Stablecoins are an alternative digital currency that is pegged to a basket of traditional currencies and other assets. They are designed to address the shortcomings of first-generation cryptocurrencies in providing adequate monetary services. They represent a disruptor to the payment and finance industries in an era where offerings by technology companies, such as Facebook’s Libra project, are substituting the services of traditional banks. If not correctly understood, this trend could disrupt the dynamics of foreign exchange markets and the monetary policies used by central banks to monitor and influence the demand for fiat currencies. We provide recommendations for the Group of 20 (G20) and the International Monetary Fund (IMF) to assess the impact of and develop regulations for global stablecoins before their widescale circulation.

Challenge

Stablecoins are a new type of digital money that followed the expansion of first-generation cryptocurrencies initiated by bitcoin. The Bitcoin network, a Distributed Ledger Technology (DLT), introduced an innovative mechanism to order, validate, and confirm transactions. It provides a public ledger secured without a central counterparty, allowing anyone with sufficient computer hardware to participate in organizing the network.

As cryptocurrencies increased in popularity, their trade on exchanges encountered significant price volatility. Given limited pools of secondary liquidity, few emerged as useful mediums of exchange and tended to lack the stability to provide a reliable store of value or unit of account. Stablecoins were introduced to address these shortcomings. They use different stabilization mechanisms for pegging their value to an underlying currency, or pool of assets, offering a more stable digitally transferable asset, to support liquidity in traditional cryptocurrency networks.

However, the collateral backing stablecoin networks are not necessarily transparent. The verification of asset management, similar to the regulations and standards enforced in G20 nations to support public trust in banks, has been absent from stablecoin networks.

Big technology (Big Tech) firms are now leading the development of stablecoins, notably the Libra project announced by Facebook (Paul 2019). The wide-scale adoption by the billions of Facebook online users has the potential to reshape the payment landscape. This could introduce new risks for the international financial system and pose new challenges for the monetary policies of central banks and the IMF. A global stablecoin could broaden the risk of such activities to the point where it threatens consumer purchasing power, an important metric used to set central bank policies. A report by Adrian and Mancini-Griffoli (2019) published by the IMF states that the most widely circulated forms of money (cash and bank deposits) will face increasing competition and could be overtaken by digital representations.

Finally, perceptions and actions toward cryptocurrencies vary among the G20, (see Appendix, A), which can hinder cooperation on new regulatory regimes. However, recent attitudes signify that governments generally fear the rise of stablecoins issued by non-government bodies (Ward and Rochemont 2019).

We examine the following challenges related to the development of stablecoin networks:

- Many of the first-generation stablecoins were launched and circulated in a gray zone of ambiguity that took advantage of gaps in regulation and supervision.

- Different stability mechanisms can be exposed to significant risk if not properly managed and regulated; this can lead to poor auditing practices and the devaluation of an asset basket.

- The stability provided by the currency basket backing Libra, or other stablecoin offerings, could provide them with an advantage against the US dollar (a dominant currency) as a store of value and medium of exchange (liquidity). A shock-induced shift could move liquidity away from the internationally dominant US dollar and disrupt exchange market dynamics overall.

- If stablecoins achieve high liquidity in cross-border payments, operational and business difficulties in the companies that provide them could produce significant negative cross-border externalities.

- Cryptocurrency and stablecoin trading/liquidity is often polluted with wash trades. This faulty architecture would experience significant stress in the face of a persistent shock.

Proposal

We call on the G20 community to investigate the risks and impact of privately issued stablecoins on the international monetary system. Approximately 70% of the additional value generated by the global economy is expected to come from digital platforms over the next decade (WEF 2020). Stablecoins offer a new payment scheme that is well suited for this growing digital economy.

Important questions for the G20 include determining the benefits of this new monetary instrument and if they outweigh the potential risks to the circulation of sovereign fiat currencies. Making remarks at the IMF-Swiss National Bank Conference, Adrian (2019) summarized several of the advantages of Big Tech firms participating in the formation of stablecoins. These include better integration with the digital platforms focusing on user-centric design, strong networking effects, and improving inefficiencies in cross-border payment schemes through faster and lower cost transfers.

Big Tech can also have a broader reach by providing financial services to remote regions. The onset of the COVID-19 pandemic and extraordinary social distancing response measures have elevated the role of digital payments. Programmable digital money, such as stablecoins, can support greater participation in the virtual and contactless digital economy.

There is also interest in the role stablecoins play in the implementation of policy instruments and operations of central banks.[1] This includes the emergence of a Central bank Digital Currency (CBDC) (Barontini and Holden 2019; Adrian 2019), a type of state-backed stablecoin that could be used to coordinate monetary policies in response to severe crises impacting the global economy.

Big Tech investment in stablecoins represents the emergence of new monetary instruments that are global in nature and will be difficult to prevent outright. We strongly encourage the G20 to continue investigating the regulatory measures proposed by the Financial Stability Board (FSB 2020) and establish a coordinated plan to align stablecoins and existing monetary instruments. We propose the following recommendations and actions:

- G20 governments and the IMF should study the lending risks and impact of highly liquid stablecoins on sovereign fiat currencies, foreign exchange markets, and capital flows;

- Adapt regulations to manage the stabilization mechanisms and risks of underlying institutions;

- Determine additional loss absorbency and minimum capital adequacy requirements;

- Determine liquidity Coverage and Net Stable Funding Ratios (NSFR) to secure sufficient reserves of high-quality liquid assets;

- Pursue collaboration with Big Tech firms and financial institutions to improve understanding and set regulatory standards for issuing and managing stablecoin offerings. For example, moving toward Basel III standards to help manage the risk from private sector stablecoins;

- Consider how CBDCs could improve the effectiveness of monetary policies (e.g., nominal interest rates and forward guidance) and support currency stability for the digital economy; and

- Support the development of industry standards for digital identifiers issued to stablecoin users, such as efforts by the World Wide Web Consortium (W3C 2020).

As long as no regulation exists to control the design, issuance, and operations of stablecoins by Big Tech companies, governments want them to stay out of the cryptocurrency industry. The first and second proposals address the possible risks of stablecoins, as well as the sovereign fiat systems that underpin such perceptions. In section 2.1, we introduce the mechanisms on which stablecoins operate to help frame these risks. In section 2.2, we review the literature that builds our case for the regulatory measures presented in proposal 2.

Stablecoins offer a new payment scheme, where merchants do not need to establish a single connection with one payment provider. Transactions are broadcast across a network of connected validators for processing and settlement. Additionally, client money is not secured by a single counterparty, such as a bank. The emergence of digital identifiers within the cryptocurrency space provides a new type of financial identity, as addressed under proposal 5. Those issued by large stablecoin offerings should be subject to industry specifications and standards, accompanied by public awareness and education.

Now is the time for governments to lay out a regulatory strategy in response to the changes stablecoins bring to traditional payment systems. Section 2.3 sets the case for collaboration between G20 governments and Big Tech companies on DLT innovation, to help advance regulatory design under proposal 3. In section 2.4, we look at intersections between cryptocurrencies, stablecoins, and financial crises, in particular, the role of CBDCs in the function of monetary policies (proposal 4).

This work builds on past briefs from the G20 community on digital money, such as standardizing the regulation of crypto-asset exchanges (Iwashita 2019) and organizing G20 perceptions and actions on the development of financial technologies (Lopez et al. 2018; Chetty et al. 2019; Edam 2019; Park, Zhao, and the Asian Development Bank 2019)

Stabilization mechanisms

G20 governments and the IMF need to study the lending risks and impact of highly liquid stablecoins on sovereign fiat currencies, foreign exchange markets, and capital flows.

Stablecoins use either a protocol approach issued on top of existing cryptocurrency networks or the application approach operating their own dedicated network. Different stabilization schemes exist among stablecoins. The simplest is the depositary receipt model, where the stablecoin is a direct claim on a single currency. An alternative design links the stablecoin value to a basket of reference assets, much like an exchange-traded fund, and the financial strength of the issuer; for example, a government-backed CBDC.

Non-collateralized mechanisms, also known as algorithmic stablecoins, attempt to preserve par value through bond issuance and algorithmic trading. Research by Mita et al. (2019) suggests that despite the potential utility of non-collateralized stablecoins (e.g., no need to manage currency reserves), there is still no sufficient method to maintain their purchasing power.

Different stabilization schemes present different levels of risk. The depositary receipt model is likely the most secure. The issuer owns the currency, fully collateralizes the claim, and commits to redeem it at par value. The biggest risk lies in bad management and the lack of transparent auditing of the issuer’s currency holdings. Collateralizing against a basket of assets can introduce risks related to portfolio performance and asset liquidity. This represents a new way for the private sector to engage in lender risks through a purely digital business model, similar to depositors in a commercial bank without outside insurance.

Tether Limited is a leading protocol stablecoin provider, collateralized by reserves of fiat currencies and cash equivalents. It operates on existing cryptocurrency networks like Bitcoin and Ethereum. Tether stablecoins are generally paired with dominant currencies, including US Dollars (USD), Euros (EUR), offshore Chinese Yuan (CNH), and gold. Cryptocurrency traders often use them on the opposite side of transactions. They provide a convenient bridge between digital and fiat currency—as an alternative to traditional currency deposits and withdrawals. As a result, it has exceeded bitcoin as the most circulated cryptocurrency (Kharif 2019b).

There have been specific concerns regarding Tether’s business activities, with no audits confirming its statement of a one to one peg against the US dollar or other currency reserves. The backing of Tether was revised in March 2019 to include loans to affiliate companies as reserve assets, a business model similar to unregulated fractional reserve banking (Coppola 2019). Tether Limited’s lawyers claimed that each Tether was backed by only 74 cents in cash and cash equivalents (Kharif 2019a), admitting they are not fully back by fiat reserves. The New York Attorney General Letitia James said the companies behind Tether and the Bitfinex exchange engaged in a cover-up to hide the “apparent loss” of $850 million co-mingled client and corporate funds (Kharif 2019a).

The Libra project by Facebook uses the application approach, providing a new network operated by a consortium of major payment providers and e-commerce platforms, such as MasterCard, Visa, PayPal, eBay, and Stripe. Facebook will likely use a collateral mechanism involving a basket of assets held by the Libra consortium, supporting its use for both domestic and cross-border payments and remittances. If Facebook succeeds in organizing Libra, it could become a significant force as a global payment system. This warrants an examination of how its wide-scale deployment could disrupt the current order of payment providers.

The impact of stablecoins on the determinants of a dominant currency

The G20 will need to adopt regulations for stabilization mechanisms and institutional risks as follows:

1. Additional loss absorbency and minimum capital adequacy requirements.

2. Liquidity Coverage and NSFR.

Ogawa and Muto (2019) analyzed the determinants of a dominant currency in foreign exchange markets (a summary is provided in Appendix B). The authors conclude that an international currency with sufficient liquidity can be circulated as a key (or dominant) currency in the international monetary system. Currently, the USD holds this position relative to other international currencies. Ogawa and Muto (2017) found that the introduction of the euro into some states of the EU resulted in no significant change in the utility of the USD while it significantly increased the utility of the euro. However, it did decrease the utility of the Japanese yen (JPY) and the Swiss franc (CHF).

Stablecoins, such as Facebook’s Libra or even a CBDC launched by China, could emerge as a substitute currency for the US dollar. Billions of people have a registered account on Facebook and other online platforms. If enough users and merchants adopt Libra and other stablecoins as a settlement instrument for online purchases, they could reach a significant level of liquidity and possibly exceed the US dollar.

Moreover, Libra was planned to be fixed to a basket of five international currencies: the USD (50%), the euro (18%), the JPY (14%), the British pound (11%), and the Singapore dollar (7%). The portfolio effect should make Libra relatively stable compared to each of the five currencies, providing an advantage against the US dollar as a store of value and a medium of exchange (liquidity). It would be closely substitutable to the US dollar, making it easier to shift to Libra when making payments.

It is more likely that a shock would induce such a shift, and would trigger instability in the international monetary system. Growth in the circulation of stablecoins resulting in a small substitution of traditional fiat currency could disrupt and even reduce the function of the US dollar as the dominant currency. This could also reduce the utility of other major international currencies, similar to how the expansion of the euro impacted the JPY and CHF, accelerating the transition to stablecoins.

A small substitution of traditional fiat currencies for stablecoins would disrupt foreign exchange market dynamics. If stablecoins achieve high liquidity as a mechanism for cross-border payments, negative cross-border externalities could emerge when the institutions operating them experience operational and business difficulties.

The FSB, Basel Committee on Banking Supervision, and national financial regulatory authorities have already set up international coordination mechanisms for financial regulations against Global Systemically Important Financial Institutions (G-SIFIs) and Global Systemically Important Banks (G-SIBs). They require additional loss absorbency requirements, in addition to minimum capital adequacy requirements. All issuers of stablecoins, which are regarded as Global Systemically Important, should be on an equal footing with the G-SIFIs from the viewpoint of global financial regulators. They should have additional loss absorbency requirements in addition to minimum capital adequacy requirements.

Additionally, financial regulations should be imposed to protect against liquidity problems, including a Liquidity Coverage Ratio (LCR) and a NSFR. The LCR is designed to ensure that banks hold sufficient reserves of high-quality liquid assets (HQLA) to allow them to survive a period of significant liquidity stress lasting 30 calendar days. The LCR requires internationally active banks to hold a stock of HQLA at least as large as expected total net cash outflows over the stress period. The NSFR aims to promote resilience over a longer period by creating incentives for banks to fund their activities with more stable sources of funding on an ongoing basis. The NSFR requires that the ratio of the bank’s available stable funding over its required stable funding equals or exceeds 100%. All of the institutions that globally issue stablecoins cross-border should follow financial regulations to protect against liquidity problems.

Collaborating with Big Tech

A framework analogous to Basel III standards for internationally active banks, to help manage risks of private sector stablecoins.

We identify two reasons for collaboration between Big Tech firms and financial institutions in the field of stablecoins:

- Existing regulatory and supervisory frameworks are not fully applicable to the interactions of stablecoins. Coordination and cooperation are necessary to set up an appropriate framework. This includes new regulatory and supervisory requirements for issuing and exchanging stablecoins.

- Technical knowledge of financial policies can be applied within an experimental digital environment hosted by Big Tech firms. This can help pave the way for the next stage of the digital economy and international payments by developing global-scale operational models for stablecoins to help evaluate and improve their management and monitoring. Governmental and international financial authorities can participate in piloting new applications, outlining standards and policies related to anti-money laundering, and countering the financing of terrorism (AML/ CFT), know your customer, and client due diligence.

Governments should propose strategies to engage the experience of Big Tech in DLT innovation to build regulatory clarity that can help the private sector. For example, a framework analogous to the Basel III standards for internationally active banks could be developed to provide guidelines on how to manage risks taken by private sector stablecoins. A guarantee could be held by stablecoins issuers, similar to central bank deposits held by commercial banks, extending the reserve requirement policy of central banks. CBDCs could also be used to extend central bank protection to consumers as a lender of last resort.

Before pursuing these efforts, we recommend that the G20 and the IMF carefully investigate the impact of stablecoins on the role of a dominant currency in foreign exchange markets, and their performance during financial crises.

Cryptocurrencies and Stablecoins in Crises

How could a CBDC improve the effectiveness of monetary policies in times of crisis?

Given their low level of utilization as a means of payment and their very limited size within the global market portfolio, cryptocurrencies do not pose a systemic risk within a global recession or financial crisis. If emerging or developing countries are deeply affected by crises, digital monies could eventually gain a larger local role (a currency substitution effect) as a store of value for nationals or as a vehicle to circumvent capital controls in cross-border transactions.

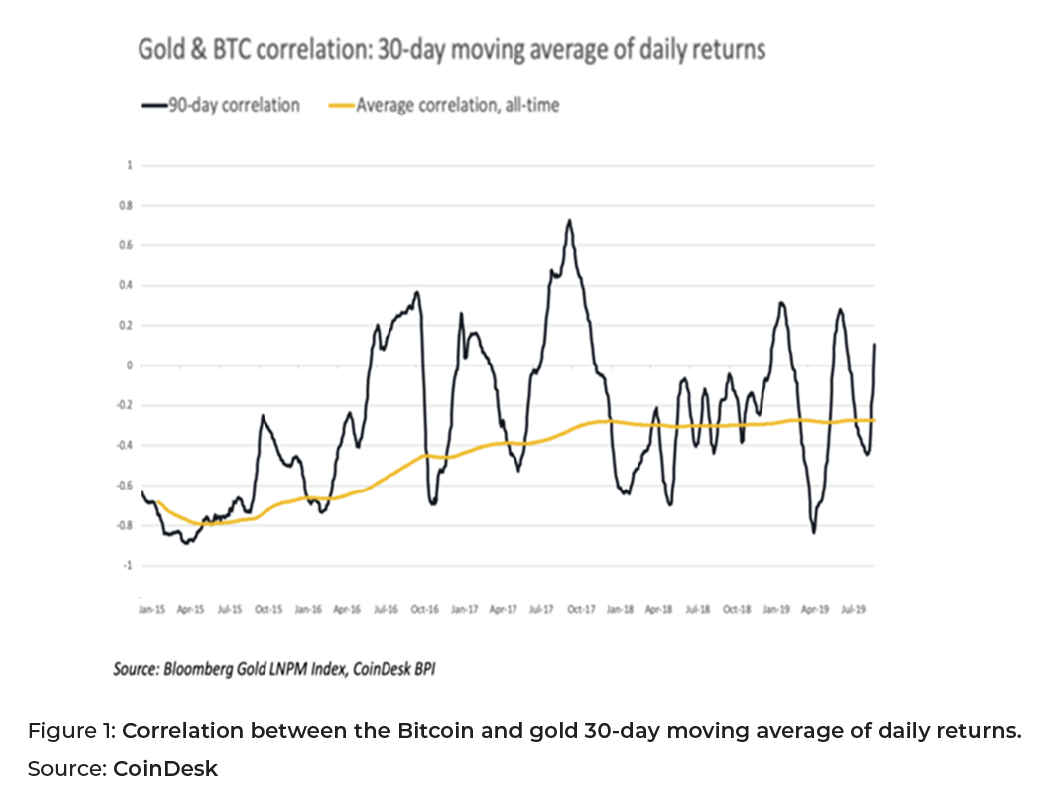

Some could develop a stronger franchise if they prove overly resilient (or a safe haven) under financial stress, becoming an alternative to traditional hedges such as gold. One important aspect would be if they can empirically demonstrate a low correlation of returns against a risky market portfolio.

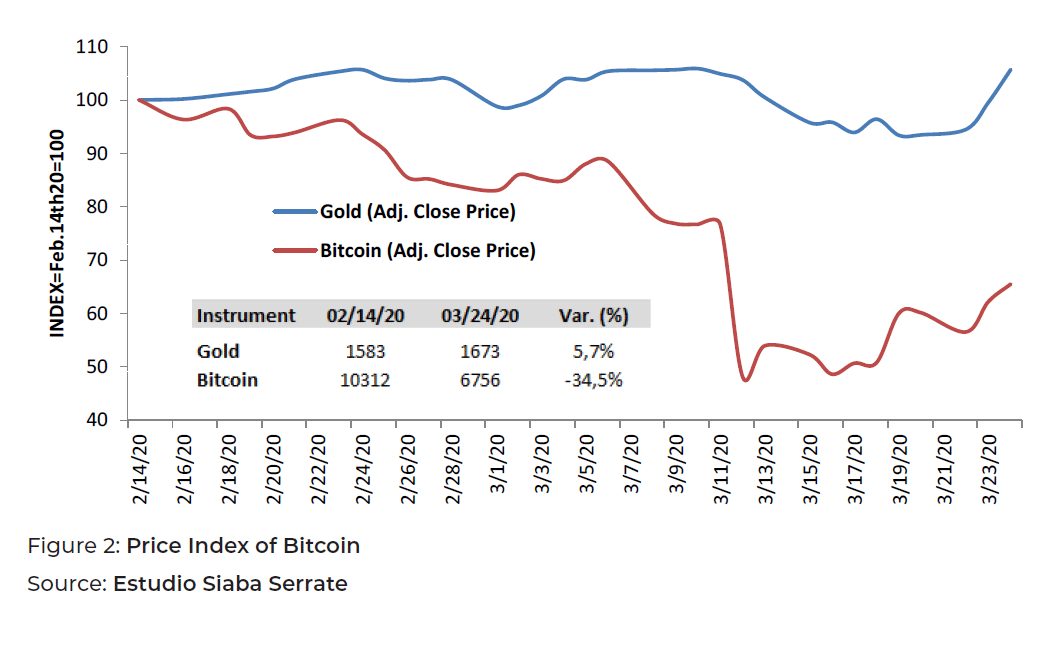

Is Bitcoin a digital version of gold? Not yet. As illustrated in Figure 1, the average performance of Bitcoin over the entire history of trading exhibits a negative correlation to gold. The current coronavirus crisis may prove otherwise. Figure 2 below illustrates the gold and Bitcoin price indices from February 2020 to March 2020. Although a longer period is required to establish solid conclusions, Bitcoin has yet to demonstrate its ability to retain value during a crisis.

How stable are stablecoins? Rough financial conditions could expose serious flaws in the governance structure, stabilization mechanisms, or the redemption of stablecoins. Discounts in net asset value backing stablecoins could emerge in times of crisis due to varying liquidity risk premiums.[2] When backed by the financial strength of the underlying institution, the issuer’s balance sheet problems or lack of liquidity could result in a loss of value. The equivalent of banking runs could materialize with poor oversight.

Stablecoins might increase liquidity, but how much of it is real? Wash trading (setting up two accounts used to buy and sell against each other to inflate volume artificially) is encouraged by many exchanges to escalate their rankings rapidly. According to the Blockchain Transparency Institute (BTI 2019), manipulation is widespread. BTI found 17 of the CMC Top 25 exchanges to be over 99% fake with many greater than 99.5% fake volumes, including 35 of the top 50 adjusted volume rankings.

Griffin and Shams (2019) discovered trading patterns that cannot be explained by cash demand from investors but were “most consistent with the supply-based hypothesis of unbacked digital money inflating cryptocurrency prices.” Analyzing the 2017 boom, they found that “purchases with Tether were timed following market downturns and resulted in sizable increases in bitcoin prices.”

A financial crisis could easily overthrow this disingenuous architecture, especially if the adverse shock is persistent and secondary prices and liquidity have been supported by “wash trades.” A real stress test could create a loss of faith in many of these arrangements, and in contrast, favor other digital assets such as central bank digital currencies. New private stablecoins—like Libra—will not find regulators unattended. The G7 already believes that “no global stablecoin project should begin operation until the legal, regulatory, and oversight challenges are adequately addressed” (BIS 2019).

Crises will generate the need for further innovation, and digital currencies could benefit if they stand up to the task. If a deflationary bias accompanies a financial crisis, and such is the consequence of the coronavirus’ containment need for non-pharmaceutical interventions, conventional monetary policy will have to return to the type of unconventional policies that were attempted after the Great Financial Crisis. However, these policies need to be reloaded. For example, we can think of negative nominal interest rates and forward guidance. CBDCs—according to certain designs—might greatly improve the effectiveness of such policies (Bordo and Levin 2019). They could be better suited for helicopter money distributions, such as the stimulus packages currently being distributed to the millions of unemployed during the coronavirus pandemic, and even to pursue true price stability (not just inflation rate stability).

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

Adrian, Tobias. 2019. “Stablecoins, Central Bank Digital Currencies, and Cross-Border

Payments: A New Look at the International Monetary System.” Remarks by Tobias

Adrian at the IMF-Swiss National Bank Conference, Zurich. May 14, 2019. https://www.imf.org/en/News/Articles/2019/05/13/sp051419-stablecoins-central-bank-digitalcurrencies-and-cross-border-payments.

Adrian, Tobias, and Tommaso Mancini-Griffoli. 2019. “The Rise of Digital Money.”

IMF FinTech Note. Vol. 19. July 15, 2019. https://www.imf.org/en/Publications/fintechnotes/Issues/2019/07/12/The-Rise-of-Digital-Money-47097.

Barontini, Christian, and Henry Holden. 2019. “Proceeding with Caution – a Survey on

Central Bank Digital Currency.” BIS Papers 101 (January). Accessed January 5, 2020.

www.bis.org.

Baumol, William J. 1952. “The Transactions Demand for Cash: An Inventory Theoretic

Approach.” The Quarterly Journal of Economics 66, no. 4: 545–56. https://www.jstor.org/stable/1882104.

BIS. 2019. “Investigating the Impact of Global Stablecoins.” G7 Working Group on

Stablecoins. Accessed January 5, 2020. https://www.bis.org/cpmi/publ/d187.htm.

Blanchard, Olivier J., and Stanley Fischer. 1989. Lectures on Macroeconomics.

Cambridge, MA: MIT Press.

Bordo, Michael D., and Andrew T. Levin. 2019. “Digital Cash: Principles & Practical

Steps.” w25455. Accessed February 5, 2020. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3319678.

BTI. 2019. “Market Surveillance Report—April 2019.” 2019. Accessed March 6, 2020. https://www.bti.live/reports-april2019.

Calvo, Guillermo A. 1981. “Devaluation: Level Versus Rates.” Journal of International

Economics 11 no. 2: 165–72.

Calvo, Guillermo A. 1985. “Currency Substitution and the Real Exchange Rate: The

Utility Maximization Approach.” Journal of International Money and Finance 4, no.

2: 175–88.

Chetty, Krish, Jaya Josie, Ephafarus Mashotola, Babalwa Siswana, Kim Kariuki,

Shenglin Ben, Zheren Wang, Edward Brient, Wenwei Li, and Man Luo. 2019. “Forming

a G20 Fintech Association Forum to Broker International Partnerships Promoting

Financial Inclusion in Developing and Emerging Economies.” T20 Japan. Accessed

May 5, 2020. https://t20japan.org/policy-brief-g20-fintech-association-forum.

Coppola, Frances. 2019. “Tether’s US Dollar Peg Is No Longer Credible.” Forbes.

Accessed January 5, 2020. https://www.forbes.com/sites/francescoppola/2019/03/14/tethers-u-s-dollar-peg-is-no-longer-credible/#16d31c73451b.

Edam, Ussal Sahbaz. 2019. “Forming a Cohesive Fintech Agenda for the G20.” T20

Japan. Accessed January 5, 2020. https://t20japan.org/policy-brief-forming-cohesivefintech-agenda-g20.

FSB. 2019. “Regulatory Issues of Stablecoins,” October 18, 2019. Accessed April 2,

2020. https://www.fsb.org/2019/10/regulatory-issues-of-stablecoins.

FSB. 2020. “Addressing the Regulatory, Supervisory and Oversight Challenges Raised

By ‘Global Stablecoin.’” https://www.fsb.org/wp-content/uploads/P140420-1.pdf.

G20. 2019. “G20 OSAKA LEADERS’ DECLARATION.” Accessed March 5, 2020. https://www.mofa.go.jp/policy/economy/g20_summit/osaka19/en/documents/final_g20_osaka_leaders_declaration.html.

Griffin, John M., and Amin Shams. 2019. “Is Bitcoin Really Un-Tethered?” Last updated

October 28, 2019. https://doi.org/https://dx.doi.org/10.2139/ssrn.3195066.

Helms, Kevin. 2019. “G20 Countries Start Implementing Unified Crypto Standards.”

Bitcoin.com, May 18, 2019. https://news.bitcoin.com/g20-countries-implementingunified-cryptocurrency-standards.

Iwashita, Naoyuki. 2019. “Regulation of Crypto-Asset Exchanges and the Necessity

of International Cooperation.” T20 Japan 2019. https://t20japan.org/policy-briefregulation-crypto-asset-exchanges.

Kharif, Olga. 2019a. “Tether Says Stablecoin Is Only Backed 74% by Cash, Securities.”

Bloomberg, April 30, 2019. https://www.bloomberg.com/news/articles/2019-04-30/tether-says-stablecoin-is-only-backed-74-by-cash-securities.

Kharif, Olga. 2019b. “The World’s Most-Used Cryptocurrency Isn’t Bitcoin.” Bloomberg,

October 1, 2019. https://www.bloomberg.com/news/articles/2019-10-01/tether-notbitcoin-likely-the-world-s-most-used-cryptocurrency?srnd=premium.

Krugman, Paul. 1984. “The International Role of the Dollar: Theory and Prospect.”

In Exchange Rate Theory and Practice, edited by J. F. O. Bilson and R. C. Marston,

261–78. Chicago: University of Chicago Press.

Lael, Brainard. 2019. “Digital Currencies, Stablecoins, and the Evolving Payments

Landscape,” 0–14. Accessed January 14, 2020. https://www.federalreserve.gov/newsevents/speech/files/brainard20191016a.pdf.

Lopez, Claude, Susana Nudelsman, Alfredo Gutiérrez Girault, and José Siaba Serrate.

2018. “The Crypto-Assets Experience: Give Technology a Chance without Milking

Users nor Investors (and Keep Close International Oversight on Potential Collateral

Damage).” T20 Argentina 2018. https://t20argentina.org/publicacion/the-cryptoassets-experience-give-technology-a-chance-without-milking-users-nor-investorsand-keep-close-international-oversight-on-potential-collateral-damage.

Matsuyama, Kiminori, Nobuhiro Kiyotaki, and Akihiko Matsui. 1993. “Toward a Theory

of International Currency.” Review of Economic Studies 60 no. 2: 283–307.

Mita, Makiko, Kensuke Ito, Shohei Ohsawa, and Hideyuki Tanaka. 2019. “What Is

Stablecoin?: A Survey on Price Stabilization Mechanisms for Decentralized Payment

Systems.” Accessed December 20, 2019. https://arxiv.org/abs/1906.06037.

Obstfeld, Maurice. 1981. “Macroeconomic Policy, Exchange-Rate Dynamics, and

Optimal Asset Accumulation.” Journal of Political Economy 89, no. 6: 1142–61.

Ogawa, Eiji, and Makoto Muto. 2017. “Declining Japanese Yen in the Changing

International Monetary System.” East Asian Economic Review 21, no. 4: 317–42.

Ogawa, Eiji, and Makoto Muto. 2019. “What Determines Utility of International

Currencies?” Journal of Risk and Financial Management 12, no. 1: 10. https://doi.org/10.3390/jrfm12010010.

Park, Cyn-young, Bo Zhao, and Asian Development Bank. 2019. “Fintech and

Distributed Ledger Technology: Issues and Challenges Beyond Crypto Assets.”

Paul, Kari. 2019. “What Is Libra? All You Need to Know About Facebook’s New

Cryptocurrency.” The Guardian, June 18, 2019. https://techcrunch.com/2019/06/18/facebook-libra.

Quarles, Randal K. 2020. “To G20 Finance Ministers and Central Bank Governors.”

Accessed June 6, 3030. https://www.fsb.org/wp-content/uploads/P190220.pdf.

Shirai, Sayuri. 2019. “China’s Digital Currency Could Threaten Dollar’s Dominance.”

The Japan Times. Nov 20, 2019. https://www.japantimes.co.jp/opinion/2019/11/20/commentary/world-commentary/chinas-digital-currency-threaten-dollarsdominance/#.XlTUYDIzZEZ.

Sidrauski, Miguel. 1967. “Rational Choice and Patterns of Growth in Monetary

Economy.” American Economic Review 57, no. 8: 534–44.

Tobin, James. 1956. “The Interest Elasticity of Transaction Demand for Cash.” Review

of Economics and Statistics 38, no. 3: 341–47.

Trejos, Alberto, and Randall Wright. 1996. “Search-Theoretic Models of International

Currency.” Federal Reserve Bank of St. Louis 78 no. 3: 117–32.

W3C. 2020. “Decentralized Identifiers.” 2020. Accessed March 1, 2020. https://www.w3.org/TR/did-core.

Ward, Orla, and Sabrina Rochemont. 2019. “An Addendum to ‘ A Cashless Society-

Benefits , Risks and Issues ( Interim Paper )’. Understanding Central Bank Digital

Currencies ( CBDC ).” Institute and Faculty of Actuaries. Accessed March 2, 2020.

https://www.actuaries.org.uk/system/files/field/document/Understanding CBDCs

Final – disc.pdf.

WEF. 2020. “Shaping the Future of Digital Economy and New Value Creation.”

2020. Accessed February 2, 2020. https://www.weforum.org/platforms/shapingthe-future-of-digital-economy-and-new-value-creation.Wharlen, Edward L. 1966.

“A Rationalization of the Precautionary Demand for Cash.” Quarterly Journal of

Economics 80, no. 2: 314–24.

Wildau, Gabriel. 2017. “China Probes Bitcoin Exchanges amid Capital Flight Fears.”

Financial Times, January 10, 2017. https://www.ft.com/content/bad16a88-d6fd-11e6-944b-e7eb37a6aa8e.

Yang, Yuan, and Hudson Lockett. 2019. “What Is China’s Digital Currency Plan?”

Financial Times, November 25, 2019. https://www.ft.com/content/e3f9c3c2-0aaf-11eabb52-34c8d9dc6d84.

Appendix

[1] . These include controlling money supply through open market operations and reserve requirements, maintaining efficient payment and settlement systems, supporting foreign exchange markets, and supervising banking risks.

[2] . This has occurred recently in the highly liquid risk-free US Treasury market as spreads have widened between “on the run” and “off the run” issues during episodes of turmoil in the coronavirus crisis.