The G20 is currently at risk of being distracted from making cooperative efforts to develop urgently-needed, new rules for digital trade. Formulating domestic strategies to develop digital industries and increase participation in fast growing “tech trade” has meanwhile emerged as a policy priority across the G20. This requires a balancing act between industrialization versus employment objectives, data protection and national security goals versus international competitiveness and openness. This paper offers an evidence-based framework of best practice policy parameters to balance these issues. International benchmarks are identified to guide structural reform efforts that can strengthen the digital potential of G20 members while avoiding protectionism. The key is to integrate into the global digital market by ensuring efficient, interoperable digital regulatory environments, enhancing online trust for business and consumer connectivity, and attracting investment to generate quality digital jobs. G20 adoption of this approach at the domestic level will improve the prospects for progress in digital trade governance.

Challenge

Recent years have seen the T20 focus increasingly on recommendations for digital trade governance (Chen et al, 2019; Borchert et al, 2020; Drake-Brockman et al, 2021). The ongoing challenge for the G20 is to jointly find ways to implement these recommendations in a manner consistent with domestic digital regulatory settings. This paper therefore switches attention to domestic policy settings and structural reform efforts for digital transformation. It offers a simplified, evidence-based policy framework of best practice guidance on how governments can facilitate digitalization of the local economy, avoiding inefficient protectionist outcomes, and ensuring global value chain (GVC) connectivity. Adoption of the proposed framework would help reverse the upward trend in regulatory heterogeneity and facilitate progress in digital trade governance[1].

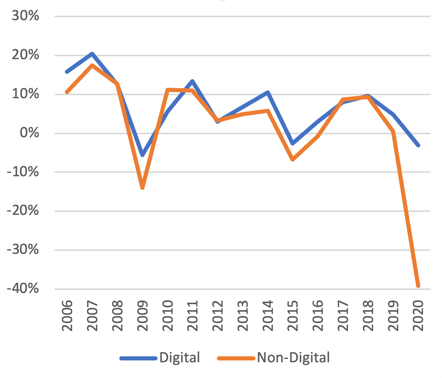

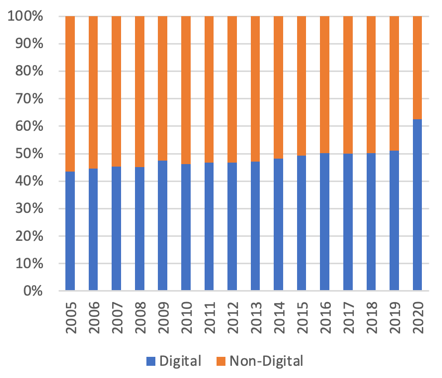

In the 21st century, globalization means production is highly fragmented into component tasks and international trade is dominated by business-to-business exchanges in GVCs. Servicification has reached the point where services exceed 50% of global exports’ value-added. As new technologies accelerate the process of services globalization, digital services have become essential to all GVCs. Pre-pandemic, digital services accounted for half of total services trade (UNCTAD, 2019). The first year of the pandemic then saw global trade in services drop 21% (Figure 1): the bulk of this decline was non-digital services trade which dropped 39% while digital services trade fell only 3%. While trade in services is now nearly back to pre-pandemic levels (WTO, 2022), the reality is that both transport and tourism remain heavily disrupted. A step change has taken place for digital services, which now account for over 60% of global services trade (Figure 2). It is widely considered that the current wave of digital services globalization, sometimes called the “third unbundling”, offers the biggest development opportunities yet for developing countries.

Protectionism however is on the rise, under the guise of digital industrial policy and under the guise of near-shoring for supply chain resilience (Miradout, 2020) or friend-shoring for security purposes. Even developing economies with export strengths in the services outsourcing industries, dependent on digital services imports and reexport of higher value-added digital services are showing counterproductive signs of retreat from pro-trade positions. Right at the time when digitalization offers enormous new possibilities for inclusive global economic growth and development, the global media delivers warnings of an approaching end to globalization.

G20 members have a global responsibility to stand firm and united to resist this current.

The policy challenges are made more complicated by ongoing absence of comprehensive WTO disciplines on digital trade. So questions arise as to what sorts of policy settings, across all the core trade, investment and industry policy arenas relevant to digital transformation, will best allow countries to build their competitiveness while resisting deglobalization to take advantage of new digital trade opportunities.

No economy can afford to wait to enhance its digital readiness by building the skill sets and investment environment for digital innovation. This has generated a resurgence of interest in industrial policy, oriented to building national champions in the digital economy. Industrial policy is inherently inward-looking, protecting targeted industries from competition. The challenge for the G20 is to calm protectionist instincts and collaborate to put in place an inclusive framework for rules-based digital trade, while addressing legitimate domestic policy objectives.

Digital policy formulation requires a balancing act between on the one hand industrial policy and employment objectives, and on the other goals associated with national security and data protection as well as international competitiveness and openness. It also requires some basic benchmarking tools to help understand and assess existing and potential performance in the digital arena. International understandings and accepted methodology have been slow to take shape with respect to the measurement and understanding of digital trade, but have started to come on stream over the recent period. Although the literature is still scattered and fledgling, this paper draws on the new sources available on the enabling factors for digital services competitiveness and provides an evidence-based framework for digital policy formulation that seeks to balance the various policy objectives involved.

Figure 1: Relative growth in global digital services trade

Source: ADB, 2022. Fig 7.6(f), p.194.

Figure 2: Digital services share in global trade in services

Source: ADB, 2022. Fig 7.6(c), p.194.

Proposal

By identifying best practice policy and regulatory settings for international digital competitiveness, this paper proposes a simplified framework of evidence-based benchmarks to guide structural reform efforts oriented to incentivizing innovation in digital industries. The paper covers policy settings in relation to: digital skills and talent development; digital infrastructure financing and investment facilitation; data protection and privacy; access to digital GVCs; competition policy; and digital services taxation. It also covers international trade governance issues relating to e-commerce, cross-border data flows, and mutual agreements on regulatory adequacy. It calls for international cooperation to reduce digital regulatory heterogeneity and facilitate development and implementation of international digital standards. G20 members are urged to adopt and promote the proposed framework for digital policy formulation, in the interests of generating global guidance on how to effectively balance competing policy objectives including openness to trade and investment.

The proposed evidence-based framework is set out in Box 1. Based on business surveys and the latest academic and other research findings, it identifies four key multi-faceted drivers of digital services competitiveness: Human Capital; Digital Readiness and Infrastructure; Entrepreneurial Innovation; and Efficient Interoperable Digital Regulatory Regimes. Each of these factors is heavily impacted by domestic policies and digital regulations. Guidance and international benchmarks are provided on core policy and regulatory issues with a view to unblocking the obstacles and enhancing the prospects for progress in digital trade governance.

Digital skills, talent development and employment

Digital transformation makes services both more tradeable and automatable. During the COVID-19 pandemic, digital transformation has deepened, with accelerated adoption of artificial intelligence (AI)-enabled digital solutions to support remote work. While demand for AI-related skills has grown rapidly in high-skilled technical services such as computer science and engineering, general ICT skills otherwise tend to remain more important, as do complementary soft skills. Where digitization leads to automation of tasks, job content has often shifted towards tasks that require soft skills (Nordås and Tang, 2022). Trade and technology can come together to generate inclusive growth if the right skills are in place. The G20 must ensure universal access to basic ICT skills[2]. Strengthening social skills, creativity, strategy and management are equally important. In these areas, human intelligence has comparative advantage over technology and there is strong potential for job creation.

Digital infrastructure financing and investment facilitation

An essential support for digital industrialization is inward foreign direct investment in the digital economy (digital FDI), which brings not only capital but also business know-how and technology (Stephenson, 2020). Given the nature of new digital business models, some adjustment is required in policies, regulations and other measures designed to attract digital FDI, whether into new digital activities (such as ridesharing apps), the adoption of digital solutions by existing firms (such as telemedicine or mobile banking); or into digital infrastructure (UNCTAD, 2017; ibid.).

Recent World Economic Forum survey evidence suggests that when investing in new digital activities, investors look most closely at data security regulations, copyright laws, and data privacy regulations. Key factors affecting investment in the adoption of digital technologies are availability of e-payment services, support for starting digital businesses and support for local digital skills development. Key factors influencing investment in digital infrastructure are ease of receiving licences for digital infrastructure, availability of skilled local engineers and other workers, and extent of international and regional coordination in infrastructure investment (Stephenson, 2020).

These findings form the basis for a structural reform roadmap to improve the digital investment climate and facilitate inward digital FDI. Economies are naturally at different starting points in terms of regulatory regimes and differ in their digital development goals. Efforts to create digital investment friendly regulatory environments must be tailored to specific domestic conditions while ensuring the identified foreign investment enablers are in place.

Digital Regulatory Regimes

Regulatory settings need to build user confidence in the online environment including stakeholder trust in data, networks, and algorithms, whether users are domestic or international. Increased cross-border trust in digital business and consumer relationships is a precondition for the big wave of services globalization known as the third unbundling, featuring extensive outsourcing of tasks, to take root. G20 members must lead the way in reducing and eliminating regulatory inefficiencies, which impose high business compliance costs, especially on smaller digital businesses.

G20 members should set a global example by undertaking public reviews of regulatory settings to ensure that they build user confidence in the online environment by facilitating innovation, minimising trade costs, and enabling cross-border digital interoperability. The time has come for all G20 members to contribute to the global dialogue on digital trade governance, ensuring an inclusive dialogue as a robust global digital market is built.

Regulatory Interoperability for GVC Connectivity

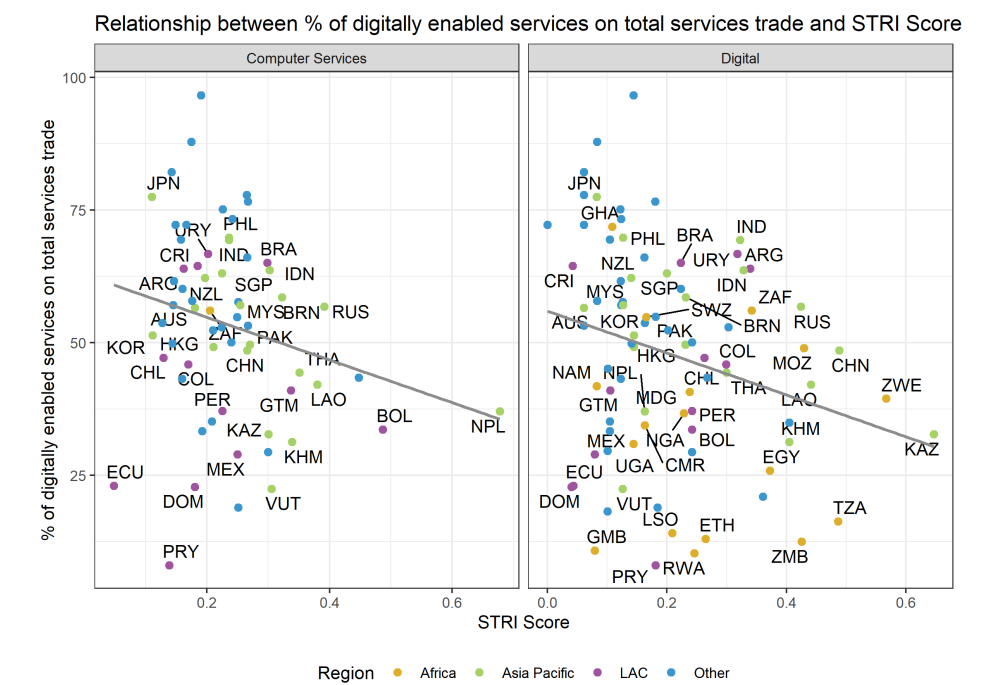

Unless domestic regulatory regimes allow for interoperability, businesses are simply unable to connect across borders with upstream or downstream business partners and clients. Regulatory heterogeneity is in itself a major constraint on digital trade, as it imposes duplicative regulatory compliance costs on all businesses seeking cross-border connectivity in global digital value chains. Academic and other research shows the most problematic barriers to digital trade are regulatory barriers such as data localization measures (Cory and Dascoli, 2021; Ferracane, 2021). As data becomes a key strategic asset and resource, some governments have swayed towards increasingly opaque and heavy-handed domestic regulations that reinforce digital sovereignty agendas (Chander and Sun, 2021) and exacerbate cross-jurisdictional regulatory fragmentation (Digital Policy Alert, 2022). Increasing divergence in regulatory regimes for cross-border data flows results in escalating compliance costs especially for small businesses and start-ups, reducing digital trade performance (Gal and Aviv, 2020). Figure 3 shows new OECD evidence of a strong global correlation between restrictive digital regulatory environments and poor performance in digital services trade.

Figure 3: Restrictive digital regulatory environments are associated with poor performance in digital services trade

Source: OECD, UNECA, UNESCAP, UNECLA, OECD Policy Brief, “Shedding New Light on The Evolving Regulatory Framework for Digital Services Trade”, July 2022

Regulatory Cooperation and Convergence

Establishing best practice regulation in the digital economy is work in progress. While regulatory harmonization across all areas of digital trade is unrealistic, improvements in transparency and interoperability are not only feasible but also urgent. G20 members stand at a critical juncture, from which the digital economy could disintegrate – or turn a corner and start to converge.

Convergence begins by establishing a dialogue identifying best practice regulatory procedures and processes and eventually establishing common or interoperable standards. G20 members should leverage the recent WTO Joint Statement Initiative (JSI) on Services Domestic Regulation to stake out paths towards regulatory interoperability, including processes and procedures for mutual recognition and regulatory equivalence. Jointly and individually, G20 countries must also show the way through forward-looking domestic regulatory reform, aiming for international standards, where relevant. The G20 should continue to engage with the OECD in developing best practice for regulatory processes through recommendations and guidelines as well as benchmarking and reviews. Regulatory cooperation is a dynamic process in which regulators draw on advances in academic research on regulation, adjust regulation to technological changes and learn from each other.

Urgent efforts are needed to develop consensus around best practices for data governance, especially for emerging digital technologies such as AI; experimenting with innovative regulatory models, especially through time-limited sandboxes; enabling informal dialogues for sharing of regulatory experiences; and coordinating on cross-border enforcement in areas such as privacy and online consumer protection. Developing innovative, inclusive and robust tools for data transfers such as trust marks/certifications requires meaningful international regulatory cooperation. Such cooperation should be geared to developing common norms and standards, consensus on best practices and soft law instruments.

Not all countries have the resources or the capacity to fully engage in international regulatory dialogues or to implement appropriate domestic frameworks. Technical assistance and capacity building initiatives are instrumental to the success of regulatory cooperation. Given the lack of binding commitments on capacity building in digital trade agreements, the G20 has a unique opportunity to announce open and inclusive initiatives in collaboration with relevant multilateral and multistakeholder institutions to address the specific challenges and needs of developing countries in integrating into the global digital economy.

Digital Standards

International standards generate major benefits for businesses: reducing compliance costs and standardizing compliance, enabling access to larger markets, and enhancing economies of scale and productivity. From a regulatory standpoint, international standards help align rules and processes across countries and reduce regulatory uncertainty. A report by the British Standards Institute found that standards contribute over 37 percent of annual productivity growth in the United Kingdom, directly contributing to both increased GDP and exports (TPRC, 2020).

Use of international standards also contributes significantly to interoperability and connectivity in digital trade: by spreading fixed infrastructure costs across a higher level of output, generating a fall in unit costs, and by facilitating interconnections at the level of business processes and methods. Interoperable systems and software then enable seamless movement of data across different networks/sectors, increase their reach/accessibility and reduce the digital divide. Benefits trickle down to consumers with widespread adoption of and access to digital technologies and applications.

International standards play a central role in digitalizing the supply chain, which in turn enhances the scope, speed and scale of digital trade. Digitalizing GVCs requires the adoption of multiple standards in a widespread and consistent manner across trading partners, including those related to e-payments, e-invoicing, QR codes, cross-border logistics and last mile delivery, wireless communication, digital identities, cross-border data flows and data portability. This is particularly critical for emerging technologies built on Big Data and AI. To give an example: last-generation telecommunications and wireless networks were based on distinctive, non-interoperable, national approaches; but ubiquitous adoption of 5G technologies requires adoption of common 5G standards to ensure compatibility across jurisdictions. Aligning 5G standards can reduce infrastructure costs and lower the barriers to data-intensive information exchange for digital trade.

G20 members should support international digital standards, and actively participate in international standards-setting processes. Governments should also be willing to offer guidance to businesses, especially SMEs, in adopting international standards.

Competition Policy

The Telecommunications Reference Paper introduced in 1996 was the first binding provision on competition policy in the WTO. Pro-competitive rules-based regulation was necessary to secure market access and national treatment in the heydays of telecommunications incumbents with significant non-transitory market power. Today “telcos” compete with internet services providers in many markets and telecommunications regulation has become more principles-based and integrated with ICT. ITU’s Generation 5 regulatory benchmark emphasizes regulatory collaboration and focuses on the digital economy rather than specific sectors, and moving from obligation-based to incentive-based and data-driven policy. International practice has been shifting from ex-ante regulation to ex-post competition policy enforcement. In this context, principles for best practice competition policy design and enforcement are needed.

Meanwhile, the arrival on the scene of other inherently digital services business models such as digital intermediation platforms[3] raises a number of potential competition policy issues. The business model of digital platforms relies heavily on data. Massive levels of data collection, storage, processing and use, and data-driven network effects coupled with consumer inertia and potential switching costs enable the platforms to capture a significant amount of data. This feedback loop helps platforms improve their services and attract more users and advertisers. However, this process confers considerable market power to a small number of big digital platforms, which may threaten competition. It also increases concerns about data privacy and consumer protection, as users are often unaware of actions to protect their privacy.

In these data-driven digital markets, competition and data protection issues are increasingly intersecting.

Digital Services Taxation

Pending recent OECD/G20 progress towards a common framework for taxation of cross-border digital services, unilateral measures have proliferated to capture tax revenue associated with cross-border delivery of digital services. These unilateral measures tend not only to diverge from international tax norms by being extraterritorial, taxing revenue rather than income and targeting specific sectors such as automated digital services, but also potentially discriminate against trading partners and hence risk WTO disputes.

An internationally recognized option is indirect Value Added Taxes (VAT) and Goods and Services Taxes (GST). States can impose indirect taxes on all goods and services supplied in their territory, including for example internet advertising and digital intermediation services. International guidelines have been developed to make digital platforms liable for assessing, collecting and remitting the VAT/GST due for online sales, and many countries have adopted this approach to create a level playing field between domestic and foreign suppliers of digital services. Tax incidence is non-discriminatory, falling effectively on the consumer.

Recent years have seen a G20 push to resolve the issues via international agreement on new taxation frameworks for digital services trade. The new frameworks involve new jurisdictions and profit allocation rules that allow taxing rights to extend beyond physical presence. The tax nexus based on where digital value is created will need to apply horizontally to all service sectors and firms.

Countries with potentially discriminatory digital services taxation measures already in place, for example requiring firms to establish commercial presence, will need to roll these measures back. Countries with aspirations as digital services exporters should avoid potentially discriminatory digital border taxation which has the potential to generate trade disputes, retaliation, and imposition of compensatory measures. The preferred approach is implementation of the destination principle for VAT and GST. Where necessary, developing countries should seek technical assistance on efficient sales tax collection systems as they reform their tax systems for the digital age.

Conclusion

G20 members should follow and promote globally the enabling policy parameters set out in Box 1 to support the digital transformation of services within an inclusive rules-based international framework. Digital protectionism is not the answer to addressing digital industry development. Regulatory cooperation and convergence around internationally agreed benchmarks backed by new trade rules can help build cross-border trust, reduce barriers to trade, and create mechanisms to support all countries build their digital readiness. G20 members should support the new rule-making processes in the WTO and encourage other WTO members to do likewise.

References

Asian Development Bank, Asian Integration Report 2022, Theme Chapter on Digital Services, 2022.

Ingo Borchert, Yose Rizal Damuri, Jane Drake-Brockman, Nigel Cory, Ziyang Fan, Christopher Findlay, Fukunari Kimura, Magnus Lodefalk, Hildegunn Kyvik Nordås, Hein Roelfsema, Sherry Stephenson, Eric Van der Marel, Shin-Yi Peng, Mustafa Yagci, Xinquan Tu, “Impact of Digital Technologies and the 4th Industrial Revolution on Trade in Services”, T20 Policy Brief, Saudi Arabia, 2020.

Anapum Chander and Haochen Sun, “Sovereignty 2.0”, Georgetown Law Faculty Publications and Other Works, 2021.

Rupa Chanda,“Building Competitiveness in Digital Services: Policy Do’s and Don’ts for Developing Countries”, Jean Monnet Network TIISA Working Paper No. 2021-13, November 2021.

Lurong Chen, Wallace Cheng, Dan Ciuriak, Fukunari Kimura, Junji Nakagawa,Richard Pomfret, Gabriela Rigoni, Johannes Schwarzer, “The Digital Economy for Economic Development: Free Flow of Data and Supporting Policies”, T20 Policy Brief, Japan, 2019.

Nigel Cory and Luke Dascoli, ”How Barriers to Cross-Border Data Flows are spreading globally, What they Costs and How to Address Them”, July 2021.

Digital Policy Alert, University of St Gallen, Switzerland, 2022 https://www.globaltradealert.org/digital

Jane Drake-Brockman, Gabriel Gari, Stuart Harbinson, Bernard Hoekman, Hildegunn Kyvik Nordås and Sherry Stephenson, “Digital Trade: Top Trade Negotiation Priorities for Cross-Border Data Flows and Online Trade in Services”. T20 Policy Brief, Italy, 2021.

Martina Ferracane and Erik van der Marel, “Regulating Personal Data: Data Models and Digital Services Trade.” Policy Research Working Paper No. 9596. World Bank, Washington, DC. 2021.

Michal Gal and Oshrit Aviv, Oshrit, “The Unintended Competitive Consequences of the GDPR.” Journal of Competition Law and Economics. March 2020.

Hildegunn Kyvik Nordås, “Services Trade Restrictiveness Index (STRI): The trade effect of regulatory differences.” OECD Trade Policy Papers, No. 189, OECD Publishing, Paris, 2016.

Hildegunn Kyvik Nordås, H. 2021. “Services Trade Governance in the Digital Economy”, CEP Policy Brief, March 2021.

Hildegunn Kyvik Nordås and Aili Tang, “Artificial Intelligence, Trade and Services Jobs”, Jean Monnet Network TIISA Working Paper No. 2022-14 March 2022.

Neha Mishra, “Can trade agreements narrow the global data divide? A novel agenda for digital trade”, Hinrich Foundation, January 2022.

OECD, UN-ESCAP, UN-ECA, UN-ECLAC, “Shedding new light on the Regulatory Framework for Digital Trade”, OECD Policy Brief, July 2022, p. 20.

Sebastien Miradout “Resilience versus Robustness- Global Value Chains: Some Implications”. Chapter in Baldwin, R. and Evenett, S. (eds) Covid-19 and Trade Policy; Why Turning Inward Won’t Work, Centre for International Policy Research, London, 2020.

Matthew Stephenson, “Digital FDI: Policies, Regulations and Measures to Attract FDI in the Digital Economy.” World Economic Forum White Paper, September 2020.

Matthew Stephenson, “Digital FDI: how to attract FDI to grow digital capacity and competitiveness,” Columbia FDI Perspectives, forthcoming, 2022.

UNCTAD, World Investment Report 2017. Investment and the Digital Economy, United Nations, Geneva.

UNCTAD, Digital Economy Report 2019: Value Creation and Capture; Implications for Developing Countries, United Nations, Geneva, 2019.

UNCTAD, Digital Economy Report 2021, Cross-Border Data Flows and Development: For Whom the Data Flow, United Nations, Geneva, 2021.

UNESCAP, OECD, 2022 Asia-Pacific Digital Trade Regulatory Review, 23 June 2022.

OECD, WTO, IMF, Handbook on Measuring Digital Trade, 2019.

TPRC, September 2020, Australia-Singapore Digital Economy Cooperation on Standards; Research Report. p.29.

WTO, Fourth Quarter Trade in Services 2021, Geneva, April 2022, p.1.

Appendix

Understanding Digital Trade

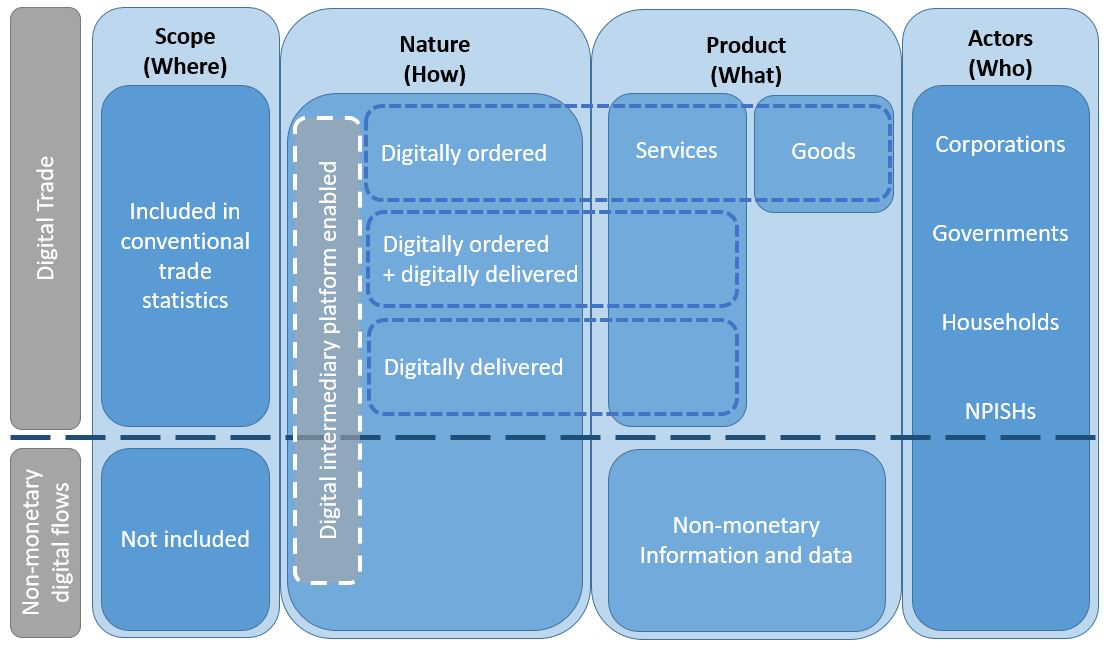

This paper adopts the definition of digital trade set out in the new international Handbook on Measurement of Digital Trade (OECD, WTO, IMF, 2019), ie ‘all trade that is digitally-ordered and/or digitally-delivered’. This includes:

- Goods that are digitally-ordered on-line over computer networks (e-commerce for merchandise).

- Services that are digitally-ordered on-line, and increasingly also digitally-delivered remotely in an electronic format, using computer networks (e-commerce for services or digital services[4]).

- The underlying commercial cross-border data flows[5],

As defined in the Handbook, only services (not goods) can be digitally-delivered. Most digitally-delivered services are also digitally-ordered[6]. Digital services constitute by far the larger of the first two components above.

Figure 4: Conceptual Framework for Digital Trade

Source: OECD-WTO-IMF Handbook on measuring digital trade

- An explanation of the concept of digital trade adopted in this paper is provided in the Annex. In brief, digital trade is defined in the Handbook on Measurement of Digital Trade (OECD, WTO, IMF, 2019) as ‘all trade that is digitally-ordered and/or digitally-delivered’ ie (1) goods that are digitally-ordered on-line (e-commere for goods); (2) services that are digitally-ordered on-line, and increasingly also digitally-delivered on-line (generally described as digital services); (3) the underlying commercial cross-border data flows (also categorised as services). ↑

- Everyday usage of digital technology includes use of a computer, tablet or mobile phone, sending email, browsing the internet, making a video call – these are examples of using basic ICT skills and technology to communicate. ↑

- These services are defined as ‘online, fee-based, intermediation services enabling transactions between multiple buyers and multiple sellers, without the intermediation platform taking economic ownership of the goods or rendering services that are being sold (intermediated). ↑

- This paper uses the expression digital services rather than alternative expressions such as digitally-deliverable, potentially digitally-delivered or digitizable services. ↑

- In this measurement framework, all monetary transactions involving transfer of data are categorized as services. ↑

- GATS Mode 1 delivery of services overlaps with the concept of digitally-delivered services but the concepts are not identical. GATS defines modes of supply according to the residence of the services supplier relative to the client, while the digital distinction hinges on ‘how’ the service is delivered. Mode 1 includes services content delivered via phone, fax or manually typed email, not all of which can (yet) be considered strictly as digitized. Some Mode 2 transactions can be delivered digitally, eg when a non-resident traveler uses a local sim card. Digital delivery is easier to measure than digital-ordering as, by definition, all digitally-delivered cross-border services transactions are mode 1 and measured by balance-of-payments (BoP) statistics. For sub-sectors such as communications and computer services, BoP statistics will readily provide reasonable upper bound estimates of digital-delivery. For business services and personal services, BoP statistics will likely include a substantial component of non-digital transactions. On balance, the non-digital component is considered to account for a relatively minor (and declining) share of the total. ↑