Public digital infrastructure, including hard and soft variants, encourages competition, innovation and inclusion. Through the India Stack and Modular Open Source Identity Platform (MOSIP), the Indian experience offers developing countries a path to leapfrog the development phase for digital platforms. Open-source systems offer countries an opportunity to establish low-cost public identity, financial and data exchange systems. The G20’s support of such platforms will accelerate adoption, allowing developing countries to advance digital usage. Funding is key to implementation. This brief offers three mechanisms specialised Digital Inclusion Social Impact Bonds, G20 coordinated multilateral collaborative funding and alternate multilateral financial mechanisms.

Challenge

LEAPFROGGING TRADITIONAL DIGITAL DEVELOPMENT PATHWAYS

Any digital inclusion agenda must be predicated on “access” and “usage” requirements. The developed world has largely solved the “access” issue and is now focused on “usage”. The developing world’s digital inclusion agenda has to concentrate on solving both the “access”1 and the “usage” challenge. Digital access alone will not allow these nations to participate as equal partners within the digital economy. Participation requires a usage-centred digital inclusion agenda2 to introduce new consumers to identification, financial and e-government service systems. If developing countries leapfrog the traditional development path, developed/developing nations will benefit from global economic growth and accelerated poverty reduction. Open-source digital infrastructure offers developing nations an opportunity to simultaneously address access and usage priorities, promoting an inclusive, competitive and innovative digital economy.

LIMITED CHOICES BETWEEN CURRENT DIGITAL STRUCTURES

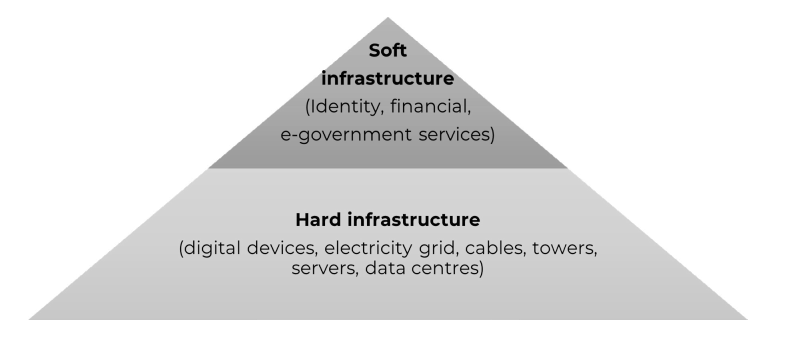

Digitalisation is fundamentally different in the developed and developing worlds. The developed world has both the hard3 and soft4 infrastructure, while the developing world lacks both. A digital economy model which focuses on usage promotes digital availability, awareness, comfort, privacy and productivity. The developing world has yet to transition its priorities to such principles. There are three predominant digital economy models adopted in the developed world, which do not suit developing countries’ requirements. China has adopted a state-controlled and mandated model, with open data-sharing among Chinese stakeholders. Europe follows strict consumer regulation intending to protect the consumer’s rights, and the USA is dominated by private companies, proprietary infrastructure and product monetisation, favouring the incumbent mega-platforms. The developing world, in contrast, requires a model which fosters inclusion, competition and innovation. The “open system” model proposed here will allow the developing world to catch up with the extant models of the developed world and work harmoniously with them.

LIMITED PUBLIC SECTOR FUNDING AND POLITICAL WILL

Given the competing developmental priorities within developing countries, there is a need for innovative financing mechanisms to coalesce alternate funding promoting digital access and usage projects. Africa, for instance, requires an annual investment of US$ 3 billion to fund digital development (Corrigan 2020). Although greater funds are needed, international development assistance for digital networks and services has shrunk, in the hope the private sector will fund such initiatives (OECD 2005). This approach neglects non-economic centres and widens the digital divide. Together with improved coordination of public-private funding arrangements, a change in political will is required to support the public sector’s digital development funding (Nyakanini et al. 2020).

Proposal

RECOMMENDATION 1: THE G20 ENDORSES OPEN PUBLIC DIGITAL INFRASTRUCTURE TO COORDINATE PUBLIC-PRIVATE COOPERATION IN THE DIGITAL ECONOMY

DEFINING AN INCLUSIVE DIGITAL ECONOMY MODEL FOR ALL

A G20 endorsed inclusive digital economy model will bring developing countries into a formal digital governance structure at a low cost and with easier access. This model adopts eight principles:

· An open system: In which no single country, vendor or technology provider lays claim to both hard and soft digital infrastructure,

· Accessibility for all: Allowing all countries/individuals/entities to use, consume, transact, share the digital infrastructure within applicable laws and regulatory frameworks.

· Affordability: No one should be excluded for financial reasons

· The Right to Use: Everyone should have the right to use, consume, transact and share infrastructure.

· Trust and Security: Trust and Security in the infrastructure must be ensured through technological, institutional, legal and regulatory mechanisms.

· Auditable: The system can be independently evaluated against a set of regulations for financial and performance purposes.

· Privacy by design: The design of the system must ensure privacy within the regulatory framework.

· Scalable, extensible, modular: The system must be scalable to handle growth and be extended to include new functions. Its modular design must be flexible enough for use in different environments.

India offers a model to encompass these principles and reconcile existing differences in the developed and developing world’s digital economy models. The Indian model treats digital inclusion as a public good through which governments and the private sector can collaborate, and enterprise, innovation and competition can thrive.

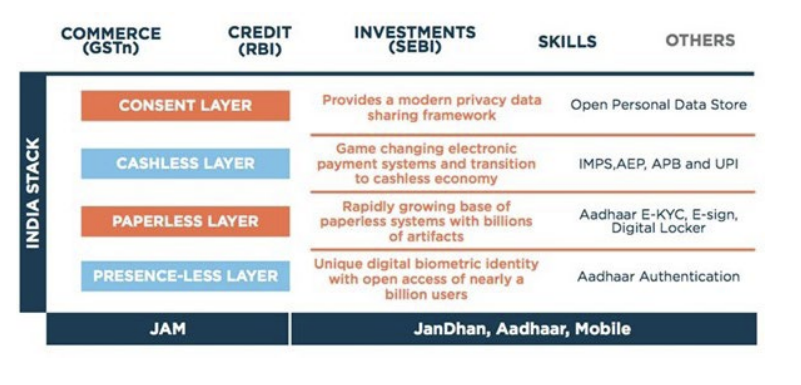

India Stack is, like the Internet Stack, a set of open, modular, interoperable software protocols. It provides the building blocks that allow “governments, businesses, startups and developers to utilise a unique digital infrastructure to solve India’s hard problems towards a presence-less, paperless, and cashless service delivery” (What is India Stack?, n.d.). Its base is a digital biometric identity that allows citizens to access connected e-government services from anywhere in the country. It is connected to a digital bank account, through which citizens receive services and subsidies, from taxes to licences to food rations. The identity stores the digital records including birth and education certificates, land records and most recently, COVID-19 cases and vaccination details and consent to share data lies with the individual (see Figure 1).

Since 2009 when India first launched a national identity card, Aadhaar, this system has been built on, tested across India’s vast, diverse population, and scaled up. As a result, it is now among the world’s most robust, affordable, accessible digital systems. In December 2019, the Bank of International Settlements, which reports to the G20 on financial implementation monitoring (Reports to the G20 on implementation monitoring, n.d.), stated that India Stack “offers an important case study where the results are relevant and applicable to all economies, irrespective of their stage of development” (D’Silva et al. 2019).

While there have been reports of Aadhaar numbers being leaked or illegally accessed, it must be noted that Aadhaar’s all-important biometric database, which uniquely authenticates an individual, has remained secure. The Aadhaar number alone without biometrics is not a tool for authenticating identity. Moreover, a personal and non-personal data privacy law is in the Indian Parliament, awaiting passage (Sharma, 2018). The India Stack is now recognised as “one of the most advanced systems in the world”(Fintechnews Singapore, 2021). It is non-proprietary without Intellectual Property Rights, patents or royalties and although it is owned or supported and used by government linked entities, it is freely accessible to private enterprise, big or small. Efforts are underway globally to adopt all or part of the India Stack model. Countries like the Philippines are keen to develop a similar “Philippines Stack” (Schellhase 2019, p. 11). The formation of the Modular Open Source Identity Platform (MOSIP) in India, inspired by the India Stack experience, is aimed at setting up a “digital foundational identity system at low cost” (MOSIP.io, n.d.). Several countries have signed on to this, including Morrocco, Philippines, Guinea and Ethiopia.

Funding for this system can come from multilateral agencies, bilateral grants or projects, philanthropic grants, entrepreneurial investment and should be prioritised by the G20. Reconciling existing piece-meal digital infrastructure and services is necessary not to waste existing investment.

Coordination between multilateral institutions is also necessary. For the African continent, a basic all-of-Africa approach will need coordination between the various institutions such as AUC, Smart-Africa, AUDA-NEPAD, ATU, and UNECA to direct the resources necessary for digital transformation optimally (African Union 2020).

Fig. 1 Illustration of the India Stack Model, Source: iSpirt

OPPORTUNITIES FOR OPEN PUBLIC DIGITAL INFRASTRUCTURE IN AFRICA LESSONS FROM INDIA

India’s public digital platform is centred on the open system principle. It encourages innovation, allowing regulated public and private service providers to use the infrastructure, supporting multiple business models (including business-to-business, business-to-government, government-to-citizen, consumer-to-consumer and consumer-to-business) (D’Silva et al. 2019, pp. 1, 17). The soft infrastructure is developed upon a robust hard infrastructure layer, which allows increased internet access and mobile phone ownership (Raghavan, Jain, and Varma 2019). In India, mobile data plans are among the cheapest in the world, resolving challenges of access and leveraging the gains made in the soft public digital infrastructure layer.

India’s public soft infrastructure provides an interface for service providers to offer identity, payments, secure data exchanges and data registration services to consumers (Omidyar Network India, 2020). When made available through MOSIP, these systems allow any country adopting the model to build their digital identification or local interbank payment system. (Raghavan, Jain, and Varma 2019). In India, the Reserve Bank regulates the digital payments platform, only allowing regulated service providers to transact. By defining data-sharing rules among all providers linked into the system, it fosters greater competition and decreases transaction costs. Open access to data lowers costs in switching across providers (D’Silva et al. 2019, p. 2), helps onboard consumers and allows a high volume of low-value transactions. Through Aadhaar, between 2011 and 2017, 470 million Indians opened a bank account, reaching 80% of the population (D’Silva et al. 2019, pp. 5, 6, 12). It provides a seamless user experience and simplifies financial literacy campaigns (Omidyar Network India 2020).

The success of the Indian model is driven by a series of use cases that led to the development of a variety of packages. These were developed in response to social problems widespread among the developing world, such as providing welfare payments to people in need and promoting efficiency in the disbursement of public funds (Raghavan, Jain, and Varma 2019).

By developing a public interface at the early implementation stage, developing countries can promote fair competition, allowing all service providers an equal opportunity to transact. Modular design allows interconnected but independent single-purpose technologies to work together. Flexibility is built into the system’s design to ensure it can be adapted to meet the users’ evolving needs (D’Silva et al. 2019, p. 23). Countries can select the systems most appropriate for their purposes.

Several African countries could benefit from an integrated identity system. While some still use paper-based registries, most have moved to smart cards, although a few allow other service providers to authenticate credentials. Countries such as Botswana, Kenya, Morocco, Namibia, and Rwanda have relatively advanced identity ecosystems. In these countries, database coverage of birth registers ranges between 63% to 95% (World Bank Group 2017, pp. 11-21). While the coverage and robustness of these systems may be strong, interoperability and interconnectivity need improvement. In this light, the identification packages of MOSIP offer immediate added value, exposing identity data and providing a foundation for secure digital financial transactions. The World Bank already supports African countries investing in identity authentication systems that offer linkages to external service providers (World Bank Group 2017, p. 61).

Within Africa’s financial sector, Kenya is recognised as a world-leading early adopter of mobile money with the MPESA system. However, as the Kenyan mobile money market is highly concentrated, the FinTech sector’s growth has slowed. Concentration limits interoperability for consumers as the dominant provider has no incentive to reduce its market share. Thus despite Kenya’s National Payment System Act articulating the value of interoperability, few alternate service providers can enter the market and compete with Safaricom’s coverage (Mazer and Rowan 2016). By introducing an underlying public payments platform that integrates mobile wallets, Kenya can boost its financial sector.

In South Africa (SA), the payments industry is replacing its real-time-clearing (RTC) interbank system due to high fees in the business-to-business sector. 90% of South Africa’s payments are cash-based, with small, medium and micro enterprises (SMMEs) not accepting expensive card payments. By developing an overlay to the RTC system, inspired by India’s Unified Payment’s Interface (UPI), the Payment Association and BankservAfrica hope to improve inclusion among SMMEs, with a new interface released in 2021. The SA Reserve Bank seeks a flexible architecture that will meet low-income consumers’ demands in particular (Arnfield 2019).

MOSIP offers an opportunity to leapfrog the development of costly soft infrastructure platforms. Some African countries have begun adopting aspects of the package appropriate to their needs. The G20’s support of public soft digital infrastructure and the principles of an inclusive digital economy model will help accelerate the adoption of these packages.

Fig. 2 An inclusive digital economy model

RECOMMENDATION 2: THE G20 ENDORSES ALTERNATE INNOVATIVE MECHANISMS, INCLUDING FINANCING FOR DIGITAL INCLUSION PROJECTS

G20 COORDINATED MULTILATERAL COLLABORATIVE FUNDING

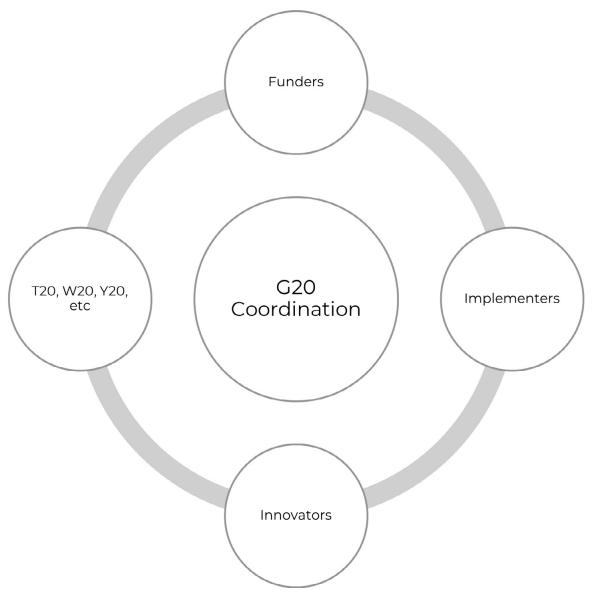

As an alternative organisation model, the multilateral collaborative model can distribute public digital infrastructure development responsibilities based on expertise, resources and activities among stakeholder groups tethered to the G20. The model emphasises collaboration in the innovation process, centring knowledge-sharing and allowing each actor to concentrate on its unique strengths. The model’s macro organisation also contributes to value creation at the micro-level, enabling dynamic relationships, collaborations, and synergies (Hasche, Höglund, and Linton 2020).

Framing the collaborative model within the multilateral context requires distributing responsibilities such as funding, implementation, innovation and oversight among nations according to their capabilities. In response to the pandemic, the United States, Japan, Australia, and India adopted a similar organisational model to mass-produce vaccines for the Indo-Pacific region. This leverages India’s manufacturing capacity, Australian logistics capacity and the funding capacity of the United States and Japan. By distributing responsibilities based on individual national strengths, the group can accelerate vaccine production while lowering production costs (Quad Summit Fact Sheet 2021). Similar collaboration may be encouraged by members of the BRICS group of countries.

The multilateral collaborative model can be introduced through a multi-stakeholder group comprising G20 representatives of developed and developing countries, supported by an auxiliary group consisting of representatives from philanthropic organisations, think tanks, academia, civil society, corporations and multilateral institutions. The auxiliary group is a recommending body only. The G20 may consider adapting the Digital Public Goods Alliance’s model, which convenes communities of practice and identifies projects that accelerate digital inclusion (“Promoting Digital Public Goods to Create a More Equitable World,” n.d.).

In the multilateral context, the G20 provides the connective tissue between nations, with well-resourced developed nations taking responsibility for funding these projects. Countries that adopted innovative public digital infrastructure share their frameworks and solutions with developing nations, which act as implementers of the innovation. Structures such as the T20, W20, Youth20, etc., help provide oversight, producing research and insights that may streamline this initiative’s implementation. In this model, the G20’s communities of practice act as policy advisors rather than regulators, pushing forward progressive strategies that promote digital inclusion.

The collaborative model promotes leapfrogging by centralising learning and knowledge-sharing in its design and succeeds by leveraging the organisational capacity of the G20 and its commitment to digital inclusion. As developing nations begin to adopt and implement public digital infrastructure, they enhance their knowledge and capacities, which can be shared with regional peers.

Fig. 3 G20 coordinated multilateral collaborative funding model

SOCIAL IMPACT BONDS

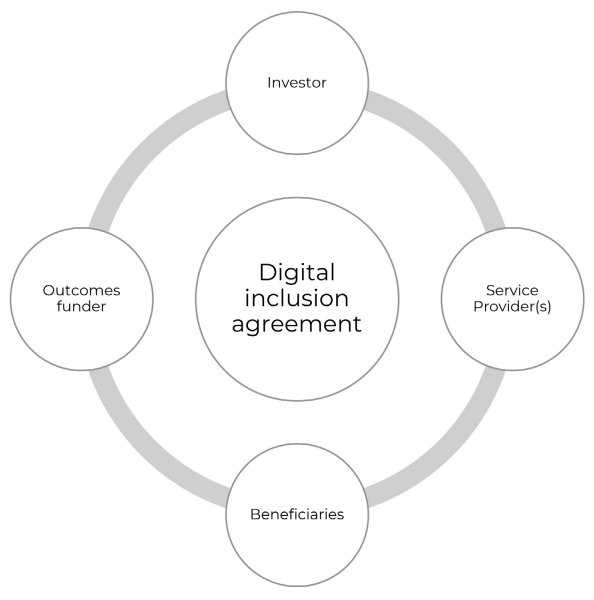

Innovative financing solutions are required to address the significant funding deficits impeding digital inclusion progress in the developing world. A specialised Social Impact Bond can coalesce private sector or donor funding promoting digital inclusion goals. The impact bond blends public-private partnerships, impact investing and results-based financing, where investors, in effect, pay to achieve a desired social impact (Gustafsson-Wright et al. 2017). These financing vehicles are more applicable when measurable outcomes are attributed to a project, the service provider has a strategy to achieve the outcomes, and the proposed intervention is innovative in design (Gustafsson-Wright et al. 2017). With clear digital inclusion principles, as described earlier in this text, digital inclusion projects promote local innovations, contributing to poverty eradication.

The Social Impact Bond is based on an agreement between investors, service providers, beneficiaries, and an outcomes-funder by forming an outcomes-based contract. The agreement mitigates the risk carried by the public sector to finance such interventions. Such initiatives are relatively new within the development finance arena but enable socially responsible financing (Sera 2020). It is critical that governments clearly define the terms of the digital inclusion agreement, guarding against the private sector or other interests monopolising project and programme objectives. It defines the boundaries of the relationship and investor expectations, and elaborates on the safeguards needed to protect vulnerable beneficiaries.

At present, the rollout of these bonds has been slow due to the mechanism’s novelty and public finance management legislation’s rigidity. Such legislation often mandates the state to commit funds to a project during the period of activity. Governments must introduce legislative provisions to unbind long-term financial commitments and permit greater flexibility in such funding arrangements (Center for Global Development, n.d.). The G20’s endorsement of these bonds and legislative changes, which offer greater flexibility, will help generate awareness about such opportunities, educate potential funders, and accelerate such projects’ rollout in developing countries.

Fig. 4 Design of Digital inclusion Social Impact bonds

PROMOTING MULTILATERAL FINANCIAL MECHANISMS

Beyond stimulating local financing mechanisms, there is a need to accelerate the multilateral financing of digital inclusion to increase funding substantially and accelerate change in developing countries. Multilateral development banks generally recognise the value of digital access but commit approximately 1% of funds to ICT projects. This slow pace of investment is premised on a belief that the private sector takes responsibility for digital infrastructure investments (Alliance for Affordable Internet 2018). However, as detailed in this brief, the public sector is encouraged to play a more central role in providing hard and soft digital infrastructure, requiring external support from multilateral development banks and other financing institutions. The G20 can leverage its IMF and World Bank relationships to coordinate increased funding of digital inclusion projects.

Recognising the importance of global digital inclusion, the United Nation’s Roadmap for Digital Cooperation has called for accelerating transformative funding models such as the International Telecommunications Union (ITU)’s GIGA Initiative (United Nations 2020). The ITU is a controlling agency that coordinates the sourcing of international funds directed to projects that meet its programme’s conditions. GIGA can coalesce long-term financial pledges from public and private sector sponsors interested in connecting schools to the internet. GIGA provides a range of financial vehicles, such as bond investment opportunities which translate long term pledges into short-term cash flows to GIGA-sponsored projects. GIGA is further supported by multilateral development banks, acting as the treasurer behind these bonds (ITU 2020). To adapt the GIGA model, the G20 can recommend forming a global programme earmarked to address digital inclusion challenges, understanding the contribution of these projects in meeting the SDGs.

REFERENCES

https://www.mosip.io/

“Quad Summit Fact Sheet”, 2021 https://www.mofa.go.jp/files/100159237.pdf

“Reports to the G20 on Implementation Monitoring” https://www.bis.org/bcbs/implementation/impl_moni_g20.htm#:~:-text=About BIS,a bank for central banks

“What Is India Stack?” https://www.indiastack.org/about/

African Union, “The Draft Digital Transformation Strategy for Africa (2020 to 2030)”, 2020 https://au.int/sites/default/files/newsevents/workingdocuments/37470-wd-annex_2_draft_digital_transformation_strategy_for_africa.pdf

Alliance for Affordable Internet, “Closing the Investment Gap: How Multilateral Development Banks Can Contribute to Digital Inclusion”, Washington DC, 2018 https://1e8q3q16vyc81g8l3h3m-d6q5f5e-wpengine.netdna-ssl.com/wp-content/uploads/2018/04/MDB-Investments-in-the-ICT-Sector.pdf

Arnfield R., “South Africa’s Digital Payments Plan Takes a Page from India’s UPI”, PaymentsSource.com, 2019 https://www.paymentssource.com/news/south-africas-digital-payments-plan-takes-a-pagefrom-indias-upi

Center for Global Development, “Investing in Social Outcomes: Development Impact Bonds”, cgdev.org https://www.cgdev.org/page/investing-social-outcomes-development-impact-bonds-0

Corrigan T., Africa’s ICT Infrastructure: Its Present and Prospects, SAIIA Policy Briefing 197, 9 June 2020 https://saiia.org.za/research/africas-ict-infrastructure-its-present-and-prospects/#

https://www.bis.org/bcbs/ Impact Bonds Work, and When to Use Them”, 2019 https://dalberg.com/our-ideas/how-development-impact-bondswork-and-when-use-them/

D’Silva D., Z. Filková, F. Packer, and S. Tiwari, The Design of Digital Financial Infrastructure: Lessons from India, in BIS Papers No 106, Basel, 2019 https://www.bis.org/publ/bppdf/bispap106.pdf

Fintechnews Singapore, “India’s Open Banking Landscape Thrives on the Back of Digital Public Infrastructure”, 2021 https://fintechnews.sg/49565/india/indias-openbanking-landscape-thrives-on-the-backof-digital-public-infrastructure/

Gustafsson-Wright E., I. Boggild-Jones, D. Segell, and J. Durland, Impact Bonds in Developing Countries: Early Learnings from the Field, Brookings Institution Reports, Washington DC, 2017 https://www.brookings.edu/wp-content/uploads/2017/09/impact-bonds-in-developing-countries_web.pdf

Hasche N., L. Höglund, and G. Linton, “Quadruple Helix as a Network of Relationships: Creating Value within a Swedish Regional Innovation System”, Journal of Small Business and Entrepreneurship, vol. 32, no. 6, pp. 523-44, 2020 https://doi. org/10.1080/08276331.2019.1643134

ITU (International Telecommunications Union), Giga: An Initiative to Connect Every Young Person in the World to Information, Opportunity and Choice, Geneva, 2020

Mazer R. and P. Rowan, “Competition in Mobile Financial Services: Lessons from Kenya and Tanzania”, The African Journal of Information and Communication, vol. 17, pp. 39-59, 2016 https://wiredspace.its.ac.za/bitstream/handle/10539/21629/AJIC-Issue-17-2016-Mazer-Rowan.pdf?sequence=3&isAllowed=y

Nyakanini G. et al., “Unlocking the Digital Economy in Africa: Benchmarking the Digital Transformation Journey”, Kigali, 2020 https://digitalimpactalliance.org/wp-content/uploads/2020/10/SmartAfrica-DIAL_DigitalEconomyInAfrica2020-v7_ENG.pdf

OECD (Organization for Economic Co-Operation), ICTs for Development: Financing Activities of DAC Members, OECD Papers, Geneva, https://www.oecd.org/fr/cad/35528240.pd

Omidyar Network Indi, “The Potential of Open Digital Ecosystems”, Redwood City, CA, https://web-assets.bcg.com/b1/32/454f846e4a7f884b30a3e63997c9/ode-executive-summary.pd

Raghavan V., S. Jain, and P. Varma, “India Stack – Digital Infrastructure as Public Good”, Communications of ACM, vol. 62, no. 11, pp. 76-81, 2019 https://cacm.acm.org/magazines/2019/11/240375-india-stack-digital-infrastructure-as-public-good/fulltext

Schellhase J., “Framing the Issues: Expanding Digital Financial Inclusion in the Philippines”, Santa Monica, 2019 https://milkeninstitute.org/sites/default/files/reports-pdf/Framing%20the%20Issues-%20Expanding%20Digital%20Financial%20Inclusion%20in%20the%20Philippines-Final-191114.pdf

Sera Z., “Social Impact Bonds: The Secret Tool for Effective Public Services?”, 2020 https://urbact.eu/social-impact-bonds-secret-tool-effective-public-services

United Nations, “Roadmap for Digital Cooperation”, New York, 2020 https://www.un.org/en/content/digital-cooperation-roadmap/assets/pdf/Roadmap_for_Digital_Cooperation_EN.pdf

World Bank Group, “The State of Identification Systems in Africa”, Washington DC, 2017 https://documents1.worldbank.org/curated/en/156111493234231522/pdf/114628-WP-68p-TheStateofIdentifica2005asessments-PUBLIC.pdf