Efforts to integrate cross-border energy infrastructure and regional power markets have been gaining momentum worldwide. Such efforts have the potential of optimizing regional generation resources, delivering more variable renewable energy to the grid, and improving social equity through more reliable and affordable electricity. However, financing these investments has often been challenging, given the number of stakeholders and different parties of interest that need to be involved. We identify several common political, technical, and financial constraints. We propose how the Group of 20 (G20) can help bridge the gaps and mitigate the risks for cross-border energy infrastructure financing, especially for developing countries.

Challenge

Despite the economic, social, and environmental benefits of regional infrastructure connection, the following challenges hinder the scaling-up of cross-border energy infrastructure finance.

- Complicated process of reaching political consensus. One overriding requirement for regional integration to be successful is that participating countries need to have the political will to cooperate with their neighbors. Over the past few decades, several inter-government cooperation initiatives and institutions have been established for regional power integration. However, political distrust and perceived risks to national security have often overshadowed the potential economic benefits when making policy decisions. For example, energy importing countries are often concerned about external supply disruptions. In many cases, conflicting priorities between participating countries or insufficient ownership of the regional development agenda hinders the alignment of legal and regulatory frameworks.

- Gaps in technical and regulatory harmonization. Regulatory harmonization is not a precondition for regional power integration. However, without certainty of transmission access, stable cash flows, and regulatory predictability, private investors would be unlikely to invest. Certain system synchronization arrangements are needed to regulate cross-border flows of electricity. Optimal efficiency of grid integration calls for coordinated capacity planning on the regional level. Higher penetration of variable renewable energy generation calls for capacity upgrades to system operations and higher grid flexibility. Coordinated market designs and regulatory frameworks all require commitment of resources and technical capacity.

- Challenges to cost and benefit distribution. An essential challenge in cross-border interconnection projects is allocating benefits of cooperation and cost of capitalintensive power infrastructure among different stakeholders, including transit countries, fairly. Materializing the socio-economic benefits of energy access through affordable electricity in poverty-stricken areas also often requires fiscal support and economic policy intervention. In such cases, how governments allocate budgetary support and recover costs on the supply and demand sides require detailed costbenefit analysis and careful design of price setting mechanisms.

- Constraints in mobilizing financial resources. Infrastructure projects are generally capital intensive and call for longer terms to maturity. In many developing countries, they come at high contracting and bidding costs, and suffer from weak domestic capital markets and credit ratings (Streatfeild 2018; IRENA 2013; Jain et al. 2017). While public fiscal space is often limited, such projects could also be unattractive to private financing. In developing countries, domestic power transmission and distribution infrastructure is often insufficient to secure the volume of consumption and returns of cross-border projects. Besides baseline cash flow concerns, the abovementioned issues of potential political distrust and regulatory inconsistency, differences in economic and fiscal conditions, complicated project coordination, and conflicting priorities of various stakeholders also add to cross-border project’s risks and transaction costs.

- Concerns on social and environmental impact. Given the potential impact of infrastructure construction on land use and local communities, proper line siting and land acquisition could be a costly and time-consuming endeavor, especially in a multi-jurisdiction setting. Potential negative impacts of large-scale energy infrastructures on the environment are another risk factor in cross-border energy projects and could lead to social unrest or project cancelation. High standards of social and environmental safeguards and stakeholder engagement are crucial in complex infrastructure projects such as grid interconnection. Meanwhile, developers could also be challenged by lengthy project development and additional investment in due diligence and project design.

Proposal

1. The G20 can strengthen regional governance and capacity building for power integration.

Enable and enhance the role of regional institutions in energy system interconnection

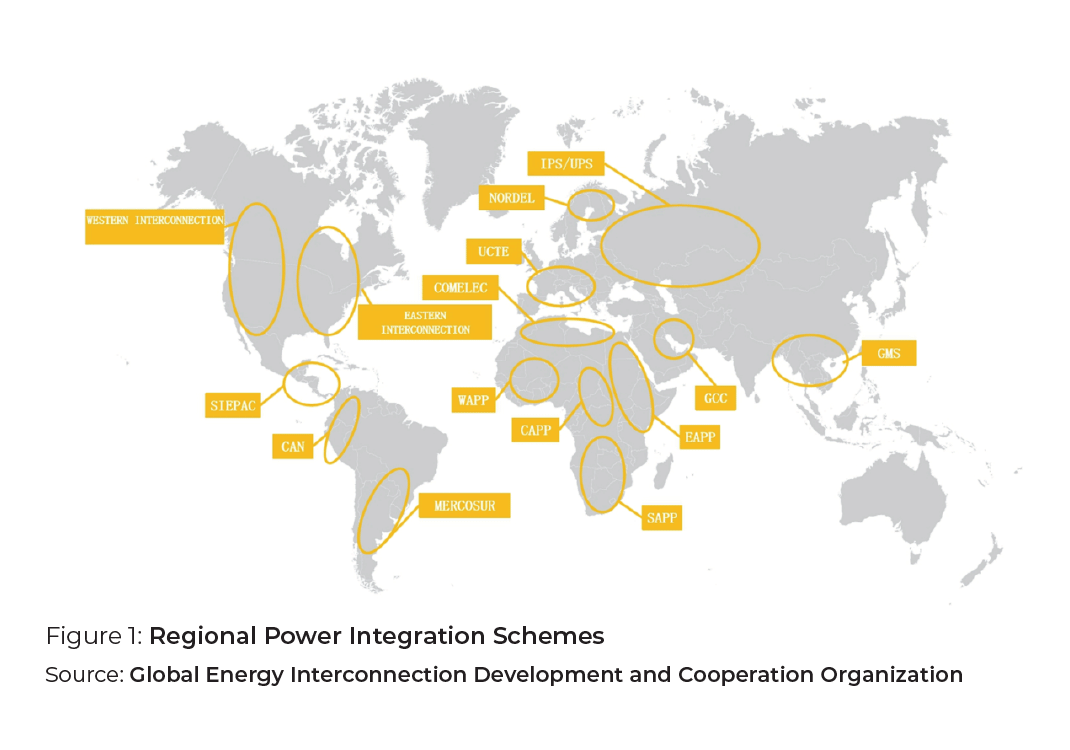

If there is a single lesson for the governance of cross-border power system integration, it is enabling and enhancing the presence of regional institutions (IEA 2019; ESMAP 2010). This is reflected in cases that span a broad spectrum, from simple bilateral trade, through multi-country trading around a set of regional rules, to fully integrated competitive markets in industrialized countries (Figure 1). Significant progress is already observed in multiple regions in the world; yet more work is needed.

For cross-border energy projects, regional political institutions could play a critical role in coordinating interests of member countries and keeping political conflicts to a minimum. Regional regulatory institutions are essential for the formation of a variety of agreements and harmonization of market design and regulatory policies, regardless of the degree of power system integration. Regional market frameworks enable independent or external investment and organize cross-border power trade. Good cross-border power system governance mechanisms can effectively coordinate market development as well as the long-term planning process. They can enable gradual shifts toward more coordinated and aligned policy and regulator frameworks. These are essential elements for creating a credible and predictable investment climate for infrastructure investors.

Continue to strengthen capacity building efforts via development finance institutions and multilateral development agencies

It is not our intention to derive rules about institutional design or to promote a standard institutional form for all regional power integration schemes. Each area has a different history and political framework, which also changes over time. However, capacity building and learning from best practices are crucial in all cases to drive the change of governance frameworks and investment environments. In Africa, for example, regional power pools have greatly benefited from technical assistance programs through development agencies of the European Union (EU), the United Kingdom (UK), France, Norway, and the United States (US), as well as the United Nations Department of Economic and Social Affairs, and multilateral, regional, and national development banks. Similarly, the Asian Development Bank, United Nations Economic and Social Council, and the International Energy Agency (IEA) have been actively involved in capacity building and technical support for regional power integration in Association of Southeast Asian Nations (ASEAN). The G20 should continue to strengthen capacity building efforts via development financial institutions and multilateral development agencies.

Support the establishment of a center of excellence for regional power integration

While it is important that the efforts mentioned above continue to enable selfsustaining regional power trade markets, a coordinated approach of promoting knowledge and experience exchanges between regions could provide significant synergy. While there are some nascent efforts to cooperate between these various programs, there is significant space for systemic sharing of best practices and capacity building. The G20 can support the establishment of a Center of Excellence for regional power integration. Such a center can draw from the experience and technical capacity of G20 financial institutions and development agencies and provide expertise for both power system integration development and infrastructure financing. The center can also foster regional and global partnerships for aligned project development.

2. The G20 could issue policy options for regional infrastructure integration to address cross-border projects’ challenges and ensure infrastructure quality and sustainability.

Due to the multi-jurisdictional nature of cross-border projects, scaling-up investment and finance for such projects is often challenged by difficulties agreeing on a cost-benefit sharing mechanism and coordination of technical, policy, and regulatory frameworks.

It is also important that such cross-border projects contribute to, rather than jeopardize, the social, environmental, and economic sustainability of affected areas. The G20 Principles for Quality Infrastructure Investment approved in 2019 have laid the groundwork to promote reliable, secure, and sustainable infrastructure systems. The G20 should support the creation and adoption of the best-practices guidelines as economic, social, and environmental safeguards in the life cycle of regional power system integration development.

Improve cost-benefit sharing mechanisms and stakeholder engagement practices

When multiple jurisdictions are involved in the regional power system integration, cost and benefit sharing mechanisms between different parties, including transit countries and regions, need to be carefully negotiated. In addition to monetary cashflows, a fully developed framework should include social and environment costs and benefits. These include right-of-way costs, environmental or biodiversity offsetting, system resilience, security investments, as well as external benefits from emission reductions, increase in social welfare, economic spill-over effects, etc. The EU’s Agency for the Cooperation of Energy Regulators (ACER) is an example of regional institution that coordinates cost-sharing arrangements. This suggests that having an unbiased central institution play a role in cost allocation can help move interconnector development forward (IEA 2019).

Stakeholder engagement is particularly important for transnational projects to determine and implement a consensus-based cost-benefit sharing mechanism. In cross-border power projects, stakeholder groups include the residents, governments, utilities, industrial consumers, environmental experts, media, etc. from the affected areas. Developers of cross-border projects need to deliver information in a timely and effective manner and respect the suggestions of relevant parties. Otherwise, projects may be difficult to advance.

Projects financed by multilateral banks and development agencies usually must follow a set of criteria on environmental and social safeguards and stakeholder engagement. However, there is still a long way to go for financing initiatives in the emerging markets. For example, some projects under China’s Belt and Road Initiative have been criticized to have “mostly been engaging with the government bodies without paying sufficient attention to the concerns of businesses, civil society organizations, and local communities” (Fang 2017). The public needs to understand why a new line or piece of infrastructure is needed. They also must know how they could be affected or compensated right from the initial planning stage to construction and operation. Online and offline public consultations, regular advisory meetings, and permanent stakeholder engagement groups based on Free, Prior, and Informed Consent (FPIC) principles could help in building long-term relations with key stakeholders in the project lifecycle.

Prioritize integrated investment planning and renewable energy development in the regional power harmonization process.

While this report zooms in on cross-border energy projects, it is important to recognize that cross-border projects are linked to domestic generation facilities, transmission, and distribution networks. Countries may be unwilling to pool their resources or trade if they risk load shedding at home. Investment in cross-border projects should go hand in hand with investment in domestic generation and infrastructure.

This would increasingly call for integrated planning as well as harmonization of technical, policy, and regulatory frameworks (ESMAP 2010). Singh, Wijayatunga and Fernando (2016) summarized several critical components, including: Harmonizing key rules governing access to transmission, reducing commercial barriers for electricity trade, developing frameworks to address system imbalances, establishing regional mechanisms to resolve disputes, and developing regional plans in the medium to long term. Combining these processes could more efficiently enable new investments. Balancing the interests of existing and new arrangements requires comprehensive planning and transition on the regional level. These processes could benefit from the experience and leadership of G20 organizations.

Given the stronger price competitiveness of renewable energy and the environmental and climate challenges we face today, renewable energy must be prioritized through new capacity planning processes. Connecting grids with complementary renewable energy resources in a larger geographic area could provide an efficient solution to intermittency concerns. Meanwhile, a high level of variable renewable energy penetration adds to the need for joint planning, coordinated policy incentives, and specific minimum set of controls and process standards for power generation and transmission. Such efforts have already started in regions such as the EU. For developing countries, the G20 could bring in international standards organizations such as the International Electrotechnical Commission (IEC) and the Institute of Electrical and Electronics Engineers (IEEE) to play a more proactive role.

Incorporate the growing momentum of smart grid and power system decentralization

Integrated investment planning should also consider the possibility of distributed power generation. There are cases where distributed power grids could be deployed more quickly and effectively than grid connections. There could also be cases where grid connection is the most cost-efficient. With the application of smart metering and net-metering technology, an integration of the two could be the optimal choice. Decision-making should be based on thorough evaluation of different scenarios, and investment needs to be coordinated according to the optimal arrangement that is the most actionable, economically viable, and that could maximize the long-term welfare that the infrastructure could create.

3. G-20 led financial institutions can enable sustainable cross-border power infrastructure investment.

Strengthen the role of development finance institutions in sustainable cross-border power infrastructure investment

Development finance institutions play an important role in enabling necessary cross-border power infrastructure investment. Multilateral, regional, and national development finance institutions have helped develop many regional interconnection initiatives, and have contributed to capacity building, technical assistance, and feasibility studies. Nevertheless, many multilateral development banks (MDBs) have been reluctant to provide substantial investment in lower-income countries to maintain low-risk profiles and “AAA” credit ratings (Humphrey 2016). Some local national development banks still lack lending capacity or the necessary safeguards for complicated cross-border projects.

Systemic reforms in the global financial regulatory mechanism might be required for development banks to commit more financial resources to riskier regions (Jones, Beck and Knaack 2018). On the other hand, research finds that AAA-rated MDBs have the headroom to scale-up lending significantly and still maintain their rating statuses (Munir and Gallagher 2018). The capacity of experienced financial institutions in project design and evaluation, social and environmental safeguards, and multilateral coordination is irreplaceable for implementing complicated cross-border projects, and the need to step up their operations in necessary areas.

For cross-border projects in particular, cooperation between multilateral, regional, and national development finance institutions should be strengthened and expanded. This will allow different financial institutions to complement each other’s comparative advantages. Such cooperation could help support resource-pooling as well as financial capacity building. Recently established development finance institutions (e.g., New Development Bank, Asian Infrastructure Development Bank, and those under the Belt and Road Initiative) have been playing increasingly important roles in infrastructure financing in developing countries. While it is important to leverage the technical knowledge and financial resources of emerging development finance providers, multilateral engagement is needed to uphold high environmental and social standards as these providers expand.

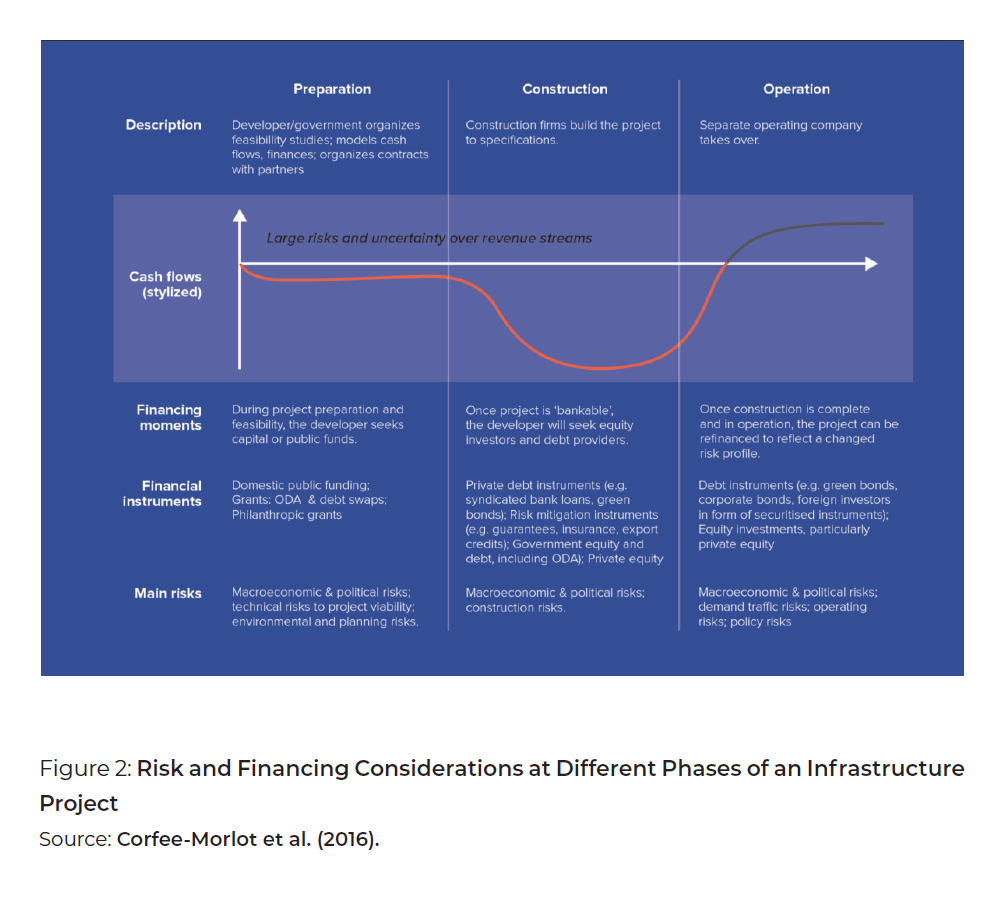

Crowd-in different financial resources with innovative development finance instruments

Figure 2 shows how various financial instruments could play different important roles in different stages of sustainable infrastructure financing. Through cross-border infrastructure projects, the G20 could encourage project developers to actively mobilize these different financial instruments to their advantage. Financial tools can be selected based on a country’s debt carrying capacity.

Development finance institutions could leverage different financial instruments to crowd-in much-needed infrastructure investments from various financial resources. They themselves could provide financial vehicles including concessional loans with low interest rates and longer terms to maturity, equity financing, guarantees, green bonds, risk management facilities, etc. In markets without sufficient investment capacity, these development finance instruments have the potential to unlock further financial resources.

Meanwhile, public-private partnerships and project finance instruments can break down complicated infrastructure projects (such as cross-border projects) into sections and allow for more detailed management. These include build–operate–transfers and leasing arrangements, as well as parallel financing or on-lending. Such financing arrangements will require greater risk management and project management efforts.

Finally, international engagement in regional projects must prioritize local ownership of infrastructure projects. For cross-border energy projects with inherent complications, it is important ensure that high standards of social and environmental safeguards are coherently implemented. Experienced development financial institutions led by G20 countries have a leadership role to play.

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

Corfee-Morlot, Jan, Ipek Gençsü, James Rydge, Helen Mountford, Ferzina Banaji

and Joel Jaeger. 2016. “A Roadmap for Financing Sustainable Infrastructure.”

Global Commission on the Economy and Climate website. Last updated 2016.

https://newclimateeconomy.report/2016/wp-content/uploads/sites/4/2014/08/NCE_2016Report.pdf

Energy Sector Management Assistance Program (ESMAP). 2010. “Regional Power

Sector Integration: Lessons from Global Case Studies and A Literature Review.”

World Bank Group website. Last updated April 1, 2010. https://documents.worldbank.org/curated/en/456981468154776209/Literature-review

Fang, Jin. 2017. “The Belt and Road Initiative: Progress, Problems and Prospects.”

In Parallel Perspectives on Global Economic Order. Edited by Center for Strategic

& International Studies. Chapter 9. https://www.csis.org/belt-and-road-initiativeprogress-problems-and-prospects

Humphrey, C. 2016. “Could Multilateral Banks be Lending and Extra $1 trillion.”

Overseas Development institute. https://www.odi.org/blogs/10389-mdbsmultilateral-develoment-banks-credit-ratings-agencies.

International Energy Agency (IEA). 2019. “Integrating Power Systems Across Borders.”

Technical report. Last updated June 2019. https://www.iea.org/reports/integratingpower-systems-across-borders

International Renewable Energy Agency (IRENA). 2013. Renewable Energy Auctions

in Developing Countries. Abu Dhabi: IRENA.

Jain, Nitin, Fumiaki Katsuki, Akash Lal and Emmanuel Pitsilis. 2017. “Deepening

Capital Markets in Emerging Economies.” McKinsey & Company website. Last

updated April 12, 2017. https://www.mckinsey.com/industries/financial-services/ourinsights/deepening-capital-markets-in-emerging-economies.

Jones, Emily, Thorsten Beck and Peter Knaack. 2018. “Mind the Gap: Making Basel

Standards Work for Developing Countries.” GEG Policy Brief. Oxford: Global Economic

Governance Programme. Accessed August 11, 2019. https://www.geg.ox.ac.uk/publication/mind-gap-making-basel-standards-work-developing-countries.

Munir, Waqas and Kevin P. Gallagher. 2020. “Scaling Up for Sustainable Development:

Benefits and Costs of Expanding and Optimizing Balance Sheet in the Multilateral

Development Banks.” Journal of International Development 32, no. 2: 222-43. https://doi.org/10.1002/jid.3453.

Singh, Anoop, Priyantha Wijayatunga and P. N. Fernando. 2016. “Improving Regulatory

Environmental For a Regional Power Market in South Asia.” ADB South Asia Working

Paper Series no 45. https://doi.org/10.2139/ssrn.2941305.

Streatfeild, Jeremy E. J. 2018. “Low Electricity Supply in Sub-Saharan Africa: Causes,

Implications, and Remedies.” Africa Energy Portal website. White Paper. Last

updated June 1, 2018. https://africa-energy-portal.org/white-paper/low-electricitysupply-sub-saharan-africa-causes-implications-and-remedies.