Global value chains (GVCs), networks of firms through international trade of goods and services, investment, and research activities, had expanded in the world economy in the 1990s and early 2000s. GVCs generate benefits for both advanced and developing countries through efficiency gains, diversification, knowledge diffusion and job creation.

However, the expansion of GVCs has slowed down since the global financial crisis in 2007-2008 because of insufficient human capital and infrastructure, as well as regulatory and institutional barriers. In addition, the slowdown is triggered by GVCs’ adverse effect on some manufacturing firms in advanced countries due to competitive pressure from emerging countries that results in the rise of protectionist sentiments and policies.

To achieve sustainable and inclusive growth, GVCs should be expanded and restructured by (1) developing human capital and infrastructure, (2) promoting business matching, (3) removing regulatory and institutional barriers, (4) upgrading manufacturing sectors in advanced countries, and (5) reducing excessive protectionist sentiments.

Challenge

Benefits of global value chains (GVCs)

In the world economy, a large number of firms are connected beyond national borders through global value chains (GVCs). GVCs consist of various types of inter-firm relationships, such as supply chains and the off-shoring of business activities of both manufacturing and services, shareholding relationships, and research collaboration. The expansion of GVCs provides benefits to both advanced, emerging and developing countries in various ways.

First, because of GVCs, a country does not need to maintain a full set of industries domestically. Rather, a country can achieve economic growth by specializing in the production of particular goods or services and providing them to GVCs (1). Accordingly, GVCs enable firms, particularly those in emerging and developing countries, to create jobs and increase outputs and wages.

Second, firms locate production plants and service centers that mostly require low skills in developing countries that feature lower wages while locating managerial headquarters and research and development (R&D) centers that require higher skills in more advanced countries. This approach results in efficient allocation of resources, leading to welfare gains in both types of countries.

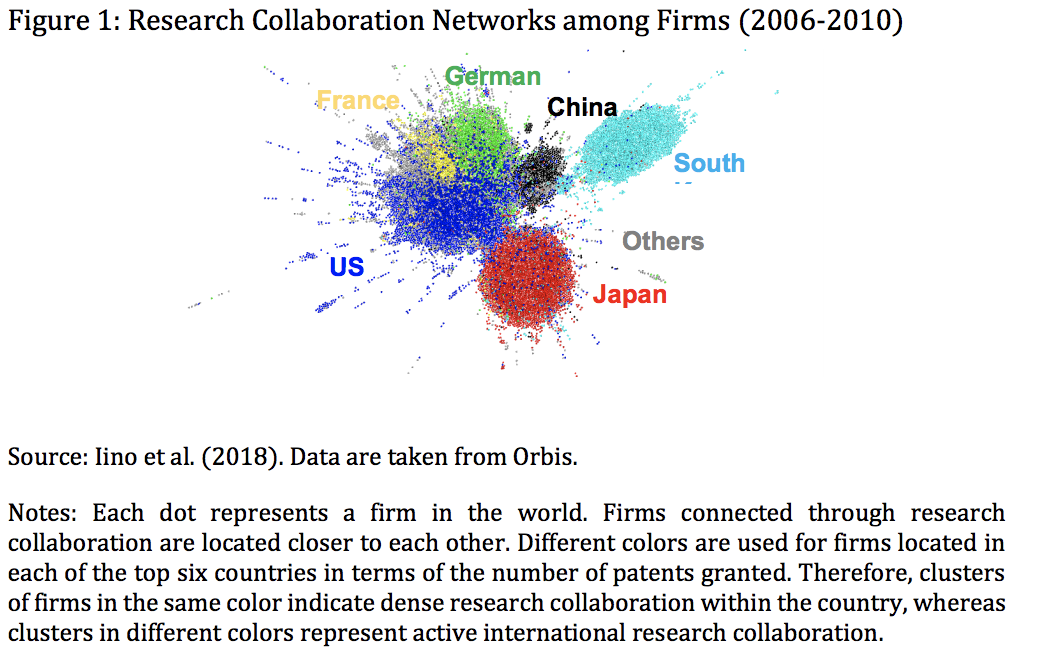

Third, GVCs contribute to the world economy by facilitating international knowledge diffusion. Knowledge spillovers from foreign direct investment (FDI) to domestic firms and learning by exporting have been observed in both advanced and developing countries (2). International research collaboration, which is often associated with trade and investment relationships and has become an important part of GVCs (Figure 1), has accelerated technological progress in the era of open innovation (3). International knowledge diffusion through GVCs is critical to the welfare of the world economy, because it enables advanced countries to achieve sustainable growth and developing countries to catch up with advanced countries.

Finally, expanded GVCs enable firms to diversify their partners geographically and thus to mitigate propagation of negative effects from partners in particular countries because of political conflicts and natural disasters. Such geographic diversification of business partners through GVCs has become an important channel of risk mitigation, as natural disasters hit the world economy more often recently than before due to climate change and seismic cycles (4).

Barriers to the expansion of GVCs

Despite their benefits, the expansion of GVCs has slowed down since the global financial crisis in 2007 and 2008 (5), as there are two major challenges to GVCs. First, the majority of firms, particularly most small and medium-sized enterprises (SMEs) in developing countries and many SMEs in underdeveloped regions in advanced countries, are not internationalized, i.e., they are unconnected to GVCs. Research collaboration among firms is often conducted within the country, not across countries, although international collaboration is increasing (Figure 1).

There are several reasons for the limited expansion of GVCs. First, it is well known that the most important determinant of firms’ internationalization, e.g., exports and FDI, is productivity (6). Firms’ low human capital and resulting low productivity do not allow them to compensate for the initial costs of participating in GVCs, e.g., costs of searching for business partners and learning about foreign markets. Therefore, only a limited number of firms are connected to GVCs. (7)

Second, the initial costs are particularly high in underdeveloped countries and regions because of poor infrastructure for transportation and information and communication technology (ICT). This poor infrastructure prevents flows of the products and information needed to participate in GVCs.

Third, many countries feature regulatory and institutional barriers that result in large costs of international transactions. Such barriers include restrictions on foreign investment, local content requirements, inefficient customs procedures, poor intellectual property rights protection, and visa regulations.8 The number of new discriminatory interventions against foreign commercial interests by G20 countries has been increasing, as documented by a policy brief at the T20 last year.(9)

Rise of protectionism

In addition, policy makers in many countries hesitate to expand GVCs in their countries because some individuals and sectors may lose as a result of GVCs. For example, imports from China to the United States (US) are reported to deteriorate income and employment in the US manufacturing sector (10). Other evidence shows that globalization is associated with rising income inequality among citizens in developed countries (11).

Rising inequality has resulted in protectionist sentiments and policies in a number of countries. Most notably, the US withdrew from the Trans-Pacific Partnership Agreement (TPP) and pressured to re-negotiate NAFTA, the United Kingdom (UK) decided to exit (Brexit) the European Union, and the US and China are involved in trade conflicts by reciprocally raising tariffs. These protectionist policies are supported by citizens’ protectionist sentiment: Only 30-40% of citizens in the US and Europe and 20% of those in Japan believe that international trade creates jobs (Figure 2). This rising skepticism about globalization and resulting protectionist policies prevent GVCs from expanding further.

Proposal

1. Development of human capital and infrastructure

Because a major barrier to the expansion of GVCs is the low productivity of firms, human capital investment through formal education and business training certainly helps firms in countries of all income levels to participate in GVCs. In more advanced countries, graduate-level education should be provided to a wider range of populations, including current workers. In less developed countries, vocational-level education is more important to participate in GVCs, while tertiary-level education should not be ignored to attract FDI in R&D and promote domestic innovation for emerging countries. Also, GVCs have not penetrated some regions of the world, partly because of a lack of transport and ICT infrastructure. The positive effect of transport and ICT infrastructure on trade, knowledge diffusion, and economic growth is well supported by empirical evidence (12). The importance of ICT infrastructure should not be underestimated because the offshoring of services, such as software development and call center operations, through the Internet has become a significant component of GVCs. Therefore, G20 countries should build up more transport and ICT infrastructure so that a wide range of firms can participate in GVCs.

In addition to the government of each G20 country, the roles of international organizations, such as the World Bank and regional development banks, provide a strong base for funding infrastructure. Also, G20 members are suggested to establish a G20 Fund for infrastructural investments.

2. Promotion of business matching and information dissemination

Firms may be reluctant to participate in GVCs because bearing costs of searching business partners and learning about foreign markets by individual firms is inefficient because of information spillovers.13 Therefore, governments should intervene and encourage business matching among firms by, for example, organizing and subsidizing trade fairs and matching sites on the Internet. In addition, governments should support the dissemination of information in foreign markets. 14 Matching for international research collaboration through, for example, science and technology fairs and industryuniversity linkages should also be encouraged for further innovation. These policy measures should particularly target small and medium-sized enterprises (SMEs) as they sufficient suze to cover the initial cost of participating in GVCs.

3. Removal of regulatory and institutional barriers

Regulatory and institutional barriers should be lowered to reduce costs of international transactions. Particularly,

- Restrictions on foreign investment and local content requirements should be minimized, although restrictions in specific cases such as national security and intellectual property rights may be allowed.

- Customs procedures in developing countries should be more efficient by, for example, reducing red tape and introducing electronic customs. (15)

- Product standards should be harmonized with global standards so that firms do not need to modify their products when they export to foreign markets.

- Intellectual property rights protection should be strengthened so that foreign firms are encouraged to engage in knowledge activities.

- Visa regulations should be relaxed to allow more efficient international labor allocation and knowledge diffusion.

These approaches to lower regulatory and institutional barriers are often incorporated in recent free trade agreements (FTAs), such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (TPP11). Such extended FTAs should be encouraged and, if possible, multilateralized by means of new rules in the context of the WTO.

4. Upgrade of manufacturing sectors in advanced countries

Because some workers in advanced countries suffer from competitive pressure from emerging countries, simply expanding GVCs may induce more protectionist policies and thus instability in the world economy. Therefore, GVCs should be restructured so that a wider range of citizens can benefit from GVCs. For this purpose, upgrading manufacturing sectors in advanced countries is necessary. If advanced countries produce the same products as emerging countries do, they will never win the competition for lower prices. Therefore, advanced countries should produce goods and services of higher value added. Then, connecting to GVCs does not necessarily incur losses for advanced countries (16). For such restructuring, human capital investment at very high levels in advanced countries is needed. High human capital enables manufacturing firms to produce high value-added goods and services and further engage in R&D, product design, and global management and marketing. This transformation requires both the re-education of current workers and the education of current students.

Furthermore, restructuring GVCs requires the destruction of outdated industries and the creation of state-of-the-art industries in advanced countries. To change the industry structure smoothly, the mobility of workers across industries and countries should be enhanced. Therefore, regulations that prevent labor market mobility should be eliminated.

It should be emphasized that this restructuring of GVCs does not hurt emerging or developing countries but instead creates more jobs in these countries through the re-allocation of industries across countries. Particularly, if combined with other policy measures suggested earlier, this restructuring of GVCs should enable emerging and developing countries to speed up their economic growth through knowledge diffusion.

5. Reduction of excessive protectionist sentiment through interventions

Rising income inequality in advanced countries is surely a source of protectionism in these countries. However, there may be another reason. As Figure 2 shows, two-thirds of citizens in advanced countries are skeptical about the benefits of globalization, although empirically it is evidenced that globalization improves aggregate income in the world economy. This suggests that the current protectionist sentiment is excessive, compared with what we would expect from the current level of income inequality.

Therefore, citizens’ lack of knowledge about the benefits of globalization may be another cause of protectionist sentiment in advanced countries. The Pew Research Center survey (2018) mentioned above also indicates that more educated citizens in developed countries are more likely to believe that trade creates jobs, which may be because more educated citizens are less likely to be adversely affected by globalization – but it may also be because they have more opportunities to learn about the benefits of globalization. Therefore, educating a wider range of citizens, including children and currently less educated workers, about the benefits of globalization is of great importance to reduce protectionism.

Finally, another possible measure to address the rise of protectionism should take a behavioral-economics approach because people are not necessarily rational in terms of monetary benefits and protectionism may be based on the intrinsically closed nature of human beings (17). Empirical studies show that social interactions promote trust in others and support for free trade, while strong within-group ties and social conflicts beyond the group generate persistent distrust and hostility to outsiders (18).

Therefore, international exchange programs, such as exchanges of students, business and academic conferences, as well as research collaboration, should be encouraged and subsidized by governments to promote mutual understanding and trust in the world. In particular, providing children opportunities to understand foreigners and to become open-minded could substantially reduce protectionism and increase benefits from globalization in the long run.

1 Baldwin (2016).

2 See Blomström and Sjöholm (1999), Haskel, Pereira, and Slaughter (2007), and Keller and Yeaple (2009) for FDI spillovers in Indonesia, the United Kingdom, and the United States, among many others. Additionally, see Blalock and Gertler (2008) and Javorcik (2004) regarding spillovers through input-output linkages and Todo (2006), Todo and Miyamoto (2006), and Todo, Zhang, and Zhou (2011) regarding spillovers from FDI in R&D.

3 Chesbrough (2003) develops the concept of open innovation. Iino et al. (2018) find that the quality of patents is 36% and 23% higher when the firm engages in international collaboration than when it engages in no collaboration and domestic collaboration, respectively.

4 See Barrot and Sauvagnat (2016) for the presence of intra-national propagation of negative shocks due to natural disasters and Kashiwagi, Todo, and Matous (2018) for how internationalization of firms can mitigate such propagation.

5 McKinsey Global Institute (2019).

6 Helpman, Melitz, and Yeaple (2004) and Melitz (2003).

7 See Bernard et al. (2007) for US firms, Mayer and Ottaviano (2007) for European firms, and Wakasugi et al. (2008) for Japanese firms.

8 We do not argue more explicit trade restrictions, such as tariffs, in this policy brief, because this issue is extensively argued in other policy briefs.

9 Evenett et al. (2018). See Global Trade Alert (2018) for the number of discriminatory interventions and Ministry of Economy, Trade and Industry (2018) for some specific examples.

10 Acemoglu, Akcigit, and Kerr (2016) and Acemoglu et al. (2016).

11 See, for example, Jaumotte, Lall, and Papageorgiou (2013), Milanovic (2013), and Piketty (2017). Another possible cause of income inequality is skill-biased technological change (Card and DiNardo 2002).

12 Donaldson (2018), Inoue, Nakajima, and Saito (2017), and Roller and Waverman (2001).

13 Antras, et al. (2017).

14 Such export promotion programs have been often found effective (Van Biesebroeck, Konings, and Volpe Martincus 2016).

15 Reducing time for exporting procedures drastically is shown to increase welfare gains from FTAs (Itakura 2014).

16 There are studies showing that GVCs can benefit manufacturing sectors in advanced countries, depending on the industry and trade structure. See, for example, Fabinger, Shibuya, and Taniguchi (2017).

17 Thaler and Sunstein (2009) and Dunbar (2016).

18 Yamamura and Tsutsui (2018), Goto (2018), and Zak (2013)

References

• Acemoglu D, Akcigit U, Kerr W. 2016a. Networks and the Macroeconomy: An Empirical Exploration. NBER Macroeconomics Annual. 30; 273-335.

• Acemoglu D, Autor D, Dorn D, Hanson GH, Price B. 2016b. Import Competition and the Great US Employment Sag of the 2000s. Journal of Labor Economics. 34; S141- S198.

• Antras P, Fort TC, Tintelnot F. 2017. The Margins of Global Sourcing: Theory and Evidence from US Firms. American Economic Review. 107; 2514-2564.

• Baldwin R. 2016. The Great Convergence. Belknap Press: Boston.

• Barrot JN, Sauvagnat J. 2016. Input Specificity and the Propagation of Idiosyncratic Shocks in Production Networks. The Quarterly Journal of Economics 131 (3):1543- 1592.

• Bernard AB, Jensen JB, Redding S, Schott PK. 2007. Firms in International Trade. Journal of Economic Perspectives. 21; 105-130.

• Bernard AB, Moxnes A, Saito YU. 2018. Production Networks, Geography and Firm Performance. Journal of Political Economy. forthcoming.

• Blalock G, Gertler P. 2008. Welfare Gains from Foreign Direct Investment through Technology Transfer to Local Suppliers. Journal of International Economics. 74; 402-421.

• Blomström M, Sjöholm F. 1999. Technology Transfer and Spillovers: Does Local Participation with Multinationals Matter? European Economic Review. 43; 915-923.

• Card D, DiNardo JE. 2002. Skill-Biased Technological Change and Rising Wage Inequality: Some Problems and Puzzles. Journal of Labor Economics. 20; 733-783.

• Chesbrough HW. 2003. Open Innovation: The New Imperative for Creating and Profiting from Technology. Harvard Business Press.

• Donaldson D. 2018. Railroads of the Raj: Estimating the Impact of Transportation Infrastructure. American Economic Review. 108; 899-934.

• Dunbar R. 2016. Human Evolution: Our Brains and Behavior. Oxford University Press: Oxford.

• Evenett SJ, Akman S, Berger A., Bianchi E, Braga CP, Cristini M, Dawar K, Helble M, Kolev G, Matthes J, Mendez-Parra M, Schmucker C, Schwarzer J, Tamura A, Tu X. 2018. Mend It, Don’t End It: The Case for Upgrading the G20’s Pledge on Protectionism. https://www.g20-insights.org/policy_briefs/mend-it-dont-end-itthe-case-for-upgrading-the-g20s-pledge-on-protectionism/.

• Fabinger M, Shibuya Y, Taniguchi M. 2017. International Influences on Japanese Supply Chains. RIETI Discussion Paper. 17-E-022.

• Global Trade Alert. 2018. The GTA Database. https://www.globaltradealert.org/data_extraction.

• Goto J. 2018. On the Origins and Persistence of Parochial Altruism: A Tenure Institution and Intergroup Conflicts in Colonial India. unpublished.

• Haskel JE, Pereira SC, Slaughter MJ. 2007. Does Inward Foreign Direct Investment Boost the Productivity of Domestic Firms? Review of Economics and Statistics. 89; 482-496.

• Helpman E, Melitz MJ, Yeaple SR. 2004. Export Versus FDI with Heterogeneous Firms. American Economic Review. 94; 300-316.

• Iino T, Inoue H, Saito YU, Todo Y. 2018. How Does the Global Network of Research Collaboration Affect the Quality of Innovation? RIETI Discussion Paper. 18-E-070.

• Inoue H, Nakajima K, Saito Y. 2017. The Impact of the Opening of High-Speed Rail on Innovation. RIETI Discussion Paper. 17-E-034. Research Institute of Economy, Trade and Industry (RIETI).

• Itakura K. 2014. Impact of Liberalization and Improved Connectivity and Facilitation in ASEAN. Journal of Asian Economics. 35; 2-11.

• Jaumotte F, Lall S, Papageorgiou C. 2013. Rising Income Inequality: Technology, or Trade and Financial Globalization? IMF Economic Review. 61; 271-309.

• Javorcik BS. 2004. Does Foreign Direct Investment Increase the Productivity of Domestic Firms? In Search of Spillovers through Backward Linkages. American Economic Review. 94; 605-627.

• Kashiwagi Y, Todo Y, Matous P. 2018. International Propagation of Economic Shocks through Global Supply Chains. WINPEC Working Paper, No. E1810, Waseda Institute of Policital Economy, Waseda University.

• Keller W, Yeaple S. 2009. Multinational Enterprises, International Trade, and Productivity Growth: Firm-Level Evidence from the United States. Review of Economics and Statistics. 91; 821-831.

• Mayer T, Ottaviano GIP. 2007. The Happy Few: The Internationalisation of European Firms. Bruegel: Brussels.

• McKinsey Global Institute. 2019. Globalization in Transition: The Future of Trade and Value Chains. available at https://www.mckinsey.com/featuredinsights/innovation-and-growth/globalization-in-transition-the-future-of-tradeand-value-chains.

• Melitz MJ. 2003. The Impact of Trade on Intra-Industry Reallocations and Aggregate Industry Productivity. Econometrica. 71; 1695-1725.

• Milanovic B. 2013. Global Income Inequality in Numbers: In History and Now. Global policy. 4; 198-208.

• Ministry of Economy, Trade and Industry of Japan. 2018. The 2018 Report on Compliance by Major Trading Partners with Trade Agreements (WTO, FTA/EPA and IIA). available at https://www.meti.go.jp/english/press/2018_06/0618_002_00.html.

• Pew Research Center. 2018. Americans, Like Many Other Advanced Economies, Not Convinced of Trade’s Benefits. Pew Research Center.

• Piketty T. 2017. Capital in the Twenty-First Century. Harvard University Press.

• Roller L-H, Waverman L. 2001. Telecommunications Infrastructure and Economic Development: A Simultaneous Approach. American Economic Review. 91; 909-923.

• Thaler RH, Sunstein CR. 2009. Nudge: Improving Decisions About Health, Wealth, and Happiness. Penguin Books.

• Todo Y. 2006. Knowledge Spillovers from Foreign Direct Investment in R&D: Evidence from Japanese Firm-Level Data. Journal of Asian Economics. 17; 996-1013.

• Todo Y. 2011. Quantitative Evaluation of Determinants of Export and FDI: FirmLevel Evidence from Japan. The World Economy. 34; 355-381.

• Todo Y, Matous P, Inoue H. 2016. The Strength of Long Ties and the Weakness of Strong Ties: Knowledge Diffusion through Supply Chain Networks. Research Policy. 45; 1890-1906.

• Todo Y, Miyamoto K. 2006. Knowledge Spillovers from Foreign Direct Investment and the Role of R&D Activities: Evidence from Indonesia. Economic Development and Cultural Change. 55; 173-200.

• Todo Y, Zhang W, Zhou L-A. 2011. Intra-Industry Knowledge Spillovers from Foreign Direct Investment in R&D: Evidence from a Chinese Science Park. Review of Development Economics. 15; 569-585.

• Van Biesebroeck J, Konings J, Volpe Martincus C. 2016. Did Export Promotion Help Firms Weather the Crisis? Economic Policy. 31; 653-702.

• Wakasugi R, Todo Y, Sato H, Nishioka S, Matsuura T, Ito B, Tanaka A. 2008. The Internationalization of Japanese Firms: New Findings Based on Firm-Level Data. RIETI Discussion Paper, No. 08-E-036, Research Institute of Economy, Trade and Industry.

• Yamamura E, Tsutsui Y. 2018. Trade Policy Preference, Childhood Sporting Experience, and Informal School Curriculum: An Examination of Views of the TPP from the Viewpoint of Behavioral Economics. Review of International Economics.

• Zak PJ. 2013. The Moral Molecule: The New Science of What Makes Us Good or Evil. Random House.