Digitalization is driving financial innovations and developing money, credit, and banking models across the world. New players, such as major technological companies (Big Tech), are entering finance with ambitious plans. In aggregate, these processes will entail increased competition and potential financial stability risks. In the context of emerging digital money and Central Bank Digital Currencies (CBDCs), this paper analyzes general principles, rules, and basic recommendations by considering their regulatory and technological aspects. We urge the G20 to set up a Digital Money & Finance Working Group (WG) and develop a comprehensive agenda with a systemic vision, in line with the SDGs. This could guide a resilient financial system through a prudent transition process, keep pace with technology, and deliver the long-term benefits to society promised by innovation.

Challenge

Digitalization is reshaping the way we work and produce, relate with others, exchange information, and entertain ourselves. Change is non-linear, and proceeds with unexpected breakthroughs that create net economic value and social plots; however, it also causes disruption, divisions, and potential instability. For the digital transformation to enhance well-being, it is crucial to support a sustainable and inclusive digital society.

Money is a social convention: we accept it because we think others will do so. In this way, payments are a social experience linking people. With vertiginous digitalization, money is changing pari passu. Currently, conventional monies (cash, central bank reserves, and commercial bank deposits) coexist with a growing array of private-sector issued digital monies: electronic money and cryptocurrencies (especially stablecoins). However, most of these are prefunded or backed by conventional monies.

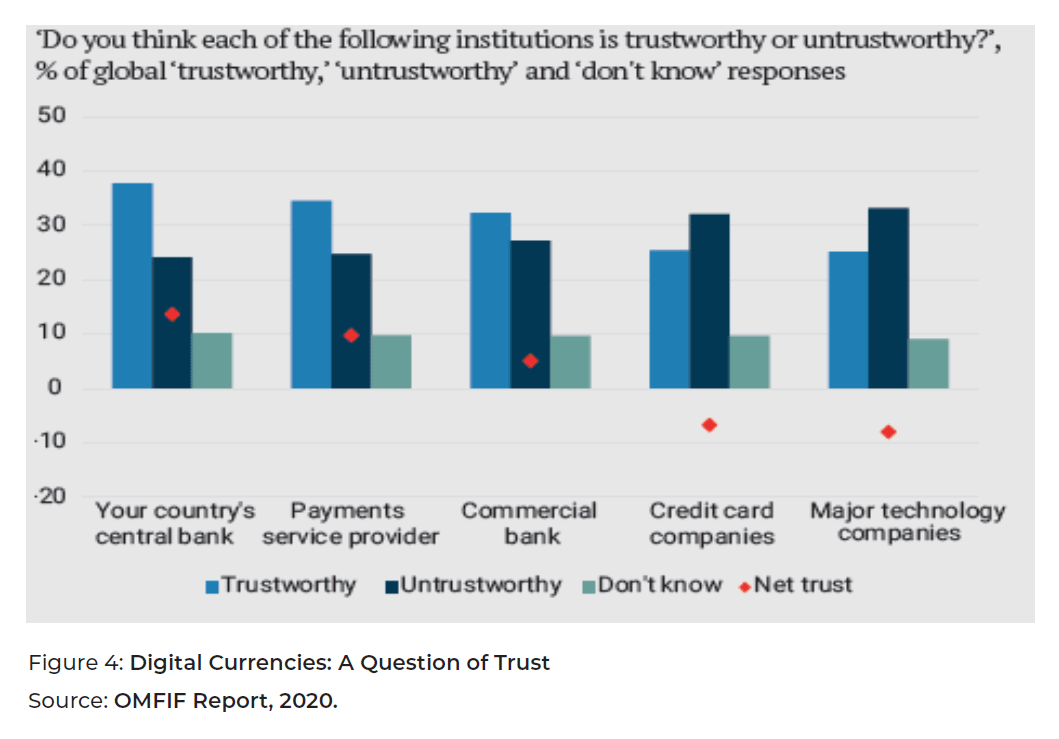

In parallel, Big Tech is entering finance, and in particular, the Libra Project was a wakeup call, as today, Facebook’s user base equals close to 40% of the world population. Subsequently, a global currency is no longer a far-fetched idea, even if its domain remains within the limits of a single global corporation’s digital ecosystem. Giant platforms like Amazon, Google, Alibaba, or Facebook could develop their own digital currencies and tie them to the multiple data, trade, and social services they provide in an integrated client package. Peer-to-peer transactions would be boosted by the convenience of using built-in payment services to complete customer experiences. Network owners could create non-compatible protocols, or impose “exit costs” that will make switching to other platforms difficult or expensive. In this way, digital fragmentation would emerge as a new risk. Assuring interoperability among platforms would be necessary for economic efficiency and consumers’ choice and welfare.

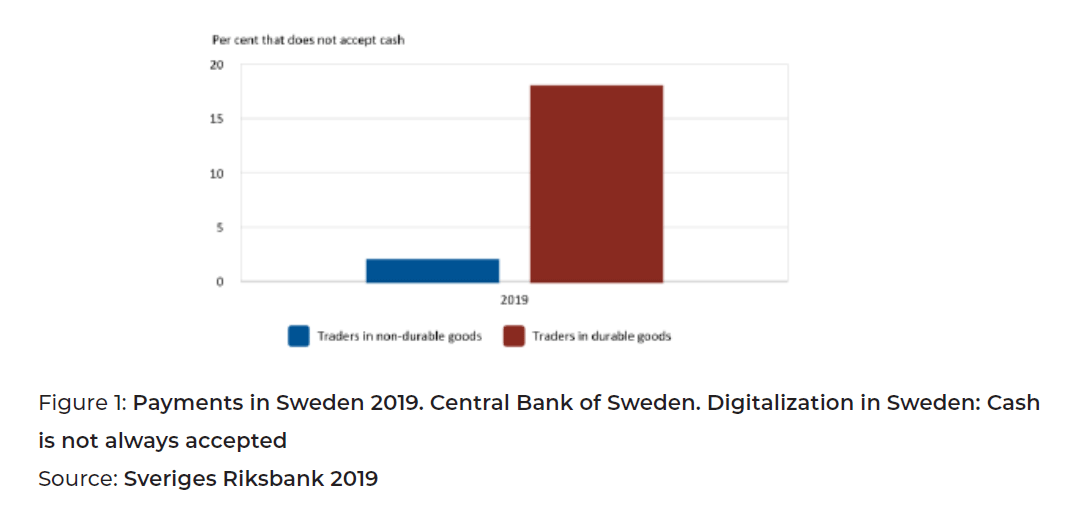

Given powerful network effects, fierce competition among monies is likely to arise, and payment instruments might disappear when utilization drops below a critical threshold. Shops might refuse to accept physical cash if its usage declines significantly (this is currently happening in Sweden [Sveriges Riksbank 2019], see Figure 1). Commercial banks might respond by cutting back on ATMs, and consequently, a reduction in payment instruments is one possible welfare diminishing outcome. While projects such as Libra might never develop because of poor design, the underlying idea is now out of Pandora’s box. Central Banks might launch CBDCs if they feel threatened or as a way to seize an opportunity. A CBDC could be created simply by widening access to central bank reserves, and China is close to achieving this (Khatri 2020), where the e-renminbi has already reportedly been adopted into the monetary system of several cities (Davidson 2020).

Digitalization will drive different money, credit, and banking models. As a result, commercial bank deposits will face increasing competition from electronic money and CBDCs. That implies a less stable funding structure, the possibility of deposit substitution and runs on banks, and credit disintermediation, with uncertain impacts on investment and output. Currency substitution, increased fragility, loss of regulatory capacities, and a potential upsurge in illicit transactions are perils to be considered in advance.

Proposal

We urge the G20 to develop a comprehensive agenda with a systemic vision on digital money and finance that could guide a resilient financial system through a prudent transition process, keep pace with technology, and deliver the long-term benefits promised by innovation. This agenda should be part of a broader agenda on the development of a sustainable and inclusive digital society.

We recommend setting up a Digital Money & Finance Working Group (DMF-WG) at the G20 level[1] to (a) perform the analysis of new digital and alternative instruments and procedures, and (b) recommend the framework(s) for their integration to improve the existing financial architecture using both national and international perspectives.[2] It is crucial to establish correct design principles from an early stage of the digitalization process and craft a careful transition course to address a new set of financial stability risks and economic policy trade-offs, which require international cooperation to function properly.

In the short term, some lower hanging fruit could be collected by taming the two major flaws of current payment systems: the lack of universal access to financial services for a large share of the world’s population and inefficient cross-border retail payments.[3]

Given time and the appropriate architecture in place, digital money could improve payment infrastructure, financial inclusion and stability, market integrity, monetary policy effectiveness, and, if the political will exists, help mitigate failings in the international monetary system.

General principles, rules, and basic recommendations

Digitalization imposes formidable challenges across a broad range of policy domains. The DMF-WG would provide thorough revisions before any change is to be proposed. However, digitalization is not driven by governments, and change might occur without their approval. Second-best solutions could arise if reactions are slow and non-optimal standards gain widespread usage.

The DMF-WG must evaluate the distinct micro-aspects of the digitalization process: the safety, efficiency, and integrity of payment systems; new instruments’ and procedures’ legal entities and governance; market integrity and competition; cybersecurity and operational resilience; consumer and investor protection; data privacy, protection, and portability; environmental and social impact and governance (ESG); and tax compliance and compliance with norms against illicit finance (anti-money laundering, countering the financing of terrorism, and countering the financing of proliferation of weapons of mass destruction).

Recommendations based on the solid foundation of granular assessments must be made with a systemic vision for financial stability but with enough flexibility to accommodate idiosyncratic features.

Basic regulatory aspects to consider:

- Financial market infrastructure must ensure resilience and trust. New instruments and procedures could be tailored to exploit regulatory arbitrage, exposing the type of risks that the regulation was to avoid.

- Competition (among currencies, procedures, and entities) should channel most of the benefits of innovation toward consumers. Strong network effects require paying attention to potential harmful concentration and other types of market failure, and the need to address these through regulation.

- Competition among more currency choices favors stronger substitutability effects permitting a higher order of instability under conditions of stress. New currencies— such as an interest rate yielding CBDC—could be designed to control or counteract these unwanted effects. In this way, monetary policy could improve alongside an intelligent foundation.

- Different monies will coexist in a competitive economic setting, although some might disappear if critical usage thresholds are breached. Regulation should take notice that a reduction in a payment instrument’s availability could diminish welfare.

- Consumer and business preferences (dependent on local institutions, social networks, and cultural identities) dictate the system. Societies might go “less cash” if they want, but there is a legitimate right to privacy that could be endangered if digitalization leads to personal data abuse.

- An ESG approach is necessary for a comprehensive vision, and drastic changes in payments have a significant social impact. Environmental costs could be prohibitive for certain technologies (Bitcoin & blockchain) at great scale, and so governance becomes more decisive as Big Tech enters finance. ESG considerations could favor alternative means to achieve the same goals.

Basic socio-technological aspects to consider:

- The DMF-WG should follow the principle of “same business, same risks, same rules.” It should have no digital bias, but be technology-neutral, as its purpose is to level the playing field.

- Embracing smart design principles and a thorough comprehension of the nature of technological changes are essential for allowing innovation to flourish without damaging the system resilience or the efficacy of existing prudential risk policies. Technological leaps could increase systemic risk exposure inadvertently, especially concerning tail risks, and place it out of the scope of conventional regulation and surveillance.

- Transition to digitalization implies the possibility of a period of higher financial stability risks. Subsequently, its timing and implementation should be carefully handled. Innovations need to be well understood, and as many of them are untested in a real-world context on the scale required, they require empirical research and local pilot projects.

- Different technologies will coexist, and these will not necessarily be only digital. Several countries are working on improving existing payment systems (real-time retail settlement systems) to match the speed and convenience of digital currencies. Fast payments like the ECB’s “TIPS” or the Federal Reserve’s “FedNow” initiatives allow nearly instantaneous and low-cost settlement of inter-bank retail payments. Revolut, N26, Transferwire, and other companies already allow users to make immediate and frictionless cross-border transactions, in different currencies, at almost no cost.

- Payment systems could further improve if paired with other reforms, such as public digital identities,[4] common communication standards, open application programming interfaces (“APIs,” which allow banking applications to interoperate and be extended by third-party developers), and data portability and protection standards. Allowing payment providers to hold accounts at the central bank with a direct interface would cut transaction times.

- Big Tech is the new elephant in the room, and a proper global regulatory framework, dealing with concepts such as interoperability, data protection, and digital fragmentation, is yet to be designed.

The DMF-WG should elaborate a view on areas of special interest to accomplish a comprehensive agenda.

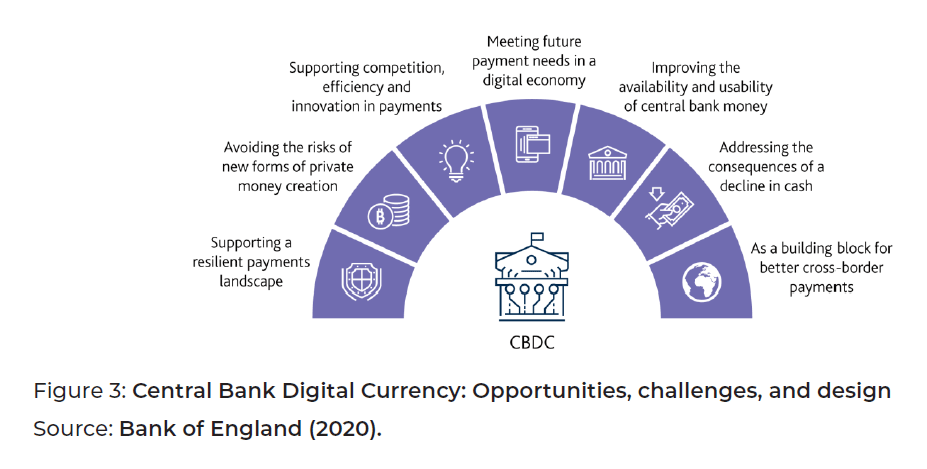

CBDC: A forced option for Central Banks?

A CBDC could be created by widening access to Central Bank reserves. This can be done at the wholesale level by letting in players such as broker-dealers and central counterparties but also through non-bank intermediaries and payment services providers. Alternatively, individuals could hold accounts at the Central Bank, but that would require the Central Bank to create the additional infrastructure that will be associated with additional costs and risks.

While wholesale CBDCs hold promise for wholesale payments, clearing, and settlements, a general-purpose CBDC is more debatable. Managing it will be daunting in terms of telecommunications, software, cybersecurity, operational risk mitigation, and reputational risks. A synthetic CBDC could be more efficient, and the Central Bank might issue it at the wholesale level through banks and payment services providers, and the latter could redistribute it to end-users across their retail channels.

A similar idea of private-public partnerships between Central Banks and private banks was advocated by Lagarde (2018): “Individuals could hold regular deposits with financial firms, but transactions would ultimately get settled in digital currency between firms… Similar to what happens today, but in a split second.” The advantage of this procedure is that payments “would be immediate, safe, cheap, and potentially semi-anonymous” (Lagarde 2018).

Finally, it is not clear that Central Banks have the legal right to issue digital money, questioning the legitimacy of a CBDC as a means of payment (legal tender). According to a Bank for International Settlements (BIS) survey (Barontini and Holden 2019), almost 25% of Central Banks have, or will soon have, the authority to issue a CBDC, while a third do not, and about 40% remain unsure.

While CBs are analyzing the feasibility of CBDCs, they may be forced into the game by the popularity of the Big Tech stablecoins to preserve monetary policy traction. A world with multiple digital currencies may also lead to currency instability and capital flow restrictions.

The dawn of a new banking model

Transitioning to digitalization will require a prudent approach as the stability risks involved are huge. Commercial bank money (deposits) will face increasing competition from e-money and CBDCs. This implies the possibility of deposit substitution and runs on banks, a change in funding sources, availability and costs, a less stable funding structure, changes in the market discipline (depending on the new weights of insured or uninsured deposits), disintermediation, and an eventual reduction of credit to firms and households with a negative impact on investment and output, conditional on the role played by banks within each national economy.

Legacy banks should accommodate the restructuring of their businesses but will require time and capital under increasing competition from Big Tech and fintech. We strongly recommend that the DMF-WG facilitates the sharing of information on CBDC design choices and testing experiences among Central Banks with a special emphasis on their cross-border impact before their eventual official launch.

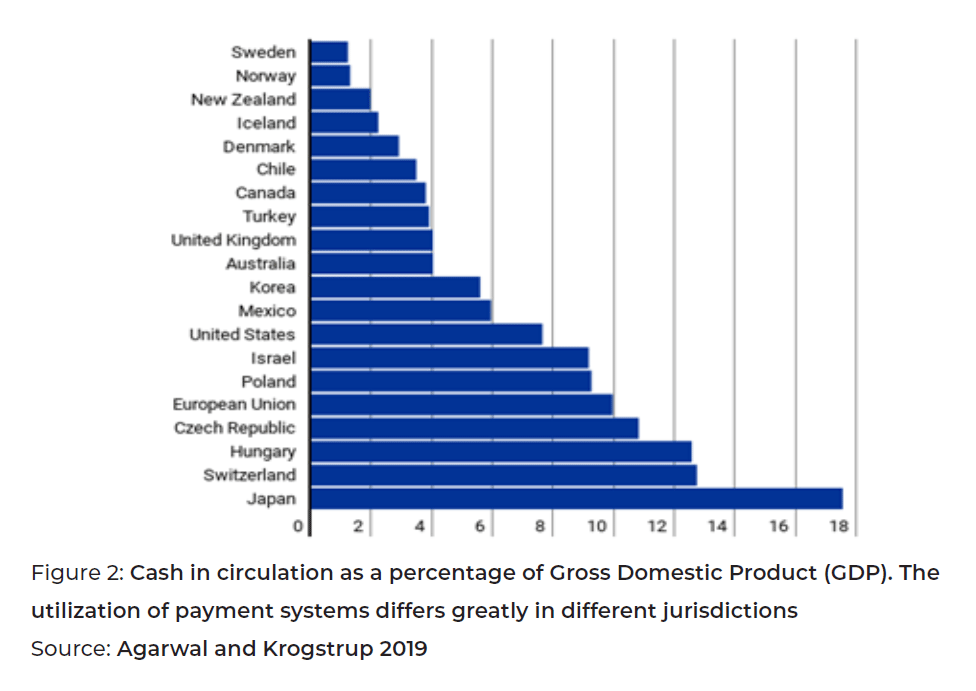

Digital currency and monetary policy

Digital cash could enhance financial stability if aptly designed. CBDCs could be considered a risk-free asset similar in nature to short maturity government bills. Paying an interest rate on CBDCs could serve as the primary tool of monetary policy, facilitating an improved framework if substitution from cash and deposits to a CBDC is made imperfect. In a financial crisis, the supply of CBDCs could be expanded by the central bank acting as a lender of last resort, while its interest rate could be reduced to discourage runs form other financial assets into CBDCs. That could eliminate the Effective Lower Bound problem in case of negative interest rates on CBDCs. Negative interest rates stimulate economic agents to use cash. Subsequently, low or zero demand for cash is required to achieve negative rates.

In effect, the Central Bank would ensure that the widening of risk spreads was offset by a corresponding drop in the risk-free interest rate, keeping the cost of credit close to normal levels, and helping to insulate the real economy from the financial crisis.[5]

Moreover, this approach would generate a relatively steep yield curve that would facilitate the expansion of bank credit and foster prudent risk-taking behavior—precisely the opposite of quantitative expansion programs and “lower for longer” forms of forward guidance.

For monetary policy to retain influence, public money must at least be used as a unit of account. CBDCs could become a new effective instrument for monetary authorities to influence economic activity through interest rates and banking channels of monetary transmission. However, one risk could be that the central bank ends up taking on a greater role than intended in the process of real resource allocation within the economy.

International monetary system reform: Are we approaching a new Bretton Woods moment?

Digitalization might foster new international monies: global private stablecoins and a synthetic digital currency provided by the public sector, perhaps through a network of CBDCs, and a digital special drawing right (SDR) could also be launched. The Bank of England Governor, Mark Carney, proposed International Monetary System (IMS) reform in Jackson Hole along these lines. Could this cause the influence of the US dollar to be reduced? An international currency based on multiple reserves will resemble the multipolar status of the world. Additionally, technology can unsettle the network externalities that prevent the incumbent global reserve currency from being displaced. Nonetheless, the answer is not anytime soon. The dollar’s dominance in credit and trade markets needs to be challenged by a whole new financial and trade invoicing architecture built around any new international currency.

Given the well-known flaws of the IMS, the DMF-WG could provide a forum for useful discussions. Reducing USD supremacy in trade and finance would tame spillovers from shocks in the US, smooth the global financial cycle, reduce the volatility of capital flows to emerging markets, and increase the supply of reliable reserve assets facilitating Emerging Market Economies (EMEs) to diversify their forex reserves. This would lessen the downward pressure on equilibrium interest rates and help alleviate the global liquidity trap.

Payments and COVID-19

The COVID-19 outbreak highlights the convenience of digital means of payment and their flexibility to respond to new, unexpected challenges. Electronic payments will increase during this crisis as people fear cash could spread the virus. Additionally, given social distancing measures, most orders will be placed from home. In that context, cash logistics (such as transportation and replenishing of ATMs) become a serious problem that can be easily solved by going digital. Most social and aid programs launched to cushion the negative economic impact of COVID-19 will also be disbursed digitally.

CBDCs could very well fit in this new environment, given the changing social preferences and the decline in the use of cash but also due to potential requirements for monetary policies. For example, getting into (deeper) negative rates or providing helicopter money. As a result, China’s Central Bank is said to be considering an earlier launch of its CBDC because of the pandemic (Khatri 2020).

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

Agarwal Ruchir, and Signe Krogstrup. 2019. “Cashing in: How to make negative interest

rates work.” IMF Blog. Accessed August 26, 2020. https://blogs.imf.org/2019/02/05/cashing-in-how-to-make-negative-interest-rates-work.

Bank of England. 2020. “Central bank digital currency: opportunities, challenges, and

design.” A Bank of England Discussion Paper. Accessed August 26, 2020. https://www.bankofengland.co.uk/paper/2020/central-bank-digital-currency-opportunitieschallenges-and-design-discussion-paper

Barontini, Christian, and Henry Holden. 2019. “Proceeding with caution – a survey of

central bank digital currency.” BIS Papers No 101, January.

Coeurè, Benoit. 2019. “Introductory remarks.” Committee on the Digital Agenda on

the topic of “Digital currencies, focusing on Libra.” Deutscher Bundestag.

Davidson, Helen. 2020. “China starts major trial of state-run digital currency.” The

Guardian, April 20, 2020. https://www.theguardian.com/world/2020/apr/28/chinastarts-major-trial-of-state-run-digital-currency

Khatri, Yogita. 2020. “China’s central bank is one step closer to issuing its digital

currency – report.” Accessed August 26, 2020. https://www.theblockcrypto.com/post/59671/chinas-central-bank-is-one-step-closer-to-issuing-its-digital-currencyreport

Kumhof, Michael, and Noone, Clare, 2018. “Central bank digital currencies – design

principles and balance sheet implications,” Bank of England Working Papers 725,

Bank of England.

Lagarde, Christine. 2018. “An even-handed approach to crypto-assets,” Blog FMI.

Accessed August 26, 2020. https://blogs.imf.org/2018/04/16/an-even-handedapproach-to-crypto-assets

OMFIF. 2020. Digital Currencies: A Question of Trust. OMFIF, Report.

Sveriges Riksbank. 2019. “Payments in Sweden 2019.” Accessed August 26, 2020.

https://www.riksbank.se/globalassets/media/rapporter/sa-betalar-svenskarna/2019/engelska/payments-in-sweden-2019.pdf

Appendix

[1] . It should be set under the umbrella of the Financial Stability Board (FSB). The IMF, the World Bank and the Bank for International Settlements (through the Committees of Payments and Market Infrastructure and on the Global Financial System and its Central Bank Governance Group) must be stable members, International Standard Setting Bodies have to participate, and the private sector must be involved.

[2] . It should also collect and systematize from dispersed initiatives information. See Appendix I.

[3] . Globally, 1.7 billion adults remain outside the payments system, with no access to basic services, even though 1.1 billion people have a mobile phone and one in four also have internet access. Payment accounts and e-wallets are gateways to additional financial services, such as credit and insurance, so a lack of access to them hampers financial inclusion. Cross-border retail payments are vital for global commerce and for migrants who send remittances home. However, they are generally slower, more expensive, and more opaque than domestic payments. Innovation could reduce this cost especially for small value transfers (Coeurè 2019).

[4] . Governments in countries such as Singapore (MyInfo) and India (Aadhaar) already provide universal digital IDs to their citizens.

[5] . Kumhof-Noone design principles: (1) CBDC pays and adjustable interest rate, (2) CBDC and reserves are distinct, not convertible into each other, (3) No guaranteed, on-demand convertibility of bank deposits into CBDC at commercial banks (and therefore by implication at the CB), and (4) the Central Bank issues CBDC only against eligible securities (principally government securities). With these principles, bank funding is not necessarily reduced, credit and liquidity provision to the private sector need not contract, and the risk of a system-wide run from bank deposits to CBDC is addressed (Kumhof and Noone 2018).