The Group of Twenty (G20) includes the world’s largest fossil fuel producers and consumers. Deep transformations in energy-consuming behavior and technology and widespread enhancement of carbon sinks are necessary for these countries to achieve net-zero emissions in alignment with Paris-compliant temperature limitation thresholds. However, policies that focus on actions to enhance carbon sinks are largely lacking. To address this gap, we propose a phased policy approach that starts as a technology mechanism and leads toward balancing the rates of carbon extraction and deposition from and to the geosphere, implemented according to fossil carbon extraction and supply. Increasing climate action on the supply side of global fossil energy markets can enable new forms of cooperation between major fossil fuel producers and users. Such cooperation can accelerate and enhance climate ambition alongside efforts to price carbon emissions.

Placing value on carbon storage through our proposed carbon storage unit creates a vital bridge between current carbon pricing policies and higher cost geosequestration abatement technologies. The G20—as a mix of major fossil fuel exporters and importers—presents an ideal forum to initiate the concept by establishing a carbon storage valuation standard with multilateral support and by adopting cooperative policies that drive value for geologically storing carbon.

Challenge

The 2018 Intergovernmental Panel on Climate Change (IPCC) Special Report on 1.5°C (IPCC 2018) emphasized the necessity of deploying a wide variety of solutions to combat climate change. These include carbon capture and storage (CCS) and negative emissions technologies (NETs) such as direct air capture with carbon storage (DACCS) and bio-energy with CCS (BECCS). While the enhancement of terrestrial carbon sinks (e.g., afforestation and reforestation) can also be an important component of the netzero transition, the scale of sequestration required for safe storage of CO2 away from the atmosphere on a multi-century timescale highlights the need for secure, longterm geosequestration. Without massive deployment of geological CO2 storage, the world will almost certainly face global temperature increases well above 1.5°C before the end of the century, which will culminate in dramatic consequences for ecosystems and societies.

With the exception of the United States, Group of Twenty (G20) member countries are committed to the Paris Agreement and its goal of “holding the increase in global average temperature to well below 2°C above pre-industrial levels and pursuing efforts to limit the temperature increase to 1.5°C.” A decade or so or so ago, the reaffirmation of the cumulative stock problem posed by greenhouse gas accumulations in the atmosphere—and the establishment of the associated notion of a “carbon budget”— in the global climate policy debate led to the idea of setting finite limits for the total allowable global emissions under different warming limitation scenarios (e.g., Allen et al. 2009). A carbon budget therefore means that any commitment to a given warming limitation target also includes a tacit acceptance that once the associated atmospheric resource is exhausted, global emissions and removals must remain in balance or at “net-zero” thereafter to avoid further warming. However, most modeled trajectories of Paris-compliant global emissions show significant gross emissions even after the point of net-zero (IPCC 2018). In other words, fossil fuels are likely to remain an important energy vector in industries like maritime shipping, aviation, iron and steel, chemicals, and cement production beyond 2050[1]. In the second half of this century, emissions from these sources will need to be continuously offset through corresponding enhancements in carbon sinks in order to restrict additional increases in mean global temperatures.

Without enduring policies that attribute value to the act of storing CO2, the sink enhancements and mass of permanently stored carbon needed to offset activities with hard-to-abate fossil carbon emissions will not be deployed at the requisite scale and speed.

Presently, sequestration-based geoengineering technologies face at least two major development challenges.

- There is no well-defined policy framework that effectively incentivizes the permanent storage of carbon in non-atmospheric pools. Present policy frameworks, such as carbon pricing under capped emissions trading schemes, are largely tied to low and volatile carbon prices. These provide only weak incentives for the deployment of CCS and no incentive for NETs (Zakkour, Kemper, and Dixon 2014). Efforts over the past decade or so to deploy CCS through carbon pricing alone suggest that a linear business model that passes the carbon price value down the chain from capture to transport and storage does not work effectively outside of niche and captive situations (for example, Sleipner, Snøhvit, Quest, Decatur, Santos Basin, and Gorgon CCS projects are all captive, single-entity projects). Experience suggests that fully private multi-party CCS projects seem to work best where commercial markets allow prices for physical CO2 to form between capturers, shippers, and storers, as is the case with CO2- enhanced oil recovery operations (e.g., Petro-Nova, Boundary Dam, and Jilin CCS projects). Thus, the permanent storage of carbon is a valuable activity, but few policies have explicitly recognized this in a manner that is separate from emission reductions.

- Carbon sequestration solutions are at various stages of maturity and encompass a wide variety of costs, ranging from near-market viability to longer-term potential. These differences, in addition to the technical variations in the scale and permanence of carbon storage need to be addressed in an effective policy package. Thus, CCS and NETs need targeted policy support in order to be deployed in time to achieve net-zero in the second half of this century.

In sum, there is an urgent need for the G20 to formulate not only more targeted policies but also to implement measures that enhance the cost-effectiveness and deployment rate of CCS and NETs.

Proposal

Our proposal aims to unify support among the G20 countries for a new international effort to measure and value actions to enhance geological carbon sinks.

The concept centers on bringing geological carbon stocks under a policy target that balances fossil carbon extraction (e.g., fossil fuel production, limestone extraction for cement making, etc.) with carbon deposition in stable sinks (i.e., geosequestration). Such a policy perspective aligns with Saudi Arabia’s G20 Presidency’s focus on a circular carbon economy (Williams 2019) as it offers a unified pathway to value carbon rather than treating it entirely as a negative externality.

A sequenced set of policy actions based on this concept, as outlined below, can collectively accelerate the deployment of carbon geosequestration and thus reinforce the G20’s ambitions in these respects, including, inter alia (Ministry of Foreign Affairs, 2019):

Strengthening and expanding ongoing international efforts in support of carbon capture utilization and storage under frameworks such as the Clean Energy Ministerial (CEM), Mission Innovation, the International Energy Agency Greenhouse Gas R&D Programme, and the Carbon Sequestration Leadership Forum; and,

Developing policy and regulatory frameworks that reduce the investment hurdles for CCS (and are in line with national efforts of major G20 members like the US).

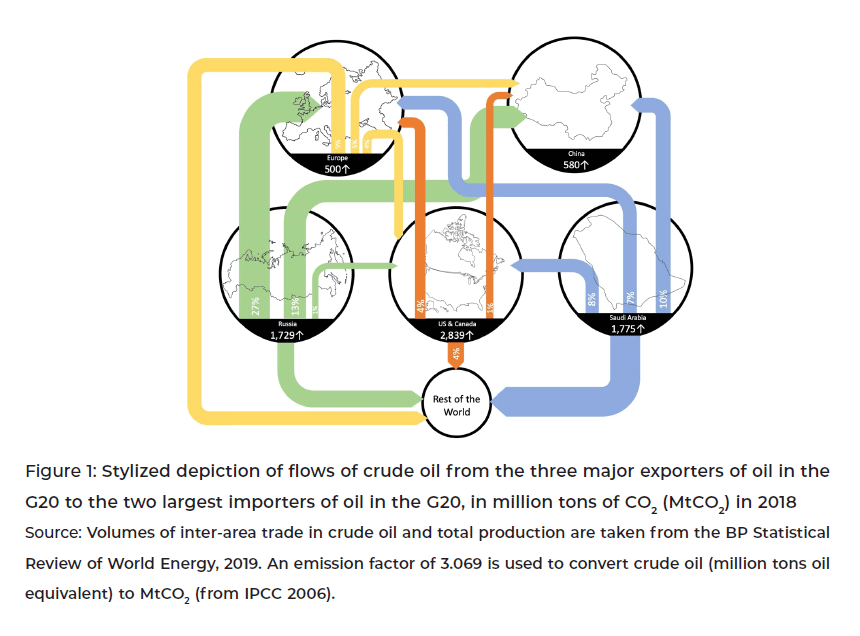

The G20 is a powerful forum that can enable the concept to be developed. Its members presently include net exporters of fossil carbon (e.g., Australia, Russia, Saudi Arabia, Canada), net importers (e.g., Japan, Germany, Italy, the United Kingdom), and countries with the potential to have a more even balance (the US) (see Figure 1). Relative carbon production and import imbalances among various G20 members and the related international flows of carbon embedded in fossil fuels present possibilities for better balancing the positions between countries using CCS and NETs and the trading of certificates of carbon storage, as described below.

Proposal I

G20 members support the establishment of a carbon storage unit

A carbon storage unit (CSU) can provide a monitored, verified, trusted, and transferable record of the addition of one ton of CO2 to carbon sinks; primarily, geological CO2 storage sites (Zakkour and Heidug 2019).

Where policy creates value for CSUs (see II and III), a price signal for storing carbon is generated. This price can complement the value for emission units typically applied to users of fossil fuels in demand-side climate policies (e.g., carbon pricing instruments like capped emissions trading schemes applied to countries, regions, and industrial emission sources). Carbon pricing policies typically employ units that measure either emissions (i.e., allocated emission allowances or rights, such as assigned amount units (AAUs) to Annex I countries under the Kyoto Protocol or various units allocated to industrial facilities in regional cap-and-trade schemes) or emission reductions (e.g., credits against a baseline in project-based instruments, such as certified emission reductions (CERs) under the Kyoto Protocol’s clean development mechanism, that also avail the holder with a right to emit[2]).

On the other hand, because CSUs measure carbon stored in the geosphere, they would be applicable for fossil fuel producers (and importers) as offsets against carbon extracted from the geosphere (and imported by major users). Consequently, they can offer a complementary climate policy tool on the supply side of fossil energy markets alongside carbon pricing policies applied to fossil fuel users[3]. On this basis, CSUs can:

- Provide new options in the policy toolbox by offering a basis to incentivize fossil fuel producers to undertake CCS and DACCS (see #2, #3, and #4 below).

- Create a new price signal for CO2 storage activities, which can create a market for physical transactions of CO2 among capturers, shippers, and storers, thus helping unlock new business models for geosequestration when compared with the linear approach of using carbon pricing alone (see #2 and #3).

- Tag and track fossil fuels as they move through the energy supply chain, thus allowing producers to demonstrate the degree to which their products and activities might be considered “Paris-compliant” as either “low-carbon” or “decarbonized” fuels (see III)[4].

- Provide an additional layer of targeted finance for geosequestration technologies whose costs generally exceed the levels of incentives on offer from carbon pricing policies (see II and III).

Where rates of fossil fuel production from the geosphere can be entirely balanced by corresponding additions of carbon to the geosphere as measured by CSUs, a Pariscompliant mitigation pathway can be achieved (see III).

By increasing climate action on the supply side of global fossil energy markets, new forms of cooperation between major fossil fuel producers and users can be established in order to accelerate and enhance climate ambition alongside efforts to price carbon emissions.

We suggest that CSUs:

- Be established at an international level in a manner that builds confidence and trust, using channels such as Article 6 of the Paris Agreement and/or plurilateral platforms such as the CEM and related cooperation (e.g., with the Oil and Gas Climate Initiative);

- Focus initially on geosequestration of CO2 rather than on other types of less stable terrestrial sink enhancements. Terrestrial carbon sinks are inherently vulnerable to short-term disturbance and risk of carbon reversal;

- Apply to CO2 captured from both point source emissions (i.e., CCS) and directly from the air (e.g., DACCS).

Proposal II

G20 to cooperate on policies and actions that create and drive initial demand for CSUs

The establishment of CSUs as proposed offers several pathways to drive investment in geosequestration and to deliver more ambitious climate action. However, as this is a departure from established global climate policies, there is an inevitable need for a phased approach that provides time for the concept to develop and mature. For this reason, we propose that G20 members cooperate to pilot the approach with a view to scaling up over time.

There are at least two approaches that the G20 can take to pilot storage crediting concepts centered around CSUs:

- Bilateral channels: CSUs can be piloted through existing bilateral schemes to support mutual climate goals, such as Japan’s Hydrogen Strategy, or through other novel forms of cooperation based on decarbonizing fossil fuels. The latter can include piloting extraction-based carbon accounting by major fossil carbon producers (either partial or through parallel accounts) that stipulate conditions for the zero-rating of fossil fuel emissions by major users (e.g., an individual importing country or sector, such as the aviation sector in conjunction with the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA) and its lowcarbon fuels initiative).

- Multilateral channels: A wider group of G20 members with interest in continuing fossil fuel use in a Paris-compliant manner could establish a “carbon storage club” that pools funding in order to procure CSUs from prospective storage site operators (Zakkour and Heidug 2019). The approach would essentially form a targeted international geosequestration technology support mechanism using resultsbased finance. The fund would be paid out to operators in return for surrendered CSUs. Rather than setting a fixed price for storage activities as with 45Q tax credits in the US[5] an open tender process or reverse-auction design can be used to enhance price discovery and cost efficiency. The “carbon storage club” can be established under existing channels and frameworks (e.g., CEM) or under a new initiative within the auspices of the cooperation framework under Article 6 of the Paris Agreement.

These early phase actions can accomplish several important and related goals that are presently beyond the scope of climate policies:

- Incentivize the avoidance of emissions to, or removal of carbon from, the atmosphere through its transfer into the geosphere.

- Provide a dedicated technology mechanism for CCS and DACCS that supports the deployment and scaling up of these essential technologies; and

- Facilitate a policy pathway that supports private sector commitments to net-zero emissions on the supply side of fossil fuel value chains (e.g., Occidental Petroleum, BP, Shell, Total, and Repsol “net-zero pledges” to address scope 3 [or embedded] emissions in their products), as well as other significant actors with interest (e.g., Microsoft’s commitment to achieve net-negative emissions in part using geological storage). CSUs can provide a common framework to ensure that such voluntary commitments are effectively tracked using an internationally trusted and verified measurement methodology.

The pilot phase described here requires government funding to enable the CSU framework. However, if the pilots prove successful, the private sector will play a key role in scaling up, with governments exploring systematic and enduring policies built upon CSUs (see III).

The total domestic production of crude oil is shown in Figure 1 for specific G20 members in their individual circles. The export of crude oil is expressed as a percentage of total production. Small flows (<15MtCO2/year) and imports of oil from non-G20 members have been omitted. CSUs representing stored carbon in one country can be used as a financial instrument to balance carbon stocks. For example, CSUs generated by the domestic storage of CO2 in Saudi Arabia can be sold to China to offset some, all, or even more than the carbon content of Saudi oil exported to China. The significant movement of oil from Canada to the US (not shown; 507 MtCO2/year) is noteworthy.

Proposal III

G20 to consider policies and measures that drive long-term demand for CSUs toward net-zero

Establishing CSUs offers significant potential to support an orderly transition to netzero emissions. Conceptually, a steadily increasing effort by fossil carbon extractors to offset their actions through the equivalent storage of carbon in the geosphere can ultimately lead to net-zero CO2 emissions (an approach that can be referred to as “SAFE-carbon,” following Allen, Frame, and Mason 2009)[6]. The approach also presents a pathway to “virtual” decarbonized fossil fuels where rates of carbon extraction and deposition converge. CSUs can provide the building block on which such approaches may be based.

Building on the “SAFE-carbon” concept, G20 members can explore and coordinate transitioning away from pilot approaches (outlined in II) toward more enduring and systematic policies based on CSUs. Approaches can be undertaken incrementally and predictably through an escalating percentage of the carbon contained in fossil fuels being offset, demonstrated by the origination of CSUs from increasing amounts of geological carbon storage.

The implementation of such approaches can build from various policy pathways. Some of these are as follows:

- Fuel supply regulations such as low-carbon fuel standards (e.g., like those already in force in California, various Canadian provinces, and in the European Union). Countries employing such measures can require a portion of the carbon embedded in imported fossil fuels to be offset by a corresponding supply and surrender of CSUs.

- Voluntary sectoral pledges are made by fossil carbon producers and suppliers toward net-zero, such as those made by oil and gas companies in relation to embedded carbon (e.g., like those of Occidental Petroleum, BP, Shell, Total, and Repsol described above). These companies can demonstrate progress toward their internal targets through origination and/or acquisition and holding of CSUs.

- “Carbon take-back schemes” based on the policy principle of “extended producer responsibility” that is widely employed in the waste management sector (e.g., such as regulations requiring the take-back of electronics waste, etc.). National governments can employ CSUs to implement and measure the level of fossil carbon that must be “taken back” by national fossil fuel suppliers.

In these scenarios, the burden of acquiring CSUs would devolve from governments (as in II) to private sector operators, who can bundle CSUs in varying proportions alongside fossil fuel supplies. Such approaches would constitute a new supply-side carbon offset market in which industries compete to store carbon at the lowest cost to satisfy a ratcheting decarbonization standard. Companies with successful CCS and NETs strategies will gain a competitive advantage through access to major fossil fuel markets. Such a long-term mechanism can support the ongoing geological storage of CO2 up to and beyond the net-zero date, paid for by the private sector.

Proposal IV

G20 to enhance support for negative emission technologies

Policies that support the removal of CO2 from the atmosphere are limited globally, with only the US Federal 45Q tax credit[7] and California’s Low Carbon Fuel Standard currently offering targeted incentives for DACCS. However, NETs will likely be crucial in achieving net-zero emissions, particularly in offsetting hard-to-abate mobile emission sources that are not amenable to capture or by removing the legacy CO2 from the atmosphere.

CSUs, as proposed, can directly support greater development of NETs by:

- Offering a direct incentive and price signal for storing carbon from any source;

- Facilitating the development of geological CO2 storage sites that are critical to the efficacy of both BECCS and DACCS; and

- Allowing countries or corporations wishing to go net-zero or net-negative to use DACCS to generate CSUs as a direct measure of action undertaken in pursuit of these goals.

Technologies such as DAC are in the early stages of maturity and will thus benefit from collaborative action by G20 member countries toward:

- Supporting research, development, and demonstration into different types of NETs;

- Supporting pilot activities to help advance to the commercial deployment stage; and

- Establishing regulatory policies and market-based frameworks and measures to promote investment and enhance commercial deployment.

Potential benefits and advantages of the CSU policy concept

The proposed phased approach would not replace any existing climate policies such as carbon pricing. Rather, it would add to the climate policy toolbox as a parallel and complementary framework to manage carbon stocks operating alongside emission reduction policies. As a suite of climate policies, the phased evolution of the CSU concept offers several advantages:

- Measuring climate progress more effectively: Restating the climate mitigation challenge in terms of ramping up sequestration to 100% of the carbon extracted, rather than focusing solely on reducing net emissions to zero, offers another way of framing progress toward meeting climate goals. This framing may be more relevant or appealing to specific G20 members. For example, countries with significant CO2 storage potential and a desire to continue developing fossil fuel resources on a carbon neutral basis may benefit from incorporating the CSU concept into their nationally determined contributions (NDCs).

- Guaranteeing net-zero: G20 members can ensure that net-zero is achieved by escalating the fraction of carbon stored per unit of carbon extracted. This can be failsafe if the demand-side carbon pricing fails to deliver net-zero (see Asheim et al. 2019).

- Decarbonizing the last 30%: Conventional carbon pricing fails to incentivize abatement at the expensive end of the marginal abatement cost curve (cement, steel, aviation, etc.) until very high prices are reached. However, many technologies that will likely be required to perform this abatement are already understood and available (primarily CCS). Placing value on carbon storage using CSUs can act as a vital bridge between carbon pricing and higher-cost abatement technologies.

- Targeted support for necessary technologies: Renewable energy technologies receive various forms of targeted support to scale up (e.g., feed-in tariffs in several EU member states, the Investment Tax Credit in the US, etc.). Similarly, carbon storage needs explicit support to drive a clear outcome: an increased volume of permanently stored CO2 at ever-decreasing marginal cost. Just as carbon prices increase the cost of fossil fuels, targeted technology support can reduce the cost of storing CO2.

- Transition plan: Directing public funds to CO2 storage (as in II) can be more easily justified when there is an “exit strategy” to ultimately transition to an enduring model in which high-carbon industries take responsibility for storing enough CO2 to neutralize the climate impact of their product (III).

- Creating opportunities to decarbonize: Valuing carbon storage broadens the range of stakeholders that are incentivized to drive global decarbonization. Supplyside CSU-based policy frameworks can allow extractive industries to proactively contribute to climate solutions while offsetting the impacts of their product through commensurately rising CO2 At all stages, the phased policy described in this brief provides directional guidance to the fossil fuel industry in aligning itself with an increasingly carbon constrained world. As the proposed approach is optional, early adopters can continually gauge their efforts against global CO2 storage amounts and reduce ambitions if global technological, economic, or political changes, or revealed risks make CCS less viable as a climate solution.

How can the G20 operationalize these proposals?

The policies and actions recommended above will benefit from being cooperatively implemented by multiple G20 member states, perhaps coordinated by the CEM. As a first step, the CEM can be directed to lead a series of consultations with policymakers, international financial institutions, industry groups (e.g., the Oil and Gas Climate Initiative), and international environmental NGOs. For II—the “carbon storage club” approach where G20 members pool resources to directly incentivize carbon storage through purchase and retirement of CSUs—a suitable entity to steward and disburse the funds should be identified or formed.

Some members of the G20 have existing ambitions for carbon storage that align well with the proposals mentioned above. However, finding effective ways to support the decarbonization of fossil fuels traded among G20 member countries has value for all members in pursuit of their NDC pledges under the Paris Agreement. As influential players in the United Nations Framework Convention on Climate Change process, G20 members can collectively act to mobilize support behind the proposals and, in parallel, support the establishment of CSUs under Article 6 of the Paris Agreement. As much as 82% of G20 energy supply still comes from fossil fuels, and this carbon intensity has remained relatively constant across the group since 1990 (Carbon Pricing Leadership Coalition 2017). The manner in which G20 countries choose to manage their carbon stocks will determine whether the world stays below Paris-compliant warming thresholds or not. The fate of the climate truly lies in the hands of the G20, and policies to explicitly incentivize carbon storage are critical to ensuring success.

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

Allen, Myles R., David J. Frame, Chris Huntingford, Chris D. Jones, Jason A. Lowe, Malte Meinshausen, and Nicolai Meinshausen. 2009a. “Warming Caused by Cumulative Carbon Emissions Towards the Trillionth Tonne.” Nature 458: 1163–1166. https://doi.org/10.1038/nature08019.

Allen, Myles R., David J. Frame, and Charles F. Mason. 2009b. “The Case for Mandatory Sequestration.” Nature Geoscience 2: 813–814. https://doi.org/10.1038/ngeo709

Asheim, Geir B., Taran Fæhn, Karine Nyborg, Mads Greaker, Cathrine Hagem, Bard Harstad, Michael O. Hoel et al. 2019. “The Case for a Supply-Side Climate Treaty.” Science 365: 325–327. https://doi.org/10.1126/science.aax5011.

BP. 2019. BP Statistical Review of World Energy June 2019. London: BP p.l.c. https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energyeconomics/statistical-review/bp-stats-review-2019-full-report.pdf.

Carbon Pricing Leadership Coalition. 2017. Report of the High-Level Commission on Carbon Prices. Supported by the World Bank, ADEME and the Ministry of Environment. France.

Davis, Steven J., Nathan S. Lewis, Matthew Shaner, Sonia Aggarwal, Doug Arent, Ines L. Azevedo, Sally M. Benson, et al. 2018. “Net-Zero Emissions Energy Systems.” Science 360: 9793. https://doi.org/10.1126/science.aas9793.

IPCC. 2006. 2006 IPCC Guidelines for National Greenhouse Gas Inventories, Prepared by the National Greenhouse Gas Inventories Programme. Japan: IGES. https://www.ipcc-nggip.iges.or.jp/public/2006gl.

IPCC. 2018: “Summary for Policymakers.” In: Special Report: Global Warming of 1.5°C. https://www.ipcc.ch/sr15/chapter/spm.

Ministry of Foreign Affairs. 2019. G20 Karuizawa Innovation Action Plan on Energy Transitions and Global Environment for Sustainable Growth. https://www.mofa.go.jp/policy/economy/g20_summit/osaka19/pdf/documents/en/annex_16.pdf

U.S. Department of Energy. 2019. “Internal Revenue Code Tax Fact Sheet.” Last modified October 2019. https://www.energy.gov/sites/prod/files/2019/10/f67/Internal%20Revenue%20Code%20Tax%20Fact%20Sheet.pdf

van Ruijven, Bas J., Detlef P. van Vuuren, Willem Boskaljon, Maarten L. Neelis, Deger Saygin, and Martin K. Patel. 2016. “Long-Term Model-Based Projections of Energy Use and CO2 Emissions from the Global Steel and Cement Industries.” Resources, Conservation and Recycling 112: 15–36. https://doi.org/10.1016/j.resconrec.2016.04.016.

Williams, Eric. 2019. Achieving Climate Goals by Closing the Loop in a Circular Carbon Economy. Riyadh: KAPSARC. https://www.kapsarc.org/research/publications/achieving-climate-goals-by-closing-the-loop-in-a-circular-carbon-economy.

Zakkour, Paul D., Jasmin Kemper, and Tim Dixon. 2014. “Incentivising and Accounting for Negative Emission Technologies.” Energy Procedia 63: 6824–6833. https://doi.org/10.1016/j.egypro.2014.11.716.

Zakkour, Paul D. and Wolfgang Heidug. 2019. A Mechanism for CCS in the Post-ParisEra. Riyadh: KAPSARC. https://doi.org/10.30573/KS–2019-DP52.

Appendix

[1] . Recalcitrant emission sources comprised around 9 billion tCO2 (GtCO2) per annum or ~30% of global CO2 emissions in 2014 (Davis et al. 2018). Global levels of these hard-to-abate emissions are expected to rise because of increasing demand, even as emission intensity drops (van Ruijven et al. 2016), and their share of global CO2 emissions will also increase as the easier-to-abate sectors are decarbonized first.

[2] . In these circumstances, CCS either avoids the need to acquire emission rights or generates emission credits that can be interchanged as emission rights. Credits are generated according to a facility’s emissions rate after applying CCS relative to either a facility not employing CCS or another type of baseline (e.g., an electricity grid emission factor). DACCS plants do not readily fit within either of these accounting approaches (Zakkour, Kemper, and Dixon 2014) (also see #4).

[3] . The energy penalty for CO2 capture results in additional CO2 being generated relative to the same facility without CO2 capture, resulting in the mass of CO2 stored being greater than the mass of CO2 emissions avoided.

[4] . This is done by demonstrating through CSUs that a portion or all the carbon embodied in the fuel has been offset by long-term geological sequestration of CO2 in monitored and verified sinks.

[5] . Set to reach $35/tCO2 for enhanced oil recovery (EOR) and $50/tCO2 for the geological storage of CO2, including non-EOR CO2 utilization and direct air capture, in 2026, thereafter escalating with inflation (U.S. Department of Energy 2019).

[6] . Allen, Frame, and Mason (2009) proposed a concept that ramps up sequestration requirements for fossil fuel producers over time in a predictable manner linked to the rate of decline in the remaining atmospheric carbon budget. The authors called this the “sequestered adequate fraction of extracted carbon,” or “SAFE-carbon.” When the remaining carbon budget is consumed, the SAFE-carbon rate would need to be set at 100%.

[7] . For activities exceeding 100,000 tCO2 stored per year, starting before 2024.