This policy brief calls on the Group of Twenty (G20) governments to support a wide range of climate change mitigation approaches in hard-to-abate industries. It uses the Circular Carbon Economy framework, proposed by the Saudi G20 presidency, as an essential means to a low-carbon future through coordinated G20 efforts towards supporting carbon management technology innovations. This enables cooperation to consolidate efforts in upscaling carbon management technologies, and incentivizes carbon-neutralization across hard-to-abate industries. The socioeconomic shock due to the COVID-19 pandemic offers the opportunity for G20 governments to “build back better” using economic stimulus packages leveraging CCE for a more inclusive, resilient, and sustainable future.

Challenge

Reducing CO2 emissions drastically will require the participation of hard-to-abate sectors, such as oil, gas, aluminum, iron, steel, cement, and petrochemicals, as well as heavy transport, which includes heavy-duty road transport, shipping, and aviation. Combined, these comprise a total of 37% of CO2 emissions (IEA 2019a, 2019b, 2019c, 2019d). IPCC models show that reaching the 1.5 °C or 2 °C target cannot be achieved without first reaching emission neutrality, coupled with significantly ramped up efforts to deploy and use negative emission technologies. In turn, these goals cannot be achieved without moving hard-to-abate sectors towards sustainability.[1]

The implications of the COVID- 19 pandemic further accentuate the challenges, as tackling climate change will prove more difficult with countries taking on additional debt to cushion the immediate impacts of the pandemic on their economies. In other words, stimulus packages will determine the rebound rate and charter the way towards a sustainable future. However, short-term stimulus priorities must not take away from clean energy and carbon neutrality targets. Large-scale investment in abatement technologies can benefit from re-energizing economies.

The implications of the COVID-19 pandemic further accentuate the challenges, as tackling climate change will prove more difficult with countries taking on additional debt to cushion the immediate impacts of the pandemic on their economies. In other words, stimulus packages will determine the rebound rate and charter the way towards a sustainable future. However, short-term stimulus priorities must not move away from clean energy and carbon neutrality targets. Large-scale investment in abatement technologies can benefit from re-energizing economies.

The key challenges can be summarized as follows:

- The scale and capital intensity of the transport, building, power, and heavy industries make it hard to transform, given the need for reliable and safe sources, leading to a prolonged “carbon lock in” inertia in the system (Smil 2010.

- Greenhouse gas emissions (GHG) continue to increase, while solutions to address their residence time remain limited due to financial barriers to deployment (Friedmann, Ochu, and Brown 2020).

- Varying national economic and social circumstances limit climate action, as some development areas are prioritized over others. Examples are choosing cheap, abundant, and reliable sources of energy that are carbon intensive, heavily dependent on fossil fuel export revenues, or shifting away from high-energy costs and scarce natural resources towards renewables (Davis and Caldeira 2010).

- Restarting economies following economic recessions has often been addressed by relaxed environmental regulations and less ambitious climate action.

- Impasse on the issues under the Paris Agreement (finance and market mechanisms) while current nationally determined contributions (NDCs) are insufficient even in case of best compliance (UNEP 2019).

- Generally, many NDCs mention “industry,” with fewer mentioning “heavy industries.” Therefore, concrete plans for industrial emissions reductions are rarely featured (Energy Transitions Commission 2018).

- CCS (carbon capture and storage) and CCUS (carbon capture utilization and storage) technology deployment remains slow (Global CCS Institute 2018).

Fossil-fuel-producing countries are exposed to different risk levels of “stranded assets” if the goals of the Paris Agreement are implemented (IEA 2013; Moret et al. 2020). Major fossil-fuel-exporting Group of Twenty (G20) countries such as Saudi Arabia, Australia, Russia, Indonesia, USA, and South Africa, who carry significant weight in climate negotiations, would be significantly affected economically. Specifically, estimates for the cost of stranded energy assets vary from $900bn (FT 2020) to $2.2trn for oil and gas companies (Euroactive 2019). Meanwhile, it is argued that one-third of oil reserves, half of gas reserves, and more than 80% of known coal reserves must remain unused (McGlade and Ekins 2015). Meanwhile, the equivalent of $1–4trn in fossil fuel assets could be removed from the global economy; for example, a loss of only $250bn triggered the 2008 crisis (Mercure et al. 2018).

Sustainable fossil fuel production is relevant for fossil fuel producers, especially for large scale, low-cost producers (e.g., Saudi Arabia) that expect to be “the last producers standing” (Alarabiya 2020). Therefore, coordinated G20 efforts become vital for the endorsement and support of carbon management technologies for carbon-neutral hydrocarbons.

Proposal

The Saudi G20 presidency proposes the concept of a circular carbon economy (CCE) for approaching climate goals, which values all options and encourages all efforts to mitigate carbon accumulation in the atmosphere.

The CCE approach stems from the circular economy or the circularity concept, which is an alternative to the traditional linear economy of make, use, and dispose (McDonough 2020). Specifically, it maximizes the values of materials, products, and processes, while minimizing costs and wastes based on the famous 3Rs—reduce, reuse, and recycle—giving rise to new ways of designing, using, and disposing, such as “cradle-to-cradle” (McDonough and Braungart 2010).

The CCE approach adds the carbon dimension to circularity to reduce carbon emissions through the efficient use and utilization of energy, materials, and processes in the economy. Adding a fourth R to the 3Rs of circularity yields the following approach: reduce, reuse, recycle, and remove carbon/GHGs (Williams 2019; Al Khowaiter and Mufti 2020).

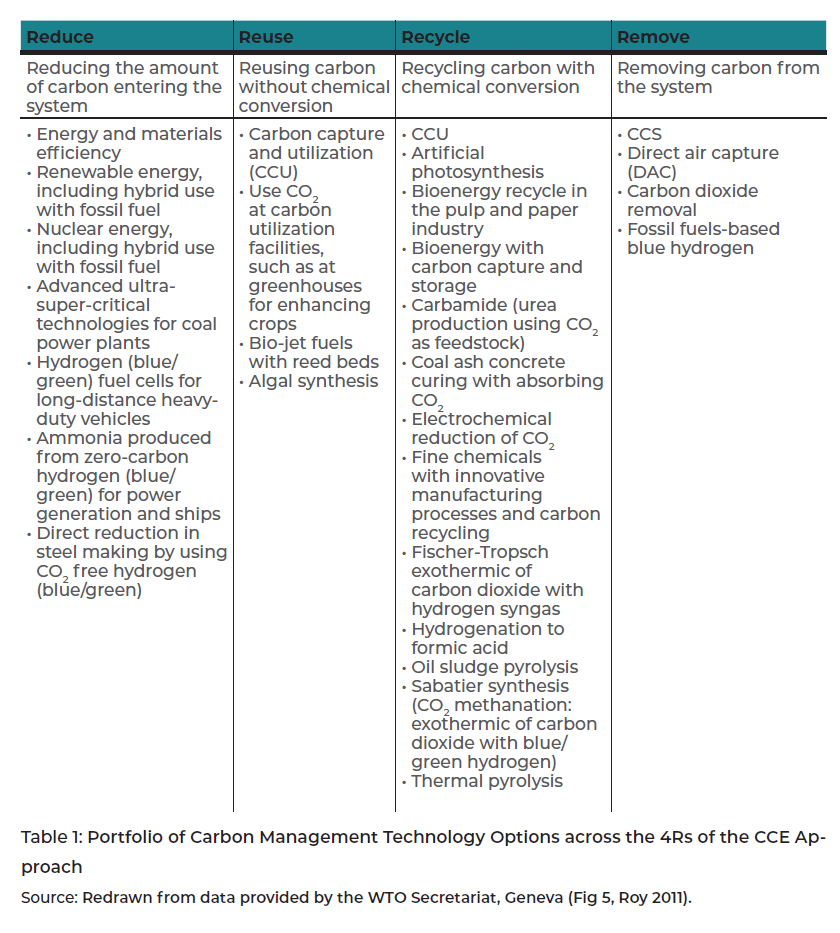

This policy brief explains the role of carbon management technological innovations across the 4Rs of the CCE (see Table 1 and Figure 1) to create sustainability pathways towards carbon-neutral hydrocarbons for the mitigation of CO2 and the costs incurred by oil-based countries and industries to attain the Paris Agreement goals in the second half of the century. Post-pandemic economic recovery stimulus packages are expected to include fossil fuel bailouts, thus emphasizing the need for the CCE framework.

Table 1 provides a comprehensive yet non-exhaustive portfolio of carbon management technology options across the 4Rs at various levels of maturity: emergence, diffusion, and reconfiguration. The development of carbon management technologies allows the industry to continue driving economic development by directing the discussion towards extracting value from carbon rather than considering it a negative externality.

This is especially relevant for fossil-fuel-based industries and economies that are “locked in carbon”[2] (Unruh 1999, 2000). The Carbon Management System of Innovation framework (Mansouri 2013) allows directing efforts towards a CCE future. This could be achieved by spurring carbon management technological innovations and facilitating diffusion across hard-to-abate industries to encourage carbon circularity towards sustainability across the value chain and in an economy. Another solution involves creating pathways towards carbon-neutral hydrocarbons using top-down and bottom-up approaches to facilitate sustainability transitions (Mansouri 2013). This is presented as a guide for governments to accelerate the bottom-up approach of lowcarbon innovations, as well as top-down policies, for a sustainable transition. It views current market dynamics and mature industries as opportunities to mobilize the vast resources of advanced industries and economies in the form of money, competencies, and technological advancement to enhance countries’ innovative capacity for lowcarbon cross-cutting technologies (Mansouri 2013).

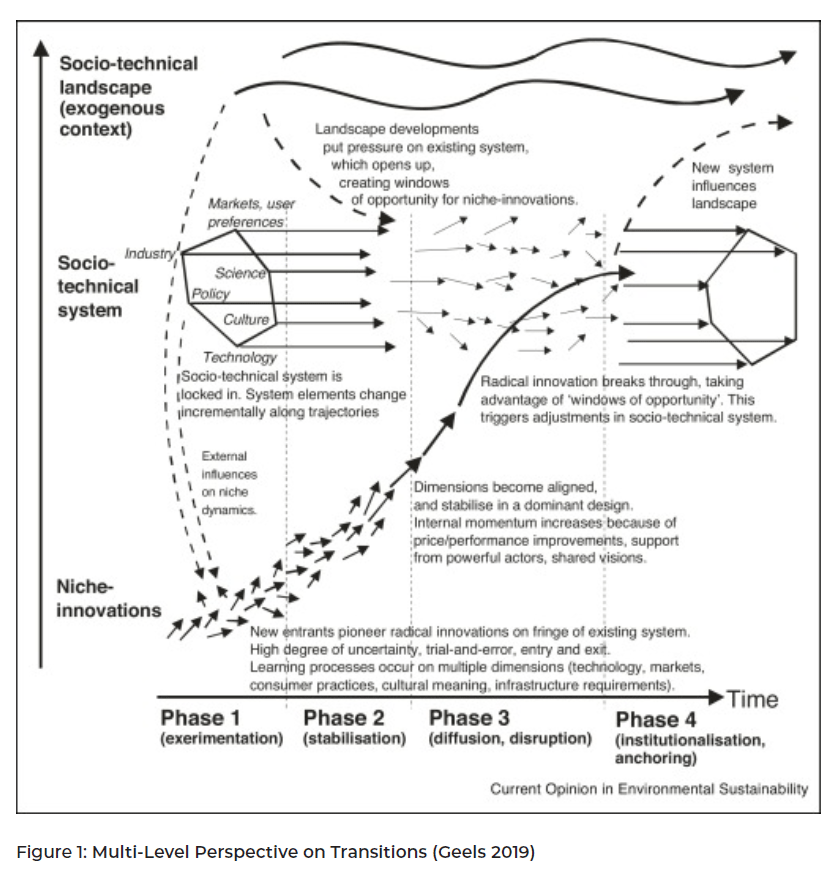

Figure 1 shows the transition of a socio-technical regime (technology, policy, industry, markets, science, and culture) as a complex process determined by the degree to which these areas are “locked in carbon” (Unruh 2000). It is also determined by the nature of path dependencies (infrastructural and economic) (Arthur 1989) and how (technological) momentum (Hughes 1983) could spur innovations and speed up transitions to create systems innovations (Geels 2002). Thus, these factors determine the rate at which systems innovations occur and how they bring change to existing socio-technical regimes and create transition paths towards sustainability (Geels 2002).

Using this perspective, the over-arching socio-technical landscape (i.e., political, cultural, and economic structure; defined today using climate change and the demand for carbon-intensive industrial commodities), the current socio-technical regime of hydrocarbons, and energy-intensive hard-to-abate sectors must transition towards sustainability. For these sectors to be transformed and reconfigured, carbon management technological niche innovations must accelerate and be deployed fast enough to meet climate targets. At the same time, they must minimize stranded assets and the risks faced by existing firms and employees, maintain economic prosperity, and respect developing countries’ rights to emissions and development.

This policy brief calls on the G20 governments to: “build back better” through COVID-19 economic stimulus packages that promote a wide range of climate change mitigation approaches, including CCE as an essential bridge to a low-carbon future.

Proposal I

Support innovations in carbon management technologies including, but not limited to, negative emission technologies such as DAC and CCUS. This can be achieved by investing in R&D and accelerating the commercialization of neutral hydrocarbon technologies to reduce their costs and expand their portfolio and deployment.

Examples of specific innovations in carbon management technologies at commercial or near-commercial stages across the 4Rs include:

1. Reduce:

- Concentrated solar panels to generate the steam needed for heating, while integrating enhanced oil recovery by injecting natural gas and using CCS.

- Using ultra-super critical or integrated coal gasification combined cycles.

- Carbon-free ammonia produced from green/blue hydrogen as fuel for power generation and/or maritime vessels (Wang et al. 2018; The Royal Society 2020).

2. Reuse:

Using captured CO2 for vegetable-growing greenhouses to enhance crop yield to reach photosynthesis potential.

3. Recycle:

- Decomposition and combustion via a pyrolysis process that converts oil sludge into various useful materials, such as liquid fuel.

- Captured CO2 may be used in a petrochemical plant that converts it into urea when combined with synthetic ammonia.

- Ecological concrete production can achieve emissions neutrality/circularity using CO2 storage under infrastructure by concrete materials (CO2-SUICOM) (Yoshioka et al. 2013; Higuchi et al. 2014). Feasible via capturing CO2 emitted from the cement production process and utilizing a special admixture to absorb this captured CO2 in its hardening process and substitute the cement used in concrete production.

- Using process heat waste as energy for industrial purposes.

4. Remove:

Remove carbon from the steel industry through CCUS for enhanced oil recovery and utilize it for cement or with carbon dioxide removal (CDR) technologies or sequester carbon in a saline formation.

Policy tools that enable large scale investments in carbon management technologies include:

- Identify areas of joint concerns and create clubs (Victor 2006) within G20 countries to leverage and coordinate mutual policy instruments and regulations.

- Clarify and constrain choices to existing standards on carbon footprint disclosure to maximize measurement consistency (Carbon Trust 2020).

- Set global standards for carbon circular materials and products (Tecchio et al. 2017) and create a tamper-proof accounting mechanism for abatement using blockchain and artificial intelligence (Khaqqi 2018).

- Deploy targeted national policies that promote low or even negative carbon technologies and industrial processes to reach declining cost curves, with a focus on public procurement conditionality that promotes circularity (Meckling, Sterner, and Wagner 2017).

- Invest in R&D to accelerate the commercialization of carbon management technologies and broaden their portfolio to include emerging and near-commercial technologies, while connecting them to ongoing efforts, such as Mission Innovation or the Combined Heat and Power for Resiliency Accelerator, launched by the US DOE (see the Appendix).

- Develop a comprehensive industrial policy framework for carbon-neutral energyintensive hard-to-abate industries and introduce stringent innovation and marketbased policies throughout the value chain to transition emerging technologies from the development and near-commercialization phases to commercialization and deployment. For instance, performance-based tax credits, such as the 2018 amendment to the 45Q that encourages plants to deploy CCUS technologies (Perry 2018); and support for innovation in CCUS technologies (IEA 2019a), such as the DOE $30 million funding round for R&D in feed studies for carbon capture in fossil fuels plants (DOE 2019).

Proposal II

Institutionalize and incentivize heavy industries and corporate-wide initiatives to manage emissions for achieving climate goals. This can be achieved by utilizing and upscaling existing schemes and creating new policy tools for instituting carbon circularity in the hydrocarbons industry across the value chain. Guide mapping highpriority technologies to be targeted for financing would help align the technology investments of G20 countries. This guide could also provide an estimate of the required level of investment, an indication of the share the private sector could contribute, and suggestions for mechanisms to incentivize the private sector’s participation.

Given the existence of hard-to-abate industries, the global economy’s heavy reliance on carbon and carbon-based products, and the implications of the COVID-19 pandemic that shifts governments’ focus on often fossil-fuel-based short-term economic relief, instituting carbon circularity is important for achieving neutrality. It requires new schemes to support technologies such as CCS and CCUS, while also building on existing efforts in the area of material circularity, which alone can reduce emissions from material by 33%, that is, the equivalent of 364 Mt CO2 per year, including 54 Mt CO2 per year for steel, 100 Mt CO2 per year for chemicals, and 17 Mt CO2 per year for cement (Turner and Mathur 2018). Process circulation suggests minimizing waste by utilizing existing industrial processes with added efficiency improvements.

Policy tools to support the transition of hydrocarbons at the industry level towards CCE:

- Tracking plants producing primary iron, steel, cement, chemicals, aluminum, and plastics and the energy type used for encouraging the identification and disclosure of carbon footprints per ton of primary products within hard-to-abate industries. This should be coupled with additional information such as chemical properties, tonnage, bulkage, and packaging format through interactive maps showing real time plant processes and emissions. Broad climate reporting scheme includes information on GHG emissions, consumption of resources and energy, strategy, practices and policies implemented by companies to address climate change, performance against targets, and main risks and opportunities expected by a company as a result of climate change (OECD 2015). Examples are the advanced mandatory schemes introduced by G20 for companies to report the carbon footprint such as Scope 1 and Scope 2 GHG emissions applied in France, Mexico, United Kingdom, and Australia including verification mechanisms and/or no penalties (OECD 2015). They can be used as a basis for common approaches on introducing carbon disclosure rules on various commodity exchanges.

- Establishing a “CCE fund” that supports all mitigation options and restructuring “green” funds to include carbon management (blue) technologies.

- Introducing “CCE indicators” to track progress on carbon mitigation across the 4Rs and qualifying these efforts by hydrocarbon companies to be included in NDCs.

- Upscaling energy efficiency and intensifying efforts towards economic diversification and job creation by restructuring energy incentives, implementing energy efficiency standards, and developing/enforcing energy performance labelling, such as Minimum Energy Performance Standards.

- Standardizing the definition of the “green supply chain” and “greener” product procurement and market through carbon footprint disclosure and certification per ton of primary product and creating a low-carbon asset class index at various trade exchanges. An example is the metals trade exchange-equivalent with carbon footprint and using LCA and materials passports by the EU.

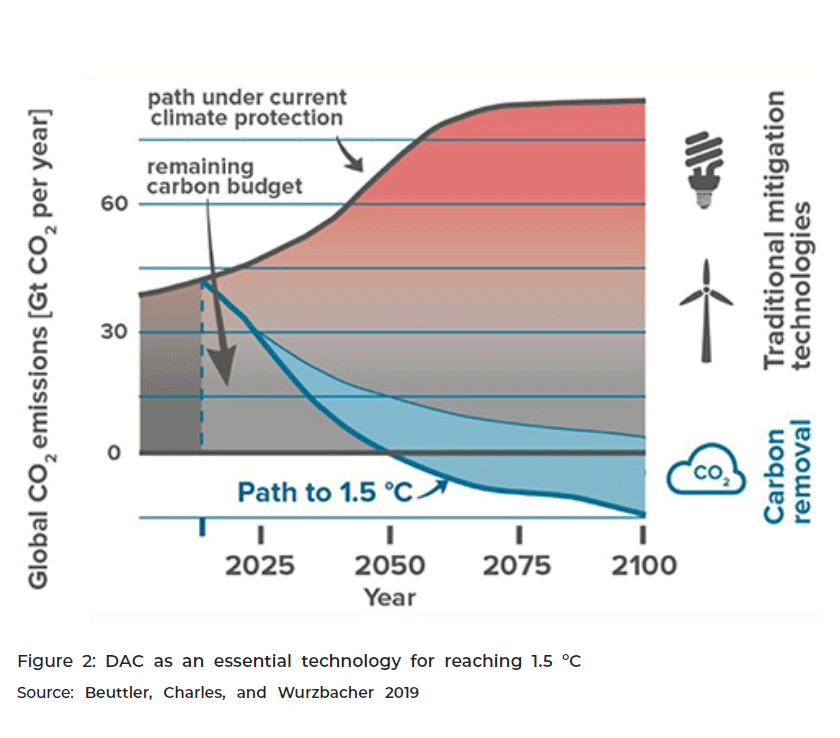

- Rapidly enhancing and scaling up CDR technology penetration, such as DAC (see Figure 2). Although its current operational/maintenance cost and CO2 capturing capacity are considered unfeasible, researchers have predicted a significant decrease in cost and an increase in capturing capacity in the long term. Its early and massive implementation will be vital for cost reduction through cost competitiveness (Babonneau, Haurie, and Vielle 2019; Fasihi, Efimova, and Breyer 2019; Nemet and Brandt 2012; Rubin et al. 2007; van den Broek et al. 2009; Rubin, Yeh, and Hounshell 2004). Without access to carbon management technologies such as CDR, the welfare loss in discounted GDP unit would be 3.8% worldwide, while the worldwide cost falls by 2.8% with access to CDR technologies (Babonneau, Haurie, and Vielle 2019).

Proposal III

Provide a platform for cooperation among nations and consolidate the efforts to manage emissions in hard-to-abate industries. This would require the G20 to emphasize the need to deploy at scale and rapidly, as well as ensure institutional sustainability. This in turn provides powerful institutional structures and good governance principles around carbon-neutralization efforts sustainable in the long run.

This can be achieved by:

- Creating a G20 Working Group on Carbon-Neutral Hydrocarbons to merge existing relevant initiatives that utilize the CCE approach, such as the first Hydrogen Ministerial Meeting held in Tokyo in 2018, International Energy Agency, International Partnership for Hydrogen and Fuel Cells in the Economy, Clean Energy Ministerial, Mission Innovation, Mission Possible, Energy Transitions Commission, and the UN Industrial Transition Leadership group.

- Enhancing international collaboration to reduce the cost of carbon management technologies and increasing the speed of commercialization opportunities for carbon capture technologies for rapid and early deployment.

- Emphasizing the need for the rapid and early deployment of CCS technologies to avoid an increase in costs if deployment is delayed (Leeson et al. 2017).

- Promoting the free flow of information and technological advancements across borders, which facilitate deployment, enhance safety, and improve communication, education, and outreach activities around the deployment of carbon management technologies for carbon-neutral fossil fuels.

- Promoting policy dialogues for the integration of the 4Rs across government departments and between governments and the private sector through multistakeholder partnerships.

Key Recommendations

- Support innovations in carbon management technologies including, but not limited to, negative emission technologies, such as direct air capture and carbon capture utilization and storage. This can be achieved by investing in R&D and accelerating the commercialization of neutral hydrocarbon technologies to reduce their costs and expand their portfolio and deployment.

- Institutionalize and incentivize heavy industry and corporate-wide initiatives to manage emissions towards achieving climate goals. This can be achieved by utilizing and upscaling existing schemes and creating new policy tools for carbon circularity in the hydrocarbon industry across the value chain. Guide mapping for high-priority technologies to be targeted for financing would help align the technology investments of the G20 countries. This process could also provide an estimate of the required investment level, an indication of the share the private sector could contribute, and suggestions for mechanisms that would incentivize private sector participation.

- Provide a platform for cooperation among nations and consolidate efforts to manage emissions in hard-to-abate industries. This approach would require the G20 to emphasize the need to deploy at scale and rapidly, as well as to ensure institutional sustainability. The latter provides powerful institutional structures and good governance principles for carbon-neutralization efforts sustainable in the long run.

Acknowledgement

We are grateful to the following people, who collaborated with us on this policy brief: Frédéric Babonneau, Adolfo Ibañez University; Ahmed Badran, Qatar University; Alain Haurie, University of Geneva; Maxime Schenckery, IFP School-IFPEN; and Marc Vielle, EPFL-LEURE. We are also grateful for the valuable and constructive suggestions by peer reviewers, including Glada Lahn, and Patrick Schroeder, from Chatham House, as well as two anonymous reviewers for their valuable comments. We also wish to thank the coordinating co-chair of this policy brief, Miranda Schreurs, for her guidance and feedback throughout the process.

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

Al Khowaiter, Ahmad O., and Yasser M. Mufti. 2020. “An Alternative Energy Transition Pathway Enabled by the Oil and Gas Industry,” Decarbonization Pathways for Oil and Gas, Forum 121, Oxford Institute for Energy Studies. https://www.oxfordenergy.org/wpcms/wp-content/uploads/2020/03/OEF121.pdf.

Alarabiya. 2020. “Saudi Arabia Will be the Biggest Oil Producer All the Way to 2050: Energy Minister.” Accessed July 01, 2020. https://english.alarabiya.net/en/business/energy/2020/06/25/Saudi-Arabia-will-be-the-biggest-oil-producer-all-the-way-to-2050-Energy-Minister.

Arthur, W. Brian. 1989. “Competing Technologies, Increasing Returns, and Lock-in by Historical Events.” Economic Journal 99 (394): 116–31.

Beuttler, Christoph, Louise Charles, and Jan Wurzbacher. 2019. “The Role of Direct Air Capture in Mitigation of Anthropogenic Greenhouse Gas Emissions.” Frontiers in Climate. https://doi.org/10.3389/fclim.2019.00010.

Babonneau, Frédéric Louis François, Alain Haurie, and Marc Vielle. 2019. “Assessment of Climate Agreements over the Long Term with Strategic Carbon Dioxide Removal Activity.” Accessed April 01, 2020. https://www.optimization-online.org/DB_HTML/2019/06/7240.html.

Moret, Stephan, Frédéric Babonneau, Michel Bierlaire, and François Maréchal. 2020.

“Decision Support for Strategic Energy Planning: A Robust Optimization Framework.”

European Journal of Operational Research 280 (2): 539–554. https://dx.doi.org/10.1016/j.ejor.2019.06.015.

Carbon Trust. 2020. “Carbon Foot printing Software.” Accessed July 30, 2020. https://www.carbontrust.com/resources/carbon-footprinting-software.

Davis, Steven J., and Ken Caldeira. 2010. “Consumption-Based Accounting of CO2 Emissions.” Proceedings of the National Academy of Sciences 107 (12): 5687–92. https://dx.doi.org/10.1073/pnas.0906974107.

DOE (Department of Energy). 2019. “U.S. Department of Energy Announces $30 Million for Front-End Engineering Design Studies for Carbon Capture Systems.” Energy.Gov. Last modified March 14, 2019. https://www.energy.gov/articles/usdepartment-energy-announces-30-million-front-end-engineering-design-studiescarbon.

Energy Transitions Commission. 2018. Mission Possible: Reaching Net-Zero Carbon Emissions from Harder to Abate Sectors by Mid-Century.

Euroactive. 2019. “Oil and Gas Companies Risking $2.2trn in stranded Assets During Low-Carbon Transition, Report Warns.” Accessed April 01, 2020. https://www.euractiv.com/section/energy/news/oil-and-gas-companies-risking-2-2trn-in-strandedassets-during-low-carbon-transition-report-warns.

Fasihi, Mahdi, Olga Efimova, and Christian Breyer. 2019. “Techno-Economic Assessment of CO2 Direct Air Capture Plants.” Journal of Cleaner Production 224: 957–80.

Friedmann, Julio, Emeka R. Ochu, and Jeffrey D. Brown. 2020. “Capturing Investment: Policy Design to Finance CCUS Projects in the US Power Sector.” New York: Columbia SIPA Center on Global Energy Policy. Accessed April 01, 2020. https://energypolicy.columbia.edu/sites/default/files/file-uploads/CCUS-Finance_CGEP-Report_040220.pdf.

FT. 2020 “Lex in Depth: The $900bn Cost of ‘Stranded Energy Assets’”. Accessed April 01, 2020. https://www.ft.com/content/95efca74-4299-11ea-a43a-c4b328d9061c.

Geels, Frank W. 2002. “Technological Transitions as Evolutionary Reconfiguration Processes: A Multi-Level Perspective and a Case Study.” Research policy 31 (8–9): 1257–1274. https://doi.org/10.1016/S0048-7333(02)00062-8.

Geels, Frank W. 2019. “Socio-Technical Transitions to Sustainability: A Review of Criticisms and Elaborations of the Multi-Level Perspective.” Current Opinion in Environmental Sustainability 39 (August 2019) 187–201. https://doi.org/10.1016/j.cosust.2019.06.009.

Global CCS Institute. 2018. The Global Status of CCS: 2019. Australia.

Gollier, Christian, and Jean Tirole. 2015. “Negotiating effective Institutions Against Climate Change.” Economics of Energy and Environmental Policy 4: 5.

Higuchi, Takayuki, Minoru Morioka, Ichiro Yoshioka, and Kosuke Yokozeki. 2014. “Development of a New Ecological Concrete with CO2 Emissions Below Zero.” Construction and Building Materials 67: 338–43.

Howarth, Nick, Natalia Odnoletkova, Thamir Alshehri, Abdullah Almadani, Alessandro Lanza, and Tadeusz Patzek. 2020. “Staying Cool in A Warming Climate: Temperature, Electricity and Air Conditioning in Saudi Arabia.” Climate 2020 8 (1): 4. https://doi.org/10.3390/cli8010004.

Hughes, Thomas P. 1983. Networks of Power: Electrification in Western Society, 1880-1930. Cambridge, MA: MIT Press.Hydrogen Ministerial Meeting. 2018. Tokyo Statement.

IEA. 2013. WEO Special Report 2013. Accessed April 1, 2020. https://www.iea.org/publications/freepublications/publication/WEO_Special_Report_2013_Redrawing_the_Energy_Climate_Map.pdf.

IEA. 2019a. Tracking Clean Energy Progress. Paris: IEA. Accessed April 1, 2020. https://www.iea.org/topics/tracking-clean-energy-progress.

IEA. 2019b. Tracking Power. Paris: IEA. Accessed April 1, 2020. https://www.iea.org/reports/tracking-power-2019

IEA. 2019c. Tracking Industry. Paris: IEA. Accessed April 1, 2020. https://www.iea.org/reports/tracking-industry

IEA. 2019d. Tracking Transport. Paris: IEA. Accessed April 1, 2020. https://www.iea.org/reports/tracking-transport-2019

IEAGHG (IEA Greenhouse Gas R&D Programme). 2014. “CO2 Capture at Coal Based Power and Hydrogen Plants.” Accessed April 01, 2020. https://ieaghg.org/docs/General_Docs/Reports/2014-03.pdf.

Khaqqi, Khamila Nurul, Janusz J. Sikorski, Kunn Hadinoto, and Markus Kraft. 2018. “Incorporating Seller/Buyer Reputation-Based System in Blockchain-Enabled Emission Trading Application.” Applied Energy 209: 8–19. https://dx.doi.org/10.1016/j.apenergy.2017.10.070.

Leeson, Duncan; Paul Fennell, Nilay Shah, Camille Petit, and Niall Mac Dowell. 2017. “A Techno-Economic Analysis and Systematic Review of Carbon Capture and Storage (CCS) Applied to the Iron and Steel, Cement, Oil Refining and Pulp and Paper Industries.” Energy Procedia 114: 6297–6302. https://doi.org/10.1016/j.egypro.2017.03.1766.

Mansouri, Noura Y. 2013. Greening the Black Gold: Saudi Arabia’s Quest for Clean Energy. CreateSpace Independent Publishing Platform.

Masnadi, Mohammad S., Hassan M. El-Houjeiri, Dominik Schunack, Yunpo Li, Jacob G. Englander, Alhassan Badahdah, Jean-Christophe Monfort, et al. 2018. “Global carbon intensity of crude oil production.” Science 361 (6405): 851–3. https://doi.org/10.1126/science.aar6859.

McDonough, William. 2020. “Work with McDonough Innovation.” Accessed April 01, 2020. https://mcdonough.com.

McDonough, William, and Michael Braungart. 2010. “Cradle to Cradle: Remaking the Way We Make Things.” New York: North Point Press, a division of Farrar, Straus and Giroux.

McGlade, Christophe, and Paul Ekins. 2015. “The Geographical Distribution of Fossil Fuels Unused when Limiting Global Warming to 2 °C.” Nature 517: 187–190. https://doi.org/10.1038/nature14016.

Meckling, Jonas, Thomas Sterner, and Gernot Wagner. 2017. “Policy Sequencing Toward Decarbonization.” Nature Energy 2 (12): 918–22. https://doi.org/10.1038/s41560-017-0025-8.

Mercure, Jean-Francois, Hector Pollitt, Jorge Vinuales, Neil Edwards, Phil Holden, U Chewpreecha, Pablo Salas, et al. 2018. “Macroeconomic Impact of Stranded Fossil Fuel Assets.” Nature Climate Change 8: 588–93. https://doi.org/10.1038/s41558-018-0182-1.

Nemet, Gregory F., and Adam R. Brandt. 2012. “Willingness to Pay for a climate Backstop: Liquid Fuel Producers and Direct CO₂ Air Capture.” Energy Journal 33 (1): 53–81.

NEOM. 2020. “NEOM will be the Home to The World’s Largest Renewable Hydrogen Project” Accessed July 11, 2020. https://newsroom.neom.com/neom-will-be-thehome-to-worlds-largest-renewable-hydrogen-project.

OECD. 2015. Climate Change Disclosure in G20 Countries, Stocktaking of Corporate Reporting Schemes.

Perry, Rick. 2018.. “45Q Tax Credit.” Washington, DC: Department of Energy. Last modified December 13, 2018. https://www.energy.gov/sites/prod/files/2019/02/f59/Letter%20from%20Secretary%20Perry%20-%2045Q.pdf.

Rubin, Edward S., Sonia Yeh, Matt Antes, Michael Berkenpas, and John Davison. 2007. “Use of Experience Curves to Estimate the Future Cost of Power Plants with CO2 Capture.” International Journal of Greenhouse Gas Control 1 (2): 188–97.

Rubin, Edward S., Sonia Yeh, and David A. Hounshell. 2004. “Experience Curves for Power Plant Emission Control Technologies.” International Journal of Energy Technology and Policy 2 (1–2): 52–69.

SABIC. 2019. “Sustainability Report.” Accessed April 1, 2020. https://www.sabic.com/en/reports/sustainability-2019/energy-efficiency/greenhouse-gas.

Pinheiro, Janet E. 2019. “Efficiency Among Energy Abundance.” Aramco.com. Last modified December 15, 2019. https://www.aramco.com/en/magazine/elements/2019/energy-efficiency.

Smil, Vaclav. 2010. Energy Transitions: History, Requirements, Prospects. ABC-CLIO.

Tecchio, Paolo, Catriona McAlister, Fabrice Mathieux, and Fulvio Ardente. 2017. “In Search of Standards to Support Circularity in Product Policies: A Systematic Approach.” Journal of Cleaner Production 168: 1533–46. https://dx.doi.org/10.1016/j.jclepro.2017.05.198.

The Royal Society. 2020. Ammonia: Zero-Carbon Fertilizer, Fuel and Energy Store. London: The Royal Society.

Turner, Adair, and Ajay Mathur. 2018. “Mission Possible: Reaching Net-Zero Carbon Emissions from Harder-to-Abate Sectors by Mid-Century.” November 2018. The Energy Transitions Commission. Accessed April 01, 2020. https://www.energy-transitions.org/sites/default/files/ETC_MissionPossible_ReportSummary_English.pdf

UNEP (United Nations Environment Programme). 2019. Emissions Gap Report 2019. Nairobi: UNEP.

Unruh, Gregory C. 1999. Fletcher School, Tufts University, doctoral thesis “Escaping Carbon Lock-In.”

Unruh, Gregory C. 2000. “Understanding Carbon Lock-In.” Energy Policy 28 (12): 817–830. https://doi.org/10.1016/S0301-4215(00)00070-7.

Unruh, Gregory C. 2002. “Escaping Carbon Lock-In.” Energy Policy 30 (4): 317–325. https://doi.org/10.1016/S0301-4215(01)00098-2.

van den Broek, Machteld, Ric Hoefnagels, Edward S. Rubin, Wim C. Turkenburg, and André P. C. Faaij. 2009. “Effects of Technological Learning on Future Cost and Performance of Power Plants with CO2 Capture.” Progress in Energy and Combustion Science 35 (6): 457–80.

Victor, David G. 2006. “Toward Effective International Cooperation on Climate Change: Numbers, Interests and Institutions.” Global Environmental Politics 6 (3): 90–103. https://dx.doi.org/10.1162/glep.2006.6.3.90.

Wang, Lu, Meikun Xia, Hong Wang, Kefeng Huang, Chenxi Qian, Christos T. Maravelias, and Geoffrey A. Ozin. 2018. “Greening Ammonia toward the Solar Ammonia Refinery.” Joule 2: 1055–74.

Williams, Eric. 2019. Achieving Climate Goals by Closing the Loop in Circular Carbon Economy. Riyadh: KAPSARC Instant Insight.

Yoshioka, Ichiro, Daisaku Obata, Hideo Nanjo, Kosuke Yokozeki, Takeshi Torichigai, Minoru Morioka, and Takayuki Higuchi. 2013. “New Ecological Concrete that Reduces CO2 Emissions Below Zero Level: New Method for CO2 Capture and Storage.” Energy Procedia 37: 6018– 6025.

Appendix

[1] . The terminology used in relation to the transition to a carbon-neutral energy system is diverse, reflecting different national and disciplinary preferences. In this policy brief, we use various terms to refer to the transition to an energy system that meets the increasingly globally accepted goal of not emitting more carbon than is, at the minimum, taken out of the atmosphere, so as to hold climate change within an acceptable level. These terms include carbon neutral, carbon/emissions neutrality/circularity, sustainable energy system, sustainability transition, and moving towards sustainability.

[2] . This concept/term was coined by Gregory C. Unruh (1999) and explained in a subsequent study: “…industrial economies have been locked into fossil fuel-based energy systems through a process of technological and institutional co-evolution driven by path-dependent increasing returns to scale. It is asserted that this condition, termed carbon lock-in, creates persistent market and policy failures that can inhibit the diffusion of carbon-saving technologies despite their apparent environmental and economic advantages” (Unruh 2000).