The socio-economic costs of infrastructure damage and lost functionality that follow natural disasters, including climate change or a major attack, are much larger than the cost of improving infrastructure resiliency to typical events and properly maintaining it. The critical review of selected case studies presented in this policy brief shows that it is both possible and desirable to evaluate resilience. Focusing on transportation and logistic issues and building on the issues outlined in the T20 policy brief Building resilient infrastructure systems in 2019 (ADBI 2020), this policy brief: (i) advocates the urgent need to include a systematic review of the integration of resilience into cost-benefit analyses and use of other economic appraisal methodologies for infrastructure projects, and (ii) recommends prioritizing public and private investment in infrastructure projects proven to be resilient and projects that adapt existing assets to risks, thus improving their resilience.

Challenge

Resilience is “the ability of a system, community or society exposed to hazards to resist, absorb, accommodate to and recover from the effects of a hazard in a timely and efficient manner, including through the preservation and restoration of its essential basic structures and functions” (UNISDR 2009).

Extending the definition of climate-resilient infrastructure proposed by the OECD (2018), the defining characteristic of a resilient infrastructure system is that it is planned, designed, built, and operated in a way that anticipates, prepares for, and adapts to changing conditions. These conditions can include not only traditional risk management approaches, but also aging, adaptation to new technologies, climate change, new uses, and socio-economic evolution.

Adverse events, whether of natural origin or otherwise, not only damage physical infrastructure assets but can also disrupt their functionality. The World Economic Forum suggests that the failure to adequately invest in infrastructure networks should be considered as one of the top five global economic risks (WEF 2020). It also found that most of the top 10 risks in terms of likelihood (extreme weather, climate action failure, natural disasters, cyberattacks, and pandemics) potentially affect transportation infrastructure.

For instance, transportation infrastructure system disruptions have multiple impacts on households and businesses: lost sales, delayed supplies and deliveries, freight delay costs, congestion and loss of time, increased fuel and operating costs for road users and goods due to longer journeys on alternative routes or those with lower capacity, or lost revenue collection on toll roads. Disruptions also affect the economy: diminished competitiveness and productivity, lower investment, less innovation, environmental externalities, decreased access to health facilities, and potential air pollution due to increased congestion or loss of the most efficient transport mode for a given commodity (e.g., inland waterways for agricultural products vs. air freight for pharmaceuticals). These impact both public and private asset owners and reduce the economic and social efficiency of the entire region.

Infrastructure physical failure or a greatly diminished level of service caused by acute natural events (e.g., hurricanes, earthquakes, heavy rainfall leading to vast flooding, uncontrolled fires) or chronic stressors (e.g., coastal surge from rising sea levels, ground movements resulting from climate variations) directly impact tax revenues. Adequate investments in resilience can potentially reduce the overall impact of disasters on businesses, communities, and governments. For example, the World Bank estimates that the overall net benefit of investments in infrastructure resilience in developing countries could reach US$ 4.2 trillion over the life of infrastructure assets; estimates suggest a US$ 4 return for every dollar invested in infrastructure resilience (Voegele 2019). Similarly, hazards and threats can impact multiple economic sectors when key dependencies cause failure in one sector to spill over to other sectors.

For example, the Victorian Government in Australia notes, in its Critical Infrastructure All Sector Resilience Report (2019), that as critical infrastructure systems increasingly rely on information and communications technologies to deliver services, the potential for disruption increases, intensifying the need to understand interdependencies and impacts from shared systems. As Mexico’s road network is not sufficiently resilient to climate, the Mexican government has established a natural disaster fund. Although the fund can be applied to all sectors, in practice, 80% of the resources are used to repair/rebuild public infrastructure, 28% of which is highways (FONDEN 2020).

The cost of not being resilient is important

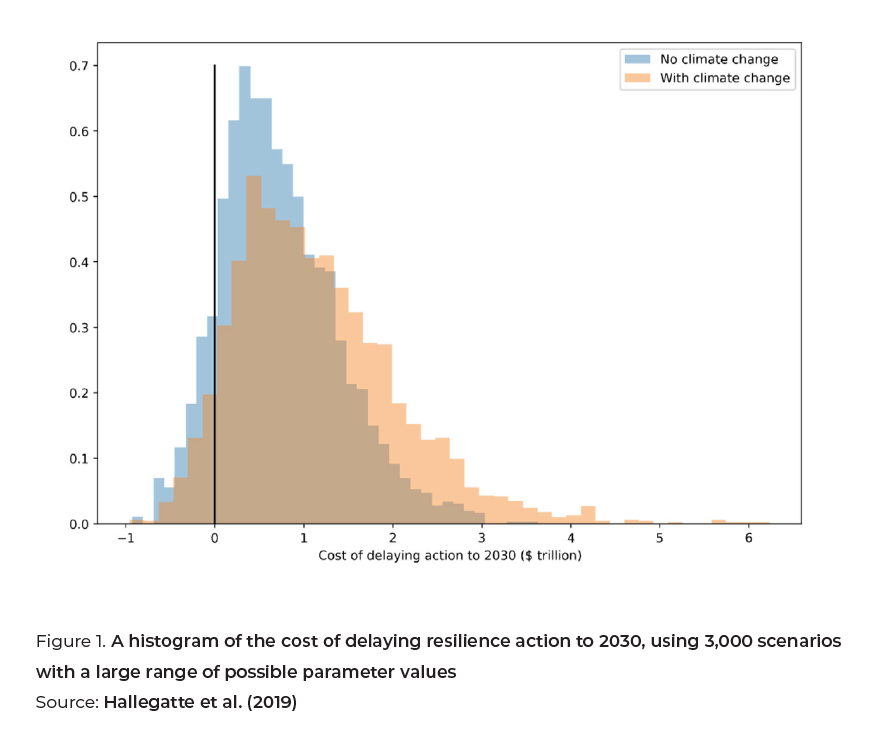

According to recent studies (Hallegatte et al. 2019; Hallegatte, Rentschler, and Rozenberg 2019) based on over 3,000 scenarios, the urgency of designing resilient infrastructure is clear when considering natural hazards: in most scenarios, it is costly to delay global action on resilience to 2030, with a median value of US$ 1.0 trillion in potential losses. Adding climate change into these scenarios almost doubles the median cost of delaying action for 10 years. Biodiversity losses and ecosystem damage should be further assessed. Figure 1 shows the global costs of delay reported by Hallegatte et al. (2019).

The cost of improving resilience is context-dependent

Several recent studies (Miyamoto 2019; Koks et al. 2019) illustrate the economic issue of adapting infrastructure (new construction or rehabilitation) to specified risks. The additional cost depends on the risk, type of asset, and location. For example, increasing a road’s resilience to flooding by improving the drainage system only costs a few percent more, while increasing the level of a railway line may increase costs by up to 50 percent.

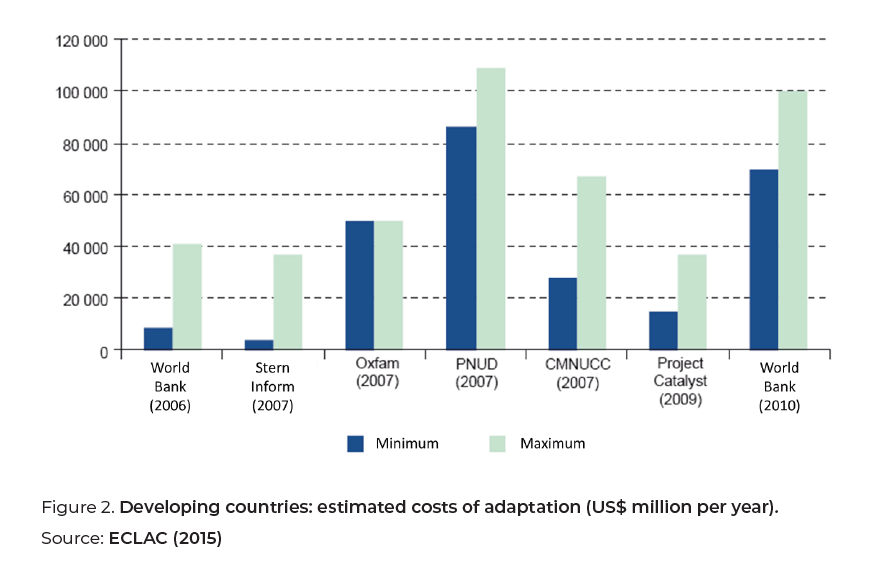

The Economic Commission for Latin America and the Caribbean (ECLAC) has compiled the estimates of the actual and potential costs of adaptation processes, such as those illustrated in Figure 2 (ECLAC 2015). Based on a selection of the types of infrastructure in developing countries in different parts of the world and a careful identification of potential risks (changes in temperature and precipitation), the average overall economic costs of adaptation for all sectors range from US$ 4 billion to US$ 100 billion per year.

The estimated adaptation costs for Latin America and the Caribbean are less than 0.5% of the region’s current GDP, although these estimates involve a high degree of uncertainty (ECLAC 2015).

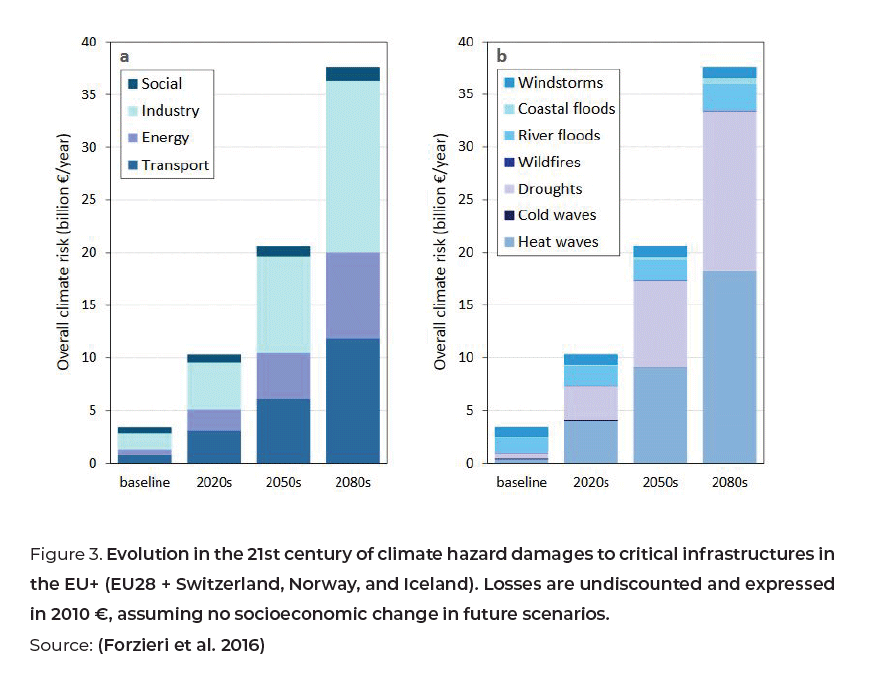

A Joint Research Centre (JRC) report for the European Union studied critical infrastructure damages from climate extremes and key investments in the energy, transport, industrial, and social sectors, which at present reach € 3.4 billion/year (Forzieri et al. 2016). The report revealed that these damages could triple by the 2020s, multiply six-fold by mid-century, and amount to more than 10 times the present damages by the end of the century (see Figure 3).

The cost-benefit ratio of improving resilience is clearly beneficial

Hallegatte et al. (2019) show that strengthening infrastructure assets exposed to natural hazards is a very robust investment: the cost-benefit ratio is greater than one in 96% of cases and greater than four in half of them. Climate change increases the importance of strengthening and doubles the cost-benefit ratio.

More resilient and less vulnerable assets can be achieved through more effective maintenance processes, resulting in reduced life cycle costs. Increasing infrastructure resilience ultimately very often benefits the asset owner when the infrastructure’s full life cycle costs are considered. While improving operating and maintenance conditions is attractive in terms of resilience, poor maintenance can increase infrastructure capital cost by 50 percent (Rozenberg 2019).

According to the analysis of OECD countries by Kornejew et al. (2019), every additional $ 1.0 spent on infrastructure maintenance is as effective as $ 1.5 of new investment. Ample and timely maintenance is a cost-effective option for increasing resilience and extends throughout the infrastructure’s lifetime, allowing continuity of operation. Nature-based solutions are created by human engineering and construction to reduce risk by acting in concert with natural processes and draw from the capacity of natural features; for example, wetland restoration, biogenic reefs, beaches, and dunes that help reduce the impacts of storm surge (International Union for Conservation of Nature, https://www.iucn.org/). These solutions exemplify how improving natural capital goes hand-in-hand with infrastructure resilience in a cost-effective response to a changing climate, while also delivering a range of other societal benefits (IDB 2019b).

Importantly, resilience is context-dependent and involves considering non-resilience costs together with important resilience improvement costs. The total cost-benefit ratio of improving resilience seemingly remains largely beneficial over the infrastructure’s lifetime.

Proposal

Successful and cost-effective implementation of solutions to increase infrastructure resilience requires addressing the vulnerabilities of the infrastructure network’s different components on a holistic basis, that is, considering all potential threats globally. While this policy brief focuses on increasing resilience to natural disasters and climate change, decision-makers should consider including other hazards (e.g., infrastructure aging, effects of pandemics, man-made threats, and cyber security in their evaluations and investment resolutions (Evans et al., 2019).

1. Include a systematic resilience review in the cost-benefit analysis of infrastructure projects.

Good infrastructure design and management alone are not enough to improve infrastructure resilience, especially when faced with rare or high-intensity risks and longterm trends such as climate change—targeted actions are also needed.

The ADB (2011) explains why climate change assessments are beneficial for building infrastructure resilience: “A climate change assessment is best integrated into the activities of the project preparation technical assistance, following the identification of climate change as a potential risk/opportunity factor to the project at the concept stage.” Similarly, a systematic resilience review is likely to create resilient infrastructure systems and improve visualizing strategic planning in a context of uncertainty.

A common basis for comparing projects is necessary for economic analysis and prioritizing adaptation solutions. However, methodologies for evaluating resilience options still need to be improved. According to ECONADAPT (Tröltzsch et al. 2016), economic assessment of adaptation measures is different from a normal economic appraisal in that the focus of the analysis is on managing uncertainties and risks. It must consider different time scales, complex systemic relationships and dynamics, and multiple sources of uncertainty.

The U.S. Government Accountability Office (GAO) describes several models for estimating the return on resilience investments and loss avoidance; however, none of these models fully account for all benefits (i.e., direct, indirect, and co-benefits) (U.S. GAO 2019). However, government efforts can contribute to a more accurate understanding of the return on investment of various resilience alternatives. As the GAO suggests, government agencies can assist by “developing and disseminating comprehensive approaches for estimating loss avoidance, analyzing costs and benefits of various hazard mitigation alternatives, and considering their impact on programmatic decisions and budgeting for disasters” (U.S. GAO 2019).

A sound review method should therefore:

- be based on economic concepts using a holistic approach to risk management,

- identify the various risks and relevant socio-economic and environmental data to be collected and structured,

- transparently identify the short-, medium- and long-term benefits of adaptation, and

- facilitate identification of sustainable solutions (i.e., those that both contribute to the Sustainable Development Goals (SDGs) and specifically increase infrastructure asset durability while remaining adaptable to a range of possible environmental and social use changes) to increase the infrastructure network’s resilience.

Such an approach should not solely consider the direct effects of infrastructure damage, which can be quite small. It must also consider the indirect effects, expressed in terms of additional costs for infrastructure users; when evaluated, the decrease of those indirect costs following a resilience policy (which may be considered as a benefit), can be several times larger than the direct ones.

A deterministic and probabilistic approach is useful in the cost-benefit analysis to determine where additional safeguard or protection costs should be incurred; it is a necessary step in the decision to purchase (or not) insurance against risks.

The best estimate of the probability a critical environmental event will occur, or its return period, is usually based on available historic data records. When data are scarce, expertise and data fusion are needed to draw deterministic safe values. However, the lower probabilities of events with major consequences feature the resilience issue. It is not straightforward to accept paying more now to protect against hypothetical future events with a (say) 1% likelihood they will happen over the next 10–20 years— which means the return period is 1,000 years or more. Relating the cost of building resilient infrastructure systems to the probabilistic expected cost of not being resilient (direct repair costs and indirect disruption costs) calculated over the project’s expected life will eventually be required by multilateral development banks (MDBs) and private investors.

Additionally, not all adaptation measures are suitable for every location. Some measures may only be appropriate from an economic, social, or environmental perspective or for a particular location (urban, regional, or rural), type of road (sealed or unsealed), or infrastructure nature (power, water, sanitation). The frequency intervals of events or possible accelerated road deterioration of aged road seals may also determine the priority and selection of adaptation measures.

Biodiversity and nature-based solutions should be included in the resilience review framework, either as an evaluation (score or rating) or a valuation (monetary value, such as a cost-benefit analysis) (WWF 2019a). In some instances, the environmental, social, and governance (ESG) analysis can complement the risk management tool. According to the WWF, “risks associated with ESG factors, if not managed and mitigated, may ultimately impact the performance of an asset and the rate of return for investors.”

To be practical, IDB (2019c) proposes a set of criteria for nature-based solutions:

- capital investment, operating, and maintenance costs,

- resilience benefits and costs avoided,

- ecosystem services or co-benefits (e.g., ESG),

- risks and tradeoffs,

- maturity timeline (the time required to provide resilience benefits), and

- lifespan.

Policy Options

a. Raise awareness of local/regional risks (including the probability of specific natural disasters) and of the economic, social, and environmental impacts of postponing infrastructure resilience solutions and investments.

In Europe, the DeTECToR project (Decision-support Tools for Embedding Climate Change Thinking on Roads) was commissioned through the Conference of European Directors of Roads (CEDR) Transnational Research Program to help European road authorities include climate change in economic appraisal and procurement processes. The project includes developing a cost-benefit tool to compare the cost-effectiveness of different adaptation strategies.

Additionally, the WWF Switzerland (2019a) conducted an in-depth review of existing infrastructure ESG tools, frameworks, and current practices for integrating ESG into infrastructure investment decisions, finding that “while there has been growing recognition of the importance of ESG in infrastructure, adoption of third-party ESG tools by investors has been limited.”

b. Include ESG criteria in the resilience review toolbox and conduct a deterministic and probabilistic assessment of the risks and uncertainties affecting them.

To help developing countries in Asia and the Pacific address climate change challenges, the ADB (2011) organized a step-by-step approach for climate proofing transportation projects, including a risk screening tool that was applied to several climate endangered countries (e.g., the Solomon Islands, Cambodia, and the Philippines).

The World Bank Group is working on a resilience rating system to inform investors about the resilience of their infrastructure investments and help them select the most resilient projects (World Bank 2019).

The Arcadis Global Bankable Resilience Tool (BaRT) is a cost-benefit and multi-criteria analysis tool used to support cities and developers in evaluating their resilience options when planning an urban (re)development project. This was applied to the EU project RESIN in Europe.

c. Introduce resilience into regulation, infrastructure standards, and training.

Mexico has implemented the International Framework for Road Infrastructure Adaptation from the World Road Association (PIARC). The methodology considers the climate economy and has been applied to five of the country’s regional networks to assess the vulnerability of roads and their elements to weather events associated with climate change (NCDP 2014).

In the UK, the Planning Inspectorate reviews major infrastructure project applications to ensure compliance with the National Policy Statements (Twigg 2007).

In Austria, the Include Cost of Inaction—Assessing Costs of Climate Change for Austria (COIN) project is an example where the costs and benefits were quantified to assess climate change impacts and impacts across other sectors. (Steininger et al. 2015) sought to determine the costs from climate change in Austria if they failed to adapt and outlined multi-sector interdependencies and estimated costs (both direct and indirect).

2. Prioritize public and private investment in proven resilient infrastructure projects and projects that adapt existing assets to risks, improving their resilience.

Concrete action is needed to fund and finance the 2030 SDGs. The 2019 UN progress report on SDG9 (“Building resilient infrastructure, promote sustainable industrialization and foster innovation”) showed that the total official flows for economic infrastructure in developing countries increased in real terms by 32.5 percent between 2010 and 2017; the main sectors assisted were transport ($21.6 billion), and banking and financial services ($13.4 billion) (UN ECOSOC 2019). Investment requires more careful attention since the Sendai Framework’s third priority for disaster risk reduction is “Investing in disaster risk reduction for resilience” (UNISDR 2015).

For the Islamic Development Bank (IsDB), “an unprecedented growth of investment in infrastructure is expected in the coming years… The opportunity is that if these massive investments are disaster and climate resilient, then this will make an important contribution to resilient and sustainable development. Co-benefits include enhanced social and economic development… and improvements in the quality, coherence and sustainability of public spending.”(IsDB 2019).

Resilience also involves the evolution of nature capital and “green infrastructure” (such as biodiversity habitat, ecosystem services) and their relationship with human-made infrastructure. The WWF (2019b) emphasizes that “more comprehensive information on the benefits nature provides, especially in supporting climate resilience in social and ecological systems, is essential to support decision-making for infrastructure design.” The T20 policy brief, “Shaping the New Frontiers of Sustainable Infrastructure,” further investigates this issue.

Some transportation assets might already be resilient enough for the anticipated threats and accepted risk and may not need to be upgraded to become resilient. A vulnerability and criticality analysis can be used to identify the most critical parts or opportunities for redundancy in a network approach.

Well-designed metrics are fundamental for informing policy and investment decisions and communicating with stakeholders (Savitz et al. 2017); they also help align financing flows with the climate resilience goals of the Paris Agreement (IDB 2019a). A critical need for infrastructure adaptation and resilience is identifying what should be measured, how to evaluate those metrics or performance indicators, and how to identify new measures that can contribute to better-informed decisions. The IDB review (2019a) presents the core concepts and other characteristics of climate resilience metrics in financing operations, focusing mainly on MDB and infrastructure development financing company (IDFC) operations.

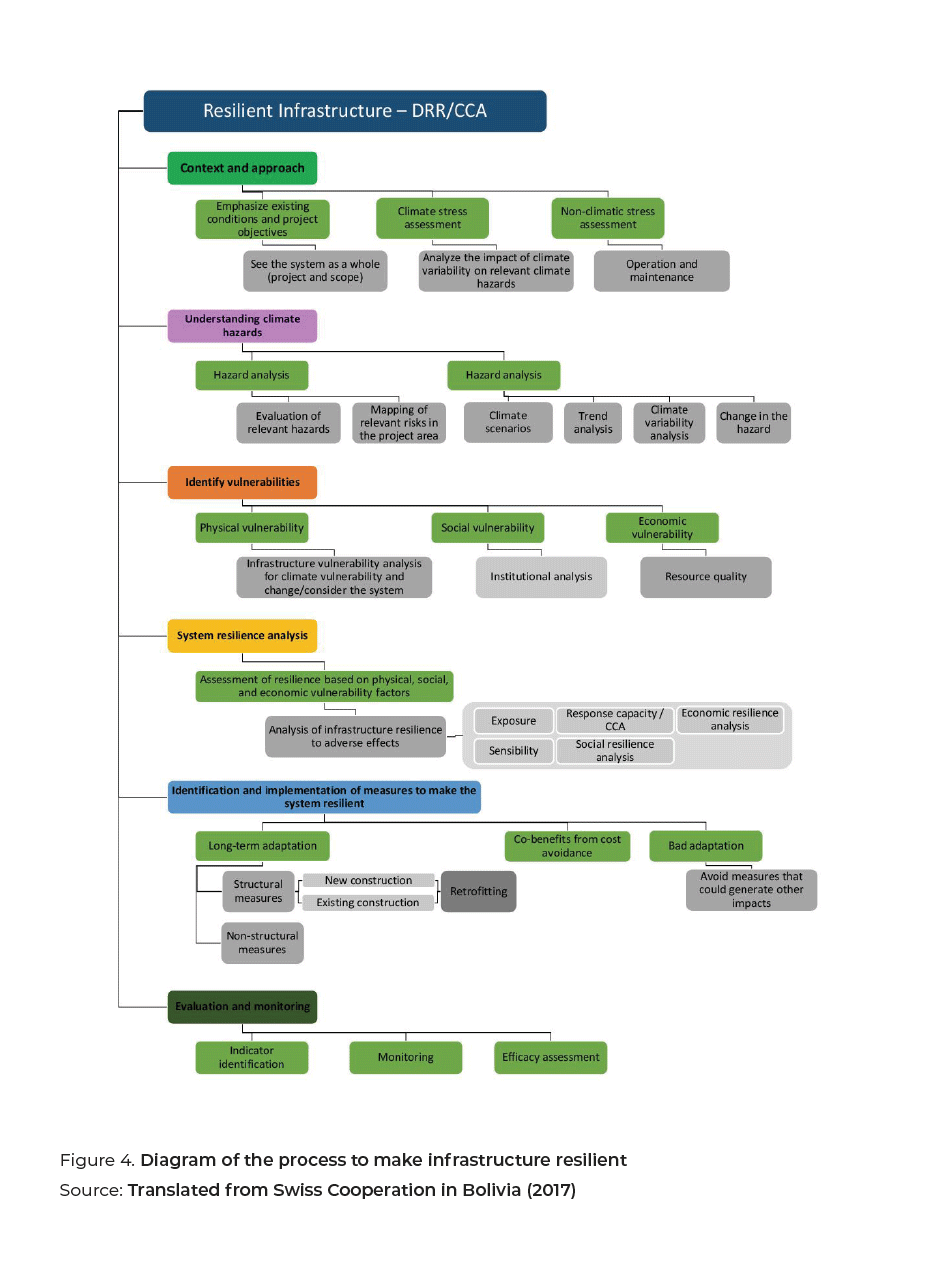

The chart in Figure 4 aims at reducing the risks of climatic maladaptation to achieve resilience to current and future climates; the recommended thorough analysis of the adaptation measures at the system level is an important feature. Parallels may be drawn with a proposed array of strategic responses to rising mean and extreme sea levels from IPCC (2019). The coastal issue “hard protection or coastal advance/coastal accommodation/ecosystem-based solutions” matches the construction triplet “structural measures/retrofitting/non-structural measures.”

Policy Options

a. Set up well-designed infrastructure resilience metrics, including nature capital issues; define acceptable and intolerable risk levels; and identify critical infrastructure.

PIARC (2019) provides a range of examples of using life-cycle costing assessment techniques to cost-effectively maintain and rehabilitate road infrastructure to decrease exposure to damage. This includes considering whether to apply fully resilient (higher cost) adaptation measures or more proactive, targeted preventative maintenance techniques (lower cost). For example, identifying the marginal benefit cost ratio over the life of an asset can help prioritize the adaptation measures for different types of roads and average annual daily traffic.

An IsDB’s initiative integrates disaster risk management into planning and evaluating public investment and the design of disaster and climate resilient infrastructure. The bank developed a tool to evaluate “how effectively physical climate considerations have been mainstreamed in projects at various phases of their implementation” (IDB 2019a).

In 2014, the Asian Development Bank (ADB) approved the Coastal Towns Environmental Infrastructure Project to strengthen climate resilience in small coastal towns in Bangladesh. The project included a performance-based allocation approach, with investments linked to improved governance criteria, including climate-resilience and participation processes (IDB 2019a).

b. Consider the countercyclical impact of resilience targeted investment plans.

Resilience targeted investment should also consider economic periods from the standpoint of countercyclical financing instruments. As the UN Economic and Social Council (ECOSOC) indicates, those measures “play a vital role in mitigating the impacts of disasters and shocks;” it is then urgent to provide least developed countries with “fast-track access to countercyclical financing mechanisms” (ECOSOC 2019). Adaptation and recovery investment plans should be evaluated against this goal.

The International Monetary Fund (Jones 2016) stresses that “investment with a patient, countercyclical focus” increases the financial system’s resilience without impeding returns for individual asset owners. The authors recognize, however, that “further analysis of optimal incentive structures in the investment community is likely required.” On the regulatory side, initiatives designed to “stimulate greater direct investment from long-term asset owners would be desirable—the application of capital relief and the judicious use of government guarantees with respect to greenfield infrastructure investment is a notable example.” Following up on the examples, the post-crisis adaptation of infrastructure (though mainly brownfield) represents shortterm economic support and a long-term robustness enhancement that is reaping double dividends.

c. Revise the standards and regulatory texts constituting the technical doctrine for design, construction, operation, or maintenance of infrastructure and adapt them to the identified risks.

Mexico used a multi-criteria analysis adapted from the PIARC Framework (World Road Association 2015, 2019) and the MCA4Climate (Trevor et al. 2011) to evaluate adaptation measures. Criteria and weightings were established, such as the degree of compliance with the objective, level of expected resilience, link to other adaptation actions, investment cost and life cycle cost, technical and environmental feasibility, duration, degree of robustness, flexibility, resource availability, participation and/or social acceptance, target population, risk of inaction, and degree of environmental protection. Two approaches have been used: disaster risk reduction and climate change adaptation. The Ministry of Communications and Transport (SCT), together with the Ministry of Finance and Public Credit (SHCP), have incorporated disaster risk analysis into public investment with the goal of reducing economic damage and losses (SCT 2015; SHCP 2018a, 2018b).

In France, 2,000 standards using climate parameters for designing and constructing transportation infrastructure were identified (Cerema 2015), and 134 documents were found that must be adapted to new climate data or indexes. A methodology for assessing physical vulnerabilities and functional criticalities was also defined to evaluate scenarios and increase the network’s global resilience (Cerema 2019). This methodology can be easily applied by local asset managers (roads, railways, bridges, port installations, waterways), as well at the national scale.

Concluding remarks

Consideration of specific financing mechanisms was outside the scope of this policy brief. Actions related to increasing private sector investment in infrastructure (transportation, power, sewage) also require further development. Nevertheless, the IDB (2019b) notes that resilience building investment can be considered for nature capital investment, which could be eligible for innovative financing mechanisms such as “resilience bonds.” Resilient infrastructure is perhaps more sustainable over the lifecycle of infrastructure assets. Therefore, with a robust evaluation toolbox, the more attractive resilience investment should be blended with green finance and other combined public and private funding sources.

Many more examples than those carefully selected for this policy brief could be drawn from case studies in several other countries and from MDB’s methodological schemes. Resilience is worth considering compared to the “wait and see approach” that many communities are tempted to follow for climate change adaptation/mitigation investments. The critical review proposed here shows that evaluating resilience is possible and desirable. There is increasing realization that “more resilient infrastructure assets pay for themselves” (World Bank 2019). A sound resilience rating and scoring adjusted for the probability of adverse events/disruptions is an essential prerequisite to mobilizing funds for ensuring the future resilience of infrastructure.

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

ADB. 2011. Guidelines for Climate Proofing Investment in the Transport Sector: Road

Infrastructure Projects. Tokyo, Japan: Asian Development Bank.

ADBI. 2020. Building the Future of Quality Infrastructure. Tokyo, Japan: Asian Development

Bank Institute.

Cerema. 2015. Potential Impacts of Climate Change on Transport Infrastructures and

Systems, on their Design, Maintenance and Operation, and Needs for Precision in

Climate Projections. Report Cerema (in French).

Cerema. 2019. Vulnerabilities and Risks: Transport Infrastructure in the Face of Climate

Change. Methodological Guide Cerema (in French).

Economic Commission for Latin America and the Caribbean. 2015. The Economics of

Climate Change in Latin America and the Caribbean: Paradoxes and Challenges of

Sustainable Development. Santiago de Chile, Chile.

Evans, Caroline, Bruno Godart, Jürgen Krieger, Jean-Bernard Kovarik, Marc Mimram,

and Fabien Palhol. 2019. Building Resilient Infrastructure Systems. T20 Policy Brief.

Forzieri, Giovanni, Alessandra Bianchi, Mario A. Herrera, Felipe Batista Silva, Luc Feyen,

and Carlo Lavalle. 2016. Resilience of Large Investments and Critical Infrastructures

in Europe to Climate Change. JRC Science for Policy Report, European Commission.

(EUR 27906; doi: 10.2788/232049).

General Directorate for Risk Management. 2020. Resources Authorized by Disaster

Declaration. FONDEN.

Hallegatte, Stéphane, Julie Rozenberg, Jun Rentschler, Claire Nicolas, and Charles

Fox. 2019. Strengthening New Infrastructure Assets—A Cost-Benefit Analysis. Policy

Research Working Paper #8896, World Bank.

Hallegatte, Stéphane, Jun Rentschler, and Julie Rozenberg. 2019. Lifelines: The Resilient

Infrastructure Opportunity. Sustainable Infrastructure. Washington, DC: World

Bank. https://openknowledge.worldbank.org/handle/10986/31805 License: CC BY 3.0

IGO

IABSE, SED 5. 2017 Introduction to Safety and Reliability of Structures (Authors: Jörg

Schneider and Ton Vrouwenvelder), 3rd reviewed and extended Edition.

IDB. 2019a. A Framework and Principles for Climate Resilience Metrics in Financing

Operations. Interamerican Development Bank.

IDB. 2019b. Nature-Based Solutions: Increasing Private Sector Uptake for Climate-Resilience

Infrastructure in Latin America and the Caribbean. Discussion Paper n°IDBDP-

00724, Interamerican Development Bank.

IDB. 2019c. Increasing Infrastructure Resilience with Nature-based Solutions: A 12-

step Technical Guidance Document for Project Developers. Interamerican Development

Bank.

IPCC. 2019. Summary for Policymakers. In IPCC Special Report on the Ocean and

Cryosphere in a Changing Climate. Edited by Hans Otto Pörtner, Debra C. Roberts,

Valérie Masson-Delmotte, Panmao Zhai, Melinda Tignor, Elvira Poloczanska, Katja

Mintenbeck, Andres Alegría, Maike Nicolai, Andrew Okem, Jan Petzold, Bard Rama,

and Nora M. Weyer.

IsDB. 2019. Disaster Risk Management and Resilience Policy.

Jones, Bradley. 2016. Institutionalizing Countercyclical Investment: A Framework for

Long-term Asset Owners. IMF Working paper WP/16/38, Feb. 2016.

Koks, Elco E., Julie Rozenberg, Conrad Zorn, Mersedeh Tariverdi, Michalis Vousdoukas,

Stuart Fraser, Jim Hall, and Stéphane Hallegatte. 2019. A Global Multi-Hazard

Risk Analysis of Road and Railway Infrastructure Assets. Nature Communications.

Kornejew, Martin, Jun Rentschler, and Stéphane Hallegatte. 2019. Well Spent: How

Governance Determines the Effectiveness of Infrastructure Investments. Policy Research

Working Paper #8894, World Bank.

Ministry of Communications and Transport (SCT). 2015. Study for the Adaptation of

the International Framework for the Analysis of the Impacts of Climate Change in

the Federal Road Network and Application to the states of Colima and Nayarit. Mexico

City, Mexico: Directorate for Technical Services. (in Spanish).

Ministry of Finance and Public Credit (SHCP). 2018a. General Guide for the Presentation

of Cost and Benefit Evaluations of Investment Programs and Projects. Mexico

City, Mexico.

Ministry of Finance and Public Credit (SHCP). 2018b. Proposal for the Inclusion of the

Disaster Risk Variable in the Analysis of Public Investment Projects in Mexico. Mexico

City, Mexico.

Miyamoto International. 2019. Overview of Engineering Options for Increasing Infrastructure

Resilience. Project Report. World Bank.

National Center for Disaster Prevention (NCDP). 2014. Socioeconomic Impact of the

Main Disasters that Occurred in the Mexican Republic in 2013. Mexico City, Mexico:

Risk Analysis and Management Department.

National Center for Disaster Prevention. 2015. Municipal Resilience Index. Mexico

City, Mexico.

OECD. 2018. Climate-resilient Infrastructure. OECD Environment Policy Paper N°14.

Rozenberg, Julie, and Marianne Fay. 2019. Beyond the Gap: How Countries Can Afford

the Infrastructure They Need While Protecting the Planet. Washington, DC:

World Bank.

Savitz, Scott, Miriam Matthews, and Sarah Weilant. 2017. Assessing Impact to Inform

Decisions: A Toolkit on Measures for Policymakers. Santa Monica, CA: RAND Corporation.

Steininger, Karl W., Martin König, Birgit Bednar-Friedl, Lukas Kranzl, Wolfgang Loibl,

and Franz Prettenthaler (eds). 2015. Climate Change in Austria: The Costs of Inaction.

Berlin: Springer.

Swiss Cooperation in Bolivia. 2017. Resilient Infrastructure Under a Disaster Risk Reduction

and Climate Change Adaptation Approach Conceptual Framework. La Paz,

Bolivia.

Trevor, Morgan, Şerban Scrieciu, Sophy Bristow, and Daniel Puig. 2011. MCA4climate

– A Practical Framework for Pro-development Climate Policy. United Nations Environment

Programme.

Tröltzsch, Jenny, Josselin Rouillard, John Tarpey, Manuel Lago, Paul Watkiss, and

Alistair Hunt. 2016. The Economics of Climate Change Adaptation: Insights into Economic

Assessment Methods. ECONADAPT Deliverable 10.2.

Twigg, John. 2007. Characteristics of a Disaster-resilient Community. A Guidance

Note. United Kingdom: DFID Disaster Risk Reduction Interagency Coordination

Group.

United Nations. 2009. Terminology on Disaster Risk Reduction. Geneva, Switzerland:United Nations Office for Disaster Risk Reduction (UNIDSR).

United Nations. 2015. Sendai Framework for Disaster Risk Reduction 2015-2030, 1st

ed. Geneva, Switzerland: United Nations Office for Disaster Risk Reduction UNISDR/

GE/2015 – ICLUX EN5000.

United Nations. 2019. Progress towards the Sustainable Developments Goals. Economic

and Social Council (ECOSOC).

U.S. Government Accountability Office. 2019. Disaster Resilience Framework: Principles

for Analyzing Federal Efforts to Facilitate and Promote Resilience to Natural

Disasters. GAO-20-100SP.

Victorian Government. 2019. Victoria’s Critical Infrastructure All Sectors Resilient Report

2018. State of Victoria. Australia.

Voegele, Juergen 2019. “Invest in Resilience, Invest in People.” Accessed June 2, 2020.

World Bank Blog. https://blogs.worldbank.org/climatechange/invest-resilience-invest-people

World Economic Forum. 2020. The Global Risks Report 2020.

World Bank. 2019. Lifeline: The Resilient Infrastructure Opportunity. Washington,

USA: International Bank for Reconstruction and Development.

World Road Association. 2015. “International Climate Change Adaptation Framework

for Road Infrastructure.” PIARC. Last updated 2015. https://www.piarc.org/en/order-library/23517-en-International%20climate%20change%20adaptation%20framework%20for%20road%20infrastructure.

World Road Association. 2019. “Adaptation Methodologies and Strategies to Increase

Resilience of Roads to Climate Change – Case Study Approach.” Last updated

2019. https://www.piarc.org/en/order-library/31335-en-AdaptationMethodologies%20and%20Strategies%20to%20Increase%20the%20Resilience%20of%20Roads%20to%20ClimateChange%20%E2%80%93%20Case%20Study%20Approach

WWF, Cadmus Group. 2019a. Valuing Sustainability in Infrastructure Investments:

Market Status, Barriers and Opportunities, A Landscape Analysis. Zurich, Switzerland.

WWF. 2019b. Visioning Futures: Improving infrastructure planning to harness nature’s

benefits in a warming world. Washington DC, USA.