Emerging digital financial technology has already had a significant impact on financial development and holds significant potential to advance the sustainable finance agenda. Various challenges limit the assessment of environmental risks, as well as the mobilisation of sustainable finance. Digital technology (including artificial intelligence, distributed ledger technologies, cloud computing, the Internet of Things and big data) can help address the risk identification and mobilisation challenges and can at the same time help promote financial inclusion and energy justice. This policy brief highlights the potential of digital solutions and presents six proposals to enhance digital technologies with implications for the Group of 20 (G20) central banks and supervisors.

Challenge

Mobilising private capital to support sustainable development and a low-carbon-economic transition while ensuring a stable financial system poses a significant challenge for policymakers. There are various barriers to scaling up sustainable finance and to assessing and mitigating environmental risks. These include the inadequate internalisation of environmental externalities; maturity mismatches; under-disclosure of sustainability risks and low degree of standardisation and comparability of environmental, social and governance (ESG) data across assets; a lack of clarity on “sustainable” finance definitions; information asymmetries; and limited analytical capabilities by financial institutions to accurately assess opportunities and financial risks.

Financial technology (fintech) and enhanced digital approaches offer solutions to overcoming some of these barriers, and monetary and supervisory authorities can play an enabling role in creating the framework conditions that support the mobilisation of sustainable finance and enhance risk assessment and mitigation practices.

However, at the same time, digital finance can be associated with its own problems and challenges, ranging from weak and vulnerable digital infrastructure, the limited robustness of systems and data protection issues, to the use of fraudulent activities, and the adverse environmental impacts of technology and digitalisation (e.g. high energy use and the environmental impact of critical minerals, including rare earths, mining and processing [Hund et al., 2020]). Fintech also raises issues that go beyond traditional prudential frameworks, relating to other public policy objectives, including the safeguarding of data privacy, cyber-security, consumer protection, fostering competition and compliance with anti-money laundering/combating the financing of terrorism (BIS, 2018). For instance, cryptocurrencies are increasingly recognised as speculative assets that in many cases are used to facilitate money laundering, ransomware attacks and other financial crimes. Bitcoin in particular has been subject to public and regulatory scrutiny, resulting in criticism for the lack of public interest attributes, as well as criticism of its wasteful energy footprint (BIS, 2021).

Furthermore, addressing limited financial and digital inclusion is a major challenge in the context of achieving a just and inclusive transition. There is still a significant usage gap – referring to people who live within areas covered by mobile broadband networks but do not yet subscribe to mobile broadband services – standing at 3.2 billion people in 2021, or 41 percent of the global population (GSMA, 2022). Reasons for this usage gap generally relate to a lack of affordability, relevance, knowledge and skills, in addition to safety and security concerns. Digitalisation is a key lever in addressing financial inclusion, and operators’ investments in network infrastructure over the last decade have helped to shrink the coverage gap for mobile broadband networks from a third of the global population to just 6 percent. For many developing and emerging markets, shifting to intelligent assets, such as real-estate assets capable of self-reporting energy consumption from smart meters, will require greater investments in the Internet of Things (IoT)-enabled digital infrastructure. This would enable commercial banks, central banks and financial regulators to benefit from sustainability data that is directly sourced from the real economy and that can be used to scale up sustainable finance while ensuring transparency and credibility of disclosed emissions data.

Due to the nature of the quickly evolving fintech landscape, financial institutions, as well as supervisory authorities, also tend to lack the expertise and capacities needed to assess the opportunities as well as threats of digital finance for consumers, financial institutions and financial stability. Furthermore, a mismatch between fintech innovation in the financial sector and the supervisory capacity of governments can create a complicated political economy of implementation challenges and gaps. There is therefore an urgent need to significantly expand capacity within governments as well as the private sector. There is also a need for close coordination among different government agencies due to the complex supervisory requirements created by fintech and digital finance that can reach across several traditional supervisory frameworks and responsible agencies.

These challenges need to be addressed to leverage digital capabilities to scale sustainable finance. Group of 20 (G20) central banks, supervisors and policymakers face the challenge of supporting the development of digital sustainable finance infrastructure. While for some the challenges lie in having to mitigate possible unintended consequences and risks to consumer protection and financial stability, others, especially in the developing and emerging economy context, are related to basic infrastructure, and financial or digital inclusion-related challenges are reflected in an underdeveloped IoT-enabled digital infrastructure.

Proposal

Digital finance offers significant opportunities for improving the collection and processing of sustainability-related information and assessing environmental risks and impacts in the financial sector through more effective systems and data-provision mechanisms. At the same time, digital solutions can foster financial inclusion and innovation in the real economy, and reduce the vulnerability to environmental degradation and climate change of low-income households and micro, small and medium enterprises (MSMEs).

This policy brief outlines six policy recommendations for monetary and financial authorities to enhance the digital infrastructure with the aim of enabling digital technologies to address sustainability-related challenges. Policymakers can play a key role as architects of financial and digital framework infrastructure to ensure access to standardised, quantified and comparable sustainability data. This includes the infrastructure for disclosure data as well as for sourcing and aggregating data directly from the real economy. The latter can be provided through collaboration with responsible ministries to enable the design of data infrastructure for high-emission and high intra-sectoral diversity asset classes such as real estate and transportation. Data lakes and warehouses can provide easy access to, for example, energy performance certificates on real estate and high-frequency energy consumption data of a national building stock via IoT. For policymakers, it is key to take on the role of digital data infrastructure enablers and architects to enhance the ability of digital technologies to help address the challenges for sustainable finance. In addition, central bank digital currencies (CBDCs) are a key technology that can enable green asset fractionalisation to crowd-in savings, facilitate low-cost cross-border payments to attract capital into green assets in developing and emerging markets, and improve the risk assessment of green investments as well as to automate proof of impact reporting.

The following proposals are based on a review of emerging best practice and include direct recommendations for G20 central banks and supervisors, which will have to mitigate and manage risks associated with digital finance to ensure consumer protection and safeguard financial stability.

1. Provide the framework to enable digital data infrastructure to play a role in scaling up sustainable finance

The digital data infrastructure that offers market participants access to a range of climate- and nature-related (financial) data through open application program interfaces (APIs) constitutes a central framework condition that can enable the growth of new sustainability-focused financial products and services. Today, 8 percent of all European and United Kingdom fintech companies using open banking APIs – which connect banks, third parties and technology providers and enable them to securely exchange data – have a sustainability-related product. Globally, 87 percent of countries have companies with some form of open APIs in place (Economist Intelligence Unit Limited, 2020), and open banking regulation is underway in a number of jurisdictions, including Kenya and Brazil, as part of payment directives to stimulate innovation via unlocking access to financial transaction data. A combination of open banking infrastructure and carbon inventory data is enabling market participants to respond to rising demand for scope 3 emissions data through automated approaches, thereby enabling small and medium enterprises (SMEs) to obtain carbon footprint data. In markets where a combination of transaction data is available through open banking APIs and carbon inventory data, new digital solutions are emerging based on algorithms, directly assessing company expenditure data from banks to automatically classify every purchase to a sector based on supplier codes and finally automatically ascribe a carbon footprint based on the size of the purchase and emission sector averages. These technology-enabled solutions allow SMEs to access the carbon footprint of their operations and, at the same time, offer banks the data needed to design SME loans that link interest rate rebates to carbon reductions or to significant contributions to climate mitigation or adaptation. It also enables banks to understand the carbon footprint of retail clients through automated analysis of card and mobile payment transactions and assigning individualised carbon footprints based on transaction data.

Furthermore, these data sets enable banks to identify patterns and provide businesses and individuals with actionable insights on how to transition to carbon lighter expenditures. Policymakers and regulators can further stimulate innovations by moving from open banking to open finance, thereby enabling market participants to access financial data on, in addition to banking transactions, pension, insurance, investments and crypto-asset holdings automatically linked to carbon data assessing current footprints. Currently, the transaction data made available by open banking is based on merchant codes, and not available on specific items purchased on online platforms or in shops. If open banking and open finance (incl. open ecommerce) were to offer people and businesses an opportunity to share more granular (product level) transaction data, then automated business and retail customer carbon (and eventually also nature) footprints would become more accurate based on real behaviour rather than on modelled sector averages. This would enable more precise and granular advice on transition pathways.

Given these significant opportunities to utilise digital solutions, including open banking APIs, open finance and automated reporting of emissions and footprints, to address sustainable finance-mobilising and risk-assessment challenges, financial policymakers should play a key enabling role by working with the private sector to provide the formal framework conditions to enable digital data infrastructure. Governments can make carbon inventory data available and, with time, build the data infrastructure to add granularity through open LCA product databases. Financial regulators can adopt open banking regulation and gradually extend this to open finance.

2. Promote machine-readable standardised disclosure infrastructure

A challenge for banks, asset managers and asset owners in allocating capital to sustainable assets is the availability of reliable, high-quality and up-to-date ESG disclosure data, which, when compared with traditional financial accounting data, is non-standard and incomplete. This limits the comparability of the environmental impact and risk of different assets. Standardised disclosure frameworks and regulations are emerging to address this challenge, and green finance taxonomies with corresponding technical screening criteria and sustainable finance disclosure regulations have been examples in the EU and the UK.

Centralised disclosure databases in machine-readable formats (e.g. XBRL) and on interoperable digital platforms can play a central role in enabling more accurate rating approaches and greater comparability of sustainable and transition finance-related assets to build market confidence and increase capital allocations through increased transparency. The proposed European Single Access Point (ESAP) (European Commission, 2021) and the Monetary Authority of Singapore’s Project Greenprint platforms (MAS, 2021) are emerging practices exemplifying this digital infrastructure. The EU ESAP is intended to provide an easy centralised point of access to disclose information about financial services, capital markets and sustainability. ESAP will, among other functions, offer APIs easy access to information in the portal and will also offer functions to download large quantities of data. MAS is piloting four digital platforms to address the financial sector’s need for quality and standardised sustainability data. The platforms have the three objectives of monitoring, quality measurement and lastly mobilisation of ESG capital. Regulators can design the disclosure infrastructure to be able to receive data directly from the real economy via the IoT firstly from transport and real estate as the first assets with self-reporting capabilities via the IoT. Other G20 countries should follow the examples of the EU and Singapore and work towards building this digital infrastructure to facilitate enhanced sustainability disclosures.

3. Develop and deploy artificial intelligence (AI) tools for verification of disclosures

Natural language processing (NLP) algorithms are already increasingly used by third-party ESG data and analytics providers to overcome the challenge of improving the low frequency of disclosure. For example, web scraping can be used to enhance data inputs into company ESG ratings through the identification of sentiments about a company on social media, in expert reports and also to discover companies receiving environmental fines or being mentioned in other penalties or regulations databases. While NLP is not a highly sophisticated form of AI, as it is a textual extraction and classification tool, it can enable the analysis of large quantities of textual data. Hence, central banks and financial supervisors can leverage NLP AI capabilities to automatically assess and compare disclosure data of supervised institutions to create automated comparisons and indexing processes, as well as to track changes in disclosed data and metrics over time of all supervised institutions.

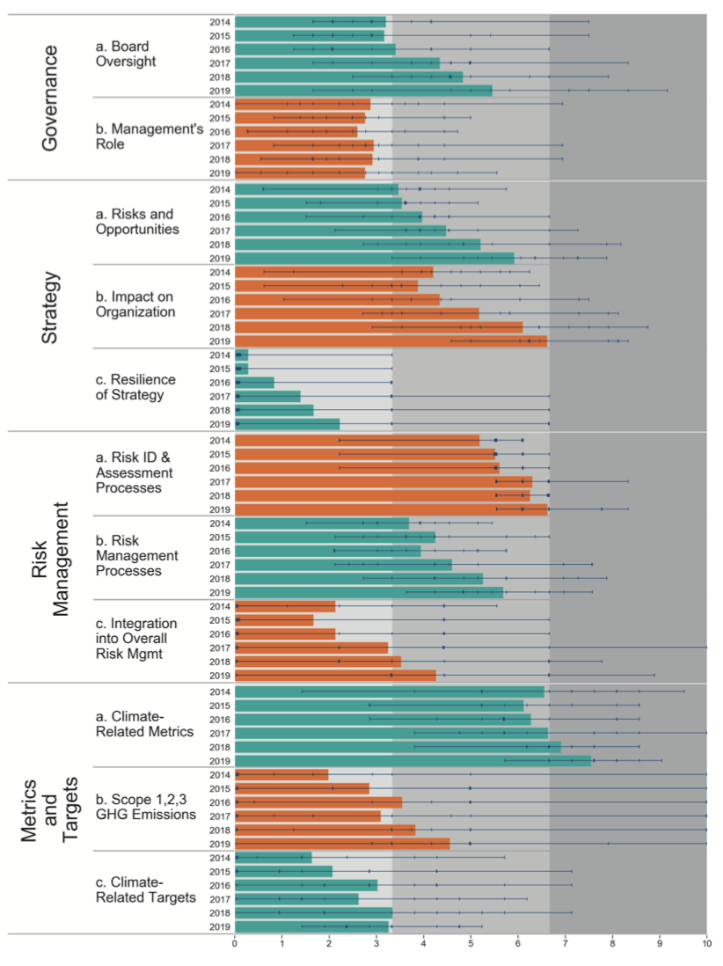

An example of an early market practice is the leveraging of NLP techniques for the tracking of disclosures along the lines of the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD) (TCFD, 2017) by Banco de España, the central bank of Spain, for information extraction to automatically generate a TCFD compliance index for each of the four main areas of the TCFD framework for the period 2014-2019 using corporate reports (Figure 1) (Moreno and Caminero, 2020). The index uses text mining to provide an overview of the evolution of the level of climate-related financial disclosures present in the corporate reports of the Spanish banking sector.

Figure 1: Estimated compliance index for the recommended TCFD disclosures.

Source: Moreno and Caminero (2020).

The XBRL is a framework of tags that allows users to digitalise data points in a company disclosure, creating a machine-readable document. Hence, it converts the unstructured data in company reports into structured data. An open international standard for digital business reporting, as well as requirements to lower the degree of fragmentation in disclosures by requiring integrated reporting where sustainability is part of annual financial statements and risk sections of annual reports, will further facilitate the use of NLP for automated disclosure monitoring. It will also create conducive conditions for central banks and financial regulators to integrate emerging sustainability risks into the AI design so that the algorithms for instance with time become adapted to integrate nature-related financial risks into the NLP AI design as regulatory expectations of integrated reporting of climate and nature-related risks emerge with the adoption of the Post-2020 Global Biodiversity Framework and the launch of the recommendations of the Taskforce on Nature-related Financial Disclosures (TNFD).

Central banks and financial supervisors should leverage NLP and machine-learning capabilities of AI for market analytics and research purposes. Furthermore, G20 central banks and supervisors should develop and deploy AI tools for verification of disclosures, building on the emerging practice by other supervisors and the private sector in this field. An additional step central banks and supervisors can explore is, as the data foundation matures, to gradually start to leverage the machine learning capabilities of AI to verify disclosed claims for high-priority climate and nature-related risks such as e.g. deforestation, which currently is one of the nature and climate-related risks with the most mature data layer, via high-resolution satellite data and where machine learning will enable the training of AI to detect financed deforestation as a means to verify disclosed claims. Or other sectors with relatively high data readiness such as real estate to leverage energy consumption data from centralised data lakes to climate stress-test mortgage parts of bank loan books.

4. Enhance the ability to crowdfund green finance

Given the urgent need to scale up investments in sustainable energy infrastructure to foster a low-carbon transition, many countries with underdeveloped capital markets face significant challenges mobilising domestic resources for infrastructure investment. Again, digital approaches can help to address the barriers that limit the scalability of sustainable finance, such as asymmetrical information between investors and other stakeholders and the lack of local community power (Sustainable Digital Finance Alliance, 2018; Sustainable Digital Finance Alliance and HSBC, 2019). Digital solutions can facilitate domestic resource mobilisation for sustainable investments and, at the same time, improve the implementation of infrastructure projects throughout the entire life cycle by facilitating processes and enhancing transparency, not least regarding sustainability impact (Chen and Volz, 2022).

Building on the mobile banking revolution, new approaches have been developed to use mobile phones to provide investment opportunities in capital markets for people who previously had neither the means nor the expertise and access to invest in securities. Most famously, the government of Kenya launched the M-Akiba project to raise money for infrastructure projects by issuing retail bonds that could be bought by small-scale individual investors on their mobile phones (National Treasury, n.d.). In 2017, the first M-Akiba (M-Savings, in Swahili) bond raised KSh247 million (US$2.47 million). In a similar project called Treasury Mobile Direct, the Central Bank of Kenya enabled users to buy treasury bills and bonds on their phones (Central Bank of Kenya, n.d.).

Chen and Volz (2022) have proposed blockchain-based project bonds to raise finance through a digital crowdfunding platform, which is also able to transparently record and certify the use of proceeds, sustainability impact and revenue streams of projects (Chen and Volz, 2022). This approach would introduce a project-management tool and provide investors with the opportunity to purchase local-currency assets and issuers to raise funds for sustainable infrastructure investment. Monetary and financial authorities, as well as national and multilateral development banks, can play a key role in supporting such initiatives and in further developing and scaling these approaches to complement conventional capital markets and mobilise financial resources for sustainable infrastructure investments.

5. Central banks to promote inclusive green finance by enhancing digital technologies

Digital finance can also be employed to promote financial inclusion and energy justice, which are key issues in the sustainable transition (Volz et al., 2020). Financial services can play a key role in empowering vulnerable parts of the population to adapt to climate change, but only if they are accessible, useful and well-designed (Volz et al., 2020). Traditional financial services have often failed to meet those standards. Digital automation can significantly reduce the transaction cost of financial services by allowing firms to harness economies of scale that make financial inclusion a profitable endeavour, rather than a regulatory requirement to be met. Non-banks, including mobile network operators and Big Tech, have done much more to foster financial inclusion over the past decade than traditional financial services providers by extending financial services through extensive agent networks and affordable mobile phones, exploiting platform economics, AI, and big data analytics in ways that traditional providers cannot (Osafo-Kwaako, 2018).

Digital microcredit harnesses user-generated data such as cash flow or transaction history to make risk assessments with minimal human involvement and thus, at a much lower cost than its traditional counterparts. Low-income households and MSMEs can use digital microcredit to reduce their sensitivity to natural disasters, and better cope in their aftermath (Dowla, 2018; Pantoja, 2002). It may also help them overcome financial barriers to investing in adaptation options such as climate-proofing crops, arable land and buildings (Fenton et al., 2017). Digital financial service providers can also promote resilience by offering better savings products and microinsurance. Micro-insurance products have helped customers adapt and become more resilient to climate change by incorporating meteorological information and geospatial data, enabling companies to make granular actuarial assessments at a very low cost (Microinsurance Network, 2017). Insurance premium payments and disbursements can be made using mobile technology, reducing human involvement and adding convenience, especially for customers in rural areas, where traditional points of financial access are sparse. Micro-insurance products that cover adverse weather events, in particular, allow vulnerable populations to manage climate risk and increase their resilience to negative economic shocks caused by climate change.

Financial inclusion can also support mitigation efforts. Even when technological change is cost-saving for MSMEs and households in the medium or long run, many businesses and households do not have the financial tools at their disposal to invest in low-carbon technology. Here, financial inclusion can make a clear difference. For example, in Kenya, the pay-as-you-go product M-Kopa harnesses mobile money transaction data to allow qualifying business owners to lease and eventually own solar panels to power their shops. Credit assessment, disbursement and payments are made electronically without human intervention. The scheme allows MSMEs to rely on their own solar power and reduce their dependence on energy grid operators (Costa and Ehrbeck (2015); Omwansa and Sullivan, 2013). Similar pay-as-you-go financing schemes have helped MSMEs transition to more climate-friendly technologies of energy and water provision across Sub-Saharan Africa and beyond (IRENA, 2020).

Furthermore, agricultural innovations from seeds to irrigation systems can help reduce land degradation, pollution and carbon emission. They also help address the impact of economic development on biodiversity and the ecosystem (Tallis et al., 2015). However, most of these climate change-mitigation measures entail significant upfront costs. Financial inclusion in general and maturity transformation services, such as credit or leasing, can help low-income families and MSMEs make the kind of investment that can contribute to better health, poverty alleviation and climate change mitigation. G20 financial authorities should create an enabling environment to foster such digitally inclusive finance solutions. The G20 can also request multilateral development banks to make concerted efforts to support inclusive green finance approaches. It is important though to highlight the need for financial regulators to devise rules to ensure that digital financial services help to increase the climate resilience of vulnerable groups, rather than adding financial turmoil to the risks they are exposed to (AFI, 2020). In addition to responsible access to credit, cyber-risk, fraud and exploitation of vulnerable groups must be addressed by regulators. While digital financial services promise to alleviate financial exclusion and reduce vulnerability to climate risks, policymakers must remain aware of underlying inequities in access. Climate finance needs to be gender-inclusive and reduce inequities in access, in order to deliver on its promise to enhance resilience and facilitate adaptation for those who need it most.

6. Leverage CBDCs to lower costs of remittances

Central banks can accelerate the introduction of CBDCs to enhance financial inclusion and facilitate remittance flows. Cross-border remittance costs range from 2 percent in Europe to 7 percent in Latin America, with the global average at over 6 percent (World Bank, 2021). Data obtained from project CBDC mBridge and existing market research estimates that CBDC holds the potential to cut remittance costs by up to 50 percent. In addition, according to the BIS cross-border transfer speed can be changed from multiple days to seconds (BIS Innovation Hub, 2021).

El Salvador has been the first country to explore the use of digital currencies to reduce the costs of remittances. Instead of relying on a CBDC, in an attempt to use cryptocurrencies as a remittance currency for Salvadorans overseas, it adopted Bitcoin as a parallel legal tender despite the growing international recognition of Bitcoin as a highly speculative asset used to facilitate money laundering, ransomware attacks and other financial crimes. World Bank data showed remittances to the country made up nearly $6 billion or around a fifth of gross domestic product in 2019, one of the highest ratios in the world. However, the global volume of cross-border remittances in cryptocurrencies currently accounts for only for 1 percent of the volume of global cross-border remittances (Arnold and Wilson, 2021), something which is expected to change towards crypto in the future, accounting for a larger share of the more than $500 billion in global annual remittances. The remittances industry has transformed from physical outlets to digital platforms and fees are on average 6 percent whereas Bitcoin transfer fees in Nigeria are between 2 and 2.5 percent. Most people use remittances to cover basic needs, so they need to exchange received crypto into local currency.

G20 central banks should advance their work on CBDGs to facilitate safe and low-cost remittance payments as alternatives to private cryptocurrencies. A CBDC leveraging DLT as the underlying infrastructure for cross-border payments would mean that the receiver would be able to leverage the received digital currency directly in the local economy. Cross-border payment efficiency already constitutes a G20 priority, as the current corresponding banking system is based on multiple intermediary steps pushing up time, complexity and costs, and in addition, correspondent banking has been rolled back due to de-risking. Central banks have a core role in accelerating the work of moving from piloting to scalable proof of concepts of CBDCs for remittances, prioritising jurisdictions with limited correspondent banking options.

Relevance to the G20

The six proposals developed in this policy brief are of direct relevance to the work of the G20 Working Group on Sustainable Finance (WGSF) and can support it in achieving its mandated objective to identify and overcome institutional and market barriers to green finance and develop options to enhance the mobilisation of private capital for green investment. The proposals build on and further advance the WGSF’s latest efforts to explore fintech-driven ESG practices by non-financial firms, and digital ratings and metrics agencies, and can inform the next steps in the development of regulatory practices. In addition, our proposals will enhance the work of priority area 5 of the G20 Sustainable Finance Roadmap on cross-cutting issues, which proposes to develop a stock-take of emerging digital solutions supporting the mobilisation of sustainable investments, by adding in a digital infrastructure component.

Central banks and supervisors need to assume a proactive role in supporting the development of digital infrastructure designed to benefit the entire financial system as a public good. Given that the incentives for building such types of digital infrastructure by the market are weak, there is a strong rationale for the role of the public sector. Moreover, central banks and supervisors need to ensure that regulation is introduced where necessary (e.g., open banking regulation).

The WGSF could, in addition to conducting a stock-take on digital finance solutions, commission further deep-dive research to identify digital financial system infrastructure with a high potential to unlock a just green transition. Such research could include several country case studies drawing out the current potential and readiness of countries to develop the recommended digital infrastructure, leading to specific policy recommendations. The WGSF should also conduct research into the challenges associated with the implementation of the six proposals, including capacity limitations, the cost of digital infrastructure investment, cyber and data security issues, and a lack of capacity to ensure continuous infrastructure upgrades.

References

Alliance for Financial Inclusion (AFI), Policy Framework for Responsible Digital Credit, Kuala Lumpur, 2020 https://www.afi-global.org/sites/default/files/publications/2020-04/EN_Policy_Framework_for_Responsible_Digital_Credit.pdf

Tom Arnold and Tom Wilson, “Analysis: Remittance Firms Slow to Add Bitcoin, Despite El Salvador Move”, Reuters, 2021 https://www.reuters.com/business/remittance-firms-slow-add-bitcoin-despite-el-salvador-move-2021-06-11/

Bank for International Settlements (BIS) Innovation Hub, Inthanon-LionRock to mBridge, Basel, 2021 https://www.bis.org/publ/othp40.pdf

Bank for International Settlements (BIS), Annual Economic Report, 2021, Chapter III. CBDCs: An Opportunity for the Monetary System, Basel, 2021, https://www.bis.org/publ/arpdf/ar2021e3.htm

Bank for International Settlements (BIS), Sound Practices – Implications of Fintech Developments for Banks and Bank Supervisors, Basel Committee on Banking Supervision, Basel, 2018, https://www.bis.org/bcbs/publ/d431.pdf

Central Bank of Kenya, Treasury Mobile Direct, Kenya, n.d. https://www.centralbank.go.ke/tmd/

Yushi Chen and Ulrich Volz, “Scaling Up Sustainable Investment through Blockchain-based Project Bonds”, in Development Policy Review, Vol. 40, No. 3 (2022) https://doi.org/10.1111/dpr.12582

Arjuna Costa and Tilman Ehrbeck, “A Market-building Approach to Financial Inclusion”, Innovations: Technology, Governance, Globalization, Vol. 10, No. 1-2 (2015), p. 53–59 https://econpapers.repec.org/article/tprinntgg/v_3a10_3ay_3a2014_3ai_3a1-2_3ap_3a53-59.htm

Asif Dowla, “Climate Change and Microfinance”, in Business Strategy and Development, Vol. 1, No. 2 (Feb. 2018), p. 78–87, https://doi.org/10.1002/bsd2.13

Economist Intelligence Unit Limited, Open Banking: Revolution or Evolution, 2020, https://www.temenos.com/wp-content/uploads/2021/02/Temenos-Open-banking-VFinal-1.pdf

European Commission, Proposal for a Regulation of the European Parliament and of the Council proposal for a regulation of the European Parliament and of the Council establishing a European single access point providing centralised access to publicly available information of relevance to financial services, capital markets and sustainability, Brussels, 2021, Brussels, https://eur-lex.europa.eu/resource.html?uri=cellar:4729104b-4ddc-11ec-91ac-01aa75ed71a1.0001.02/DOC_1&format=PDF

Adrian Fenton, Jouni Paavola and Anne Tallontire, “The Role of Microfinance in Household Livelihood Adaptation in Satkhira District, Southwest Bangladesh”, in World Development, Vol. 92 (Apr. 2017), p. 192–202 https://doi.org/10.1016/j.worlddev.2016.12.004

Global System for Mobile Communications (GSMA), The Mobile Economy 2022, London, 2022, https://www.gsma.com/mobileeconomy/wp-content/uploads/2022/02/280222-The-Mobile-Economy-2022.pdf

Kirsten Hund, Daniele La Porta, Thao P. Fabregas, Tim Laing and John Drexhage, “Minerals for Climate Action: The Mineral Intensity of the Clean Energy Transition”, World Bank, Washington, 2020 https://pubdocs.worldbank.org/en/961711588875536384/Minerals-for-Climate-Action-The-Mineral-Intensity-of-the-Clean-Energy-Transition.pdf

International Renewable Energy Agency (IRENA), Innovation Landscape Brief: Pay-as-you-go Models, Abu Dhabi, 2020 https://www.irena.org/-/media/Files/IRENA/Agency/Publication/2020/Jul/IRENA_Pay-as-you-go_models_2020.pdf?la=en&hash=7A2E7A7FF8B5BAB7748670876667628A39DE40D5

Microinsurance Network, Microinsurance Solutions for Climate Change. The State of Microinsurance. The Insider’s Guide to Understanding the Sector, Issue Nr. 3, 2017 https://cenfri.org/wp-content/uploads/2017/07/The-State-of-Microinsurance-issue-3_Microinsurance-Network_2017.pdf

Monetary Authority of Singapore (MAS), MAS and Industry to Pilot Digital Platforms for Better Data to Support Green Finance, Singapore, 2021, https://www.mas.gov.sg/news/media-releases/Appointments-to-MAS-Board-of-Directors/mas-and-industry-to-pilot-digital-platforms-for-better-data-to-support-green-finance

Ángel Iván Moreno and Teresa Caminero, “Application of Text Mining to the Analysis of Climate Related Disclosures”, Banco de Espana Working Paper No. 2035, Working Paper No. 2035, Madrid: Banco de España, 2020, https://ssrn.com/abstract=3738629

National Treasury, M-Akiba, Kenya, n.d. https://www.treasury.go.ke/916-2/

Tonny K. Omwansa and Nicholas P. Sullivan, “Prepaid & Pay-as-you-go Models for Asset Financing, Analysis of Mobile-Money Business Models for Kickstart (Irrigation Pumps) and M-KOPA (Solar Panels) in Kenya”, mimeo, Nairobi: University of Nairobi, 2013 https://profiles.uonbi.ac.ke/tomwansa/files/prepaid_nicholas_sullivan_and_tonny_omwansa.pdf

Philip Osafo-Kwaako, Marc Singer, Olivia White and Yassir Zouaoui, Mobile Money in Emerging Markets: The Business Case for Financial Inclusion, Lagos et al.: McKinsey & Co, 2018 https://www.mckinsey.com/industries/financial-services/our-insights/mobile-money-in-emerging-markets-the-business-case-for-financial-inclusion

Enrique Pantoja, Microfinance and Disaster Risk Management: Experiences and Lessons Learned, Draft Final Report, Geneva: ProVention Consortium, 2002 https://www.gdrc.org/icm/disasters/microfinance_drm.pdf

Sustainable Digital Finance Alliance and HSBC, Blockchain: Gateway for Sustainability Linked Bonds—Widening Access to Finance Block by Block, Sustainable Digital Finance Alliance and HSBC Centre of Sustainable Finance, London, 2019 https://www.sustainablefinance.hsbc.com/mobilising-finance/blockchain-gateway-for-sustainability-linked-bonds

Sustainable Digital Finance Alliance, Digital Technologies for Mobilizing Sustainable Finance: Applications of Digital Technologies to Sustainable Finance, 2018 https://greendigitalfinancealliance.org/wp-content/uploads/2019/11/Digital-Technologies-for-Mobiizing.pdf

Heather Tallis, Christina M. Kennedy, Mary Ruckelshaus, Joshua Goldstein and Joseph M. Kiesecker, “Mitigation for One & All: An Integrated Framework for Mitigation of Development Impacts on Biodiversity and Ecosystem Services”, in Environmental Impact Assessment Review, Vol. 55 (June 2015) p. 21–34

Task Force on Climate-related Financial Disclosures (TCFD), Final Report. Recommendations of the Task Force on Climate-related Financial Disclosures, 2017, https://assets.bbhub.io/company/sites/60/2021/10/FINAL-2017-TCFD-Report.pdf

Ulrich Volz, Peter Knaack, Johanna Nyman, Laura Ramos and Jeanette Moling, “Inclusive Green Finance: From Concept to Practice”, Alliance for Financial Inclusion and the Centre for Sustainable Finance at SOAS, University of London, Kuala Lumpur and London, 2020 https://eprints.soas.ac.uk/34540/1/AFI_IGF_SOAS_digital.pdf

World Bank, Remittance Prices Worldwide, retrieved Mar 2021, from https://remittanceprices.worldbank.org/en