In response to the COVID-19 global pandemic, G20 member nations have pledged to do “whatever it takes.” It is imperative that this pledge includes the deployment of sustainable infrastructure investment and financing policies that harness technology and innovation (G20 2020). This policy brief identifies the ways the G20 can leverage innovation to implement sustainable infrastructure investment and financing policies globally by using existing technologies and case studies. Policy and regulation should incentivize the use of sustainable financing, as well as advanced technologies.

Challenge

The world faces an intensifying urgency to reduce carbon emissions while continuing to expand the infrastructure due to the growing global population. In some cases, this means updating bridges, roads, ports, sewer systems, power plants, and power supplies. In others it means building new large-scale cities with supportive social infrastructure from scratch. To achieve global infrastructure sustainability, policy makers will need to leverage experts from a wide variety of sectors—from financial and frontier technology services to urban planning—to implement the changes needed to scale sustainable infrastructure projects at an impactful level. The demands of sustainable global infrastructure reinforce and unite almost all the UN Sustainable Development Goals: from clean energy, clean water and sanitation, and zero hunger to no poverty and life on land. Sustainable infrastructure should therefore be a priority in any country’s development planning, both in the short and long term.

COVID-19 has further demonstrated the need for systemic change. Experts predict that pandemics will occur with increased frequency in the future, as human population growth and development will encroach further on ecological systems. This will result in the increased presence of zoological diseases (Saijel 2020). Combined with the expectation that climate change will force the mass migration of human populations, it becomes imperative that new infrastructure projects are fully sustainable. Therefore, what we build next must protect human lives, as well as the health of our planet. As national economies look for ways to rebuild, sustainable infrastructure investment and financing provide a roadmap for recovery that can both act as a stimulus and as preparation for the future.

COVID-19 has had a disastrous impact on countries’ real economies, global markets, and, most importantly, the health of humans worldwide. Multilateralism is therefore more important now than ever. The G20 coordinated macroeconomic policies following the 2008 global financial crisis. The world again looks to the G20 to provide a coordinated policy response and support capital enhancements for action programs and the operationalization of initiatives. If the G20 is able to implement sustainability as the founding principle for all policy and financial responses, the world will be able to make significant steps toward a full recovery from COVID-19. This will also prepare us for the impending threat of climate change. COVID-19 has reminded us of the fragility of our global systems but, more importantly, the fragility of human life and the associated costs of decades of inaction. The G20 should heed the occasion to implement a coordinated response that addresses both COVID-19 and climate change. The world would welcome such leadership.

Proposal

While the G20 has long discussed the need for member nations to prepare for the realities of climate change, 2020 has been a wakeup call that not enough is being done. The COVID-19 pandemic’s shock to the real economy serves as a warning of how fundamental fragilities and structural weaknesses could be disrupted by the effects of climate change in the coming years. To prepare for this reality, sustainability must be integrated into infrastructure policies. G20 leaders should heed the opportunity by determining global guidelines for sustainability and task relevant bodies to study and work on policy implementation.

In the world of asset management, infrastructure is considered a long-term investment, which is expected to provide income and/or returns over 30 years. Given that the planet now only has 30 years to meet the emissions reduction goals set by the Paris Agreement in 2015, it would be dangerous to allow for new infrastructure investment without sustainability considerations. According to the World Bank, 70% of global greenhouse gas emissions come from infrastructure construction and operations, such as power plants, buildings, and transport (Deblina and Modi 2017, 4). Sustainable infrastructure investment and financing is thus critical to keep the warming of the planet below 1.5 ºC. Additionally, future climate patterns will only increase in unpredictability. Infrastructure resilience that enhances adaptation and mitigation through sustainability is equally important to implement.[1]

In the face of the global pandemic and the ensuing economic recession and financial crisis, G20 member nations should have the ability to prioritize a sustainable infrastructure agenda, having pledged USD 5 trillion to support the global recovery. Sustainable infrastructure investment and financing will have positive stimulatory effects, including job creation, improved economic efficiency and trade, and investment and economic development. This policy brief focuses on key recommendations for policy and financing, as well as highlights technologies that can enable success.

A sustainable infrastructure investment policy should focus on projects being “climate proof” in a way that traditional infrastructure investments are not. It should also expand and promote the use of financial products that address environmental, social, and governance (ESG) factors. Infrastructure investments require significant initial capital expenditure and have long payback periods. Therefore, supportive and incremental policies that mobilize public and private financing will be key to moving sustainable infrastructure investments forward (Deblina and Modi 2017, 17). According to the International Finance Corporation (2018, 5), the bank loan financing of climate-related investments needs to increase dramatically from an estimated 7% today to more than 30% by 2030. Financing tools for sustainable infrastructure should leverage all capital sources: from government tax incentives, banks, and corporate financing to institutional investors and capital markets, as well as all stakeholders— non-bank financial institutions (NBFI) and development finance institutions (DFI), equity and debt capital markets, and the banking sector.

Proposal 1: Embed sustainability in infrastructure policy

- G20 nations should take the lead in setting global sustainability investment standards (regulations and guidelines) for new infrastructure projects (International Finance Corporation 2018, 3). The G20 can seek to enforce the mandatory inclusion of climate disclosures and the use of green financing debt instruments.

- G20 nations should implement sustainable and strategic procurement regulations. For example, increasing sustainable capacity-building and government funding for procuring authorities to encourage innovation. Technical assistance should be provided for low carbon tenders and the importance of low carbon as a metric to consider alongside cost should be emphasized (Wuennenberg and Cassier 2018). An example would be South Africa’s Renewable Energy Independent Power Producer Procurement Programme.[2]

- G20 nations should develop policy support to increase public–private partnerships (PPP) for investment in public infrastructure. PPPs help drive much needed private finance toward public infrastructure projects, but their success is dependent on coherent and transparent policy. G20 nations could provide a policy roadmap that emphasizes the deployment of new technologies (especially DeepTech) and green finance to achieve sustainability standards. An example of a sustainability-focused PPP is the environmental and natural resource management in the Swedish mountains, driven by the Swedish National Environmental Quality Objectives and Swedish Government’s Nature Protection Policy (Thellbro et al. 2018).

- G20 nations should emphasize the use of tax credits for industrial carbon capture utilization and storage (CCUS) as a component of all new industrial infrastructure builds and an aid for energy transition in both developing and developed countries. An example policy is the 45Q in the United States.[3]

Proposal 2: Use sustainable (green) financing to raise capital for new infrastructure projects

- The G20 should incentivize the widespread adoption of green bonds. Having been issued for the first time by the World Bank in 2008, the use of green bonds to finance sustainable infrastructure projects should be scaled until they become the default option. Mexico City was the first municipality to issue a green bond and the Egyptian stock exchange plans to issue USD 500MM of green bonds by the end of 2020 (United Nations Environment Programme 2019, 18). The International Institute for Sustainable Development further suggests that infrastructure banks should become champions of sustainable infrastructure, making sustainability a requirement for assistance (Uzsoki 2018).

- Another financing model that needs to be more widely adopted is pay for performance (PFS), which is a financial structure where repayment is dependent on project performance. This reduces the financial risk that a public or private investor would otherwise need to assume for a green infrastructure project. In 2016, the DC Water and Sewer Authority’s environmental impact bond (EIB) became the first environmental services project to use PFS (Environmental Defense Fund and Meister Consultants Group 2017, 47).

- Green banks should be established in partnership with local financial institutions in every G20 member nation to set an example for the rest of the world. They have been already established in the United States and South Africa, with projects in progress in India and Rwanda.[4] Green banks, as defined by the Organisation for Economic Co-operation and Development, are public-private entities that facilitate investment in domestic, low-carbon, climate-resilient infrastructure. Green banks can provide lending and project finance at earlier (and riskier) stages of investment, allowing traditional financiers to come in once the technology is further developed (Environmental Defense Fund and Meister Consultants Group 2017, 60).

- Policies should also ensure that financial products incorporate a wider use of digital payments and wallets, as well as advances in lending technology, such as cloud technology and automation. Developing and emerging markets can leapfrog traditional lending practices that rely on in-person meetings and paperwork, following the example of M-PESA in Kenya.[5]

Proposal 3: Incentivize the use of advanced technologies to better enable sustainable infrastructure

- The above policies should incentivize the adoption of Blockchain in sustainable infrastructure projects. Blockchain is a technology that records data points linked by cryptography and cannot be modified. It can thus be used for more precise tracking of land value and ownership and can also assist with data collection for building management by providing incorruptible data on the emissions of infrastructure projects (Organisation for Economic Co-operation and Development, the UN Environment, and the World Bank Group 2019). Blockchain can allow the tokenization of infrastructure, which, if applied to the debt or equity financing of a project, can mitigate and minimize financial risk (Uzsoki 2019).

- Policies also should incentivize wider adoption of Internet of Things (IoT)—the process of linking everyday objects through the Internet to enable them to send and receive data—and artificial intelligence (AI)—the development of computers to perform tasks normally done by humans, such as data collection and analysis— in sustainable infrastructure projects. IoT and AI are already used in practice for water management, smart cities projects, and natural disaster responses (Stanley and Gunn 2018). AI and IoT can also be leveraged for ecosystem management by assisting with big data management and analysis to broaden the understanding of threats and trends (Gunn and Stanley 2018).

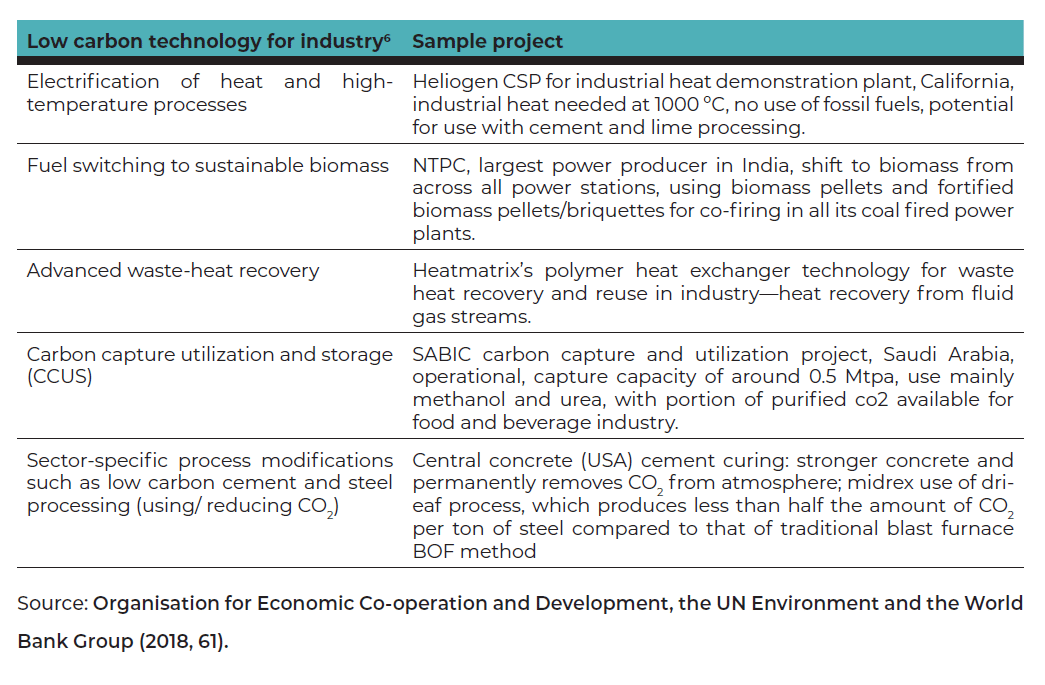

- Finally, policies should incentivize the use of clean tech such as CCUS, electric vehicles (EV), and photovoltaic + storage technology (PV + storage) in sustainable infrastructure projects at scale (Ryan and Celia 2018). Implementing these technologies, as well as other low-carbon technologies for the industry (see examples in the following chart) as alternatives to normal carbon-intensive energy sources can speed up the much-needed reduction of emissions from infrastructure construction and operations.

The technologies highlighted in this section can be directly applied to achieve sustainable infrastructure investment and financing. Appropriate policies will leverage these technologies to scale their impact, whether through broader adoption in practice or increased investment on the R&D side.

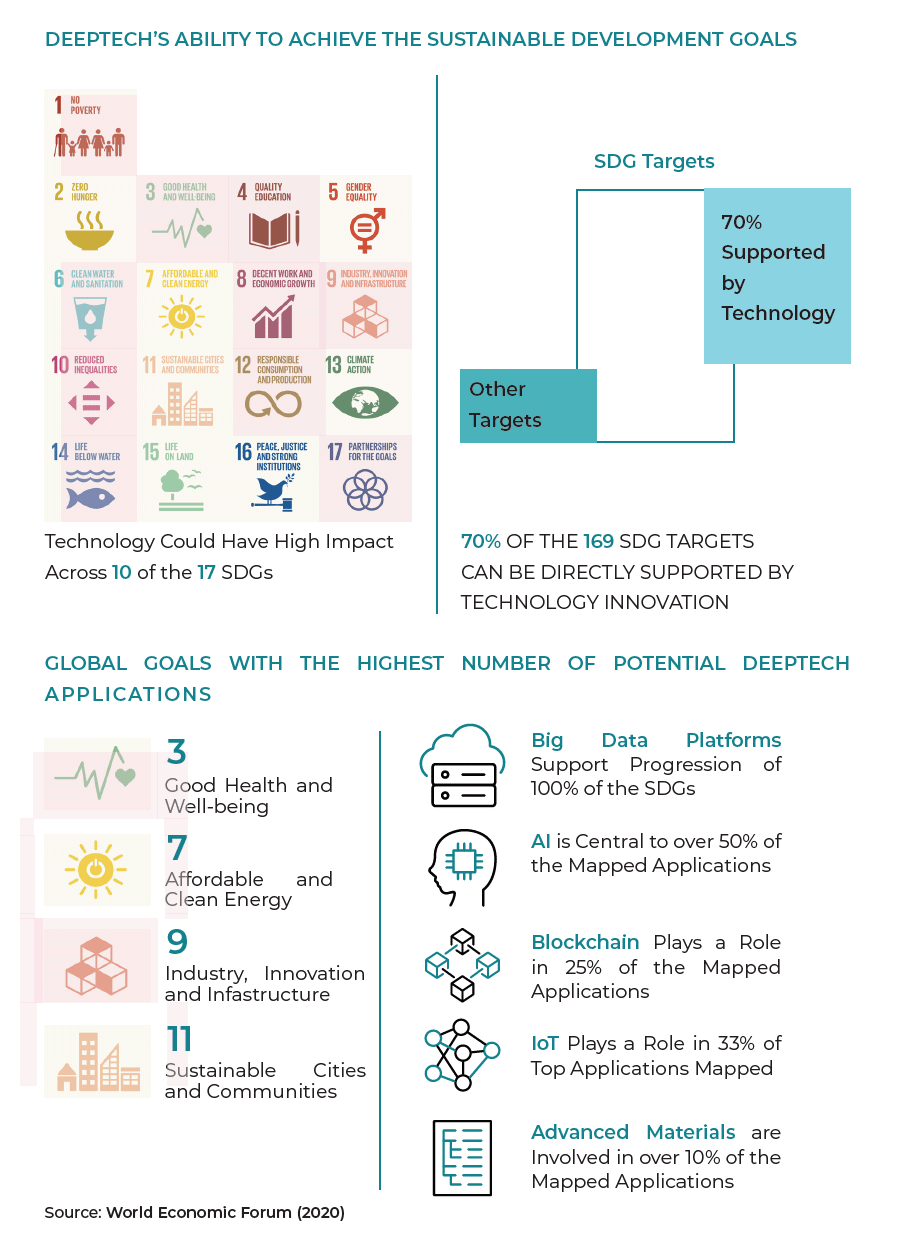

In addition to incentivizing their use in sustainable infrastructure policy, G20 nations should scale their incubation of the development of frontier technologies (DeepTech), for example, the US government’s Defense Advanced Research Projects Agency (DARPA) and Advanced Research Projects Agency–Energy (ARPA-E) programs, the European Investment Bank’s (EIB) technology incubation programs, and Israel’s subsidies and grants for science and technology PhD graduates.[7] These technologies often have transformative potential—as they take a long-term view on solving the world’s greatest challenges—and yet there is a significant capital gap in the early stage funding rounds for most DeepTech (2020, 8) companies. By increasing support for greater DeepTech R&D at the domestic level, G20 nations can better ensure those challenges are met.

At the G20 meeting in Japan in 2019, it was recognized that infrastructure development needs to be in line with the 2030 Agenda for Sustainable Development. In 2020, that recognition must be codified. The G20 has long been a body where real action has been limited and defused because of effort duplication—too many entities, too many agencies, and not enough continuity in absence of an independent secretariat. In the face of a new global crisis, the G20 has once again the opportunity to reassert itself as a meaningful multilateral body. The G20 would be wise to act as it did in 2008, when it emerged as a leading body, that is, by combining forces and eliminating the overlapping efforts of working groups.

The G20 should consolidate actions from the Global Infrastructure Hub, Global Infrastructure Facility, the Private Sector Advisory Group, G20 Principles for the Infrastructure Project Preparation Phase, and Roadmap to Infrastructure as an Asset Class. Infrastructure policies and regulation should mobilize advanced technologies and incentivize the deployment of sustainable financing. By harnessing technology and innovation to embed sustainability into infrastructure reforms and policy recommendations, the G20 will be providing the much needed hope for the future.

Key Recommendations

- G20 countries should support sustainable infrastructure investment and financing through policies such as global sustainability standards (regulations and guidelines), sustainable and strategic procurement regulations, tax credits for CCUS, and expanded support for PPPs.

- G20 countries should increase their support for—and wider adoption of—sustainable (green) financing options, such as green bonds, green banks, and PFS to finance infrastructure products.

- G20 countries should ensure that these policies, as well as financial products, leverage advanced technologies such as AI, IoT, and Blockchain, which can better enable a sustainable infrastructure.

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

Deblina, Saha and Akhliesh Modi. 2017. Low Carbon Infrastructure: Private

Participation in Infrastructure. The World Bank Group.

DeepTech. 2020. “DeepTech Investing Report 2020.” Different Funds. Accessed June 12, 2020. https://differentfunds.com/deeptech-investing.

Edwards, Ryan and Michael A. Celia. 2018. “Infrastructure to Enable Deployment of Carbon Capture, Utilization, and Storage in the United States.” Proceedings of the National Academy of Science 115 (38): E8815–E8824.

Environmental Defense Fund and Meister Consultants Group. 2017. Unlocking Private Capital to Finance Sustainable Infrastructure. Environmental Defense Fund.

G20. 2020. “Extraordinary G20 Leaders’ Summit Statement on COVID-19.” Accessed June 12, 2020. https://g20.org/en/media/Documents/G20_Extraordinary%20G20%20Leaders%E2%8%99%20Summit_Statement_EN%20(3).pdf.

Gunn, Geoffrey and Madeline Stanley. 2018. Harnessing the Flow of Data: FinTech Opportunities for Ecosystem Management. Winnipeg: International Institute for Sustainable Development.

International Finance Corporation. 2018. “Raising $23 Trillion: Greening Banks and Capital Markets for Growth.” G20 Input Paper on Emerging Markets. IFC.

Organisation for Economic Co-operation and Development, the UN Environment and the World Bank Group. 2018. Financing Climate Futures: Rethinking Infrastructure. OECD Publishing.

Organisation for Economic Co-operation and Development, the UN Environment, and the World Bank Group. 2019. “Blockchain Technologies as a Digital Enabler for Sustainable Infrastructure.” OECD Environment Policy Paper No. 16. OECD Publishing.

Saijel, Kishan. 2020. “Professor Sees Climate Mayhem Lurking Behind COVID-19 Outbreak.” Bloomberg, March 28, 2020.

Stanley, Madeline and Geoffrey Gunn. 2018. Using Technology to Solve Today’s Water Challenges. Winnipeg: International Institute for Sustainable Development and IISD Experimental Lakes Area.

Thellbro, Camilla, Therese Bjärstig, and Katarina Eckerberg. 2018. “Drivers for Public–Private Partnerships in Sustainable Natural Resource Management—Lessons from the Swedish Mountain Region.” MDPI Sustainability Journal 10 (11): 3914.

United Nations Environment Programme. 2019. UN Environment Programme Inquiry: Annual Overview 2019. United Nations.

Uzsoki, David. 2019. Tokenization of Infrastructure: A Blockchain-Based Solution to Financing Sustainable Infrastructure. Winnipeg: International Institute for Sustainable Development and The MAVA Foundation.

World Economic Forum. 2020. Unlocking Technology for the Global Goals. World Economic Forum with PwC.

Wuennenberg, Lauren and Liesbeth Cassier. 2018. Infrastructure: The Role of Public Procurement. Winnipeg: International Institute for Sustainable Development and Industrial Innovation for Competitiveness.

Appendix

[1] . Deblina and Modi (2017) note that, based on the current rate of emissions from key infrastructure industries, continuing to allow this sector to operate business-as-usual would push more than 720 million people into extreme poverty, with projected deaths per year rising from 150,000 to 250,000.

[2] . See: https://ppp.worldbank.org/public-private-partnership/library/south-africa-s-renewable-energy-ippprocurement-program-success-factors-and-lessons-0.

[3] . See https://www.betterenergy.org/blog/primer-section-45q-tax-credit-for-carbon-capture-projects.

[4] . For Green Bank definitions, case studies, and recent implementation, see https://coalitionforgreencapital.com.

[5] . For examples of these technologies in action, see https://defisolutions.com/defi-insight/2018/05/23/newlending-technology-reshaping-loan-origination-process and https://digital.hbs.edu/platform-rctom/ submission/m-pesa-transforming-kenya-with-mobile-money.

[6] . Also see fastcompany.com/90290780/these-startups-are-trying-to-reduce-the-massive-carbon-footprint-

of-concrete; https://www.ntpc.co.in/; https://www.globalccsinstitute.com/; https://www.greentechmedia.

com/articles/read/heliogen-cranks-solar-thermal-up-to-1000-degrees-cel.

[7] . Also see 8400 in Israel: https://www.8400thn.org.