This brief assesses the work capacity in South Korea and U.S. and draws policy implications. We find two facts: One is that there exists substantial amount of additional work capacity overall and the other is that there is a considerable heterogeneity in work capacity related with differences in educational background. Given these findings, we need to encourage seniors to adjust themselves by providing sufficient time and Benefit options when designing socially sustainable public pension schemes. In addition to gradual public pension reforms, we recommend complementary targeted welfare programs, policies to boost the demand for aged workers, and strengthened safety regulations.

Challenge

While public pension programs offer essential income security for the elderly, they also create a fiscal challenge for governments to maintain the programs’ sustainability. In most advanced countries, these pension programs already account for significant share of their government budget; In 2015, the total public pension spending of the OECD countries recorded 7.5% of their GDP, and Greece and Italy spent more than 16% of their GDP on financing their pension programs. (1)

In the midst of retirement of baby boomers, the financial burden of pension programs has been continually growing: For the first time in history, the U.S. Social Security spending outpaced its projected revenue last year. The European Commission forecasts a steady rise in pension expenditures for Greece and Italy by 2040 (European Commission, 2018). For the OECD as a whole, public pension expenditures rose by about 2.5% of GDP since 1990 and the spending is expected to keep increasing in 21 out of 35 OECD countries by 2050 (OECD, 2017).

These fiscal challenges have initiated active discussions with policy evaluations to gain long-term sustainability of public pension programs (see Wallenius (2013) and Kitao (2014), for instance). (2) In particular, along with the improvement of older adults’ health status, more pension systems have adopted reforms that can incentivize older individuals to work beyond the previous normal retirement age. These policy changes include, but not limited to, the rise in full retirement age, the extended mandatory contribution periods, and the removal of early retirement option.

While these policy options would effectively allow the government to regain fiscal sustainability of the public pension system, the welfare consequences of these pension reforms crucially depend on labor supply responses of the older population. If older individuals attach to the labor force and delay their benefit claims along with the pension reforms, then the welfare impacts of the policy change during the transition periods could be minimal. On the other hand, if older individuals do not have enough work capacity, then these individuals would experience income lapses between retirement and benefit claims. As a consequence, the new pension system would be unable to provide very social safety nets that it was aimed to.

Indeed, recent studies on health conditions find that there exists vast heterogeneity in work capacity (and needs for early retirement) depending on socioeconomic statuses, and the degree of health inequality has been growing over the past two decades (Meara et al., 2008). In this brief, we assess the work capacity of the U.S. and South Korea, which demonstrate a similar degree of health improvement in recent years but have adopted different public pension programs. By comparing the relation between health, work capacity, and actual employment of the elderly, this analysis allows us to draw lessons for future pension reforms.

Proposal

Empirical Strategy

The goal of our empirical analysis is to measure the work capacity based on health status of elderly men in ages between 60 and 74. Unlike younger workers, older individuals’ labor market participation decisions could be affected by retirement incentives which are independent from their own work capacity. Similar to Coile et al. (2016), we address this issue and quantify the older male’s health capacity to work by taking younger males aged 51 to 54 as a base group. Under the assumption that influence of public pension programs on younger workers’ labor supply decision is limited, we first estimate the relationship between health status and labor market outcomes. Then, by applying these estimates to actual health status of older males, we obtain the projected employment absent from the influence of pension programs. The measure of “additional” work capacity is defined as the difference of the projected employment rates from the actual employment rates observed in the data.

Data

Since we are interested in older working-age individuals’ behaviors in the labor markets, we utilize the panel datasets designed for studying the characteristics of health and economic outcomes near retirement in both countries. For the U.S. labor market analyses, we use the Health and Retirement Study (HRS), a biennial panel survey representing the U.S. population over the age of 50. Similarly, we use the Korean Longitudinal Study of Aging (KLoSA) to estimate the relationship between health and employment of older Korean populations. Both datasets provide a wealth of information on health measures and labor market outcomes along with pension and other government program statuses, which covers the key dimensions of our research questions. Our empirical analyses focus on individuals in male individuals with ages between 60 and 74.

Finding 1: Overall Additional Work Capacity

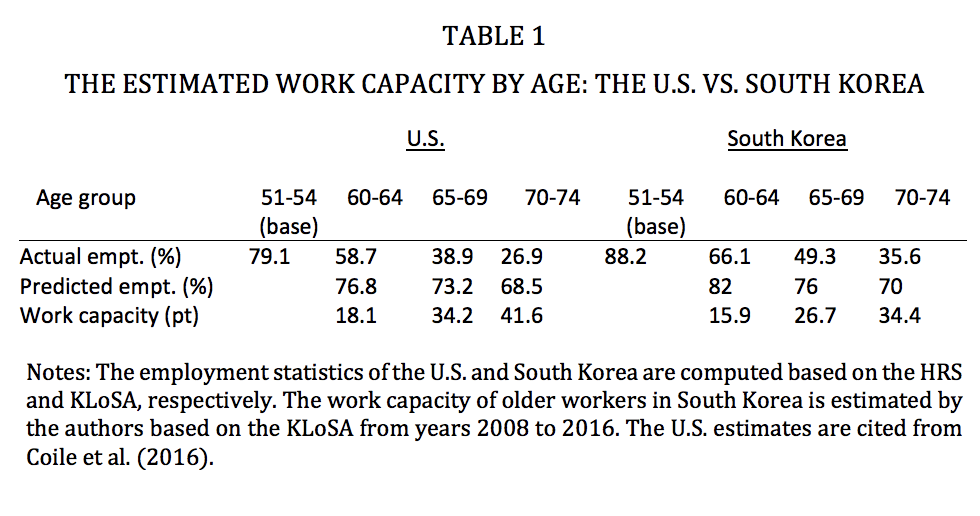

We first compare the trends of work capacity over the life-cycle between the U.S. and South Korea. Table 1 shows the results of our work capacity calculations. In both countries, the estimated probability of working declines with age as health status deteriorates. However, the share of men actually working declines more quickly with age than our estimates predict. As a result, we find that in both countries, there exists substantial amount of additional work capacity, which is rising sharply with age.

Finding 2: Heterogeneity in Work Capacity

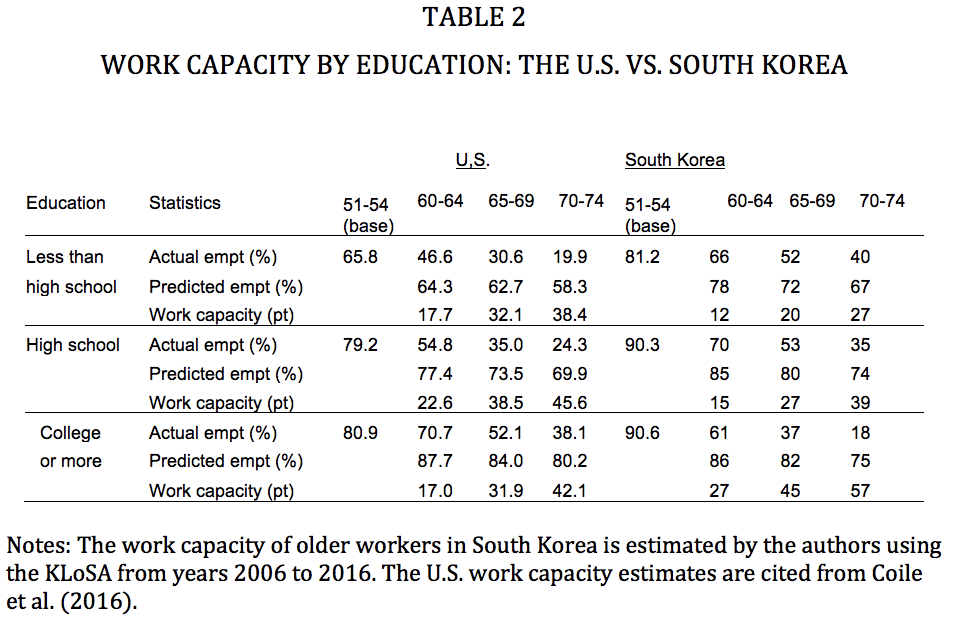

To better understand our estimation results, we re-estimate the work capacity by education group and examine possible heterogeneity in capability of working longer. Though aggregate statistics suggest that overall health statuses have improved last decade, the extent of improvement varies across individuals’ socioeconomic status (SES). As a consequence, increasing health inequality may lead differences in work capacity in older ages by education group, as less educated workers have higher probabilities of having physically demanding occupations and experiencing disability episodes.

Our estimation results are summarized in Table 2. There are noticeable heterogeneities in two dimensions. First, unlike the divergence of actual employment rates of college graduates between the two countries, their predicted employment rates based on health status are fairly similar; the difference in the estimated share of employed population in each age group is in within the range of 1 to 5 percentage points (pt.), while the actual employment rates differ by 9 to 20 pt.

Another distinction in work capacity predictions and actual employment comes from lower educated workers’ capacity to work. Measured by the predicted employment rates, the U.S. high school graduates have comparable work capacity with South Korean individuals with less than high school education. Their estimated probabilities to work range in between 67 to 78%, and the difference in the working probabilities within the same age group is less than 3 pt. However, the actual realization of employment rates are 11 to 17 pt.

Descriptive evidence suggests that the differences in incentive structures of government programs of the two countries could be the results behind these findings. While the immature pension system of South Korea leave many noncollege graduates left behind, the U.S. provides a wide range of social safety net targeting older, particularly less-educated, populations (3). On the other hand, lack of additional financial incentives to work among the college graduates fails to tap in possible work capacity of highly educated South Koreans compared to those in the U.S.

In the midst of retirement of baby boomers and increasing inequality, it is more important than ever to establish a social welfare system that could reduce elderly poverty while attaining older individuals with work capacity to the labor markets. Based on our findings, we make the following policy suggestions in the context of South Korea. To make policy recommendation concrete, we consider the Korean context but policy recommendations apply to other similar countries.

Policy 1: Increase the pensionable age slowly enough

First, an increase of the retirement age for pension benefits should be sufficiently gradual that beneficiaries can have enough time to plan their retirement accordingly. In South Korea, normal pension payments begin at age 62 now and the pensionable age will gradually increase to 65 years old until 2033. That extension of pensionable age from 60 to 65 was introduced in the 2008 national pension reform and further reform proposal to age 68 is under discussion. When we consider the additional age increase, we need to check the degree of health improvement and the employment opportunity for vulnerable groups rather than the entire group. If the long-term health improvement of vulnerable groups and the increase in their employment possibility are uncertain, prolongation of pensionable age needs to be carefully decided. In that case, it is desirable to design the incentive structure to be described later.

Policy 2: Provide flexible benefit options

Second, it is desirable to provide flexible benefit options considering growing inequality of work capacity. Extension of a uniform pensionable age and excessive pay cuts can pose an excessive risk to the individuals. Individuals should have the right to choose the period of work and the type of work that suits their situation. In South Korea, the pension benefit is reduced by 6% per year up to 30% with early pension receipt and increased by 7.2% per year up to 36% with late pension receipt, which are close to the actuarially neutral level. However, the incentive to work during the pension receipt is need to improve. Pension benefits are reduced with earnings exceeding the average of those insured up to 50% of pension benefit, which essentially works as tax wedges for labor supply of pensioners preventing the pensioner with partial work capacity from working further. It is possible to induce the elderly to work part time by eliminating the penalty on pensioners’ earnings.

Policy 3: Complement pension reforms with other welfare programs

With the inequality in work capacity, public pension reforms may lead more elderly at risk of poverty, by pushing them to work despite lack of work capacity. By enhancing welfare programs targeting those elderly workers with limited work capacity, the government can potentially reduce the welfare costs of pension reforms while improving the pension system.

In general, there are two approaches helping individuals with limited work capacity, or disabilities (OECD, 2010). First, the government can provide direct income supports in form of disability insurance or public assistance. If proper screening mechanisms can prevent moral hazard problems, complementary targeted income supports could provide the minimum standard of living with reasonable resources. Those measures could weaken fiscal sustainability but can improve social sustainability by providing adequate consumption smoothing and income insurance.

While direct income supports are more conventional, more countries have introduced alternative labor market policies to remove barriers to work for workers with limited work capacity since the beginning of 2000. These integration polices can be in form of support in job search and training (labor supply), subsidized employment for hiring the older workers (labor demand), and changing overall cultures and work environment (legislation of antidiscrimination laws). Recently, researchers find the expansion of integration policies, particularly focusing on labor demand side, are associated with better labor market outcomes of the disabled in 19 OECD countries (OECD, 2010). (4)

Policy 4: Boost the demand for aged workers

The government needs to remove disincentives to hire older workers that older workers are encouraged to continue their work beyond “normal retirement age.” For instance, higher insurance premiums for health and disability have been cited as one possible cause for employers to avoid hiring elderly workers. In 2005, the Netherlands reduced employers’ obligation on these social insurance contributions when they hire a person older than 50. Policies can be in form of providing financial incentives to employees for continuing or renewing employment of older workers. Moderate deduction in pension amounts or financial gains from extra contribution beyond retirement age can be possible candidates.

In addition to providing employment support, it is necessary to make policy efforts to eliminate the structural factors that hinder the demand of aged work such as mandatory retirement and seniority-based salary system. In the short term, temporary rehiring, bridge jobs, and self-employment can be addressed but retirement and salary system must be fundamentally redesigned to encourage productive people to remain in the labor market. This can lead to an increase in the employment of the elderly, an increase in output, and an increase in contributions and tax revenues, thereby improving overall sustainability.

Policy 5: Make work environment safer

Finally, safety regulations should be strengthened that more people age healthy. Lose of work capacity is much more common than many would imagine. According to the U.S. Social Security Administration, one in five 20- year-old workers entering the workforce exit the labor market before reaching the “normal” retirement age due to health problems. This labor market exit rates are more profound among the non-college graduates and physically demanding occupation holders. The industrial accident death rate in South Korea is 8 per 100,000 people, the third highest among OECD, next to Turkey and Mexico (5).

Loss of work capacity due to industrial accidents can lead workers and their family in financial hardship, and social support costs and personal suffering can be severe. Furthermore, with the extension of life expectancy, it is expected that the economic and social losses caused by unsafe working environments will continue to increase. To reduce industrial accident, the government needs to strengthen the industrial safety regulations and to provide incentives for companies to enhance working environment. It can also encourage firms to develop safer production technologies.

1 OECD (2019), Pension spending (indicator). doi: 10.1787/a041f4ef-en (Accessed on 21 January 2019).

2 Policy options for pension reforms can be grouped into four different categories: increase in tax contributions, changes in progressivity, retirement ages, and the deduction of benefits.

3 In 2016, South Korean college graduates received annual pension benefits of more than 30 million Won (or $26,800) on average, while older males with a high school diploma and middle school graduates received 15 million Won ($13,400) and 9 million ($8,000), respectively.

4 The analysis is based on countries including Australia, Austria, Belgium, Canada, Denmark, Finland, Germany, Ireland, Luxembourg, the Netherlands, Norway, Poland, Portugal, South Korea, Spain, Switzerland, the United Kingdom and the United States.

5 Due to the different standards of industrial accidents, in international comparisons, the safety of workplace is compared based on the rate of industrial accident deaths.

References

• Coile, Courtney C., Kevin S. Milligan, and David A. Wise, Health Capacity to Work at Older Ages: Evidence from the U.S., University of Chicago Press, 2016.

• European Commission, “Pension Adequacy Report 2018: Current and Future Income Adequacy in Old Age in the EU,” Publications Office of the European Union, 2018.

• Kitao, Sagiri, “Sustainable Social Security: Four Options,” Review of Economic Dynamics, 2014, 17 (4), 756-779.

• Meara, Ellen R., Seth Richards, and David M. Cutler, “The Gap Gets Bigger: Changes In

• Mortality and Life Expectancy, By Education, 1981-2000,” Health Affairs, 2008, 27 (2), 350-360.

• OECD, “Sickness, Disability and Work: Breaking the Barriers,” OECD, OECD Publishing, Paris 2010.

• OECD, “Pensions at a Glance 2017: OECD and G20 indicators,” OECD, OECD Publishing, Paris 2017.

• Wallenius, Johanna, “Social security and cross-country differences in hours: A general equilibrium analysis,” Journal of Economic Dynamics and Controls, 2013, 37 (12), 2466- 2482.