With Environmental, Social and Governance (ESG) investing becoming mainstream, it is urgent to develop a standardised set of information that investors and companies can use in their decision-making process. Information consistency, integrity and trustworthiness, and appropriate evaluation of the impact of the ESG-related efforts are essential to ensure positive spill-over in societies, countries and the environment. We urge the G20 to play a proactive role in defining standardised disclosures and narrative, and assessing companies’ ESG policies. More specifically, we recommend identifying a vision that will encompass the final goals at the society level and backtrack to define companies’ goals, in terms of ESG policies, and metrics to achieve them.

Challenge

The pandemic and the globally slow and asymmetric vaccination rate will only exacerbate societal and environmental issues, populations’ related concerns and the pressure on companies to be part of the solution.

ESG issues have become particularly important for investors, leading many publicly traded firms to release more information about their related efforts. Unfortunately, the lack of standardisation in terms of goals, policies and progress monitoring has led to a proliferation of ESG disclosure standards and metrics.

The increasing complexity of information reports has spurred an increase in the number and influence of ESG ratings. Ideally, these ratings should provide clear, cost-effective and consistent information about companies’ ESG performance. Ultimately, they will play a crucial role in helping funds and other investment groups pinpoint firms that meet their ESG philosophies and standards. They should also help companies assess their ESG performance among their peers and identify opportunities to differentiate themselves.

Building trust emerges as a key challenge. Market participants remain sceptical of the value of ESG information, from the disclosed data to the ratings. Many identify the inconsistencies and lack of comparability across companies and ratings as the main challenges when dealing with ESG investing.

At this crucial stage, the main obstacle to an effective ESG approach is no longer neglect or lack of awareness, but fragmentation, methodological inconsistency and the spread of confusion. Society needs to embrace impactful ESG policies, and successful ESG policies require buy-in from companies and investors.

Proposal

ESG INFORMATION

ESG information, disclosed directly by firms and expressed synthetically in ratings, plays a crucial role in ESG investing. On the one hand, it helps investors identify and manage risks and opportunities that standard financial analysis would miss. On the other hand, it helps companies highlight their ongoing ESG policies. Beyond that, ratings could influence companies to adopt better practices to avert downgrades or improve their scores.

Many investors have already been incorporating non-financial indicators into their investment frameworks. In contrast, the modern reference to ESG investing denotes an explicit and systematic integration of ESG factors into the investment process. However, recent surveys find that many investors struggle with a lack of clarity around ESG terminology and definitions, and find the ratings challenging to use (State Street Global Advisors 2018; Wong & Petroy 2020). For many, the lack of quality and consistency of public companies’ ESG disclosures and the lack of comparability across ratings, are barriers to greater uptake of ESG investing (GAO 2020). More specifically:

COMPANY-LEVEL INFORMATION

There are hundreds of ESG-related variables available for review. Some come from company reports and regulatory filings, while many others come through interviews or questionnaires and third-party independent reports. The large number of interviews, questionnaires and data-reporting requirements faced by companies has become a burden and a natural barrier for some who would otherwise be interested in disclosing ESG information.

There is no universally accepted approach to measuring non-financial indicators. In September 2020, the Global Reporting Initiative, the Climate Disclosure Standards Board, the Sustainability Accounting Standards Board, the International Integrated Reporting Council and the Carbon Disclosure Project five leading standard setters for ESG reporting suggested that “existing frameworks, standards and standard-setting processes can provide the basis for progress towards a comprehensive corporate reporting system” (Statement of Intent 2020). Shortly afterwards, the World Economic Forum’s International Business Council, in collaboration with the Big Four accounting firms, released its reporting framework for ESG standards (International Business Council 2020).

On the regulatory side, very little has been done to establish global ESG standards. In February 2021, after a year-long evaluation, the International Organization of Securities Commissions (IOSCO) identified three priorities: “encouraging globally consistent standards, promoting comparable metrics and narrative, and coordination across approaches” (IOSCO 2021). In March 2021, the European Commission published two reports on non-financial reporting standards, proposing a roadmap for developing a comprehensive set of EU sustainability reporting standards, and reforms to the existing governance structure, in order to establish a non-financial reporting pillar mirroring the financial one (EFRAG 2021a and 2021b).

RATING INFORMATION

With ESG adoption rapidly becoming mainstream, ESG ratings have become essential, as investors seek to interpret and compare ESG information. As a result, there are currently at least 125 organisations, comprising a mix of niche players, major data providers and credit rating agencies, that provide ESG ratings and research (Kramer et al. 2020). However, these ratings are challenging to interpret, leaving rated companies struggling to use them in their internal assessment of ESG performance, and investors unsure of which ratings to use.

Divergences in ESG ratings are well documented and have several sources. Berg et al. (2020) estimate that the correlations between six major ESG ratings range from 0.38 to 0.71, and explain most of the difference by divergence in the definition of ESG, its scope and the factors used to measure it. Lopez et al. (2020) show that differences arise even when the ratings rely on similar definitions, and even then, the methodology used strongly impacts the ratings.

Aggregate confusion: ESG ratings aggregate a variety of issues, making their interpretation challenging. The final score used for ESG ratings combines environmental, social and governance factors. These three topics are equally broad and can have different interpretations of scope and measures. SEC Chairman Jay Clayton recently referred to this aggregation confusion, stating he has not “seen circumstances where combining an analysis of E, S, and G together, across a broad range of companies, for example with a ‘rating’ or ‘score’, particularly a single rating or score, would facilitate meaningful investment analysis that was not significantly over-inclusive and imprecise.” (Flood, 2020)

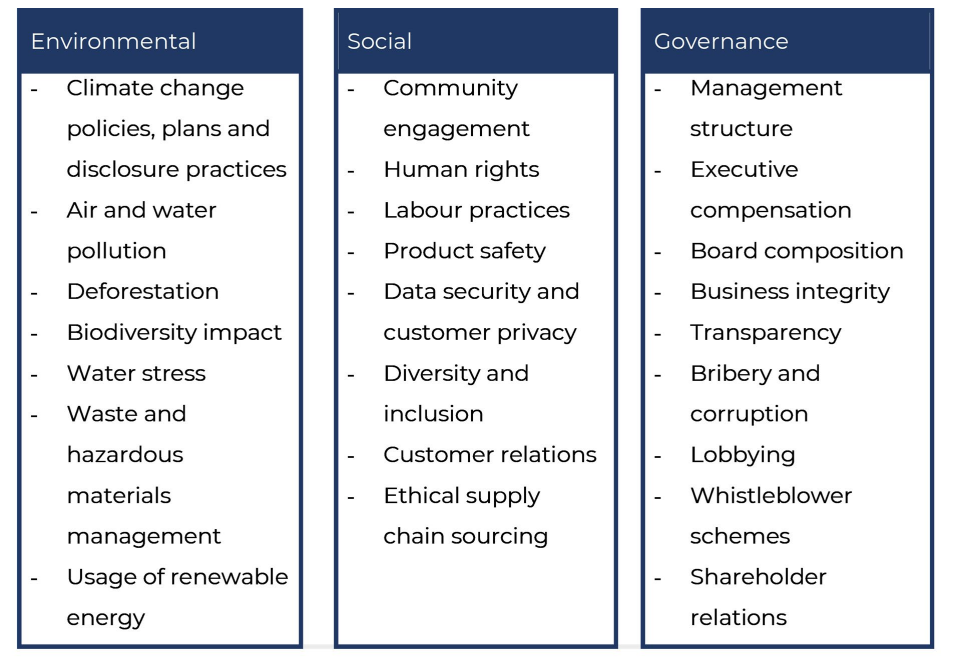

EXAMPLES OF ENVIRONMENTAL, SOCIAL AND GOVERNANCE FACTORS

Source: Lopez et al. (2020)

GOALS TO ACHIEVE

As discussed previously, ESG investing integrates metrics in investment decision-making, potentially leading to a more efficient allocation of capital, with enhanced returns for investors and positive outcomes for companies, individuals, the environment and society.

Of course, the ability to effectively integrate ESG themes into investment processes depends on the availability metrics that:

- are broadly accepted;

- provide sufficient information about the key drivers of risk and long-term value creation;

- measure progress on the ESG policy implemented, where such policies have been designed to achieve specific goals relating to environmental, social and corporate; governance concerns, agreed upon at industry and national /regional levels.

- In other words, the ESG information shared by the company should:

- help investors better understand and compare risk, while identifying opportunities and including them in their overall assessment of the company;

- help companies adjust their strategy according to their goals, and understand the corresponding impact on their ESG-assessment;

- help domestic and international regulators and authorities better monitor how efforts at company level facilitate progress towards longer-term goals at societal or national level, such as Sustainable Development Goals and other countries’ specific goals of inclusion, diversity policies and fair employment policy, among others.

FOUR ACTIONABLE POLICY RECOMMENDATIONS

We urge the G20 leaders to develop a comprehensive vision to reconcile the different existing efforts from the private sector, auditors, standard-setters, governmental and international institutions, while getting companies involved. This would identify where these initiatives fit in the broader ESG strategy. The credibility of ESG investing lies in its ability to be held accountable for the promises it is making, from better assessment of risk and long-term valuation, to the positive impact on societies and the environment. This assessment must consider the different time frames necessary for changes to take place at the corporate, societal and environmental levels.

ESG investing is at the nexus of several G20 working groups’ scope, and all need to be involved at different stages, especially when it comes to identifying appropriate benchmarks. The working groups and partnerships we refer to are as follows: Agriculture, Environment, Labour, Energy Transition and Climate Sustainability, International Financial Architecture, Tourism, Trade and Investment and Global Partnership for Financial Inclusion.

We propose four actionable policy recommendations that will guide the design of the overall ESG strategy:

- What are the goals? Define the scope and goals of ESG investing for the medium term.

- How to achieve them? Identify the relevant policies that will make it possible to achieve these goals.

- How to measure progress? Identify the corresponding metrics, narratives and benchmarks.

- Assessment transparency

What are the goals? Define the scope and goals of ESG investing for the next 10 years, i.e. what priorities and goals are to be achieved and their expected timeline. Clarifying the purpose of ESG investing at the corporate, societal and environmental levels is essential to bring rigour and credibility to the current system, where the terms ESG, Responsible Investing and Sustainability are often used interchangeably. Only identifying clear and specific E, S and G goals can lead to the successful definition and standardisation of metrics, and both developed and less developed economies need to be part of this goal-setting process.

How to achieve them? Identify the relevant E, S and G policies at company, industry, national and regional level to achieve these goals. These policies need to help achieve the ESG goals, while accounting for an industry or a region’s specificities. This is especially true for companies in less developed countries. The low level of inclusion and participation of emerging markets in the development of ESG frameworks would be counterproductive to Global Sustainability. It is the responsibility of the G20 to ensure that developed and emerging markets are part of the strategy-design process, and that closing the ESG gap becomes a specific focus.

How to measure progress? Identify the corresponding metrics, narratives and benchmarks. The assessment of ESG policies requires standardised metrics, narratives and benchmarks. The current ESG metrics predominantly measure the existence of policies or certain activities, rather than their impacts (O’Connor & Labowitz 2020).

To better understand and compare risk across companies and jurisdictions, it is necessary to define international standards and a structured framework for reporting and monitoring companies’ ESG information. While leveraging existing sustainability-related reporting frameworks, these metrics and narratives should consider industry-specific factors as well as country-specific factors. This would help provide stronger benchmarking for investors, while enabling companies to track their performance against peers and make more accurate assessments. Furthermore, the ESG framework is designed to enhance companies’ and society’s resilience to shocks, so these benchmarks could be used in ESG stress test exercises.

To avoid unexpected consequences, the implementation of ESG standards of disclosure and narrative implementation should be supported by a companion programme in countries where ESG reporting remains a low priority.

Assessment Transparency. Creating consistent, high-quality data is only part of the solution. Assessment of a company’s performance relies either on specific benchmarks or scores and ratings provided by a third party. While identifying relevant benchmarks is part of the previous point, ESG scores and ratings also need to be transparent regarding the information they convey. Rating providers’ different emphases on E, S or G can be informative as long as the rating users know it. Rating providers must be transparent about their methods with investors, firms and other users, who can then decide which rating most aligns with their priorities. Finally, due to the complexity and the novelty of ESG assessment, benchmarks, scores and ratings should be assessed regularly: the goal is to evaluate their success rate in protecting investors from significant underlying risks.

These recommendations encompass existing efforts relating to companies’ ESG assessments. They rely on a private-public effort between companies, auditors, standard-setters, rating providers, governmental and international institutions. The credibility of ESG investing lies in its ability to facilitate the disclosure of information that is useful for the purposes of making decisions, assessing risk and long-term value, and educating the different stakeholders (firms, investors, governments, international institutions and regulators, among others) on the transmission between firms’ initiatives and their impact on society and the environment, in each jurisdiction.

REFERENCES

Berg, F., J.F. Koelbel, and R. Rigobon, “Aggregate confusion: the divergence of ESG ratings”, MIT working papers, May 2020

European Financial Reporting Advisory Group (EFRAG), “Proposals for a Relevant and Dynamic EU sustainability Reporting Standard Setting”, February 2021, https://ec.europa.eu/info/sites/info/files/business_economy_euro/banking_and_finance/documents/210308-report-efrag-sustainability-reporting-standard-setting_en.pdf

European Financial Reporting Advisory Group (EFRAG), “Potential Need for Changes to the Governance and Funding of EFRAG”, March 2021 https://ec.europa.eu/info/sites/info/files/business_economy_euro/banking_and_finance/documents/210308-report-efrag-governance-funding_en.pdf

Flood, C. “SEC chair warns of risks tied to ESG ratings”, Financial Time, 28 May 2020

International Business Council, “Measuring Stakeholder Capitalism” World Economic Forum, 22 September 2020

International Organization of Securities Commissions (IOSCO), media release, 24 February 2021 https://www.iosco.org/news/pdf/IOSCONEWS594.pdf

Kramer, M., N. Jais, E. Sullivan, C. Wendel, K.Rodriguez, C. Papa, C. Napoli, and F. Forti, “Where ESG Ratings Fail: The Case for New Metrics”, Institutional Investor, 7 September 2020

Lopez, C., O. Contreras, and J. Bendix, “ESG Ratings: The Road Ahead”, Milken Institute, November 2020

O’Connor, C. and S, Labowitz, “Putting the ‘S’ in ESG: measuring human rights performance for investors”, NYU Center for Business and Human Rights, March 2017

State Street Global Advisors, Performing for the Future. ESG’s Place in Investment Portfolios. Today and Tomorrow, ESG Survey Report, 2018

Statement of Intent, “Statement of Intent to Work Together Towards Comprehensive September 2020 https://29kjwb3armds2g3gi4lq2sx1-wpengine.netdna-ssl.com/wp-content/uploads/Statement-of-Intent-to-Work-Together-Towards-Comprehensive-Corporate-Reporting.pdf

United States Government Accountability Office (GAO), “Public Companies Disclosure of Environmental, Social, and Governance Factors and Options to Enhance Them”, July 2020 https://www.gao.gov/assets/gao-20-530.pdf

Wong C. and E. Petroy, “Rate the Raters 2020: Investor Survey and Interview Results”, The SustainAbility Institute, 2020