The financing gap has been a major concern for countries to realise their 2030 Agenda for Sustainable Development even before the coronavirus (COVID-19) pandemic outbreak. Quality infrastructure is needed to accelerate the service provisions in the 2030 Agenda.

Closing the trillion-dollar infrastructure gap and addressing social, environmental and economic priorities will require global policy directives that build on and support local development. Revenue bonds can be used to channel a portion of the tax revenues from infrastructure spillover effects to private investors. Crowdfunding collected from private investors can be a source of financing to small and medium-sized enterprises (SMEs) which will leverage the tax revenue and return to investors in infrastructure. Crowdfunding can be used for local solar power projects and small hydro projects to supply electricity in rural communities. Innovation in government policies to accommodate extreme behavioural changes in the aftermath of the COVID-19 pandemic and the urgent needs for health services, water and sanitation are analysed further in this policy brief.

The policy brief emphasises the financing aspects, and how government policy innovation can meet the urgent needs of financing for infrastructure provision under the Sustainable Development Goals in the aftermath of the pandemic.

Challenge

THE PANDEMIC CRISIS CALLS FOR A NEW GLOBAL INFRASTRUCTURE RATIONALE, AMONG MANY RISKS AND CONSTRAINTS

Repositioning the G20 as a central forum for shaping future infrastructure investments

Prior to the coronavirus (COVID-19) pandemic outbreak, converging estimates from the United Nations, multilateral financial institutions and private accounting and advisory companies warned of systemic finance gaps to realise the 2030 Agenda for Sustainable Development of about $2.5 trillion annually (UNCTAD, 2014; Doumbia and Lauridsen, 2019). Similarly, other studies highlighted trillion-dollar infrastructure finance gaps. Such figures are good indications of the many economic, environmental and social imbalances of the pre-pandemic world, which explain why the pandemic has had so many detrimental consequences on the global economy and growth, posing greater challenges to address global environmental and development goals.

Despite the development of vaccination campaigns, the spread of multiple variants of the initial severe acute respiratory syndrome coronavirus 2 (known as SARS-CoV-2) continues to threaten public health and to mobilise unprecedented amounts of public expenditure in support of social infrastructure, emergency relief, welfare and labour markets. In response to the economic recession generated by the COVID-19 crisis between early 2020 and the first quarter of 2021, the Group of 20 (G20) countries alone have pledged over $11 trillion in support providing immediate relief to companies and households (IMF, 2020). This is about three times more money than during the 2008 global financial crisis, and about 100 times the amount of the Marshall Plan enacted in 1948 for the reconstruction of post-World War II Europe (Steil and Della Rocca, 2018).

Risks of a K-shaped global recovery are real, with a handful of market shareholders gaining a lot from the abundance of liquidities emitted by central banks and by low interest rates, and a vast majority of middle-class and lower-income households exposed to revenue losses and socioeconomic vulnerabilities. Furthermore, the pandemic has also revealed how workers in informal economic sectors were more exposed to contagion risks, in particular in large metropolitan regions.

Therefore, recovery policies should not only target investments supporting a return to “infrastructure for growth” scenarios, but also infrastructure investments with maximised spillover effects and co-benefits on redistribution, social inclusion, access to innovation and digital opportunities. Such co-benefits should also target environmental goals, including carbon neutrality, the circular economy and biodiversity preservation as well as the development of ecosystem services, although their valuation still remains a weak spot (Buchoud et al., 2020; Croci, Lucchitta, and Penati, 2021).

Introducing private finance to support infrastructure investment is even more critical now than before the pandemic outbreak, and the G20 could become instrumental in shaping future directions through a harmonised tax levy on multinational companies, through harmonised carbon pricing and through the assessment of harmonised ecosystem services.

The G20 Finance Track should therefore reposition infrastructure investments among its top priorities in 2021-2022/23 and get beyond a theoretical alignment of global finance and the SDGs as proposed by the Group of Seven.1 Such a strategic repositioning should build on complementarities and convergence between public and private sources of funding for infrastructure, including cities in the equation, as exemplified by climate finance and as prioritised by the G20 through the organisation of a joint summit of environment and energy ministers ahead of the meetings of the conference of the parties on climate and on biodiversity to be held in Rome in October 2021.

Combining Vision and Relevant Tools

For infrastructure investments to effectively support global recovery, we argue it is urgent to revise the long-lived paradigm of infrastructure for growth, one that barely took into account health and social factors, and that valued interconnectivity without evaluating its impacts on the fragmentation of ecosystems. In that perspective, a major challenge that still lies ahead for the G20 and international financial institutions is to manage huge and even enlarged discrepancies between developed and emerging countries on the one hand, and lower-income and developing countries on the other, in particular regarding debt levels and payment.

Without waiting for a great realignment to take place and a comprehensive new global infrastructure doctrine to emerge, it is possible to address many practical issues offering significant leverage potential for sustainable growth, which is the reason for this policy brief.

The crisis has exacerbated challenges that have long been discussed in global infrastructure forums, such as the risks and relatively low rates of return associated with the long life cycle of infrastructure projects. Risks in construction, land acquisition, political change and low user charges have historically limited private sector infrastructure finance, and these have been aggravated by the COVID-19 pandemic. Typical revenue models based on infrastructure user charges which are often too low in developing countries are facing greater scrutiny with the decline in public transport use due to the ongoing health crisis and remote working practices.

Attracting funds for the development of soft infrastructure such as broadband networks, and physical infrastructure projects such as water supply and roads remains of paramount importance in developing countries where infrastructure needs are high, whereas in developed countries the obsolescence of existing assets also calls for massive investments to reinforce the resilience of infrastructure systems. If positive spillover effects of infrastructure into the region were partly returned to infrastructure operators and investors, maintenance and repair costs could be covered despite low user charges.

While we agree that aligning infrastructure and SDG finance could bring significant leverage to support global environmental and social inclusion goals, we believe it is time to move back from “trillions to billions” and target effective drivers for private sector engagement. As large-scale infrastructure packages are being introduced throughout the G20 countries, such as in the European Union and in the United States, we have developed five proposals to maximise their economic, social and environmental leverage and develop bankable infrastructure projects, in particular in lower-income and developing countries.

Proposal

PROPOSAL 1. QUANTIFYING SPILLOVER EFFECTS OF INFRASTRUCTURE PROJECTS TO INCENTIVISE PRIVATE INVESTMENT

The key to achieving SDGs is the availability of infrastructure. However, with the COVID-19 pandemic there is a risk that many infrastructure plans will be postponed due to the diversion of public funds to immediate or short-term economic recovery needs. In this situation, it is important to allocate incentives for private sector investment to ensure the sustainability of the infrastructure projects. Naturally, it will not be possible to source the incentives from existing budget revenues. The incentives should come from the infrastructure project itself, or the positive spillover created by it.

Infrastructure projects create jobs and are a powerful stimulus for social and economic development. According to Castagnino et al. (2020), every $1 billion invested in infrastructure will create at least 10,000 total jobs. In addition, infrastructure investment itself has an annual multiplier effect of 0.4 to 2.2 times in gross domestic product.

Yoshino and Abidhadjaev (2017) measured the economic impact of the Kyushu high-speed railway using the tax revenue of the prefectures affected. The study calculated the tax revenue in three prefecture categories: regions where the construction and operation of the Kyushu railway occurs, adjacent prefectures and prefectures connected to the Kyushu railway via existing railways. They applied a difference-in-difference approach to their analysis by comparing the periods before, during and after construction. They found a significant increase of the tax revenue in the three prefecture categories (by more than 50,000 times). The increase peaked during the construction period, and slightly declined after construction finished (operation phase 1). However, after the railway was connected to the broader railway network (operation phase 2), the tax revenue was even higher than the level in the construction period.

As the spillover effect of infrastructure can be quantified in terms of tax revenue, Yoshino, Hendriyetty and Lakhia (2019) suggested that the increase should be utilised to encourage more private investment in infrastructure and reduce the composition of public finance in infrastructure investment. This concept is a possible solution for countries looking to stabilise their fiscal balance, while meeting their demands for infrastructure provision, especially after the COVID-19 pandemic. To be able to take benefit from this concept, a country needs to have decentralised tax administration. Sectors and types of taxes that will benefit from the infrastrcuture project should be identified in advance. The quantifying and tracking process should be transparent and independent. The process should be conducted by an institution (trust) that represents both sides: private sectors, including investors and construction companies, as well as governments.The mechanism should be supported by a conducive regulatory framework. The G20 can help countries to implement this concept by mandating Multilateral Development Banks to develop guidance to establish the framework.

PROPOSAL 2. ISSUING REVENUE BONDS

Infrastructure projects require a long-term horizon to complete construction and become ready for operation. It also takes time for a project to generate a return and for the economic multiplier to take effect and increase tax revenue. For example, a highway project in Manila took about four years after operation had begun before the net rate of return rose. In the case of the high-speed railway in Japan, the rate of return rose after connectivity with large cities had been completed.

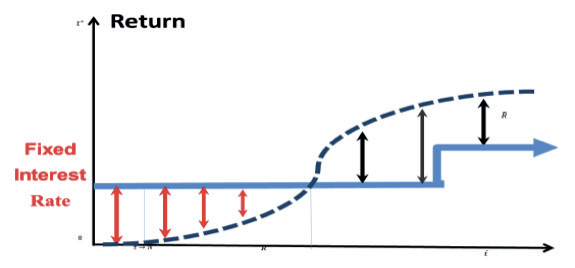

On the other hand, the source of financing in developing countries primarily comes from bank deposits rather than the capital market. These deposits are usually short to medium term in nature. This situation can create a timeline mismatch if the infrastructure investment is financed through bank loans. From the banks’ perspective, long-term loans will expose them to liquidity risk, while from the point of view of project development, borrowing from short-term credit creates a refinancing risk. In this situation, a possible solution could be the use of a revenue bond with a floating yield. This instrument can channel a portion of the tax revenue from infrastructure spillover effects to private investors. Banks, insurance companies, pension funds and other financial institutions that are expected to finance infrastructure projects demand positive and relatively higher rates of return in all stages of the projects. This return can be compensated or subsidised by governments through the increase of spillover tax revenue.

Infrastructure projects usually have low or no rates of return in the beginning stage of development. With that, governments should guarantee minimum returns of the revenue bonds and encourage investors to develop regions alongside infrastructure projects, increasing their rates of return through tax revenues created by infrastructure investment. This model depends on governments’ ability to incentivise business development and micro, small and medium enterprises to drive sustainable urbanisation and industrialisation.

The application of a floating rate to the revenue bond will attract private financing to infrastructure projects. The bond could be issued by either governments or infrastructure companies. The yield of the bond can be adjusted in line with the return from the projects. With this mechanism, governments and infrastructure companies will work together to boost economic development in the region by enhancing the positive spillover effects of the infrastructure project. The more the regional economy develops, the more the positive spillover will increase, and the more tax revenue there will be to further increase the yield of the bond. The government and infrastructure companies will also be motivated to provide SME finance to start-ups and small businesses in the expectation that the spillover tax revenue will increase even faster.

As seen in Figure 1, there is a fixed interest rate as the lowest rate of return of the project. When the return of the project is below the fixed rate, the government is expected to subsidise. To manage the risk, government should be closely involved to assess the risk from the initial stage of the project, including the planning stage. With this mechanism, government can ensure that the project is inclusive and follows environmental, social and governance (ESG) criteria.

Figure 1. Revenue Bond with Floating Rate

Source: Yoshino, Hendriyetty, et al. (2019)

PROPOSAL 3. REBALANCING INFRASTRUCTURE CONNECTIVITY

As explained in Proposal 1, connectivity can enhance the economic and social value created by infrastructure projects. With greater infrastructure connectivity, countries can boost their productivity and growth. However, the COVID-19 crisis has illustrated that trade and infrastructure systems based upon marginal efficiency optimisation are fragile. Besides, higher connectivity in and between regions and cities has exponentially enlarged the environmental impacts of urbanisation and production and distribution systems. Finally, the benefits of higher digital or physical connectivity are rarely evenly distributed.

For infrastructure connectivity to support regional integration and development in the long term, cross-border data management is important and should be aligned with ESG criteria. In many cases, the diversity and competition among different standards makes it difficult for national governments and investors to select the right ones. Therefore, international financial institutions need to cooperate together and with national development banks to issue commonly agreed and well understood new norms.

In the past years, it was argued that infrastructure connectivity can improve supply chain efficiency and increase resilience of the region to natural disasters (GICA, 2018), but infrastructure interconnectivity also matters to avoid the duplication of similar projects or the development of needlessly large infrastructure that wastes financial and natural resources. The interconnectivity between physical, digital, natural and social infrastructure is key to recover from the COVID-19 pandemic crisis, and it requires urgent upgrade of analytical capabilities. This is especially true to build stronger valuation systems of eco-system services and to strengthen the macro-economic foundations of the designated well-being economy.

To build a new sustainable economy, the convergence between multilateral initiatives such as the new G7 Building Back a Better World initiative or the existing Belt and Road Initiative should be explored. As a truly multilateral convening forum, the G20 can leverage effective public and private cooperation to strengthen ESG frameworks. Improving the quality of the infrastructure discussion within the G20 between ministerial working groups and engagement groups is much needed to avoid a situation where new norms created only in developed countries or incubated by multinational engineering and accounting companies would apply unequivocally everywhere.

Refining the Quality Infrastructure Investment (QII) principles and creating corresponding indicators could become the place to build a wider consensus about future environmental and sustainability standards for infrastructure development that 1) build on all forms of infrastructure, 2) take into account people and users’ needs and not only the supply side and 3) balance connectivity with infrastructure socio-economic distribution impacts in support of the local and global achievement and restoration of the 2030 Agenda.

PROPOSAL 4. HOMETOWN INVESTMENT TRUST FUNDS TO PROMOTE SMES AND START-UP BUSINESSES

Governments should think beyond “building infrastructure”. Encouraging businesses to grow in the regions impacted by infrastructure is also important. Business growth will encourage economic activity in the area and inevitably increase tax revenue.

SMEs and start-ups play an important role for economic growth. The dynamics of SMEs and businesses is key to support productivity and growth. SMEs are sources for job creation and innovation, while also raising income levels in the area. Policy support for new market entrants will encourage new business and start-ups and in turn, will cultivate new ideas and innovation around the area.

One of the big challenges that SMEs and start-ups face is the issue of financing. In order to grow, companies and businesses need financial support and typically they seek it from banks. However, the gap is high between the demand and supply of financing. On the demand side, most SMEs and start-ups are inexperienced in seeking and managing funding and bids, and are sceptical of funding instruments, such as equity financing. On the supply side, the primary challenges come from conventional financial institutions’ perception that SMEs and start-ups are high risk due to their small-scale activities, sizable costs in terms of their financing, lack of collateral, and information asymmetries between investors and business owners. Therefore, a coordinated policy approach is needed to support the scaling-up of SMEs and start-ups, especially for businesses that are associated with infrastructure projects. The strategic approach for SMEs and start-ups in the region should be included in the project masterplan.

Crowdfunding for SMEs and start-ups is one option to alleviate the financing gap issue. Based on the crowdfunding financing concept, Yoshino and Kaji (2013) proposed hometown investment trust (HIT) funds a concept similar to crowdfunding introduced in Japan two decades ago to stimulate entrepreneurships. These funds had two primary objectives: 1) to provide finance for start-ups, especially for women who wanted to start their own businesses; and 2) to start Internet-based selling portals where villagers could sell their products to markets outside their villages. Through Internet marketing they were able to capture a large clientele around the country and, thanks to the well-built infrastructure, goods and produce could be dispatched without significant delay. The major advantages of using HIT funds are: 1) the off-balance sheet, 2) risk tolerance, 3) independence (silent partnership), 4) direct participation and 5) the possibility that investors could become consumers (Shiozawa, 2013).

This concept can improve inclusiveness in regions, and due to the nature of SMEs and startups, female participation in labour markets can be encouraged. Hence, HIT funds can help SMEs to start their businesses around highways, railways and other large-scale infrastructure projects, while also helping to move their products conveniently through modern infrastructure.

PROPOSAL 5. LEVYING TAX ON WASTE (SUCH AS CO2 AND NOX) AND PLASTICS

The United Nations (2020) indicated that the world is not on track to achieve the Paris Agreement target at current Nationally Determined Contributions. Greenhouse gas emissions have declined in developed countries (around 6.5 per cent in eight years) but have surged in developing countries (around 43.2 per cent in 13 years). Despite the fact that financing for climate-friendly projects has increased (by 17 per cent), the number has not surpassed the total investment in fossil-fuel-related projects. Therefore, to achieve the Paris Agreement target and true climate resilience, global action should be coordinated and enforced.

Some countries argue that they need more room to grow, despite the compromises they will need to make to their greenhouse-gas-level targets and their reluctance to implement SDG measures such as environmental, social and governance requirements of carbon pricing. The refuted argument proposes that a carbon tax is a better solution because it is set and collected by governments. It is said that the proceeds will remain in the country and can be used to build facilities and infrastructure to achieve other SDG targets (Edenhofer et al., 2017). However, the countries have been hesitant to adopt such policies, fearing a loss of competitiveness and a “race to the bottom” with their neighbours.

This policy brief proposes a uniform tax levy rate for CO2 and NOX emissions, and plastic waste or use. This policy is based on the assumption that investors would prefer to look at two parameters: rate of return and risk, rather than consider the SDGs and environmental components separately. Furthermore, CO2 and NOX emissions and plastic waste are the primary causes of two of the major components of climate change: the increase in ocean temperatures and rising global sea levels. In order to prevent an increase of temperature by 2°C by 2030, levying taxes on waste, such as CO2, NOX, and plastics will be the best option (Yoshino, Taghizadeh-Hesary and Otsuka, 2021).

Consulting companies have created several SDG indicators to meet investors’ demand for optimal asset allocation and diversify their portfolios. Many criteria have been developed to measure the achievement of SDGs. KPMG has examined SDG indicators such as demographics, income growth, technology including renewable energy sources and knowledge sharing cultures, and collaboration among governments, companies, international organisations and academia. The Nomura Research Institute sets four key performance indicators in investigating business activities: innovation, business opportunity, impact and cost. The SDG indicators used by Pricewaterhouse Coopers include leadership (business and financial strategies), employee engagement (awareness and bottom-up initiatives), reporting (risk assessment and management) and collaboration (among suppliers, consumers, governments and nongovernment organisations). This disparate use of the SDG indicator models between consulting firms is not effective in creating a reliable investment environment and is not aligned with investors’ actual interest, i.e., risk and return (Yoshino, Taghizadeh-Hesary and Otsuka, 2021).

To address the tendency of corporate profit shifting to avoid a carbon tax, waste products should be taxed instead. In doing so, optimal portfolio allocation can be achieved. As addressed in Yoshino and Hendriyetty (2020), the two primary reasons for this are: 1) by levying waste such as CO2 and NOX, and plastics with identical mechanisms or at the same rate as they are taxed internationally, investment decisions can be simplified to a conventional examination of risk and rate of return; and 2) regional taxation will lead to optimal asset allocation and achieve sustainable growth. With uniformity in the rate and mechanism, policies can be enforced globally. The revenue from these waste emission levies can then be invested in green sectors of the economy to increase their rate of return, which will attract more private investors to green energy projects.

These arguments are echoed in the recent paper from the IMF authored by Parry, Black and Roaf (2021) proposes the concept of an international carbon price floor (ICPF) to address the carbon emission price dilemma and to avoid unilateral measures by countries through Border Carbon Adjustment. The ICPF concept will narrow the focus of G20 countries to negotiate a price floor and a set of policy actions for countries to apply. Even though this IMF paper does not propose a uniform rate due to equity between countries, competitiveness and country-specific circumstances, the concept somehow has established the basis for further waste emission reduction policy actions.

ACKNOWLEDGMENTS

This policy brief was prepared with the help of Alexander Boden and Derek Hondo, capacity-building and training associates, Asian Development Bank Institute.

NOTES

1 In the last quarter of 2020, the Organization for Economic Co-operation and Development (OECD) and the United Nations Development Programme (UNDP) introduced a proposal to mitigate the pandemic’s impacts by tapping into the “over $379 trillion dollars of assets held by banks, institutional investors and asset managers” to support the SDGs (OECD and UNDP, 2020). However, this new framework remained largely silent regarding infrastructure finance and prioritization in the pandemic context.

REFERENCES

Buchoud, N.J. A. et al. (2020), “Shaping the New Frontiers of Sustainable (Urban) Infrastructure: Reviewing the Long-term Value of Infrastructure Investments and Enabling System Change, in T20 Saudi Arabia, Task Force 3, Infrastructure Investment and Financing, https://www.g20-insights.org/policy_briefs/shaping-the-new-frontiers-of-sustainable-urban-infrastructure-reviewing-the-long-term-value-of-infrastructure-investments-and-enabling-system-change/

Castagnino, S.; S. Subudhi; J. Sogorb; and P. Colomar (2020), The Role of Infrastructure Stimulus in the COVID-19 Recovery and Beyond. 25 September, Boston Consulting Group, https://www.bcg.com/publications/2020/infrastructure-stimulus-in-covid-pandemic-recovery-and-beyond

Croci, E.; B. Lucchitta; and T. Penati (2021), “Valuing Ecosystem Services at the Urban Level: A Critical Review”, in Sustainability, Vol. 13, No. 3, pp. 1-16

Doumbia, D.; and M. Lykke Lauridsen (2019), “Closing the SDG Financing Gap: Trends and Data”, in IFC EM Compass Emerging Markets, https://www.ifc.org/wps/wcm/connect/842b73cc-12b0-4fe2b058-d3ee75f74d06/EMCompass-Note73-Closing-SDGs-Fund-Gap.pdf?MOD=AJPERES&CVID=mSHKl4S

Edenhofer, O.; C. Flachsland; B. Knopf; and U. Kornek (2017), “Carbon Pricing for Climate Change Mitigation and Financing the SDGs”, in G20 Insights, https://www.g20-insights.org/policy_briefs/carbon-pricing-for-climate-change-mitigation-and-financing-the-sdgs/

Global Infrastructure Connectivity Alliance (GICA) (2018), “Why Connectivity Matters”, in GICA Discussion Papers, 10 May, files/Discussion-Paper-Why-Connectivity-Matters-May-10-2018.pdf

International Monetary Fund (IMF) Group of Twenty (2020), G-20 Report on Strong, Sustainable, Growth, November, https://www.imf.org/external/np/g20/pdf/2020/110220.pdf

Organisationation and Development (OECD) and United Nations Development Program (UNDP) Aligned Finance, https://www.oecd.org/development/financing-sustainable-development/Framework-for-SDG-AlignedFinance-OECD-UNDP.pdf

Parry, Ian; Simon Black; and James Roaf (2021), “Proposal for an International Carbon Price Floor among Large Emitters”, in IMF Staff Climate Notes (001), https://www.imf.org/en/Publications/staff-climate-notes/Issues/2021/06/15/Proposalfor-an-International-Carbon-Price-FloorAmong-Large-Emitters-460468

Shiozawa, S. (2013), “Concluding Remarks and the Way Forward”, in N. Yoshino and S. Kaji (eds.), Hometown Investment Trust Funds: A Stable way to Supply Risk Capital, Tokyo, Springer, pp. 85-91

Steil, B.; and B. Della Rocca (2018), “It Takes More Than Money to Make a Marshall Plan”, in Council on International Relations Blog, 9 April. https://www.cfr.org/blog/it-takesmore-money-make-marshall-plan

United Nations Conference in Trade and Development (UNCTAD) (2014), Investing in the SDGs: An Action Plan. World Investment Report, Geneva, UNCTAD

United Nations (2020), The Sustainable Development Goals Report 2020, New York, https://unstats.un.org/sdgs/report/2020/The-Sustainable-Development-Goals-Report-2020.pdf

Yoshino, N.; and U. Abidhadjaev (2017), “Impact of Infrastructure on Tax Revenue: Case Study of High-Speed Train in Japan”, in Journal of Infrastructure, Policy and Development, Vol. 1, No. 2, doi: 10.24294/jipd.v1i2.69

Yoshino, Naoyuki; and Nella Hendriyetty (2020), “Quality Infrastructure Investment in the Face of COVID19 crisis: Sustainability, Profitability, and Demand versus Resilience”, in T20 Saudi Arabia Policy Briefs: Task Force 3 Infrastructure Investment and Financing, https://t20saudiarabia.org.sa/en/briefs/Pages/Policy-Brief.aspx?pb=TF3_PB14

Yoshino, N.; N. Hendriyetty; and S. Lakhia (2019) “Quality Infrastructure Investment: Ways to Increase the Rate of Return for Infrastructure Investments”, in T20 Japan, Task Force 4: Economic Effects of Infrastructure Investment and Its Financing

Yoshino, Naoyuki; Nella Hendriyetty; Saloni Lakhia; and Widya Alwarritzi (2019), “Innovative Financing for City Infrastructure Investment by Increasing the Rate of Return from Spillover Tax Revenues”, in ADBI Working Paper Series (Asian Development Bank Institute), No. 979, https://www.adb.org/publications/innovative-financing-city-infrastructure-investment-spillover-tax-revenues

Yoshino, N.; and S. Kaji (2013), Hometown Investment Trust Funds: A Stable Way to Supply Risk Capital, Tokyo, Springer

Yoshino, N.; F. Taghizadeh-Hesary; and M. Otsuka (2021), “COVID-19 and Optimal Portfolio Selection for Investment in

Sustainable Development Goals”, in Finance Research Letters, Vol. 38, p. 101695, https://www.ncbi.nlm.nih.gov/pmc/articles/PMC7354763/pdf/main.pdf

Yu, H. (2017), “Infrastructure Connectivity and Regional Economic Integration in East Asia: Progress and Challenges”, in Journal of Infrastructure, Policy and Development, Vol. 1, No.1, pp. 44-63