In the last three years, green hydrogen has been gaining significant momentum. Hydrogen will become a key component of decarbonisation strategies, enabling low-carbon energy storage and transportation. Producing cost-competitive hydrogen is difficult because of insufficient technology and manufacturing readiness levels, lack of scale and lack of political support. Economies of scale for hydrogen production could be achieved by introducing hydrogen in global industries which are major CO2 emitters. One of those is steel-making, accounting for roughly 7% of global CO2 emissions. This policy brief evaluates pathways and suggests enabling policy mechanisms for decarbonizing the steel industry and for the deployment of green hydrogen at scale.

Challenge

THE ROLE OF HYDROGEN IN DECARBONISATION

More and more countries are committing to reach net zero emissions by mid-century to achieve the Paris Agreement goal of keeping global warming well below 2°C. Hydrogen is a cornerstone of increasingly ambitious energy transition plans because it enables seasonal storage and long-distance transportation of zero-carbon energy. It also allows to decarbonize sectors such as industry, trucking, shipping, and aviation which face serious difficulties in greenhouse gas (GHG) mitigation. 24.2% of global CO2 emissions are currently related to energy use in industry and another 5.2% stem from industrial processes, making industry the world’s largest GHG emitting sector (Ritchie and Roser n.d.). Iron and steel alone are responsible for 7.2% of global CO2 emissions (Ritchie and Roser n.d.). Nonetheless, the iron and steel sector is often side-lined in the public discourse on energy transition.

Electrification is estimated to realistically and cost-efficiently be able to cover only about 50% of future energy use (Wouters and van Wijk 2019). But wind and solar production costs keep falling and thus green hydrogen produced through electrolysis would enable to fully harness the wind and solar production potential (while overcoming the challenge posed by intermittency of electricity production).

Hydrogen has had false dawns in the past, but this time looks different as it is now supported by a broad range of energy market players (Faenza 2020). It also enjoys unprecedented political support around the world. This has gained further momentum after the outbreak of Covid-19 as (green) hydrogen is being identified as an instrument of green growth in many countries.

Political coordination, also at international level, is key for kickstarting this promising yet infant market, where scale remains small and costs high. Open value chains, technology sharing, synergies and cross-border investments can help reducing costs. This has happened in wind and solar. Conversely, value chain fragmentation and protectionism risk inflating costs. For this reason, the G20 (responsible for 80% of global CO2 emissions) (UNEP 2019) is a forum of paramount importance to boost international cooperation on hydrogen, as it has itself already recognised (IEA 2019).

Recent stimulus packages (amounting to US$ 12 trillion in G20 countries) (Climate Transparency 2020) offer an unprecedented opportunity to allocate public investments needed to create a hydrogen backbone and reduce costs by increasing project scale. It is important not to lose momentum. After Australia, France and Japan which adopted their hydrogen strategies in 2019, Chile, Finland, Germany, the Netherlands, Norway, Poland Portugal, South Korea and Spain followed. Russia adopted a hydrogen roadmap and California, Canada and New Zealand adopted hydrogen vision documents. Austria, Colombia, Denmark, Italy, Morocco, Oman, Paraguay, the UK and Uruguay are expected to launch their hydrogen strategies in the upcoming months (IRENA 2020).

BARRIERS TO GREEN HYDROGEN. THE STEEL-MAKING SECTOR AS A “LIGHTHOUSE” FOR HYDROGEN DEVELOPMENT

BARRIERS TO GREEN HYDROGEN

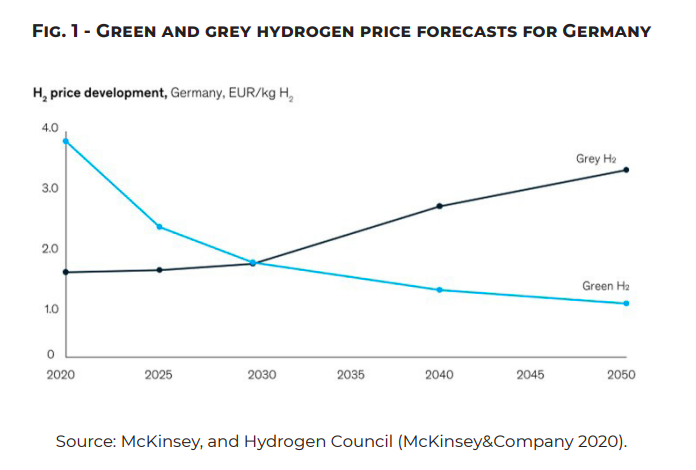

Green hydrogen does not face the public acceptance hurdles faced by blue hydrogen due to the need to capture carbon and inject it in underground formations. However, green hydrogen is approximately three times more expensive than blue hydrogen and presently accounts for less than 0.1% of global hydrogen production. Cost is a particularly important factor for energy-intensive industrial users, which have to compete on a global stage. The impact of costs on competitiveness is also being carefully addressed by climate-ambitious governments, which are committed to avoid carbon leakage.1

Green hydrogen production is currently limited to demonstration projects, adding up to slightly more than 200 MW of electrolyser capacity (IRENA 2020). The largest green hydrogen production units in the world have a capacity of 20-25 MW.2 Small electrolyser and plant scale is a significant factor behind high unit cost. Low-capacity factors of renewable energy resources translate into a low utilization rate of electrolysis plants. Costs can be reduced by standardizing system components and through optimal plant design (larger size of modules and stack manufacturing). By merely increasing the plant from 1 MW to 20 MW costs can be reduced by a third (IRENA 2020). The number of newly commissioned electrolysers will break a new record in 2021 (240 MW compared to only 90 MW finished in 2020).3 Projects announced between 2020 and 2025 add up to more than 25 GW. New types of alkaline electrolysers and Anion Exchange Membrane (AEM) electrolysers are being explored (IRENA 2020).

Cost reductions in electrolysers would not however be able to make up for high electricity costs which currently are the largest cost component for green hydrogen on-site production. Green hydrogen could already be cost-competitive with blue hydrogen with current technologies, using renewable electricity priced at around $20 per megawatt-hour (MWh) (IRENA 2020). The good news is that such low costs are in sight. Solar PV projects in competitive jurisdictions like Australia, Chile, China, India and the United Arab Emirates are estimated to achieve a Levelized Cost of Electricity (LCOE) in the range of US$ 23-29 per MWh (BloombergNef 2020). The world’s lowest cost onshore wind plants found in Brazil can achieve an LCOE of US$ 24 per MWh, followed by top projects in the US, India and Spain (US$ 26-US$ 29 MWh) (BloombergNef 2020).

Hydrogen can be transported using existing gas pipelines and stored in depleted gas fields and salt caverns at a major cost advantage relative to transporting and storing electricity (8 and 100 times cheaper, respectively) (Franza 2021). However, carrying hydrogen through retrofitted gas transmission pipelines faces technical challenges as hydrogen is very light and thus tends to escape. Besides, technologies to limit corrosion, such as polypropylene coating, might be required. Converting distribution networks to hydrogen is significantly more challenging. Also, salt cavern availability for storage is limited in some countries.

SPECIFIC BARRIERS IN THE STEEL INDUSTRY

Steel is a primary building material and global commodity used in numerous industries, from construction, heavy industry, and transportation to energy and housewares. According to the World Steel Association, global crude steel production in 2020 reached 1864 million tonnes (GSA 2021).

High GHG emissions in steel-making are largely due to fossil fuels like natural gas and coking coal being used as iron ore reductants (IEA 2020; McKinsey 2020). The steel industry has large mitigation potential to deploy renewable energy and green reductants, including green hydrogen and green ammonia, to displace fossil fuels.

While various technologies, including molten oxide electrolysis of iron ore and electrowinning of iron ore emerge, existing traditional iron ore processing infrastructure, including blast furnaces and direct reduced iron (DRI) can be upgraded and retooled to operate with green hydrogen (or green ammonia) in a relatively straightforward and inexpensive way. The majority of the costs lie in green hydrogen production and thus green steel is still far from achieving cost parity with traditional non-green counterparts. However, surveys show that certain industries and end customers are willing to pay a premium for green products, and this could apply also to steel (McKinsey 2012).4

Green iron and green steel specifications need to be defined by policymakers, and certification mechanisms need to be deployed to drive this new industry. It seems that mining companies and steel-makers are significantly more active in advocating for green iron and green steel than policymakers themselves. The G20, which includes major steel-producing countries (such as Brazil, China, Germany, India, Japan, Russia, South Korea, Turkey and the US) is well-positioned to drive policy development in support of green steel.

Proposal

OPTIONS TO ADDRESS BARRIERS

THE IMPORTANCE OF INTERNATIONAL SUPPORT: TOWARDS AN INTERNATIONAL HYDROGEN ECONOMY INITIATIVE (IHEI)

In the past, international coordination of policies underpinning technology development has been crucial to prevent costly deadlocks. International collaboration can provide the public good of information and convene discussions between key stakeholders, accelerating the diffusion of best practices. In this context, it is important to set up dedicated institutions once a technology field has become specific. We therefore propose an International Hydrogen Economy Initiative (IHEI) underwritten by the G20. The IHEI should be led by a small secretariat funded by G20 member countries. It would develop policy recommendations to accelerate the roll-out of green hydrogen technologies and bring costs down. It would serve as a knowledge repository of policies around the world, highlighting successes and drawing attention to key reasons that generate policy failures. Data collection and publication would play an important role to enable real-time dissemination of progress achieved. The IHEI would convene international working groups on key aspects of policy design, bringing together government officials, private sector, academia and non-government stakeholders. It would coordinate efforts to develop baseline and monitoring methodologies for greenhouse gas reductions achieved by green hydrogen applications in international and domestic carbon market mechanisms. A vibrant IHEI would be a central node in the emergence of an ‘epistemic community’ of professionals working on green hydrogen around the world.

PRIORITY POLICY INSTRUMENTS TO ADDRESS BARRIERS

GREEN HYDROGEN CONTRACTS TARGETING PRICE DIFFERENTIALS

In the past two decades, several countries have successfully implemented policy instruments to facilitate a quick roll-out of new technologies. These instruments, after some adaptations, can also be used to establish a green hydrogen economy.

In the 1990s, Germany was the first country introducing feed-in electricity tariffs (FiT) to encourage renewable energy consumption. FiTs guaranteed a fixed electricity price over 20 years to be paid to the renewable energy producers. The rate was substantially higher than the market price for non-renewable electricity, and also differentiated rooftop-mounted and ground-mounted PV technologies. The instrument was highly successful, enabling to lower the tariffs for new installations just 4 years after the introduction of the scheme to adjust for technological progress and reduced generation costs. A similar scheme can be highly effective in green hydrogen. While the capital expenditure of electrolysers has already declined significantly over the last years, a further reduction is expected with increasing demand. A quick demand booster can be a premium payment on green hydrogen that guarantees green hydrogen producers a fixed price and secured offtake for a certain period. Price and payment period should be sufficient to make investments economically attractive over the lifetime of the investment. As green hydrogen production costs vary by technology and region, governments should define tariffs under consideration of national parameters such as solar radiation and wind potential. In addition, tariffs for imported green hydrogen can be introduced with a view to facilitate international trade. Once capital expenditure declines further, tariffs can be reduced for new installations.

Another potentially interesting mechanism is a price-differential scheme for commodities produced with green hydrogen, such as steel. As the main resources for the implementation would come from public budgets, it constitutes a targeted form of subsidy. To avoid market distortion in the long term, such mechanism should be introduced for a limited duration (i.e. three to five years) and be extendable if needed. In this case, the commodity producer can apply for a compensation of the additional costs incurred by having switched to green hydrogen. The producer will have to justify the level of increased costs, and the implications on the price of its products. Compensation should be designed as to preserve the virtuous investor’s competitiveness. IPCEIs (Important Projects of Common European Interest) rest on a similar rationale but have complex eligibility requirements (e.g., must take place in and involve actors from several EU member states) and an even more complex approval process (both by EU member states and the EU). Hence, long lead times result, and the complexity of the mechanism likely discourages “normal companies”. Therefore, a simpler approach with easy access is recommended.

OECD proposed measures towards directing and facilitating a green recovery (OECD 2021), many of which are directly applicable to green hydrogen and green steel. A proper regulatory framework is needed to minimize possibilities for gaming or regulatory capture. The effectiveness and ability of the proposed measures to reduce these risks has to be continuously tested and corrective measures introduced when needed.

Some of the interventions proposed in this paper introduce subsidies to close the green hydrogen price gap compared to more carbon intensive alternatives (blue and brown hydrogen). The subsidies will have to take into account the price elasticity of hydrogen and can be designed in a way that they would not create perverse incentives to increase artificially global consumption.

CARBON MARKET MECHANISMS

Carbon market mechanisms can be used to create economic incentives in countries that do not have (sufficient) domestic hydrogen support policies in place. The underlying principle is that the climate benefits resulting from a shift from fossil-fuel based production to green hydrogen in the host country are quantified in tonnes of CO2-eq. The amount of avoided greenhouse gas emissions is issued in form of credits that can be sold internationally.

Under the UNFCCC, the Clean Development Mechanism (CDM) is the most advanced scheme. Since the early 2000s, almost 8200 CDM activities5 have been registered and generated more than 2 billion tCO2 e in emission reductions, leveraging investments in mitigation for almost US$ 430 billion6 in several sectors.7 The CDM flourished in the period 2008-2012, but suffered from a politically induced lack of demand ever since. However, its success over many years has impressively demonstrated that such a mechanism can work effectively if there is sufficient demand: the private sector from all over the world was actively engaged and interested to mobilize climate protection projects. Such a mechanism could also be used to mobilise investments in green hydrogen. In the future, the Art. 6 mechanism under the Paris Agreement could become the central carbon market instrument, see section 3.3 below.

However, one general aspect needs to be considered for all carbon market mechanisms: the marginal abatement costs (MACs) of green hydrogen projects may be higher than the abatement costs of other mitigation opportunities (“low-hanging-fruits”) so that carbon markets may advantage the latter unless certain buyers are willing to pay price premiums for green hydrogen projects. Such premiums are already offered on the voluntary carbon markets for some technologies, such as CO2 removal, which have significantly increased their volumes in 2019 and 2020 8 (Espelage 2020).

TAX BREAKS

Tax breaks can be introduced at various levels of the green hydrogen value chain. Firstly, they can be used to stimulate domestic manufacturing of electrolysers. Tax incentives can limit the impact of high capital costs on the profitability of projects. Lower income or sales taxes, or lower taxes on investments, are possible solutions. In a few countries, tax breaks that benefit hydrogen production already exist. In Norway, green hydrogen is already exempt from electricity consumption taxes (Dolci et al. 2019). In the US, the Biden Administration is considering a tax credit of US$ 0.42/kg for the production of low-carbon hydrogen and ammonia, based on the emission intensity. Moreover, it is considering a manufacturers production tax credit of US$ 500/kW (IRENA 2020). Two options exist for the basis of the tax credit, one being the CO2 emissions reduced in the project for which the application is filed and the other one being the amount of low-carbon hydrogen produced (Penrod 2021). The US Congress is also considering a bill that would expand a stand-alone 30% investment tax credit to include energy storage technologies with a minimum capacity of 5 kWh (Hale 2021). Wind and electric vehicles benefitted from similar schemes in the past.

Infrastructure can also benefit from tax breaks, such as those in place to build hydrogen filling stations in Germany, the Netherlands and Norway. Downstream tax incentives vary quite remarkably from one segment to the other. Currently the use of hydrogen in fuel cells for transportation is the most incentivized from a fiscal perspective (Dolci et al. 2019). Conversely, green hydrogen in industry does not yet enjoy substantial tax incentives, only indirect ones in a few countries. In France, for instance, using green hydrogen instead of fossil fuels in industry would allow to avoid the country’s carbon tax, which is set to reach €100/tCO2 by 2030 (Dolci et al. 2019). In the Netherlands, investments resulting in the displacement of fossil fuels are tax deductible. Tax breaks for essential equipment and infrastructure should be implemented in early stages of hydrogen deployment and reduced over time as the technology matures.

POLICIES ENCOURAGING TECHNOLOGY SHARING

Technology sharing can help reducing costs. At the same time, however, countries want to protect innovation when significant amounts of public funds are spent on research and development (R&D). First movers feel that they should be rewarded for the risk they take, rather than seeing benefits being captured by free-riders. This is also a result of lessons learned from the first solar PV cycle, when EU manufacturers lost competitiveness to lowcost Chinese manufacturers. At the moment, the EU is signalling a strong willingness to achieve strategic autonomy in low-carbon energy, including hydrogen, and is launching private-public partnerships (e.g. the European Hydrogen Alliance) to strengthen EU value chains and green champions. China is also pursuing green industrial policies and the same is expected of the US since the election of President Biden.

But legitimate geo-economic interests should not distract from the fact that cooperation on technology is desirable to help green hydrogen becoming competitive. International innovation platforms can strengthen the green hydrogen ecosystem and accelerate learning.9 Data transparency and openness can speed up innovation as universities, companies and other innovators can build on previous experiences rather than “reinventing the wheel”. Like-minded countries can voluntarily set common priorities, processes and plans for research on green hydrogen and jointly design and develop research funding schemes. Building international public-private alliances to drive technological breakthroughs allows to increase scale and reduce costs. These alliances are particularly in the interest of smaller countries that lack complete ecosystems to trigger innovation and cut costs.

Future R&D will most likely focus on electrolysers. Current density, diaphragm thickness and electrode and catalyst design will be the key focus areas for alkaline electrolysers. Bipolar plates and Porous Transport Layers (PTLs) will be focus areas of innovation for PEMs. R&D on AEM membranes and electrolyte conductivity for solid oxide, which have great potential to unlock breakthroughs in electrolysis, are also expected to receive more attention and funding. At a later stage, R&D should also address material optimisation to limit utilisation of critical minerals like iridium and platinum (IRENA 2020). Technological innovation is also needed to ensure a safe transportation of hydrogen in pipelines and limit the possibility of leakage, as well as in the downstream segment by improving the efficiency and flexibility of hydrogen-powered appliances.

STEEL SECTOR EXAMPLE: WAYS TO ACCELERATION REDUCTION OF GREEN PRODUCTION COSTS

The major cost contributor to the cost of green iron and green steel is the LCOE of the renewable electricity, followed by capital expenditure on electrolysis, including pre- and post-treatment (e.g., water purification and hydrogen purification and drying, depending on the concrete technology).

Policy planning should focus on reducing these two cost components. Policies that enable renewable energy and hydrogen will directly impact uptake, cost-competitiveness, and green iron and green steel production readiness. The creation of national and international green steel hubs and centers of excellence attached closely to green steel processing facilities would enable collaboration, investment, and faster green steel uptake (Wood and Dundas 2020). Further, granting those hubs and centers of excellence special industrial zone rights with no or reduced taxes would close or reduce the price gap between green and nongreen steel. Carbon taxes have already been identified as enablers of green hydrogen and green ammonia (McKinsey 2020; Ferreira Marques 2020) and can also play enabling role in the green steel industry. Carbon taxation will also drive market creation in green steel export states. The green steel industry will create new paradigms where iron ore will be produced and processed next to the extraction location if renewable resources allow for it or shipped to the nearest location with vast and cheap renewable energy production assets. This paradigm shift breaks decades-long supremacy of coal and natural gas-rich countries, where iron ore was being transported to coal-rich geographies for processing. Lastly, global certification mechanisms for green iron and green steel are crucial to moving this industry forward.

THE CARBON MARKET UNDER ARTICLE 6 OF THE PARIS AGREEMENT

Article 6 of the Paris Agreement (PA) introduces two distinct market-based approaches to cooperation: Article 6.2 lays the foundation for the “cooperative approaches” (CA) based on the transfer of “internationally transferred mitigation outcomes” (ITMOs) on a bilateral or multilateral level; Article 6.4 establishes a new centrally governed, internationally overseen mechanism10.

The benefits of utilizing the market mechanisms under the PA to support green hydrogen development are manyfold. Functioning carbon markets can reward mitigation activities with additional cash flow: once proven that it reduced GHG emissions, an activity receives an equivalent amount of emission reduction units that can be traded in the market for a price. These additional revenues can contribute to close the viability gap of green hydrogen and contribute to its upscaling.

Market mechanisms require that an activity, before being rewarded with credits, is validated by a third-party entity ex-ante and the actual performance is verified ex-post. The existing standards, including those under the voluntary market, have robust validation and verification procedures. This certification system allows project owners to effectively quantify and claim the mitigation benefits delivered in a transparent manner to their stakeholders, such as financial institutions, regulatory bodies, and customers. This “label” can be used to market products that have a lower climate impact, thereby strengthening their position relative to competing products. More and more companies are announcing plans to achieve mitigation targets in line with the PA goals, as described under the Science Based Target Initiative (SBTi)11 and this trend will further intensify in the future.

Article 6.2 provides a promising venue for developing targeted cooperation agreements between countries on a bilateral or multilateral level: this mechanism gives sufficient flexibility to participants regarding the type of cooperation, technologies covered, and type of support to be deployed. This enables a tailored approach for cooperation in hydrogen: importing and exporting countries could join forces and design cooperation activities that focus on specific elements according to their specific needs. This could include technology transfers, support to infrastructure investments, demand stimuli, removal of regulatory barriers, and harmonization of border taxation. Under Article 6, parties could also implement carbon pricing mechanisms that could generate ITMOs. It is important to support early movers and help them reduce their investment risks, considering that this sector is still at an initial stage of development.

Development of robust methodologies for the quantification and for the monitoring, reporting and verification (MRV) of the emission reductions that can be achieved by green hydrogen applications is a necessary condition for enabling carbon market support. These methodologies could be developed and tested in the context of Article 6. Once they are established and risks related to environmental integrity are minimized, they provide a robust and scientifically tested approach. The CDM has a body of almost 250 methodologies (UNFCCC, n.d.) that have undergone a rigorous process of review and approval. These existing methodologies constitute a solid starting point for the development of a new one that covers the production and use of green hydrogen.

However, market mechanisms also face barriers. First, there are no agreed rules by all parties on how Article 6 should be implemented. Several issues are still being debated, such as accounting procedures, approaches to baseline definition, and options to ensure consideration of national policies and of the NDCs’ targets, just to name a few. However, some countries such as Sweden and Switzerland are actively seeking pilot Article 6 activities to purchase the resulting emission reductions. Green hydrogen could be supported by one of these pilot activities. This would simultaneously boost the development of hydrogen and carbon markets. The implementation of an Article 6 pilot activity requires a significant level of joint efforts of involved governments to agree on a cooperation framework and its modalities and requirements, within which private investors can also operate. While this may represent an additional layer of complexity, it will also stimulate international cooperation at the highest political level in technology development and mitigation, paving the way for closer private sector cooperation. G20 countries could seek cooperation under the auspices of the PA’s Article 6 as a venue for testing potential partnerships on green hydrogen in the context of an international agreement.

STEEL-MAKING INDUSTRY AND CARBON MARKETS

The steel-making industry is well positioned to make use of the new mechanisms under the PA. There is a wealth of experience in the implementation of carbon reduction projects: 97 iron and steel projects have already been registered under the CDM, mainly focusing on energy efficiency and waste heat recovery. This signals the capacity of managing carbon projects and of applying a methodology for the quantification and monitoring of emission reductions with more than 60% of the projects that issued emissions credits at least once (UNEP DTU 2021a).12 Technical expertise for the MRV of green hydrogen uses in steel-making is available and could be further expanded as hydrogen uptake increases. The combination of potential additional revenues, increased attention to mitigation as well as the need for positioning in an international and competitive market, can provide significant benefits to early movers.

In addition, steel makers are already covered under existing carbon pricing schemes (e.g., under the ETS in the European Union, in South Korea, or under the Mexican Pilot ETS), or are due to be covered in the next phases of implementation, for instance under the Chinese ETS (ICAP 2021). Sometimes, emissions from fossil fuel combustion and non-energy industrial processes are covered by a carbon tax (e.g. South Africa’s carbon tax). As carbon prices may become more common and higher in both developed and emerging economies, the industry is bound to strive for reducing the carbon intensity of its production. Green hydrogen could be a cost-effective manner of meeting the regulatory caps under the different carbon pricing schemes.

RECOMMENDATIONS

The costs of green hydrogen to be used in the steel industry need to be brought down, both through reductions in electricity generation cost as well as electrolyser cost. Policies such as lower income or sales taxes, or lower taxes on investments, would help the economics of hydrogen projects. High-level political support leading to the signature of agreements on concrete international and cross-border projects would greatly help increase scale and reduce unit costs.

A G20-orchestrated International Hydrogen Economy Initiative (IHEI) could greatly advance international cooperation on green hydrogen, ensuring coordinated and mutually reinforcing approaches. The Italian G20 presidency should aim at getting endorsement of the full G20 for setting up an IHEI Secretariat, which could be located in Rome.

The Secretariat should convene working groups, inter alia one on green steel support policies, in collaboration with the World Steel Association.

International policy initiatives in support of open value chains, technology sharing, R&D public-private partnerships, the joint development of research funding schemes and the creation of international hubs and centres of excellence should also be welcome as they can help reducing costs, realizing synergies and exploiting complementarity.

The IHEI could also play a key role in diffusing best practices in policy instrument design. Such policies could include degressive contracts for difference for green steel production, linked to temporal milestones specified ex ante. Similarly, electrolyser producers could be offered ex-ante fixed uptake prices for their hydrogen whose level declines over time.

Moreover, certification mechanisms need to be deployed to drive this new industry and international initiatives to create universally accepted standards are key.

A dedicated baseline and monitoring methodology for green hydrogen applications in the steel industry should be developed and used in the context of Article 6 pilot activities undertaken by G20 members. Here the emerging economy members of the G20 like Brazil, China, India and South Korea could engage as sellers of emissions credits.

A capacity building plan should be developed to enable diffusion of technologies worldwide, especially in locations with a large supply of intermittent renewable energy. This could be done by the IHEI in collaboration with the World Steel Association.

NOTES

1 An additional hurdle is that current iridium and platinum output used in PEM electrolysers is not sufficient to supply expected electrolysis needs, calling for a reorientation towards alternative electrolytic technologies that do not hinge on scarce materials.

2 A 20 MW Polymer Electrolyte Membrane (PEM) electrolyser in Canada by Air Liquide and a 25 MW facility in Sarawak, Malaysia.

3 Hydrogen Production Database | BloombergNEF (bnef.com)

4 Tests, optimization, and parameter tuning are still ongoing to find the best operating conditions for green reductants. Technology readiness is still relatively low, but can progress relatively quickly. Lack of expertise in hydrogen production, handling and safety is also considered a major limiting factor for this emerging industry. In addition, green steel requires a cross and multidisciplinary approach combining expertise from hydrogen production and steel-making.

5 This includes 7,848 projects and 339 Programs of Activity (PoA).

6 This figure includes only investment in stand-alone CDM projects.

7 UNEP DTU, 2021a,b.

8 Espelage et al., 2020.

9 European Commission, “International cooperation in clean energy research and innovation”, International cooperation in clean energy research and innovation, Mission Innovation and cooperation agreements https://ec.europa.eu/info/research-and-innovation/research-area/energy-research-and-innovation/international-cooperation_en 1

0 Article 6.4 design builds on the successful experiences with the CDM and Joint Implementation (JI) under the Kyoto Protocol

11 More information on SBTi is available at: https://sciencebasedtargets.org/

12 UNEP DTU, 2021a

REFERENCES

BloombergNef, (2020), “Scale-up of Solar and Wind Puts Existing Coal, Gas at Risk”, 28 April https://about.bnef.com/blog/scaleup-of-solar-and-wind-puts-existing-coalgas-at-risk/

Bolton P. et al., (2020), “Born Out of Necessity: A Debt Standstill for COVID-19”, CEPR Policy Insight, no. 103

Bolton P., M. Gulati, and U. Panizza, (2021), “Legal air cover”, Journal of Financial Regulation (forthcoming)

Climate Transparency, (2020), The Climate Transparency Report 2020. Comparing G20 Climate Action and Responses to the Covid-19 Crisis https://www.climate-transparency.org/g20-climate-performance/the-climate-transparency-report-2020

Dolci F. et al., “Incentives and legal barriers for power-to-hydrogen pathways: An international snapshot”, International Journal of Hydrogen Energy, vol. 44, Issue 23, 3 May 2019, pp. 11394-11401 https://www.sciencedirect.com/science/article/abs/pii/S0360319919309693

Espelage, A.; Poralla, M.; Butzengeiger, S.; Darouich, L.; Weidacher, S.; Beeg, J, Geres, R. (2020): Aktueller Stand des freiwilligen Treibhausgas-Kompensationsmarktes in Deutschland, Allianz für Klima und Entwicklung, https://allianz-entwicklung-klima.de/wp-content/uploads/2020/09/studie2020-treibhausgas-kompensationsmarkt-deutschland.pdf, accessed April 2021.

eurelectric, (n.d.), “Decarbonisation Pathways. Full Study Findings”, https://www.eurelectric.org/decarbonisation-pathways/

Faenza L., (2020), The momentum behind hydrogen, ENI, 20 August 2020 https://www.eni.com/en-IT/low-carbon/momentum-hydrogen.html

Ferreira Marques C., (2020), “The Missing Piece of the Hydrogen Puzzle”, Bloomberg Opinion, 3 December https://www.bloomberg.com/graphics/2020-opinion-hydrogen-green-energy-revolution-challenges-risks-advantages/policy.html

Franza L., (2021), Clean Molecules across the Mediterranean. The Potential for North African Hydrogen Imports into Italy and the EU, Istituto Affari Internazionali (IAI), 12 April https://www.iai.it/en/pubblicazioni/clean-molecules-across-mediterranean

Gladstone A., (2021), “New York Lawmakers Float Crackdown on Hedge Funds’ Sovereign Debt Tactics”, Wall Street Journal, 8 February

Global Steel Association (GSA), (2021), Global crude steel output decreases by 0.9% in 2020, Brussels26 January https://www.worldsteel.org/media-centre/press-releases/2021/Global-crude-steel-outputdecreases-by-0.9–in-2020.html

Hale Z., (2021), “US developers seek standalone storage tax credit to boost green hydrogen”, S&P Global Market Intelligence, 3 March https://www.spglobal.com/marketintelligence/en/news-insights/atest-news-headlines/us-developersseek-stand-alone-storage-tax-credit-toboost-green-hydrogen-62989204

ICAP (2021): Emissions Trading Worldwide: Status Report 2021. Berlin: International Carbon Action Partnership.

International Energy Agency (IEA), (2019), The Future of Hydrogen, Technology report, June https://www.iea.org/reports/the-future-of-hydrogen

International Energy Agency (IEA), (2020), “Iron and Steel Technology Roadmap”, part of Energy Technology Perspectives, Technology report https://www.iea.org/reports/iron-and-steel-technology-roadmap

International Renewable Energy Agency (IRENA), (2020), Green Hydrogen Cost Reduction: Scaling up Electrolysers to Meet the 1.5⁰C Climate Goal, Abu Dhabi https://irena.org/-/media/Files/IRENA/Agency/Publication/2020/Dec/IRENA_Green_hydrogen_cost_2020.pdf

Krugman P., (1988), “Financing vs. Forgiving a Debt Overhang”, Journal of Development Economics, vol. 29, pp. 253-268

McKinsey&Company, (2012), How much will consumers pay to go green?, McKinsey Sustainability, 1 October https://www.mckinsey.com/business-functions/sustainability/our-insights/how-much-will-consumers-pay-to-go-green

McKinsey&Company, (2020), Decarbonization challenge for steel, 3 June https://www.mckinsey.com/industries/metals-and-mining/our-insights/decarbonization-challenge-for-steel

OECD, (2021), “Structural policies to deliver a stronger, more resilient, equitable and sustainable COVID-19 recovery”, in Going For Growth 2021: Shaping A Vibrant Recovery https://www.oecd.org/economy/growth/structural-policies-for-stronger-more-resilient-equitable-sustainable-COVID-19-recovery-going-for-growth-2021.pdf

Penrod E., (2021), “New tax credits are best option to spur clean hydrogen, Resources for the Future analysis finds”, Utility Dive, 10 March https://www.utilitydive.com/news/new-tax-credits-are-best-option-to-spur-clean-hydrogen-resources-for-the-f/596438/

Ritchie H., and M. Roser, (n.d.), Emissions by sector, Our World in Data https://ourworldindata.org/emissions-by-sector

UN Environment Programme (UNEP), (2019), Lagging in climate action, G20 nations have huge opportunities to increase ambition, Press Release, Climate Action, 21 September https://www.unep.org/newsand-stories/press-release/lagging-climate-action-g20-nations-have-huge-opportunities-increase

UNEP DTU (2021a). CDM pipeline, https://www.cdmpipeline.org/ Accessed March 2021

UNEP DTU (2021b): PoA pipeline, https:// www.cdmpipeline.org/ Accessed March 2021

Wood T. and G. Dundas, (2020), Start with steel, A proctical plan to support carbon workers and cut emissions, Grattan Institute https://grattan.edu.au/wp-content/uploads/2020/05/2020-06-Start-with-steel.pdf

Wouters F., and A. van Wijk, (2019), “50% Hydrogen for Europe: a manifesto”, energypost.eu, 7 May https://energyposteu/50-hydrogen-for-europe-a-manifesto/