Population ageing poses unique challenges for social security systems. Developed countries, with well-established structures, will face increasing age-related spending. They will require further reforms that balance spending cuts against core promises across generations. Most emerging economies, on the other hand, lack comprehensive social security yet are ageing rapidly. They must establish comprehensive retirement income support structures, universal health services, and publicly supported long term care in a rapidly changing macro-demographic environment.

This policy brief, while bringing a broad perspective to these challenges, focuses ist policy analysis on retirement income, the first frontier in reforming social security systems in an ageing world. In line with the UN’s Sustainable Development Goals, our key policy recommendation is that future social security reforms be re-directed towards a greater emphasis on non-contributory pension programs that can provide a much-needed safety net for older people. These will be the most important structures to deliver the SDGs, especially for emerging economies.

Challenge

1. Background: Rapid population ageing

The last 30 years have seen new social and economic forces emerge which challenge standard models of social security. Population ageing, labour market trends, and uneven growth can compromise the insurance, saving, and redistributive functions of social security and result in fiscal stress.

Developed countries, with established social security systems, are facing increasing age-related spending, which will require further reforms that balance spending cuts against core promises across generations and providing for the most vulnerable. Emerging economies, on the other hand, are faced with the task of establishing comprehensive retirement income support structures, universal health services, and publicly supported aged care in a rapidly changing macro-demographic environment (Chomik and Piggott 2015). For these countries, a range of economic and social trends complicate the issue of appropriate policy structure. Labour market disruption arising from technological change, trade openness, and high levels of informal workforce participation make contributory pension arrangements more difficult to administer. Fewer children, changing social expectations, and large scale regional migration are compromising intergenerational family support structures. The old, who have exhausted their human capital, are exposed to a range of risks that are difficult to insure effectively in the private market. In the absence of public sector intervention, they will become the most vulnerable.

Social security policies need to be designed carefully. For example, policies that delay retirement may translate to less time devoted to the care of family members. Policies that establish universal pensions may appear to distort behaviour less than means tested programs, but are costlier, require higher taxes, and may have more negative impacts. While contributory pension schemes are important, these may inhibit labour force formalisation. Indeed, there is a strong case for expanding non-contributory social security in many countries.

Coordination of policy development within and between G20 countries could generate substantial benefits. For example, some countries need to make greater use of immigrant labour in aged care and offset declining labour forces (Chomik et al 2017). Education policy needs to be redesigned to deal with longer careers where mature age workers need to retrain more often (Chomik and Piggott 2018).

2. Challenge: Addressing SDGs in an ageing world

Nationally appropriate social security programs are at the centre of the Sustainable Development Goals (SDGs). The SDGs envision: (i) social protection with substantial coverage of the poor and vulnerable that insure against economic shocks and address inequality (SDG1 and SDG10); (ii) universally provided health programs, that insure against health shocks and offer access to quality essential health-care services and medicines, and an adequately resourced health workforce (SDG3); and (iii) social programs that recognise the gender dimension of unpaid care via appropriate public services and infrastructure (SDG 5) (UN 2015).

If the goals envisaged under this agenda are to be met globally, then G20 nations – comprising 60% of the world’s population and 70% of the population aged 65 and over – will need to initiate and develop policies that deliver on these aspirations, using policy structures which are fiscally sustainable in the face of demographic change and macro-economically prudent. This is a challenge that developed countries have been wrestling with for some time, with mixed success, and one that emerging economies are beginning to contemplate. How to sustainably address the social security needs of ageing populations is therefore of central importance to the G20. It is also an opportunity to rebalance growth across the G20 – allowing individuals to pool idiosyncratic risks associated with income and health shocks and reducing the need for excessive precautionary savings.

3. The social security needs of older people as a starting point

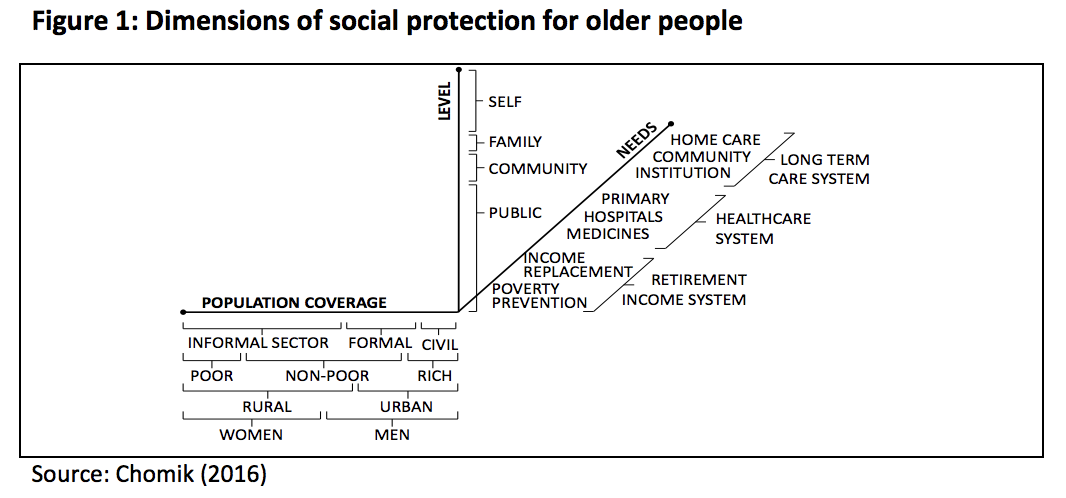

The needs of older people are the starting point in designing appropriate social programs. Chief among them are providing retirement income, health services, and long term care. Other needs commonly addressed via public programs may also be relevant – e.g., housing and social or recreational needs. Each need is addressed to a greater or lesser degree by government, community, family and the individuals themselves, and differences exist for sub-groups within each country’s population (Fig 1).

There is a range of settings which define where each country sits along the different dimensions. For example, developed countries will have a quite small informal sector, whereas in emerging economies, more than half the labour force works in the informal sector, which requires different mechanisms to ensure coverage of social security. It’s a framework for thinking about the extent to which public social security systems can serve older people, allowing a wide diversity of national circumstances to be accommodated. But the public sector, which can pool risks across generations and provide substantial economies of scale, is critical. Some responsibility will remain in private hands: voluntary self-provision of savings, co-payment for healthcare, and especially, informal care provision for old age.

4. How should governments respond?

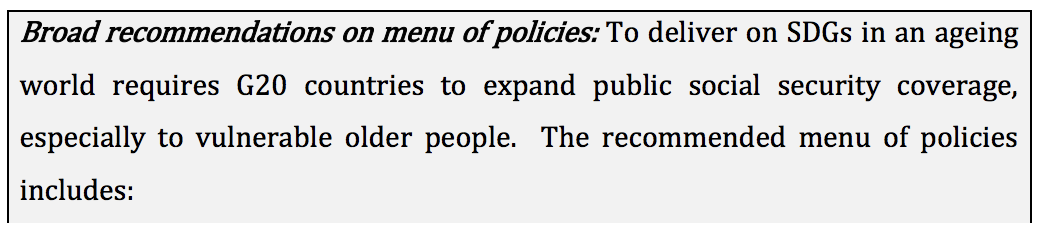

Public policy design should be flexible enough to cope with changing demographic structures and encourage macroeconomic growth, which funds revenue for public outlays. It should also reflect and build on the local context. But there is a broad menu of policies that G20 countries should all sign up to.

Each of these requires a detailed treatment. Because of space considerations, the focus here is on retirement income, the first frontier of social policy reform in responding to an ageing demographic. We also cover macroeconomic considerations that ultimately help fund such social programs. The detail of health and long-term care policy design we leave to other G20 processes. Recommendations relating to retirement income policy are summarised below, followed by a discussion of the evidence.

Proposal

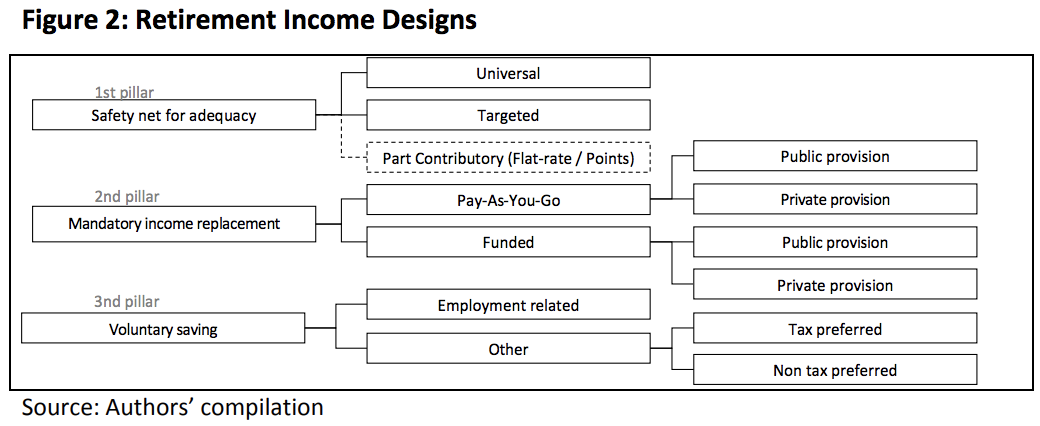

5. What makes a retirement income system? Each country has a different retirement income system. They are best systematised in terms of three pillars (Bateman et al 2001; OECD 2017): see Figure 2.

First pillar benefits are unrelated to an individual’s past earnings and are sometimes referred to as non-contributory or social pensions. The payment, financed out of general revenue, may be universal (i.e., available to all eligible citizens above a certain age) or targeted (i.e., dependent on the retiree’s other resources). It may also depend on a minimum number of years of work, citizenship, or contributions – in this way first pillar schemes may be partly contributory and not strictly a safety net. These schemes serve as a safety net for those without other savings and safeguard against poverty. That is, their primary aim is to ensure a minimum adequacy of retirement incomes.

By contrast, the aim of the second pillar is to provide income replacement – replacing income enjoyed pre-retirement. The benefits are typically related to a person’s salary, based on some defined benefit (DB) formula or on some defined contribution (DC) into a funded or notional (NDC) account. Second pillar benefits can be unfunded, wherein the individual has a legal claim on the future revenues of employers, insurers, or governments, or funded with an underlying accumulation converted into a lump-sum or income stream. Such schemes can be administered through public social security programmes or through private pension funds, at arm’s length from government.

The reason for mandating saving in a second pillar is two-fold. Firstly, without it, some people with capacity to save will nevertheless choose to rely (or “freeride”) on the first pillar (Hayek 1960). This is of most concern in countries with means-tested payments, where lower personal savings mean greater public support. Secondly, mandatory saving acts as a commitment device. Many people may want to and can afford to save a portion of their income for retirement but don’t get around to it, displaying myopic behaviour (Mitchell and Piggott 2016).

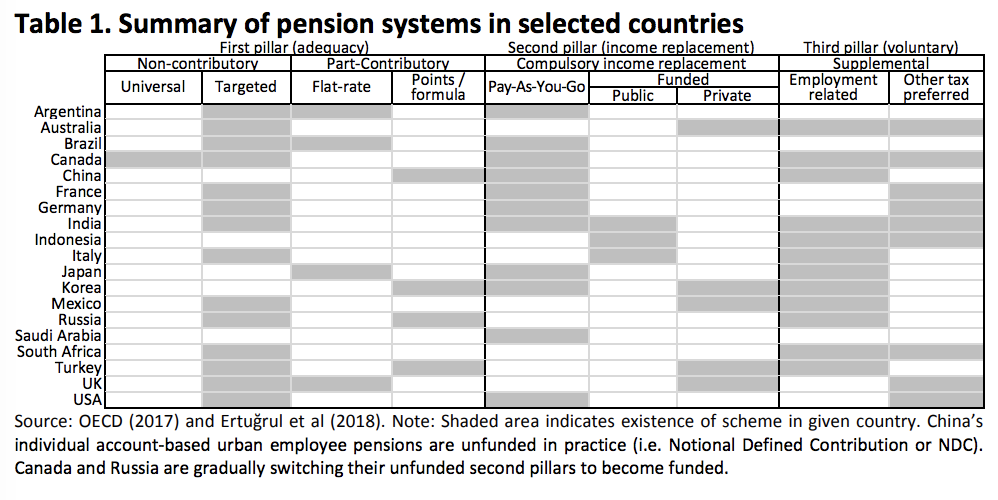

There is also often a third pillar, involving incentives for further voluntary saving, for people who want retirement incomes beyond the mandated level. Most G20 countries have some form of targeted non-contributory pension. In most developed countries this is in the form of social assistance (Table 1). Benefits generally sit between 15 and 25% of average wages, and are heavily means tested, so that only a small fraction of older cohorts receive payouts from these programs. For these countries, the major form of publicly funded retirement income support is a traditional Pay As You Go (PAYG) social security, a Pillar 2 structure.

Many of these Pillar 2 arrangements are now under increasing strain from a demographically-induced decline in the ratio of contributors to beneficiaries. Consequently, some countries have converted to pre-funded or NDC second pillar systems that limit publicly funded second pillar payouts. For emerging economies, the pattern is different. Sometimes, the first pillar does not exist at all or requires some minimum level of contribution. This is the case, for example, in Indonesia, China and India, three G20 countries which between them account for about 40% of the world’s population. Where such structures do exist, payments are often very low, mostly below 10% of average wages. Second pillar structures tend to be uneven, with generous benefits for civil servants. For informal sector workers, which in the emerging G20 countries overall constitute a large minority of workers, and in many cases a majority, no second pillar plan exists at all. This is one reason why countries such as China have developed heavily subsidised part contributory schemes which lie somewhere between a non-contributory safety net and contributory income replacement pillar. These raise coverage but provide little substantive benefit. To deliver on SDGs more is needed.

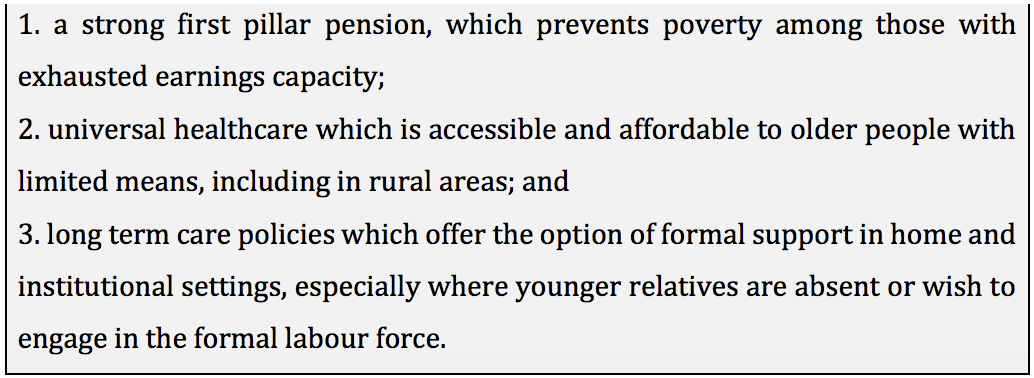

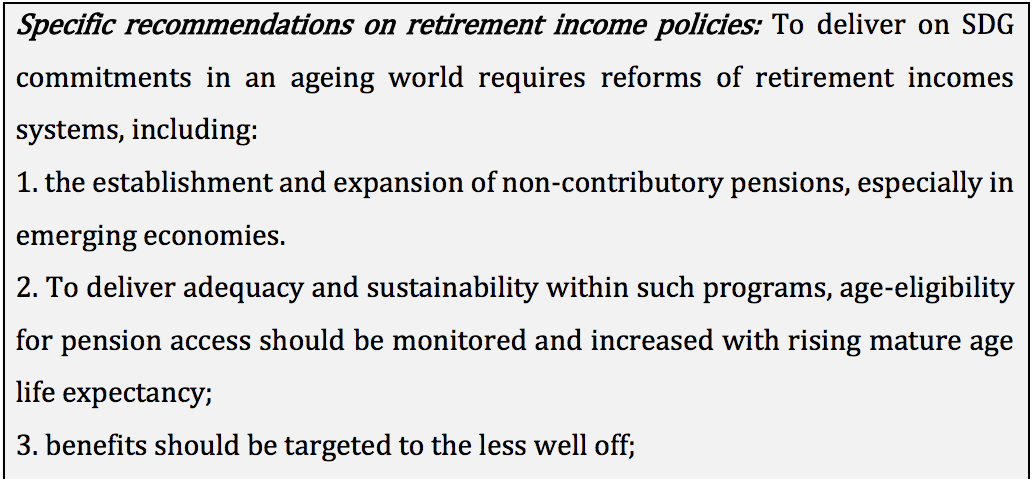

6. How to strengthen first pillar pensions across the G20?

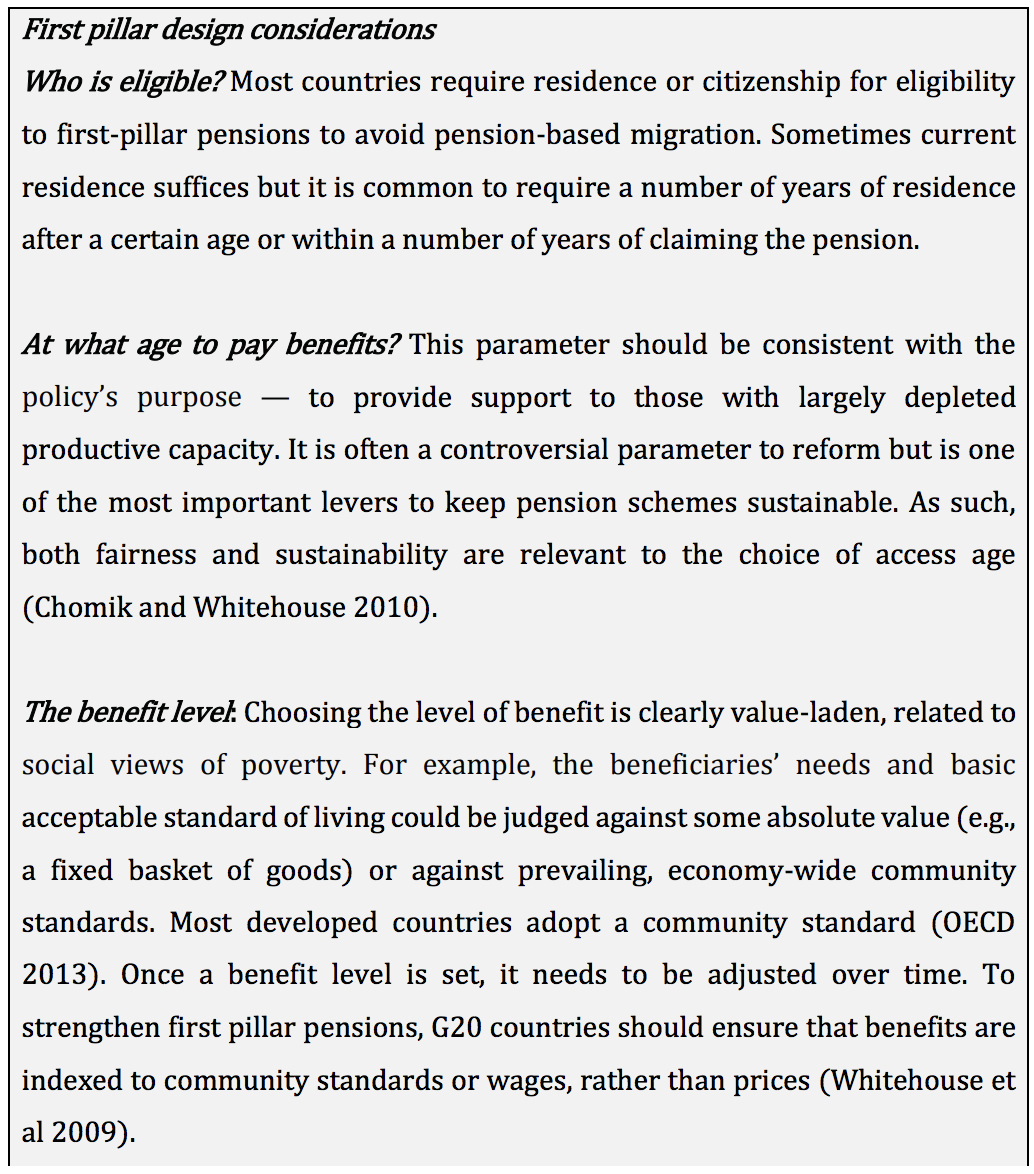

To deliver on SDG commitments the focus of G20 efforts should be on the first pillar. These schemes must be expanded in range and relevance, ensuring that as the world ages, its older and most vulnerable citizens are looked after. This will be important in developed countries as automation makes work more precarious and the gig economy generates more contingent disconnected from contributory structures and in emerging economies with large informal sectors. There are several key choices which need to be made when designing an effective first pillar. For example: What should access age be? How should benefits be set and maintained over time? And should the benefit be meanstested and how? Local values, objectives, and constraints will influence the answer. But existing research and policy experience from across the G20 can guide the policymakers’ hands. Strategies to deliver adequate but sustainable first pillar schemes include ensuring that the benefit is high enough and pegged to wages; but that eligibility age is also high and increased with mature-age life expectancy (at least of the poorest); and that benefits are targeted (generous pensions are likely to operate more efficiently with sharp means-testing; see Chomik et al 2015). The box below summarises some of these design issues.

Population ageing reinforces the sustainability of a means tested design in two ways (Kudrna et al 2018). First, as people live longer, they save more for their retirement, and this will reduce the payouts of a means-tested pension. Second, mortality differentials between poor and rich make a means tested pension equity-enhancing. That is, they provide more pensions to lower income, shorter-lived, residents compared to universal schemes (Waldron 2007; Cristia 2009). In emerging economies, delivery of age-related benefits to people in the informal sector can be challenging (Chomik and Piggott 2018). Various studies examine the efficacy of digital technology in delivering social programs in developing countries. Some of these involve identification and information, others involve payment mechanisms (e.g., Muralidharan et al 2016). These tools can help in delivering first pillar payments in emerging economies. A first pillar, especially if means tested, should be accompanied by a mandatory or heavily incentivised income related scheme, to minimise free-riding. We now turn to such second pillar structures.

7. How to ensure effective and sustainable second pillars across the G20

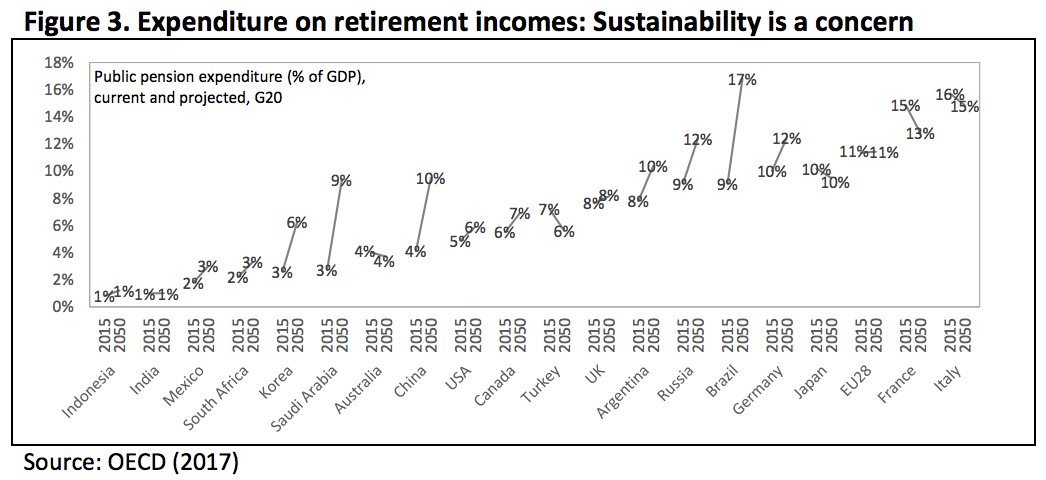

A key issue with second pillar schemes is their sustainability. In many countries, traditional PAYG second-pillar structures are likely to become unsustainable as demographic change takes hold. Some countries have pared back benefits but across the G20 pension spending growth remains of concern. For example, public pension expenditure in Germany has reached 10% of GDP – driven largely by its second pillar – and despite various reforms this is expected to increase to 12% by 2050 (Fig. 3). This is high by global standards, and calls into question the long-term sustainability of the system. Some emerging countries are repeating the mistakes of developed countries. For example, the generosity of China’s and Brazil’s second pillars are likely to see their spending soar in future.

Both the structure and design parameters of the second pillar can affect its sustainability. For example, a pre-funded, defined contribution pillar (e.g., in Australia or Mexico) adjust automatically to the economic and demographic environment – if people don’t contribute enough, retire too early, or live longer they will receive fewer benefits in retirement. The incentive to work and save is clear.

Unfunded, defined contribution schemes can incorporate adjustment mechanisms by, for example, reducing benefits with fewer contributors (e.g., in Germany or Japan) or requiring higher contributions (e.g., in Japan). But the link is obscured by benefit formulas and often overridden for political reasons. The most radical reforms have moved to a pre-funded defined contribution structure (e.g., Canada and Russia). Others implemented a notional defined contribution structure, where individual accounting keeps track of a notional accumulation, and annuity type benefits are paid at retirement.

Where sustainability remains a challenge, parametric reforms could include increasing contributions, reducing benefits, or increasing eligibility age. Across the G20 countries have implemented each of these to lesser or greater extent. Currently, Italy has the highest contribution rate at 33% of earning, well above the G20 average of 19%. Australia, Indonesia, Korea, and Mexico set the contribution rate at less than half the average. Eligibility age has also gone up but is not keeping up with life expectancy.

Among emerging countries, sustainability is of less concern. Here, a lack of coverage of the second pillar is the greatest challenge. The driver is high levels of informality. Informal employment is defined as unregistered, unregulated or unprotected remunerative work or non-remunerative work in an incomeproducing enterprise. It is especially prevalent in emerging economies, ranging from a third of total employment in South Africa to over 80% in India and Indonesia. Developed country rates are non-trivial, at between 10% in France to almost 20% in the US. A trend to a more flexible workforce, may see such numbers increase and the reach of second pillar pensions decline. Efforts to incentivise informal workers into second pillar pensions may need to involve heavy subsidies (e.g., as in China) but if these are not unwound, the schemes could in turn become less sustainable.

While strategies to contain public costs via better targeting of the first pillar and better self-provision in the second pillar are important, policies that affect economic activity – which in turn provides a tax base for public revenue – are critical during the demographic transition.

8. How can social security contribute to macroeconomic integrity across the G20?

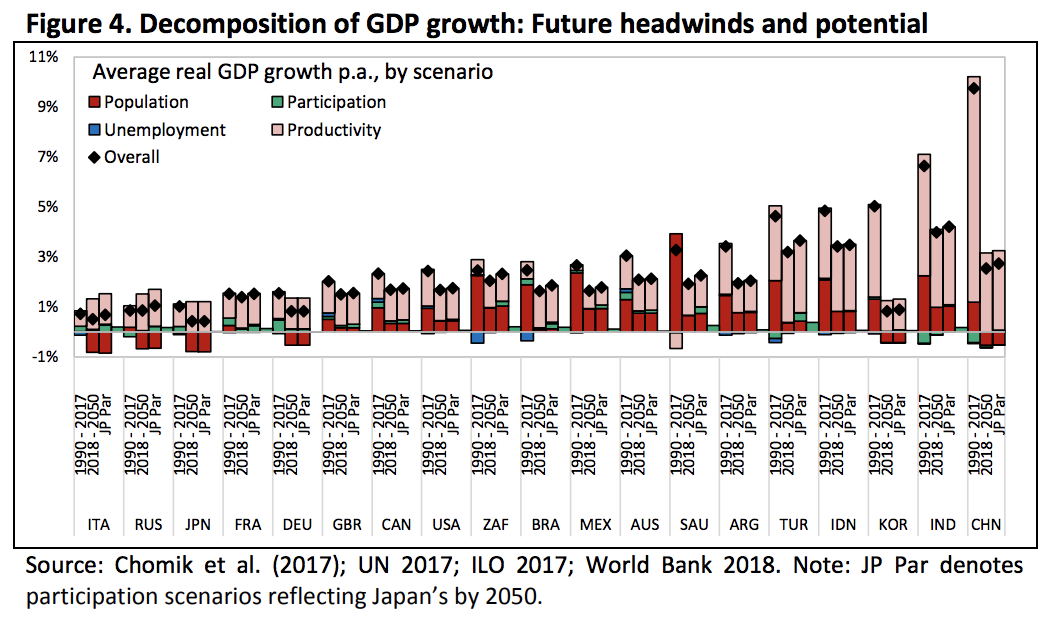

Economic activity can be decomposed into the population available for work, the proportion in employment, and the average level of productivity of workers. This Population-Participation-Productivity framework lends itself to long-term modelling of the aggregate supply-side of GDP. Here we track the composition of GDP growth across the G20 between 1990 and 2050 (1). The calculations are based on the product of historic and projected data relating to (1) population by 5-year-age-group and sex from UN (2017); (2) labour force participation by 5-year-age-group and sex from ILO (2017); (3) unemployment by age (ages 15-24, 25+) and sex; and (4) productivity (GDP per worker, calculated as a residual based on historic GDP estimates from World Bank, 2018, and assumed to converge over the projection). As shown in Figure 4, each factor contributes to the average annual changes in real GDP (2). Between 1990 and 2017, the Chinese, Indian, and Korean economies grew fastest, at between 5% and 10% per annum; those of Italy, Russia, and Japan grew slowest, at 1% or below.

In future, economic growth across the G20 is projected to slow, from an (unweighted) average of 3.2% per annum between 1990 and 2017, to 1.8% between 2018 and 2050. Those projected to grow fastest, with rates of 3% or above, include India, Indonesia, and Turkey. China is expected to slow dramatically by 2050 – it is expected to have a modest average growth of 2.5% p.a. over the period. The results illustrate how population was a strong contributor to economic growth in the G20 in the past, but that its impact will be less future and in some cases it will be negative.

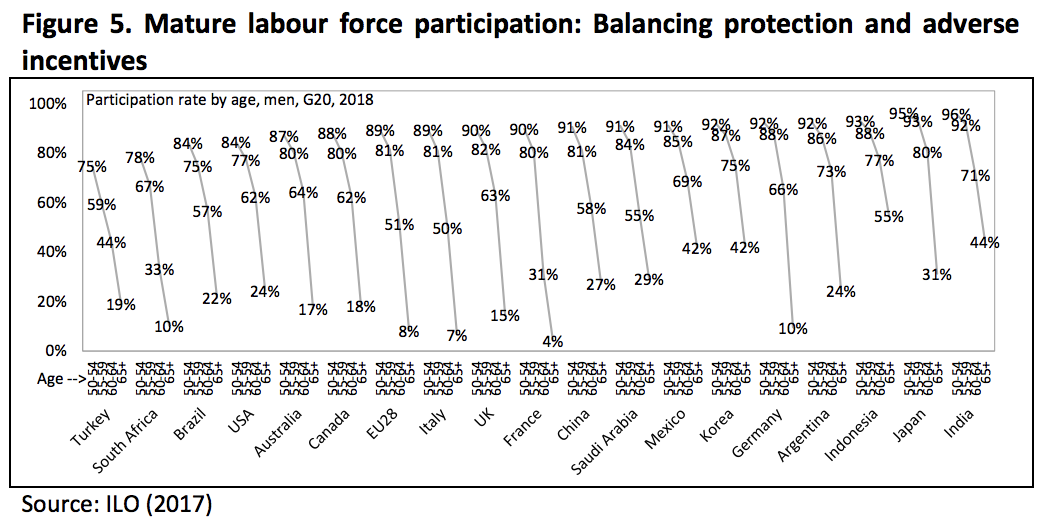

Social security design can impact these outcomes. For example, if raising the access age to pension increases labour force participation, then both pensions cost less and GDP increases. The third column for each country in Figure 4 shows projected real 2018-2050 GDP growth if the participation rate for those aged 55-64 increased to match the level seen in Japan. The outcome is an annual real GDP growth of 1.94% on average. Countries expected to benefit more are Italy, India, South Africa, Brazil, Saudi Arabic and Turkey, with extra GDP growth of above 0.2%. This is because in some countries participation of older workers drops faster with age than in others (Fig 5). Similarly, improved health policies can impact productivity. In thinking about what structural features a sustainable social security policy might have, it is critical that it should be thought of not only in terms of moderating liabilities, but also in terms of its impact on GDP. Finally, it is worth mentioning that robust migration policy may help raise growth in smaller, ageing countries. Such strategies would require various labour and social security protections and pension portability would need to be in place for migrants. As becomes apparent, well designed social security can be sustainable and result in inclusive growth across the G20.

References

• Bateman, H., G. Kingston and J. Piggott (2001) Forced saving: Mandating private retirement incomes, Cambridge University Press, Cambridge

• Chomik, R., (2016) ‘Sustainable Development Goals, population ageing, and social security in Asia’, CEPAR Working Paper 2016/23, presented at the United Nations Expert Group Meeting on ‘Changing population age structures and sustainable development’, New York, 13-14 October.

• Chomik, R., and E. Whitehouse (2010) ‘Trends in pension eligibility ages and life expectancy, 1950-2050’ OECD Social, Employment and Migration Working Papers, No. 105, OECD Publishing, Paris

• Chomik, R., and J. Piggott (2015) ‘Population Aging and Social Security in Asia’, Asian Economic Policy Review, 10, 2, 199-222.

• Chomik, R., and J. Piggott (2018) ‘Population ageing and technology: Two megatrends shaping the labour market in Asia’. Keynote Paper prepared for the ADB Conference on ‘Technology and the Aging Workforce’, Korea University, Seoul, Korea, 17-18 May 2018

• Chomik, R., J. Piggott and P. McDonald (2017) ‘The impact of demographic change on labour supply and economic growth: Can APEC meet the challenges ahead?’, presented to APEC Forum on Labour mobility, Nha Trang, March 2017

• Chomik, R., J. Piggott, A. Woodland, G. Kudrna, C. Kumru (2015) ‘Means Testing Social Security: Modelling and Policy Analysis’ CEPAR Working Paper

• Commonwealth of Australia (2015) ‘2015 Intergenerational Report: Australia in 2055’, Circulated by The Honourable J. B. Hockey MP Treasurer of the Commonwealth of Australia, Canberra

• Cristia, J. P. (2009) ‘Rising mortality and life expectancy differentials by lifetime earnings in the United States’, Journal of Health Economics 28 (5), 984–995

• Hayek F. (1960) The Constitution of Liberty, Routledge and Kegan Paul, London

• ILO [International Labour Organization] (2017) ‘ILOSSTAT’, https://www.ilo.org/ilostat

• ILO [International Labour Organization] (2018) ‘Women and men in the informal economy: A statistical picture’, International Labour Organization.

• Kudrna, G., C. Tran and A. Woodland (2018) ‘Sustainable and Equitable Pensions with Means Testing in Aging Economies’, CEPAR working paper, https://www.cepar.edu.au/publications/working-papers/sustainable-andequitable-pensions-means-testing-aging-economies

• Mitchell, O. S. and J. Piggott (2016) ‘Workplace-linked pensions for an aging demographic’, in Handbook of the Economics of Population Aging (Vol. 1, pp. 865- 904), North-Holland

• OECD [Organisation for Economic Cooperation and Development] (2014), Budgeting Practices and Procedures in OECD Countries, OECD Publishing, Paris

• OECD (2013) Pensions at a Glance: OECD and G20 indicators, OECD, Paris • OECD (2017) Pensions at a Glance: OECD and G20 indicators, OECD, Paris

• UN [United Nations] (2015) ‘Resolution adopted by the General Assembly on 25 September 2015: Transforming our world: the 2030 Agenda for Sustainable Development’, General Assembly, United Nations, New York

• UN [United Nations] (2017) ‘The world population prospects: 2017 revision’, Department of Economic and Social Affairs, Population Division, United Nations, New York

• Waldron, H. (2007). ‘Trends in mortality differentials and life expectancy for male social security-covered workers by socioeconomic status’, Social Security Bulletin 67, 1

• Whitehouse, E., A. D’Addio, R. Chomik, A. Reilly and J. Seisdedos (2009) ‘What are the prospects for the standard of living of retirees?’ International Social Security Association, Paris • World Bank (2018) ‘GDP (constant 2010 US$)’,