The advancement and spread of digital technologies is reshaping the global financial landscape. These technologies could dramatically increase financial efficiency and inclusion by expanding access to financial services and offering a broader range of financial products at lower cost. Despite the potential benefits, significant risks must also be managed. From blockchain development to the use of cryptocurrency, a range of policy and regulatory issues have emerged. This policy brief reviews key policy issues and challenges related to fintech development, in particular digital ledger technology applications. It proposes a functional and proportional approach to these issues that balances the evident challenges—such as in transparency, cybersecurity, and immutability—arising alongside the significant opportunities for innovation.

Challenge

Finance today is being transformed by mobile technology, big data, distributed ledger technology, cloud computing, artificial intelligence, and machine learning. The advance and spread of digital technologies could dramatically increase financial inclusion by expanding access to financial services— especially among the underserved population; among micro, small and medium enterprises (MSMEs); and in rural and agricultural areas. The potential benefits from this transformation are huge, but the risks must also be managed.

Distributed ledger technology (DLT) and blockchain, particularly its application in cryptocurrencies (or now increasingly referred to as crypto assets to avoid misunderstanding them as a part of currencies), have attracted extraordinary global attention. However, from blockchain development to the issuance and use of crypto assets, a range of issues has emerged that carry regulatory challenges in the areas of transparency, cybersecurity, and financial stability risks. This is particularly so for non-sovereign crypto assets. Some countries are even examining the feasibility of introducing a sovereign crypto asset (generally central-bank issued) as an alternative settlement currency, medium of exchange, or store of value. This idea remains untested and adds policy-related uncertainties.

As such, while the systemic risk these technologies pose may still be limited, monitoring is nonetheless in order, particularly given market integrity and consumer protection concerns.

In understanding the new technologies, distributed ledgers in general must first be distinguished from blockchain, which is commonly only run on distributed ledgers. The ledgers should also be distinguished from various end uses of the technologies, particularly crypto assets and initial coin offerings (ICOs). While crypto assets can exhibit certain features of money, such as acting as a medium of exchange, they have proven too speculative and have largely failed to function as a store of monetary value.

DLT applications have triggered regulatory actions across the region, mainly as warnings of the associated investment risks related to speculation or consumer protection (largely with ICOs). These actions have gradually shifted towards regulation of DLT-based products and services, either by extending existing law to them or by issuing new regulations or guidance. However, DLT varies widely and specific features of each DLT application—particularly relating to governance, such as consensus mechanisms—will influence the risks to be taken into account in deciding whether or to what extent to regulate their applications.

This policy brief reviews key policy issues and challenges related to financial technology (fintech), DLT applications in particular. It suggests the need for a functional and proportional approach to the technologies that balances the evident challenges that are arising—such as in matters of transparency, cybersecurity, and immutability—with the significant opportunities for innovation. It explores three issues:

• Issue 1: Managing technological innovation to promote greater financial inclusion.

• Issue 2: Developing the ecosystem to support the creation, diffusion, and scaling up of technology and innovation.

• Issue 3: Managing risks and developing the regulatory environment to balance the conflict between innovation, consumer protection, and financial stability.

Proposal

Issue 1: Managing technological innovation to promote greater financial inclusion

The rise of new technology is reshaping the financial services industry toward digitalization, decentralization, and disintermediation of economic transactions. This digital transformation of the industry is happening alongside developments in telecommunications and computing technology. Sizable data provision, cloud storage, automated analytical tools, growing computing power, and wide connectivity are being applied to financial services. These developments have increased market access, the range of product varieties, and efficiency, and lowered the cost of offering financial services.

This digitalization has been also accompanied by decentralization and disintermediation, with the distributed ledger (including applications in crypto assets and smart contracts) a salient example of decentralized services. In addition, new technology-driven business models, such as peer-to-peer platforms and robo-advisors, have supplanted some traditional financial intermediaries, posing distinct challenges for incumbent financial service providers and regulators. Massive change is also transforming the way payment services are delivered, savings and credit are mobilized, business risks are managed, and investment advice is given.

Despite myriad associated technological advancements, about 60% of the global population—about 4 billion people—still has no access to a bank account. Distance, high costs, and lacking credit-score information are key hurdles to household access to finance. And collateral requirements, unfavorable interest rates, and complex procedures hinder MSME access to finance.

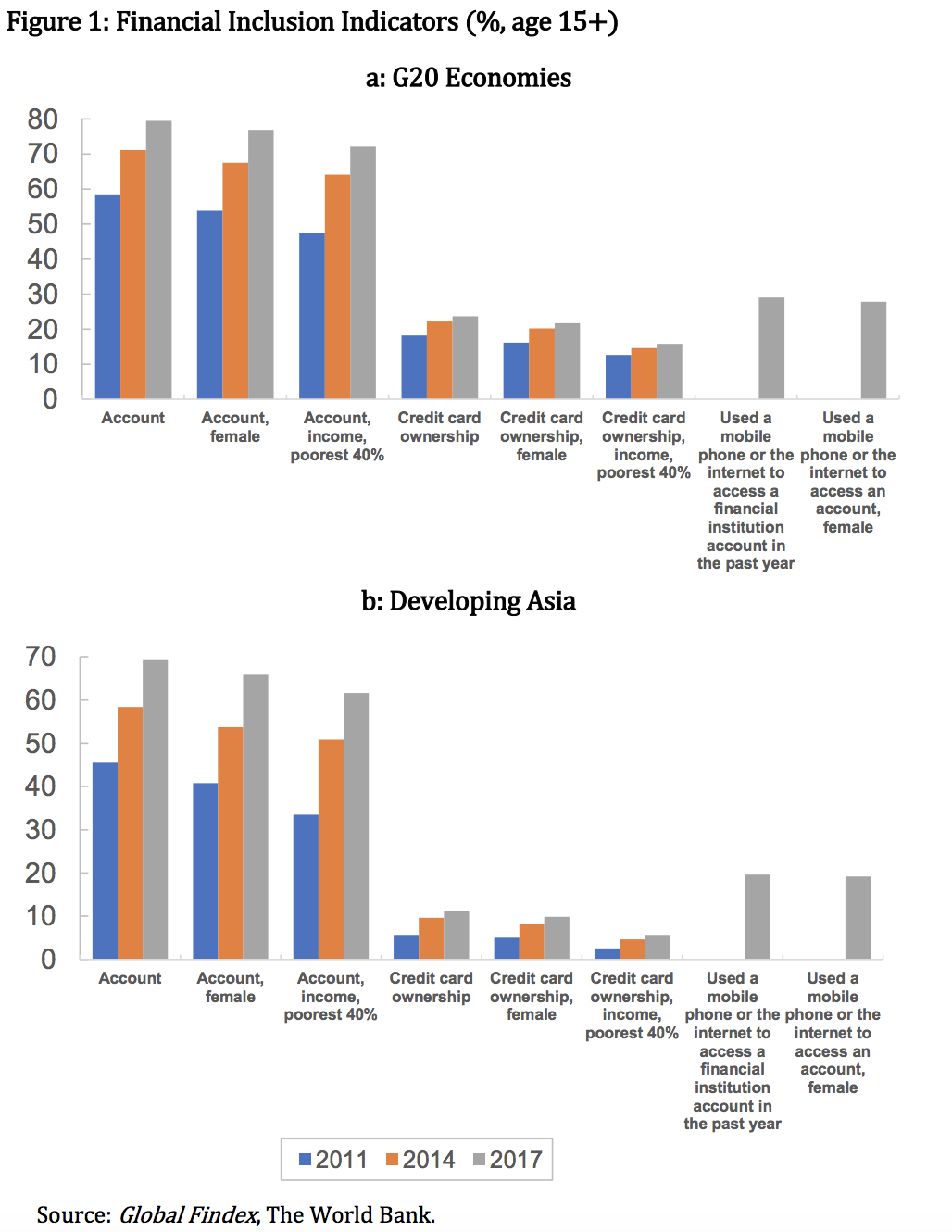

Significant progress has been made on financial inclusion globally. The G20 economies show greater financial inclusion compared with developing countries. Nevertheless, in both G20 economies and developing Asia, crosscountry and intra-country disparities remain high (Figure 1a, 1b). A wide gap in accessing financial services still favors the rich over the poor, male over female, and urban over rural populations (IMF 2017).

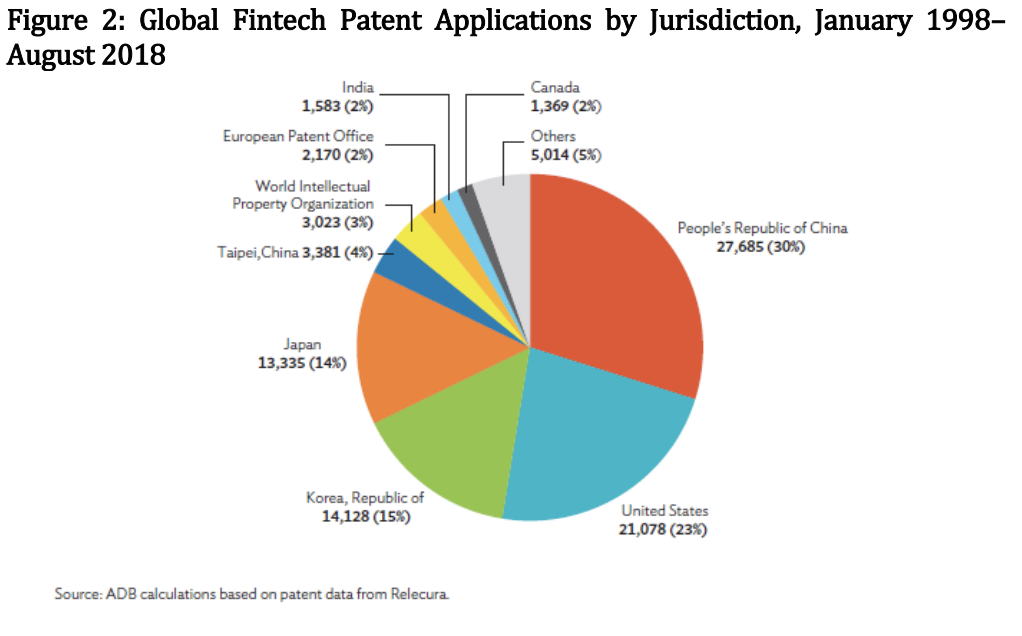

Moreover, technological innovation seems to be more geographically concentrated than income or wealth are (Figure 2), occurring mostly in Canada and the United States, East Asia and Western Europe. It is also highly concentrated in banking and monopolized by a few large firms.

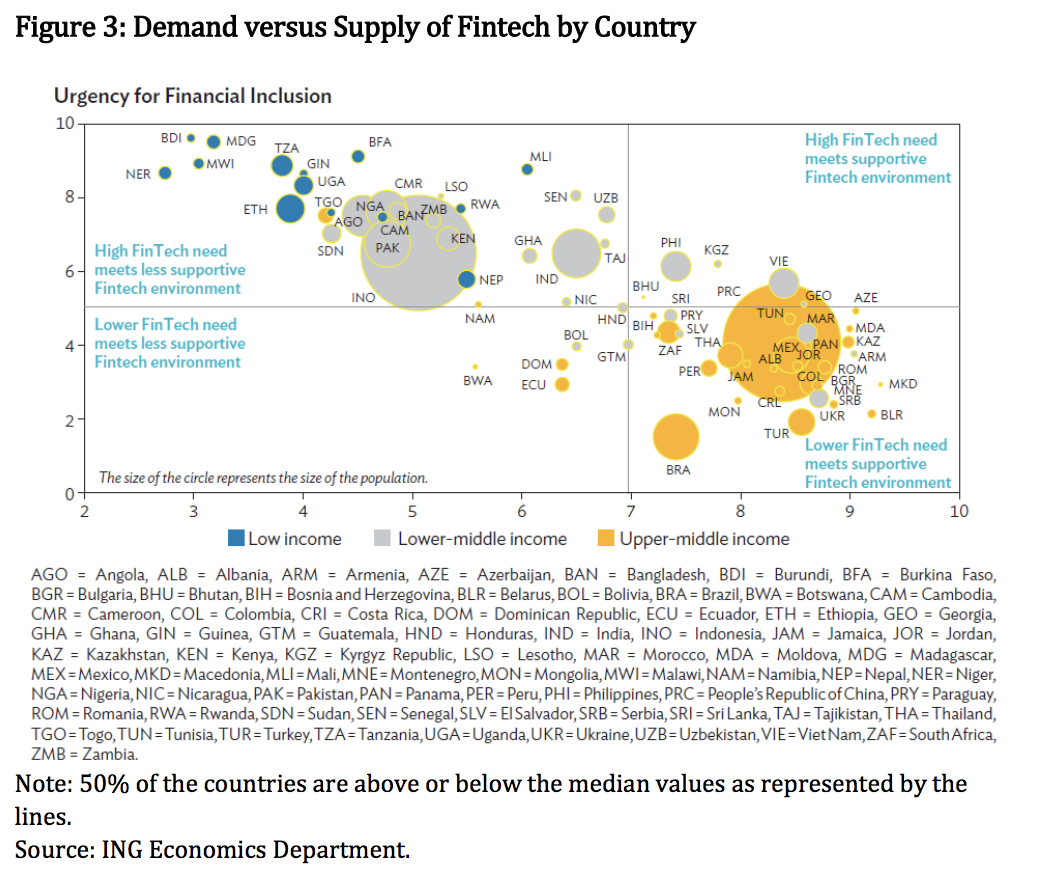

Financial inclusion is often weakest in low-income countries; meanwhile, fintech infrastructure and ecosystems evolve as countries become richer. Poorer countries, where bank branches are few and concentrated in urban areas, have larger underserved populations than richer countries. And setting up bank branches is costly, especially in rural areas. The traditional banking system is therefore unlikely to serve people in poor countries very well, raising the urgency for fintech-led financial inclusion (ING 2016). Indeed, as Figure 3 shows, many low- and lower-middle-income countries have a high need for fintech yet an unsupportive environment, such as Pakistan and Nepal. Richer economies in the region such as the People’s Republic of China and Thailand, by contrast, show lower need yet a supportive environment.

Access to secure internet servers also remains very uneven across the world. Yet, the new technologies can gather and analyze more and better data, which reduces information asymmetry. And big data and artificial intelligence can offer good substitutes for traditional credit bureaus or credit registries in places where these systems are lacking or are inefficient. Such fundamental internet infrastructure is essential for fintech development and applications. Improving infrastructure—through telecommunications and credit information services—can thus boost financial inclusion by helping banks reach underserved populations and broadening the range of available financial services in countries accounting for half of the world’s population (PERC 2016).

Policy options and reforms are therefore needed to create an enabling environment for fintech to serve households and MSMEs. In the fast-evolving fintech world, greater financial literacy and education that empowers consumers and MSMEs would also help.

Issue 2: Developing the ecosystem to support the creation, diffusion, and scaling up of technology and innovation

Generally, two key components drive technological revolution and innovation. First is the invention and the creation of the technology or innovative products and services themselves. Second is the way these innovations are diffused, which can typically involve the introduction of innovations or qualitative enhancements to existing technologies to lift living standards or facilitate customization of the technologies to match different settings and needs of the communities.

Encouraging innovation and diffusion in technology areas should be a major focus for policymakers. The rationale for such intervention largely stems from the argument that private actors will undersupply these activities, leading to the assumption that subsidizing private sector returns in some way will help solve the problem. From a Schumpeterian perspective, the policy response can be led by developing national innovation systems that form an environment sufficient to forge a strong relationship between the key actors creating, diffusing, and utilizing technology and innovation (such as firms, public labs, government ministries, financial players, and patents and educational systems).

Early evidence suggests that the private sector has provided enough fintechrelated innovation, with little need for government subsidy. To date, the relationship between financial institutions and technology firms also appears to be largely complementary and cooperative (FSB 2019). However, it is evident that strong economic environments and institutions play important roles in forging links and enhance mutual benefits for such partnership.

A healthy ecosystem for technological innovation relies on enabling infrastructure, human capital, economic and social assets, and environment. Recently, however, more focus has been given to the social dimension of the ecosystem. In this, “networking assets” are central to and a key success factor for growth and sustainability of any ecosystem. The social dimension of networking assets allows the ecosystem to expand beyond geographical clustering or any administrative boundaries. Networking assets in particular are central to the ecosystem’s social dimension, being nodes of connection for startups and innovators.

Another key issue in developing an enabling ecosystem is related to competition policy. Fintech innovations do not only come from technology startups, but also from large commercial banks, incumbent computer and software companies, and manufacturing firms. Fintech brings some industry concentration and the market is dominated by a few large companies.

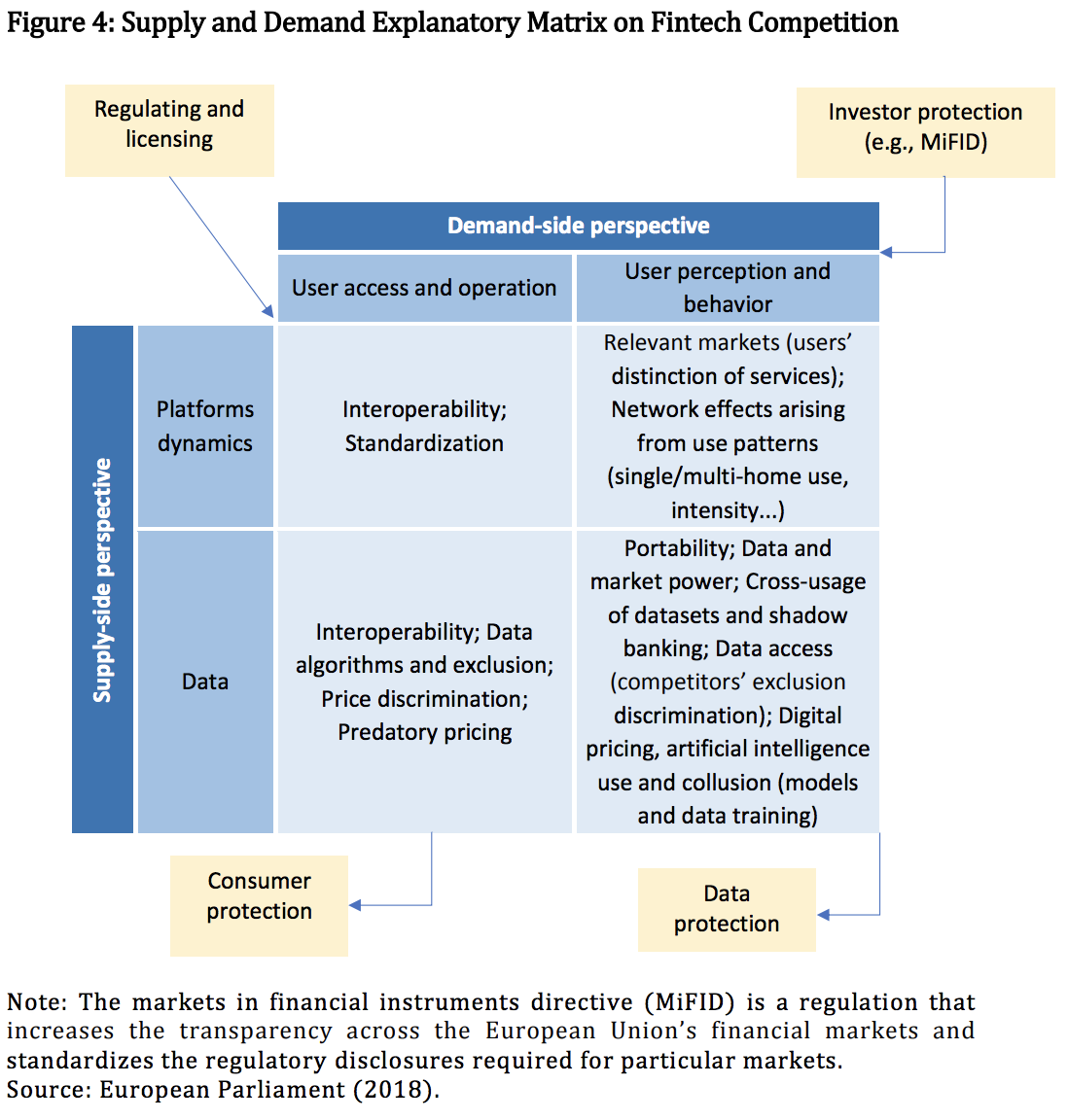

Fintech’s competitive challenges can be examined from supply- and demandside perspectives (European Parliament 2018). From the supply-side, platform technologies and data are two major categories that could bring competition problems. From the demand-side, access and the operation of the technology and user perception and behavior should be considered (Figure 4).

Large tech companies, whose advanced technologies look suited to entrench their positions, are bringing more competition problems than fintech startups. Payment services, as the most mature category of fintech services, gather a large amount of customer data that can be used by providers of payment services to lever their positions. Firms with an established place in the market, such as Alibaba and Tencent in the People’s Republic of China, have a strong incentive to lock in customers and use payment services as the starting point to sell other services.

Issue 3: Managing risk and developing the regulatory environment to balance conflicts between innovation, consumer protection, and financial stability.

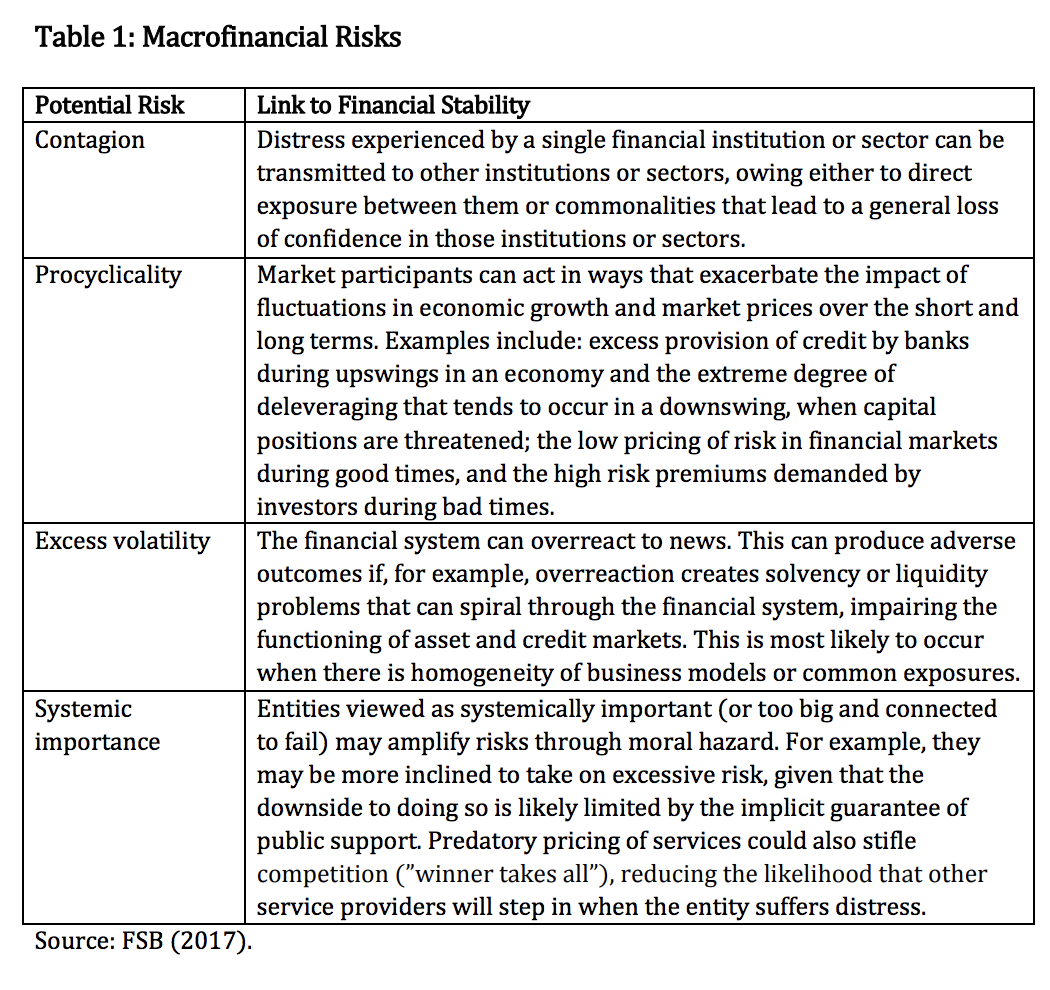

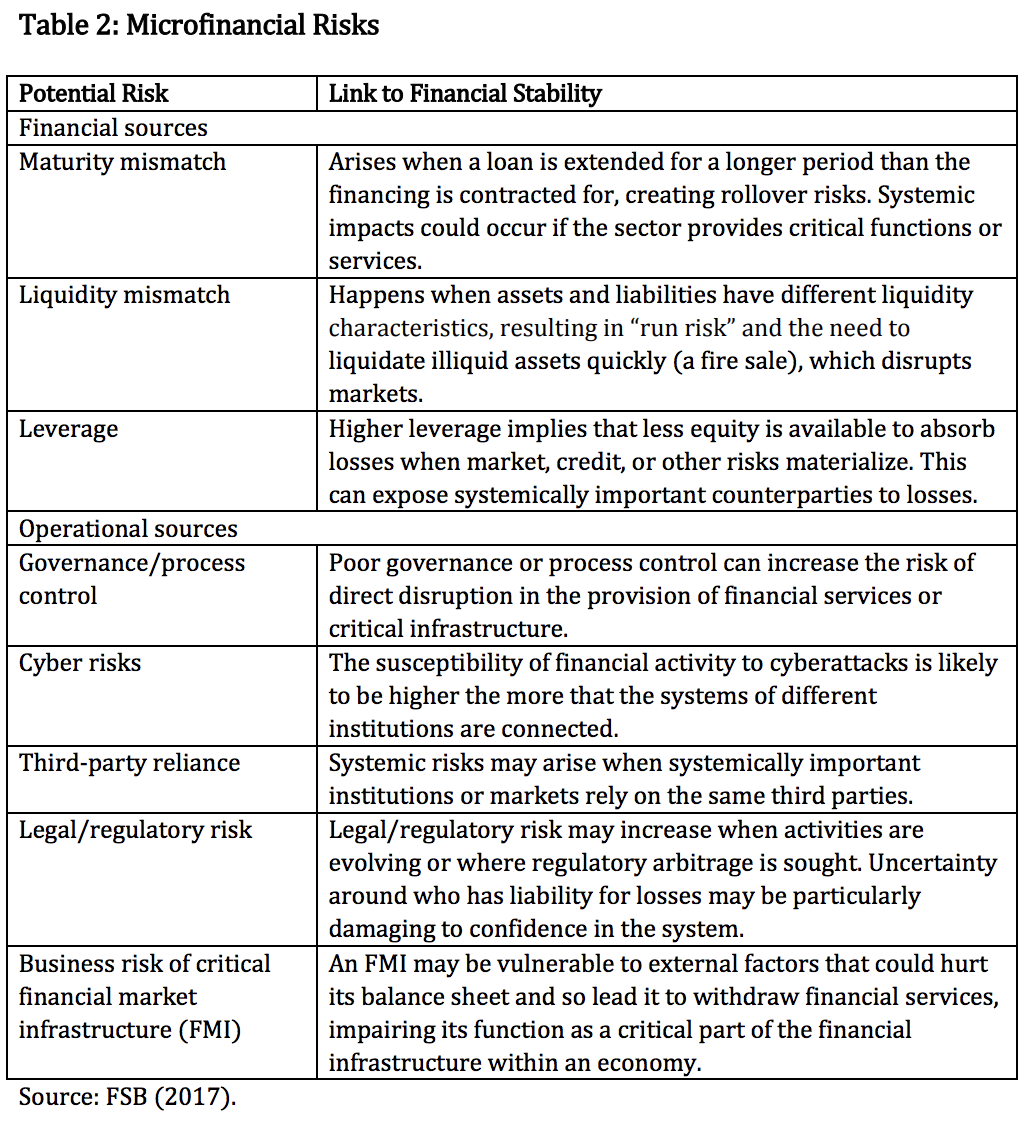

Fintech innovation and applications present a range of macro- and microrelated risks (Tables 1 and 2). At the macro level, technology can be a transmission mechanism for contagion as well as an important source of systemic problems through excessive risk-taking related to the potential gains from new financial technology and innovation. At the micro level, poor governance or process control can increase the risk of direct disruption to financial services provision.

Recent Fintech developments—such as the emergence of bank-like providers competing or cooperating with financial institutions, provision of financial services by large technology companies, and reliance on third-party providers for cloud and computing services—all have direct implications on financial stability and consumer protection (FSB 2019). Policymakers should aim to provide incentives for market participants to be aware of systemic risk, protect consumers, and encourage a competitive environment.

Regulatory measures addressing technological innovation generally take time to develop. In particular, the multifaceted nature of DLT and its applications pose great regulatory challenges. While some legislatures recently have attempted to provide a concrete legal basis for distributed ledgers or with particular focus on blockchain, the majority of jurisdictions are silent on the matter of specific regulation of either.

As it is likely that different jurisdictions will take different approaches in the absence of international rules, it is recommended that regulators, for the time being at least, focus primarily on regulating the principal applications of DLT, which are crypto assets and ICOs, rather than trying to regulate the technology itself. The regulation of technology is hardly possible (given its rapid pace of development) and rarely necessary.

In general, policymakers and regulators should treat DLT as a platform technology which can be used across a wide variety of functional areas, from identity to property registration to financial infrastructure, payment, and fundraising. At the most general level, they may consider a system of categorization and certification (generally on an industry basis, for example through the ISO) combined with the general legal system. This system can apply in particular to consumer protection, data protection, choice of law/courts, and competition frameworks.

Beyond this general framework of certification and standardization, there will be a need to consider how specific applications fall into functional categories which draw additional regulatory attention. Among these are money, payment, fundraising, credit provision, insurance, and so on. In each case, DLT systems should be treated according to the same general objectives and principles applicable (such as financial stability, prudential regulation, financial integrity and conduct, data protection, and competition considerations). A part of such a treatment is whether the technology itself furthers market concentration (which in turn prompts antitrust concerns).

Regulators need to pay special attention to crypto assets to protect investors and maintain the stability of the financial market (1). If the price of crypto assets remains volatile and risk spreads to other financial markets on a larger scale with multiple channels, it may bring instability and harm investors and consumers.

Regulators should also be aware of fraud, theft, terrorist financing, money laundering, and possible manipulation of value in crypto asset transactions. Heightened susceptibility to cyberattacks that could compromise interlinked financial systems is also a concern, such as when financial services are migrated from intermediary-based to network-based providers. This may require regulators to rely less on entity-based regulation.

When it comes to data and information flows, particular problems arise in the cross-border context, in that data protection legislation varies from jurisdiction to jurisdiction, often with conflicting requirements (with the exception of the European Union, where the new General Data Protection Regulation has been in effect since May 2018). There is an urgent need for international cooperation in addressing data issues—and for a range of possible technological solutions, including through DLT systems.

International financial institutions and multilateral development banks may help in areas including helping to establish needed infrastructure and enabling environments, providing assistance for the general framework of certification and standardization, and promoting international cooperation for data privacy, consumer protection, and cybersecurity.

1 Leaders from the Group of 20 nations made commitments to better regulate “crypto-assets” as part of a communique released Sunday after a meeting in Buenos Aires. In a declaration titled

References

• Asian Development Bank (ADB). 2018. Harnessing Technology for More Inclusive and Sustainable Finance in Asia and the Pacific. Manila.

• European Parliament. 2018. Competition Issues in the Area of Financial Technology (FinTech). Strasbourg. • Financial Stability Board (FSB). 2017. Financial Stability Implications from FinTech. Basel.

• _____. 2019. Fintech and Market Structure in Financial Services: Market Development and Potential Financial Stability Implications. Basel.

• International Monetary Fund (IMF). 2017. “Fintech and Financial Services: Initial Considerations.” Staff Discussion Notes No. 17/05.

• _____. 2018. “Financial Inclusion in Asia-Pacific.” Departmental Paper No. 18/17.

• ING. 2016. The Fintech Index: Assessing Digital and Financial Inclusion in Developing and Emerging Countries. Amsterdam.

• Public Employment Relations Commission (PERC). 2016. From Competition to Collaboration—Fintech, Big Data, and Traditional Financial Services. PERC: Durham, New Jersey.

• World Economic Forum. 2015. “The Future of Financial Services: How Disruptive Innovations Are Reshaping the Way Financial Services Are Structured, Provisioned and Consumed.” Final Report. Geneva.

• _____. 2016. “A Blueprint for Digital Identity.” Geneva.