This policy brief warns about the risks of discontinuation of the policy responses to the COVID crisis by pursuing exit strategies too early and/or too sharply. It outlines a comprehensive strategy for limiting such risks at a global level, and offers an in-depth discussion of the EU situation. In our view, the Euro Area could be left with long-lasting scars, so that its situation requires special treatment. We therefore present some policy proposals designed to preserve and strengthen the recovery in this area.

Challenge

Since March 2020 a global recession, triggered by the public health policies enacted worldwide to fight the COVID-19 pandemic, has shaken the global economy interrupting the expansion that occurred in most G-20 countries after the Great Financial Crisis of 2007-2009. The crisis is likely to induce persistent demand and supply side effects.

On the one hand, slack in demand might be a persistent legacy of the crisis. In line with evidence presented in Jordà et al. (2020) about the effects of pandemics in the past, the COVID-19 pandemic could be followed by a prolonged period of lower-than-expected real rates of return. This could be due to an increase in precautionary savings driven by higher unemployment risk,1 and by the perception that pandemics might be a recurring phenomenon in the future. The COVID-19 pandemic also falls in the category of deep recessions that have long-lasting adverse effects on risk attitudes (Malmandier and Nadler 2011; Giuliano and Spilimbergo 2014).

On the other hand, there is no doubt that social distancing has accelerated digitalisation, raising the share of e-commerce and inducing a change in business models, especially in the services industry. This change, in turn, is likely to stimulate sectoral reallocation of resources and a potentially painful reorganisation of those metropolitan areas that were the catalyst of growth in the pre-COVID-19 era. Furthermore, a large number of firms is likely to remain under financial distress and the usual controversy has already arisen about the emergence of zombie firms in consequence of the widespread use of state guarantees during the recession. The standard argument is that excessively generous state support artificially reduced the exit of unproductive firms and prevented Schumpeterian creative destruction.

Key policy questions concern the exit strategies from exceptional fiscal, monetary and regulatory policies. Based on a careful assessment of potential tradeoffs between supporting adequate demand levels and preserving microeconomic efficiency, this policy brief warns about the risks of discontinuation of the efforts so far undertaken by pursuing exit strategies too early and/or too sharply. It outlines a coherent strategy for limiting such risks.

Another fundamental challenge concerns the unevenness of the global recovery. So far, the policy response to the COVID shock has been mainly concentrated in the G-20, because many developing countries lacked the necessary fiscal space (UN 2021). It is therefore critical that G-20 countries’ coordinated actions maintain the stimulus necessary to support a global recovery.

At the time of writing, both the US and China are set on a path to steady recovery. By contrast, the lagging vaccination campaign and the third wave of the pandemic raise severe concerns for recovery in the EU. In our view, the Euro Area could fall into a slow recovery trap, so its situation requires special treatment. We therefore present some policy proposals specifically designed to preserve and strengthen the recovery in the EU.

Proposal

The prominent role of macroeconomic policies adopted in response to the COVID pandemic warns against a quick reversal of the emergency measures undertaken by governments, regulators and central banks. In our view, it is of the utmost importance that monetary and fiscal policymakers set a macro-prudential framework geared towards limiting uncertainty and precautionary attitudes. Letting “creative destruction” work its course in the aftermath of the COVID-19 pandemic would kill not only declining firms but also profitable and growing enterprises, which would be “strangled” by an exogenous, persistent, yet temporary contraction in demand. Empirical evidence confirms that reallocation raises unemployment if it occurs during a period of generalised slack activity (Chodorow-Reich and Wieland 2020). Similarly, a premature liberalisation of layoffs, i.e., one occurring before aggregate demand recovers, would generate cumulative depressing effects on aggregate demand. If the exceptional policies implemented to limit bankruptcies and workers layoffs were hastened, then one could also expect a further depressing effect in economic activity.

The recently approved Biden plan is consistent with this approach. Critics of the programme essentially rely on the view that US consumers’ demand would endogenously rebound and absorb the forced savings accumulated during the pandemic so that the fiscal stimulus might eventually lead to a resurgence of inflation. We disagree with this view because these excess savings are unlikely to unleash pent-up demand for services, due to inertia in precautionary savings and preference for consumption smoothing (Bilbiie et al. 2021). Private savings may also be instrumental for private sector deleveraging in countries, like in the USA, where private sector indebtedness has reached high levels. Furthermore, a successful one-off demand stimulus might lead to a one-off increase in the price level, as opposed to a permanent increase in inflation expectations. The FED rejected concerns about overdoing stimulus (Powell 2021) and confirmed its Flexible Average Inflation Targeting Approach (FAIT). The strong fiscal stimulus and the FED’s accommodation may be seen as buying insurance against a ZLB scenario.

Macroprudential and regulatory policies must be designed to deal with the potential resurgence of non-performing loans (NPLs). Preliminary evidence suggests that the phenomenon so far has been relatively limited (Cros et al. 2021). In our view, the task of regulatory and supervisory agencies should be simpler now than in the aftermath of the GFC. The COVID-19 pandemic was a truly exogenous shock and detailed business model analysis should allow separating firms whose sector is likely to recover back to normal from firms that were already under stress in 2019. This approach could not be adopted at the time of the GFC. In fact, that crisis was primarily triggered by a real estate boom that was both the cause and effect of massive credit misallocation. There is an important caveat here because this argument fully applies only to the extent that the world goes back to pre-pandemic normal; however, the COVID-19 shock might be a game-changer for the consumption of certain services (Hodbod et al. 2020).

In virtually all countries, the fiscal stimulus has taken the form of targeted transfers to support those most severely affected by the pandemic. Policymakers should implement a change in the budgetary mix, where targeted transfers are reduced, but the fiscal stance remains expansionary until the slack is absorbed. In this regard, one can imagine forms of fiscal support to displaced workers as restrictions to layoffs are gradually lifted. In the longer term, policymakers should strengthen the fiscal safety net (e.g. unemployment benefits, support to the working poor and so on),2 to counteract precautionary attitudes generated by the pandemic-induced recession.

As mentioned above, in the EU, the lagging vaccination campaign and the third wave of the pandemic raise serious concerns for recovery. Besides, preliminary drafts of the National Recovery plans suggest that EU governments are reluctant to apply for loans extended from the European Commission. The EU fiscal stimulus might turn out to be weaker than expected. In our view, the Euro Area could be left with long-lasting scars, so that its situation requires special treatment. We recommend an exit strategy for the Euro Area based on the following points.

MONETARY POLICY SHOULD REMAIN EXPANSIONARY FOR AN EXTENDED PERIOD

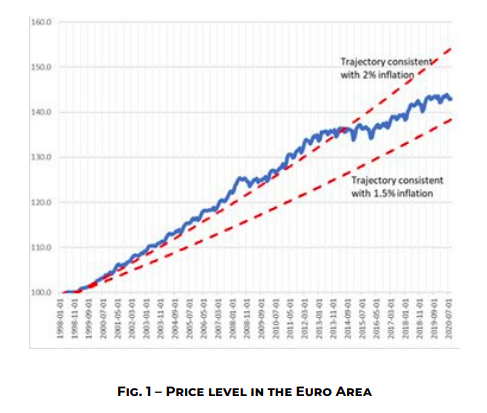

The ECB should take the opportunity of its forthcoming monetary policy strategy review (due in 2021) to clarify its interpretation of the price stability mandate and the role of asset purchases. Regarding price stability, it could involve a statement about the symmetry of its long-term inflation aim (to be maintained at 2%) and a clarification about the convergence paths to achieving its long-term objective. In practice, the ECB’s clarification could entail average inflation targeting strategy (AIT) at least until the Euro Area reversed the historically accumulated deviation of the price level from the 2% growth path aim (see Figure 1).3 Regarding the asset purchases, the ECB should affirm the strategic importance of the debt securities portfolios held by the Eurosystem. The QE policies pursued since 2015, coupled with the policy of reinvesting maturing debt and interest income, turned the Eurosystem into a significant player in European sovereign debt markets. From such a position, the ECB should steer the “riskfree” Euro Area yield curve (German) and influence the spreads of other Euro Area yield curves vis- à-vis the “risk-free” curve. Asset purchases allow the pursuit of the financial stability mandate, besides “lubricating” the transmission mechanism of monetary policy. There is evidence that QE has layed an important role in restoring growth in the Euro area since 2015.4 It is likely that the pandemic emergency purchase programme (PEPP), which started in March 2020, also contributed to containing the GDP contraction (Morana 2021). The ECB de facto facilitated debt relief by buying large quantities of sovereign bonds in the secondary markets (see Figure 3) and has announced a policy of maintaining an unchanged stock of government bonds on its balance sheet at least until 2023. This relatively shortterm policy horizon might become a self-defeating policy. High-debt countries could be exposed to substantial rollover risk, and concerns for the sustainability of their debt could trigger a new sovereign bond crisis. Thus, the ECB should extend the commitment to keeping government bonds on its balance sheet well beyond 2023. The exact timing should prevent the taper tantrum that caused the 2013 surge in US Treasury yields. In principle, the ECB might even consider asymmetric tapering actions on holdings of national bonds.

BANKING SUPERVISORY AND REGULATORY POLICIES SHOULD CONTRIBUTE TO AVOIDING AN ABRUPT DELEVERAGING PROCESS

Regulatory forbearance, loan moratoria and public guarantees contributed to maintaining the flow of bank credit to SMEs and other corporates during the pandemic (ESRB 2021a). The gradual withdrawal of the exceptional measures requires close cooperation between the banking sector and the authorities, in order to prevent massive bankruptcies (ESRB 20121b). In this respect, banks should identify businesses likely to remain viable after the pandemic and what is needed for those borrowers to remain liquid and solvent. Viability-enhancing measures such as debt restructurings, equity participation and mergers should be evaluated in the context of 2021-22 European Banking Authority (EBA) stress-testing and Single Supervisory Mechanism (SSM) exercises. This notwithstanding, NPLs are likely to increase even if support measures are phased out smoothly. The EU needs a strategy for dealing with this problem which could involve the creation of European AMCs (asset management companies) outside the scope of the current EU directive which considers their creation as one tool for the resolution of an individual bank and requires “bailing-in” private creditors. In our view, this is not the most appropriate framework for dealing with, or preventing, a systemic crisis.

Moreover, the ESM’s non-taped pandemic funds could contribute to a new strategy for banks’ recapitalisation and support for the establishment of AMCs with a view to achieving a quick disposal of NPLs. Accountancy rules could accommodate, for another year or so, the exceptional situation by delaying the reclassification of loans for the purposes of expected loss provisioning.

FISCAL POLICIES

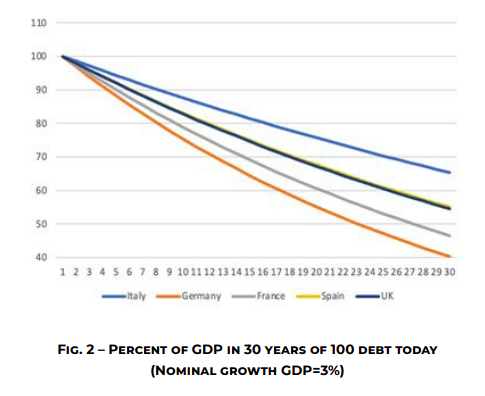

Euro Area governments should convince markets they will undertake the steps necessary to prevent the conflicts that led to the sovereign bond crisis. A new phase of sovereign debt instability and austerity policies would then likely exercise similar and probably even more adverse effects, unduly postponing the recovery and triggering a prolonged phase of financial and political instability in Europe. Therefore, we put forward two specific suggestions here. Our first proposal is that fiscal policies should remain stimulatory until GDP has reached its pre-pandemic growth path. Thus, it will be necessary for the European Commission to maintain its waiver on applying SGP rules. This proposal should not raise concerns for highly indebted countries. In fact, COVID-19 induced debt bears extraordinarily favourable real interest rates for the years to come. Under a recovery scenario of nominal GDP growth at a 2-3% annual rate, this extra debt as a percentage of GDP will tend to decline every year, making the future rollover of this debt easy (Figure 2). The monetary policy strategy proposed

above gives credibility to this scenario. One downside risk for this proposal would be that an overaccelerated recovery in the US induced the Fed to rein in the monetary stimulus. In that case we simply recommend that the ECB policy remains focused on domestic conditions, letting the euro/dollar exchange rate absorb the interest rate differential on the two currencies. In line with the underlying philosophy of the Recovery Plan, a sustainable growth path for the EU economy requires massive private and public investments. Unfortunately, public investments were insufficient in the Euro Area countries, possibly due to a perverse fiscal rule that requires member countries to maintain a structural budget balance at all times. Such a rule requires investments to be financed today by either more taxes or less government spending even if their benefits accrue to future generations. This is unlikely to make public investments a popular choice.

Our second proposal is that the balanced budget rule should apply to current government spending and taxation, but bond issues should finance capital spending. To overcome the risk that governments would game the system by classifying current budget items into capital spending, a prior agreement can be reached about what spending will qualify as an investment. Then, European institutions can be given the authority to monitor and enforce the new rule. Another criticism is that the debt burden transmitted to future generations will become unsustainable. This objection is ill-advised because the public investment will also create productive assets, whose revenues will make it easier to service debt in the future.

We think that the above changes should be enough to fix governments’ reluctance in applying for loans extended from the European Commission, enabling the EU fiscal stimulus to exercise its expansionary force in full.

Reform of the economic governance of the Euro area is long overdue. The focus should shift towards medium-term debt sustainability and quality of public expenditure instead of mechanistic compliance with debt/deficit targets that would likely backfire in the face of increased dispersion in national debt ratios. In the longer run, the Euro Area sustainability requires mutualisation of the national government debts and a centralisation of fiscal capacity. Achieving this will take a long time. An important step in that direction is the implementation of the Next Generation EU programme. This is the most extensive stimulus package ever financed through the EU budget, marking a meaningful change relative to the austerity policies recommended in the recent past to foster public debt sustainability. EU leaders have agreed to a recovery package of EUR 1.8 trillion that combines the EU budget for 2021-27 and the Next Generation EU programme. Under the agreement the Commission will be able to borrow up to EUR 750 billion on the markets, which is unprecedented in the history of European integration.

The package is designed to fight the COVID-19 crisis, sustain recovery in Europe, and start the green transition towards a carbon-free economy by 2050. Accomplishing this transition will require massive public and private investment in the research and innovation sectors, digital technologies, health and medical programmes, sustainable agriculture and animal farming, green energy production, and sustainable transportation systems. The EC should foster the idea that common EU objectives, such as preventing future health crises and supporting the green transition, cannot be delegated to national governments and require joint issuance of European sovereign bonds.

CONCLUSION

We argue in favour of a common exit strategy based on the following points:

1. The monetary policy stance should remain expansionary for an extended period, tolerating a foreseeable overshooting of long-term inflation targets. In this regard FAIT provides an appropriate framework for Central Bank strategy in the next years. Essentially, higher-than-normal-inflation should be tolerated until the price level reaches the original 2% growth path.

2. The banking supervisory and regulatory policies should avoid an abrupt deleveraging process.

3. The fiscal policy should remain stimulatory until GDP growth reaches its pre-pandemic path.

4. In the EU we argue in favour of a Golden Rule that frees public investment expenditure from the straitjacket of the current EU economic governance.

The perceptions of the post-pandemic risks differ sharply between the US and Europe. In the US there is a growing perception that inflation may become the number one risk during the recovery from the pandemic. This creates the danger that the US Fed feels compelled to start fighting inflation early on, thereby harming the recovery. In Europe there is little fear of inflation for the post-pandemic recovery period. This difference in perception has much to do with the fact that the US monetary and fiscal policy mix has been extraordinarily strong, while the policy mix in the EU, and in particular in the Euro Area, has been much more cautious.

The risk perceptions in the post-pandemic period in the EU, and in particular in the Euro Area, emanate from the surge in government debts during the pandemic. We have argued that this debt accumulation should not be of great concern. However, the political momentum in a number of countries of the Euro Area to restore fiscal discipline is strong. This will create a risk that the fiscal rules will be restored too early, leading to pressures to impose misguided fiscal discipline, thereby harming the economic recovery. Thus, while in the US the risk of an early exit from monetary-fiscal stimulus originates from a fear of inflation, in the EU it arises from a fear of government debt. Franklin Roosevelt’s dictum “what we should fear most are our own fears” remains highly relevant, both in the US and in Europe. We could say that our proposals are fearless.

Note: This chart simulates the path of debt-to-GDP 30 years in the future following a debt issue today (normalised at 100). It is assumed that governments issue 30-year bonds. We used the yields on these national bonds in February 2021 and a yearly nominal growth of GDP = 3%.

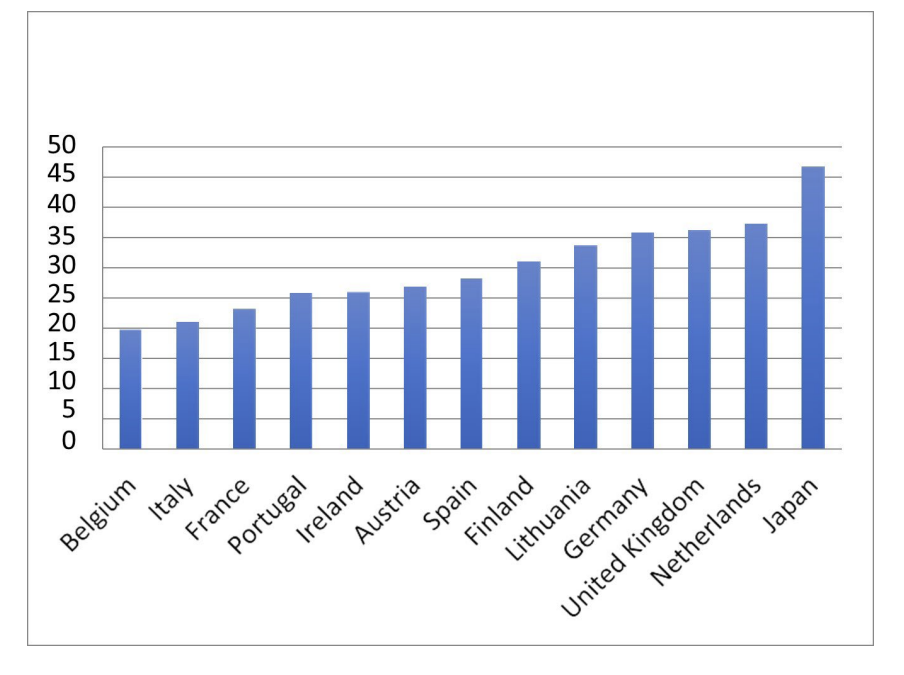

Fig. 3 Percent of government bonds held by central bank

Source: OECD, Economic Outlook 1

NOTES

1 Campos and Reggio (2015) provide evidence on the relationship between unemployment risk and precautionary savings.

2 According to World Bank estimates, the recovery phase will be characterised by a severe and persistent increase in poverty (Lakner et al. 2021)

3 Busetti et al. (2021) forcefully argue that price level targeting is the most effective strategy in terms of stabilising inflation and output and of reducing the duration and frequency of interest rate effective lower bound episodes.

4 An extensive literature exists on the effects of QE policies. See, among others, Rodnyansky and Darmouni (2017), Di Maggio et al. (2020), Dedola et al. (2021), Koijen et al. (2021).

REFERENCES

Andrade P., J. Galí, H. Le Bihan, and J. Matheron, Should the ECB adjust its strategy in the face of a lower*?, Working Papers 1236, Barcelona Graduate School of Economics, 2021

Bilbiie F., G. Eggertsson, and G. Primiceri, “US ‘excess savings’ are not excessive”, VoxEU, CEPR Policy Portal, 01, 2021 https://voxeu.org/article/us-excess-savings-arenot-excessive

Busetti F., S. Neri, A. Notarpietro, and M. Pisani, Monetary policy strategies in the New Normal: a model-based analysis for the euro area, Working Papers 1308, Bank of Italy, 2020

Campos R. and I. Reggio, “Consumption in the shadow of unemployment”, European Economic Review, vol. 78, 2015, pp. 39-54

Chodorow-Reich G. and J. Wieland, “Secular labor reallocation and business cycles”, Journal of Political Economy, vol. 128, 2020, pp. 2245-2287

Cros M., A. Epaulard, and P. Martin, Will Schumpeter catch Covid-19?, CEPR Discussion Paper 15834, 2021

Dedola L., G. Georgiadis, J. Gräb, and A. Mehl, “Does a big bazooka matter? Quantitative easing policies and exchange rates”, Journal of Monetary Economics, vol. 117, 2021, pp. 489-506

De Grauwe P., The governance of a fragile Eurozone, CEPS Working Documents, Economic Policy, May 2011 https://www.ceps.eu/book/governance-fragile-eurozone

De Grauwe P. and Y. Ji, “Mispricing of sovereign risk and macroeconomic stability in the Eurozone”, Journal of Common Market Studies, vol. 50, 2012, pp. 866-80

Di Maggio M., A. Kermani, and C.J. Palmer, “How quantitative easing works: Evidence on the refinancing channel”, The Review of Economic Studies, vol. 87, 2020, pp. 14981528

European Systemic Risk Board (ESRB), “Financial stability implications of support measures to protect the real economy from the COVID-19 pandemic”, February 2021a.

European Systemic Risk Board (ESRB), “Prevention and management of a large number of corporate insolvencies”, April 2021b

Giuliano P. and A. Spilimbergo, “Growing Up in a Recession”, Review of Economic Studies, vol. 81, 2014, pp. 787-817

Guerrieri V., G. Lorenzoni, L. Straub, and I. Werning, Macroeconomic implications of COVID- 19: Can negative supply shocks cause demand shortages?, Working Papers w26918, National Bureau of Economic Research, 2020

Hodbod A, C. Hommes, S.J. Huber, and I. Salle, “Is COVID-19 a consumption game changer? Evidence from a large-scale multi-country survey”, Covid Economics, no. 59, London, CEPR Press, 2020, pp. 40-76

Koijen R.S., F. Koulischer, B. Nguyen, and M. Yogo, “Inspecting the mechanism of quantitative easing in the euro area”, Journal of Financial Economics, vol. 140, 2021, pp. 1-20.

Jordà Ò., S.R. Singh, and A.M. Taylor, Longer-run economic consequences of pandemics, Working Papers w26934, National Bureau of economic research, 2020

Lakner C., N. Yonzan, D.G. Mahler, R.C. Aguilar, H. Wu, and M. Fleury, Updated estimates of the impact of COVID-19 on global poverty: The effect of new data, The World Bank, 2020 https://blogs.worldbank.org/opendata/updated-estimates-impact-covid-19-global-poverty-effect-new-data

Malmandier U. and S. Nadler, “Depression babies: Do macroeconomic experiences affect risk-taking?”, Quarterly Journal of Economics, vol. 126, 2011, pp. 373-416.

Morana, C., A new macro-financial indicator for the euro area, CefES WP no. 467, 2021, available at SSRN https://ssrn.com/abstract=3823720

Powell J.H., “Getting back to a strong labor market”, Speech, Board of Governors of the Federal Reserve System, 2021 https://www.federalreserve.gov/newsevents/speech/powell20210210a.htm

Rodnyansky A. and O.M. Darmouni, “The effects of quantitative easing on bank lending behavior”, The Review of Financial Studies, vol. 30, 2017, pp. 3858-87

United Nations, Financing for Sustainable Development Report 2021, https://developmentfinance.un.org/fsdr2021

Vinci F. and O. Licandro, Switching-track after the Great Recession, CFCM Discussion Paper No. 2020/02, 2020