Economic globalization has achieved a major breakthrough in global supply chain operations in recent decades. Raw materials and services are procured from multiple locations beyond the domestic economy and distributed through complex networks to other locations around the world. The COVID-19 pandemic, however, has disrupted both domestic and global components of supply chain systems and impacted their resilience. Logistics bottlenecks and fleet shortages combined with capital and financing difficulties, especially for shipping companies outside the Main Line Operators (MLOs) alliances, have led to chronic price increases. Even before the pandemic, Indonesia’s domestic supply chain was suffering inherently high costs from discrepancies in regulations, system operations, infrastructure facilities and more. Added to this are costs associated with domestic and international Sustainable Development Goal (SDG) commitments on climate change, green economy and other sustainability issues. These developments call for supply chain enhancement policies to contribute to those externalities as well as to alleviate high costs in the supply chain ecosystem. Enhancement can be achieved both at upstream level via smart industry and trade policies, and at downstream distribution level via smart logistics. G20 members should cooperate to build the required global resilience and sustainability in supply chain systems. This Policy Brief proposes empowerment of Single Window (SW) systems, at domestic, regional and global levels. The proposals focus on trade and investment facilitation, and the contribution from digitalization of supply chain systems within the SW framework. It calls in particular for digitalizing exchange and processing of data and information among SW stakeholders, and integration of several digital platforms to empower them for more resilient supply chain operations.

Challenge

THE PANDEMIC DISRUPTION CALLS FOR A RESILIENT GLOBAL SUPPLY CHAIN STRATEGY TO OVERCOME INHERENT RISKS AND CONSTRAINTS

Repositioning the G20 as Central Forum for Creation of Resilient Global Supply Chains

Global economic turbulence resulting from the COVID-19 pandemic has negatively impacted global supply chain resilience. Even prior to the pandemic, some developing countries were still not enjoying the benefits of increased global trade and integration in global supply chains due to the uncompetitive costs of trade. This is further exacerbated by divergences and lack of harmonized procedures and regulations among countries. The high cost of trading has become a barrier to the cross-border flow of exports and imports within global production networks. As a result, there is an imbalance in trading conditions among countries. Follow-on consequences from this situation include the slow progress by developing countries in attracting investment which is oriented towards international cross-border production sharing in the form of Multi-National Corporation (MNC) investment.

The disruption caused by changing global trade patterns and geopolitical issues further increases the bottlenecks in global shipping especially containerized cargo and drives up logistics costs. Spill-over impacts of the bottlenecks are gradually transformed into increasing prices across the globe. The price impact is likely to keep climbing as the logistical bottleneck persists.

Several challenges are dynamic in nature, and they relate to the continuation of past actions and efforts to achieving green economy and mitigating climate change. Lessons learned and unforeseen yet of COVID-19 pandemic impacts require the creation of resilient global supply chain systems in the future. This resiliency has to deal also with other low-probability/high-impact disruptions such as labor-strikes, congestions, theft, natural disasters, terrorism, and even wars (e.g., Russia-Ukraine). The G20 must become a global role model in resolving the following challenges:

- Enhancing resiliency in supply chain systems to face pandemic-related and future global challenges – Many G20 members, with various geographic conditions, supplies and demands, and stakeholders, must intertwine and work together to become sustainable global supply chain systems.

- Harmonization and simplification of international trade procedures that give rise to green economy and supply chain actors – General concessions and agreements and the derived policies to secure resilient and global supply chain system should be created on the basis of balanced and fair regulations and procedures, and able to eliminate any thwarting divergences.

- Platform integration at local/domestic as well as global level – Integration and interoperability among supply chain instruments is needed to create/ease cost-effective undertakings, and to further eliminate silos among stakeholders.

- Digitalization and capacity building within global supply chain ecosystems – One common and standard platform of digital supply chain operation should be established involving appropriate, digitally-talented human resources. Promoting investment of hard and soft digital infrastructure is also key to reach resiliency of global supply-chain ecosystem (Rahimi et. al., 2021)

- Price Caps to tackle unreasonable and uncompetitive cost – With the characteristic of capital-intensive industry, alliance between MLOs in shipping sector is seen as a good strategy in the context of sharing facilities, fleet, and others as it could reduce intermediate costs, eventually pushing shipping costs down. But as the alliances grow larger, now comprising roughly 85% of total capacity (The White House, 2021) and the market takes an oligopolistic shape, the side effect of these alliances becomes more obvious and proves to be a double-edged sword, especially during the pandemic. The oligopolistic market structure of the MLOs implies that the adjustments in freight clearing rates are not necessarily influenced by the prevailing global market demand and supply for container shipping. In fact, the freight rates are largely the outcomes of the reaction curves of the three largest alliances: the Alliance, the Ocean alliance and the 2M alliance. Controlling more than 80% of total capacity, these Alliances can control the supply and bring up freight rates, especially given the demand spike amid post-pandemic economic recovery.

- Financial institutions to support logistics industry – To reduce the fleet shortage, shipping companies could procure additional fleets to support the market. It is a challenging exercise especially in the short run without strong support from the financial sector. The price of cargo vessels is not only very expensive, but the fluctuation is also very dynamic, entailing huge risks and uncertainty for ship owners to acquire new fleet not even to lease in the recent moment. Vessel prices could plummet quickly, massively reducing their value. Such excessive risks might discourage the shipping companies from buying additional fleets, especially those with a very limited capital. Ultimately, shipping companies outside the alliances could findfiind it difficult to do anything and the shipping status-quo will keep being dictated. There is a dangerous risk this could increase shipping costs world-wide, exacerbating inefficiencies in world trade.

The G20 should therefore put facilitation of resilient global supply chains among its top priorities this year and next, and get beyond many risks and constraints for implementation. Such facilitation should build on complementarities and inclusion among the member countries.

Combining Needs, Ideas and Relevant Undertakings

G20 members need to ensure resilient supply chain ecosystems as fundamental supports to world trade activities and economic integration. Each and every country also has its own inherent problems in managing disruptions and green economy and sustainability imperatives, and to stimulate it to develop ideas for sound ecosystem. Cooperation in competition for trade transactions may exist among the member countries, but this is largely to maximize profit in financial terms rather than economic terms. Many private sector supply chain operators/providers and traders act to exacerbate the situation and often sideline government policy implementation.

Some inherent local/domestic divergences in supply-chain operations due to natural disasters like floods, poor infrastructure and facilities, human resource skills gaps and many more are no less important to comprehend for resiliency. Despite the differences in situations facing individual G20 members, cooperative approaches are needed to find global solutions. Member countries would need to support each other to reach common and greater goals. For example, overloading and over-dimension cases in many developing countries require road financing schemes that beyond their governments’ limited budget. Provision of loading/unloading equipment, and other supporting facilities at ports are vital for seamless movements along supply chains, and may need special funding support.

Laws and regulations have been issued to facilitate physical movements of merchandise and more efficient practices with respect to administrative papers/documents have been achieved via automation and digitalization. However, in the context of the ASEAN single window (ASW), jointly developed by ASEAN member countries since 2003, there is evidence that this long-established system is not yet working optimally, and it is still being corralled into silos. At the individual national level, the Indonesian single window (NISW), for example, apparently needs further improvement to reach its goal of simplifying cross-border paperless trade. Since the G20 forum is prioritizing resilient supply chain issues, we offer three proposals to support the establishment of resilient global supply chains, taking into account the goals associated with green economy, sustainable community, balance trade, and related issues on climate change.

Proposal

PROPOSAL 1. TRADE & FINANCING: ENHANCEMENT THROUGH PRICE CAP AND FINANCING FACILITIES

Given the current shipping bottlenecks and shortage of fleet, combined with a non-existent financing facility, especially for developing countries, we propose:

Price Caps to Tackle Unreasonable and Uncompetitive Cost

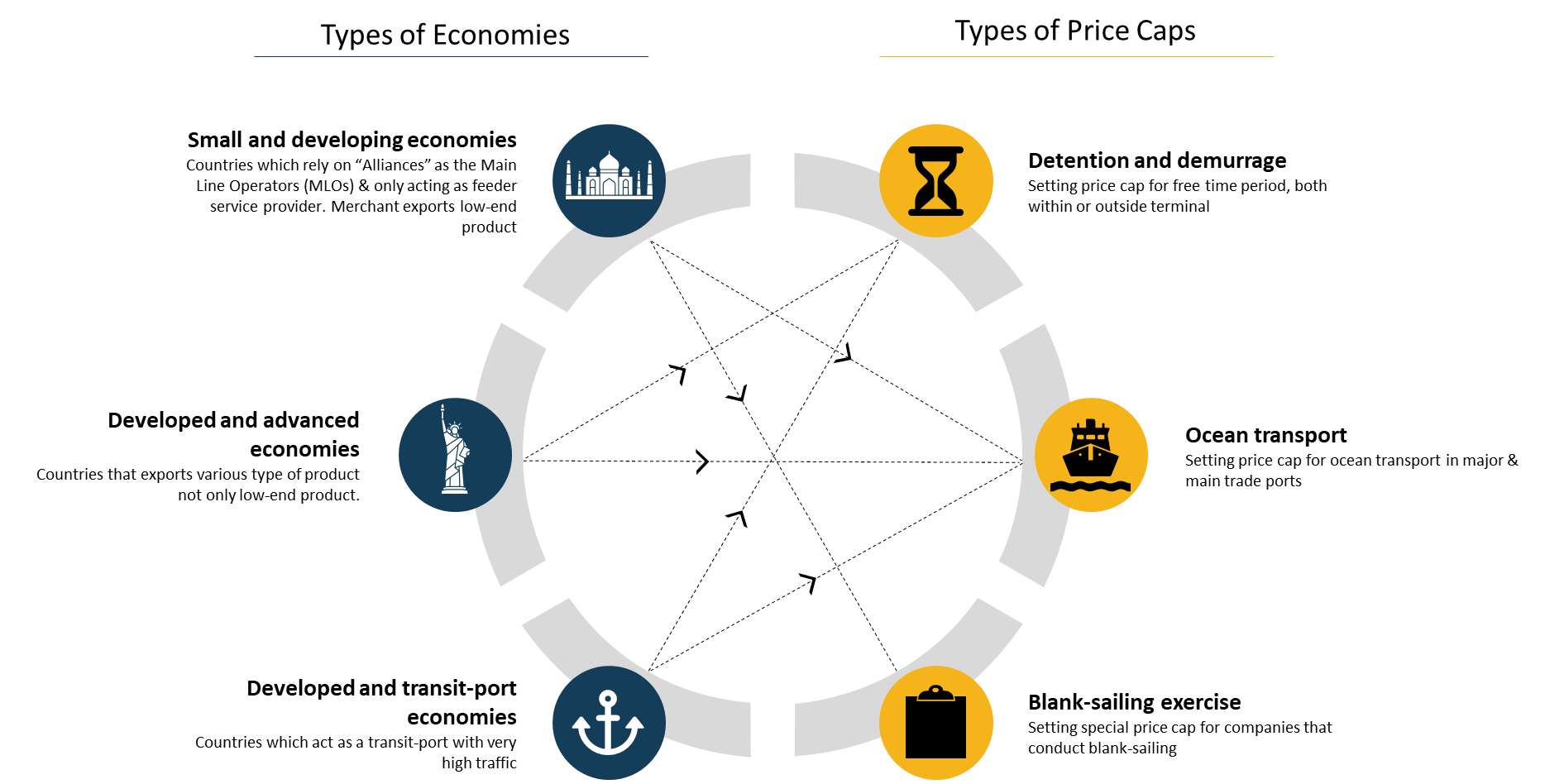

This price caps would consist of several structures and scenarios, 1) price cap for detention and demurrage, 2) price cap for ocean transport, and 3) price cap for companies that conduct blank sailing/empty haulage (Figure 1). These three price caps, although they could be implemented for every country, will need match-up with what is relevant for the country. Setting price caps without taking into account individual country characteristics would prove to be harmful. We have mapped out three specific characteristics of countries based on their economic and trade characteristics as the matching target for the price caps: 1) Small & developing economies, 2) Developed & advanced economies, and 3) Developed & transit-port economies. Detention and demurrage problems are more likely to be encountered by developed and advanced economies with strong domestic consumption demand or by transit-port economies such as Singapore. On the other hand, price cap for high-cost of ocean transport is applicable for every country, but even more so for small-developing countries that have limited MLOs and exports dominated by low-value added commodities. Lastly, price cap for blank-sailing is especially relevant for small developing countries as they will experience the biggest impact of blank-sailing practices.

For the first price cap (detention and demurrage), as what we have seen with the effect of economic recovery that induced a very strong demand, the backlog and traffic of trade have surpassed the capacity of many ports to handle. This forces many shipments to park their container in the ports waiting to be loaded or stranded in the ship waiting to dock and unload. The extent of both loading and unloading time incurred very significant costs for merchants and increased their production cost. Under these circumstances, merchants would have two options, 1) increase the price of their goods or reduce their production and 2) endure this cost and reduce their profit margin and sustain their expansion and growth. This problem is very acute, especially over 2021 – 2022 for United States, Europe, and others.

Figure 1: Types of Economies & Proposed Price Caps

Source: IFG Progress Analysis

For the second price cap (Ocean transport), most trade flows, especially from developing countries, must go through transshipment processes, starting from the origin, Feeder Service, MLOs, and finally to the destination. The role for developing countries in ocean transport is very limited and solidified generally involving, for example, transporting exports (imports) to (from) ports in transshipment hubs such as Singapore. The process from port of Singapore to the destination is handled by MLOs. This means that for a particular region, such as ASEAN, the role of shipping is only acting as a feeder service for MLOs, not the MLOs itself. Developing countries lack of capacity to transporting their own exports or imports is an ongoing problem and deteriorating on an annual basis. For example, around 30% of Indonesia’s current account deficit can be attributed to this problem. The proposed price cap for ocean transport, is seen to be an alternative especially for developing countries such as Indonesia and other ASEAN countries.

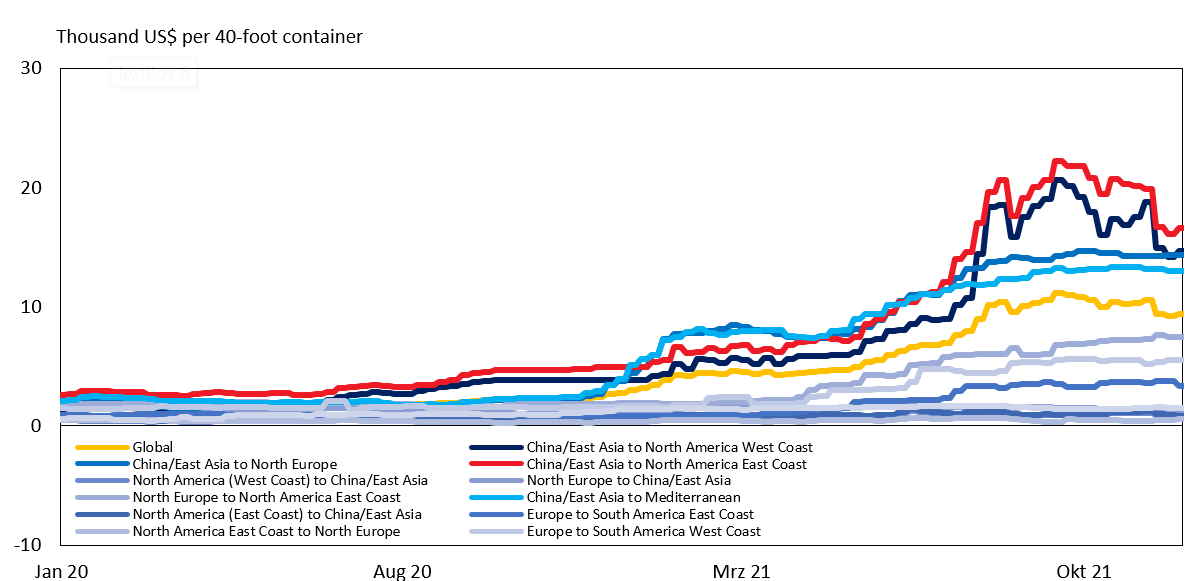

Figure 2: The Increase of Container Freight Cost Per Route

Source: Bloomberg

Lastly, for the third price cap (Blank sailing), the fluctuation in freight rates could hurt many countries especially those who are highly dependent on MLOs which control more than 80% of the market. Blank sailing from these alliances could generate a significant drop in supply and increase the price of ocean transport. It is up to these alliances mercy to increase their supply, particularly in terms of the sudden spike in demand experienced in the beginning of 2021. As a result, almost every route from eastern to western hemisphere is experiencing an increase in ocean transport cost (Figure 2). The proposed price cap for companies that conduct blank sailing, might be the key to this practice, including acting as a deterrent against these kinds of practices by these alliances.

Financial institutions to support logistics industry

The challenge associated with the high volatility of vessel prices is yet another issue for ship operators in many countries. The fluctuation of vessel prices of tanker, bulker, and container liner ship is very concerning, to the point that it might impact the continuity of fleet fulfilment to meet market demand. The movements of these three types of ship, reflected in vessel price index, are very dynamic and unpredictable. There are two reasons behind this movement: first is the price fluctuation of the type of the goods being transported; second is due to the price of raw materials to build the ship.

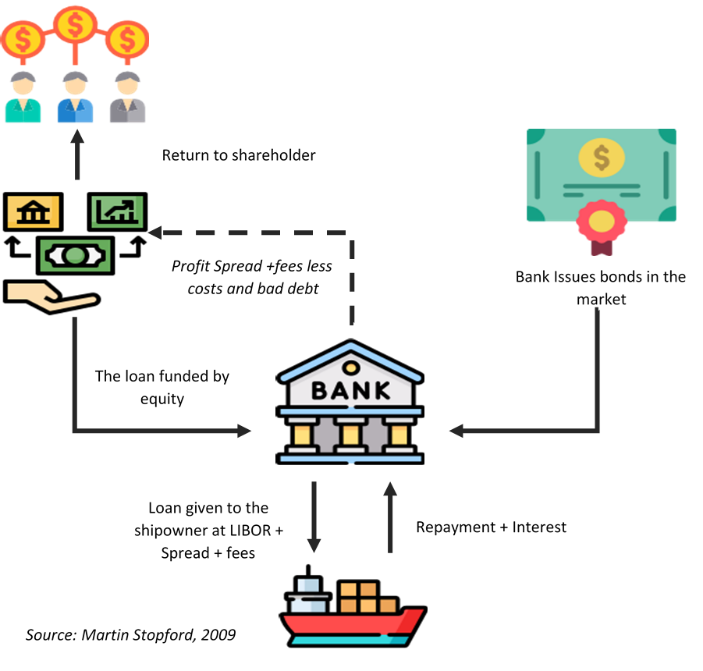

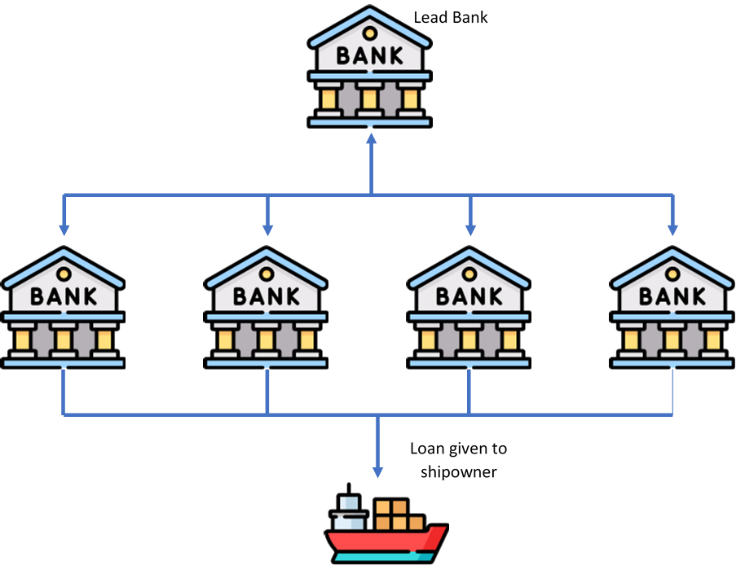

In some countries, shipping financing is supported by the government through development banks or other financial institutions managed by the government[1]. Bank loans also play an important role in shipping industry. The general model of financing from bank loan is shown in figure 3. The fund which bank raises to meet demand of loan by issuing bond in the capital market and getting from bank’s equity. For larger loan, banks tend to spread the risk by sharing the loan across several banks, split into small distributed packages across the syndicate. This enables banks which are not specialized or expert in appraising shipping loans to participate under the guidance of the lead bank which has expertise in shipping industry (figure 4).

Figure 3: General Scheme of Bank Loan for Shipping Industry

To make this financing scheme more attractive to lenders for building new ships, government can also take part. (1) government guarantee can be obtained to help shipowner gain a loan from commercial bank. The value of this guarantee depends on how government agency sets the credit standard. (2) Subsidy on interest rate charged by the lenders to borrowers or shipowner is offered by the government. The subsidy offered by the government covers the difference between the market interest and agreed rate of the loan (Stopford, 2009)[2].

Figure 4: Scheme of Syndication Loan

We call on G20 members to collaborate in facilitating the dialogue between the relevant government authorities/agencies and the MLOs in designing these price caps and the financing schemes. Optimistically, we can see a robust price stability, a gift we would all appreciate, especially in this economic recovery phase.

PROPOSAL 2. PRODUCTION DISTRIBUTION FACILITIES REARRANGEMENT: HOW TO SUPPORT GLOBAL VALUE CHAIN TOWARDS GREEN ECONOMY

Two major logistics roles influencing inflation in economic markets are: at a micro level, to improve distribution system within industries by applying logistics management concerned with transportation and warehousing, and at a macro level to maintain distribution to secure commodity availability and price stability. The outcomes are demonstrated by the situation in Ukraine. The resilience of global supply chains is being tested due to the war. Nowadays, many countries consequently face the situation of food insecurity and skyrocketing of food price due to the disruption of food supply chains. The global supply chain is also impacted by this situation, and it is transmitted to the domestic inflation of food and energy of other countries. There is an urgency to improve the resilience of global supply chains to keep food and other vital commodities transported and distributed smoothly.

Moreover, Indonesia and some other countries are facing the problems related to the scope and the size of their market share and wide geographic spread with different market densities. Besides the logistics, infrastructure like roads, railways, seaports, airports, and container depots also need to be developed and improved. No less important are the unresolved issues related to the fleet capacity utilisation for efficient distribution.

Creating resilient global supply chains, to some extent, needs rearrangement of production and distribution infrastructures. It is prerequisite for optimal operation of domestic and global supply chain, and green economy outcomes, for this to cover both a physical and non-physical development of the whole supply chain ecosystems. Distribution improvement needs a comprehensive systemic approach covering flows of input-process-output. The policies proposed are as follows:

Standardization of Resources

Inherent discrepancies in operation across every country must be rearranged to shape seamless systems. Standardization of facilities involved in the operations of the global supply chain system, namely transportation, warehousing, equipment, containers, and logistics infrastructure needs to be built to facilitate the smooth flow of goods among countries. Standardization of transportation includes capacity, dimensions, payload, green transportation, minimum and maximum speed limits, access road, vehicle load factors, lead times from origin to destination for each distribution channel, and others. This global standardized system must connect distribution points more effectively and efficiently.

Policies on standardization of resources within the G20 should aim at improving the competitiveness of companies in the G20 environment through:

- The analysis of value-added activities and standardization in the global value chain

- The increase in predictability, efficiency, agility, and resiliency of G20 global supply chains to create a sustainable environment

- Facilitating the implementation of company’s supply chain standardization among G20 countries

Capacity Building in Human Resources

Human resources are of prime concern input since they are related to distribution operators at all levels, including government policy makers and enforcement personnel as well as other public services within the distribution operations.

Policies to improve human resources capacity should focus on:

- Collaboration among companies of G20 members on training programs, internships, benchmarks, and human resources competency certification in supply chain and logistics.

- Encouraging business organization leaders of G20 members to improve employee knowledge, skills, understanding values, attitudes, motivation, and capabilities.

- Development of relevant programs to improve entrepreneurial and management skills, especially among SMEs to meet the new demands of globalization and the new economy.

- Providing necessary incentives for businesses participating in the human resources capacity building, such as provision of facilities and infrastructure to ensure access to the e-commerce business

- Providing grants for SME’s Go-Digital programs in developing countries, as well as collaborating experts, for example, in Indonesian’s triple helix for digital technology training. This needs to be complemented with a road map leading to human resources upskilling on the digital economy in relation to the production and distribution processes.

Private Sector Participation

Distribution systems need to be equipped with modern technologies, equipment, and other logistics infrastructures at enterprise and national levels, and it gets beyond government investment since most of supply chain players are private. G20 must promote participation of private sector for this system development at national and international level, since the global supply chain ecosystem requires tight commitment of many countries to achieve their common goals. Foreign direct investment (FDI) should be part of these multilateral agreements, and be attracted through the involvement of MNCs. FDI should become a bridge to fill the fiscal gap among countries with different capacity to establish the system.

PROPOSAL 3. DIGITALIZATION OF GLOBAL SUPPLY-CHAIN SYSTEMS: HOW TO SUPPORT GLOBAL SINGLE WINDOW WITH STAKEHOLDER INCLUSION

Resiliency is expected to survive any low-probability/high-impact situation and condition, it is not merely about staying robust enough to recover from the chaotic situation of the recent pandemic, but also other disruptions like labor-strikes, theft, system-breakdowns, natural disasters, terrorisms, even wars. Digitalization, on the other hand, equips and supports supply-chain systems with less human involvement, effective data/information exchanges and multiplications, and automatization of facilities (Sheffi, 2005). All these features are keys to building effective and efficient supply chain ecosystems, which are less prone to disruptions. Critical conditions may impact availability of human resources, especially when physical activities are needed, but cohesion of digital automation and robotics keeps their paces, and so overcomes disruptions.

ASEAN Single Window (ASW) and Indonesia Single Window (ISW) provide examples of efforts made to digitalize data/information of documentation and administration within the supply-chain framework, with the specific goal of simplifying cross-border paperless trade in ASEAN. Its global value chain has total cycle of cross-border cooperation, at B2B and G2G level, suppliers, logistics, customs and governments, transporters, and buyers/users. Total potential of logistic cost saving after implementation was estimated at around USD15.2 million per year, and even higher at around USD 38 million with South Korea and China participations (Noor, 2022; Kementerian Keuangan, 2022). Despite its current non-optimal functioning, ASW/ISW have started digital era in supply-chain and held digital data/information important to optimizing the operations. These very beginning efforts need, however, support for enhancement not only for system development but also for digitalization of the ecosystem. This scope comprises the architecture of total supply chain operating systems, laws, regulations, ethics, human resources, and infrastructures/facilities.

Big Data Center and Analytics

It is important to take into account the lessons-learned from ASW/ISW, COVID-19 pandemic, and other disruptions, when designing resilient supply-chain architecture based on digital data/information. It is time for global supply chain management to address filling the digital divide with big data center and analytics (BDCA). The G20 forum must keep in line with this vast development. Trade transactions among members must be the agenda to establish BDCA and their inclusion. Data/information is provided and used by members with equality, and BDCA must become a single hub providing access to members based on agreed concession. BDCA should be a center for analyses resolving issues of disruptions, as well as common trade facilitation issues on imbalance trade, non-tariff barriers, and other local/domestic and international logistic problems. Furthermore, BDCA should stand as an entity being run by all representatives of member countries, so ownership does not matter rather usage matters. It can be considered as multiple-ownership contending exclusiveness and inclusions to members.

The G20 forum should promote the support instruments of commitments from G20 leaders, business communities/supply-chain providers, to be reflected in both national and G20-wide legislation. Instruments here are policies, regulations, infrastructures and facilities in the multi-lateral context among member countries. These keys are bottom-line to reach global commitment, and BDCA to perform as planned and expected, as well as to attain solutions for many primary aspects of the other proposals.

References

Kementrian Keuangan. (2022). Lembaga National Single Window. Presentation Material.

Noor, M.M. (2022). ASEAN Single Window (ASW) & Indonesia National Single Window (INSW). Best Practice of Cross Border Paperless Trade Integration. Presentation Material.

Rahimi, I., Gandomi, A.H., Fong, S.J., and Ulku, M.A. (2021). Big Data Analytics in Supply-Chain Management, First Edition, CRS Pres.

Sheffi, Y. (2005). The Resilient Enterprise: Overcoming Vulnerability for Competitive Advantage, MIT Press.

Stopford, M. (2009). Maritime Economics (3rd ed). New York: Routledge.

The White House. (July 2021). Executive Order on Promoting Competition in the American Economy, https://www.whitehouse.gov/briefing-room/statements-releases/2021/07/09/fact-sheet-executive-order-on-promoting-competition-in-the-american-economy/

- Singapore has developed ship financing through an incentive program, a particularly generous feature is tax exemption on qualifying income for the entire life of any vessel acquired by an Approved Ship Investment Vehicle (ASIV) within its incentive period. In Malaysia, Bank Pembangunan Malaysia Berhad (BPMB) has been providing financing facilities through medium-long term loans scheme for shipping, shipyard, or others maritime related activities. In Thailand, Export-Import Bank of Thailand under the Ministry of Finance has been providing a long-term credit facility to purchase of old or new ships. ↑