The advancement in marketplace platform economies, collective intelligence, financial technology, and artificial intelligence models is radically resolving formidable business and economic impediments. Likewise, these models could be adopted for public–private partnership (PPP) infrastructure projects through the development of rigorously designed and regulated intelligent marketplaces. This policy brief reviews the prominent challenges facing PPP projects, particularly, contractual complexity, information asymmetry, austerity policy inefficiencies, mismatches in stakeholder incentivization, and high transaction costs. It proposes the adoption of an extensible intelligent PPP marketplace architecture and the development of international standards for PPP contracts.

Challenge

Most governments and experts propound that the private sector has adequate agility and competencies to efficiently implement infrastructure and public services (Boardman et al. 2015; Engel et al. 2014; Forrer et al. 2010; Levitt and Erikson 2016). Besides, risk transfer from the public to the private sector is the most prominent objective of public–private partnership (PPP). In contrast, empirical evidence reveals that most PPP projects are inefficient and induce new types of risks to the public sector (Chung and Hensher 2016; Chan, Osei-Kyei, et al. 2018; Iossa and Martimort 2012; Lewis 2002; OCED 2018). These are mainly attributed to austerity policy anomalies, information asymmetry, PPP complexity and high transaction costs, inefficient stakeholder incentives, and contractual anomalies (Engel et al. 2014; Aizawa 2015; Hall 2015; Tang et al. 2013; US Department of Treasury 2015; Iossa and Martimort 2012; Tang et al. 2013; Berner et al. 2014).

1. Austerity Policy Anomalies

The main goal of most governments for PPP engagement is to decrease government spending and debt. This austerity goal incurs more expensive private borrowing with inefficient implementation of infrastructure and public services. Most governments use PPP as a vehicle to conceal borrowing and this is referred to as sovereign-debt phobia (Engel et al. 2014; Gonzalez et al. 2015).

2. Information Asymmetry

Due to the involvement of parties with conflicting interests, different sets of information are shared between the parties, where the private sector especially conceals much of this information to maximize their return. Furthermore, PPP projects are executed over comparatively longer time horizons and become more prone to unexpected events such as economic, political, environmental, and public health crises, among others. Information asymmetry coupled with unexpected events impose great uncertainty in PPP projects (Aizawa 2015; Hall 2015).

3. PPP Complexity and Higher Transaction Cost

PPPs are inherently complex compared to public sector projects. This complexity is induced mainly via complex negotiations, contracting, coordination, and management requirements of PPP projects. Furthermore, uncertainty, information asymmetry, and lack of efficient contextual knowledge elevate this complexity. Such complexity inevitably imposes higher transaction cost that debilitate the feasibility of PPP projects (Hall 2015; Iossa and Martimort 2015; Love 2015; Roberts 2015).

4. Inefficient Mutual Incentives

To optimize PPP projects, we must design efficient and balanced incentives for the diverse stakeholders. These incentives should be elicited by strongly emphasizing the needs and challenges of each stakeholder. Nonetheless, most PPP incentives are neither rigorously nor holistically designed to collectively satisfy stakeholders (Hall 2015; Cruz et al. 2015; Athias and Saussier 2007).

5. Contractual and Financial Guarantee Anomalies

Due to the complexity of PPP engagements, information asymmetry, and natural language ambiguity, PPP contracts are fraught with immense ambiguity, incompleteness, and inconsistencies (Berner et al. 2014; Chohra et al. 2011; Cruz et al. 2015; Umar et al. 2018). Furthermore, most of these contracts do not address performance efficiency guarantees, financial and revenue guarantees, specification of nonrecourse loans, and holistic risk management (Albalate et al. 2015; Athias and Saussier 2007; Burger and Hawkesworth 2011).

Most PPP engagements are based on the consensus of the private sector to invest based on revenue guarantees pledged by the public authority. Governments also provide subsidized loans, and financial guarantees to the private sector. Empirical studies show that these guarantees fail due to contractual anomalies or unexpected events such as economic crises (Ashuri et al. 2011; Feng et al. 2015; Hemming et al. 2006). Due to these contractual complexities, fewer partners would be willing to bid, which decreases the number of competing parties and significantly compromises the bargaining power of the public authority to optimize public interests (Iossa and Martimort 2015; Hall 2015).

Proposal

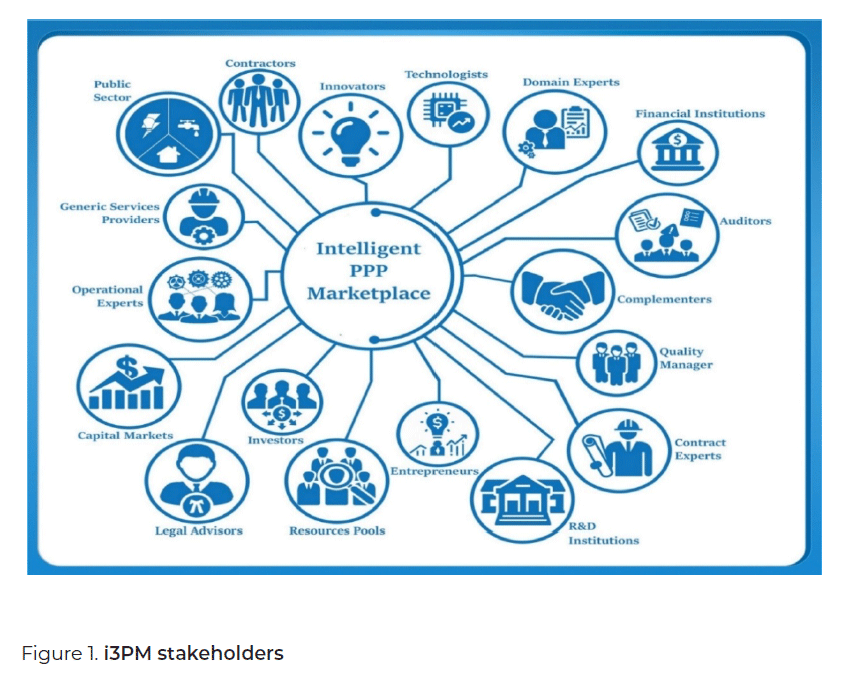

To resolve these challenges, we propose the adoption of an open and intelligent PPP marketplace (i3PM) platform by public and private sector stakeholders. The proposed marketplace employs the hybrid of multisided platform economies, artificial intelligence, financial technology, and collective intelligence. These factors foster efficient PPP business, investment, contractual, and operational models that create optimal mutual value and incentives for diverse stakeholders to efficiently catalyze the adoption of PPP projects. This marketplace has a dual functionality; it promotes the optimal execution of PPP projects and provides an exchange marketplace platform where PPP securities are seamlessly traded. These securities are called tradable PPP partitions (TPPs). Figure 1 depicts the interactions of diverse stakeholders with i3PM marketplaces.

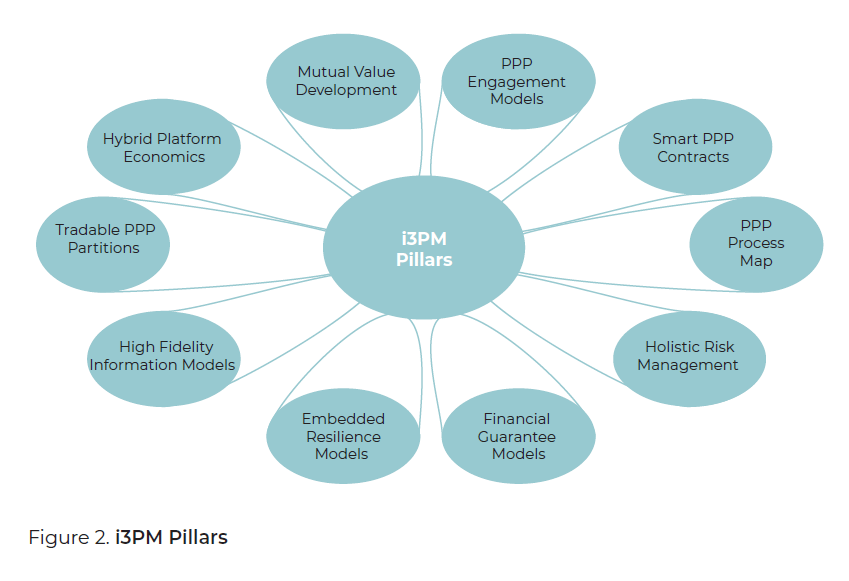

This efficient solution to resolve the complex problems currently associated with PPPs provides a holistic approach that concurrently addresses the multifaceted root causes. The proposed marketplace comprises the 10 pillars depicted in Figure 2, while Table D1 (Appendix D) maps these pillars to the impediments that they address.

i3PM employs hybrid platform economies to efficiently resolve the current formidable challenges facing PPP projects. The following are the prominent features of i3PM:

- i3PM enables and incentivizes diverse stakeholders to embrace PPP initiatives and symbiotically interact to create mutual value.

- It uses high information fidelity models to efficiently manage information asymmetry.

- i3PM standardizes PPP contracts using rigorous contract and computational models to promote the efficient design and validation of contracts. These are wrapped within a smart contract in a blockchain infrastructure, thereby enforcing reliability, optimal arbitration, regulatory compliance, fraud management, and exception handling. These features inevitably resolve contractual complexity, ambiguity, and inconsistency.

- It standardizes PPP engagement processes using rigorously business, operations, innovation, and financial models. These standard engagement models are developed by diverse competent stakeholders interacting via collective intelligence and marketplace platform economies. This resolves PPP complexity and ambiguity and optimizes PPP efficiency while minimizing transaction costs.

- This marketplace seamlessly connects PPP stakeholders with globally competent innovators and multidisciplinary domain knowledge experts, thereby promoting the execution of PPP projects with high competency.

- i3PM can easily attract the required critical mass of stakeholders due to high information symmetry, flexible capital guarantee models, and expected high returns.

- TPP via i3PM significantly stimulates both supply and demand, thereby enabling the liquidity and scalability of this marketplace.

- i3PM liquidity, transparency, reliability, and efficiency inevitably attract diverse domestic and foreign investors into PPP projects.

1. Hybrid Platform Economies

The proposed i3PM employs a hybrid of multisided platform economies, artificial intelligence, financial technology, and collective intelligence to foster efficient PPP business, investment, contractual, and operational models. It creates optimal mutual value and incentives for diverse stakeholders to efficiently catalyze the adoption of PPP projects. Figure C1 (Appendix C) depicts a higher level i3PM topology. This marketplace seamlessly connects PPP stakeholders with globally competent innovators and multidisciplinary domain knowledge experts. Thus, it significantly leverages the competencies of stakeholders and promotes the implementation of efficient and innovative PPP projects. Hence, i3PM encourages the initiation of PPP projects with relatively higher maturity and efficiently satisfies the ultimate PPP goals. Appendix C explains how each model contributes to the implementation of hybrid platform economies.

2. PPP Engagement Models

Most PPP engagement models such as Build–Operate–Transfer (BOT) are generically and non-rigorously defined. They are complex in nature and are characterized by extreme rigidity, fuzziness, and inefficiency (Cruz et al. 2015; Umar et al. 2018). The implementation of intelligent marketplaces necessitates the standardization and computational representation of engagement models. This cultivates collective intelligence to develop agile, adoptable, and extendable standard models by engaging regulators, domain experts, and other competent stakeholders. The entire interaction is seamlessly facilitated and mediated by the market economies and collective intelligence to foster mutual collaboration. These standard models can be represented using international standards such as W3C standard ontology web language (OWL) (Trang 2010). This computational representation inevitably promotes PPP engagement automation, optimization, rigorous validation, and competency development via the embedded knowledge within the standards. These models can easily be tailored and extended based on the constraints imposed by specific PPP projects to stimulate innovation and efficiently achieve the ultimate goals. Table A1 (Appendix A) lists some of the proposed PPP engagement models.

3. Tradable PPP Partitions (TPPs)

PPP projects in i3PM are tradable, and the atomic tradable unit is called a TPP. These are identical to tokenized securities that define the ownership and rights of a shareholder in a PPP project or in an entity created via a PPP initiative. TPP certificates are represented digitally and are stored within a tamper-free blockchain infrastructure.

These partitions are traded on the hybrid marketplace (Smith et al. 2019; Kaal and Evans 2019; Mass 2019; Le Gear 2020). TPPs are well regulated and are distinct from Initial Coin Offerings (ICO) (Mass 2019). Their function is to digitally represent PPP securities certificates in a flexible, secure, and efficient format to promote seamless trading of these assets via the i3PM environment.

4. Mutual Value Development

The main objective of this marketplace is to create mutual and balanced value for all stakeholders. This is accomplished through the hybrid platform economies that automate the coordination and negotiation processes to promote the rigorous specification and optimization of stakeholder benefits, which are codified using computation ontology. The entire mutual benefit development lifecycle is managed by a negotiation engine that utilizes computational negotiation models, an intelligent bargaining engine, distributed multiagents, computational Nash equilibrium models, operations research and artificial intelligence (AI) based optimization models. Robo-advisors are used to simplify the interaction and optimize the experience of stakeholders by abstracting technical and deep knowledge required to codify and optimize their returns (Dong and Li 2011; Rangaswamy and Shell 1994).

5. PPP Process Map

i3PM projects are required to generate unique returns for stakeholders to symbiotically attract investors, public and private sector entities, consumers, regulators, and other stakeholders. As such, this intelligent marketplace manages the entire project lifecycle, from pre-inception to operation, thereby assuring the development of mutual benefits, and the execution of PPP projects with high transparency, efficiency, and optimal ROI.

In this policy brief, we propose the development of a standard process map through global collaboration. This map encompasses the best practices developed by groups of multidisciplinary domain experts, regulators, and public and private sector stakeholders. These processes are expected to be represented in a digital format to promote seamless tailoring and automation (Trang 2010).

6. High Fidelity Information Models

To handle information asymmetry, we propose the adoption of a high-fidelity information model (HFIM) that captures relevant structural, and behavioral information about an enterprise (Peri and Campana 2003; Lee et al. 2019). This includes in-depth knowledge of its supply chain, revenue streams, and product and consumer models, among others. Figure A3 (Appendix A) depicts the topology of the proposed 32-dimensional information model. These models are represented in machine comprehensible format as a computational ontology (Trang 2010). Each sector has its own HFIM schema developed by its domain experts, and other relevant stakeholders. This schema is used to elicit high-fidelity information about a project or an enterprise.

The purpose of HFIMs can be summarized as follows:

- Promotes the elicitation of high-quality PPP engagement information with minimum time, cost, and effort.

- Resolves daunting information asymmetry impediments to promote high transparency and improves market efficiency.

- Serves as domain knowledge represented in digital format.

- Promotes the development of sector or industry specific benchmarking, rating, and scoring models.

7. Smart PPP Contracts (S3PCs)

The purpose of Smart PPP Contracts (S3PCs) is to resolve critical PPP contractual pitfalls and anomalies such as information asymmetry, contractual ambiguity, incompleteness, and inconsistency (Berner et al. 2014; Chohra et al. 2011; Cruz et al. 2015; Umar et al. 2018). S3PCs resolve these by employing an efficient PPP contract designing methodology based on hybrid and artificial intelligence models (Pourshahid et al. 2009; Liiva et al. 2018; Wei 2019; Cath 2018; Pennings and Leuthold 2000). Most of these anomalies are induced during the inception of the contract (Viljanen 2020; Chohra et al. 2011; Cruz et al. 2015). Consequently, this methodology resolves ambiguity via rigorous computational representations, debiasing behavioral anomalies via plausible reasoning, and enforces contractual completeness and consistency via model-based validation (Pourshahid et al. 2009; Liiva et al. 2018; Wei 2019). Furthermore, this facilitates the design of resilient contracts by stress testing them under extreme conditions such as during a financial crisis, with their contents represented in a digital format using computational ontologies (Kruijff and Weigand 2017a, 2017b). Once the contract is validated and approved by the stakeholders, it is deployed as a smart contract into a blockchain infrastructure. Smart contracts enforce contractual reliability, regulatory compliance, security, optimal arbitration, fraud management, and exception handling (Tai 2017; Caso et al. 2012).

Since the development of such contracts from scratch can be time consuming, we propose the origination of reusable contracts called PPP contract templates (P3CTs) by subject matter experts and relevant stakeholders. These templates can be created using the collective intelligence environment supported by i3PM. P3CTs are extendable by nature. Hence, they can easily be tailored and adapted according to the constraints imposed by a specific PPP engagement.

8. Capital Guarantee Models

Financial guarantees in PPP projects play a pivotal role in promoting their attractiveness to diverse private sector stakeholders. However, most are inflexible and misaligned with performance, thereby creating information asymmetry and offering inadequate incentives to private sector stakeholders (Albalate et al. 2015; Athias and Saussier 2007; Burger and Hawkesworth 2011).

To efficiently address these issues and appeal to diverse stakeholders, we propose the development of rigorous capital guarantee models designed using an engineering tradeoff approach that holistically addresses the mutual benefits, constraints, and risks to stakeholders (Daniels et al. 2001). Stakeholders employ a workshop analysis approach to elicit the spatiotemporal constraints and risks of the contract, while designing the capital guarantee model to efficiently resolve these issues (AntolínDíaz et al. 2020; Barbacci et al. 2020). In the context of the i3PM, this is referred to as the optimization of the return on capital guarantee (RoCG). This process also employs mathematical and AI models to help in traversing the solution space and generates optimal solutions and RoCG (Peri and Campana 2003). Table A2 (Appendix A) lists sample capital guarantee models developed using this framework.

This marketplace can easily attract the required critical mass because of relatively high information symmetry, flexible capital guarantee models, and expected high returns. The TPPs are incrementally offered through the marketplace, and at each stage, different guarantee models are used to handle risks that conform to the risk appetite of investors. This is expected to incrementally increase the value of the asset, thereby stimulating both supply and demand, which inevitably increases the liquidity of the market. Due to its high liquidity and scalability characteristics, this marketplace efficiently attracts sufficient domestic and foreign investments.

9. Holistic Risk Management

PPP projects are complex in nature as are the risks associated with them. This complexity arises from numerous factors and their causal interactions (Chan, Osei-Kyei, et al. 2018; Chan, Yeung, et al. 2011). Most PPP projects do not efficiently enumerate these factors due to information asymmetry. In an i3PM, an HFIM spanning 32 dimensions is employed. These provide high-resolution information about the supply chains, revenue streams, product, microeconomics, and project models, among others (Peri and Campana 2003; Lee et al. 2019). Figure A3 (Appendix A) illustrates the proposed model. By ultimately optimizing information symmetry, the risk parameters can be efficiently extracted and defined with high levels of accuracy, credibility, and fidelity (Waring 2003; Soliwoda et al. 2018). Furthermore, the causal interaction between these risk parameters can be defined using computational models such as system dynamics, and Bayesian models (Wang et al. 2013; Milling 2006; Struben et al. 2015). The rationale of using these computational models is to overcome the limitations of human cognition in dealing with complex causal relationships (Yao 2017; Tóbiás 2020; Rescher 1997), which otherwise result in cognitive limitations and inefficiencies in addressing the salient interactions within PPP projects.

Once the risk attributes are efficiently captured, a scenario-based analysis is used to identify, communicate, evaluate, prioritize, and define risk mitigation plans (AntolínDíaz et al. 2020; Barbacci et al. 2020). The entire risk management process is derived from a continuous risk management framework (Alberts et al. 1996).

10. Crisis Resilience Models

It is clear that PPP projects are vulnerable to exceptional events such as financial or public health crises (including the coronavirus pandemic), which inevitably have serious impacts that compromise the benefits of PPP projects, and in some extreme cases, lead to their termination (Coelho et al. 2009; Hertati et al. 2002). The latest economic crisis precipitated by the coronavirus pandemic has taught us a severe lesson: it is impracticable to react to these crises when they transpire because their impacts are rapidly and chaotically propagated. Short-term interventions generally fail to absorb or deter this chaotic propagation. Yet, we need not reinvent the wheel, as we can adopt the proactive style that is currently employed by the financial services industry. An example is the BASEL III accord, which requires financial institutions to proactively deal with unexpected exceptional events by developing a multitude of proactive measures (McNamara et al. 2014; Demirguc-Kunt and Detragiache 2005). Therefore, the aim of embedded resilience models (ERM) is to analyze diverse exceptional scenarios during the inception of PPP projects and proactively formulate interventions to deter their occurrence or absorb their adverse impacts.

The purpose of these models is to proactively deal with PPP engagement exceptions and risks during crises using multidisciplinary resilience and reliability management models (Soroka et al. 2019; Bristow and Healy 2017; Hermansen and Roehn 2017; Sensier et al. 2016; Sunley and Martin 2014). To efficiently implement this, we propose an iterative approach called Proactive Resilience Lifecycle Management (PRLM). This constitutes Exception Event Scenario Analysis, Potential Event Enumeration, Resilience Model Development, Resilience Model Validation, Continuous Exception Surveillance, and Resilience Model Optimization. Appendix B presents a more detailed explanation of this iterative lifecycle.

Recommendations

To promote the adoption of an intelligent PPP marketplace that can resolve formidable PPP impediments, we recommend the following main actions:

Extendable PPP marketplace architecture

We call on G20 policy makers and multilateral financial institutions to facilitate the development of an open and extendable PPP marketplace by incentivizing global stakeholders to collaborate in extending the i3PM pillars. The proposed incentives include:

- The adoption of a PPP marketplace by governments and multilateral institutions in the implementation of their PPP projects.

- The formal standardization of the architecture of the PPP platform economies by government and other credible standard bodies.

- Funding multidisciplinary academic research aimed at extending and optimizing PPP platform economies.

Standardization of PPP contracts

We recommend that G20 governments, multilateral financial institutions, and standard bodies standardize the process, structure, and representation of PPP contracts to handle contractual complexity, ambiguity, risk, and high transaction costs. These standards should include:

- The development of an optimal and rigorous contract designing and validation methodology by efficiently extending the smart PPP contract methods employed in i3PM.

- The implementation of PPP contracts using smart contracts.

- The implementation of reusable domain-specific PPP contract templates that can easily be tailored and extended. This will minimize the time, cost, effort, and risk to develop PPP contracts from scratch.

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

Adrian, Tobias, James Morsink, and Liliana B. Schumacher. 2020. “Stress Testing

at the IMF—International Monetary Fund.” https://www.imf.org/en/Publications/Departmental-Papers-Policy-Papers/Issues/2020/01/31/Stress-Testing-at-the-IMF-48825

Ahamed, Mohiuddin, and Al Sakib Khan Pathan. 2020. “Deep Learning for

Collective Anomaly Detection.” International Journal of Computational Science and

Engineering 21(1): 137.

Aizawa, Motoko. 2015. “Five Things that can Promote Transparency in Public–Private

Partnerships.” Heinrich Boell Stiftung. https://us.boell.org/2015/11/12/five-things-canpromote-trans-parency-public-private-partnerships

Akitoby, Bernardin, Richard Hemming, and Gerd Schwartz. 2006. “Public-Private

Partnerships, Government Guarantees, and Fiscal Risk.” Fiscal Affairs Department,

International Monetary Fund. https://lst-iiep.iiep-unesco.org/cgi-bin/wwwi32.exe/[in=epidoc1.in]/?t2000=026025/(100).

Albalate, Daniel, Germà Bel, and R. Richard Geddes. 2015. “The Determinants of

Contractual Choice for Private Involvement in Infrastructure Projects.” Public Money

and Management 35(1): 87–94.

Alberts, Christopher J., Audrey J. Dorofee, Ron Higuera, Richard L. Murphy, Julie

A. Walker, and Ray C. Williams. 1996. Continuous Risk Management Guidebook.

Carnegie Mellon University: Software Engineering Institute. https://resources.sei.cmu.edu/library/asset-view.cfm?assetid=30856

Anderlini, Luca, Leonardo Felli, and Andrew Postlewaite. 2001. “Courts of Law and

Unforeseen Contingencies.” Journal of Law, Economics and Organization 23(3).

Antolín-Díaz, Juan, Ivan Petrella, and Juan F. Rubio-Ramírez. 2020. “Structural

Scenario Analysis with SVARs.” Journal of Monetary Economics. https://doi.org/10.1016/j.jmoneco.2020.06.001

Ashuri, Baabak, Hamed Kashani, Keith R. Molenaar, S. Lee and J. Lu. 2011. “Risk-

Neutral Pricing Approach for Evaluating BOT Highway Projects with Government

Minimum Revenue Guarantee Options.” Journal of Construction Engineering and

Management 138(4): 545–557. doi: 10.1061/(ASCE)CO.1943-7862.0000447

Athias, Laure, and Stéphane Saussier. 2007. “Contractual Flexibility or Rigidity for

Public Private Partnerships? Theory and Evidence from Infrastructure Concession

Contracts.” MPRA Paper No. 10541. https://mpra.ub.uni-muenchen.de/id/eprint/10541

Ayres, Ian, and Robert Gertner, 1989. “Filling Gaps in Incomplete Contracts: An

Economic Theory of Default Rules.” The Yale Law Journal. https://digitalcommons.law.yale.edu/fss_papers/1545

Baker, Tom, and Benedict G. C. Dellaert. 2018. “Regulating Robo Advice Across

the Financial Services Industry.” Faculty Scholarship at Penn Law. 1740. https://scholarship.law.upenn.edu/faculty_scholarship/1740

Barbacci, Mario R., Robert J. Ellison, Anthony J. Lattanze, Judith A. Stafford, Charles

B. Weinstock, and William G. Wood. 2020. Quality Attribute Workshops (QAWs). Third

Edition. Carnegie Mellon University: Software Engineering Institute. doi 10.1184/

R1/6582656.v1

Berner, F., M. Hermes, and A. Weigl. 2014. Risk Assessment of PPP Contracts.

Bauingenieur 89: 416–420.

Beuve, Jean, Aude Le Lannier, and Zoe Le Squeren. 2018. Renegotiating PPP

Contracts: Opportunities and Pitfalls.

Bingham, Lisa Blomgren, Tina Nabatchi, and Rosemary O’Leary. 2004. “The New

Governance: Practices and Processes for Stakeholder and Citizen Participation in

The Work of Government.” Public Administration Review 65(5): 547–558.

Boardman, Anthony E., Carsten Greve, and Graeme A. Hodge. 2015. “Comparative

Analyses of Infrastructure Public–Private Partnerships.” Journal of Comparative

Policy Analysis: Research and Practice 17(5): 441–447.

Boyer, Eric J. 2016. “Identifying a Knowledge Management Approach for Public–

Private Partnerships.” Public Performance and Management Review 40(1): 158–180.

Brabham, Daren Carroll. 2010. “Crowdsourcing as a Model for Problem Solving:

Leveraging the Collective Intelligence of Online Communities for Public Good.”

Dissertation, University of Utah, December.

Bristow, Gillian, and Adrian Healy. 2017. “Innovation and Regional Economic

Resilience: An Exploratory Analysis.” The Annals of Regional Science 1-20. doi. 10.1007/s00168-017-0841-6

Burger, Philippe, and Ian Hawkesworth. 2011. “How to Attain Value for Money:

Comparing PPP and Traditional Infrastructure Public Procurement.” OECD Journal

on Budgeting, OECD Publishing 11(1): 91–146.

Busch, Christoph. 2019. “When Product Liability Meets the Platform Economy: A

European Perspective on Oberdorf v. Amazon.” 8 Journal of European Consumer and

Market Law: 173–174.

De Caso, Guido, Victor Braberman, Diego Garbervetsky, and Sebastian Uchitel. 2012.

“Automated Abstractions for Contract Validation.” IEEE Transactions on Software

Engineering 38(1): 141–162.

Cath, Corinne. 2018. “Governing Artificial Intelligence: Ethical, Legal and Technical

Opportunities and Challenges.” Philosophical Transactions of The Royal Society

A Mathematical Physical and Engineering Sciences 376: 20180080. https://doi.org/10.1098/rsta.2018.0080

Chan, Albert P. C., Robert Osei-Kyei, Yi Hu, and Le Yun. 2018. “A Fuzzy Model for

Assessing the Risk Exposure of Procuring Infrastructure Mega-projects through

Public–Private partnership: The Case of Hong Kong-Zhuhai-Macao bridge.” Frontiers

of Engineering Management 5(1): 64–77.

Chan, Albert P. C., John F. Y. Yeung, Calvin C. P. Yu, Shou Qing Wang, and Yongjian

Ke. 2011. “Empirical Study of Risk Assessment and Allocation of Public-Private

Partnership Projects in China.” Journal of Management in Engineering 27(3): 136–148.

Chatterji, Shurojit, and Dragan Filipovich. 2004. “Ambiguous Contracting: Natural

Language and Judicial Interpretation.” Econometric Society 2004 North American

Winter Meetings: 419, Econometric Society.

Chohra, M., S. Mu, and H. Cheng. 2011. “Risks and New Transformations of PPP

Contracts.” Journal of Southeast University (English Edition) 27: 458–462.

Chung, Demi, and David A. Hensher. 2016. “Risk-sharing in Public–Private

Partnerships: A Contractual Economics Perspective.” In Michiel Bliemer, Corinne

Mulley and Claudine J. Moutou (eds), Handbook on Transport and Urban Planning in

the Developed World: 254–273. Cheltenham, UK and Northampton, MA, USA: Edward

Elgar Publishing.

Coelho, Maria, Philippe Burger, Justin Tyson, and Izabela Karpowicz. 2009. “The

Effects of the Financial Crisis on Public-Private Partnerships.” International Monetary

Fund, IMF Working Papers.

Cruz, Carlos, Rui Cunha Marques, and Pedro Cardoso. 2015. “Empirical Evidence for

Renegotiation of PPP Contracts in the Road Sector.” Journal of Legal Affairs and

Dispute Resolution in Engineering and Construction 7(2): 05014003.

Daniels, Jesse, Paul Werner, and A. Terry Bahill. 2001. “Quantitative Methods for

Tradeoff Analysis.” Systems Engineering 4: 190–212.

De Kruijff, Joost, and Hans Weigand. 2017a. “Understanding the Blockchain Using

Enterprise Ontology.” 29th Int. Conference on Advanced Information Systems

Engineering, 12–16 June.

De Kruijff, Joost, and Hans Weigand. 2017b. “Ontologies for Commitment-Based

Smart Contracts.” OTM 2017 Conferences. Confederated International Conferences.

Demirguc-Kunt, Asli, and Enrica Detragiache. 2005. “Cross-Country Empirical Studies

of Systemic Bank Distress. A Survey.” National Institute Economic Review 192: 68–83.

Dong, Shaobin, and Aihua. 2011. “Negotiation Model Based on Artificial Intelligence

in the E-Commerce.” Proceedings – 3rd International Symposium on Information

Science and Engineering, ISISE: 193–196.

Engel, Eduardo, Ronald D. Fischer, and Alexander Galetovic. 2014. The Economics of

Public–Private Partnerships: A Basic Guide. Cambridge: Cambridge University Press.

Farajian, Morteza, Alexandra Lauzon, and Qingbin Cui. 2015. “Introduction to a

crowdfunded public–private partnership model in the United States: policy review on

crowdfund investing.” Transportation Research Record: Journal of the Transportation

Research Board 2530: 36–43.

Feng, Zhuo, Shui-Bo Zhang, and Ying Gao. 2015. “Modeling the Impact of Government

Guarantees on Toll Charge, Road Quality and Capacity for Build–Operate–Transfer

(BOT) Road Projects.” Transportation Research Part A: Policy and Practice 78: 54–67.

Ferris, Timothy. 2020. “Measurement of Resilience, and the Time Value of

Resilience.” IEEE Systems Journal: 1-8. https://dspace.lib.cranfield.ac.uk/bitstream/handle/1826/15590/Measurement_of_resilience_and_the_time_value_of_resilience-2020.pdf

Forrer, John, James Edwin Kee, Katherine E. Newcomer, and Eric Boyer. 2010. “Public-

Private Partner- ships and the Public Accountability Question.” Public Administration

Review (70): 475–484.

Garvin, Michael J. 2015. “Payment Structures in Public–Private Partnership Projects:

Contrasting Tolls and Availability Payments.” Research Report for Virginia’s Office of

Public–Private Partnerships (VAP3), Virginia Tech, Blacksburg, VA.

Le Gear, Andrew. 2020. “A Blockchain Supported Solution for Compliant Digital

Security Offerings.” In Blockchain and Distributed Ledger Technology Use Cases.

Treiblmaier, Horst and Trevor Clohessy (Eds.), Springer Nature, Switzerland : 113–131.

Gonzalez, Edwin, Martha E. Gross, and Michael J. Garvin. 2015. “Use of Fiscal Support

Mechanisms in Public–Private Partnerships: An Exploration of Three International

Case Studies.” 2nd International Conference on Public–Private Partnerships, Austin,

TX, May 25–29.

Hagemann, Daniel and Monika Wohlmann. 2019. “An Early Warning System to

Identify House Price Bubbles.” Journal of European Real Estate Research 12: 291–310.

Hall, David. 2015. “Why Public-Private Partnerships Don’t Work: The Many Advantages

of The Public Alternative.” Public Services International Research Unit, University of

Greenwich, UK. https://cisp.cachefly.net/assets/articles/attachments/53912_rapport_eng_56pages_a4_lr.pdf

Hargreaves, Carol. 2013. Stock Portfolio Selection using Data Mining Approach. IOSR

Journal of Engineering 3: 42–48.

Hargreaves, Carol, Vallaru Chandana, and Vishnu Reddy. 2017. “Machine Learning

Application in The Financial Markets Industry.” Indian Journal of Scientific Research

Conference, Singapore.

Hawlitschek, Florian, Benedikt Notheisen, and Timm Teubner. 2018. “The limits of

trust-free systems: A literature review on blockchain technology and trust in the

sharing economy.” Electronic Commerce Research and Applications doi. 100935.

10.1016/j.elerap.2020.100935.

Hermansen, Mikkel, and Oliver Roehn. 2016. “Economic Resilience: The Usefulness

of Early Warning Indicators in OECD Countries.” OECD Journal: Economic Studies 1:

9–35

Hertati, Lesi, Marlina Widiyanti, Desfitrina Desfitrina, Afriapollo Syafarudin, and Otniel

Safkaur. 2020. “The Effects of Economic Crisis on Business Finance.” International

Journal of Economics and Financial Issues 10: 236–244.

Iossa, Elisabetta, and David Martimort. 2012. “Risk allocation and the costs and

benefits of public—private partnerships.” RAND Journal of Economics RAND

Corporation 43(3): 442–474.

Iossa, Elisabetta, and David Martimort. 2014. “Corruption in PPPs, Incentives and

Contract Incompleteness.” SSRN Electronic Journal doi. 10.2139/ssrn.2468101.

Iossa, Elisabetta, and David Martimort. 2015. “The Simple Microeconomics of Public–

Private Partnerships.” Journal of Public Economic Theory 17(1): 4–48.

Jie, Yan, LIU Ren-jing; XU Bo; “Effects of Centralized, Decentralized and Reintegrated

Group Structures on Group Performance”;2016-05

Kaal, Wulf, and Samuel Evans. 2019. “Blockchain-Based Securities Offerings.” SSRN

Electronic Journal. doi. 10.1007/s41471-020-00090-5

Kivleniece, Ilze, and Bertrand V. Quelin. 2012. “Creating and capturing value in public–

private ties: a private actor’s perspective.” Academy of Management Review 37(2):

272–299.

Lee, Y., S. Chang, and C. In. 2019. “Unfaithful Disclosure and Information Asymmetry.”

Journal of Finance and Accounting Information 19: 89–107.

Lehdonvirta, Vili, Otto Kässi, Isis Hjorth, Helena Barnard, and Mark Graham. 2018.

“The Global Platform Economy: A New Offshoring Institution Enabling Emerging-

Economy Microproviders.” Journal of Management 45(2): 567–599.

Leitner, Yaron. 2005. “Legal uncertainty and contractual innovation.” Business

Review 2: 26–32.

Levitt, Raymond E., and Kent Eriksson. 2016. Developing a governance model for PPP

infrastructure service delivery based on lessons from Eastern Australia. Journal of

Organization Design, 5(1).

Lewis, Michael. 2002. “Risk Management in Public-Private Partnerships.” Working

Paper. School of International Business, University of South Australia.

Liiva, Kristjan, Paul Jackson, Grant Passmore, and Christoph Wintersteiger. 2018.

“Compositional Taylor Model Based Validated Integration.” 20th International

Symposium on Symbolic and Numeric Algorithms for Scientific Computing (SYNASC).

https://www.pure.ed.ac.uk/ws/files/138526506/Compositional_taylor_model_based_validated_integration.pdf

Liu, Henry, Jane Matthews, Michael C.P. Sing, and Jim Smith. 2015. “Future proofing

PPPs: Life-cycle performance measurement and Building Information Modelling.”

Automation in Construction 56:26–35. doi. 10.1016/j.autcon.2015.04.008

Maas, Thijs. 2019. “Initial Coin Offerings: When Are Tokens Securities in the EU and

US?” SSRN Electronic Journal February 2013. https://ssrn.com/abstract=3337514

Mani, Chandrika, and Carol Hargreaves. 2016. “Stock Trading Using Analytics.”

American Journal of Marketing Research 2(2): 27–37.

Markeeva, Anna, and Olga Gavrilenko. 2019. “Future of Platform Economy: Digital

Platform as New Economic Actor and Instance of Social Control.” Postmodern

Openings 11(2): 65-73

McNamara, Christian, Michael Wedow, and Andrew Metrick. 2014. “Basel III B: Basel

III Overview.” SSRN Electronic Journal doi. 10.2139/ssrn.2576939.

Milling, Peter. 2006. “Do complex system dynamics projects require special study

processes? Comments on the paper by Winch and Derrick.” Systems Research and

Behavioral Science doi. 23. 10.1002/sres.777.

Mishra, Wricha, Anirban Chowdhury, and Debayan Dhar. 2017. “Optimizing Operation

Research Strategy for Design Intervention: A Framework for GOMS Selection Rule.”

Conference paper. doi. 10.1007/978-981-10-3518-0_6

Monk, Ashby, Rajiv Sharma, and Duncan L. Sinclair. 2017. Reframing Finance: New

Models of Long-Term Investment Management. Stanford, CA: Stanford University

Press.

Moon, Woo Young, and Soo Dong Kim. 2017. “Adaptive Fraud Detection Framework

for FinTech Based on Machine Learning.” Advanced Science Letters.

Nikiforova, Tatiana. 2017. “The Place of Robo-Advisors in the UK Independent Financial

Advice Market. Substitute or Complement?” SSRN Electronic Journal. Masters Thesis.

OECD. n.d. “Public-Private Partnerships: In Pursuit of Risk Sharing and Value for

Money.” OECD Paris.

Papaioannou, George, and Ahmet Karagozoglu. 2017. “Structuring Securities

Offerings.” In Underwriting Services and the New Issues Market Science Direct: 241–

264.

Pennings, Joost. M. E. and Raymond M. Leuthold. 2000. “Hedging Revisited: Resolving

Contractual Conflict.” SSRN Electronic Journal.

Peri, Daniele, and Emilio Campana. 2003. “High-Fidelity Models in Global

Optimization.” Lecture Notes in Computer Science 3478: 112–126.

Pourshahid, Alireza, L. Peyton, S. Ghanavati, D. Amyot, P. Chen, and M. Weiss. 2009.

“Model-Based Validation of Business Processes. Business Process Management:

Concepts, Technology, and Application.” Advances in Management Information

Systems, ME Sharpe Inc.

Prelec, Drazen, Hyunjune Seung, and John McCoy. 2017. “A solution to the singlequestion

crowd wisdom problem.” Nature 541(7638): 532–535.

Rangaswamy, Arvind, and G. Richard Shell. 1994. “Using computers to realize

joint gains in negotiations: Toward an electronic bargaining table.” Management

Science 43.

Reinhardt, William. 2011. “The case for public–private partnerships in the US.” Public

Works Financing 265(11): 87–102.

Rescher, Nicholas. 1997. “Coping with Cognitive Limitations: Problems of Rationality

in a Complex World.” Philosophic Exchange 27(1): 2–7.

Roberts, Michael R. 2015. “The role of dynamic renegotiation and asymmetric

information in financial contracting.” Journal of Financial Economics 116(1): 61–81.

Saksonova, Svetlana, and Irina Kuzmina-Merlino, 2017. “Fintech as financial innovation

– The possibilities and problems of implementation.” European Research Studies

Journal 20: 961–973.

Salhi, Yakoub. 2020. “A Framework for Measuring Information Asymmetry.”

Proceedings of the AAAI Conference on Artificial Intelligence 34: 2983–2990.

Sensier, Marianne, Gillian Bristow, and Adrian Healy. 2016.” Measuring Regional

Economic Resilience across Europe: Operationalizing a complex concept.” Spatial

Economic Analysis : 1–24.

Smith, Julie, Manasi Vora, Hugo Benedetti, Kenta Yoshida, and Zev Vogel. 2019.

“Tokenized Securities and Commercial Real Estate.” SSRN Electronic Journal https://mitcre.mit.edu/wp-content/uploads/2019/11/Tokenized-Security-Commercial-Real-Estate2.pdf

Soliwoda, Michal, Joanna Pawłowska-Tyszko, Jacek Kulawik, and Grzegorz Konat.

2018. “Holistic risk management as a response to budgetary constraints.” Conference

Paper. doi: 10.30858/pw/9788376587516.2

Song, Jinbo, Honglian Zhang, and Wanli Dong. 2016. “A review of emerging trends in

global PPP research: analysis and visualization.” Scientometrics 107(3): 1111–1147.

Soroka, Anthony, Gillian Bristow, Mohamed Naim, and Laura Purvis. 2019. “Measuring

regional business resilience.” Regional Studies 54(6): 838–850.

Spoann, Vin, Takeshi Fujiwara, Bandith Seng, Chanthy Lay, and Mongtoeun Yim. 2019.

“Assessment of Public–Private Partnership in Municipal Solid Waste Management in

Phnom Penh, Cambodia.” Sustainability 11: 1228.

Struben, Jeroen, David R. Keith, and John Sterman. 2015. “Social Influence and

Spatio-Temporal Diffusion of New Durable Products: The Toyota Prius Hybrid Electric

Vehicle in the United States.” Preprint.

Sunley, Peter and Ron Martin. 2014. “On the Notion of Regional Economic Resilience:

Conceptualization and Explanation.” Journal of Economic Geography 15: 1–42.

Tai, Eric. 2017. “Formalizing Contract Law for Smart Contracts.” SSRN Electronic

Journal. doi. 10.2139/ssrn.3038800

Tang, Liyaning, Qiping Shen, Martin Skitmore, and Eddie W. L. Cheng. 2013. “Ranked

critical factors in PPP briefings.” Journal of Management in Engineering 29(2): 164–

171.

Tóbiás, Aron. 2020. “Cognitive Limits and Preferences for Information.” SSRN

Electronic Journal https://doi.org/10.2139/ssrn.3543157

Trang, Mai. 2010. “A Meta-Logical Approach for Reasoning with an OWL 2 Ontology.”

Journal of Ambient Intelligence and Humanized Computing 3(4): 293–303

Trebilcock, Michael and Michael Rosenstock. 2015. “Infrastructure Public–Private

Partner- ships in the Developing World: Lessons from Recent Experience.” The

Journal of Development Studies 51(4): 335–354.

Umar, Abdullahi Ahmed, Noor Amila Wan Abdullah Zawawi, and Abdul-Rashid

Abdul-Aziz. 2018. “Exploratory factor analysis of skills requirement for PPP contract

governance.” Built Environment Project and Asset Management doi. 10.1108/

BEPAM-01-2018-0011

US Department of Treasury. 2015. “Expanding the Market for Infrastructure Public–

Private Partnerships: Alternative Risk and Profit-Sharing Approaches to Align Sponsor

and Investor Interests.” Office of Economic Policy, US Department of Treasury.

Vargas, Rocio, Amir Mosavi, and Ramon Ruiz. 2017. “Deep Learning: A Review.”

Advances in Intelligent Systems and Computing 5(2).

Viljanen, Mika. 2020. “Actor-Network Theory Contract Theory.” European Review of

Contract Law 16: 74–94.

Wang, Huanming, Wei Xiong, Guandong Wu, and Dajian. Zhu. 2018. “Public–

private partnership in public administration discipline: a literature review.” Public

Management Review 20(2): 293–316.

Wang, S., J. Zhang, and H. Wang. 2013. “Dynamic Bayesian network method for causal

analysis between enterprise operation indexes.” ICIC Express Letters.

Waring, Alan. 2003. “Holistic Risk Management in Practice.” Risk Management 5:

83–84.

Wei, Likai. 2019. “AI-Design: Architectural Intelligent Design Approaches Based on

AI.” DEStech Transactions on Engineering and Technology Research. https://www.dpi-proceedings.com/index.php/dtetr/article/view/28985/28001

World Bank Institute. 2012. “Public-Private Partnerships – Reference Guide Version

1.0.” The World Bank.

Wu, Jheng-Long, Liang-Chih Yu, and Pei-Chann. Chang. 2014. “An intelligent stock

trading system using comprehensive features.” Applied Soft Computing 23: 39–50.

doi: 10.1016/j.asoc.2014.06.010.

Xu, Yelin, John F. Yeung, and Shaohua Jiang. 2014. “Determining appropriate

government guarantees for concession contract: lessons learned from 10 PPP

projects in China.” International Journal of Strategic Property Management 18(4):

356–367.

Yao, Yao. 2017. “The Rational and Behavioral View in Project Management.” DEStech

Transactions on Social Science, Education and Human Science doi. 10.12783/dtssehs/

icss2016/9105.