As they fight the Covid-19 pandemic, countries across the world are pushed to spend big to weather the crisis. Due to their limited fiscal capacity, many lowand middle-income countries are facing debt distress which might lead to a future debt restructuring process. With the current conventional instrument of sovereign debt, debt restructuring is a painful process and sometimes hurts the economy more than is necessary. To improve the current approach, we propose an alternative sovereign debt instrument with the critical features of an automatic, rules-based restructuring process for bonds issued and a guarantee provided under this facility.

Challenge

A prolonged economic downturn caused by extended below-normal economic activities during the Covid-19 pandemic has created a unique problem for emerging market economies (EMs). The ongoing crisis has substantially increased the risk of debt distress in many countries, pushing the poorest ones to the brink. In times of crisis, EMs are struggling to finance the stimulus needed to address the underlying problems and spur growth as a means to overcome the crisis. The most obvious attribute is their strong reliance on external financing. Even before the pandemic, numerous countries had a very high level of external debt as a percentage of their GNI (e.g., Mongolia: 253.1%; Montenegro: 150%; Lebanon: 144.9%) (World Bank 2021).

As EMs continue to grapple with the pandemic, outstanding debts not only limit their fiscal space to respond swiftly to the crisis but also prevent future development. Numerous EMs, particularly those with a lower income level and a shallow domestic capital market that is already struggling to service existing debt, have needed immediate and massive fresh financing, only to find that it is too expensive or difficult to borrow in sufficient amounts to facilitate post-pandemic economic recovery. Even if they still have access to the capital market, the additional debt burden will hinder them for years, reducing their prospects for long-term economic development.

Most EM economies do not have a deep domestic financial market, which means that bonds issuance, even the ones in local currency, will have to be partially absorbed by international investors. This poses a vulnerability issue for both exchange rate and government bond yield in the medium-term. A possible increase in global interest rate in the next few years could trigger episodes of massive capital outflow. Financing through bonds issuance in hard currencies also poses medium-term risks, as hedging in EM currencies is generally costly, and unhedged bond issuance may expose EM borrowers to a highly unsustainable fiscal position should the global interest rate increase and EM currency depreciation occur simultaneously.

In response to the current crisis, the G20 has established a Debt Service Suspension Initiative (DSSI), allowing EMs to suspend official bilateral debt-service payments until 2021. Furthermore, the G20 also implemented a new framework to address sovereign-debt restructuring needs on case-by-case basis. However, this temporary solution is not addressing the fault lines that have developed and which have become apparent due to the current crisis. First, the DSSI framework deals on a case-by-case basis, which fails to address the problem of any country that avails itself of relief. Aside from the fact that several developing countries have already effectively lost access to capital markets, those that can still finance themselves through international bonds face growing risks (Akhtar, Volz, Kraemer, and Griffith-Jones 2021). Second, while the DSSI gave breathing space to EMs, allowing them to postpone their debt payments, the net present value of those countries’ debts is unchanged, thus only delaying the debt restructuring process, which is often painful. Going forward, the current solution has not addressed systemic problems; thus, the need for an alternative instrument to finance the sovereign debt of EMs with better restructuring prospects is imperative.

Proposal

In order to address the medium-term risk posed by domestic revenue shortfall due to sluggish recovery and currency depreciation for fiscal authorities in emerging markets and highly indebted developing countries, we propose the introduction of a new facility called Countercyclical Sovereign Financing Mechanism (CSFM, hereafter referred to as “facility”). This facility aims to provide cheaper access to the international debt market and to allow for the automatic reduction of debt burden and servicing cost if the issuer’s economy is adversely affected by changes in global monetary policy and risk appetite. These objectives are to be achieved through two components of this proposed facility. The first component is the formalisation of an automatic, rules-based restructuring process for bonds issued under this facility. The second component is the credit enhancement process, achieved through the creation of a purpose-built credit insurance underwritten by an independent agency, supported by G20 member states.

COMPONENT 1: FORMALISING A RULES-BASED DEBT ADJUSTMENT PROCESS FOR FIXED-RATE SOVEREIGN BONDS

Whenever the risk of external debt to lowand lower-middle-income countries is increasing, ensuring the swiftness and seamlessness of subsequent debt restructuring (i.e. reducing debt servicing cost and/or debt principal) is highly desirable for the issuer’s economy. While debt restructuring commonly resulted in temporary exclusion from the international capital market, a restructuring process that allows the issuer to exit the default period with a reduced debt load can be beneficial for the issuer’s economy, as the issuer will not have to allocate an unsustainably large portion of their budget for debt servicing. This subsequently allows the issuer to spend more on productive uses, which facilitates more rapid recovery. This is particularly true after the final restructuring process (Forni, Palomba, Pereira, and Richmond 2016) and for issuers that suffer from debt overhang.

However, under the normal fixed-rate debt instrument commonly issued by sovereign issuers, restructuring is often very costly and lengthy for both investors and issuer. In an environment with weak contractual enforcement like the sovereign debt market, competition for repayment and enforcement of seniority among private lenders means that the resulting equilibrium may be one where the debts issued by sovereign issuers are excessively difficult to restructure (Bolton & Jeanne, 2007) (Bolton & Jeanne, 2009). This creates a dynamic where sovereign issuers end up having to risk protracted default (and consequently being shut out of international debt market) in order to tap into the capital market for deficit financing. A process that allows for restructuring to happen automatically without triggering technical default would therefore be highly valuable, as it can allow for reduction in debt load and servicing cost without being shut out of the international debt market.

While a GDP-linked bond framework is very suitable to achieve the objective of debt servicing cost reduction during economic downturns, its current design suffers from several drawbacks when applied in the current context of highly indebted developing countries. First, debt securities with a floating rate that is linked to GDP may become less attractive in times of higher perceived sovereign risk, thus reducing market appetite for such an instrument (especially among more conservative institutional investors) and drive the resulting interest rate higher. Second, if a sufficiently large portion of the debt issued is GDP-linked, the issuer may have more incentive to revise the GDP figure to unfairly reduce their debt servicing cost, thus introducing a costly verification problem for the buyer of GDP-linked bonds. Third, and most importantly, GDP-linked bonds do not take into account currency mismatches faced by sovereign issuers. This is an especially challenging issue to tackle since this class of issuers (lowand lower-middle income issuers) have limited ability to issue debts in local currency and when there is a risk of capital outflow and ensuing depreciation due to monetary policy tightening in major economies.

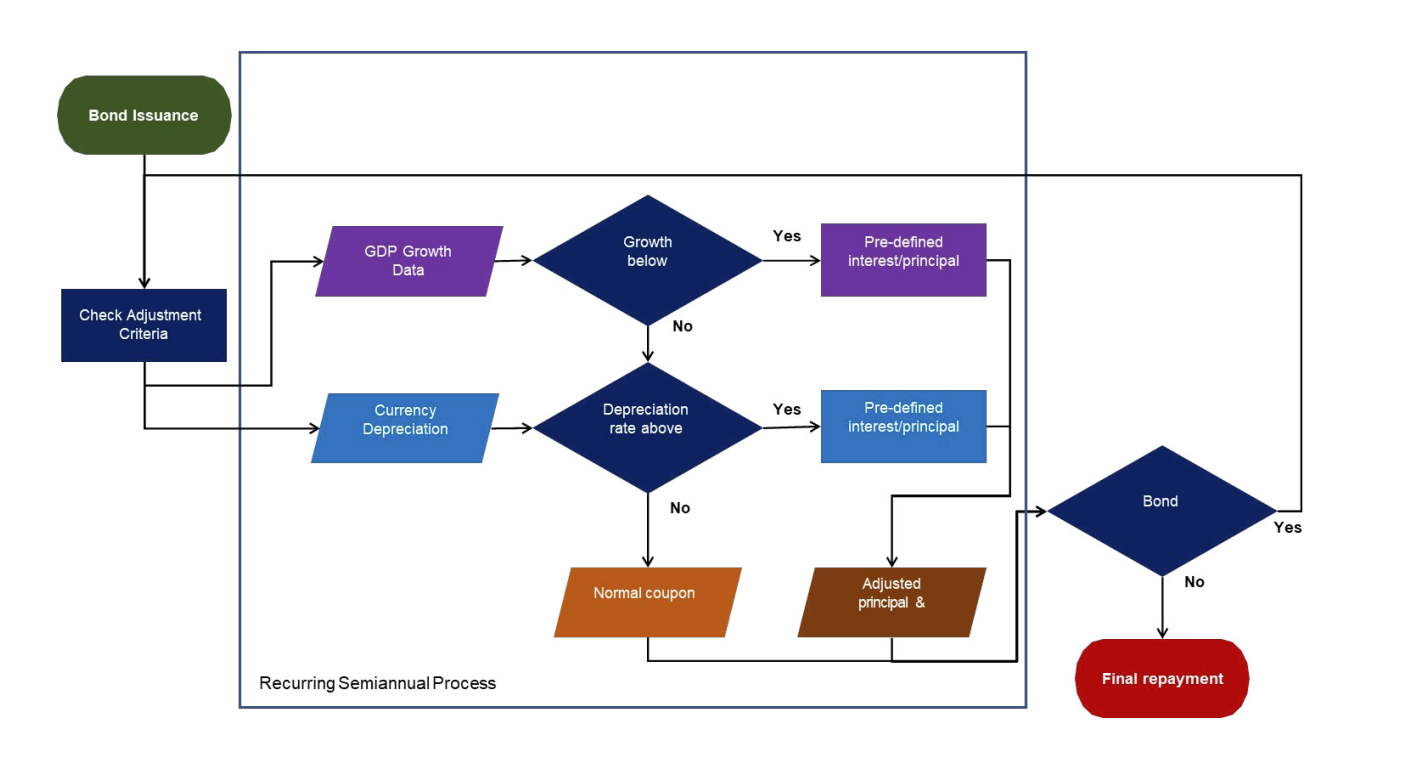

Our proposed countercyclical financing instrument for developing countries with high debt builds on the core ideas of GDP-linked bonds (i.e. formalisation of a rules-based debt adjustment process) and adjusts it so that the resulting securities act like fixed rate sovereign debts in non-adverse conditions. Under this facility, issuers will have to explicitly specify the threshold(s) that will trigger an adjustment in either bond’s coupon or the principal value, depending on the severity of the downturn experienced by the issuer’s economy or currency value, prior to debt issuance. The idea is to make financing under this facility work like a conventional fixed income instrument in normal times to increase the appeal to a broader class of institutional investors, but is automatically adjustable should the issuer’s economy suffer from adverse conditions such as sluggish growth, recession, and/or substantial currency depreciation, and helps prevent issuers from ever having to trigger technical default altogether. This can be achieved by comprehensively specifying the interest/principal adjustment rate under a wide range of adverse scenarios.

At the conceptual level, having the debt instrument acts like a normal fixed-rate instrument in normal times (and only becomes adjustable when the issuer experiences adverse condition) and allows for more favourable terms to sovereign issuers. This is because explicit rules-based adjustment, as stipulated in the covenant, means that payoffs are pre-determined and potential securities buyers only need to assess the probability that the debts issued under this facility will experience interest and/or principal adjustment. This helps the investor to price the bonds better. Furthermore, unlike GDP-linked bonds, monitoring the variables that are being referenced for the debt adjustment process (e.g. GDP growth and currency depreciation) will be less costly for the investor, even when the verification process is costly (Townsend 1979). The lower supervision cost and more straightforward monitoring should lead to relatively low-interest premiums for an issuer who issues debts under this scheme vis-à-vis vanilla debt issuance; under an idealised condition where the cumulative probability of default and the resulting debt haircut is known ex-ante, the yield for debts with built-in automatic adjustment should be equal to vanilla debt.

Fig. 1 Flowchart for the countercyclical adjustment for sovereign bonds

Having the debt instrument acts like fixed-rate bonds during normal times and may also alleviate some of the concerns of adverse selections and moral hazard associated with the current design of GDP-linked bonds. By insisting that issuers pay a fixed rate in normal times and having the trigger set up at a sufficiently distant level from current growth rate, potential debt issuers who have strong prior concerns about an immediate deterioration in their economy are less likely to self-select to issue this instrument vis-à-vis the normal fixedrate instrument (adverse selection). Having the trigger set up at a sufficiently distant level from the current growth rate also makes it less likely for the debt issuer to manipulate the macroeconomic figure downward to obtain rapid debt adjustment. This is because there will be no immediate gains (growth or exchange rates have to decline substantially from current level for the adjustment to be triggered) from issuing this instrument and/or downward manipulation of macroeconomic figures, and the incentive from such action will be dominated by political concern from bad economic performance.

Given that the debts issued under this facility will most likely be denominated in hard currency, which poses a currency risk to the issuer, we propose that the countercyclical adjustment take into account both the economic growth rate and exchange rate. The amount of interest rate reduction and/or debt principal haircut should also take into consideration the severity and length of economic contraction and exchange rate depreciation of local currency relative to the currency in which the debt is denominated. The specific details of how the countercyclical adjustment component works are available in the appendix.

It should be acknowledged, however, that the countercyclical adjustment component may not work as intended in cases where the incentive to present good macroeconomic figures for political purposes strictly dominates the incentive to reduce debt load under the terms of this debt instrument. In the case of developing countries with a non-diversified economy, a way to deal with this issue is by complementing the GDP triggers with a trigger (or triggers) consisting of price indexes for key export commodities. The prices of these commodities may act as good proxy for GDP growth, but with the advantage of being hard (or impossible) to manipulate by the debt issuer.

COMPONENT 2: GUARANTEE PROVISION TO ENHANCE THE MARKETABILITY OF THE FACILITY

One of the most crucial issues that is being made glaringly evident by the Covid-19 pandemic is the high level of outstanding debt prior to the start of the pandemic in most economies. With uncertain growth and compressed global interest rates, the potential benefits from issuing debt instruments that better buffer against macroeconomic shocks are greater than ever. Average public debt in EMs and middle-income economies has grown from 38.74% in 2019 to 46% in 2020 (IMF, 2021), making it the highest year-on-year jump since 1998. Due to this situation, any relatively small future macroeconomic shocks could cause debt vulnerabilities to increase substantially. Thus, insuring against GDP and exchange rate volatility has the potential to considerably reduce risks to debt sustainability. However, to ensure an optimum enhancement of debt sustainability, especially on rainy days, insurance needs to protect both the issuers and the holders of the sovereign debt. We propose the introduction of a guarantee mechanism as an integral part of this facility, designed to avoid triggering the default altogether.

SYMMETRIC PROTECTION PROVISION

As highlighted before, one of the key features in our proposed facility and instrument is to provide protection for sovereign issuers. In times of economic downturn, the feature embedded in the facility enables the issuers to have a more expansive fiscal space by adjusting the repayment amount (principal and/or coupon) in relation to its capability. On the creditor’s side, in the case of extraordinary severity that might lead to little-to-zero repayment during this period, the instrument holders will bear the risks. Therefore, to amplify the marketability of the instrument, we also propose the introduction of a protection mechanism for the investors through insurance or guarantee provision. The main benefit of the guarantee facility is to put a loss limit for investors if the coupon reduction/haircut is triggered during an economic downturn of sovereign issuers. To ensure the credibility and accountability of the guarantee mechanism, the role of insurance provision to the creditor needs to be held by an independent body that acts as the guarantee agency.

MINIMISING INSTITUTIONAL-INCONSISTENCY RISKS

While the proximate cause of most economic downturns is often exogenous, some endogenous factors, such as institutional issues, do play a substantial role in leading an economy into a crisis. The guarantee agency could step in to minimise the institutional risks to the sovereign creditors that will benefit both the issuer and the bondholder. While, ideally, the proposed instrument is used by EMs to mobilise capital needed to finance long-term economic development, in reality, the instrument is still embedded in institutional issues. History has shown that conventional sovereign debt could be used by extractive or short-sighted previous governments/administrations to mobilise funding for inefficient use that has led to future economic contraction. This scenario leaves the next administration in a debt overhang situation. Also, under conventional/uninsured sovereign debt past issuance, the sovereign risks accumulated by the previous government could still be held even after the change or reform in administration. Thus, it gives the succeeding administration a more limited fiscal space than it should have due to higher perceived risks for investors, fuelled by the incompetence of the previous ruling regime. Besides having difficulty in borrowing to facilitate the recovery, bondholders of past sovereign issuance also face the risk of no repayment.

GUARANTEE MECHANISM

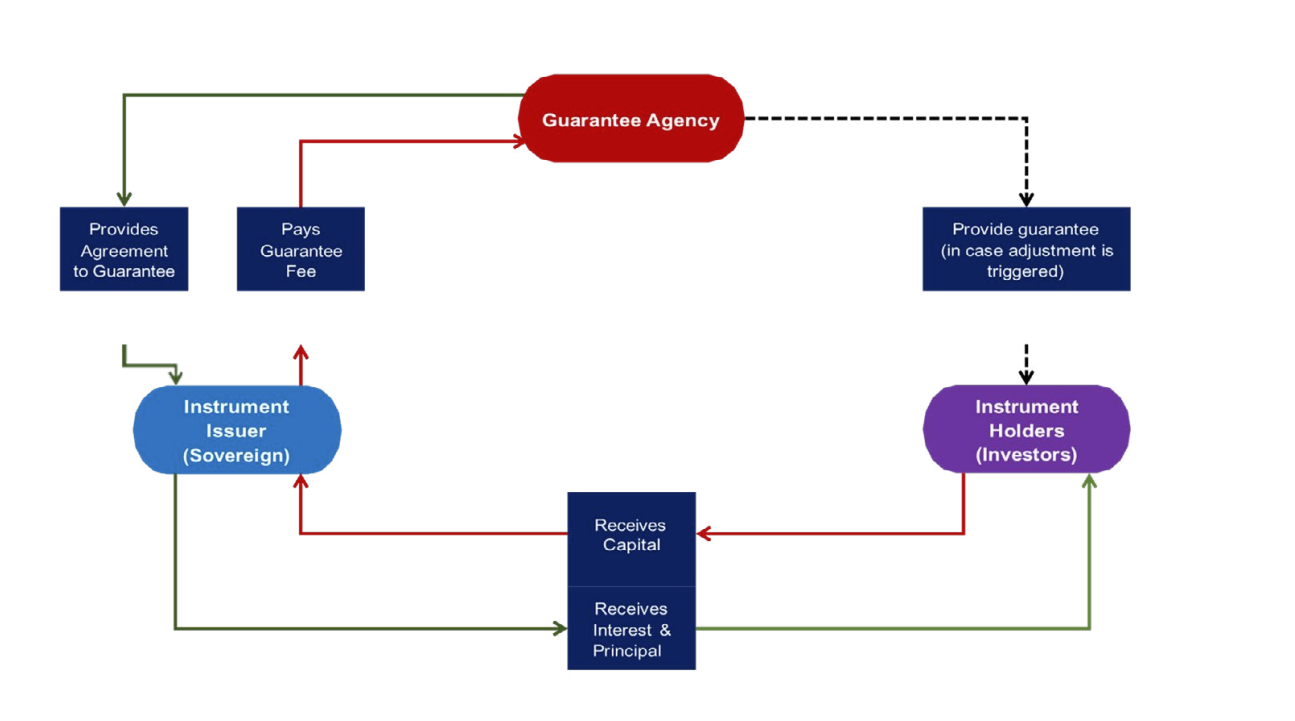

The main task of the guarantee agency is to provide guarantees for the capital invested by the bondholders against the risk of excessive loss from coupon reduction/haircut should the sovereign issuers experience massive depreciation/economic contraction. In the proposed guarantee scheme, there are mainly three bodies involved the sovereign issuer, the investors/creditors, and the guarantee agency. Under this mechanism, a sovereign nation that intends to raise capital by issuing CSFM will engage with the guarantee agency to earn a guarantee on the instrument issued by paying a guarantee fee (illustrated below).

Fig. 2 Flowchart for the guarantee mechanism

Consequently, the guarantee agency will issue insurance for the investor who holds the instrument as a protection against the risk of failing to fulfil the payment obligation by the sovereign issuers. Guarantee provision by an independent body is needed to limit the loss for investors if the coupon reduction/haircut is automatically triggered. For example, if the automatic trigger allows complete coupon elimination for a 4% USD CSFM bond, the guarantee can provide the investor with partial coupon repayment (e.g. 2%). In terms of financing, the guarantee agency will take up the guarantee fee from the instrument issuers as their paid-in capital. The guarantee fee paid by the issuer will provide higher leverage in terms of the notional value of the instrument that can be issued under this facility compared to conventional and unguaranteed sovereign bonds issuance. Furthermore, G20 member states can also contribute to the paid-in capital in this facility to increase the soundness of the facility, consequently boosting the marketability of the insured instrument.

On top of increasing the marketability and the pool of potential buyers for this debt instrument, the guarantee facility that accompanies the countercyclical adjustment component of these debt securities aims to lower the interest charged to potential issuers. Since adverse economic conditions in developing economies tend to lead to both lower GDP growth and currency depreciation, and currency depreciation tends to be persistent long after the crisis, investors might want to charge a higher interest rate to hedge against persistent depreciation if there is no guarantee mechanism in place. A sufficiently generous guarantee will reduce the perceived risk of persistent decline in their asset value and lead them to charge a more favourable ex-ante interest rate for the issuer.

ROLE OF G20

In April 2021, G20 finance ministers agreed to an additional six-month moratorium on debt payment for up to 73 developing countries and to create an IMF reserve asset for special drawing rights (SDRs) worth USD650 billion. To this end, the G20 has made efforts to provide the fiscal space needed for tackling the current crisis. Although it is necessary to fight the ongoing crisis and the agreement can be seen as a step in the right direction, it has not addressed the underlying problem of the looming debt crisis. Essentially, debt distress is a systemic problem that requires a systemic solution that has not been offered by the DSSI initiatives. Amplified by the Covid-19 turmoil, the need for greater resolution in managing the debt restructuring process for overindebted countries is more imperative than ever.

Going forward, we propose an alternative instrument for conventional sovereign bonds that will help the process of future sovereign debt restructuring in a more prudent and institutional manner through its rule-based feature. Considering its influence, we identify at least three channels in which G20 could contribute to the development of CFSM. First, G20 member states can play unique roles in popularising CSFM as an alternative financing mechanism for HIDC. Second, the G20 could take the leadership role to set up the framework of the CSFM instrument and establish an independent guarantee agency to support the instruments. Third, G20 member states can contribute to the paid-in capital pooled in the guarantee agency to enhance the soundness and marketability of the insured CSFM instrument. The additional funds contributed by G20 member states to the guarantee agency would increase the leverage of the guarantee fee paid by sovereign issuers and optimise the notional amount of bonds that can be issued under CSFM.

APPENDIX

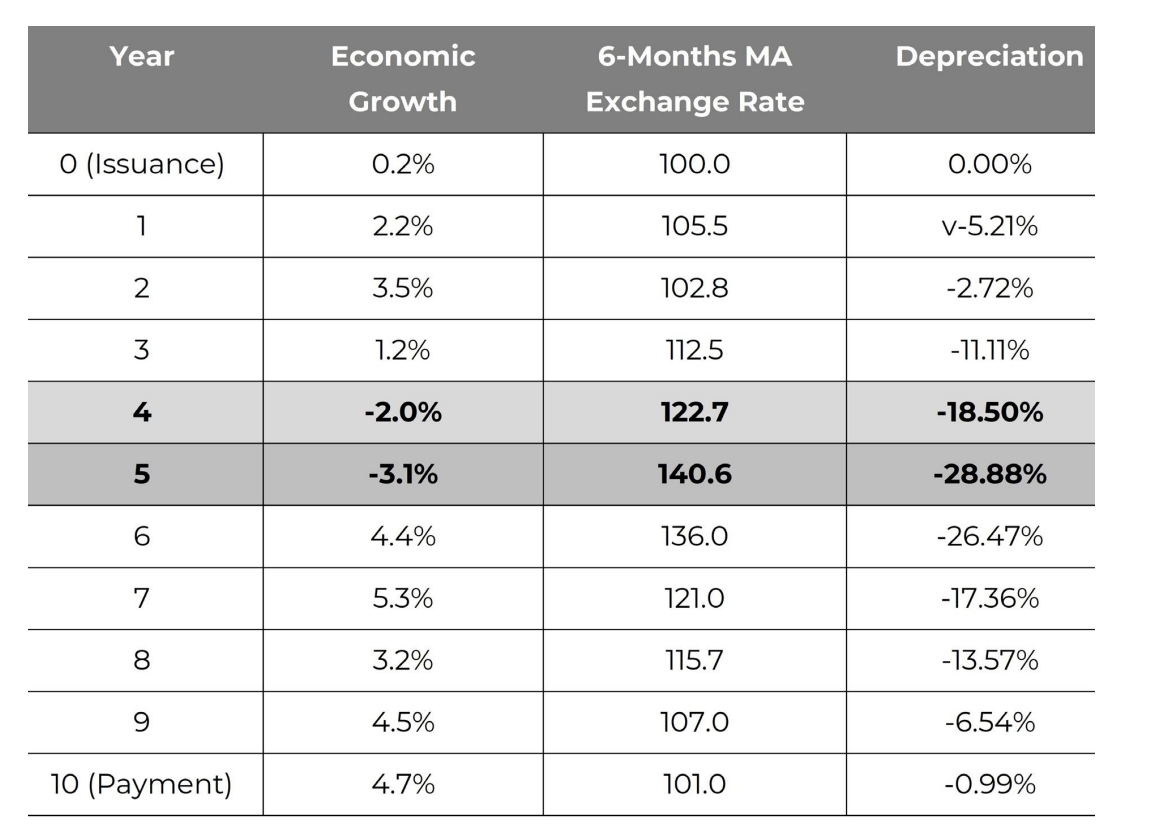

To illustrate how the Countercyclical Sovereign Financing Mechanism works, we will take a look at the following hypothetical example; all the following figures should be construed as being for illustrative purpose only. In our example, country ABC is allowed to issue a USD1 billion 10-year note at 5.00% p.a. The reference rate for the exchange rate is specified to be the six months moving average (MA) of the USD/LCY exchange rate prior to the date of issuance. For the sake of simplicity, we also assume that the issuer and the G20-led insurance agency agree to the following terms for adjustments (note that the adjustment terms are not set in stone and are left to potential issuers and G20-backed guarantee agency to decide):

A. GDP-based adjustment

a. If ABC enters technical recession (negative growth for two consecutive quarters), coupon payment will be suspended once

b. If ABC enters technical depression (negative growth for six consecutive quarters), coupon payment will be suspended indefinitely until country ABC returns to positive economic growth

B. Currency-based adjustment: final haircut is contingent on the depreciation vis-à-vis the reference rate; the principal amount will return to the normal/previous threshold if the exchange rate appreciates again below the threshold specified below

a. If 6-months MA of USD/LCY exchange rate depreciates by at least 25%, debt principal (and the resulting coupon payment) will be reduced by 25%

b. If 6-months MA of USD/LCY exchange rate depreciates by at least 50%, debt principal (and the resulting coupon payment) will be reduced by 50%.

Our assumed scenario, where GDP growth only affects coupon payment and currency depreciation only affects the outstanding principal amount, is chosen for the sake of simplicity; actual terms may be tailored to the specific needs of issuers and insurer. The coupon payment is to be made on a semi-annual basis. That adjustment to coupon payment happens immediately before the next coupon payment is made (e.g. Q2/H1 adjustment is made immediately before coupon payment in Q2).

To simulate how the mechanism works, let us suppose the following scenario over the lifetime of the bond:

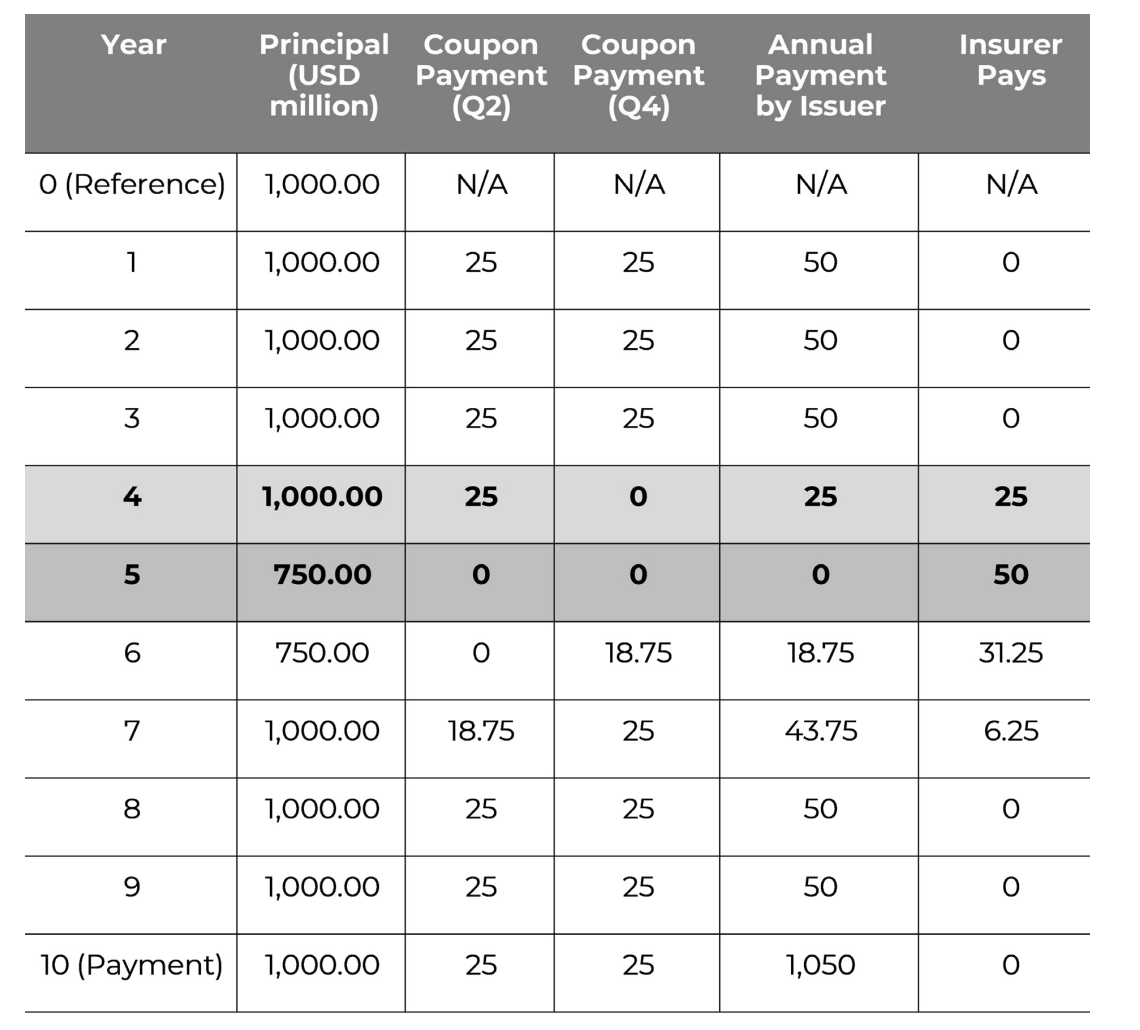

Note that under such a scenario, the adjustments happen as follows:

· Q2, Year 4: technical recession triggered. One of the 2 payments in Year 4 is stopped

· Q4, Year 5: technical depression and 25% depreciation triggered. Debt suspension and principal reduction triggered such that coupon payment is stopped indefinitely until growth returns to positive and, should the exchange rate remain at this level until the bond matures in Year 10, the issuer will only have to pay at 75% of the original amount.

· Q4, Year 6: growth returns to positive. Coupon payment resumes at 25% reduction (due to 25% reduction in principal)

· Q4, Year 7: currency starts appreciating again. Principal payment returns to normal for the following payment

Given the above adjustments, the eventual principal and the payment schedule under that scenario will then be:

Since the exchange rate in our example appreciates again close to the reference rate, the principal amount of the debt will be readjusted again to the original (according to the terms of the debt). However, should the debt mature at Year 5, the principal repayment by the issuer at maturity will only be 750, with 250 being paid by the insurer.

REFERENCES

Akhtar S., U. Volz, M. Kraemer, and S. Griffith-Jones, (2021). The G20’s Missed Opportunity, Spring Meetings 2021, World Bank Fund, Project Syndicate, https://www.project-syndicate.org/commentary/g20-debt-framework-must-go-further-byshamshad-akhtar-2-et-al-2021-04

Bolton P. and O. Jeanne, “Structuring and Restructuring Sovereign Debt: The Role of a Bankruptcy Regime”, Journal of Political Economy, vol. 115, no. 6, 2007, pp. 901-924.

Bolton P. and O. Jeanne, Structuring and Restructuring Sovereign Debt: The Role of Seniority. The Review of Economic Studies, vol. 76, no. 3, 2009, pp. 879-902.

Borensztein E., P. Mauro, M. Ottaviani, and S. Claessens, “The Case for GDP-Indexed Bonds”, Economic Policy, vol. 19, no. 38, 2004, pp. 167-216.

Forni L., G. Palomba, J. Pereira, and C. Richmond, Sovereign Debt Restructuring and Growth, IMF Working Paper WP/16/147, Washington, DC, International Monetary Fund, 2016.

International Monetary Fund (IMF), IMF Fiscal Monitor, 2021, https://www.imf.org/external/datamapper/GGXWDN_G01_Group

Krugman P., “Financing vs. forgiving a debt overhang”, Journal of Development Economics, vol. 29, no. 3, 1988, pp. 253-268.

Miyajima K., How to Evaluate GDP-Linked Warrants: Price and Repayment Capacity, IMF Working Paper WP/06/85, Washington DC, International Monetary Fund, 2006.

Townsend R.M., “Optimal contracts and competitive markets with costly state verification”, Journal of Economic Theory, vol. 21, no. 2, 1979, pp. 265-293.

Worldbank, 2021, https://data.worldbank.org/indicator/DT.DOD.DECT.GN.ZS?end=2030&most_recent_value_desc=true&start=2007