Developing Asia must mobilize $1.7 trillion annually to meet ist infrastructure needs. Governments can increase public investment in infrastructure by raising more revenues, reorienting spending, and borrowing prudently, as well as adopting innovative approaches such as “land value capture.” Also, expanded private financing of infrastructure investments is indispensable. Particularly, public–private partnership can help fill the financing gap by allocating risk to the party best able to manage it. The success of the approach depends on governments identifying projects suitable for it, engaging qualified private partners, and instituting the right process.

Challenge

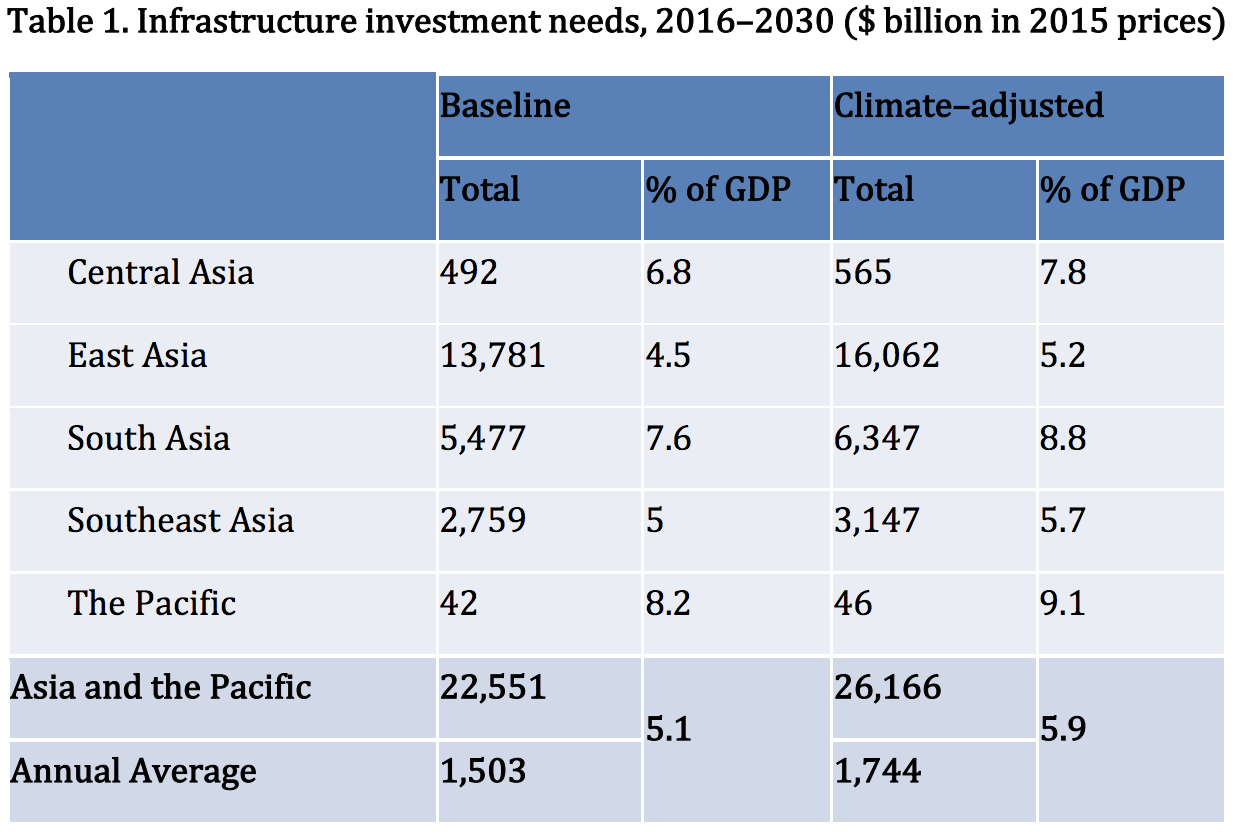

While Asia has been the engine of global growth, continued investments in infrastructure is indispensable for keeping the growth engine active. Also, over 400 million Asians live without electricity, 300 million without safe drinking water, and a staggering 1.5 billion without basic sanitation. According to ADB (2017), developing Asia will need to invest $26 trillion from 2016 to 2030, or $1.7 trillion per year, if the region is to maintain its growth momentum, eradicate poverty, and respond to climate change. This estimate incorporates the costs of climate change mitigation (in particular, for more efficient and cleaner power generation and electricity transmission), and adaptation (in particular, for “climate proofing”), mainly in transport and water by making infrastructure more resilient to the impacts of climate change. Without these climate change mitigation and adaptation costs, $22.6 trillion will be needed, or $1.5 trillion per year (baseline estimate).

Sources: 2030 population projections from UN Population Division; others are ADB estimates.

Currently, the region annually invests an estimated $881 billion in infrastructure (for 25 economies with adequate data, comprising 96% of the region’s population). The infrastructure investment gap, i.e., the difference between investment needs and current investment levels, equals 2.4% of projected GDP for the 5-year period from 2016 to 2020 when incorporating climate change mitigation and adaptation costs.

Asia’s infrastructure needs dwarf traditional sources of finance. The infrastructure investment gap should be filled by both public and private sectors. Accordingly, the two main challenges are: First, to expand fiscal space for larger public investments in infrastructure; and second, to attract and mobilize private resources in financing the gap.

Proposal

1. Innovative Approaches to Augment Public Infrastructure Investments

Governments can increase public investment in infrastructure by raising more revenues, reorienting spending, and borrowing prudently. Policy makers must evaluate how much fiscal space is available to increase infrastructure investment under various options for reforming public finance. Many countries in developing Asia can increase revenues through tax reform (including improving tax administration). There is also scope to reorient budget expenditures toward public investment by cutting energy subsidies, for example, and by borrowing prudently while keeping debt levels manageable.

Innovative approaches exist to expand government funds available for financing infrastructure development. These include, for example, using “land value capture” to finance infrastructure, or capital recycling (selling brownfield assets and auctioning concessions, and allocating proceeds to finance greenfield infrastructure). At the same time, other actions, like setting user charges for infrastructure services with greater regard to cost recovery will also help.

2. Tapping Private Investments

While state funds currently finance 92% of the Asia and the Pacific region’s infrastructure investment, some economies struggle to meet these needs, constrained by high fiscal deficits and deepening public debt. Even factoring in funds saved through public finance reform or received from multilateral agencies, a significant infrastructure financing gap remains. Hence, expanded private financing of infrastructure investments will be indispensable.

Currently, the main sources of infrastructure project finance are equity and debt. Banks have been the largest providers of debt finance for infrastructure projects, both in Asia and around the world. But this is not sustainable. Banks’ ability to provide debt financing for Asia’s vast infrastructure needs is limited especially because of recent changes in bank regulations and capital requirements. Bonds are more desirable, as they allow for long-term financing. But bonds are used only minimally for infrastructure investment financing in Asia.

Especially, public–private partnership (PPP) can be an innovative tool to meet Asia’s infrastructure needs. A suitable project, pursued with qualified private partners, and overseen through the right processes is the surest combination for the efficient and effective delivery through PPP of public infrastructure and the services it enables. For this to materialize, regulatory and institutional reforms are needed to make infrastructure more attractive to private investors and generate a pipeline of bankable projects for PPPs.

Countries should implement PPP-related reforms such as enacting PPP laws, streamlining PPP procurement and bidding processes, introducing dispute resolution mechanisms, and establishing independent PPP government units. Deepening of capital markets is also needed to help channel the region’s substantial savings into productive infrastructure investment.

3. Enhancing the Role of MDBs

The role of multilateral development banks (MDBs) is crucial to catalyze and add value to private sector investment into infrastructure assets. The infrastructure financing gap is essentially a risk gap. The large infrastructure gap in Asia coexists with a substantial pool of long-term savings that can be mobilized if offered the appropriate balance of risk and return. Credit enhancement mechanisms such as partial credit or revenue guarantees, offtake guarantees, subordinated debt, pooling and tranching, and infrastructure debt or equity funds, can mitigate certain risks from PPPs to make them more attractive to a wider range of capital providers. MDBs can also facilitate development of local capital markets.

References

• ADB (2017). Meeting Asia’s Infrastructure Needs. Asian Development Bank. Manila.

• ADB (2018). Asian Development Outlook 2018 Update: Sustaining Development through Public-Private Partnership. Asian Development Bank. Manila.