Ultimate Beneficial Owners (UBOs) are defined by complex legal rules that differ across countries. Identifying UBOs is increasingly costly and time consuming. Gathering more data and refining already complex domestic legal arsenals is not the solution.

We therefore propose a risk-based approach to identifying possible UBOs, which is enabled by recent theoretical advances in economics and corporate finance.

The proposed methodology is robust, rigorous and cheap to implement. In the same way that a risk-based approach has facilitated the adoption of transparency standards for banks (Basel), this methodology could constitute the basis for the gradual adoption of an international standard.

Challenge

Progress towards a significant reduction of Illicit International Financial Flows (IIFF) has been slow, reflecting several factors: e.g. data on financial interlinkages are not apparent from Direct Investment (DI) statistics; a comparison of inward DI data compiled by various Organisation for Economic Co-operation and Development (OECD) member countries has revealed major inconsistencies due to the use of different small DI databases rather than a comprehensive dataset; measuring pass-through funds is complicated and information-intensive; and it is difficult to determine who ultimately owns and controls investments (UBOs), in part because the complex shareholding patterns associated with multinationals cannot easily be disentangled, and because relatively small shareholdings can sometimes translate into significant levels of control. The efforts made to develop a UBO Identification tool kit to assist countries in implementing the method that best suits their legal and policy frameworks, have highlighted how difficult it is to reach an international standard.

The current approach of gathering more and more data and refining the domestic legal arsenals is increasingly costly and time-consuming. It is also difficult to implement. The result is that transparency in IIFF remains an issue, while some de facto UBOs continue to fly under the legal radar and others can use their network of subsidiaries for unethical purposes. A new approach, combining parsimony and effectiveness, is needed.

We propose a “risk-based” approach to identifying possible UBOs. In the same way that a risk-based approach has facilitated the adoption of transparency standards for banks (the Basel Principles), the methodology we propose could constitute the basis for the gradual adoption of an international standard. It is robust and solidly anchored on proven theoretical grounds. The proposed methodology would be cheaper and more efficient than the current practices, and would increase transparency.

Proposal

THE RATIONALE

Reducing Illicit Financial Flows is a requirement (Goal 16, target 16.4) of the United Nations (UN) Sustainable Agenda, but it remains a major challenge for International Organisations. International Monetary Fund (IMF) Committee on Balance of Payment (BOP) Statistics recently (IMF 2019) failed to agree on a definition of ultimate investing and host economies, partly because of the difficulty of disentangling complex multinational ownership structures and identifying investors, especially UBOs. The Financial Action Task Force (FATF) has included the identification of UBOs in its measures to fight money laundering, but substantial difficulties remain and the legislative arsenals vary considerably across nations.

A recent G20 paper observes that efforts against IIFFs are “measurable” but hard to follow through. The paper (Perez and Rodriguez 2020) argues that the G20 could take a leading role in boosting efforts in this area, but that the secretariats of FATF and other concerned international organisations “are reluctant to generate controversies around ranking with member states” and the paper therefore recommends that the G20 enforces international agreements against IIFF.

In addition, there is some level of myopia that prevails when it comes to identifying UBOs (a cornerstone of the fight against IIFF). One reason is the complexity of the task. In spite of the increased availability of data, the information is not easy to interpret, with multi-layered shareholding structures, cycles and a few remaining data gaps. Ginglinger et al. (2018), for example, show that investors who hold equity in a company are not fully aware of ownership connections of their investee firms. That myopia extends to parties indirectly involved, such as regulators or fiscal authorities, especially in complex cases with ownership cascades involving many intermediate investment vehicles. Some may be listed on a stock exchange and others privately held, sometimes with multiple share classes, with parts of ownership chains being located in different countries, where different transparency rules apply. It can therefore reasonably be expected that the complexity of ownership structures sometimes aims at complicating the identification of UBOs so as to avoid detection.1

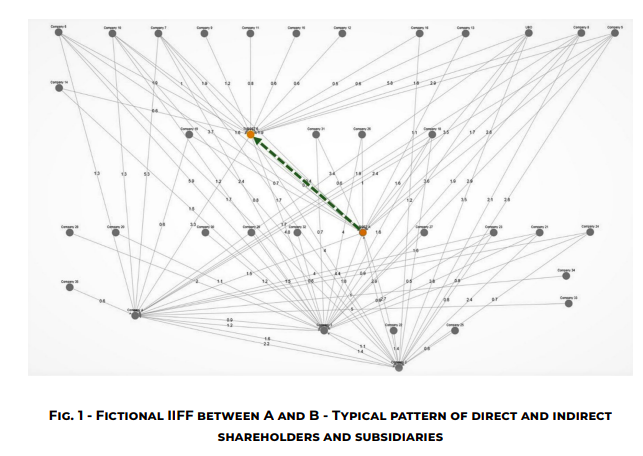

To illustrate the complexity of the task (and why myopia is understandable), consider Figure 1 below where we have assumed a (fictional) suspicious transfer of money between two anonymised entities A and B. The figure identifies and displays all shareholdings associated with both entities (a tedious task). This could be done with any database, e.g. from a supervisory authority.2 The difficulty of identifying UBOs for A and B is immediately apparent (the number on an arrow from Company i to Company j represents the percentage of j’s shares held by i).

Fig. 1 Fictional IIFF between A and B Typical pattern of direct and indirect shareholders and subsidiaries

An additional difficulty is that control, whether exercised through direct or indirect shares in a firm (or both), is not a simple, linear or even continuous function of the percentage of shares held. In fact, it depends, in a highly non-linear fashion, on the global distribution of shareholdings, including the magnitude of the free float. In order to understand this, it is sufficient to observe, for instance, that the level of control “jumps” from partial to total control when a new purchase allows a shareholder to cross the majority threshold of 50% of ownership. In fact, it depends, in a highly non-linear fashion, on the global distribution of shareholdings, including the magnitude of the free float. In order to understand this, it is sufficient to observe, for instance, that the level of control “jumps” from partial to total control when a new purchase allows a shareholder to cross the majority threshold of 50% of ownership.

Possibly as a reaction, there has been a move to reinforce domestic legal arsenals, and UBOs are now defined by complex rules that differ across countries. The efforts made to develop a UBO Identification tool kit to assist countries in implementing the method that best suits their legal and policy frameworks, have shown their limits. It is also clear that they will not lead to a global convergence towards an international standard that would be acceptable to all, or even most, countries. And some UBOs continue to fly under the radar, which complicates the task of assigning responsibility when an illicit transfer of funds is suspected.

The situation is therefore very different from what is happening with bank supervision, where there is a high level of international convergence. The Bank for International Settlements’ Basel Committee regularly issues principles and offers “guidance” emphasising the critical importance of effective corporate governance for the safe and sound functioning of banks. Banks across the world are supposed to comply with the “Core Principles” and if they do not comply, the host country is blacklisted. In contrast, because of the lack of maturity of tools and techniques dedicated to the identification of UBOs, a similar level of international convergence is not going to occur in the near future.

Yet, identifying UBOs is of critical importance. An ill-intentioned UBO can use its subsidiaries worldwide to indulge in unethical practices that lead to IIFF (such as transfer pricing) and other actions that are detrimental to the common good, such as recuperating losses made by one subsidiary through transfers from another (Azar et al. 2018);3 or even obtaining good Environment, Social, Governance (ESG) scores for some subsidiaries by purposely underperforming with others.4 In addition to these possible problems, another important reason to gain insight into ownership structures is that natural competitors may be held by a small set of large institutional investors. A hidden social cost could arise in the form of reduced product market competition.

Over the years, countries have developed their own legal arsenal to identify UBOs. Historically, scholars often referred to a “blockholder-based” system of governance (also known as an “insider system” e.g. in Continental Europe and Japan, see Crama et al. 2003) characterised by a high concentration of ownership held by families, individuals or other corporations; a relatively small number of listed companies; and an illiquid capital market because controlling blocks are held by a few dominant shareholders. The Anglo-American system was called a “market-based” system of governance (also known as an “outsider system”), characterised by the exact opposite5 and supposed to be more (informationally) efficient, while providing stronger shareholder-protection. The system in most countries was something in between.

Countries will keep their complex legal arsenal in the future, even if the differences between “systems” continue to be eroded. Over the years, there has been some evolution in Continental Europe towards less complex ownership structures. This may also partly reflect the increased universal activity of large investors from emerging countries where the “blockholder-based” system was largely prevalent. While hard and soft corporate governance laws have shown some degree of convergence, an integrated corporate governance system did not arise, largely because the corporate landscapes in terms of ownership concentration, or dominance by specific types of owners, did not evolve towards one system. Consequently, a universally applicable corporate governance regulation was not warranted and national regulatory authorities retained and further developed their own tailored set of legal instruments.6

Seeking international convergence in the identification of UBOs by gathering more data and refining already complex domestic legal arsenals is not the solution. This is becoming increasingly costly and time-consuming for firms and regulatory authorities, while also proving difficult to implement. Legal loopholes will always remain, furthermore, and ill-intentioned UBOs will find a way to take advantage of these.

ACTIONABLE POLICY RECOMMENDATIONS

A new approach is needed and it requires the support of International Financial Institutions

Recent theoretical advances in economics and corporate finance make it possible to develop an effective “risk-based” approach to identifying possible UBOs, derived from rigorously defined indices of control. The methodology relies on a well-established game-theoretic approach initially proposed by Banzhaf (1965, 1968) and closely related to work by Nobel-prize winner Shapley (Shapley and Shubik 1960). It measures the ability of a direct or indirect shareholder to change the result of a vote when the votes of the other shareholders are given. It allows the computation of a single index measuring the level of control that the shareholder could potentially exercise over the target company. The initial methodology has been generalised to handle large datasets a major step compared to the original work and has successfully been applied to financial markets (Crama et al. 2007, 2013). It discriminates between financial links that are only associated with portfolio investments and those that can potentially translate into significant control. It addresses the main weaknesses of the indices traditionally used by researchers to measure concentration (e.g., Herfindahl indices: sums of squared proportions of shares held by shareholders). The index of control takes into account the fact that a large free float implicitly increases the level of control detained by minority (yet significant) shareholders.7 The Appendix, based on the work of Banzhaf, illustrates this and explains how the index is calculated.8

The Index of control is robust across systems. It is applicable to all systems of corporate governance and to large sets of data, so that frequent changes of ownership can be quickly analysed, which is an important consideration for supervisory authorities currently struggling with that issue. The methodology also applies to multi-layer shareholding patterns or cycles of ownership (Crama and Leruth 2013).

Availability of data on shareholdings has improved, making the methodology applicable worldwide. The global efforts towards greater transparency (by the public sector and concerned investors) have motivated data providers to improve the collection of shareholding data. The methodology has been used in the past (with various databases) to provide support and evidence for several academic or IFI papers (see for instance Crama & al., 2003, or Khatri & al. 2002).9

Why is it a risk-based approach? Because the system does not aspire to identify UBOs as defined by domestic regulations and legal texts. However, it identifies individuals or ultimate voters who potentially have the ability to substantially decide on an issue at stake (they could be pivotal when deciding on an issue). These ultimate voters would be the centres of “risk”. Not all of these risks will materialise, however, and sometimes, as with all risk-based approaches, a centre of risks may be missed (shareholder activists, special relationships between presumably independent voters, voter intimidation, etc.).

Why is it cheaper? Once these ultimate voters are identified, supervisory authorities can concentrate their efforts on researching them rather than undertaking an unnecessarily exhaustive research of direct shareholders or presumably important indirect ones. This saves time and money (as with all risk-based approaches). The procedure can be repeated at will and at virtually no cost.

Why is it helpful? Beyond the cost-saving aspect, the approach presents several advantages:

- it is relevant irrespective of the legal system prevailing in any specific country and it can therefore be embraced by all (much like a “green yellow red” system of risk in customs management);

- since it treats all systems in the same way, the output can be compared across countries, thus increasing transparency across borders for UBOs and for the group of companies that they control;

- individual countries can continue using their own legal instruments to go after a potential source of risk that might indeed turn out to indulge in fraudulent activities.

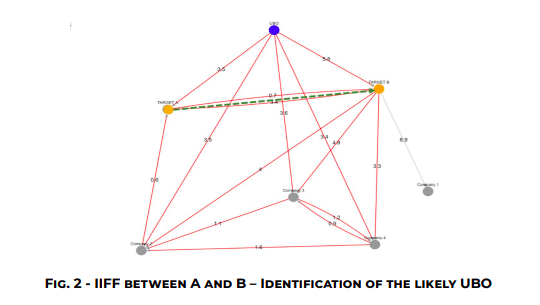

How would it work? Let us consider Figure 1 again, with a suspicious transfer (the green, dashed arrow) between two entities (in orange) that are surrounded by a large number of shareholders. In a risk-based perspective, the software calculates the UBO (in this case one only), using the approach described above and in the appendix. The software then removes the shareholding links that do not carry substantial control (they correspond to portfolio investments only), which yields Figure 2 below. This emphasises the control structure around the nodes that warrant further investigation (Targets A and B in Figure 2). The UBO is identified (at the top, in blue) and the links through which it exercises control are shown in solid red. The influence of the UBO runs not only through its direct ownership stakes in Targets A and B, but also through its stakes in Companies 1, 2 and 3.

The supervisory authority in the host country (or countries, if there are several UBOs of different nationalities) can then undertake a deeper analysis of this (or these) UBO(s).

What would be the role of IFIs? In the same way that a risk-based approach has facilitated the adoption of transparency standards for banks (the Basel Principles), the adoption of the methodology we propose could constitute the basis for the gradual adoption of an international standard. This would, however, require that organisations interested in international governance and the monitoring of IIFF use it to that end. And so they should, as the methodology is robust and solidly anchored on proven theoretical grounds. It would also be efficient and greatly increase transparency.

Which part of the G20 system could best use the proposed methodology? The main user would be the Financial Stability Board (FSB). In 2011, the G20 called on the FSB to set up a Legal Entity Identifier (LEI), as this would underpin a number of financial stability objectives and benefit the private sector. The Global LEI has been active since 2012 and is supported by regulators across the globe. It has data on “who owns whom”. The system we propose would add a lot of value to that database and, in line with the stated objective of making the LEI a broad public good, would identify UBOs in a scientifically rigorous, robust and user-friendly manner (see LEI 2021). It would also facilitate the work of the Regulatory Oversight Committee (ROC), established in 2020 to coordinate the work of the Global LEI and improve the data (see ROC 2021).

APPENDIX

Why is control not a simple, linear or even continuous function of the percentage of shares held? And why are our proposed indices of control superior to the traditional measures of the Herfindahl family?

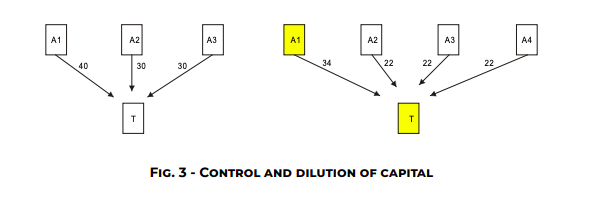

Consider the left-hand exhibit in Figure 3 below. In the Figure, the number on an arrow from (Ai) to T represents the percentage of T’s shares held by (Ai). Does (A1) have more control over T than (A2), as a look at the percentage of shares would suggest? No. A majority requires more than 50%. Thus, even the largest shareholder (A1) requires a collusion with either (A2) or (A3) to ensure a majority. However, any of the smaller shareholders is in exactly the same situation: if (A3) colludes with (A2), they hold a majority. Intuitively (and correctly), the control of each shareholder over T is identical.

- All three indices of control (and the Banzhaf values) are equal to ½. All three shareholders are correctly identified as equal UBOs.

- A Herfindahl-type index would suggest a concentration of control in the hands of (A1) and could be computed as (4/10)² + 2x(3/10)² = 0.34 for example.

Let us now dilute the capital of T as in the right-hand exhibit. We claim that dilution has increased (A1)’s control. Indeed, if (A1) joins forces with any other shareholder, the coalition has a majority. However, the situation is no longer the same for the others: all three would have to join forces to create a coalition with a majority, which is clearly a much more difficult task than it would be for (A1): diluting the capital has increased (A1)’s control over T. Most other indices would overlook this.

- Indices of control would yield 3/4 for (A1) (up from ½) and 1/4 for each of the others. (A1) is correctly identified as the main UBO.

- A Herfindahl-type index would suggest that concentration of control has decreased and this would be misleading. Using the same methodology, it would be computed as (34/100)² + 3x(22/100)² = 0.2608 (< 0.34).

Fig. 3 Control and dilution of capital

It should also be noted that the proposed method is flexible, in that it has many applications beyond the measurement of control. The ability to influence corporate decisions can also be easily built in, e.g. the degree to which shareholders are instrumental in the creation of blocking minorities that can erode the power of a UBO to change voting rights attached to stock, to apply asset restructuring (takeovers, divestitures) and to install anti-takeover devices. Likewise, the impact of shareholders in the creation of supermajorities (of 67% or 75% of the voting rights) may highlight potential problems relating to the expropriation of minority shareholders.

NOTES

1 This does not mean that UBOs are necessarily involved in IIFFs. The point is rather that if the authorities detect a flow of funds that is suspicious between entity A and entity B (whether both based in the same country or not), it is the UBOs of each entity (and they may be the same) that ultimately bear responsibility for this.

2 This is based on work done at HEC, University of Liège, typically using data from LSEG (Refinitiv), processed by a software made available by ZENO-Indices (a FinTech spin-off of HEC Liège). In this (anonymised) example, the data is a real-life selection from Asian countries with a fictional suspicious transfer to illustrate the point.

3 The corporate networks created by so-called “common ownership” may result in value maximisation in one subsidiary to the detriment of another and its non-UBO owners.

4 A similar situation can occur with the issuance of green bonds by one subsidiary to levy capital that will ultimately be used by another, less clean, subsidiary.

5 The “market-based” system of governance can be described by: liquid stock exchanges with many listed firms; largely absent dominant blockholders; and the vast majority of shares held by institutional shareholders who only hold small stakes in individual firms.

6 The EU taxonomy and the Sustainable Finance Disclosure Regulation (SFDR) are aimed at harmonising the indicators to be taken into account when evaluating the sustainable aspect of companies. But so far, only the environmental and part of the social aspects have been finalised. Governance is still under elaboration.

7 Founders of big U.S. tech companies are very aware of this and several have managed to retain a substantial level of control over their company while their percentage of ownership was diluted.

8 The Appendix demonstrates why control is not a simple function of the percentage of shares held and why the measure we propose is superior to those traditionally used that belong to the Herfindahl family.

9 As stated earlier, the ZENO-indices software is also used at HEC Liège to compute the Index of Control in conjunction with LSEG (Refinitiv) data in the context of on-going research on ESG and other related topics.

REFERENCES

Azar J., M.C. Schmalz, and I. Tecu, “Effects of common ownership”, Journal of Finance, vol. 73, 2018, pp. 1513-65

Banzhaf J.F. III, “Weighted voting doesn’t work: a mathematical analysis”, Rutgers Law Review, vol. 19, 1965, pp. 317-43.

Banzhaf J.F. III, “One man – 3,312 votes: a mathematical analysis of the electoral college”, Villanova Law Review, vol. 13, 1968, pp. 304-32

Crama Y. and L. Leruth, “Control and voting power in corporate networks: Concepts and computational aspects”, European Journal of Operational Research, vol. 178, no. 3, 2007, pp. 879-93

Crama Y. and L. Leruth, “Power indices and the measurement of control in corporate structures”, International Game Theory Review, vol. 15, 2013, pp. 134-48

Crama Y., L. Leruth, L. Renneboog, and J.-P. Urbain, “Corporate control concentration measurement and firm performance,” in J.A. Batten and T.A. Feherston (eds), Social Responsibility: Corporate Governance Issues, Oxford, JAI Press, 2003 pp. 123-49

Ginglinger E., C. Hebert, and L. Renneboog, “Are investors aware of ownership connections?”, Paris, Finance Meeting EUROFIDAI – AFFI, 2018 https://papers.ssrn.com/sol3/papers.cfmabstract_id=3184965

International Monetary Fund (IMF), BOP Committee on statistics, Final Report of the Working Group on Balance of Payments Statistics Relevant for the Analysis of Global Value Chains, BOPCOM 19/04, Washington DC, 2019 https://www.imf.org/external/pubs/ft/bop/2019/pdf/19-04.pdf

Khatri Y., L. Leruth, and J. Piece, Corporate Performance and Governance in Malaysia, IMF WP 02/152, International Monetary Fund, Washington DC, 2002

LEI, Introducing the Legal Entity Identifier (LEI), 2021 https://www.gleif.org/en/about-lei/introducing-the-legal-entity-identifier-lei

Perez A. and G. Rodriguez, Monitoring countries’ commitment against illicit financial flows, Policy Brief, Task Force 8 International Financial Architecture, G20/ T20, Saudi Arabia, 2020 https://t20saudiarabia.org.sa/en/briefs/Pages/Policy-Brief.aspx?pb=TF8_PB5

The Regulatory Oversight Committee ROC, 2021 https://www.leiroc.org

Shapley L.S. and M. Shubik, “A method for evaluating the distribution of power in a committee system”, American Political Science Review, vol. 48, no. 3, 1954, pp. 787-92