Investors worldwide are pushing for green recovery from the Covid-19, but how might the global community scientifically evaluate the actual contribution of investments to a sustainable future? Recent studies show that gross domestic product (GDP) is problematic and misleading in assessing human well-being (Rogers et al., 2012), and that human and natural capital are essential components of the productive base of an economy (Agarwala et al., 2012; Managi et al., 2022). Furthermore, the lack of common standards for ESG evaluation for sustainable investment initiatives is leading to significant differences in ESG scores and evaluations for the same sustainable investment activity (Chatterji et al., 2016). For these reasons, presenting a scientific assessment framework for sustainable investment is critical for the global community so that investors and stakeholders can objectively evaluate the initiatives.

Challenge

The sustainable investment (i.e., environment, social, and governance (ESG) investment) environment underwent numerous changes in 2021 such as the pandemic, regulatory developments, and increased investor engagement. According to a report by the Global Sustainable Investment Alliance (GSIA, 2021), the total global ESG investments in 2020 reached $35.3 trillion, which is an increase of 15 percent from 2018 and 55 percent from 2016. Sustainable investment has become an opportunity for businesses to tap into the growing social demand for lasting change and the emerging ESG market, and is seen as a vital means to create a sustainable society. The disclosure of non-financial information and rating ESG performance are essential for informed investment decisions. However, how can the global community scientifically evaluate the actual contribution of investments to sustainable recovery?

Until now, gross domestic product (GDP) has been used as the primary metric for assessing progress toward improving human wellbeing, but this has been shown to be problematic and often misleading (Rogers et al., 2012). Recent studies show that human and natural capital are essential components of the productive base of an economy (Agarwala et al., 2012; Managi et al., 2022). A possible alternative to GDP is the Inclusive Wealth index based on the social value of capital assets (Dasgupta et at., 2022). Recent reports, such as The Economics of Biodiversity (Dasgupta, 2021) and Making Peace with Nature (UNEP, 2021), suggest that investment decisions need to be based on such wealth indicators, not just GDP.

In promoting the trend toward sustainable investment, it is necessary to value corporations using non-financial indicators that are different from those used in the past. Society, which until now has mainly focused on economic growth as measured by GDP, can no longer ignore the importance of non-financial indicators such as environmental friendliness, responsiveness to employees, and stakeholder relations as indicated by ESG and the SDGs.

As environmental, social, and governance concerns move to be top-of-mind for investors, advisers, and regulators, it is important that companies actively and effectively disclose information about sustainability/ESG, and consider the adequacy, accuracy, and timeliness of both financial and sustainability-related disclosures. In recent years, there has been a growing awareness of the problem of the inconsistency of standards for disclosing sustainability and ESG information, which is important in assessing the ESG initiatives of companies. While a wide variety of sustainability disclosure guidelines exist, there has been a growing demand for unification and simplification. Many have also critiqued the lack of common theorization and commensurability among the ESG metrics commonly used in the market as well as the incomplete coverage of ESG metrics, which are limited to major listed firms (Chatterji et al., 2016). Moreover, considering the materiality of the issue, product- and service-level ESG impact should be disclosed by companies, which is as important as assessment of company-level ESG impact. Without significant progress, these challenges could hinder the efficacy of sustainable investment.

Proposal

The authors propose that the G20 initiate a forum to discuss an evaluation framework for sustainable investment initiatives to help address these challenges. The forum should initially focus on the following: unification of corporate disclosure standards (Proposal 1); enhancement of the transparency, commensurability, and coverage of ESG metrics (Proposal 2); and guidelines for the implementation of product and service-level ESG evaluation (Proposal 3).

Proposal 1: Unification of corporate disclosure standards

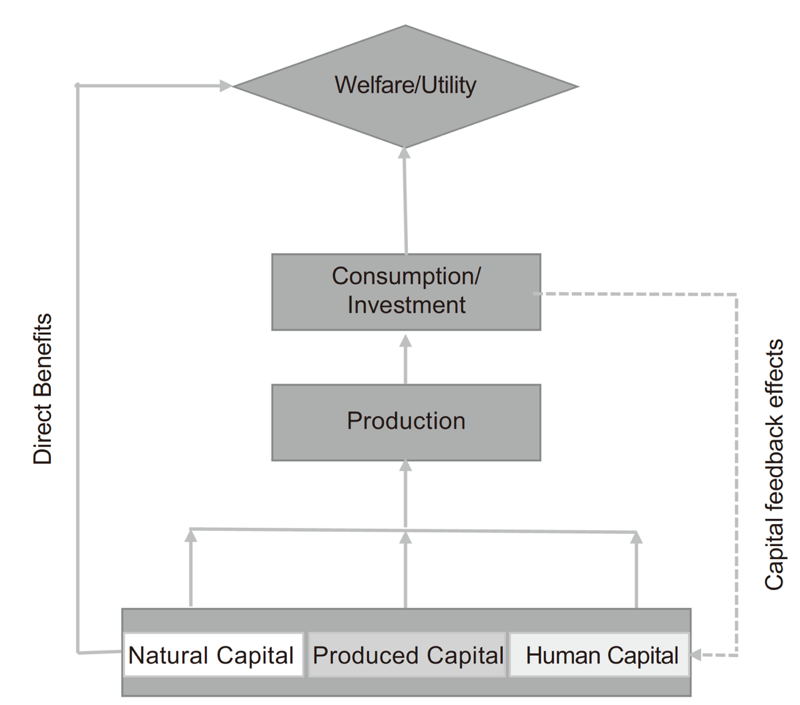

In 2009, at the request of the French government, Nobel laureate Joseph Stiglitz and colleagues published a report on new and more expansive indicators of wealth to replace GDP (Stiglitz, 2009). The Stiglitz report discusses indicators related to quality of life and other alternatives to GDP to measure production in order to evaluate wellbeing (happiness and welfare). In the United Nations, alternative indicators were further developed and favorably received in 2012, when the United Nations Conference on Sustainable Development (Rio+20) held a meeting on “Green Economy” and “Institutional Framework” and presented a new Inclusive Wealth Index (IWI). Figure 1 depicts the three capital models of wealth creation of IWI. This index was subsequently compiled in reports in 2014 and 2018 (UNU-IHDP and UNEP, 2014; Managi and Kumar, 2018). Since then, IWI has been applied at country level and municipality levels in various countries: in 2021, the UK government released a report, The Economics of Biodiversity: The Dasgupta Review, which examines the impact of biodiversity loss on economic growth prospects in the coming decades and assesses the sustainability of how humans interact with nature (Dasgupta, 2021). The report finds that natural capital has decreased by 40 percent since 1992, compared to increases in produced and human capital (doubling and 13 percent growth, respectively). It recommends that nature be integrated into the financial and educational systems. More recently, on April 22, 2022, the U.S. Secretary of Commerce Gina M. Raimondo announced a Department Administrative Order, directing the Department to integrate climate considerations into its policies, strategic planning, and announced the initiation of the first U.S. national system of natural capital accounts and standardized environmental-economic statistics that builds upon the IWI framework[1].

Figure 1: A three capital model of wealth creation of the Inclusive Wealth Index

Source: UNU-IHDP and UNEP, 2014

Today, more and more companies are emphasizing corporate social responsibility and their companies’ contributions to society. As a way to encourage such an orientation, sustainable investment has been attracting increasing attention in recent years. When considering only profits, companies measured their value in terms of financial capital, and efforts to increase non-financial capital and to address social issues as part of their operations were not valued. In recent years, major social issues such as climate change and ensuring decent jobs have emerged as major concerns. In order to address these challenges and create a sustainable society, companies are increasingly being asked to focus on ESG.

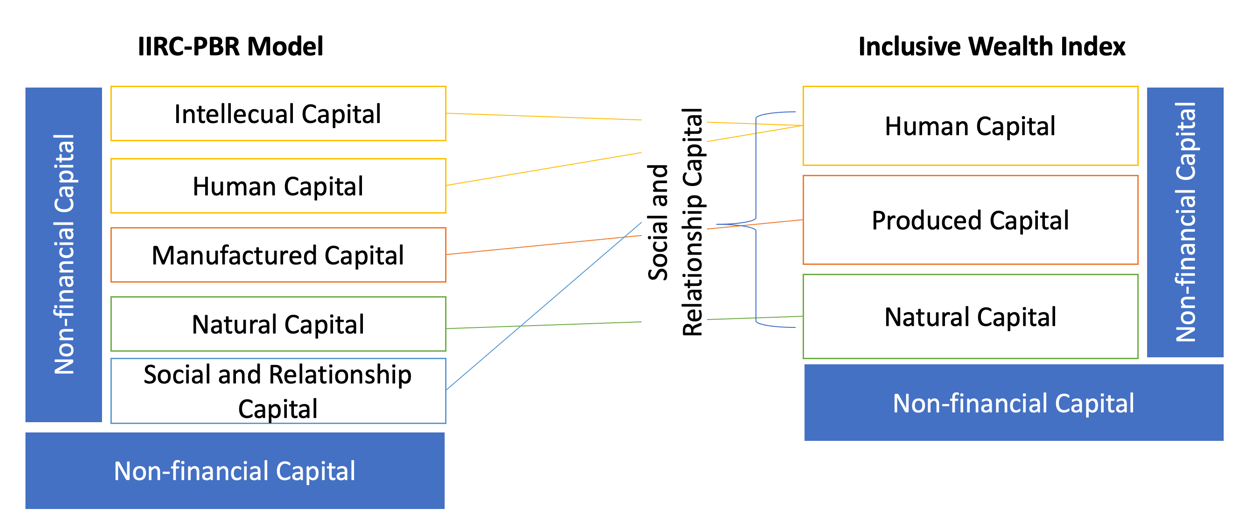

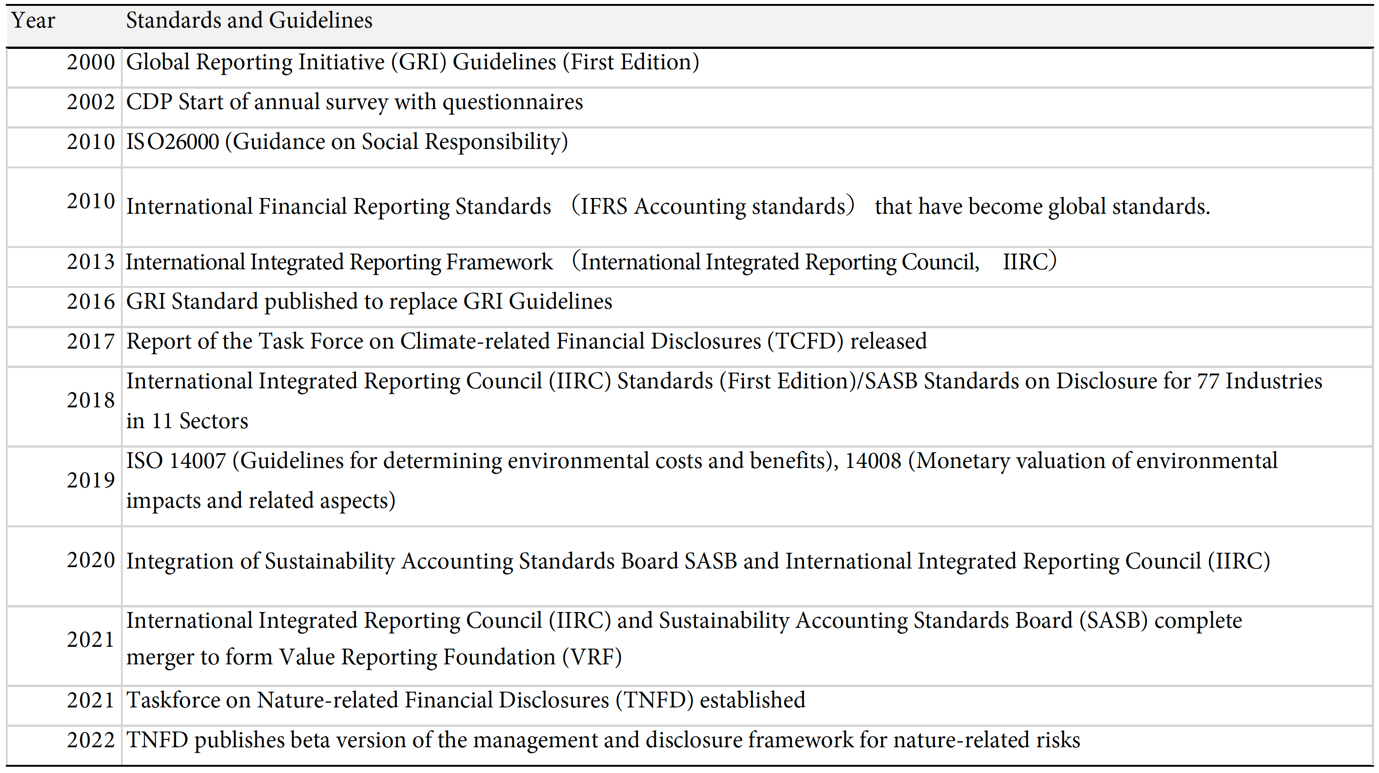

It is more costly to collect information on sustainable investments than general equity and fixed income investments, leading to increasing pressure to improve corporate disclosure regulations, fiduciary responsibility, criteria for ESG investment eligibility, and ESG risk management. In addition, standards and methods for objective evaluation of specific content by a wide range of investors are still in the process of development. The International Integrated Reporting Council (IIRC), an international NGO founded in the United Kingdom in 2010, develops and promotes “integrated reporting,” a framework for companies to disclose non-financial information. In addition to financial capital, the IIRC has identified five types of non-financial capital: intellectual capital, manufactured capital, human capital, social and relational capital, and natural capital (IIRC, 2013). The relationships between the framework proposed by IIRC and IWI are depicted in Figure 2, whereas Table 1 summarizes the major disclosure frameworks developed since 2000.

Figure 2: Relationships between IIRC and IWI framework

Source: Developed by the author based on: IIRC, 2013; UNU-IHDP and UNEP, 2014

Table 1: Flow of the disclosure framework development

Source: Developed by the authors

The main disclosure standards for ESG information vary, depending on the purpose of the disclosure. Differences include the topics to be disclosed, level of detail, assumed stakeholders, disclosure channels, principles to be followed, and specific disclosure items. As shown in the table above, while a wide variety of sustainability disclosure guidelines exist, there has been a growing demand for unification and simplification. In September 2020, the World Economic Forum, with Partners including Deloitte, EY, KPMG and PwC, identified a set of universal metrics and disclosures and developed the Stakeholder Capitalism Metrics. In December 2020, the five major sustainability disclosure standard-setting bodies (CDP, CDSB, GRI, IIRC and SASB) collaborated to publish “Reporting on Enterprise Value Illustrated with a Prototype Climate-related Financial Disclosure Standard” (CDP et al., 2020). In June 2021, IIRC and SASB merged to form the Value Reporting Foundation. Although progress has been made for unification and simplification of sustainability disclosure guidelines and standards, it is important to clarify and discuss the scientific foundation of the guidelines and standards in order to ensure the adequacy of unification and simplification.

The authors propose that the G20 host discussions on the unification of the corporate disclosure standards so that policymakers and stakeholders can objectively assess each initiative. The Inclusive Wealth Index by UNEP, which represents the social value of all capital assets including natural, human, and produced capital, could provide a scientific foundation.

Proposal 2: Enhancement of the transparency, commensurability, and coverage of the ESG metrics

ESG investment has become an opportunity for businesses to tap into the growing social demand for investments that promote sustainable development. Total global ESG investments in 2020 reached $35.3 trillion (GSIA, 2021). Because of the growth in such demand, the importance of developing sound ESG metrics to evaluate ESG activities has been increasing. In recent years, there has been a growing awareness of the inconsistency of commonly used ESG metrics. Studies have highlighted the low correlations between different ESG metrics and called for caution in drawing conclusions based on these ratings (Berg et al., 2019; Chatterji et al., 2016; Siew, 2015). The main problems are the lack of common theoretical foundations (different definitions of good CSR) and commensurability (different measurements) (Chatterji et al., 2016). The scope, measurement, and weights contribute to divergence of ESG metrics (Berg et al., 2019). Moreover, only a few ESG rating agencies disclose the details of their evaluation criteria and methods, so the ratings are perceived as being a black box. A universal ESG accounting standard with “dynamic materiality” is therefore needed (Eccles and Mirchandani, 2022).

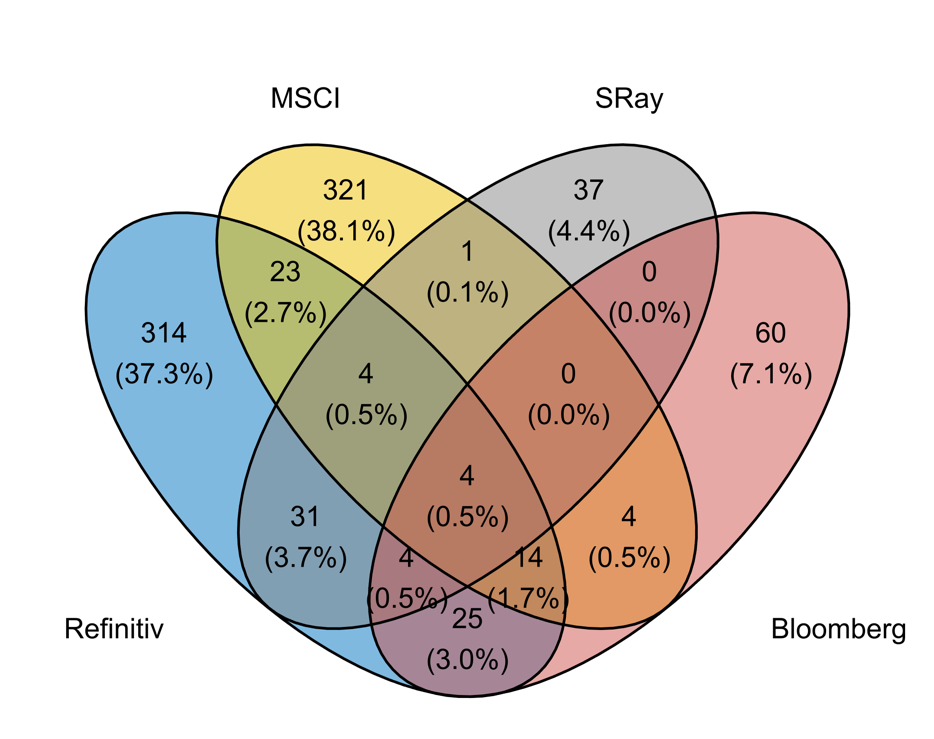

Based on accessible methodology descriptions for four leading ESG databases widely used in academic research, investment, and business—Thomson Reuters’ Refinitiv, MSCI, Bloomberg, and Arabesque S-Ray—the authors collected the elements used in each ESG database. The total number of elements assessed across all four databases is 842. Unfortunately, the elements assessed have a significant divergence across the four ESG measurements. The Venn diagram of Figure 3 compares all of the elements assessed. Only four elements are common among all four ESG ratings. The ratios of exclusive elements are 37.3 percent for Refinitiv, 38.1 percent for MSCI, 4.4 percent for S-Ray, and 7.1 percent for Bloomberg. Furthermore, although all four databases have global coverage of at least 8,000 firms, they are limited to major listed firms, thus the firm coverage of the rating systems need to be enhanced[2].

Figure 3. Comparison of evaluated factors across ESG database

Source: Developed by the authors based on Keeley, et al. (2022)

The promotion of ESG activities can reduce various risks associated with management; Keeley et al. (2022) systematically reviewed articles published in top-ranked journals from January 1, 2000 to December 31, 2021, and found that studies have shown a mixed relationship between ESG management and short-term accounting earnings measures or stock returns, while they consistently show a negative relationship between ESG management and cost of capital and a positive relationship between ESG management and Tobin’s Q. Under the Discounted Cash Flow method, cost of capital is the denominator. Therefore, if other conditions remain constant, the lower the cost of capital, the higher the value of the company, and this risk reduction pathway is important.

This risk reduction effect of ESG promotion has attracted attention not only from academics but also from practitioners. In particular, ESG management has long been a focus of attention among financial intermediaries, who pay a great deal of attention to credit risk management and, therefore, to the viability of a company. Attig et al. (2013) and Cooper (2015) found that credit ratings are higher for firms that are more active in ESG management. Goss and Roberts (2011) also point out that banks lend at preferential interest rates—lower lending spreads—to companies that are active in ESG management. Furthermore, Suto and Takehara (2018) calculated default rates using the Merton model and found that for a group of companies with relatively high management instability and small company size, the more active a company is in ESG management, the lower the default probability.

The above studies imply that the more proactive a company is in ESG management, the lower the probability of default. Therefore, it should be emphasized that financial intermediaries have a voluntary incentive to include the ESG management status of their portfolio companies in their lending decisions. International initiatives are promoting financial market participants, including financial intermediaries, to internalize a sustainable perspective in their financial services in the form of soft law. The EU has applied the Sustainable Finance Disclosure Regulation (SFDR) to financial market participants effective March 10, 2021. The Regulation requires financial market participants and financial advisors to disclose their sustainability risk policies for investment decisions on the web. While the implementation of this regulation forces the listed companies and financial intermediaries to pay more attention to the ESG ratings of their own companies and those they finance, it is important to promote ESG management and investment not just among listed companies and large corporations, but also small and medium-sized enterprises (SMEs) .

SMEs are important players in the supply chains of large companies and in CO2 emission reduction. SMEs also have a strong incentive to disclose ESG information to justify their operations or as a means of publicizing their reputation to stakeholders. However, it is difficult for them to devote as much effort to disclosure as larger companies. In fact, many current rating agencies score companies based on their “disclosed information,” and their main target groups are listed companies and large corporations.

On the other hand, in Japan, relationship banking has traditionally been a distinctive feature of the financial intermediation system. Japanese financial intermediaries obtain information on potential client companies through interviews conducted by loan officers based on long-term, continuous business relationships. Considering this history, financial intermediaries are expected to play a key role in the ESG ratings of SMEs[3], not just in Japan but around the world.

Development and application of corporate evaluation methods for SMEs that include non-financial information is expected to promote better ESG management by SMEs, which have thus far not focused enough on ESG management. This can make a significant contribution to the realization of a sustainable society.

For these reasons, the authors propose that the G20 host discussions on the transparency, coverage, and commensurability of the ESG metrics used in the market for listed companies, and also encourage the development and application of ESG evaluations for SMEs so that policymakers and stakeholders including financial intermediaries can objectively assess the sustainability of different investments.

Proposal 3: Facilitating the implementation of a product and service level ESG evaluation

Product- and service-level ESG impact assessments remain one of the most undervalued ESG issues despite the significant level of risk it presents to companies.

Considering the importance of the issue, product- and service-level ESG impact should be a critical ESG disclosure requirement for companies. Poor management of product-related risks can have an immediate impact on workers along the supply chain and could lead firms exposed to risk of massive fines.

Life cycle assessment (LCA) quantifies the environmental impact of a product or service through all life cycle stages, from raw material production to manufacturing. In recent years, LCA has evolved beyond environmental impact assessment of products to Social LCA (S-LCA), which quantifies impacts on human rights and governance. S-LCA was developed in accordance with ISO 14040/44, the international standard for LCA, and its first guidelines were published by the United Nations Environmental Programme and Society of Environmental Toxicology and Chemistry (UNEP, 2009).

This has opened up a new path for more robust and quantifiable product- and service-level ESG impact assessment. By combining environmental LCA and S-LCA, the ESG impact of products and services can be quantitatively assessed, which is as important as evaluating corporate level ESG performance. This integrated approach, often called Life Cycle Sustainability Assessment (LCSA), can identify hotspots in the supply chain, and/or compare the adverse impacts between products and services. Through this, LCSA can provide vital information not only for corporations, but also for consumers, investors, and policy makers, which could significantly contribute to the realization of a sustainable society.

Figure 4: Life Cycle Sustainability Assessment (LCSA)

Source: UNEP (2012), Social Life Cycle Assessment and Life Cycle Sustainability Assessment

Product- and service- level ESG impact assessment through LCSA is a fast-developing field, with methodologies and protocols increasingly being studied and proposed[4]. As a recent example, on 23 February 2022, the European Commission has adopted a proposal for a Directive on corporate sustainability due diligence, which aims to foster sustainable and responsible corporate behavior throughout global value chains. There are a range of methodological challenges in collecting data including concerns over the boundaries of company reporting, reporting of data over a consistent time period and accurately measuring or estimating product- and service-level impacts especially in the case of SMEs. However, the increasing sustainability reporting by the listed companies and the large firms are overcoming these issues, thus product- and service-level ESG indicators could focus primarily on larger firms. The policy-making process based on an LCSA result is a typical example of a multiple attribute decision making (MADM) process in which policy-makers need to make decisions based on multiple conflicting attributes, thus a science-based MADM method for such product- and service- level ESG impact assessment is greatly needed.

The G20 is composed of both industrialized and developing nations and accounts for around 90 percent of the world’s capital with historical focus on finance and inclusive growth. With permanent guest invitees including WBG, IMF, OECD, and the UN, the G20 can be a venue for discussing such a framework which will have practical implications for corporations, consumers, and policymakers as well as for creating a sustainable future.

References

Agarwala, Matthew, Giles Atkinson, Benjamin Palmer Fry, Katherine Homewood, Susana Mourato, J. Marcus Rowcliffe, Graham Wallace, and E. J. Milner-Gulland. “Assessing the relationship between human well-being and ecosystem services: a review of frameworks.” Conservation and Society 12, no. 4 (2014): 437-449.

Attig, Najah, Sadok El Ghoul, Omrane Guedhami, and Jungwon Suh. “Corporate social responsibility and credit ratings.” Journal of business ethics 117, no. 4 (2013): 679-694.

Berg, Florian, Julian F. Koelbel, and Roberto Rigobon. Aggregate confusion: the divergence of ESG ratings. Cambridge, MA, USA: MIT Sloan School of Management, 2019.

Chatterji, Aaron K., Rodolphe Durand, David I. Levine, and Samuel Touboul. “Do ratings of firms converge? Implications for managers, investors and strategy researchers.” Strategic Management Journal 37, no. 8 (2016): 1597-1614.

CDP, CDSB, GRI, IIRC and SASB. Reporting on enterprise value Illustrated with a prototype climate-related financial disclosure standard. 2020.

Cooper, Elizabeth W., and Hatice Uzun. “Corporate Social Responsibility and the Cost of Debt.” Journal of Accounting & Finance (2158-3625) 15, no. 8 (2015). Dasgupta, Partha. The economics of biodiversity: the Dasgupta review. Hm Treasury, 2021.

Eccles, Robert G, and Bhakti, Mirchandani. We Need Universal ESG Accounting Standards. Harvard Business Review. (2022, February 15) https://hbr.org/2022/02/we-need-universal-esg-accounting-standards

Dasgupta, Partha, Shunsuke Managi, and Pushpam Kumar. “The inclusive wealth index and sustainable development goals.” Sustainability Science 17, no. 3 (2022): 899-903.

GSIA (Global Sustainable Investment Alliance). Global Sustainable Investment Review 2020. Global Sustainable Investment Alliance, 2021.

Goss, Allen, and Gordon S. Roberts. “The impact of corporate social responsibility on the cost of bank loans.” Journal of banking & finance 35, no. 7 (2011): 1794-1810. IIRC. The International IR Framework, International Integrated Reporting Council, 2013.

Keeley, Alexander R, Andrew, J. Chapman, Kenich,i Yoshida, Jun, Xie, Janaki, Imbulana Arachchi, Shutaro, Takeda, and Shunsuke, Managi. ESG Metrics and Social Equity: A Critical Review. Accepted in Frontiers in Sustainability, 2022.

Managi, Shunsuke, David Broadstock, and Jeffrey Wurgler. “Green and climate finance: Challenges and opportunities.” International Review of Financial Analysis 79 (2022): 101962.

Managi, Shunsuke, and Pushpam Kumar. Inclusive wealth report 2018. Taylor & Francis, 2018.

Siew, Renard YJ. “A review of corporate sustainability reporting tools (SRTs).” Journal of environmental management 164 (2015): 180-195.

Stiglitz, Joseph E., Amartya Sen, and Jean-Paul Fitoussi. “Report by the commission on the measurement of economic performance and social progress.” (2009).

Suto, Megumi, and Hitoshi Takehara. “Effects of Corporate Social Performance on Default Risk: Structural Model-Based Analysis on Japanese Firms.” In Corporate Social Responsibility and Corporate Finance in Japan, pp. 179-199. Springer, Singapore, 2018.

Rogers, Deborah S., Anantha K. Duraiappah, Daniela Christina Antons, Pablo Munoz, Xuemei Bai, Michail Fragkias, and Heinz Gutscher. “A vision for human well-being: transition to social sustainability.” Current Opinion in Environmental Sustainability 4, no. 1 (2012): 61-73.

UNEP. Making Peace with Nature: A scientific blueprint to tackle the climate, biodiversity and pollution emergencies. Nairobi, 2021. https://www.unep.org/resources/making-peace-nature

UNEP. Guidelines for Social Life Cycle Assessment of Products: Social and Socio-economic LCA Guidelines Complementing Environmental LCA and Life Cycle Costing, Contributing to the Full Assessment of Goods and Services within the Context of Sustainable Development. Nairobi, UNEP/Earthprint, 2009.

UNEP. Towards a Life Cycle Sustainability Assessment: Making Informed Choices on Products. Nairobi, UNEP/SETAC 2011.

UNEP. Social Life Cycle Assessment and Life Cycle Sustainability Assessment. Nairobi, 2012.

UNU-IHDP and UNEP. Inclusive Wealth Report 2014. Measuring progress toward sustainability. Cambridge: Cambridge University Press, 2014.

Valdivia, Sonia, Jana Gerta Backes, Marzia Traverso, Guido Sonnemann, Stefano Cucurachi, Jeroen B. Guinée, Thomas Schaubroeck et al. “Principles for the application of life cycle sustainability assessment.” The International Journal of Life Cycle Assessment 26, no. 9 (2021): 1900-1905.

Appendix

Table 1: Proposals for Amending the DSU

| Initiator | Format | Proposed ideas |

|---|---|---|

| Canada | WTO Communication JOB/GC/201 24 September, 2018 | In safeguarding and strengthening the DSM, Canada suggests that the WTO should:

|

| European Union (EU) +Australia, Brazil, Canada, Chile, Japan, Kenya, South Korea, Mexico, New Zealand, Norway, Singapore, Switzerland | Ottawa Ministerial Conference 25 October, 2018 | These countries acknowledge that the blocking of the appointment of the AB members is instigated by the concerns raised regarding the functioning of the DSM. Accordingly, discussions to advance ideas to safeguard and strengthen the DSM need to be conducted. Moreover, they acknowledge the need to reinvigorate the WTO’s negotiating function. |

| EU, China, Canada, India, Norway, New Zealand, Switzerland, Australia, Republic of Korea, Iceland, Singapore and Mexico | WTO Communication WT/GC/W/752 26 November, 2018 | These countries acknowledge that concerns have been raised about the functioning of the DSM. They propose to amend certain provisions of the Understanding on Rules and procedures Governing the Settlement of Disputes (“DSU”):

|

| EU, China and India | WTO Communication WT/GC/W/753 26 November, 2018 | Regarding concerns which have been raised about the functioning of the dispute settlement system, these countries proposed the following ideas:

|

Footnotes

- U.S. Department of Commerce, “Secretary Raimondo Establishes Commerce Climate Council, Directs Department to Integrate Climate Considerations into Policies, Strategic Planning, and Programs”, April 2022, https://www.commerce.gov/news/press-releases/2022/04/secretary-raimondo-establishes-commerce-climate-council-directs ↑

- The ESG scoring service by Vector Inc., the largest PR company in Asia, is one of the recent endeavors to expand the coverage. The service ensures transparency by disclosing the ESG score calculation method, and by using AI and natural language processing the service has coverage of ESG scores for all the approximately 3,800 listed companies in Japan, calculated based on disclosed corporate information (https://vectorinc.co.jp/sdgs/materiality/pr_consulting/esg-scoring-service). ↑

- In April 2021, Fukuoka Financial Group (hereinafter referred to as “FFG”), the largest local bank in Japan, established a wholly owned SDG support subsidiary, Sustainable Scale Co (https://www.s-scale.co.jp/). Based on industry-academia collaboration with Kyushu University, the subsidiary has succeeded in building a model that is comparable to the scoring of major overseas evaluation agencies, with 163 global standard evaluation items and the ability to conduct relative evaluation of non-listed companies. ↑

- “Towards a life cycle sustainability assessment: making informed choices on products “ by UNEP (2011), and “Principles for the application of life cycle sustainability assessment” by Valdivia et al (2021) elaborate on the development of LCSA methodologies and principles in detail. ↑

Endnotes

1: This is a term first coined by The Economist (2019), referring to a pattern showing the slowing advancement of globalization following the end of the 2008 Global Financial Crisis.

2: The G20 has been reiterating its political support for WTO reforms over the years. The Saudi Arabia Presidency saw the launch of the Riyadh Initiative “on the Future of the WTO, which aims to identify common ground and shared principles for the next 25 years of the WTO” (WTO, 2021b). The G20 Rome Leaders’ Declaration (G20, 2021) also emphasizes G20’s continued efforts to play an essential role in providing political support for WTO reform discussions. Indonesia’s Presidency of the G20, therefore, offers a crucial opportunity to take forward this legacy issue and discuss reform measures more concretely to take them to their logical conclusion.

3: Several points in the G20 Trade and Investment Ministerial Meeting communiqué of 2020 refer to the G20’s acknowledgement of the need for the WTO reforms and its commitment to facilitate the same (G20, 2020).

4: The Riyadh Initiative on the Future of the WTO in the G20 Saudi Arabia and its reaffirmation in the G20 Rome Leaders’ Declaration.

5: We recommend a multidimensional approach so that the concerns of member countries that fall under various levels of development are taken into consideration.

6: Making the MTS more effective through WTO reforms is important to address the challenges of ensuring broad-based recovery from the ongoing crises. While the WTO reform agenda is expected to figure prominently in this year’s G20 meetings, the members of the grouping need to show greater willingness by mobilizing the needed political will to set the direction and scope of the reform process.