G20 countries should make a renewed commitment towards providing stronger incentives for investment in low-carbon technologies, including through carbon pricing, but also via a more rapid phasing out of fossil fuel subsidies. To help redirect finance towards green investment G20 countries should work on the establishment of common international standards for consistent and comparable public disclosure as well as supervisory and regulatory reporting.

Challenge

The COVID-19 crisis presents an enormous challenge to economies and societies around the world, mobilising governments’ attention and resources. The magnitude and urgency of the crisis notwithstanding, they should not lose sight of other pressing global challenges, such as climate change. Climate change is an existential threat, posing severe risks to individuals, society and the economy, as exemplified by the increasing frequency and intensity of extreme weather events. There is no evidence directly linking the COVID-19 outbreak to climate change. However, COVID-19 is testing the resilience of our economies in responding to potential climate-related disasters, and as such can provide lessons about the vulnerability of our societies to high-impact global shocks and on the important role of public policies in mitigating the risks.

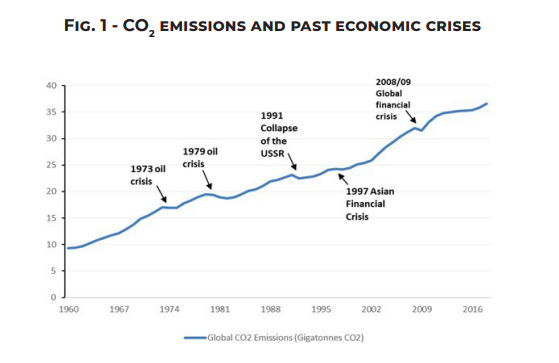

Addressing the health crisis and providing relief to affected businesses and workers remain the current priority. However, it will be important that post-crisis recovery packages closely align public policies with climate objectives. The lockdowns imposed across the globe and the associated reductions in economic activity have caused large reductions in greenhouse gas emissions in 2020 (between 5 and 8%), in particular from a fall in transportation and industrial activity. Still, the experience from previous crises suggests that this reduction is likely to be inconsequential for climate change unless followed up with strong climate policy action (Figure 1).

Note: CO2 emissions from the use of coal, oil, and gas (combustion and industrial processes), gas flaring and manufacturing of cement.

Source: Global Carbon Project (2020).

In fact, in around half of G20 countries, GDP is expected to exceed the pre-crisis level before or by the end of 2021 (OECD 2021a), including the two largest emitting members (China, where the GDP recovery was already completed in 2020, and the United States). Pre-pandemic projections based on stated policies highlight the magnitude of the challenge in aligning public policies with objectives. For example, coal consumption in China is expected to decline by around 10% between 2018 and 2040 whereas a profile consistent with Paris objectives would call for a 60% reduction (IEA 2019). In India, coal consumption is expected to double over the same period, with the support of private investment, while a 30% cut would be required.

Considering the short time window available to put global GHG emissions on a path that is consistent with the objectives of the Paris agreement, it is important that policy strategies be designed and implemented to achieve a low-carbon transition, including through economic stimulus packages. The experience of the 2008 Global Financial Crisis indicates that green stimulus measures need to be bold and consistent to make a difference. The lessons from that episode show that green recovery packages have helped to expand the role of renewable energy, but that this impact remained limited, especially in the absence of longterm carbon price signals (Agrawala, Dussaux, and Monti 2020).

In response to the COVID-19 crisis, many countries have indeed committed to a green recovery and have included measures to that effect in their stimulus packages. Assessing the environmental impact of specific measures is in many cases difficult and so such assessment needs to be interpreted with caution. Nevertheless, a recent analysis of stimulus packages across many countries indicates that “green” measures amount to a very significant share of the total budgetary cost, but that they are also matched on average by measures viewed as having a negative impact on the environment (OECD 2021b; Vivideconomics 2021).

Another challenge that will have to be taken into account in recovery packages is the significant reallocation of labour and capital that will be required to accommodate a fairly rapid shift from fossil fuels to renewables. Sectors such as solar PV, the retrofitting of buildings to reduce energy consumption, or even organic agriculture may well offer significant prospects for job creation, helping with the labour market recovery. Still, redeploying workers from fossil fuel based activities (mining, refineries, power generation, etc.) to expanding industries will require additional investment to support workers, households and, in some cases, communities or regions during the transition. Lastly, the decarbonisation of economies will likely need to be supported by changes in lifestyles and consumption patterns, requiring further measures to raise awareness and provide incentives.

Proposal

In this context, several policy options can be identified to ensure that stimulus packages are designed to support the longer-term recovery in a way that also facilitates the low-carbon transition. This alignment between the growth pick-up and climate objectives in stimulus packages can be achieved through measures in a number of areas.

INVESTING IN LOW-CARBON INFRASTRUCTURE

For most countries, one of the many legacies of the COVID-19 crisis will be high public debt. Yet, the claims on public support will continue to be numerous well into the recovery phase, emphasising the need to spend money in ways that are most effective in reigniting growth, generating jobs and meeting emission reduction pledges. It will be crucial in this context to ensure that public investment is largely preserved from public finance consolidation strategies likely to be implemented in a post-COVID world, contrasting in this regard with the large reductions observed in the wake of the 2008 Global Financial Crisis Public. However, to be justified it will also be important that infrastructure spending focus on projects that have a strong public good component and that are financially viable over the longer term. Furthermore, public investment plans should be based on the “no harm principle”, that is, leaving out investment in fields or areas harmful to the climate.

There are many investment opportunities that could support a low-carbon transition such as investments in power system flexibility (e.g. energy storage, smart grids, long-distance and cross-border power transmissions), public transport infrastructure, charging stations for electric or hybrid vehicles, energy-efficient retrofitting of buildings, carbon capture facilities and renewable energy deployment. Their need and efficiency in achieving targets needs to be assessed, taking into account individual countries’ circumstances and low-carbon transition pathways as well as their distributional implications.

• Renewable energy infrastructure: Significant additional investment will be required in the electricity generation sector to achieve the emission reductions consistent with the Paris agreement objectives (IEA 2020a). Public investment will play a key role not only in providing some of the incremental investment relative to a scenario of no significant climate change mitigation action, but also in stimulating private investment. Large increases will be needed in particular in electricity grids and battery storage to accommodate the sharp rise in renewable-based power (IEA 2020a). Moreover, expanding transmission lines and reducing regulatory constraints, to deliver renewable energy from often sparsely populated regions to regions where the demand for that energy is much higher, can accelerate the transition to low-carbon energy infrastructure. In the United States, about 3.3 million people work in the renewable energy sector about three times as many as in the fossil fuel energy sector.

• Retrofitting of buildings: The retrofitting of buildings to make them more energy-efficient addresses simultaneously the necessity to provide much-needed jobs, for example to workers from the construction sector, and to progress towards climate change policy targets. The retraining of workers could help accommodate the shift in jobs from affected industries and reduce unemployment (Motherway and Oppermann 2020). Uncertainties remain on the overall costs and benefits of retrofitting programmes because of the high upfront costs and the impact on emission reductions due to rebound effects, i.e. the increase in demand and uses of energy as a result of greater efficiency (Fowlie, Greenstone, and Wolfram 2018). Still, the experience with post-2008 stimulus packages has shown that investment in energy efficient buildings and retrofitting can successfully contribute to keeping existing and generating new jobs.1

• Communication networks: Measures taken at the outset of the pandemic to limit mobility and physical contacts between individuals have led to the rapid generalisation of practices such as teleworking, teleconferencing and online shopping. These have highlighted the critical importance of digital technologies to continue many business operations and maintain social interactions. Insofar as such practices contribute to reducing emissions (via lower transport needs), targeted investments in communication networks can be part of green recovery packages, provided measures are also taken to reduce the environmental footprint of digital technologies. More permanent teleworking arrangements will only be feasible if high-speed internet access is widely available. On average across OECD countries, the share of high-speed fibre internet in total broadband is less than 30%, although large differences exist, with Korea and Japan having around 80% and Italy and Germany less than 10% (OECD 2020a).

• Public transport: While public transport may be less frequently used, it will likely continue to play an important role in reducing transport-related emissions, even if teleworking reduces the demand for commuting compared to before the crisis. Better access to public transport infrastructure facilitates a transition from individual passenger car transport to mass transportation, reducing GHGs, local pollutants, as well as congestion. Investment in public transport also tends to benefit poorer households which may not have access to individual transportation. The COVID-19 crisis may spark a rethinking of public transport organisation or incentives to spread out working times to respond to the challenge of ensuring passenger loads that allow sufficient physical distancing while maintaining the low-emission potential of public transport. In the same vein, policy support to micro-mobility both in terms of infrastructure and financial incentives to encourage use can help provide a flexible, accessible and low-carbon transport alternative.

• Private transport: Electric vehicles still represent a tiny fraction of total passenger cars in G20 countries but rapid growth is foreseen in the coming years, at least in advanced economies where substantial subsidies help bridge the cost difference vis- à-vis cars with internal combustion engines. Stimulus packages could help accelerate the transformation of the car fleet with investment support in charging infrastructure.

Substantial investments are required over the next decade to ensure that sales of electric vehicles are not hampered by limited access to charging stations (IRENA 2020). In the case of road freight, which represents 65% of all freight emissions (or 27% of all transport-related emissions), useful measures would include the removal of the tax exemptions for fossil fuels, combined with support to carriers to invest in low-carbon fleets, while encouraging the development and adoption of common standards for new equipment and processes to create collection points and promote route optimisation (ITF 2021).

SUPPORT FOR INNOVATION AND START-UPS

Public support for research and development is well justified as technological progress plays a key role in achieving the low-carbon transition and considering the presence of market failures hampering investment in green technologies. First, it can address classical underinvestment in R&D caused by knowledge spillovers, and provide incentives to overcome the technological hurdles of the low-carbon transition, which drive its cost (Popp, Newell, and Jaffe 2010). Green R&D is typically at a disadvantage due to path-dependencies in fossil fuels use but policy support can help break this lock-in and then be progressively phased out as green technologies become profitable (Acemoglu et al. 2016). Second, it can decrease abatement costs and free up firms’ resources for other productive purposes, especially in energy-intensive industries (e.g. power generation). Stable public R&D subsidies can support green patenting, especially when coupled with well-designed environmental policies (Veugelers 2012; Aghion et al. 2016).

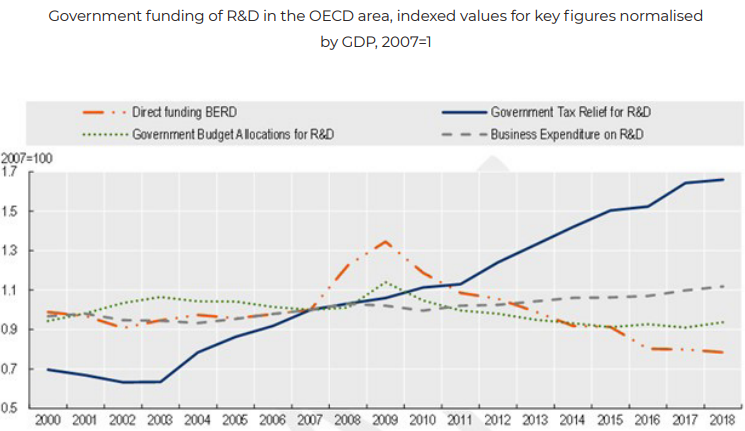

While not necessarily destined as recovery stimulus per se, policy can support green R&D directly through “technology-push” measures, including direct subsidies, tax credits, project grants and project loans. These subsidies should be directed at those technologies with the largest potential for emissions reduction that are furthest from the market, such as carbon capture and storage, batteries for intermittent energy sources, hydrogen and smart grids. Over the past two decades, governments have moved towards a greater use of R&D tax credit (Figure 2). However, there is some evidence that well-designed direct grants for R&D are better suited to supporting longer-term, high-risk research, and to targeting innovations that either generate public goods (e.g. health) or have significant potential for knowledge spillover (OECD 2020b).

Note: For general and country-specific notes on the estimates of government tax relief for R&D expenditures (GTARD), see https://www.oecd.org/sti/rd-tax-stats-gtard-ts-notes.pdf. Direct support estimates include government R&D grants and public procurement of R&D services, but exclude loans and other financial instruments that are expected to be repaid in full.

Source: OECD (2021c) and OECD R&D Tax Incentives Database, https://oe.cd/rdtax, November 2020.

“Market-pull” measures (i.e. tariff incentives, renewable portfolio standards, public procurement) should also flank technology-push ones as they can address the environmental externality, increase demand for green goods and thus spur green innovation (Costantini, Crespi, and Palma 2017). This has been the case of the feed-in-tariffs and feed-in-premiums, subsidising the production from renewable sources (Dechezleprêtre and Glachant 2013). The effectiveness of such measures is enhanced by structural policies that support the reallocation of skilled labour towards productive firms (see below), given that the supply of researchers is fixed in the short-run (Acemoglu et al. 2018).

RAISING THE EFFECTIVENESS OF RECOVERY PACKAGES THROUGH PRICE SIGNALS

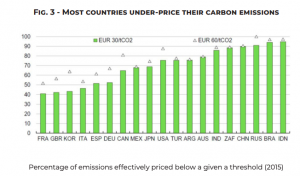

The effectiveness of stimulus measures oriented towards a climate-friendly recovery would be enhanced with the support of carbon pricing to help steer incentives. One lesson learnt from the green recovery packages adopted during the Global Financial Crisis was that investment support alone is not enough to make the business case for investing in low-carbon assets. Such packages often lacked the important longer-term signals provided by carbon prices. In the EU, ETS permit prices remained low for many years after the crisis, though they have risen considerably lately. In the United States, attempts to introduce a federal carbon price were abandoned. Latest OECD data shows that 76.5% of emissions are priced below EUR 30/tCO2, a conservative estimate for the social cost of carbon (Figure 3).

Note: The carbon pricing gap measures how much countries fall short of pricing carbon emissions in line with benchmark values. Carbon pricing gap at EUR 30/tCO2 is a low end estimate of the carbon costs today and EUR 60/tCO2 is an alternative benchmark. The gap is calculated as the difference between benchmark carbon pricing rate and the effective carbon rate (which is the total price that applies to CO2 emissions from energy use due to market-based policies, which sums explicit carbon taxes, specific taxes on energy use and tradable emissions permits).

Source: OECD, 2018.

As a result, investment support during the Global Financial Crisis did not benefit from a clear commitment to long-term carbon pricing trajectories that can render low-carbon investments more viable. For example, the American Recovery and Reinvestment Act of 2009 provided US$ 2 billion to develop carbon capture and storage (CCS) technologies for coalfired power plants. Similarly, in 2009 the European Energy Programme for Recovery (EEPR) dedicated EUR 1 billion to co-finance CCS projects. All such CCS projects were later abandoned in part due to low carbon prices, but also due to other factors such as falling prices in renewables and political acceptance, which all contributed to reducing attractiveness to private financing.

Yet, early commitment to the increasing use of carbon taxes in the recovery phase with clear price trajectories (based on the social cost of carbon) can provide forward guidance to investors, without immediately burdening businesses with new taxes (Van Dender and Teusch 2020). This will lower uncertainty and help fill the green investment gap, given that higher environmental policy uncertainty (e.g. arising from frequent policy reversals) significantly dampens investment, especially amongst capital-intensive manufacturing firms (Dechezleprêtre, Kruse, and Berestycki 2021). Alongside carbon pricing, increased disclosure of carbon emissions and better climate-related taxonomies can help in making such pricing mechanisms be more effective and better align private investments including in innovation with climate goals.

At the same time, phasing out fossil fuel subsidies and tax expenditures can generate much needed funding and can leverage wider efforts to broaden a country’s tax base while strengthening the alignment of public finances with emission-reduction targets. The latest combined OECD and IEA estimates indicate that governments provided US$ 340 billion in fossil fuel support in 2017, almost double that of support given to renewable energy (OECD and IEA 2019). Support for fossil fuels has proved to be inefficient in delivering affordable and accessible energy since it is often poorly targeted and therefore can be replaced with betterdesigned policies.

The political economy and public acceptability of carbon pricing needs to play an important role in the design of such policies (Carattini, Carvalho, and Fankhauser 2018). Carbon taxes and the phasing out of fossil fuel subsidies carry the risk of disproportionally affecting lower-income households and small businesses, which would magnify the negative impact of the crisis on vulnerable populations. Compensation measures and other complementary policies can be used to offset the distributional impacts of higher taxes or the removal of subsidies (Douenne and Fabre 2020). Lessons learnt from the successful introduction of the British Columbia carbon tax could be applied to other countries (Harrison 2013). Providing lump-sum payments to households and to the most affected firms, as well as boosting investments in green infrastructure can increase public acceptance of such policies (Yamazaki 2017; Murray and Rivers 2015; Douenne and Fabre 2020).

DESIGN ENVIRONMENTAL POLICIES WITH REALLOCATION IN MIND

Stronger environmental policies do not necessarily hinder economic performance. The trade-off between the economy and the environment is traditionally predicated on the grounds that environmental policies impose costs and reduce firms’ competitiveness. But the case for joint gains in economic and environmental performance at the firm level has been progressively put forward (Porter and Van der Linde 1995; Ambec et al. 2013). Firms facing stricter environmental policies can capitalise on new opportunities to increase revenues (e.g. via new and expanding markets or satisfying demand for greener goods) and decrease costs (e.g. via technological spillovers and lower borrowing costs) (Ellis, Nachtigall and Venmans 2019; Dechezleprêtre et al. 2019).

More stringent environmental policies can also disproportionately raise the costs for less productive firms, which may spur market rejuvenation by facilitating the exit of less productive technologies, practices and firms (Albrizio, Kozluk, and Zipperer 2017). This will boost aggregate productivity to the extent that polluting plants that exit are less productive (Greenstone, List, and Syverson 2012), which creates space for more productive (surviving) plants to expand (Dechezleprêtre, Nachtigall, and Stadler 2020). But realising these gains depends on environmental policy design and complementary structural policies to support reallocation.

Environmental policies need to be carefully designed so as to not crowd-out the growth of innovative firms and the technological renovation necessary for the low-carbon transition. Design should avoid inadvertently:

• Hampering competition by raising barriers to firm entry and exit and distorting the level playing field (Kozluk 2014). This may occur if policies impose different costs on firms by either explicitly differentiating on plant vintage or providing a more favourable treatment to existing installations based on prior use (“grandfathering”). Across OECD countries, there are notable examples of differential treatment of products, technologies and installations spanning emission standards for automobiles and power plants (Stavins 2006), and mandated investments in carbon capture and storage in coal plants (OECD 2017). This may be necessary especially at inception to garner policy support but can amplify resource misallocation by: i) favouring incumbent over new firms, regardless of their ability to attract financing; ii) incentivising rent seeking behaviours and “gaming” (Branger et al. 2015); and iii) impeding market rejuvenation, as demonstrated by coal-fired power plants exposed to vintage-differentiated air pollution emission limits (Coysh et al. 2020).

• Creating stranded assets, either: i) directly, when mandated standards render technologies which cannot be retrofitted unviable; or ii) indirectly, through policies that support competing technologies or affect consumers’ behaviour. Stranded assets raise the value at risk of firms and contribute to systemic risk, which raises the likelihood of specific and market-wide shocks and suppresses investment below the social optimum. Political opposition to greening policies could arise amongst owners of assets at risk of being stranded (Vogt-Schilb and Hallegatte 2017).

COMPLEMENTARY STRUCTURAL POLICIES CAN HELP SUPPORT REALLOCATION

The effectiveness of environmental policies can be further boosted by measures aimed at addressing information asymmetries and other market failures, including:

• Easing financial market frictions: Investors are progressively reinforcing their positions on ESG (Environmental, social and corporate governance) and sustainability-themed assets attracted by their ability to manage climate-related risk (OECD 2020c) but financial market imperfections still place the financing of green investments at a disadvantage. There is potential to reduce the information asymmetries and level the playing field by: i) reinforcing and specialising the informational and disclosure tools on sustainability (i.e. establish standards for how firms disclose and report environmental information to stakeholders), which can lead to divestments into carbon-intensive firms (Mésonnier and Nguyen 2021); ii) favouring the adoption of standards in project financing and banking operations; iii) providing a favourable regulatory and institutional environment for new financing products (e.g. green bonds), benchmark indexes that track environmental performances, and specialised investment vehicles (e.g. responsible investment funds) (OECD 2015); and iv) mainstreaming of climate considerations in central banking operations (e.g. portfolio management).

• Skill mismatches can impede the low-carbon transition: Policies that support labour market transitions are crucial to the low-carbon transition. While empirical evidence points to limited effects of environmental policies on employment in general equilibrium (Metcalf and Stock 2020; Hafstead and Williams 2018), reallocating workers can be costly for: i) workers in declining (i.e. brown) sectors via persistent employment and earnings losses (Marin and Vona 2019); and ii) firms in expanding (i.e. green) activities, if they encounter difficulties in hiring workers to fulfil their demand for green skills. This latter is relevant at the current juncture, as skill mismatches reduced the gains especially in the short-term from green stimulus measures in the Global Financial Crisis (Popp et al. 2020). These friction costs depend on the transferability of skills between green and brown activities. Task-based evidence suggests that the general skills requirements of brown jobs is often closer to that of green jobs than in other types of jobs (Vona et al. 2018). This raises the prospect that framework policies that support labour mobility and market competition which can reduce skill mismatch and boost productivity (Adalet, McGowan, and Andrews 2015) can support the efficient allocation of green skills and the low-carbon transition. The same is true for active labour market policies, which may help garner political acceptability for climate policies and foster reallocation by protecting workers, rather than jobs.

NOTES

1 For example, it is estimated that the US weather station programme a retrofitting policy generated at least 25,000 jobs in the initial year and that a total 200,000 jobs were created as a result of the overall programme (IEA 2020b).

REFERENCES

Acemoglu D. et al., (2018), “Innovation, Reallocation, and Growth”, American Economic Review, vol. 108, no. 11, pp. 3450-91 https://dx.doi.org/10.1257/aer.20130470

Adalet McGowan, M. and D. Andrews, (2015), Skill Mismatch and Public Policy in OECD Countries, OECD Economics Department Working Papers, vol. 1210 https://doi.org/10.1787/5js1pzw9lnwk-en

Aghion P. et al., (2016), “Carbon Taxes, Path Dependency, and Directed Technical Change: Evidence from the Auto Industry”, Journal of Political Economy, vol. 124, no. 1

Agrawala S., D. Dussaux, and N. Monti, (2020), What policies for Greening the Crisis Response and Economic Recovery?, OECDilibrary, no.164 https://www.oecd-ilibrary.org/environment/what-policies-for-greening-the-crisis-response-and-economic-recovery_c50f186f-en.

Albrizio S. et al., (2014), Do Environmental Policies Matter for Productivity Growth?: Insights from New Cross-Country Measures of Environmental Policies, OECD Economics Department Working Papers, no. 1176, Paris, OECD Publishing https://dx.doi.org/10.1787/5jxrjncjrcxp-en

Ambec S. et al., (2013), “The Porter Hypothesis at 20: Can Environmental Regulation Enhance Innovation and Competitiveness?”, Review of Environmental Economics and Policy, vol. 7, no. 1 https://dx.doi.org/10.1093/reep/res016

Branger F. et al., (2015), “EU ETS, Free Allocations, and Activity Level Thresholds: The Devil Lies in the Details”, Journal of the Association of Environmental and Resource Economists, vol. 2, no. 3, pp. 401-37 https://dx.doi.org/10.1086/682343.

Carattini S., M. Carvalho, and S. Fankhauser, (2018), “Overcoming public resistance to carbon taxes”, WIRES Climate Change, vol. 9

Costantini V., F. Crespi, and A. Palma, (2017), “Characterizing the policy mix and its impact on eco-innovation: A patent analysis of energy-efficient technologies”, Research Policy, vol. 46, no. 4 https://dx.doi.org/10.1016/j.respol.2017.02.004

Coysh D. et al., (2020), “Vintage differentiated regulations and plant survival: Evidence from coal-fired power plants”, Ecological Economics, vol. 176, p. 106710 https://dx.doi.org/10.1016/j.ecolecon.2020.106710

Dechezleprêtre A., D. Nachtigall, and B. Stadler, (2020), The effect of energy prices and environmental policy stringency on manufacturing employment in OECD countries: Sector- and firm-level evidence, OECD Economics Department Working Papers, no. 1625, Paris, OECD Publishing https://dx.doi.org/10.1787/899eb13f-en

Dechezleprêtre A. et al., (2019), “Do Environmental and Economic Performance Go Together? A Review of Micro-level Empirical Evidence from the Past Decade or So”, International Review of Environmental and Resource Economics, vol. 13, no. 1-2, pp. 1-118 https://dx.doi.org/10.1561/101.00000106

Dechezleprêtre A. and M. Glachant, (2013), “Does Foreign Environmental Policy Influence Domestic Innovation? Evidence from the Wind Industry”, Environmental and Resource Economics, vol. 58, no. 3 https://dx.doi.org/10.1007/s10640-013-9705-4

Douenne T. and A. Fabre, (2020), “French attitudes on climate change, carbon taxation and other climate policies”, Ecological Economics, vol. 169, p. 106496 https://dx.doi.org/10.1016/j.ecolecon.2019.106496

Ellis J., D. Nachtigall, and F. Venmans, (2019), Carbon pricing and competitiveness: Are they at odds?, OECD Environment Working Papers, no. 152, Paris, OECD Publishing https://dx.doi.org/10.1787/f79a75ab-en

Fowlie M., M. Greenstone, and C. Wolfram, (2018), “Do Energy Efficiency Investment Deliver? Evidence from the Weatherization Assistance Program”, The Quarterly Journal of Economics, vol. 133, no. 3

Global Carbon Project, (2020), https://www.globalcarbonatlas.org/en/content/welcome-carbon-atlas

Greenstone M., J. List, and C. Syverson, (2012), The effects of environmental regulation on the competitiveness of US manufacturing, No. w18392, National Bureau of Economic Research

Harrison K., (2013), The Political Economy of British Columbia’s Carbon Tax, OECD Environment Working Papers, no. 63, Paris, OECD Publishing https://dx.doi.org/10.1787/5k3z04gkkhkg-en

International Energy Agency (IEA), (2020a), World Economic Outlook 2020, Paris, IEA

Internationa (2020b), Energy efficiency and economic stimulus, Paris, IEA https://www.iea.org/articles/energy-efficiency-and-economic-stimulus#reference-3

International Renewable Energy Agency (IRENA), (2020), The post-COVID recovery: An agenda for resilience, development and equality, Abu Dhabi

Koźluk T., (2014), The Indicators of the Economic Burdens of Environmental Policy Design: Results from the OECD Questionnaire, OECD Economics Department Working Papers, no. 1178, Paris, OECD Publishing https://dx.doi.org/10.1787/5jxrjnbnbm8v-en

Mésonnier J. and B. Nguyen, (2021), Showing off cleaner hands: mandatory climate-related disclosure by financial institutions and the financing of fossil energy, Working Paper, Series no. 800, Banque de France, https://publications.banquefrance.fr/en/showing-cleaner-handsmandatory-climate-related-disclosurefinancial-institutions-and-financing

Motherway B. and M. Oppermann, (2020), Energy efficiency can boost economies quickly, with long-lasting benefits, IEA Commentary, International Energy Agency, https://www.iea.org/commentaries/energy-efficiency-can-boost-economies-quickly-with-long-lasting-benefits

Murray B. and N. Rivers, (2015), “British Columbia’s revenue-neutral carbon tax: A review of the latest “grand experiment” in environmental policy”, Energy Policy, vol. 86, November https://www.sciencedirect.com/science/article/pii/S0301421515300550

Organisation for Economic Co-operation and Development (OECD), (2017), Policies for Scaling Up Low-Emission and Resilient Investment, Paris, OECD Publishing

Organisation for Economic Co-operation and Development (OECD), (2020a), OECD broadband statistics update, OECD, July https://www.oecd.org/sti/broadband/broadband-statistics-update.htm

Organisation for Economic Co-operation and Development (OECD), (2020b), The effects of R&D tax incentives and their role in the innovation policy mix – Findings from the OECD microBeRD project, 2016-19, OECD Science, Technology and Industry Policy Papers, no. 92, Paris, OECD Publishing https://doi.org/10.1787/65234003-en

Organisation for Economic Co-operation and Development (OECD), (2021a), OECD Economic Outlook, vol. 2021/1, no. 109, Paris, OECD Publishing

Organisation for Economic Co-operation and Development (OECD), (2021b), The OECD Green Recovery Database: Examining the Environmental Implications of COVID-19 Recovery Policies, OECD Policy Responses to Coronavirus (COVID-19), April https://www.oecd.org/coronavirus/policy-responses/the-oecd-green-recovery-database-47ae0f0d/

Organisation for Economic Co-operation and Development (OECD), (2021c), OECD Science, Technology and Innovation Outlook 2021, Paris, OECD Publishing

Organisation for Economic Co-operation and Development (OECD) and International Energy Agency, (2019), Update on recent progress in reform of inefficient fossil-fuel subsidies that, https://www.oecd.org/fossil-fuels/publication/OECD-IEA-G20-Fossil-Fuel-Subsidies-Reform-Update-2019.pdf

Popp D. et al., (2020), The Employment Impact of Green Fiscal Push: Evidence from the American Recovery Act, National Bureau of Economic Research, Cambridge, MA, https://dx.doi.org/10.3386/w27321

Popp D., R. Newell, and A. Jaffe, (2010), “Energy, the Environment, and Technological Change”, in Handbook of the Economics of Innovation, vol. 2, Elsevier https://dx.doi.org/10.1016/s0169-7218(10)02005-8

Porter M. and C. Van der Linde, (1995), “Toward a new conception of the environment-competitiveness relationship”, Journal of economic perspectives, vol. 9, no. 4

Stavins R., (2006), “Vintage-Differentiated Environmental Regulation”, Stanford Environmental Law Journal

Van Dender K. and J. Teusch, (2020), “Making environmental tax reform work”, La Revue des Juristes de Sciences Po, vol. 18, pp. 106111 https://revuedesjuristesdesciencespo.com

Veugelers R., (2012), “Which policy instruments to induce clean innovating?”, Research Policy, vol. 41, no. 10, pp. 1770-78 https://dx.doi.org/10.1016/j.respol.2012.06.012

Vogt-Schilb A. and S. Hallegatte, (2017), “Climate policies and nationally determined contributions: reconciling the needed ambition with the political economy”, Wiley Interdisciplinary Reviews: Energy and Environment, vol. 6, no. 6 https://dx.doi.org/10.1002/wene.256

Vona F. et al., (2018), “Environmental Regulation and Green Skills: An Empirical Exploration”, Journal of the Association of Environmental and Resource Economists, vol. 5, no. 4, pp. 713-53 https://dx.doi.org/10.1086/698859

Yamazaki A., (2017), “Jobs and climate policy: Evidence from British Columbia’s revenue-neutral carbon tax”, Journal of Environmental Economics and Management, vol. 83, May https://www.sciencedirect.com/science/article/pii/S0095069617301870