Asian cities have always been under pressure to provide for the growing need for urban and socioeconomic infrastructure. In the current post-pandemic times, the focus has shifted towards policies that can change human lives for the better, along with creating sustainable and resilient built forms. This move towards inclusive urbanism aligns with the “leave no one behind” ideology of Agenda 21 and Sustainable Development Goals (SDGs) (UNSDG, 2022), and must address spatial, social as well as economic inclusion, as these are interdependent and reinforce each other. One crucial way to enable inclusive cities is to focus policy attention to informal spatial-economic constructs, which form an important core of cities in the developing world; where more than 68 percent of the employed population of Asia-Pacific engaged in the informal economy (ILO, 2018) and more than 90 percent of South Asia’s businesses in the informal sector (UNICEF, 2021). For the foreseeable future, the informal sector will continue to play a pivotal role in urban economics, and hence, there is a dire need to identify informal economies and spaces, recognise their tenures, include them in regulatory frameworks and above all accept and allow for dynamic community-based funding mechanisms along with formal ones.

In planning for both old and new cities, the provision of funding and financing for informal urban as well as socioeconomic infrastructure at the grassroots level requires multilayered and holistic policy that covers the core issues for their current exclusion. This policy brief proposes a framework that identifies and recognises the dynamic attributes of informality through adaptive, inclusive and multifold pathways. The pathways to address inclusiveness in the old and the new built environment are outlined to cover identification, recognition, reforming, adapting, implementing and incentivising the informal spatial-socio-economic constructs in cities.

Challenge

Inclusive cities are challenging to achieve due to the pressures of fast urbanisation and a lack of public financial resources, especially in the developing world. There are multilayered barriers to the inclusion of informal settlements, informal economies and the financing of community-level infrastructure. Despite a plethora of research, studies and government schemes and programs, the issue of urban informality has been a patchwork of short-term solutions and remains outside of urban regulations and mainstream planning, leading to widening chasms of income poverty and socioeconomic infrastructure provision gaps.

The first and foremost challenge faced is that there is no legal definition and identification of these urban informalities mainly due to the complexities and dynamism in the nature of informality itself. Local urban bodies have not been successful in providing actionable solutions for urban infrastructure issues in informal settlements, urban villages and historic core areas due to the lack of definition and inventory of informal public assets, including the spatial (common spaces, streets, multi-use areas etc.), socioeconomic (multi-use areas, economic adaptions of space for informal activities, traditional crafts and so on) as well as environmental (water bodies, trees, fishery etc.) assets. In addition, urban infrastructure is mainly defined as physical infrastructure, like water supply, sanitation and roads, while socioeconomic infrastructure is not identified with equal and due importance. The facilities and amenities are restricted to the basic minimum and often lack a holistic view of informality and the adaptive multiple uses of common spaces.

Second, informal settlements are not legally recognised due to land tenure and ownership ambiguity. Most informal settlements are categorised as unauthorised settlements, which creates legal or regulatory conflicts for policymakers when providing basic urban services to such areas. These settlements, historic core city areas, urban fringes, etc. have been completely overlooked and often designated as either slums and redundant built forms or excluded from city masterplans due to the complexities of legal tenures, organic and congested growth patterns and difficulty to fit into modern land-holding patterns.

The third challenge pertains to the fact that the urban development regulations, guidelines and urban codes in most developing countries do not include provisions for informal settlements. The formal development guidelines, building bylaws, regulatory frameworks, formal master plans and urban policies have recognised only the new age structures and formal plans, and miss out on the age-old traditional markets, selling patterns and outreaches with embedded informality. For example, in India a review of the urban development guidelines (URPDFI) reveals that they do not provide any guidance on the informal settlements, urban villages and old historic core city areas etc. As a case in point, modern cities in India like Chandigarh and New Delhi follow rigid land-used based master plans and are criticised for ignoring the informal settlements and integral urban villages. Burail in Chandigarh, Hoshiyarpur in Noida, Tughalpur in Greater Noida and Kathwaria Sarai in New Delhi as examples are dense traditional typologies that house informal economies but have been overlooked in their respective city plans.

Added challenges, combined with the earlier three, include the traditional top-down financing and funding mechanisms, which are unable to adapt, implement and incentivise the priorities of the urban informalities to effectively reach the grass roots. Informalities have been seen as bottlenecks and not as an inherent part of the urban economy by both government bodies and the private sector alike. The formal ways of government funding and top-down investment strategies have not been effective at filtering through the layers of informal- and community-level economic dynamism to be able to have an impact on livability for the marginalised population and workforces.

Proposal

This policy proposal is based on a paradigm shift where economic development, rooted in culture and social cohesion, contributes to inclusive cities and the urban infrastructure, which by definition should include informal socio-spatial constructs to benefit grassroots-level economics and well-being. Urban infrastructure finance requires adaptive financial frameworks to not only include the private sector, but also community-based financing structures. An inclusive, adaptive and flexible approach to urban socioeconomic infrastructure finance will involve the usage of shared spaces for economic activities, acceptance of community ownerships and informal tenures in the regulatory system, adopting instruments like public-private partnerships (PPPs) but in more adaptive ways to include bottom-up community-based models to strengthen what already exists, rather than to finance something new.

The main policy proposals for innovative infrastructure finance to create inclusive cities follow a holistic approach to inclusion through regulatory and economic reforms, by way of identifying, recognising and reforming the informality regulatory focus while adapting, implementing and incentivising infrastructure finance:

Exhibit: Policy brief and action framework for infrastructure finance outreach to urban informalities to create inclusive and resilient Asian and African cities

| Focus | Policy intent | Proposed policy actions |

| Regulatory | Identify |

|

| Recognize |

| |

| Reform |

| |

| Economic | Adapt |

|

| Implement |

| |

| Incentivize |

|

A. Inclusive cities need to define and categorise informal shared spaces and socioeconomic infrastructure

An inclusive city, whether existing or newly planned, requires rethinking on community spaces, public spaces, informal areas and common facilities where space needs to be defined beyond morphology and physicality. Spaces are socio-spatial constructs, that are based on active, complex and transitional use, and use of tactical urbanism or regenerative urbanism allows low-cost temporary change in shared spaces, intended to provide improvement in local conditions and infrastructure. Identifying and establishing “urban informal typology” will strengthen the economic activities that these carry within their spatial intricacies. This can be achieved through a systematic classification of urban informal socio-spatial constructs and updating the current urban guidelines to include the informalities – categorised and reoriented towards multiple use, flexible use, temporal use, shared ownerships, community management and cooperative networking. Categories given in Appendix 1 provide a sample list of practices that are common to informal urbanisation observed across Asia and Africa and need to be acknowledged in the urban planning policy and community based urban-design discourse.

B. Inclusive cities need to update bylaws and guidelines to include urban informalities in mainstream planning

Urban villages, informalities and formal development have long coexited as parallels, with a consistent economic interconnectedness that has been recognised in SDG11. The approval process for greenfield development projects needs to recognise traditional building typologies, such as courtyard houses, which are intrinsic to urban villages and follow the traditional house forms, which are climatic responsive and hold higher density (Raj, 2020). Communities that live in this traditional connectedness are integrated not just culturally but also have high economic porosity. For example, a traditional house in an urban village in India has a place for cattle, a portico kitchen, a courtyard to park agricultural machinery and to stock produce etc., which are not only economic annexes to living spaces but also favourable for climate resilience, which need to be accepted in building bylaws without segregating built forms into rigid land uses and zones. Similarly, road width and open spaces in informal settlements need to be identified in the current urban guidelines, like the URDPFI guidelines in India for example (URDPFI, 2015; Niti Ayog 2021). A special addendum for urban villages and informal settlements is needed to include them in the development definitions and adaptive reuse of heritage areas (MRI, 2019). Similarly, refuge areas, gathering areas during natural disasters, building quality and construction quality guidelines, ambulance clearance areas, nurseries and schools and provision of safety regulations require revisions for the informal areas. The current ad hoc regenerative efforts as seen in many Indian urban villages and Jakarta’s kampung as examples (Irawaty 2018), need to be more integrated and more sensitive towards the local communities and traditional economic activities to create infrastructure and investment connectedness.

C. Reforms to recognise informal land tenure and holdings

Legal landholdings are conventional, measurable and administrable approaches to land governance and economics, however, land tenures and holdings in the informal settings are complex due to the fact that economic activity in the developing world is often more spontaneous and does not follow a formal structure of procedures. Informal land tenures can be a mix of private, state, communal or open access types, with a multitude of user, control or transfer rights involved. The conventional tenure holding structure is insufficient in terms of economic transactions, tenures, holdings and information collected (Lamba, 2005), and these are often inconsistent with ground realities against the records (Mesgar, 2021), therefore need in need of update and reform. In reworking land use policy and ease of change, it is essential to include tools that address ground realities rather than see ownership as limiting outlines of land. Land use needs to be connected to planning through dynamic economic functions and not through preassigned broad uses. For inclusion, urban villages and informalities need recognition as active dynamic land-use-economics. This could be achieved through adopting tenure regularisation guidelines and implementing these through community participation across informal settlements for documentation and registration. However, considering the legal complexities involved in regularisation, various hybrid reforms should be adopted that can reduce tenure insecurity. These can include community-based rights to access and protection from eviction where applicable.

D. Adapt flexible and innovative finance models for community-level interventions

The informal spaces and economies that flourish at the community-led grassroots level require a shift from regularly desired government funding or more recent PPP modes. Innovative models especially in the developing world, need to involve community-based organisations (CBOs) in financing infrastructure. This economic change, which creates more employment, and encourages secondary and tertiary economies to bring in choice, freedom and motivation into communities with limited governance, can be attained through facilitating the domestic processes (Frühling, 2010). Community-led funding initiatives, where resident groups come together to complete basic infrastructure needs, and government aid with know-how or initial capital should be adopted to strengthen the collaborative innovative finance mechanism for inclusive cities. One such approach, applied at community level financing is demonstrated in Appendix 2, and similar ones can be applied with contextual adaptations. Funding in informal communities needs to take an integrated approach to investments including accessibility, affordability, resilience and sustainability (ADB, 2017). Newer, tailor-made and context specific arrangements may dominate this approach, including a combination of social safety nets, social insurance and microfinancing models etc., which reinforce collective accountability and joint decision-making. Community saving models provide a basis for collective action in low-income settlements (ICED, 2017). To create an enabling environment for such flexibility in financing a community’s economic infrastructure, penetration of digital technology could play a crucial role in terms of accessibility and outreach.

E. Implementing community asset management for achieving sustainability in infrastructure and urban development

Community infrastructure assets, like shared spaces, instruments and machinery are a crucial aspect of informal economic activities, and their financial management is based in depreciating value over time, which needs to be strengthened by engaging the community in the management of these assets. Typically, government authorities deal with aging and quickly declining asset conditions with limited funds for replacement, as mostly communities cannot afford service charges pertaining to livelihood assets. The involvement of communities in the planning, design and management of such assets leads to reduced risks and encourages private sector engagement. This model solves issues related to site access, information sharing, traditional design and conservation wisdom, resettlements and compensation and other issues. Community engagement in managing assets may also lead to reduced construction costs and labour costs (IECD, 2017). Such community-led asset management bodies, where implemented, will strengthen the position of local community groups to negotiate with the private sector through a much more organised approach for future financing and reduces the knowledge gap between communities and the private sector.

F. Creating effective incentives for private sector participation in new cities

For government bodies to consider innovative collaborative models beyond PPPs involves a long-term vision and a sharing of risks and rewards over time on infrastructure investments, especially at the grassroots level. Community-level infrastructure finance, especially in the informal sector is perceived by the private sector as being high risk and carrying high transaction costs. Thus, to enable an environment that can attract not only potential national but multinational corporations, the need is to treat them not as contractors or vendors, but as business partners. The same principles need to be applied to CBOs. Transparency, dialogue and active communication are key drivers along with bankability requirements, and the minimum investment return for investors may not be a lone driving factor. In the developing world, there is a wide diversity of institutional investors that look out for socially responsible investments not only seeking a financial market return, but are also motivated by creating value (value-based investments) and increasing their social impact (impact investing) (IECD, 2017). To create incentives for such investors, the government needs to provide part capital, and inspire the private sector to achieve social and sustainability objectives. Hence, it is imperative to introduce innovative partnership models with governments that would make informal communities feel comfortable with private sector capital and support long-term collaboration, which could go beyond traditional methods.

Conclusion

To achieve inclusive and resilient cities, urban informal spaces and the associated physical and socioeconomic infrastructure finance need due recognition in a regulatory and economic policy focus. The multitude of barriers and challenges surrounding informalities can be abridged only by a holistic multilayered policy approach that is inclusive spatially, socioeconomically, as well as financially. The proposed policy actions are cohesive, interdependent and inclusive of the identification, recognition and reforms in spatial and regulatory mechanisms, while superimposing adaptive and dynamic/hybrid community-based finance models.

Relevance of the policy brief to T20 goals

In 2018, the Group of 20 leadership acknowledged that infrastructure (we include socioeconomic infrastructure) has been a driver of economic prosperity. Outlining pathways for creating inclusive cities is a win-win for SDG localisation efforts and addressing multiple SDG impacts in urban informal settings especially at the community level. The policy brief is also clearly applicable and aligned with the G20 Platform on SDGs Localisation and Intermediary Cities (G 20 PLIC) adopted in 2021, with respect to the intermediary cities in Organisation for Economic Co-operation and Development (OECD) countries, especially in low-income economies that are usually left out from the sustainable development agenda. At the heart of the above policy, there is a need for multilevel governance thinking, and stakeholder’s involvement at the community level, as strongly recommended for SDG localisation. This policy brief will directly impact built environment quality, quality of life, micro-economies and community networks and co-ownerships of common spaces in informal spatial settings, which have traditionally been outside of formal regulatory frameworks. The Asian and African G20 community will benefit from similar approaches in the informal built environments, which dominate the urbanisation in the global south.

Appendices

Appendix 1: Recognition of informal and adaptive shared spaces

| Parameter | Multiple criteria to be applied for recognition and definition by government agencies and authorities |

| Spatial typology | Street, green space, water body, drain, under a bridge or flyover, other |

| Structural typology | Permanent, semi-permanent, built, semi-built, covered, open |

| Size | Area coverage |

| Usage | Historic usage, current usage, discontinuous/occasional usage, temporal usage, events |

| Ownership and tenure | Authority, agency, community, private, other |

| Operation and maintenance | Government, private, community, institutional, other |

| Activity | Economic activity, cultural activity, no. or people using it |

| Temporal potential | Day (morning, noon, evening) activities, night-time activities and usage, occasional usage, |

| Available Infrastructure | Lighting, sanitation facilities, seating, temporary structures, shade, landscape, pathways, kiosks |

| Stakeholders | Community, NGOs, government and administrative bodies, service providers, institutions |

| Need-based economic adaptations of space | Recycle/reuse/refurbishing tactics (de-fencing, de-paving, food trucks, guerrilla art, shop extensions, pop-up cafes and retail, roadside consultation pods, farmer markets are canopies, shop in-front, subletting etc.) |

| Economic Activities | Small butcheries, building material stores, car washes, welding shops, powder coating, anodizing/chemical treatments, repair shops, small retail, retail banking, ATMs etc. |

Source: Authors

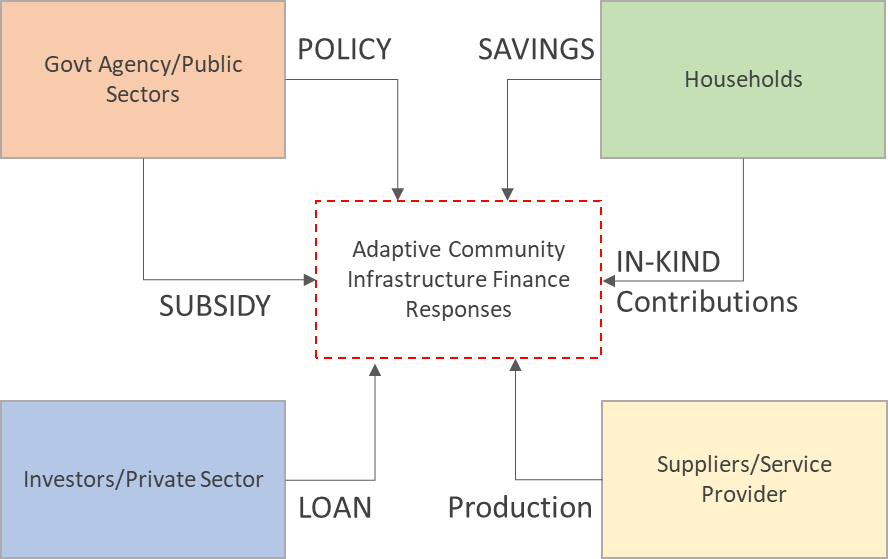

Appendix 2: Conceptual framework of adaptive community infrastructure finance responses

References

ADB, 2020, Managing the risks of public infrastructure financing: Toward sustainability. Asian Development Bank Institute, Working Paper Series, Tokyo, Japan.

ADB, 2017, Enabling Inclusive Cities, Toolkit for Inclusive Development, Accessed at: https://www.adb.org/sites/default/files/institutional-document/223096/enabling-inclusive-cities.pdf

Davis, R., 2012, An Introduction to Asset Management: A simple but informative introduction to the management of physical assets. Chester: EA Technology.

EPA, 2016, Community based public-private partnerships (CBP3s) and alternative market tools for integrated storm water infrastructure, A guide for local governments, U. S. Environmental Protection Agency.

FCM, 2005, Decision Making and Investment Planning: Managing Infrastructure Assets. Federation of Canadian Municipalities (FCM), Canada.

Giglio, J., Friar, J., & Crittenden, W., 2018, Integrating lifecycle asset management in the public sector. Federation of Canadian Municipalities and National Research Council, Business Horizons, 61(4), 511-519.

IECD, 2017, Enabling private investment in informal settlements Exploring the potential of community finance, Accessed at: https://pubs.iied.org/sites/default/files/pdfs/migrate/G04180.pdf.

MRI, 2019, Open Heritage Report, Mapping of current heritage re-use policies and regulations in Europe, Complex policy overview of adaptive heritage re-use, Metropolitan Research Institute, December 2019, Ref. Ares (2019) 7896005 – 23/12/2019.

Niti Aaayog, 2021. www.niti.gov.in. Retrieved from:

https://www.niti.gov.in/sites/default/files/2021-09/UrbanPlanningCapacity-in-India-16092021.pdf.

OECD, 2020a, G20/OECD Report on the collaboration with institutional investors and asset managers on infrastructure: Investor proposals and the way forward. Organisation for Economic Co-operation and Development, Retrieved from:

OECD, 2020b, Organisation for Economic Co-operation and Development Compendium of policy good practices for quality infrastructure investment. Retrieved from:

Pierre Frühling, 2010, How Basic Community Infrastructure Works can Trigger Livelihood Improvements and Good Governance, Personal notes on a validated model integrating socio-economic progress and democracy, development in poor urban areas, SIDA, Edita 2010.

Together 2030, 2019, Realizing the SDGs for All: Ensuring Inclusiveness and Equality for Every Person, Everywhere Together 2030 written inputs to the UN High-Level Political Forum on Sustainable Development.

ILO, 2018, Internatioal labour organization, I. L., 2 . www.ilo.org. Retrieved from : https://www.ilo.org/asia/media-centre/news/WCMS_627585/lang–en/index.htm

Irawaty, Dian Tri, 2018, Jakarta’s Kampungs: Their History and Contested Future, A thesis for the degree of Master of Arts in Geography UCLA.

Lamba Antony O., 2005, Thesis : Land tenure Management systems in Informal Settlements – Nairobi. Enschede, The Netherlands: Interntional Institute for Geo-information Science and Earth Observation.

Mesgar, M., 2021. Informal Land Rights and Infrastructure Retrofit. MPDI Journal, 10(Land 2021), p. 273.

Raj, M, 2020, www.panchayat.gov.in. Retrieved from : https://panchayat.gov.in/documents/20126/0/RADPFI+Guidelines.pdf/4cc61805-4e48-d15f-26f6-98128d1716d9?t=1610617777201 [Accessed 10 March 2022].

UNICEF, 2021. www.unicef.org. Retrieved from:

https://www.unicef.org/rosa/private-sector-engagement

UNSDG, 2022, www.unsdg.un.org. Retrieved from:

https://unsdg.un.org/2030-agenda/universal-values/leave-no-one-behind