The Token Economy presents revolutionary digital solutions to the traceability and certification of sequential transactions. Beyond financial markets, tokenisation has the potential to multiply all types of transaction exponentially and to develop customised investment options to suit almost any interest. Due to its universality and increasing applications, there is a need for wider supervision and a regulatory approach as we gain a better understanding of the token economy. The G20 can significantly contribute to the organised development of the global economy by establishing an open and multidisciplinary Forum qualified to discuss and draft recommendations and guidelines on the advancement of the sector in the fourth (digital) industrial revolution.

Challenge

A tokenised economy (see Annex 1 for a broader elaboration of the basic concepts) based on Distributed Ledger Technology (DLT) or Blockchain management of tokenised assets (financial and non-financial) offers an opportunity for dynamising secondary markets and for increasing liquidity and the volume of transactions, as well for ensuring transparency and accessibility to a wide range of users, public and private, institutional and others (Schwab 2016). Different transformation processes occur at different stages of the financial market value chain. Thus, digital securitisation of rights and goods through DLT, regardless of the amount transacted, generates extensive tradable assets (payment, security, and utility tokens), making the financial industry more attractive to an immense number of investors and intermediaries (Spankowski 2021). The tokenisation phenomenon has an implicit democratising effect by making financial instruments available to all citizens equally and digitally, through ample financial inclusion, while at the same time allowing value creation through the extension of tokenisation to new and on previously illiquid assets. Also worth mentioning is the fact that the fractionalisation of ownership allows retail investors to access opportunities usually reserved to institutional investors, hence increasing the democratisation of finance. This also entails major risks, as retail investors are not as sophisticated and forward-thinking as institutional investors: this can lead to more erratic market participation and price volatility. This is also why access to information and the classification of digital tokens is of great importance.

The adverse side of such promising features of the tokenised economy is the challenge posed by the potentially disruptive effects of the decentralised nature of blockchain, the complex jurisdictions involved and the still emerging regulations on the creation and exchange of tokens (domestically and internationally), as well as the absence of internationally agreed protocols and rules for the compliance of token securities (Au andPower 2018).

Indeed, blockchain is affected by its own technical challenges and is facing a trilemma of limitations, not being able to optimise simultaneously its three cardinal and distinctive qualities: decentralisation, security, and scalability. These constraints do not allow blockchain to govern itself satisfactorily or unchain its full potential without proper regulatory framework and a consequent institutional array of solutions to compensate for or correct its deficiencies (Longchamp, Deshpande and Mehra 2020).

Most advanced and sophisticated markets in developed economies are hoping for the transboundary management of disciplines and the adoption of common principles in tokenised transactions to allow proper functioning, worldwide use and access to multiple benefits while limiting risks and correcting distortions. Such an approach may bring opportunities for all economies as well as greater security in international exchanges.

The revision of presently regulated markets, the establishment of common minimal requirements for the functioning of tokenisation, as well as international agreements (or at least regional, and inter-regional agreements) on essential guidelines and regulatory baselines is imperative to give wide recognition to token processes and the operation of blockchain/ DLT transactions.

Proposal

For the token economy to thrive there is a fundamental need for legitimacy and market acceptance of token practices. Such legitimacy will only be achieved through international standards and framework regulations. Spreading knowledge of the potential of this technology will motivate market participants to adopt it to increase efficiency and productivity (Lewis 2020). The reduction of complexity in investment processes by tokenisation is already transforming financial markets. There are many relevant aspects to reflect upon in the evolving landscape of the token economy, including some already identified in the section on challenges, such as interoperability among blockchains, safety in a decentralised environment, coordination or at least a common ground for compatibility in regulations governing the establishment and operation of competing public or private initiatives, and many other issues (Collomb and Sok 2016). In consideration of such complexity, dialogue and reflection are required among actors, particularly regulators, developers and users.

In the best interests of development and international cooperation, the token economy should be better understood and then fostered and supported. We point out that the OECD is already exploring the implications of this new economy through its Global Blockchain Policy Centre initiative. In an early move to allow markets to function and position their economies as pioneers in these aspects, Germany, Liechtenstein, and Switzerland have recently adopted regulatory solutions of different scope on their own. The Liechtenstein solution is one of the most innovative in its outlining of a container token model (Duenser 2020) that applies to any existing token or to those yet to be created (since it is developed on a basic and technology-neutral definition of tokens). The German and Swiss approaches focus on the civil law problem rather than on financial and fiscal aspects, opting for extended corrections and supplements to existing DLT security regulations. The US and the European Union are also considering alternatives to cope with these new comprehensive transboundary transactional realities.1

Given the wide range of flavours presented by the digital token economy, regulators and policy makers are faced with major challenges. A common way to make digital tokens available is through initial coin offerings (ICO) where a party or a group makes tokens available in exchange for fiat currency or other digital tokens. It would be inaccurate to say that ICOs are mostly forbidden as it would also be inaccurate to say that they are universally allowed. Currently, decisions are made case by case, country by country, based on the analysis of digital objects representing elements like investments in future technology (Telegram), means of exchange (Bitcoin or hybrids like Ethereum), digital art (NFTs) and digital clothing (RTFKT Studios). 2

Another approach to ICOs, which serves as a gauge to possible policy towards the wider digital token economy, is the Security and Exchange Commission (SEC) of the United States. As billions of dollars have been raised through ICOs in the United States by the sale of digital tokens, the SEC had little choice but to proceed through Regulation by Enforcement (Park 2020). Such an approach, defined by Park as “Regulation by Selective Enforcement” entails the SEC’s selection of a handful of carefully chosen significant actions for digital token offerings. The SEC’s current position is that ICOs may or may not be security offerings depending on specific facts that are assessed case by case. The decision is based on the SEC’s Howey test to determine whether the case involves an investment of money, a common enterprise, expectations of future profits and whether such profits are derived from the effort of others. Some concrete examples to be highlighted are the recent 2020 SEC vs. Telegram Group Inc. decision, where the SEC halted the ICO from the technology company based on the premise that the digital tokens or “grams” where securities (United States District Court 2020). Another concrete example is the second largest crypto-asset, Ethereum, which has been placed in regulatory limbo by a comment from the SEC’s Director, William Hinman, that it was not a security. However, no official press release has been issued to define the position. Bitcoin, on the contrary has not been defined as a security. One interpretation of this selective enforcement is that it avoids penalising pioneers developing new transformative technology. More players or financial agents of this kind are expected to emerge, pinning their operations on the asset layer of decentralised finance (DeFi). Others, such as the European Revolut bank, or payments specialist Klarna who have no visiting locations yet continue to increase their market share of retail customers use DeFi ecosystems and therefore challenge regulators and traditional financial markets (Schär 2021). These new digital banks/ financial agents still make use of fiat currencies but have the ability to include other types of digital tokens in their clients’ portfolios or bank accounts, hence offering advantages to incumbents.

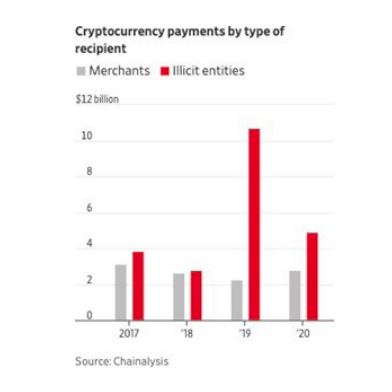

Many other aspects of the token economy remain to be addressed and eventually solved, such as responsibility in the case of technology failures or security breaches (depending on the token, investors generally bear the risk, unless the token is issued by a central bank or secured by a physical asset), money laundering and other illicit transactions (one of the biggest challenges to cryptocurrencies, considering that currently the largest digital currency, Bitcoin, is widely used for illicit or at least not formally registered activities). See Annex 3 for further considerations on these problematics.

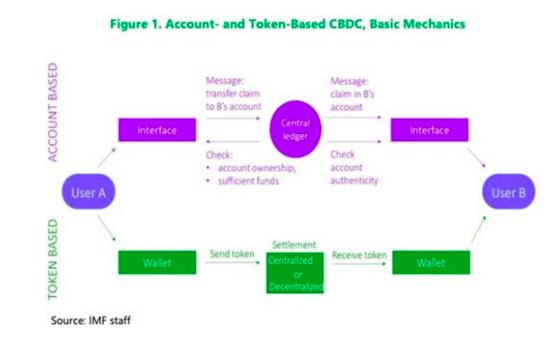

Central Banks’ response to digital tokens has been the issuance of Central Bank Digital Currencies (CBDC), which are also digital tokens but, in this case, issued digitally by central banks in different types of DLTs, mostly controlled by the issuer (For a graphic representation of the process, see Annex 2).

Although no G20 nation has yet issued a CBDC, the majority have been enquiring into the possibility and implications of such issuances for many years. CBDCs also come in a variety of types and there is no single definition of them other than that they have the unique characteristic of being a legal tender and a digital fiat currency. CBDCs could easily be used for person-to-person, person-to-business, government-to-person, business-to-business and business-to-government transactions of any amount, a notable improvement over cash (Comelli, Kahn and Poh 2018). 3

Although there is clearly increased efficiency in the account mechanics of CBDCs, the wider implications are far from straightforward, and have major consequences for traceability, innovation, geopolitical dynamics, and financial stability. The ability to complete anonymous transactions with cash assumes a different quality once digitalised, as the volume and reach of transactions become limitless. For instance, a Swedish e-krona could become widely adopted in a country on another continent with a more volatile currency. Regarding innovation, it is unclear if it is a good idea to leave the digitalisation of fiat currencies up to governments or if it would be in better hands handled by competing financial companies’ dependent on market participants. CBDCs would closely compete with evolving commercial bank deposits and e-money, standing out when it comes to anonymity and default risk (Ibid. 2018). Only from a default risk perspective, it is natural to assume that CBDCs will play an important role in the future of the economy.

Unilateral approaches should give way to a more ambitious proposal from a G20 perspective, especially if what is ambitioned is a more robust and better cross-border integrated financial market.

Markets, legal frameworks, and technological solutions must go hand in hand to allow the correct insertion of fintech and blockchain-type solutions into international transactions. Governments still have a long way to go to respond in a coordinated manner to the needs posed by this innovative transaction modality. The public and private sector globally must reach common ground on appropriate regulatory approaches to address risk, maximise benefits to all parties and generate economic development opportunities on equable terms for the international community. Moreover, there is an urgent need to articulate regulations among countries to avoid gaps and regulatory loops that might jeopardise consolidation of the modality in key sectors and disrupt markets (especially financial ones). We envisage a new regulatory framework that would enable broad financial regulations to be adapted and aligned to allow all participants to enjoy the benefits of fintech developments such as greater financial stability and risk prevention. Currently, no specific regulatory framework exists and tokens are assessed on a case-by-case basis. This is extremely time-consuming and creates uncertainty among market participants, hindering the financial stability that is one of the goals of the G20.

As the adoption of tokens increases, ramifications will grow and without multilateral efforts to promote best practices (and eventually a global framework), it will become increasingly challenging to develop adequate guidelines. Thus, the earlier an instance is instituted the more impact it will have in ensuring high standards, sustainability and stability within the global economy.

The specific solution proposed by this Policy Brief is for the G20 to create a Forum on the Token Economy and Blockchain for the exchange of best practices, regulation advancements and market knowledge, with a capacity to conduct further assessments of the state of the art and advise on all relevant aspects of the token economy and its impacts on the global economy and societies.

The Forum would act as an advisory, regulatory, repository and research body and would be entrusted with drafting recommendations and guidelines for G20 governments on the advancement of the token economy, evaluating the most appropriate global operational and regulatory aspects.4

It could synergically integrate G20 members, non-members, specialist institutes and international organisations. It would benefit from the participation of various stakeholders with significant interest, from the private and public sectors.5 It would function under the leadership of the pro-tempore presidency of the G20.

Through this Forum, the G20 could respond institutionally to the need to deal with this rapidly emerging sector with its increasing direct effects on the real economy. As new bridges are built between the token digital economy and the real economy, it will be essential to have a comprehensive understanding of the nature of such bridges and of their ontology and functions to ensure that they do not pose threats to financial stability or risks to other sectors, and to promote high standards and best practices to ensure that future digitised token systems improve on existing ones. A concrete example of the ramifications could be Exchange Trade Funds (ETF), that contain crypto-assets in their portfolios, such as ARKQ, hence indirectly exposing shareholders to the token economy. Another would be the purchase of tokens by listed companies, yielding the same result.

Among its main tasks, the Forum would report to the G20 on the state of global regulations and standards and produce policy recommendations to G20 Members.6 It could also issue guidelines to central banks and other national and regional agencies, as well as policy makers. Other tasks could include the design of model policies and analysis tools. Moreover, the Forum could act in coordination with domestic agencies in providing market agents with sandboxing environments to test different tokens at a limited scale to minimise risk and gradually allow them to gain legitimacy.

Another key feature of the Forum would be to identify all risks embedded in the token economy, including risks to the integrity of the token economy and risks posed to the real economy by the increasing adoption of aspects of the token economy. The changing payment landscape and technological developments are challenging the scope of current policy and creating a need for new policy tools to promote discussion and research, to review existing policies in the light of new developments, and to amend or propose new policies where needed.

The main task of the proposed Forum would be to give form to the economic environment and regulatory landscape in which the token economy can prosper in an organised manner. In terms of relevance to the G20, the establishment of such a Forum would provide members’ economies, other national and regional actors, and the multilateral system as a whole with tools for harmoniously considering the multidisciplinary aspects involved and, from the perspective of a global agenda, for promoting informed high-level discussions on how to tackle challenges in the financial sector with a view to achieving the UN’s Sustainable Development Goals.

APPENDIX

TOKENS AND DLT

For the scope of this Policy Brief, a digital token can be considered as a unique string of computer code, protected by cryptographic means, corresponding to a digital object that may be linked to a unit of value in itself or backed by a digital or physical asset. In this sense, digital tokens can be used as payment tokens, store of value tokens, security tokens and so forth, and even as art tokens containing artwork, usually referred to as non-fungible tokens. These digital objects or tokens are handled by Distributed Ledger Technology (DLT), a new type of secure database or ledger that is replicated across multiple sites, countries, or institutions, often with no centralised controller, and provides a new way to keep track of who owns a financial, physical, or electronic asset (Perlman 2021).

The purpose of tokenisation differs from one kind of token to another, but a general characteristic is the ability to increase efficiency by eliminating the need for intermediators and thus allowing peer-to-peer transactions. What makes tokens unique is the inception of tokens into DLTs, which has increased speed without compromising the integrity of the ledger.

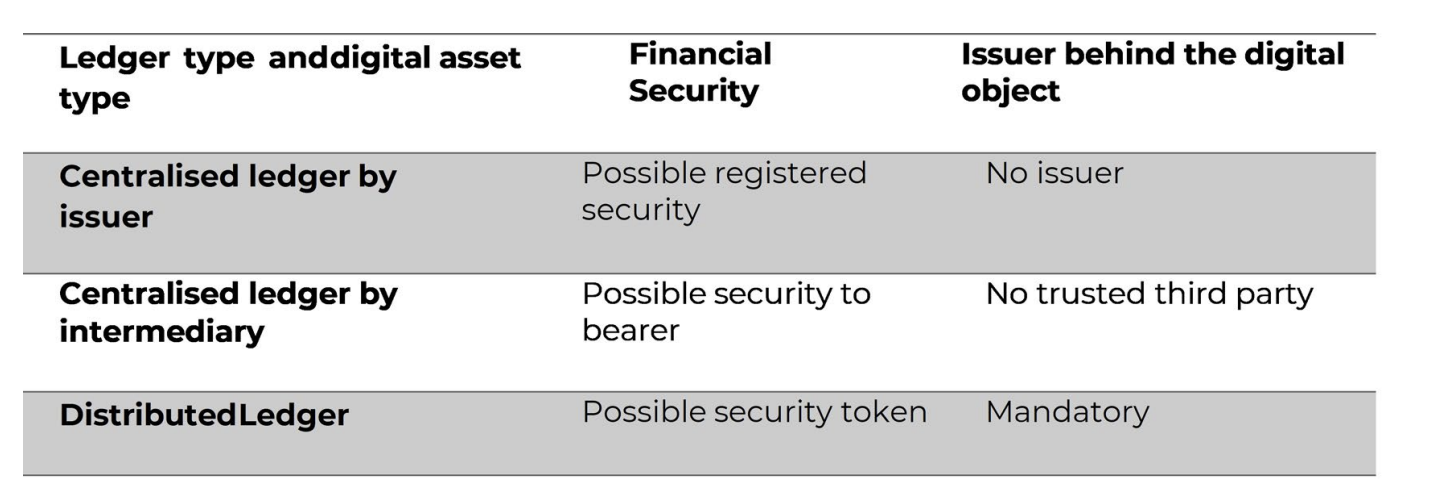

Example of types of tokens:

DLTs can have different configurations based on the level of distribution of the nodes that process the ledger. For instance, in the case of Bitcoin, the ledger is fully distributed among the nodes that process the data of the ledger, and is thus fully decentralised, with no entity controlling the system or being able to overwrite or change entries on the ledger. At the other extreme, a private DLT would be a ledger controlled by two or more parties for the distribution of digital objects privately amongst them according to whatever protocol they agree upon on inception of the ledger. For example, a central bank may want to have a private DLT with certain other banks in a given country.

CBDC MECHANICS

CRYPTOCURRENCY OPERATIONS AND PROPORTION OF ILLICIT ACTIVITIES

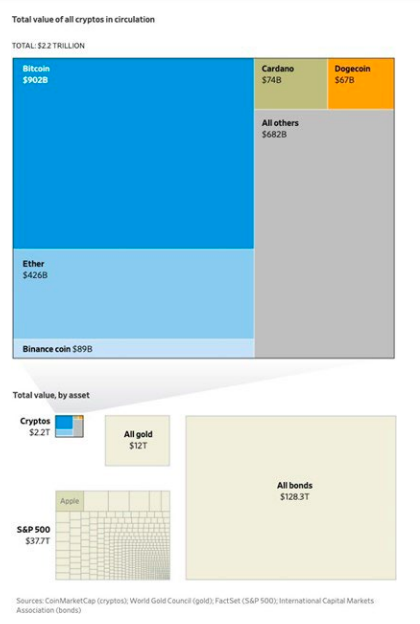

The charts below visualise the size of Bitcoin as well as the extent of criminal/irregular transactions.

As can be seen from the figures above, more than half of Bitcoin transactions are used for transactions by illicit entities. Given that Bitcoin as a DLT is spreading globally, this emphasises the need to collaborate at a G20 level to prevent the wider penetration of criminal activity into the token economy.

NOTES

1 Regionally, for instance, the European Securities and Market Authority (ESMA) identifies the importance of a technology-neutral approach while identifying challenges to regulators and market participants, as there may be a lack of clarity as to how regulatory framework applies to such instruments (ESMA 2019).

2 Concrete cases that highlight regulatory difficulty include ESMA’s effort to determine the legal status of crypto-assets and the applicability of EU financial regulations in 2018. EU Member States were surveyed as to how MiFID II rules applied to national law, based on a transposition of six crypto-assets issued in an ICO qualified as “financial instrument”. Answers from EU member states diverged greatly from investment-type, utility type, hybrids of investment-type, utility-type and payment type assets for the same instruments. Within the European Union, the actual classification of a digital token asset as a financial instrument is the responsibility of the individual country’s national competent authorities (NCA), further dimming the status of this wide range of digital objects that increasingly form an element of the wider economy.

3 The aforementioned transactions would occur instantly, without need for settlement through wholesale interbank payments. This can have many positive consequences such as the increased efficiency of transactions and the elimination of intermediation. Eliminating intermediation is particularly important in areas of international cooperation where funds are targeted for aid and development through intermediators who are not always reliable. CBDCs could be used effectively to deliver directly to the target. Furthermore, sovereign nations that have moved towards a cashless economy have in effect experienced the privatisation of cash: in Sweden, for instance, the desire for greater control over money could be satisfied by the issuance of the e-krona. See the chart below to appreciate the increased efficiency in CBDC mechanics.

4 Proof of the increasing urgency of addressing these topics comes in the report on central bank digital currencies published in 2020 with the support of the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Federal Reserve, the Riksbank of Sweden and the Swiss National Bank Board. The report addressed issues of financial stability and the effects that central bank issued tokens would have. At the other end of the scale, the private sector has also gained momentum with the company Coinbase debuting its IPO in Q2 2021, demonstrating the growth and consolidation of token market making with backing from both retail and institutional investors.

5 Experts, academia representatives and regulators from member countries as well as nonmember countries, open to interaction, exchange, and discussion with specialists from the OECD (and its Global Blockchain Policy Centre), as well as other international organisations and related projects (such as the BIS, Bank of International Settlements and its Innovation Hub). The Forum should enhance collaboration with the private sector and its initiatives in the token economy (such as IWA´s Token Taxonomy Framework and ITSA´s International Token Identification Number). Moreover, an important collaboration between the G20 and the private sector could lie in the definition of different digital tokens as securities, utilities, or other types of instrument for which sandboxing environments could allow entrepreneurs to issue tokens in limited sizes, and regulators to follow the development by providing feedback on the ontology of the token in the eyes of the regulator.

6 After delving into different digital tokens, some existing and others in the making, we realise the complexity of the space. The one quality all tokens share is increased speed in settlement, which both increases efficiency and the risk of flash crashes. It is in this context that there is need for an information repository in a forum with the capacity to develop a multi-lateral approach to the new digital economy. The G20 was created in 1999 to provide a new mechanism for informal dialogue in the framework of the Bretton Woods institutional system, to broaden.

REFERENCES

Au S. and T. Power, Tokenomics: The Crypto Shift of Blockchains, ICOs, and Tokens, Birmingham, Packt Publishing Ltd, 2018

Collomb A. and K. Sok, “Distributed Ledger Technology (DLT): What Impact on the Financial Sector?”, Digiworld Economic Journal, No. 103, 3rd Q., 2016, pp. 93-111

Comelli F., A. Kahn, and K. Poh, Casting Light on Central Bank Digital Currency, Washington DC, International Monetary Fund, 2018

Duenser T., Legalize Blockchain: How States Should Deal with Today’s Most Promising Technology to foster prosperity, Norderstedt, BoD, 2020

European Securities and Market Authority (ESMA), “Initial Coin Offerings and Crypto-Assets”, Paris, 2019 https://www.esma.europa.eu/sites/default/files/library/esma50-157-1391_crypto_advice.pdf

Ip G., “Cryptocurrency Has Yet to Make the World a Better Place”, Wall Street Journal, 20 May 2021 https://www.wsj.com/articles/cryptocurrency-has-yet-to-make-the-world-a-better-place-11621519381?mod=searchresults_pos7&page=1

Lewis R., The cryptocurrency revolution: finance in the age of Bitcoin, blockchains and tokens, London, KoganPage, 2020

Longchamp Y., S. Deshpande, and U. Mehra, The Blockchain Trilemma, Zug, SEBA, 2020

Park J., “Regulation by Selective Enforcement: The SEC and Initial Coin Offerings”, Washington University Journal of Law & Policy, vol. 61, 2020 https://figi.itu.int/wpcontent/uploads/2021/04/Security-Aspects-of-Distributed-Ledger-Technologies-1.pdf

Pentland A., A. Lipton, and T. Hardjono, Building the New Economy: Data as Capital, Cambridge, MIT Press, 2021

Perlman L., Security aspects of distributed ledger technologies. Financial Inclusion Global Initiative, Geneva, International Telecommunications Union, 2021 https://figi.itu.int/wp-content/uploads/2021/04/Security-Aspects-of-Distributed-Ledger-Technologies-1.pdf

Santilli P., C. Ostroff, and P. Vigna, “From Bitcoin to Dogecoin: What’s Driving Cryptocurrencies’ Rise and the Challenges Ahead”, Wall Street Journal, 17 May 2021

https://www.wsj.com/articles/the-factors-driving-crypto-markets-boom-and-the-challenges-ahead-11621243809

Schwab K., La cuarta revolución industrial, Barcelona, Penguin Random House Grupo Editorial España, 2016

Schär F., “Decentralized Finance: On Blockchain – and Smart Contract-Based Financial Markets”, Economic Research, Federal Reserve Bank of St. Louis, vol. 103, no. 2, 2021 https://research.stlouisfed.org/publications/review/2021/02/05/decentralized-finance-on-blockchain-and-smart-contract-based-financial-markets

United States District Court, “S.D. New York, Securities and Exchange Commission vs. Telegram Group Inc.”, WL 143005 SEC 2020, WESTLAW, Thomson Reuters, 2020 https://static.reuters.com/resourc-es/media/editorial/20200325/secvtele-gram–castelopinion.pdf

Spankowski U., “Tokenization in Financial Markets: Efficiency Gains and New Investment Opportunities”, in A. Sunyaev et al. (eds), Token Economy, Bus Inf Syst, Springer, February 2021