Natural disasters disrupt the financial and economic infrastructure and stability, particularly in small or low-income countries and those concentrated in a single industry. The authors recommend the G20 and broader international community support financial and economic resilience in the face of increasing natural disasters. Critical interventions for support include improved local resilience through early warning and response mechanisms and economic diversification initiatives; rapid stimulation of local businesses in critical industries; and coordination of international financial markets in support of local economies.

Challenge

Vulnerable regions and nations are in a chronic struggle to react to catastrophe while working to build robust economies and financial systems that can absorb future hazards. As natural disasters become more frequent and vulnerable populations grow in high-risk areas, the cost of disaster response and recovery will continue to grow. Hurricanes and tropical storms accounted for 45.2% of total catastrophe losses between 1990 and 2009, and it is likely that climate change will increase the occurrence and intensity of such natural disasters in the future[1].

The G20 is called upon, in collaboration with multilateral development banks (MDBs), to support the following interventions through advocacy, financial support, and technical assistance:

I. Build local resilience to reduce economic impact

II. Stimulate local economies and markets post disaster

III. Stimulate international financial markets to support national/local governments through coordinated donor aid and financing mechanisms

IV. Increase local and international private sector contribution in disaster preparedness and recovery.

[1] PricewaterhouseCoopers (2012): “Insurance 2020: Turning change into opportunity”: https://www.pwc.com/gx/en/insurance/pdf/insurance-2020-turning-change-into-opportunity.pdf. Accessed 4/22/2018.

Proposal

I. Build local resilience to reduce economic impact

Disruption from disasters is devastating to local economies. Direct impacts such as loss of life and infrastructure repair can be quantifiable. For example, global insurance group Swiss Re estimated total economic losses from disasters in 2017 to be US$306 billion, a significant increase over the 2016 estimate of US$190 billion, and the 10-year average of US$188 billion.[1] In addition to these costs, communities experience displacement of citizens and businesses as well as setbacks in in the areas of environmental protections, health, education, and poverty reduction. Therefore, as the frequency and intensity of disasters increase, the international community should support communities in improving planning and preparedness to reduce impact and build back better to mitigate future risk.

A. Improve planning and preparedness to reduce impact

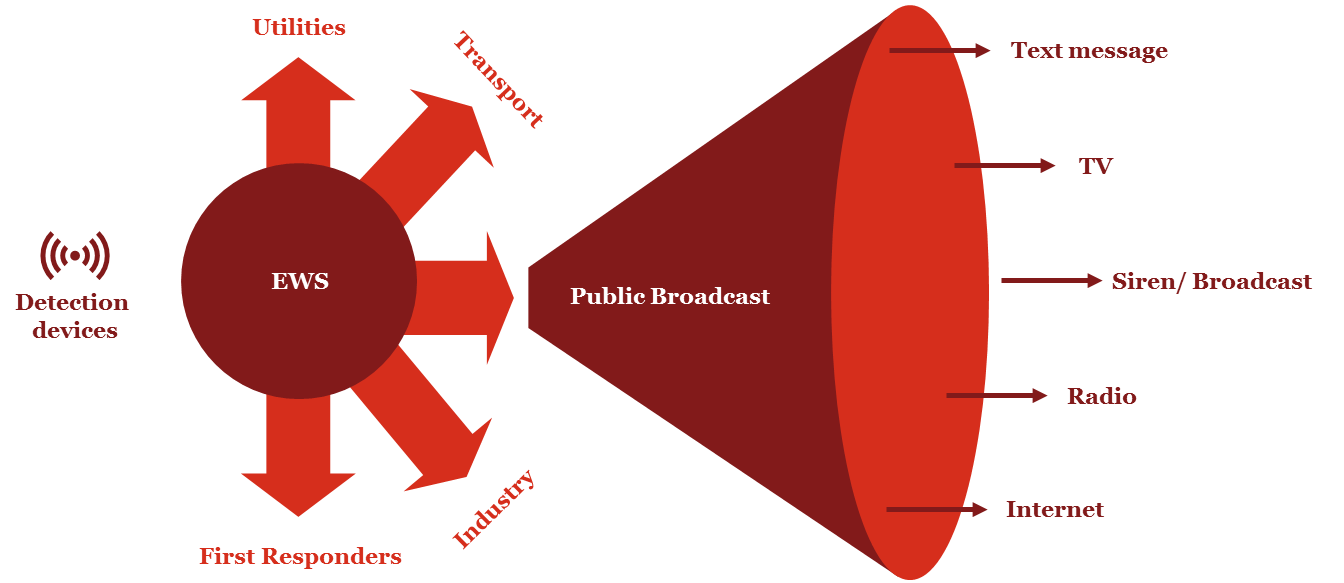

State-of-the-art detection technology and early warning systems (EWS) are critical disaster preparedness investments, benefiting the entire population. However, countries must work to ensure warnings and subsequent instructions reach affected populations in a manner that incites action. To accomplish this, it is important to link early warning systems to community-based education programmes and leverage information and communication technology (ICT) to coordinate emergency response.

| Figure 1: Japan’s EWS technology

|

Examples can be seen in disaster-prone Japan and Nepal, economically diverse countries who are both investing in systems. [2] Japan’s top-ranked system detects tremors via its network of seismic detection devices, calculates the epicenter and likely impact, and automatically broadcasts warnings through multiple channels (television, radio, internet, cellphone). The official national system operates in parallel with several EWS run by private companies and offices.[3] Japan’s system is effective at saving lives in part due to high level of citizen knowledge, engagement, readiness, and compliance with the emergency response protocols. Government-mandated earthquake safety training is reinforced with drills and public relationship (PR) campaigns. Access to information technology is ubiquitous, which allows for faster, more consistent dissemination and reinforcement of emergency plans and procedures. Nepal is much earlier on the journey to a robust EWS and is progressing at a less centralised level.

In addition to EWS, technology should be employed to coordinate communications throughout and immediately following disasters. India’s Aadhaar digital identification platform, for example, assigns each citizen a unique, 12-digit ID that can be authenticated online using demographic or biometric data. Following severe floods, Aadhaar has been used to track distribution of relief materials and to help people access their bank accounts if they have lost their personal identification cards and bankcards.[4] More broadly, the UN Refugee Agency (UNHCR) is now using a global biometric identification platform[5] and disaster vulnerable countries such as Jamaica are planning to implement a national identification system. These investments improve critical communication channels during disaster response efforts.

B. “Build back better” to mitigate future risk

The international community has recognised the need to rebuild in a manner that considers resiliency and sustainability. Designing economies that are more resilient could reduce the significant financial and social burden in recovery. However, the financing and technical assistance gaps are significant and require support from MDBs and the donor community.

Local governments find it difficult to arrest the cycle of business closures, unemployment, and mass displacement that follows a catastrophic event. Puerto Rico for example, which was battered by both Hurricane Harvey and Hurricane Maria in 2017, continues to suffer the economic effects of having over 135,000 citizens relocate to mainland USA.[6] According to the Economic Development Bank of Puerto Rico, economic activity on the island declined by more than 20% in the first three months following the hurricane.[7] Therefore, building diversification into economies so they can withstand the shock of a major disaster is critical in building for resilience. At the country level, this may mean working to attract alternative sectors such as technology and financial services companies and investing in comprehensive “skills for the future” educational programmes to upskill the workforce. At a business level, this may mean developing export markets and building online sales channels to spread the market risk.

Following Hurricane Maria in 2017, the Prime Minister of Dominica committed to build the first 100% climate-resilient nation and established an executive agency to plan and lead the rebuilding of physical infrastructure and implement climate resilient systems within the country’s productive sectors.[8] Building costs are estimated at 230% of the country’s GDP, making funding the first objective. To date, Dominica has received pledges totaling approximately US$300 million in funding from MDBs and bilateral donors. The wider Caribbean raised over US$1.3 billion in pledges and US$1 billion in loans and debt relief at the CARICOM-UN high-level pledging conference in November 2017.[9] These funds should be deployed to relief efforts but also used as a catalyst to attract private sector investment and promote stability across impacted economies to drive stability and resiliency.

II. Stimulate local economies and markets post disaster

Economic resilience is typically most critical at the local level. The G20 should call the MDBs and private sector to action in building sustainable local economic infrastructure to survive and rebound quickly during and after natural disasters.

Build local capacity to adapt to disaster

As noted, part of early economic stimulation relies upon a resilient economic structure. Other interventions can be considered ex post depending on level of devastation.

Diverse economies must be considered prior to disaster to aid early economic stimulation, as they are typically less vulnerable to economic disruption when compared to those with one or two large industries.[10]Additionally and as revealed through studies of post-disaster business recovery, businesses with multiple locations and those in good financial health have capacity to absorb losses and recover quicker. Finally, businesses with diversified or redundant supply chains can circumvent supply chain disruptions, and those with multiple revenue sources and distribution channels (e.g. internet) will fare better.[11]

In the wake of disaster, businesses can continue production with fewer inputs by making use of inventories or excess capacity. They can find substitutions for inputs to reduce the cost of materials in short supply, offer overtime to compensate for lost production, or reschedule production based on capacity and demand requirements. Disasters also present an opportunity to re-evaluate unprofitable segments of their business or invest in new technologies. Cost savings or new revenue sources created from these adaptations result in a recoup of economic losses via increased profitability.[12]

To address employee displacement after major disasters, the US, New Zealand, Australia, Indonesia, China, and Japan – through the public sector or in cooperation with private companies – directed funds to re-employment assistance. Some of these programmes focused specifically to bridge the gap between job openings and displaced workers’ skills. Programmes in Japan created after the Great East Japan Earthquake in 2011, for example, supported approximately 580,000 jobs. [13]

Perhaps one of the most grassroots methods for speedy economic recovery is that of mutual assistance among residents and businesses. After Hurricane Katrina in New Orleans, residents traded skills and materials, while businesses provided low interest credit or free supplies to other businesses, knowing that their simultaneous recovery would expedite the return of residents.[14]

Enable rapid payment mechanisms for recovery funding and insurance claims

Still, early economic stimulation cannot be fully realised without efficient payment mechanisms to finance recovery. Innovative technological advancements such as blockchain and biometric authentication provide an opportunity to increase disbursement speed without increasing the risk of corruption or transparency.

An opportunity exists to integrate blockchain technology, for example, with insurance, an oft-cited mechanism for quick disaster recovery. Insurance payments could come in the form of smart contracts, “which are small programmes running on a blockchain and initiating certain actions when predefined conditions are met”.[15] Much the same way that catastrophe bonds are triggered when specific catastrophic conditions are met, parametric insurance policies distribute payments to policy holders based on pre-set parameters “like wind speed or rainfall”.[16] Smart contracts can monitor “verified climate/weather databases” [17] and automate secure payments when these parameters are reached. Using blockchain to store contract documentation[18] could also eliminate the need for paper documentation, frequently destroyed or lost in a disaster. Finally, blockchain technology lowers handling costs and reduces fraud, while smart contracts can enforce predefined contract terms, like withholding payment unless disaster repairs are carried out by preferred repair shops.[19]

Equitable, speedy delivery of post-disaster goods or financing could also be expedited using biometric data. Recipients could verify themselves using retina scanning or fingerprint technology, eliminating duplicate distributions. India’s Aadhaar system, described above, collects biometric markers and links the information to documentation (birth certificates, tax filings) and transactional data. In the immediate aftermath of natural disaster, public institutions could distribute funds to verified bank accounts, and lenders can use money saved on validation procedures to extend additional liquidity.

Biometric authentication systems, however, carry known privacy concerns, requires a functioning internet infrastructure, which may be unavailable post-disaster. Furthermore, vulnerable populations like the elderly and disabled have lost benefits because they cannot walk to distribution sites, and there are documented cases of manual laborers whose weathered fingerprints will not scan.[20] These risks and limitations make back up processing mechanism crucial to ensure inclusion of the full population.

Consider policy shifts to enable rapid recovery

Local governments play a significant role by creating an environment to allow for early economic stimulation. Public sector leaders should consider providing streamlined regulatory requirements and procedures in post-disaster recovery environments, supporting subsidised small business grant or loan programmes, and evaluating financial incentive structures.

In the wake of disaster, governments can activate emergency policies and procedures to empower local actors to engage in rapid recovery efforts. Processing times around procurement selection and new construction licenses can be accelerated to reduce the time required by businesses and individuals to begin recovery. At present, many cities have onerous construction permitting requirements, significantly increasing the time businesses remain closed resulting in citizens being out of work longer and lacking access to critical supplies.

In addition to streamlined policies, researchers found evidence that grants provided to microenterprises did increase recovery speed post-disaster, the most successful cases found in the retail sector. Countries should therefore explore targeting specific industries with post-disaster grants, particularly to small companies that act as key support structures for local communities.[21]

Finally, moderate price ceilings may be considered to protect disaster victims in immediate response efforts but should be tempered by the risks of encouraging hoarding and dis-incenting businesses from sourcing additional supplies.[22] Price ceilings, if too low, may also discourage businesses from working creatively to bring resources to difficult-to reach-disaster zones because the “profit-seeking motive” is removed.[23]

III. Stimulate international financial markets to support national/local governments through coordinated donor aid coordination and financing mechanisms

In recent years, many international donors have expressed interest in providing funding for humanitarian preparedness and response efforts. To optimise the adoption and use of these funds, specific operational and financial challenges must be addressed with solutions championed by the international community. Operationally, governments often find the requirements of coordinating different donor disbursement criteria, monitoring policies, and reporting requirements too onerous for their limited capacity recovery teams. Financially, a number of factors contribute to prohibitive cost. First, public expenditure reviews and fiduciary risk analyses combined create high transaction costs[24]. Next, the concept of “tied aid” designed to reduce programmatic and fiduciary risk may require the provision of high cost international goods and supplies if low cost local alternatives do not meet specific requirements. Finally, once projects are complete, they may not be maintained if ongoing costs are not considered in the initial funding package.

Improve cost structure, coordination, and agility in donor financing

Recognising some donor and MDB requirements cannot be compromised, increased flexibility should be considered in financing for humanitarian response to reduce cost and increase efficiency. Key considerations for donors and local governments include those detailed in Figure 2.

Figure 2: Key principles for effective aid coordination at local government levels

Capacity issues of local governments may pose a serious constraint when it comes to taking ownership of aid coordination efforts and driving the agenda. In such a situation, donors should consider complementing the activities of local governments by placing trusted advisors at their disposal. Advisors can be embedded in key departments of the local government, providing support to the government functionaries in designing and coordinating the appropriate responses while building sustainable capacity.

Implement alternative resilient financing approaches

Alternative approaches to donor aid financing must be embedded in resilience programmes. While the official aid should continue to play a key role, some alternative mechanisms are proposed that will allow for donors to increase the potential for private financing options detailed in Section IV while enabling governments increased access. Alternative approaches can include establishing emergency financing reserves, designing forecast-based financing instruments, increasing the use of de-risking mechanisms, and authorising concessional financing for resilience programmes.

Establishing emergency financing reserves: MDBs and other donors should increase the use of emergency financing reserves for vulnerable partner countries with formalised draw down procedures. In the event of a natural disaster, partner country should be able to use these funds disaster relief that will help to cut down the lead-time for response. Periodic review arrangements between the donors and the partner country can be instituted to oversee the functioning of this account.

Designing forecast-based financing instruments: Forecast-based financing is an innovative mode of financing disasters that has recently gained traction. In this mode of financing, aid providers, local communities/ local governments, and the meteorological services come together to agree on specific funds which are activated whenever predictions from the meteorological station crosses a particular threshold. Financing is automatically disbursed once meteorological predictions reaches that threshold[25]. SOP are also in place to detail the mechanism for disbursement of funds in such situations. Germany, for example, has employed this type of instrument in its partnership with International Federation of the Red Cross and Red Crescent Societies.

Increasing the use of de-risking mechanisms: MDBs play a critical role in de-risking resilience and recovery financing to increase bankability by the private sector. In addition to standard loan guarantees and political risk insurance, there are various products including catastrophe insurance pools, weather derivatives, index based insurance etc., which can help developing nations to de-risk natural disaster and resilience spend. These instruments can be paired with technical assistance facilities for capacity building and institutional strengthening of partner institutions in recipient countries.

Authorising concessional financing for resilience programmes: Mechanisms can be established by MDBs for governments in vulnerable regions to provide reduced rate loans and grants for resilience financing. Concessional financing can incent resource-constrained countries to invest in resilience at a low cost to reduce potential recovery costs.

IV. Bring local and international private sector contribution and support into disaster preparedness and recovery

Adopt a private sector-led coordination framework

Private sector support is necessary to drive economic resilience and rapid recovery. Private sector stakeholders can provide much-needed financing, innovation, and rapid mobility. However, at present the private sector faces multiple limiting factors in identifying a meaningful role before, during, and after a natural disaster strikes. A UN International Strategy for Disaster Reduction (UNISDR) report found that companies generally recognise the value of collaboration, want to collaborate, but existing collaboration initiatives are “isolated, insufficient and only at early stages of development.” [26] Private sector financing often suffers due to the lack of visibility to a bankable pipeline of resilience projects. Additionally, when working across municipalities, regions, or multiple countries, the private sector often struggles to interpret complex government processes, communication methods, and procurement policies.[27]

Examples of private sector-led mechanisms exist and should be studied to identify best practices. In 2009 large private and non-profit organisations formed an entity in the Philippines to work directly with the government’s commission on disaster management. This group is able to focus private sector engagement on specific efforts, such as working with banks to identify innovative financing for small businesses impacted by devastating floods. Based on previous success, it recently launched the world’s first private sector-run national emergency operations center. [28]

Based on tangible success, the international community should collaborate to develop an overarching framework specifically for private sector engagement in resilience and recovery. This framework should encourage private sector leadership in coordination efforts, integrate local, regional, and international private sector actors, promote mechanisms that build resilience investment and planning into existing activities, and provide guidelines for private sector investment opportunities.

The United Nation’s Sendai Framework for Disaster Risk Reduction 2015-2030 provides the broad context for the existing coordination environment. Additionally, the United Nations has a series of coordinating mechanisms to enable UN bodies and other humanitarian organisations to work effectively with national governments when responding to a disaster. Through its Connecting Business initiative (CBi), the UN is able to tap into a broad network of private sector actors to support response and resilience efforts. UNISDR developed a Disaster Risk Management Framework (DRM-F), which focuses on creating a common understanding of disaster risk management across industries and sectors and to formalise knowledge capture. Likewise, at the national and subnational levels, governments have organised committees and networks to coordinate actors. [29] However, most mechanisms have not consistently integrated private sector representation at all these levels (local, national, multinational).

While the recently released UN Office for the Coordination of Humanitarian Affairs (UNOCHA) Playbook serves as a solid foundation for lessons learned and best practices of integrating private sector in crisis management, a robust framework building on these existing efforts should be considered for private sector-led coordination efforts.

Enable local, regional, and international integration and coordination

The link between multinational and large national businesses and their local private sector counterparts needs to be strengthened[30] in order to increase economic resilience, especially within emerging economies. This should be complemented by strong collaboration across the private and public sectors, including the donor community.

Multinational and national private sector leaders should work through local chambers of commerce, industry associations, and networks to identify and make connections with local business partners. Often those on the ground have a better sense of what is needed and are most willing to help during times of uncertainty. For example, local financial institutions that have ties to an affected community are more likely to lend to those local businesses after a devastating natural disaster than financial institutions without local ties. [31] Incorporating local financial institutions into disaster risk planning and connecting them with multinational and national companies for capacity building support may prove an effective way to enable quick and responsive financial services for affected local enterprises in a disaster.

Collaboration across sectors can take multiple forms. Examples of such forms include the following:

- Broadly defined Public-Private Partnerships (PPPs) or a network of PPPs that establish pre-determined protocols, communication channels, and roles in the event of a disaster and enables risk sharing. In the wake of the 2004 tsunami and earthquake in Asia, the companies with pre-existing relationships and partnerships provided the most coordinated and effective response efforts[32]. Encouraging a coordinated network of PPPs will enable more companies to help when the time comes. These PPPs should be designed to quick scale, focus efforts, and have multiple ways to respond in order to ensure flexibility and effectiveness.

- Procurement processes for infrastructure and finance should be jointly developed to incorporate disaster risk management and response protocols. This could include outlining clear processes, roles, as well as financing schemes and obligations across a variety of disaster types [33] and should encourage standard best practices and expectation setting in procurement across all levels of government and across governments to reduce the risk and burden on private sector investors.

Increase the use of innovate private sector financing

The private sector’s role in building resilience and preparedness should include driving innovative financing mechanisms. For instance, traditional financial tools often require time to process. In the aftermath of a natural disaster, time is of the essence and financial tools available to local businesses trying to recover must be nimble and responsive. Innovative and adaptive financial tools to support infrastructure resilience and recovery are perhaps the clearest immediate area for the private sector to play a role, particularly in the case of financial institutions. Figure 8 below outlines some of the innovative financing tools available today.

| Figure 3. Innovative Solutions for Disaster Risk Financing Mobile money. As access to mobile phones in emerging markets becomes pervasive and outpaces access to traditional banking,[37] authorities will need to incorporate mobile money tools as part of the broader arsenal of natural disaster response strategies. There is an opportunity to gain synergy through partnership; telecom and banking communities should continue to work together to identify the best methods for reaching vulnerable businesses and communities. Peer-to-peer lending. Peer-to-peer lending takes the intermediary out of lending process and could serve an important role in bridging the financing gap for micro, small, and medium enterprises. Crowdfunding. A tool used to pull in individual and small-scale funders as well as larger ones; crowdfunding has been used successfully to finance many efforts and can be scalable. In order to realise economies of scale and strategic investment in response efforts, crowdfunding should be coordinated and focused. Blockchain-enabled tools. As discussed in Section III, blockchain has the power to render traditional and newer financing mechanisms less risky by adding a level of transparency and traceability that is key in times when funding must flow quickly and in different directions. A framework to guide the infusion of blockchain into disaster response financing would enable controlled progress. Adaptive financing. Traditional financing instruments are often slow and inflexible, therefore difficult to work within times of crisis. Financial institutions should identify more flexible terms and conditions that could quickly adapt when situations shift. Pre-negotiated terms that are tapped once disaster strikes and based on damage levels can help small businesses to gain access to their financing faster.[38] Micro-insurers. Micro-insurers serve local enterprises and individuals who may not have access to quick forms of liquidity or financing. These schemes transfer disaster risk for low-income and informal businesses and individuals. Micro-insurance payouts can represent the first wave of financing reaching vulnerable businesses. However, poorly designed schemes can also results in high premiums and overburden the populations they are meant to benefit.[39] Thus, the larger international community should play a role in developing these best practices. |

II. Conclusion

Through supporting the interventions discussed above, the G20 can play a pivotal role in increasing economic resilience and recovery for disaster prone and vulnerable countries. Ultimately, it can help to achieve the goals of establishing resilience as an inclusive strategy covering the lifecycle of events, ranging from prevent and protect, to respond and recover in the face of disasters.

[1] https://www.swissre.com/media/news_releases/nr20171220_sigma_estimates.html. December 2017. Accessed 4/13/2018. Disasters include extreme weather events (hurricanes, cyclones, thunderstorms) which cause wind damage and flooding, drought which leads to wildfires and crop failure, earthquakes, explosions, oil fires and spills. Loss of life: over 11,000 people in 2017. Loss of inputs (natural resources, power, buildings, equipment, communications, transport).

[2] IMF World Economic Outlook Database. April 2018. GDP per capita 2017: Japan $39,013.81 vs Nepal $2,440.15.

[3] Source: Japan Meteorological Agency website (https://www.jma.go.jp/jma/en/Activities/eew2.html). Accessed 4/13/2018. Note that content has been edited for use in this paper.

Source: Kafle SK. 2017. Disaster Early Warning Systems in Nepal: Institutional and Operational Frameworks. Journal of Geography & Natural Disasters 7: 196. doi: 10.4172/2167-0587.1000196

[4] Source: Unique Identification Authority of India website. (https://www.uidai.gov.in/your-aadhaar/about-aadhaar.html). Accessed 3/22/2018.

[5] Source: UNHCR website (https://www.unhcr.org/en-us/news/latest/2018/3/5a9959444/uganda-launches-major-refugee-verification-operation.html?query=biometric%20identification). Accessed 3/22/2018.

[6] Source: Centro, Centre for Puerto Rican Studies. March 2018. Puerto Rico Post Maria Report. (https://centropr.hunter.cuny.edu/sites/default/files/PDF/puerto_rico_post_maria-2018-final.pdf). Accessed 4/13/2018.

[7] Source: Economic Development Bank of Puerto Rico. Economic Activity Index. April 2018. (https://www.bde.pr.gov/).

[8] https://resilientcaribbean.caricom.org/documents/rebuilding-dominica-as-a-climate-resilient-nation-the-climate-resilient-execution-agency-for-dominica-cread-proposal-from-the-government-of-the-commonwealth-of-dominica/. Accessed 3/22/2018.

[9] Source: UNDP website (https://www.undp.org/content/undp/en/home/news-centre/news/2017/Caribbean-can-only-build-back-better-with-international-support-and-urgent-climate-action.html). Accessed 3/22/2018

[10] Xiao, Yu, and Joshua Drucker. Spring 2013. Does Economic Diversity Enhance Regional Disaster Resilience? Chicago, IL: Journal of the American Planning Association

[11] Stevenson, Joanne, Ilan Noy, Garry McDonald, Erica Seville, and John Vargo. July 2016. Economic and Business Recovery. USA. Oxford Research Encyclopedia of Natural Hazard Science

[12] Stevenson, Joanne, Ilan Noy, Garry McDonald, Erica Seville, and John Vargo. July 2016. Economic and Business Recovery. USA. Oxford Research Encyclopedia of Natural Hazard Science

[13] Stevenson, Joanne, Ilan Noy, Garry McDonald, Erica Seville, and John Vargo. July 2016. Economic and Business Recovery. USA. Oxford Research Encyclopedia of Natural Hazard Science

[14] Boettke, Peter J., and Daniel J. Smith. 2010. Private Solutions to Public Disasters, Self-Reliance and Social Resilience. Kalamazoo, MI: The Economics of Natural and Unnatural Disasters by William Kern

[15] Lorenz, Johannes-Tobias, Björn Münstermann, Matt Higginson, Peter Braad Olesen, Nina Bohlken, and Valentino Ricciardi. July 2016. Blockchain in insurance – opportunity or threat? McKinsey & Company

[16] Talbot, Theodore and Owen Barder. July 2016. Payouts for Perils: Why Disaster Aid Is Broken, and How Catastrophe Insurance Can Help to Fix It. Washington, DC: Center for Global Development

[17] Lorenz, Johannes-Tobias, Björn Münstermann, Matt Higginson, Peter Braad Olesen, Nina Bohlken, and Valentino Ricciardi. July 2016. Blockchain in insurance – opportunity or threat? McKinsey & Company

[18] Mainelli, Michael and Bernard Manson. July 2016. Chain Reaction: How Blockchain Technology Might Transform Wholesale Insurance. London, UK: A Long Finance report prepared by Z/Yen Group.

[19] Lorenz, Johannes-Tobias, Björn Münstermann, Matt Higginson, Peter Braad Olesen, Nina Bohlken, and Valentino Ricciardi. July 2016. Blockchain in insurance – opportunity or threat? McKinsey & Company

[20] Kolachalam, Namrata. September 5, 2017. The Privacy Battle Over the World’s Largest Biometric Database. USA: The Atlantic

[21] Stevenson, Joanne, Ilan Noy, Garry McDonald, Erica Seville, and John Vargo. July 2016. Economic and Business Recovery. USA. Oxford Research Encyclopedia of Natural Hazard Science

[22] Mohammed, Rafi. July 23, 2013. The Problem with Price Gouging Laws. Harvard Business Review.

[23] Boettke, Peter J., and Daniel J. Smith. 2010. Private Solutions to Public Disasters, Self-Reliance and Social Resilience. Kalamazoo, MI: The Economics of Natural and Unnatural Disasters by William Kern

[24] Bigsten A ( 2006): “Donor coordination and uses of aid” https://gupea.ub.gu.se/bitstream/2077/2723/1/gunwpe0196.pdf accessed on 10/4/2018 and OECD. 2003. Harmonizing Donor Practices for Effective Aid Delivery. Paris: OECD

[25] Kellett, J and Caravani, A (2013): “Financing Disaster Risk Reduction; A 20 year story of international aid” ODI and the Global Facility for Disaster Reduction at the World Bank report,2013 https://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/8574.pdf accessed on 8/4/2018

[26] PricewaterhouseCoopers (2013): “Working together to reduce disaster risk.” https://www.pwc.com/gx/en/governance-risk-compliance-consulting-services/resilience/publications/pdfs/pwc-unisdr-report.pdf. Accessed 4/33/2018.

[27] National Research Council (2010): “Private-Public Sector Collaboration to Enhance Community Disaster Resilience: A Workshop Report”: Washington, DC: The National Academies Press.https://www.nap.edu/read/12864/chapter/5#45. Accessed 4/22/2018

[28] Philippine Disaster Resilience Foundation (2018): “PDRF inaugurates world’s first private sector-led national emergency operations center”: https://www.pdrf.org/media/newsroom/pdrf-inaugurates-worlds-first-private-sector-led-national-emergency-operations-center/. Accessed 4/22/2018.

[29] UNOCHA. https://interactive.unocha.org/publication/asiadisasterresponse/InternationalHumanitarianArchitecture.html#InternationalCoordinationMechanisms. Accessed 4/22/2018.

[30] Zyck, Steven and Randolph Kent (2014): “ Humanitarian crisis, emergency preparedness and response: the role of business and the private sector”: https://www.odi.org/sites/odi.org.uk/files/odi-assets/publications-opinion-files/9078.pdf. Accessed 4/22/2018.

[31] Koetter, Michael and Feliz Noth and Oliver Rehbein (2016): “Borrowers under water! Rare disasters, regional banks, and recovery lending”: https://www.aeaweb.org/conference/2017/preliminary/paper/7KeBSKHA. Accessed 4/22/2018

[32] Thomas, Anisya and Lynn Fritz (2006): “Disaster Relief Inc.”: https://hbr.org/2006/11/disaster-relief-inc. Accessed 4/22/2018

[33] World Bank Tokyo Disaster Risk Management Hub (2017): “Resilient Infrastructure PPPs. Contracts and Procurement: The Case of Japan” Solution Brief: https://www.gfdrr.org/sites/default/files/publication/PPP_Solutions%20Brief%20Japan%20Case%20Study_20171222%20FINAL.PDF. Accessed 4/22/2018.

[34] World Bank Group. “World Development Indicators”: https://databank.worldbank.org/data/reports.aspx?Id=5494af8e&Report_Name=Mobile-penetration-. Accessed 4/22/2018.

[35] Hammett, Laura M. and Katy Mixter (2017): “Adaptive Finance to Support Post-Disaster Recovery”: https://cbey.yale.edu/sites/default/files/CBEY_AdaptiveFinancing_Oct2017.pdf. Accessed 4/22/2018.

[36] Ali, Arshad, and Asad Mahmood and Shahnila Gul (2014): ‘Effectiveness of microinsurance during and after a disaster”: ttp://jnrd.info/2014/12/10-5027jnrd-v4i0-12/. Accessed 4/22/2018.

[37] World Bank Group. “World Development Indicators”: https://databank.worldbank.org/data/reports.aspx?Id=5494af8e&Report_Name=Mobile-penetration-. Accessed 4/22/2018.

[38] Hammett, Laura M. and Katy Mixter (2017): “Adaptive Finance to Support Post-Disaster Recovery”: https://cbey.yale.edu/sites/default/files/CBEY_AdaptiveFinancing_Oct2017.pdf. Accessed 4/22/2018.

[39] Ali, Arshad, and Asad Mahmood and Shahnila Gul (2014): ‘Effectiveness of microinsurance during and after a disaster”: ttp://jnrd.info/2014/12/10-5027jnrd-v4i0-12/. Accessed 4/22/2018.