Micro, Small and Medium Enterprises (MSMEs) are an integral cog of the growth engine of different global economies. In India in 2018, MSMEs employed 40% of the workforce, contributed 37% of GDP and 43% of exports. [1] In spite of exclusive legislations and policies, lack of access to formal credit has hampered MSMEs from realizing their full potential. For lenders, the fragmented and opaque nature of available MSME information poses serious challenges in underwriting. This policy brief proposes a policy framework for establishing databanks intended to further facilitate the use of alternative data in the MSME lending landscape.

Challenge

MSMEs are the backbone of every economy and contribute heavily towards employment in a nation. According to the World Bank, MSMEs play a major role in most economies, particularly in developing countries. [2] Formal MSMEs contribute up to 60% of total employment and up to 40% of national income (GDP) in emerging economies. [2] However, across both emerging markets as well as developed nations, many MSMEs are excluded from the credit ecosystem due to various challenges – the primary one being lack of easy access to reliable credit information to justify credit disbursal.

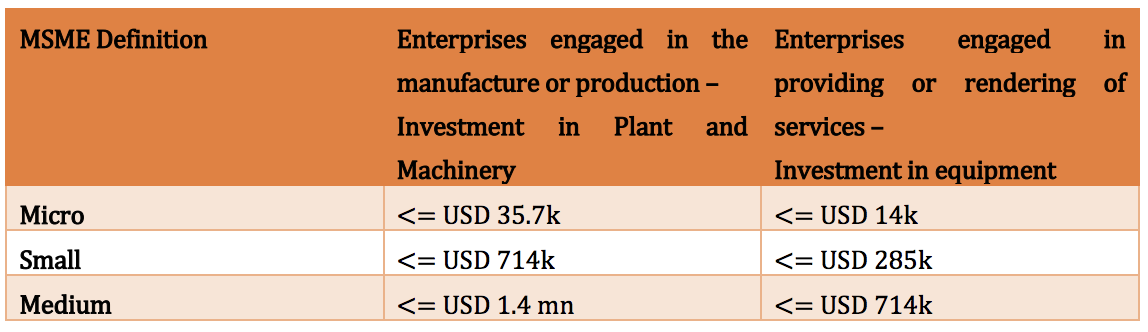

The following table provides the definition of MSMEs as per the Micro, Small and Medium Enterprises Development (MSMED) Act, 2006, by the Government of India:

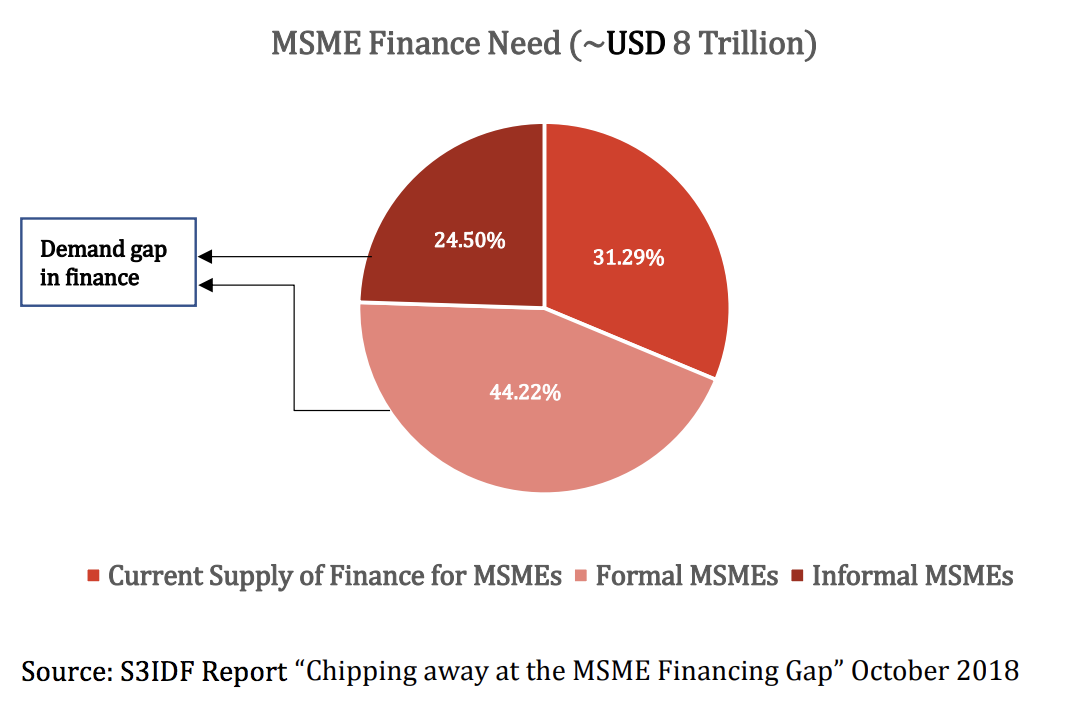

As per the International Finance Corporation’s MSME Gap Assessment report, the global gap in MSME funding in the formal sector is USD 5.2 trillion. [3] Adding the USD 2.9 trillion estimated gap in funding for MSMEs in the informal sector, the total funding gap is approximately USD 8 trillion. [4]

In India, as in other parts of the world, the MSME sector will continue to serve as the backbone of the economy. Yet, the long turnaround time for loans disincentivizes enterprises from borrowing in the formal sector to address their credit needs. Further, lending institutions consider MSME lending to be a high-cost and high-risk venture, primarily owing to the opaqueness of MSME credit information.

However, with improvements in digital infrastructure and lower costs of data, along with structural reforms such as the implementation of the Goods and Services Tax (GST), digital lending is transforming the MSME lending landscape. With the proliferation of new MSME digital data streams in recent years, digital MSME financing using alternative data provides a significant opportunity to address the most crucial bottlenecks – lack of reliable information for lenders and loan turnaround time for debtors.

The alternative data streams are providing lenders with greater flexibility and increased opportunities to lend to traditionally underbanked customer segments. As our society considers how to bring about a systemic alignment of economic growth and social progress at a macro level, new technological advancements conceived and deployed to facilitate MSME lending will play an increasingly critical role in enabling more businesses to thrive where they are most needed.

Proposal

This proposal is laid out in two major sections:

• Section 1 explores the opportunities emerging in the MSME lending landscape and examines the alternative data used and frameworks developed to bridge the MSME financing gap.

• Section 2 details the proposed initiative to establish a databank to enhance credit access for MSMEs.

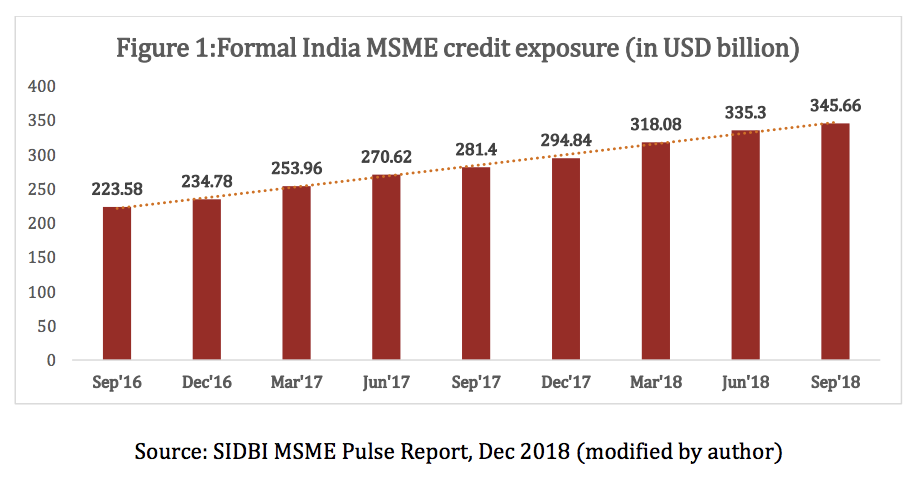

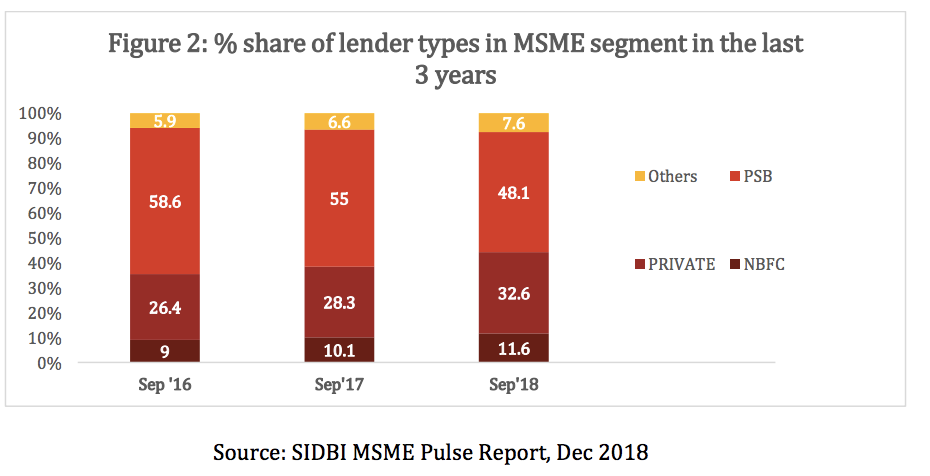

1) Opportunities in the MSME lending landscape Over the last few years, MSME lending has witnessed steady growth in India. From September 2016 through September 2018, MSME credit issuances in the formal sector increased from approximately USD 224 billion to USD 346 billion.

In addition to the increase in the amounts of formal credit issued to MSME borrowers, there has been a change in the composition of the market share. Market share is gradually shifting from public sector banks (PSBs) to private banks and non-banking financial companies (NBFCs), with some of these entities increasingly adopting digital technologies and partnering with Fintech players for MSME lending. [5]

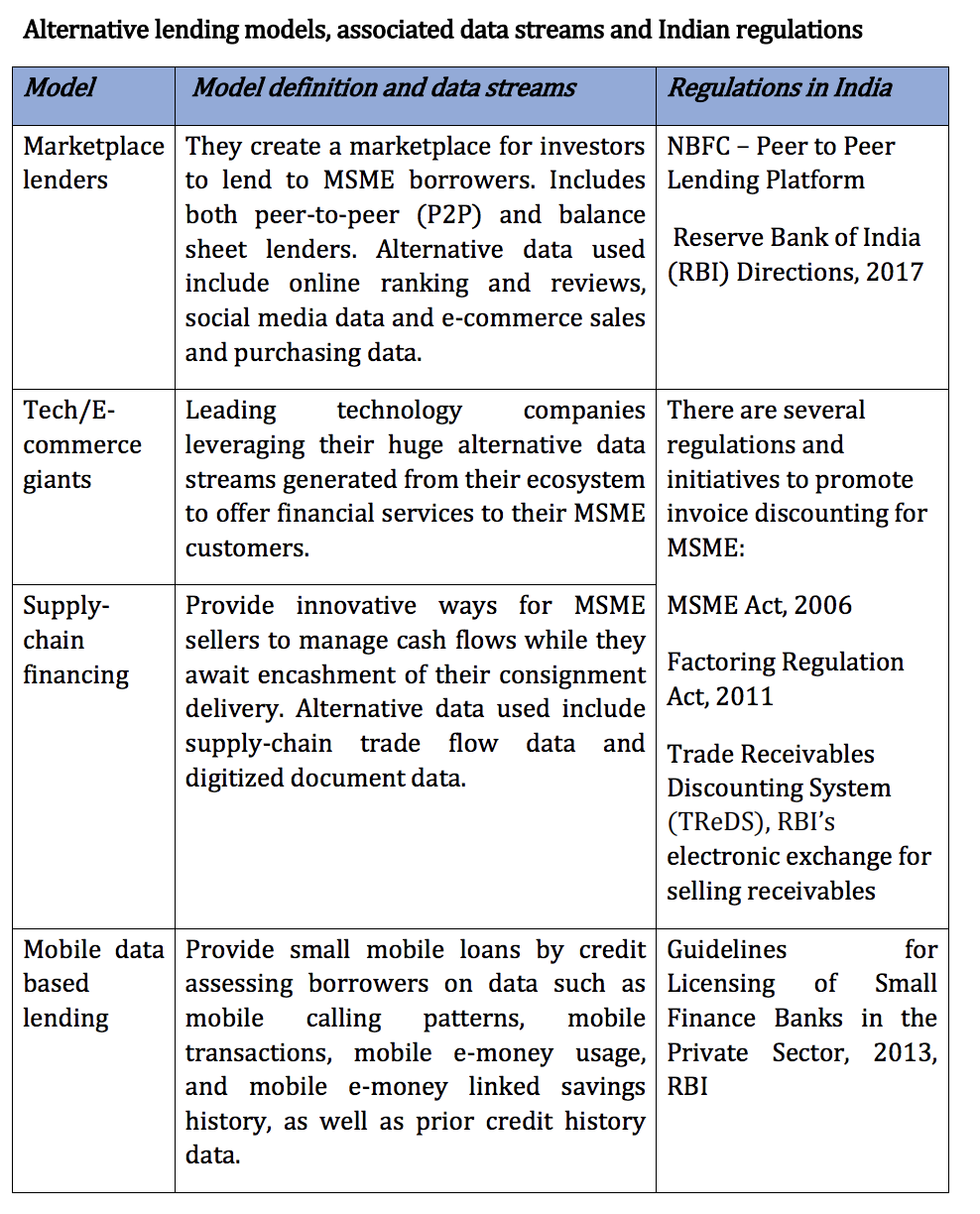

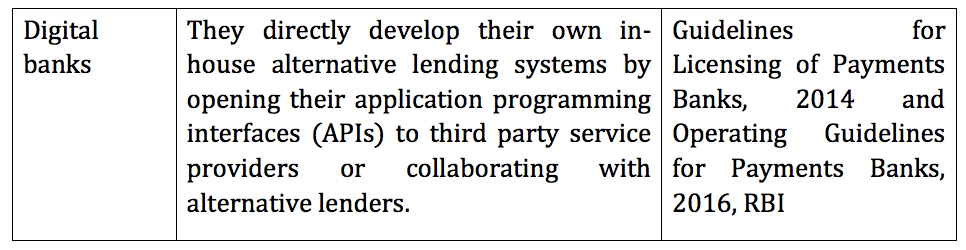

A new breed of technology-focused digital lenders is disrupting the MSME lending landscape in India through the innovative use of alternative data. In contrast to traditional lenders, Fintech lenders study both conventional and unconventional data points to build more robust customer financial identities. The approach of harnessing unconventional data sources for a holistic assessment of customer creditworthiness has transformed the MSME lending space. In underwriting loans to MSMEs, lenders today are using alternative data such as e-commerce data (e.g., borrower’s active online engagement with the market), psychometric credit information, digital footprints (e.g., digital supply-chain data), mobile phone usage data (via call detail records), social network data (via social media platforms) and location data (via the Global Positioning System and the Geographic Information System). [6]

As set forth in a G20 2017 report, lending models around alternative data can broadly be categorized as follows. [6] Together they highlight the growing trend of MSME lending based on decisions that are informed by nontraditional data.

Benefits of alternative data

The value of loans issued by Indian Fintechs utilizing alternative data can be upwards of USD 1 million. The loan tenure varies across Fintech players. While working capital loans typically have a tenure of 30-120 days, certain loans can have a tenure of up to 24 months. [7]

One of the benefits of using alternative data is the potential reduction in the cost of credit. Traditional MSME lending through supply-chain financing, for example, can involve various acquisition costs: from physical meeting and document collection (USD 70 to USD 200) to query resolution (USD 150 to USD 300) to manual credit underwriting (upwards of USD 350). The use of digitized processes and alternative data streams is expected to result in a significant reduction in the costs associated with the acquisition. [7]

Initiatives to utilize alternative data for MSME lending

Recognizing the benefits of using alternative data in determining the creditworthiness of MSME borrowers, governments are beginning to develop initiatives that incorporate alternative data into MSME lending platforms.

In India, the Small Industries Development Bank of India (SIDBI), the principal financial institution for the promotion, financing, and development of the MSME sector, established in 2016 the Udyami Mitra Platform, an online marketplace connecting MSME borrowers and lenders. Currently, approximately 125,000 entities (e.g., PSBs, private sector banks, NBFCs, Fintech lenders) are connected to the platform and can provide loans to MSME borrowers. Ecosystem players that can provide alternative data such as marketplace aggregators and credit rating agencies are also expected to become a part of this platform. [8]

Udyami Mitra represents a move towards a digital platform that will use alternative data, which in turn is expected to improve accessibility to credit, streamline data, and result in more robust credit decision making. The available data is, however, limited to data provided by the entities connected with the platform. Moreover, under its present form, the platform serves a matchmaking function primarily and does not serve as a data repository.

Malaysia has also launched an MSME loan/financing referral platform called imSME in 2018, which connects MSMEs with lenders. [9] It plans to embed alternative data-based analytical models by 2020 to widen its reach across MSMEs that do not currently have access to credit.

Public credit registries

In order to improve the quality of credit assessment by financial institutions and to strengthen bank supervision, public credit registries (PCR)1 have been established in many countries. [10] According to a 2012 World Bank report, 87 out of the 195 countries surveyed had a public credit registry. [11] The G20 report on SME financing also highlighted the importance of credit reporting institutions for SMEs. [12]

The RBI has recently decided to establish a PCR as an extensive database that captures granular credit information for all credit products in the country, from the point of origination to its termination, eventually covering all lenderborrower accounts without a size threshold. [11] Apart from acting as a single point of reporting of data by all credit institutions, the PCR will also facilitate linkages with external information systems (e.g., tax, utility payments) to capture alternative data relating to credit assessment. The PCR would function on the principle of reciprocity and the credit institutions submitting data would in turn receive regular reports at fixed intervals. [13] The PCR’s ability to track all borrowings in real-time will contribute to keeping aggregate risks at the economy level visible and in check. The PCR is expected to assist financial institutions in identifying creditworthy borrowers and monitoring over-borrowing and loan stacking effectively, thus reducing the cost of credit and resulting in higher credit growth.

2) Recommendations for establishing a databank to enhance MSME lending

With rapid technological developments, previously uncaptured data is increasingly available to lenders in assessing the creditworthiness of MSME borrowers. This policy brief recommends that the G20 define a common framework for establishing a new type of digital, regulated entity called a databank, to facilitate sharing of alternative data to MSME lenders in a secure, efficient and streamlined fashion to promote MSME lending. The databank would be a domestic entity that draws upon data from the local jurisdiction.

We propose a databank that would house a wide-ranging set of data points, acting as a custodian of data for its customers – individuals, MSMEs, and corporates. Customers would have consent rights to their own data (e.g., data generated on their mobile devices) to be shared with the databank. In addition, customers would have the right to determine which “data service providers” the databank could link with to collate data attributed to them. Relevant “data service providers” for an MSME customer would be the ecosystem stakeholders that the MSME transacts with as part of its operations (e.g., government entities the MSME registers with and reports to, utility companies the MSME transacts with, suppliers of the MSME, the MSME’s downstream customers.)

The key value of the databank from a lending perspective is its ability to provide a broader range of data that may be relevant to lenders in making a robust credit decision. To this end, the databank would not define what constitutes “relevant” data, so as not to exclude other data that might otherwise serve as a factor in a lender’s credit decision. Rather, the databank should have the capacity to store as much data as possible, within the boundaries of customer consent, and provide lenders with the flexibility to choose which data can be used for the credit decision.

Thus, while other sources, including a PCR, could be an important input to such a databank, the databank would not have a predefined boundaries or scope in terms of the data it would store, unlike a PCR that, by its structure, pre-defines the scope of data it would store.

Key features of the envisioned databank are as follows:

- Databank entity: The databank would be a repository of collected data structured in a systematic way for easy and quick retrieval of data whenever needed. This data repository could be accessed on both local and remote servers and could store information on a single, dedicated subject or multiple subjects in a well-organized manner.

- Databank eligibility: Any regulated entity managed by a public or private enterprise could be eligible to be a databank. The entity would need to enter into a new type of licensing arrangement and operate under the ambit of data privacy norms applicable in that particular jurisdiction

- Mode of operation: Any MSME could enter into an agreement with the databank by sharing their data in return for certain specialized services offered by the databank or other ecosystem players using their data. The databank would in turn act as the custodian of the MSME’s data across private and public enterprises in the ecosystem. Upon obtaining upfront consent from the MSME, the databank could monetize this data by sharing access to it with the other ecosystem players in exchange for data access/convenience fees. For instance, an MSME can share its know your customer2 (KYC) documents (e.g., relevant address document proofs) with a data bank. The MSME can then authorize the data bank to share this information with any external service provider that it intends to use, and which requires such documentation (e.g., KYC requirements of a lender). This would eliminate the need for the MSME to submit such documents each time it liaises with a service provider. While address proof is not a typical data point that lenders may use for credit underwriting (and may therefore not necessarily be stored in a PCR), the databank offers the lender the opportunity to decide which data it would use to make a credit decision (e.g., a lender may choose to use this data if location is a variable in its credit decision model).

- Data privacy, access control, and data security: Securing customer rights is critical to ensuring the success of the databank. To this end, clear access rights and data handling policies should be established to ensure the integrity of the databank ecosystem. Upfront consent mechanisms should be implemented so that customers have knowledge of the possible uses of their data. Participants should conduct regular risk assessments and communicate cyber incidents to relevant parties, including consumers, in a timely manner. As cyber threats continuously evolve, participants should create adaptable and dynamic processes to ensure continuous monitoring.

For the databank to be sufficiently comprehensive, it should allow customers to, at minimum, link to the following “data service providers”: (i) lenders, (ii) alternative data providers / private databases, (iii) credit bureaus and credit registries, (iv) government / public databases, and (v) credit rating agencies.

- Lenders: Lenders would primarily include banks, NBFCs, Fintechs, and alternative lenders. These financial institutions should provide granular credit information on all its MSME borrowers to the databank. They should also report all material events for each MSME loan without any threshold amount.

- Alternative data providers / private databases: They include organizations that provide alternative data about the borrower which can aid lenders in decision making. This can include payment companies, mobile operators, utilities, online cloud-based accounting systems, etc.

- Credit bureaus and credit registries: Existing credit reporting institutions like credit bureaus and credit registries will play a crucial role by sharing all MSME credit information to the databank. These institutions already collect a significant amount of credit data from lenders. Hence, with respect to each local jurisdiction, policies need to be developed to ensure that there is minimal overlap in the data collection efforts between these institutions and the databank.

- Government / public databases: These entities control access to key public databases including litigation cases, collateral registries, unique identifiers, federal and state tax information, etc. It is proposed that the databank should have external linkages to these databases to give a full profile of the MSME borrower.

- Credit rating agency: This refers to an organization that assigns MSME credit ratings by assessing borrower’s ability and willingness to repay the debt.

While the above list is indicative, the scope of data service providers would constantly evolve and grow, based on inputs and consent from the databank’s customers, thus ensuring comprehensiveness while balancing privacy needs.

Through this construct, the databank would evolve into a comprehensive, secure, digital and regulated entity that would act as a custodian for customer data, and facilitate the regulated, consented sharing of data for various purposes, including facilitating the sharing of relevant traditional and alternative data to lenders for MSME credit decisions.

References

1. Small Industries Development Bank of India (SIDBI) and TransUnion CIBIL. (2018). MSME Pulse Report, March 2018. Available at: https://sidbi.in/files/article/articlefiles/Report-msme-pulse.pdf

2. The World Bank. Small and Medium Enterprises (SMEs) Finance; Improving SME’s access to finance and finding innovative solutions to unlock sources of capital. Available at: https://www.worldbank.org/en/topic/smefinance

3. International Finance Corporation (IFC). (2017). MSME Finance Gap: Assessment of the Shortfalls and Opportunities in Financing Micro, Small and Medium Enterprises in Emerging Markets. Washington, DC. Available at: https://openknowledge.worldbank.org/handle/10986/28881

4. Marks, E. (2018). Chipping Away at the MSME Financing Gap. S3IDF. Available at: https://medium.com/s3idf/chipping-away-at-the-msmefinancing-gap-db5f252ce539

5. Small Industries Development Bank of India (SIDBI) and TransUnion CIBIL. (2018). MSME Pulse Report, December 2018. Available at: https://sidbi.in/files/article/articlefiles/report-msme-pulse-december2018.pdf

6. Owens, J. and Wilhelm, L. (2017). Alternative Data Transforming SME Finance. International Finance Corporation (IFC) and Global Partnership for Financial Inclusion (GPFI). Available at: https://www.gpfi.org/sites/default/files/documents/GPFI%20Report %20Alternative%20Data%20Transforming%20SME%20Finance.pdf

7. PwC Research – figures sourced through primary research with an India Fintech lender (2019).

8. (2017, October 26). ‘Over 2,500 loans out of 14,800 online applications received on ‘Udyami Mitra’ sanctioned for MSMEs,’ The United News of India. Business Economy. Available at: https://www.uniindia.com/over-2-500-loans-out-of-14-800-onlineapplications-received-on-udyami-mitra-sanctioned-formsmes/business-economy/news/1028698.html

9. Mahapar, N. (2018, February 9) ’2000 SMEs to benefit from imSME financing reference platform,’ The New Straits Times. Available at: https://www.nst.com.my/business/2018/02/333847/2000-smesbenefit-imsme-financing-reference-platform

10. Miller, M. (2000). Credit Reporting Systems Around The Globe: The State of the Art in Public and Private Credit Registries. The World Bank. Available at: https://siteresources.worldbank.org/INTRES/Resources/469232- 1107449512766/Credit_Reporting_Systems_Around_The_Globe.pdf

11. Reserve Bank of India (RBI). (2018). Report of the High Level Task Force on Public Credit Registry for India. Available at: https://rbi.org.in/scripts/PublicationReportDetails.aspx?ID=895

12. Global Partnership for Financial Inclusion (GPFI). (2015). G20 Action Plan on SME Financing. G20, Turkey. Available at: https://g20.org.tr/wp-content/uploads/2015/11/Joint-Action-Plan-onSME-Financing.pdf

13. PwC. (2018). Journey towards a robust credit ecosystem. Available at : https://www.pwc.in/research-insights/2018/journey-towards-arobust-credit-ecosystem.html

14. Mohapatra, A. (2018, September 28). Fintech startups augur positive change for cash-strapped SMEs. VCCircle. Available at : https://www.vccircle.com/fintech-startups-augur-positive-change-forcash-strapped-smes/

15. Ujaley, M. (2018, January 10). OfBusiness: SME finance and fulfilment made easy. The Financial Express. Available at : https://www.financialexpress.com/industry/ofbusiness-sme-financeand-fulfilment-made-easy/1008623/

16. Pani, P. (2018, January 15). Flexiloans looking to double lending to small businesses over next one year. The Hindu Business Line. Available at : https://www.thehindubusinessline.com/money-andbanking/flexiloans-looking-to-double-lending-to-small-businessesover-next-one-year/article9606641.ece

17. (2018, July 16). Vayana Network enables over USD 1 billion Trade Financing. Vayana Network Press Release. Available at : https://vayana.com/press/vayana-network-enables-over-usd-1-billiontrade-financing/

18. Sangani, P. (2019, April 10). Vayana Network hits $2b in loan disbursals. The Economic Times. Available at : https://economictimes.indiatimes.com/small-biz/sme-sector/vayananetwork-hits-2b-in-loandisbursals/articleshow/68804979.cms?from=mdr

Appendix

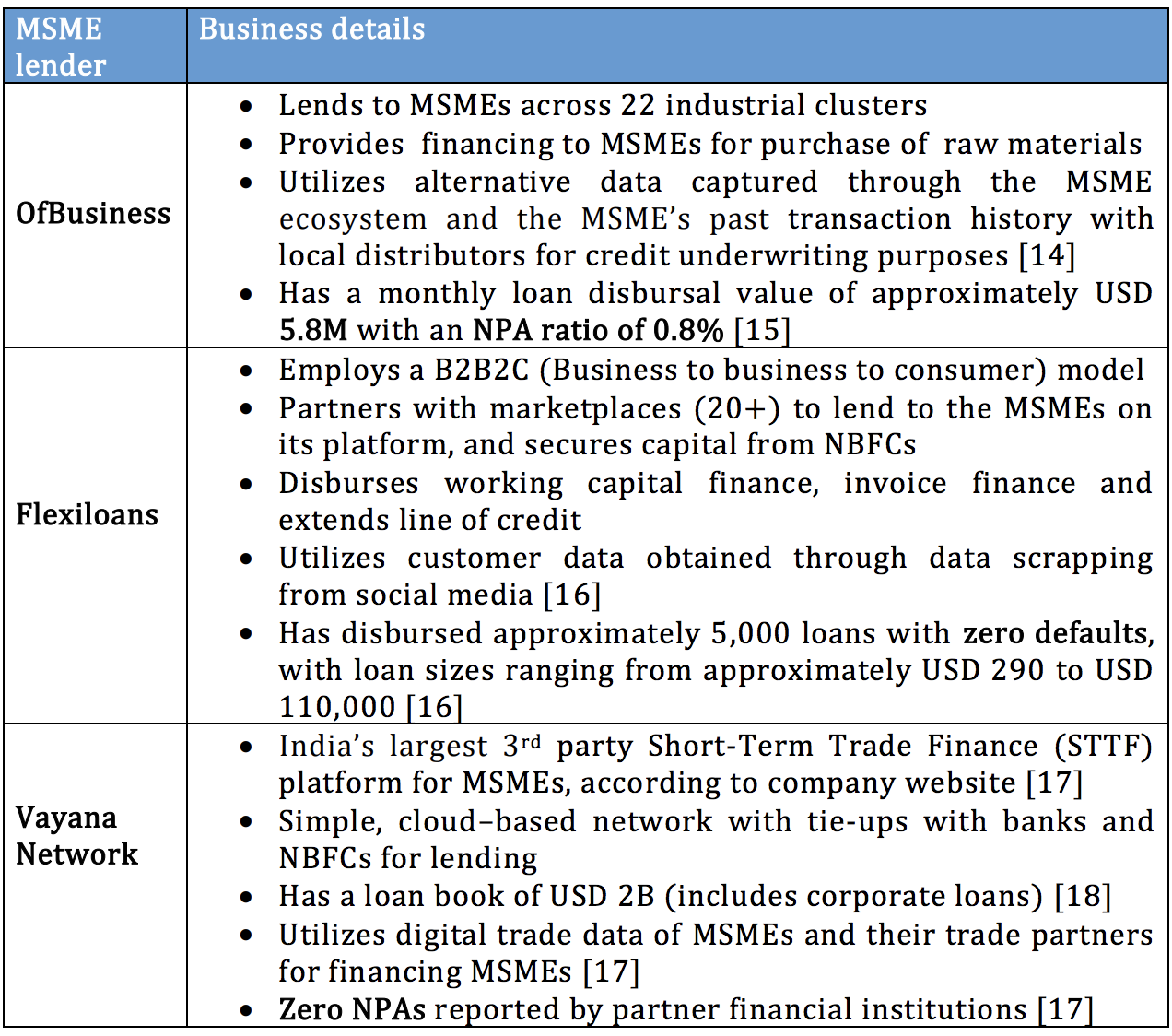

MSME digital lenders: business models, loan book and non-performing asset (NPA) figures Business models, loan book and NPA figures of several MSME digital lender profiles that utilize both traditional and alternative data for credit underwriting are as follows.