Public and private sector actors provide the financing, investment and insurance to power ocean-linked sectors; but current business-as-usual (BAU) activities are far from sustainable development pathways. A transition to a sustainable blue economy (SBE) is an opportunity to re-cast how we use, manage and protect ocean resources in line with the United Nations Sustainable Development Goal 14 (SDG 14, Life below water).

To achieve an SBE, mainstream ocean finance must be redirected through two complementary approaches: integrating SBE criteria into financial processes and proactively financing SBE activities. Both will require concerted action from governments, regulators, the private sector and development partners.

Challenge

A healthy ocean is fundamental to a sustainable future for people and the planet. Its value is estimated to be US$24 trillion (WWF, 2015), with the annual value of produced goods and services across multiple sectors estimated to be $2.5 trillion per year, equivalent to the world’s seventh largest economy in gross domestic product (GDP) terms. However, ocean health is under threat. Pressures from human activities have degraded the ocean and destroyed marine ecosystems. The many benefits that the ocean provides to humankind, particularly dependent coastal communities, are increasingly undermined by our failure to achieve integrated sustainable management of the ocean and coasts (UN, 2021). A sustainable development approach is not only crucial to achieving the United Nations Sustainable Development Goals (SDGs) but is imperative for our survival.

By channelling capital away from business-as-usual (BAU) into sustainable businesses and critical transition activities, the finance sector could fill the financing gap and effect the transition towards a sustainable blue economy (SBE) — the sustainable and integrated development of economic sectors in a healthy ocean. Regardless, ocean health and negative impacts on the marine environment and coastal communities are rarely integrated into public and private finance decisions. Although the ocean contributes substantially to the global economy, SDG 14, life below water, is among the least-funded SDGs in terms of official development assistance and philanthropic funding (OECD, 2020). BAU activities also present substantial risks. A WWF (2021) report revealed that under a BAU scenario, up to $8.4 trillion worth of assets and revenues across 66 percent of listed companies are at risk over the next 15 years. These losses are substantially reduced under a sustainable development scenario.

Redirecting finance towards an SBE involves two complementary approaches: integrating sustainable blue criteria into mainstream finance processes and proactively financing sustainable “blue” projects and businesses. Concerted action from governments, regulators, the private sector, and development partners is needed to achieve both approaches. One considerable obstacle to this is that, for most financial institutions, the ocean is uncharted territory.

To enable this transition, the United Nations Environment Programme – Finance Initiative (UNEP FI) convenes the Sustainable Blue Economy Finance Initiative (hereafter referred to as “the Initiative”). As of June 2022, it brings together a community of practice of over 70 pioneering institutions with a total asset size of over $11 trillion to build industry-wide guidance and tools to support the flow of capital towards sustainable-development pathways. Supported by the European Commission and the Swedish government, the Initiative champions the Sustainable Blue Economy Finance Principles (hereafter referred to as “the Principles”) – the world’s first global guiding framework supporting the alignment of financial activities with SDG14 (UNEP FI, no date (b)). Additionally, market-first guidance on transitioning away from funding unsustainable practices has been developed in a multi-stakeholder effort to produce a practical science-based toolkit supporting blue finance decision-making across major ocean sectors, from shipping and waste management to seafood.

The Principles are also entirely relevant to public sector finance, and the Initiative’s efforts have led to their endorsement by the government of Portugal. Further endorsement of the Initiative’s work by the G20 would significantly improve urgent global efforts to transition ocean-linked industries towards an SBE.

Proposal

The path towards a sustainable blue economy

The term SBE is used to refer to the sustainable and integrated development of economic sectors in a healthy ocean. The concept of a blue economy emerged during the 2012 Rio+20 Conference, emphasising conservation and sustainable management, based on the premise that healthy ocean ecosystems are more productive and form a vital basis for sustainable ocean-based economies (UN DESA, 2014). Its sustainable development approach implies that economic development is both inclusive and environmentally sound (The World Bank, 2017). An SBE involves the sustainable use of marine resources, reduction of carbon emissions and pollution, enhanced energy efficiency, harnessing the power of natural capital and halting the loss of biodiversity. It aspires to rebuild ocean prosperity, restore its biodiversity and to regenerate the ocean’s health while understanding that economic needs cannot be separated from social and environmental sustainability.

The finance sector can play a pivotal role in delivering an SBE (UNEP FI, 2021). Financing the SBE encompasses all financial activities (including investment, insurance, banking and supporting intermediary activities) in, or in support of, the development of an SBE. As such, it covers both finance being deployed directly to invest in SBE projects, as well as financial activity/capital being deployed to support the development of the SBE (e.g., habitat restoration and protection, capacity building, transition to sustainable practices — such as decarbonisation of shipping and replacing fishing gear for more sustainable options, or mainstreaming activities).

The work of the Initiative addresses the root causes of declining ocean health. The Principles and Initiative provide a guiding and cross-cutting framework enabling financial actors globally to drive forward the transition towards an SBE. Through these mechanisms, the Initiative actively works towards restoring the ocean’s health alongside protecting the livelihoods of coastal communities and of those involved in maritime economic activities. By working directly with leading financial actors and supporting them in implementing the Principles, the Initiative aims to tackle existing ocean-related environmental and social issues by leading finance away from unsustainable practices and towards “seeking out” sustainable alternatives.

The need for action to tackle SDG 14 is urgent, and there is a growing interest in this area from financial institutions. However, for most financial institutions, there is little-to-no expertise on how to align financial flows and activities to an SBE. To address this major road-block to action, the Initiative has developed guidance documents for financial institutions to implement the Principles across major ocean sectors that collectively contribute to an SBE, such as maritime transportation, seafood and marine renewable energy.

Governments can take a leading role in closing the financing gap on SDG 14 by bolstering an enabling environment that provides stability for capital to be mobilised towards a thriving SBE. If widely endorsed by governments, the Principles would provide a framework and vision to help transform how the ocean’s assets are used and managed to secure healthy ecosystems, assuring future environmental, social and economic resilience. The associated guidance developed by the Initiative could further add value to governments by offering a framework to set national and regional standards for the sustainable use of coastal and marine areas, creating clarity for financial institutions as well as for governmental authorities. It also provides a risk-based narrative on social and environmental impacts in ocean sectors, highlighting best practices for sustainability that align with SDG 14 and the Paris Agreement, as well as how these might be translated into policy commitments.

Governments could also further support the flow of capital towards an SBE by de-risking the enabling environment.[1] This could be achieved through substantially strengthening and integrating ocean-based legislation, policies and governance arrangements towards ensuring that ocean and coastal ecosystems, and the goods and services they provide, are restored, protected and sustainably managed. In addition, fiscal and market incentives and disincentives will play a critical role in steering finance towards sustainable pathways.[2] Finally, governments could also support and encourage targeted research, as well as the management and dissemination of ocean-based data that captures the value of natural capital and outlines both the risks of BAU and the benefits of pursuing sustainable development pathways — thus supporting investment decisions.

Guiding finance away from harmful activities and toward sustainability

The seminal guidance (UNEP FI, 2021; UNEP FI, 2022) supports financial institutions to avoid and mitigate environmental and social risks and impacts. It also highlights opportunities when providing capital to companies or projects within an SBE. Leveraging best practices based on input from more than 70 pioneering institutions and experts, it provides financial decision-makers in public and private organisations with a science-based and actionable toolkit and case studies (UNEP FI, no date (a)), giving easy-to-follow recommendations on how to approach investment, lending, underwriting and other financing decisions across seven key ocean sectors:

- Seafood, including fisheries and aquaculture, as well as their supply chains;

- Ports;

- Maritime transportation;

- Marine renewable energy, notably offshore wind;

- Coastal and maritime tourism, including cruising;

- Coastal infrastructure and resilience, including Nature-based Solutions (NbS)

- Waste prevention and management, including plastics.

These sectors were chosen due to their scale and clear links to marine ecosystems, as well as the central role they play in global economic development, alongside their impacts on the environment and society.

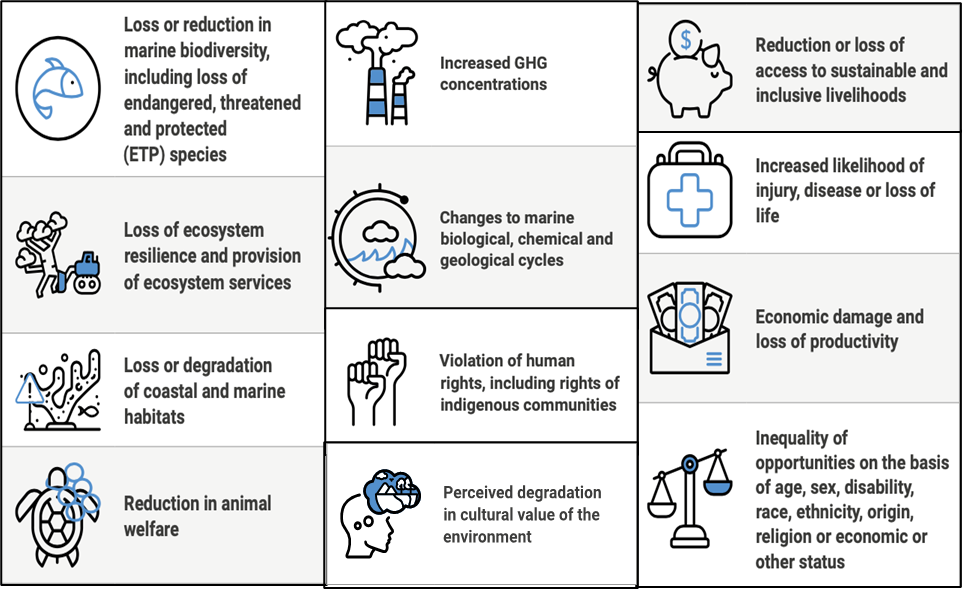

Taking a sector-based approach, the guidance has been developed following a modified Driver-Pressure-State-Impact-Response framework and examines the key drivers of impact stemming from each sector, the different pressures these drivers exert on the environment and society, and the impacts these pressures create. While pressures vary per sector, the following impacts on the environment and society identified are common throughout:

Table 1: Environmental and social impacts identified across SBE sectors

Source: UNEP FI, 2021; UNEP FI, 2022

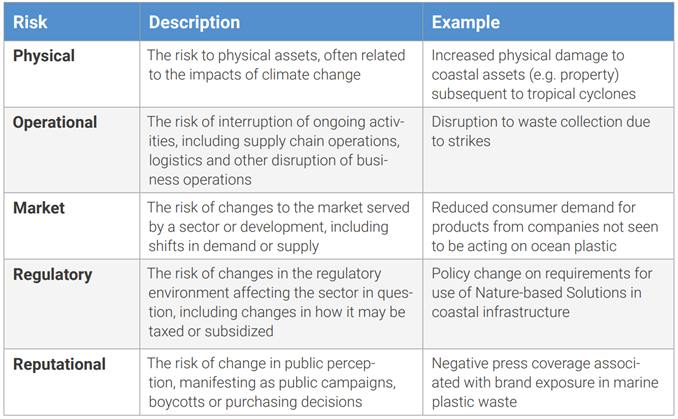

Further denoting its relevance to actors involved in the financial sector, the guidance also maps the pressures and impacts identified against current and potential risks to financial institutions. The risks — which are aligned with those used by the Task Force on Climate-Related Financial Disclosures (TCFD) — cover the following five categories:

Table 2: Table of risks and descriptions

Source: UNEP FI, 2021; UNEP FI, 2022

It is worth noting that the guidance does not offer investment advice or replace existing requirements for due diligence by financial institutions when engaging ocean-linked businesses. Rather, this resource is intended to guide financial institutions through some of the common and critical social and environmental challenges facing these sectors and assist institutions in their decision-making.

The guidance is structured by dividing each sector into separate chapters. Each chapter includes case studies of current best practices and innovative approaches to financing the corresponding sector. Sector-specific recommendations — provided in a technical annex — represent the centerpiece of the guidance, building on the materiality of each sector’s impacts and risks and offering specific recommendations on how to deal with relevant activities across the covered sectors. Depending on the activity in question, one of three recommendations are made:

- Avoid, where it is recommended that financial institutions do not provide financing due to the severity of a given activity;

- Challenge, where financial institutions are recommended to address a specific issue before financing a given project or business (e.g. via engagement with the company or requesting proof of legal compliance);

- Seek out, where an activity denotes current best practice on a particular issue and where financing is encouraged.

Policy recommendations

This paper illustrates that there are a variety of already existing resources that can be enforced or adopted to transition towards sustainable finance practices and drive forward the delivery of an SBE. As highlighted, the ocean environment is considered to be a relatively high-risk investment opportunity due to a number of challenges, not least because of significant gaps in ocean governance, coherent regulation and data availability (Sumaila et al., 2021). In addition, it is critical that the ocean’s natural assets are restored, protected and sustainably managed to support a resilient SBE. To effect the redirection of mainstream finance towards SBE pathways and increased investment in building the resilience of the ocean, it is critical that governments provide a robust enabling environment that incentivises best practices, regulates to shift away from BAU pathways and encourages financial flows that support ocean health.

There is an urgent need for accelerated engagement and action as the health of the ocean continues to deteriorate. Embracing an SBE requires action from all ocean-related stakeholders, including financial institutions, governments and other public sector actors, intergovernmental organisations, academia, civil society, commerce and industry. As such, this paper makes the following recommendations:

1. Strengthen ocean policy and governance. Redirecting both public and private sector finance towards SBE pathways will need to be guided by integrated SBE policy frameworks and grounded in strong ocean governance. Most critical is strengthening and integrating ocean-based legislation, policies and governance arrangements towards ensuring that ocean and coastal ecosystems, and the goods and services they provide, are restored, protected and sustainably managed. As such, governmental entities should work towards a common goal of a resilient and equitable SBE supported by a healthy ocean; aligning the actions and decisions of different government departments towards the delivery of an SBE.

The Principles aim to underpin a multi-sector shift towards an SBE by fostering cooperation on priorities ranging from ocean health and scientific research to data collection and technical innovation. These Principles recognise that the ocean requires a systems-based approach so that the inter-dependencies and the interrelated risks across sectors operating within the ocean and coastal environment are fully understood. The Principles acknowledge that we already have many of the governance tools, regulations and approaches to build ocean resilience and improve long-term investment opportunities – including marine protected areas and ecosystem-based marine spatial planning. Yet, to accelerate progress towards an SBE, government actors are required to act based on these tools, regulations and approaches as much as financial actors are.

2. Undertake country-level SBE planning. Governments should consider developing national plans that support the delivery of an SBE, placing, restoring and maintaining ocean health as a high-level priority in underpinning social and economic resilience.[3] As such, governments should place a focus on employing ecosystem-based integrated ocean management approaches, including ecosystem-based marine spatial planning. The Principles provide an integrated, high-level framework on which such national SBE visions and plans can be based and are aligned with wider UNEP-led efforts to support countries in developing equitable, resilient and integrated national SBE transition pathways.

To complement this, governments should encourage and incentivise financial institutions to become signatories of the Principles and use the associated guidance. Additionally, government ministries should use the Principles’ guidance to integrate SBE considerations into financial risk assessments and disclosure frameworks (Fenichel, Addicott, Grimsrud, et al., 2020). Fiscal and market incentives and disincentives will also play a critical role in steering finance towards sustainable pathways

3. Creating, managing and making available ocean-based data to guide SBE decisions. The challenges associated with accessing ocean data are well known and significantly increase the risks associated with ocean-based investments (Sumalia et al., 2021; WWF and Metabolic, 2021). Governments should support and encourage applied research and the management and dissemination of ocean-based data that captures the value of natural capital and outlines the risks of BAU, as well as the benefits of pursuing sustainable development pathways. Furthermore, governments should encourage and facilitate the collection and sharing of non-competitive data from ocean-based businesses, pushing forward the delivery of integrated and adaptive management approaches, strengthening transparency and traceability, as well as supporting best practice decision-making across maritime business and finance sectors

4. Endorse the Principles. The endorsement of the Principles by G20 members would help raise awareness about the SBE and encourage their use by public and private sectors. In turn, this would provide a critical framework and pragmatic science-based guidance to steer future decisions towards sustainable development pathways

References

Eli Fenichel, Ethan Addicott, Kristine Grimsrud, Glenn-Marie Lange, Ina Porras and Ben Milligan, “Modifying national accounts for sustainable ocean development”, in Nature Sustainability, Vol. 3 (August 2020), p. 889–895, https://doi.org/10.1038/s41893-020-0592-8.

Organisation for Economic Co-operation and Development (OECD), Sustainable Ocean for All: Harnessing the Benefits of Sustainable Ocean Economies for Developing Countries, Paris, 2020, https://doi.org/10.1787/202afb81-en.

Rashid Sumaila , Melissa Walsh, Kelly Hoareau, Anthony Cox, Louise Teh , Patrizia Abdallah , Wisdom Akpalu, Zuzy Anna, Dominique Benzaken, Beatrice Crona, Timothy Fitzgerald , Louise Heaps , Ibrahim Issifu , Katia Karousakis, Glenn Marie Lange, Amanda Leland , Dana Miller , Karen Sack , Durreen Shahnaz , Torsten Thiele, Niels Vestergaard, Nobuyuki Yagi and Junjie Zhang, “ Financing a sustainable ocean economy” , in Nature Communications, Vol. 12, No. 3259 (June 2021), p. 1-11, https://www.nature.com/articles/s41467-021-23168-y.

The World Bank, The Potential of the Blue Economy: Increasing Long-term Benefits of the Susatinable Use of Marine Resources for Small Island Developing States and Coastal Least Developed Countries, Washington, 2017, https://openknowledge.worldbank.org/bitstream/handle/10986/26843/115545.pdf?sequence=1&isAllowed=y.

United Nations, The Second World Ocean Assessment, New York, 2021, https://www.un.org/regularprocess/woa2launch.

United Nations Department of Economic and Social Affairs (UN DESA), Blue Economy Concept Paper, New York, 2014, https://sustainabledevelopment.un.org/index.php?page=view&type=111&nr=2978&menu=35.

United Nations Environment Programme – Finance Initiative (UNEP FI), Diving Deep: Finance, Ocean Pollution and Coastal Resilience, Geneva, 2022, https://www.unepfi.org/publications/diving-deep/.

UNEP FI, ‘Sustainable Blue Finance: Case Studies’, no date (a), https://www.unepfi.org/blue-finance/resources/case-studies/.

UNEP FI, ‘Sustainable Blue Finance: The Principles’, no date (b), https://www.unepfi.org/blue-finance/the-principles/.

UNEP FI, Turning the Tide: How to finance a sustainable ocean recovery – A practical guide for financial institutions, Geneva, 2021, https://www.unepfi.org/publications/turning-the-tide/.

World Trade Organ isation (WTO), ‘WTO Fisheries Funding Mechanism readied to provide support for ending harmful subsidies’, 2022, https://www.wto.org/english/news_e/news22_e/fish_14jun22_e.htm.

WWF, Reviving the Ocean Economy: The case for action 2015, Switzerland, 2015, https://www.worldwildlife.org/publications/reviving-the-oceans-economy-the-case-for-action-2015.

WWF and Metabolic, Navigating Ocean Risk: Value at Risk in the Global Blue Economy, 2021, https://value-at-risk.panda.org/assets/file/BlueEconomy_SummaryReport_v06_MSG_compressed.pdf.

- Read more about the potential for sustainable and equitable blue economy and what it would take to achieve this in the journal Nature’s collection on the ocean economy available at https://www.nature.com/immersive/d42859-020-00084-7/index.html#section-yTdoW0Rw3y and in particular the ocean finance paper available at https://www.nature.com/articles/s41467-021-23168-y. ↑

- An example of this is ending harmful subsidies in the seafood industry. Mechanisms such as the recently announced WTO Fisheries Funding Mechanism have been introduced to support countries in implementing a prospective agreement to curb harmful fisheries subsidies (WTO, 2022), further evidencing the need of governmental intervention and support to achieve an SBE. ↑

- Delivering national Sustainable Ocean Plans is also further supported by the High-Level Panel for a Sustainable Ocean Economy ‘Ocean Action 100’ coalition. ↑