FinTech is a dynamic segment at the intersection of the financial services and technology sectors. Innovation and evolution of FinTech are reforming the financial systems (1). FinTech has become an integral part of the economic fabric and we have witnessed tremendous upheavals in the global financial systems. Under the transformation of the current ecosystem, new risks are arising in the eyes of consumers. And the disruptive trends could exacerbate those risks – managing privacy, digital identity, cyber security threats are increasingly complex and expensive. The G20 should play a leading role in sustaining the trust in the global financial ecosystems, by incentivizing innovation and maximize returns for the general public and the future of humanity.

Challenge

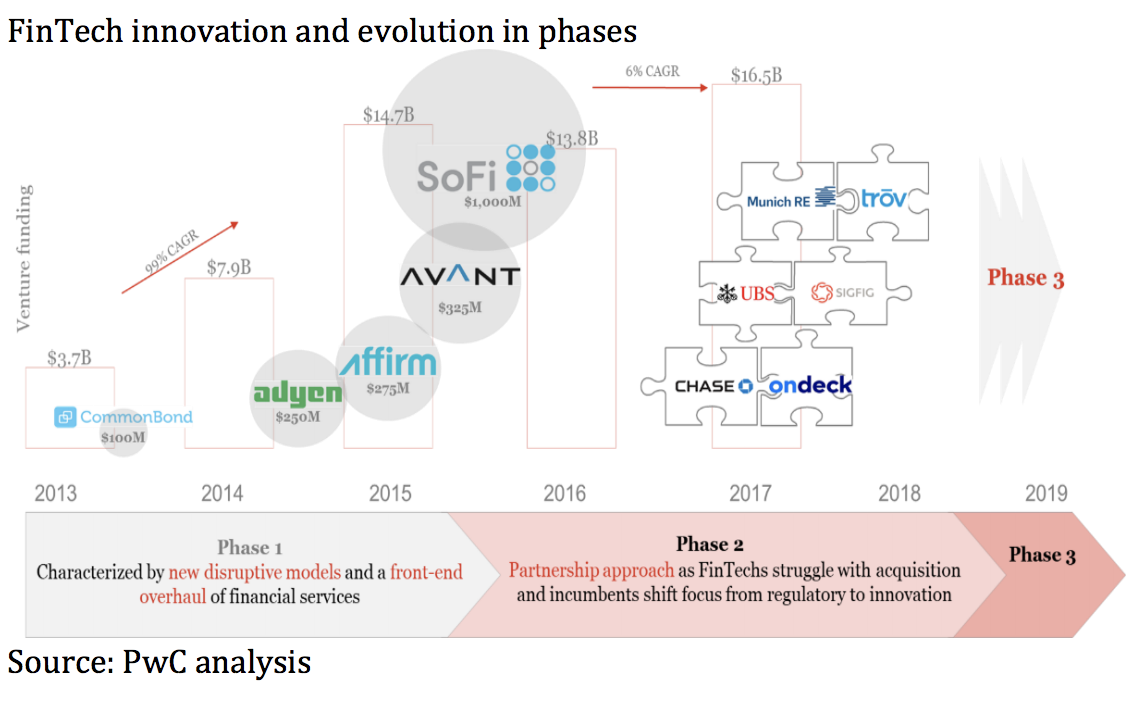

FinTech innovation is now also coming from outside the financial services industry and being driven by a variety of sources including technology companies, e-retailers, and social media platforms. From a technology perspective, open-source frameworks, scaled cloud computing, developers ondemand, and smartphone devices are the four key developments which have lowered capital and knowledge-based barriers to entry into the FinTech space. As a result, the global FinTech market has grown exponentially (2). Innovation and evolution of FinTech are reforming the financial systems in the digital age. A greater convergence is yet to come but there is also a risk of having a greater divergence in the eyes of consumers.

- Security and privacy: Cyber security and privacy are top threats to the rise of FinTech. FinTech firms are increasingly prime targets for cybercrime attacks. Complexities of managing privacy, digital identity, and detailed customer data can also be expensive hurdles.

- Regulations and governance: Regulations are double-edged sword under a balance between innovation and consumer protection; their role is to sustain “trust” in the system and society for the future of humanity. Although technological advancement has blurred borders, there are clear differences between advanced countries on their approaches in regulations for both protecting consumers and promoting innovations.

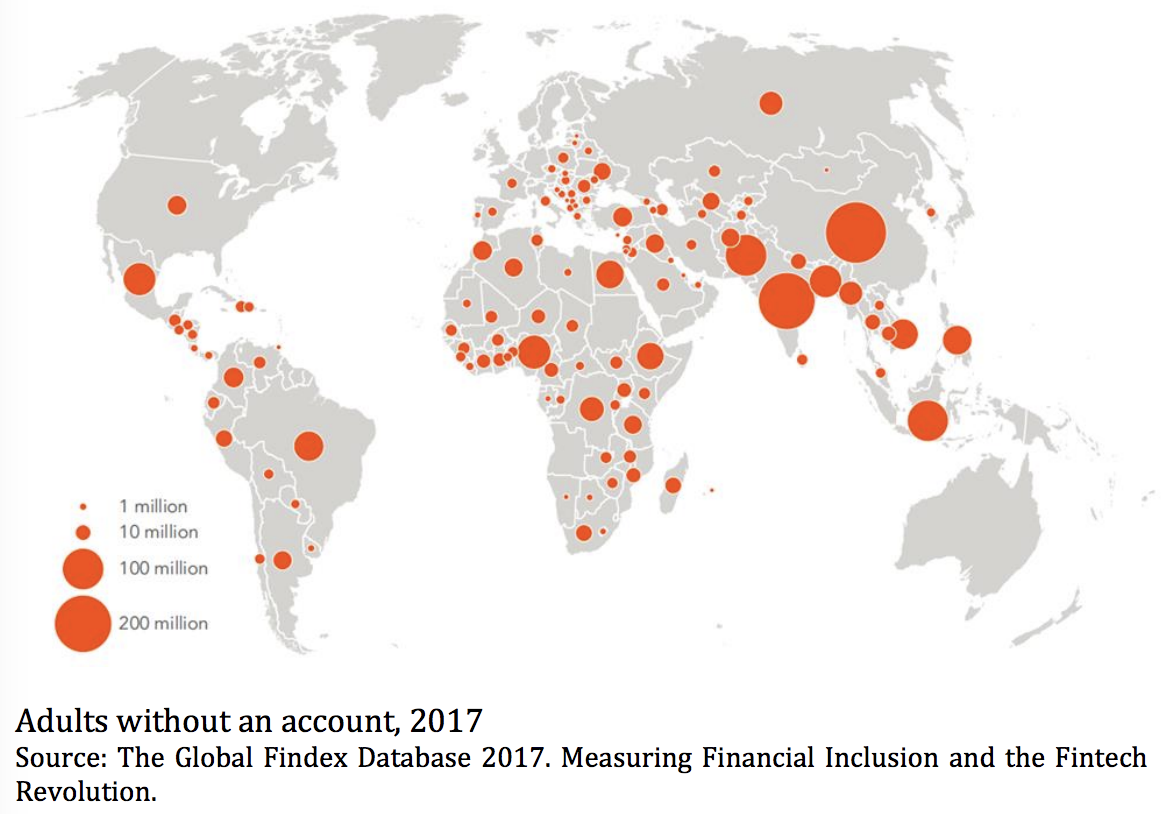

- Financial inclusion: According to the World Bank, globally, about 1.7 billion adults still remain unbanked, and fifty-six percent of all unbanked adults are women (3). The statistics show that among the unbanked, women are more likely than men to be out of the labor force. At the same time, mobile-led FinTech has enabled 700 million people becoming account holders between 2011 and 2014, (4) mainly in developing countries. Historical data proves that financial inclusion is one of the key drivers in reducing poverty and achieving inclusive economic growth (5).

Proposal

G20 should lead on developing principals in policy and regulation to ensure an adequate level of cybersecurity and data privacy while encouraging innovation. Technology has radically altered risks related to reliability, security and sustainability of the global financial ecosystems (6). A malicious cyber-attack could lead to a widespread loss of trust in the financial ecosystems as well as to a profound social instability (7). Cyber threats also remain one of the top concerns for the Global CEOs (8) and 69% of financial services’ CEOs reported that they are either somewhat or extremely concerned about cyber-threats (9). Breaches of security in the financial ecosystem will put billions of dollars at risk and will shake consumers’ trust in the system. Cybersecurity is, therefore, now a critical component of financial regulation. Privacy is another critical concern as many societies are struggling to balance between protecting privacy and increasing security. Consumers should not feel their private lives are infringed.

Although we are living in a fractured world with different belief systems, rules of law, and economic models, and regulators in each jurisdiction enshrine competitiveness in their own statutory objectives, better coordination on cybersecurity regulation and approach in managing consumer privacy are critical to promote innovation in the global financial ecosystems and maximize returns for the general public and the future of humanity.

G20 can promote coordinated efforts in governance and regulatory structures. Regulations are double-edged sword under a balance between innovation and consumer protection. Their role is to sustain “trust” in the system and society for the future of humanity. Although technological advancement has blurred borders, there are clear differences between advanced countries on their approaches in regulations for both protecting consumers and promoting innovations. By collating recent trends in each market and the high-level comparisons of differences in governance and regulatory structures in major markets, G20 can craft and promote coordinated efforts in governance and regulatory structures.

G20 should also actively play a leading role in Identifying and managing risks in financial stability considering how legal experts and regulators are grappling with the rapid growth of FinTech businesses in different markets. Despite the fact that regulations are imperative in protecting consumers and for risk management purposes, there are arguments that regulations have hampered innovations in some cases. Big Tech companies and FinTech ventures are encroaching on established markets and not only redefining “Finance” but also bringing new values and benefits to consumers through their innovations. However, at the same time, we must pay attention to new risks being brought with those innovations, and the roles of financial regulations and policymakers need to be reviewed from the ground up in a coordinated manner by recognizing how people are affected – from the local to the regional to the global levels.

The fragmentation in principals in governance and regulatory structures between countries results in overlapping and duplicative mandates which can be costly. G20 should help regulators find their way for streamlining and coordinating through the tangled web of financial regulations. Other T20 policy briefs (10) also propose cohesive approaches among G20 countries to manage regulations on protecting consumers and promoting innovations. Fragmentation only increases risks and limits the capacity to respond to challenges across borders.

G20 should champion and promote a coordinated effort by governments to support improving financial inclusion through bridging technology, innovation, and policies and regulations for consumer protection, and through sharing best-practices in building necessary infrastructures, physical, financial, technology, for driving financial inclusion (11). Accompanying T20 policy briefs (12) also address the impact and the importance of promoting financial inclusion for public good.

Nearly a half of the adult population on earth are still unbanked. Financial inclusion is one of the key drivers in reducing poverty (13) and achieving inclusive and sustainable economic growth (14).

Over the past 20 years, there has been a four-fold increase in trade and a fivefold increase in financial flows around the globe, and nearly a billion people have been lifted out of extreme poverty. But these changes have also brought with them some difficulties: rising inequality, growing mistrust in business and discontent socially and with the political establishment. For these reasons, a systemic transformation is needed so that economic growth delivers better for society once more.

The global economy will continue to be defined by a complex and shifting set of economic relationships. Navigating this environment requires increased sophistication and importance in defining the roles of the traditional financial institutions, FinTech companies, and Big Tech players in the financial ecosystem coexisting in the eyes of consumers. Addressing these challenges is growing in importance as we consider how to bring about a systemic alignment of economic growth and social progress at a macro level. G20 can and should play a role in exploring and building goodwill and trust from the governance and policy mechanism perspectives by protecting consumers and promoting innovations for the future of humanity.

Footnotes:

1 See Appendix

2 dealroom.co (2019). “Globally, €43 billion was invested in FinTech in 2018, twice the 2017 amount of €21 billion.” https://blog.dealroom.co/global-fintech-investment-doublesto-e43-billion-in-2018/

3 The Word Bank (2017). The Global Findex Database 2017. Measuring Financial Inclusion and the Fintech Revolution.

4 The World Bank (2015). “Massive Drop in Number of Unbanked, says New Report” https://www.worldbank.org/en/news/press-release/2015/04/15/massive-drop-innumber-of-unbanked-says-new-report

5 The Economist Intelligence Unit (2018). Global Microscope 2018

6 See e.g. PwC (2018). Pulling fraud out of the shadows, Global Economic Crime and Fraud Survey 2018: “, 14% of survey respondents who said cybercrime was the most disruptive fraud told us they lost over $US1 million as a result, with 1% indicating they lost over $US100 million.”

7 World Economic Forum (2019). The Global Risks Report 2019 14th Edition. “In the GRPS (Global Risks Perception Survey), “massive data fraud and theft” was ranked the number four global risk by likelihood over a 10-year horizon, with “cyberattacks” at number five.”

8 PwC (2019). 22nd Annual Global CEO Survey. Cyber threats is ranked at top 5 concern among global CEOs and at the top concern for US CEOs in 2019 survey.

9 PwC (2016). Financial Services Technology 2020 and Beyond: Embracing disruption

10 Ussal Sahbaz. (2019). Forming a cohesive fintech agenda for the G20; Krish Chetty, Jaya Josie, Ephafrus Mashatola, Babalwa Siswana. (2019). Forming a G20 fintech association forum to broker international partnerships promoting financial inclusion in developing and emerging economies; Cyn-Young Park, Bo Zhao (2019). Fintech and Distributed Ledger Technology: Issues and Challenges Beyond Cryptocurrency

11 The Word Bank (2017). The Global Findex Database 2017. Measuring Financial Inclusion and the Fintech Revolution.

12 Krish Chetty, Jaya Josie, Ephafrus Mashatola, Babalwa Siswana, Kim Kariuki, Shenglin Ben, Zheren Wang, Edward Brient, Wenwei Li, Man Luo. (2019). Forming a G20 fintech association forum to broker international partnerships promoting financial inclusion in developing and emerging economies; Krish Chetty, Jaya Josie, Babalwa Siswana, Ephafarus Mashotola, Kim Kariuki, Chernay Johnson, David Saunders, Herman Smit, Shenglin Ben, Zheren Wang, Edward Brient, Wenwei Li, Man Luo. (2019). Review of Fintech Strategies for Financial Inclusion in Sub-Saharan Africa.

13 The Word Bank (2017). The Global Findex Database 2017. Measuring Financial Inclusion and the Fintech Revolution. “A study in Kenya found that access to mobile money services delivered big benefits, especially for women. It enabled women-headed households to increase their savings by more than a fifth; allowed 185,000 women to leave farming and develop business or retail activities; and helped reduce extreme poverty among womenheaded households by 22 percent.”

14 The Economist Intelligence Unit (2018). Global Microscope 2018

REFERENCES

• World Bank Group (2017). The Global Findex Database: Measuring Financial Inclusion and the Fintech Revolution. Available at: https://globalfindex.worldbank.org/

• World Economic Forum (2019). The Global Risks Report 2019. 14th Edition. Available at: https://www3.weforum.org/docs/WEF_Global_Risks_Report_2019.pdf

• PwC (2018). Global Economic Crime and Fraud Survey 2018 – Pulling fraud out of the shadows. Available at: https://www.pwc.com/gx/en/forensics/global-economic- crime-andfraud-survey-2018.pdf

• PwC (2016). Financial Services Technology 2020 and Beyond: Embracing disruption. Available at: https://www.pwc.com/gx/en/industries/financial-services/ publications/financial-services-technology-2020-and-beyondembracing-disruption.html

• dealsroom.co (2019). Global fintech investment doubles to €43 billion in 2018. Available at: https://blog.dealroom.co/global-fintechinvestment-doubles-to-e43- billion-in-2018/

• PwC (2019). 22nd Annual Global CEO Survey. Available at: https://www.pwc.com/gx/en/ceo-agenda/ceosurvey/2019/gx.html

• The Economist Intelligence Unit (2018). Global Microscope 2018. Available at: https://www.centerforfinancialinclusion.org/globalmicroscope-2018

APPENDIX

In the Phase 1, FinTech has emerged and attracted a significant amount of capital with a combination of impacts from an enabled low cost digital distribution with technological innovation, policy changes, and an increasing number of digital-native generation. Venture funding into FinTech surged through 2015. In the Phase 2, venture funding stabilized as FinTech firms struggled with customer acquisition, regulations, and developing infrastructure, and the market became crowded rapidly. FinTech firms therefore pursued and materialized partnerships with traditional players. In the Phase 3, incumbent players in the financial ecosystem has started to adopt many of the early disruptive business models and products by FinTech players. By leveraging emerging technologies, including Artificial Intelligence (AI) and Application Programming Interfaces (APIs), in both front- and back-end, traditional players and FinTech firms alike are reforming the financial systems. In this phase, we expect a new style of competition among various partnerships with innovations in both technologies and business models.

From a viewpoint of governance in the financial industry, there are points to be noted: FinTech companies are not subject to traditional banking regulations. Even so, we must maintain an economic order and avoid damages to consumers. It means that we need regulations for FinTech companies to protect consumers. However, if we restrain FinTech companies under the same regulations as traditional incumbents, the dynamism of innovation might be lost in the process. The balance between regulations and promotion is critical.