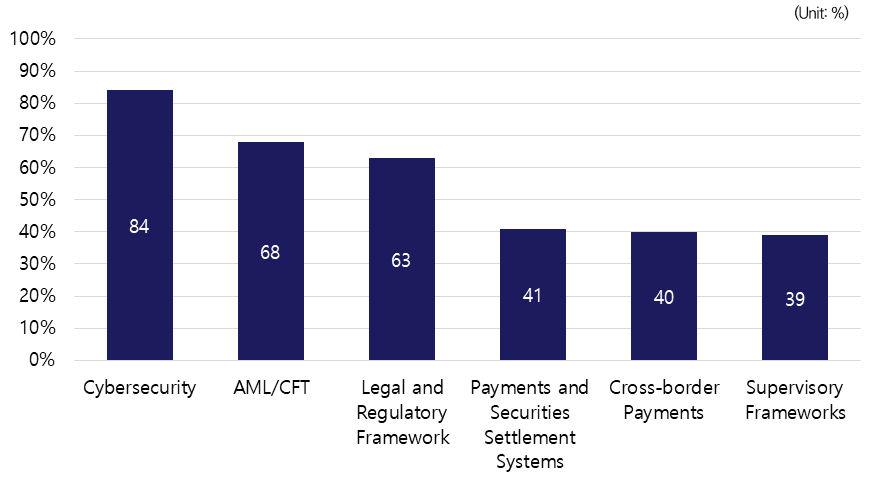

The International Monetary Fund (IMF) and World Bank (2019) conducted a global fintech survey in which member countries identified major areas that require international cooperation in relation to fintech. Also, areas in need of the establishment of international standards were pointed out. The following figures summarise the survey results with the proportion of respondents.

Figure 1. Key areas for international cooperation

* AML: anti-money laundering, CFT: combating the financing of terrorism.

Source: IMF-WB, FinTech: The Experience So Far, 2019; Recomposed by Author

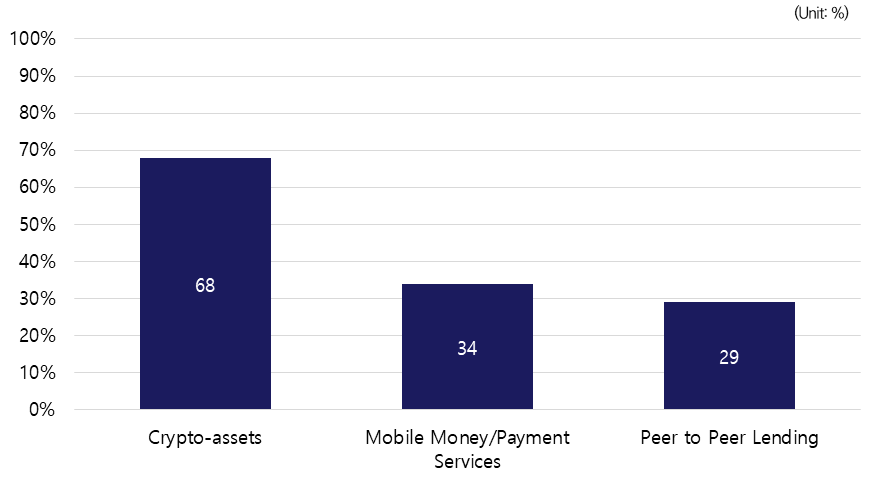

Figure 2. Areas in need of international standards

Source: IMF-WB, FinTech: The Experience So Far, 2019; Recomposed by Author

The top list of priorities that require deeper international cooperation consisted of cybersecurity (84 percent), anti-money laundering and combating the financing of terrorism (68 percent), and legal and regulatory framework (63 percent). The need for collaboration on payments and securities settlement systems (41 percent), cross-border payments (40 percent), and supervisory frameworks (39 percent) also was stressed.

Activities and transactions in need of consensus on international standards and regulatory approaches were crypto-assets (68 percent), especially among high-income countries, mobile money and payment services (34 percent), and P2P lending (29 percent). Moreover, 38 percent of authorities revealed that crypto-assets suffered from the largest data gaps in cross-border activities.

Relevant international organisations, such as the Financial Stability Board (FSB), the Bank for International Settlements (BIS), the Basel Committee on Banking Supervision (BCBS) and the Financial Action Task Force (FATF), promptly responded to this request from the international community for cooperation. In particular, the FATF has released guidance on AML/CFT for those who would like to develop their own regulatory framework. Despite recent attempts at supervision, however, there has not been a comprehensive framework capable of managing and monitoring new economic activities related to fintech. Appropriate regulation is an essential basis for ensuring market transparency and stability; the absence of an institutional framework is rather an unsettling factor for financial development.

The voices of the world demanding international cooperation are becoming louder. In order to overcome the problems associated with fintech, we propose the following suggestions on international cooperation. First, international authorities should establish standards for data collection on fintech and encourage active data sharing by forming standard-setting bodies (SSBs). Varied levels of industrial development in different countries affect the interoperability and consistency of data collection around the world. Through international cooperation, constructing a common ground for data policy frameworks could help risk management and supervision. However, since jurisdictions have different positions on the international transfer of data, it would be desirable to implement the standards first in agreeing countries and later expand the scope of participation.

Second, standardisation of regulations in major fintech fields should be conducted. In particular, most countries are raising concerns for international regulation of crypto-assets, mobile money services and P2P lending due to the immense, rapidly growing volume of cross-border transactions. Consumer harm is often the greatest in these sectors. It is therefore necessary for the international community to introduce regulations that will guarantee at least the minimum level of market stability.

Third, there is a dire need for standardisation of regulatory architecture around fintech. Specific supervisory practices may vary depending on the financial market conditions of each country as well as the level of fintech advancement. However, consistent regulatory principles common to most jurisdictions must exist for further development and success of fintech services. Policy objectives would have to include not only consumer and investor protection but also financial stability. International collaboration on developing a solid set of supervisory guidelines and reporting practices will help achieve a more stable, reliable and sustainable financial system.

Fintech is currently the most dynamically advancing economic sector in the international community, as continuous technological progress and digitalisation are combined to lead innovations in the financial sector. However, as new types of products and consumers/suppliers emerge, the effectiveness of the current regulatory and supervisory mechanisms proves insufficient to manage the market. The G20 has already announced several agreements for the institutionalisation of a fintech-related framework in a communique. However, these agreements do not yet fully meet the needs of the market. By providing clearer guidance and introducing appropriate approaches, the Group of 20 (G20) will need to take the lead in reducing the mismatch between the pace of fintech advancement and the currently available institutional framework.

References

International Monetary Fund & World Bank, FinTech: The Experience So Far, in Policy Paper No. 19/024, 2019

World Bank. Global Experiences from Regulatory Sandboxes, Fintech Note, No. 8, 2020