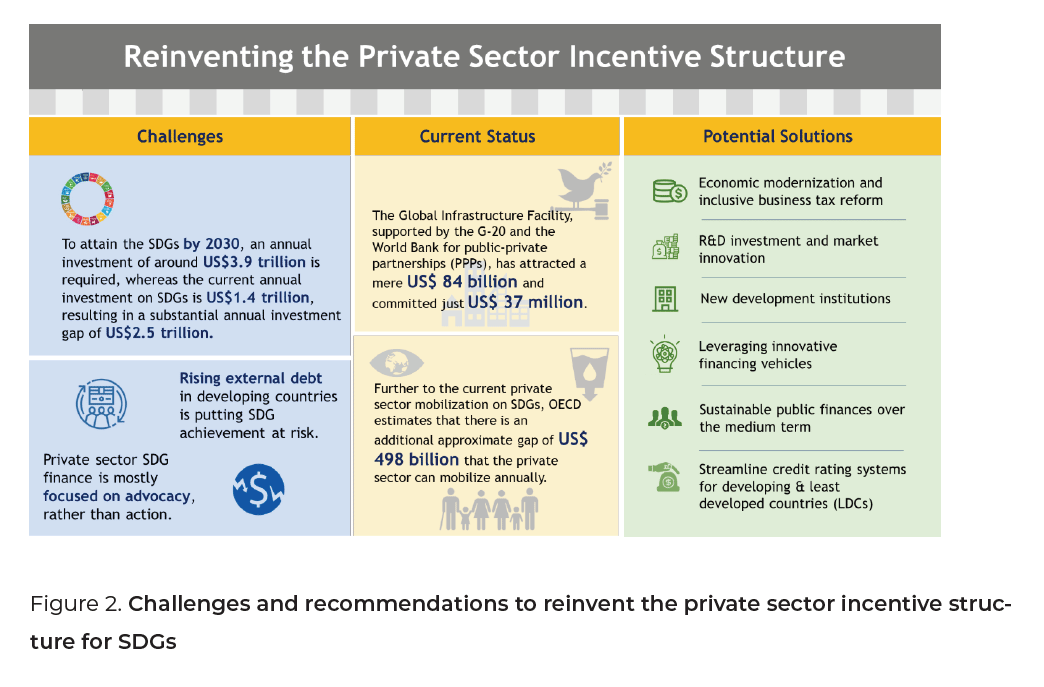

With the plateauing of global financial flows, achieving the Sustainable Development Goals (SDGs) of the UN by 2030 demands a coordinated resource mobilization approach. Developing countries have been facing major challenges in mobilizing private financing to implement the SDGs at grassroot level, while traditional approaches have been ineffective in bridging the annual SDG financing gap of around US$ 2.5 trillion. Consequently, incentivizing the private sector has been a widely discussed topic within SDG financing discourses. Reinventing the incentive structure to catalyze efforts in mobilizing private finance is essential. In this context, this policy brief proposes that the Group of Twenty community takes action in six key areas: 1) Economic modernization and inclusive business tax reform; 2) Investment in R&D and market innovation; 3) Promoting development institutions that focus on gender equality; 4) Leveraging innovative financing vehicles; 5) Maintaining sustainable public finances over the medium-term; and 6) Streamlining credit-rating systems.

Challenge

In an era marked by populism, climate change, and upheavals in the geo-politico environment, the development fund is shrinking rapidly as indicated by the drastic reduction in foreign aid in recent years. Between 2015 and 2018, foreign aid from official donors fell by 5.7% with the poorest countries being most heavily affected by their declining share (OECD 2019). Simultaneously, over the past decade, development finance requirements have almost doubled (Kring and Gallagher 2017). With the special focus of SDGs on initiatives to ensure gender equality, this reduction in funding has disproportionately undermined the empowerment of women.

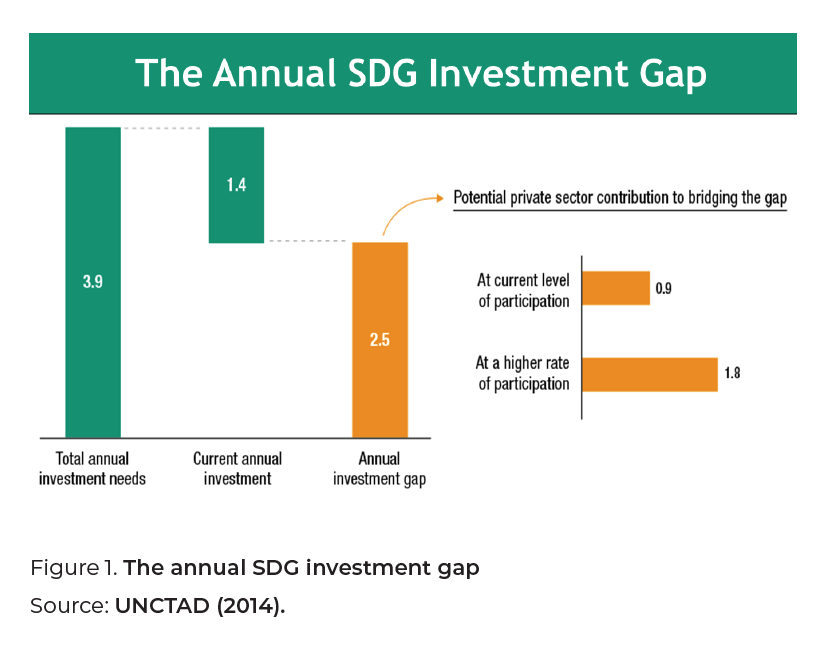

In its current state, the global economic cycle is inadequate to deliver the Official Development Assistance (ODA) target of the SDGs (Khan and Tashfiq 2019). Compared to the current levels of US$ 1.4 trillion, an annual investment of US$ 3.9 trillion is required to realize the SDGs by 2030, resulting in a substantial annual investment gap of US$ 2.5 trillion. According to the United Nations Conference on Trade and Development (UNCTAD 2014) report, the private sector has the potential to bridge this gap by at least US$ 0.9 trillion annually as seen in Figure 1 below. Greater participation could increase this contribution to US$ 1.8 trillion.

The private sector has repeatedly been heralded as the prime catalyst in mobilizing funds for the SDGs. The introduction of various instruments such as Green, Blue, and Sustainability Bonds have succeeded in channeling private funds into SDG aligned projects. During FY 2015–2016, SDG aligned private investments estimated at US$ 966 billion were mobilized through foreign direct investment using long- and short-term debt instruments. The Organization for Economic Co-operation and Development (OECD), however, estimates that there is a gap of approximately US$ 498 billion that the private sector can mobilize.

Despite the challenges in mobilizing private sector finance, there are available opportunities. According to the Standard Chartered (2020) Report, there is potential for high impact investments in fast growing economies of almost US$ 10 trillion. However, progress has often been impeded by the challenges inherent in engaging the private sector on development projects. Private sector investment is based on the underlying business motives and profit outlook, while SDGs are more development-oriented and people-centric. Moreover, private sector investors demand attractive rates of return for given levels of risk, along with affordable and accessible logistical facilities. For instance, private sector financing operations are governed by various risk factors, while developing economies that require the bulk of the SDG financing perform poorly in the Doing Business risk indices. This raises operational costs while increasing uncertainty, thereby discouraging participation by private sector entities.

SDG financing discourses at global leadership forums have given extensive consideration to incentivizing the private sector. Despite substantial discussion and debate, existing modalities and ODA-centric interventions have proved inadequate in mobilizing private capital for SDGs (OECD 2019). To overcome these structural concerns, it is critical that private capital is mobilized through reformulating incentive structures and intervention modalities in those areas where markets frequently fail, causing delays in development.

Proposal

Channeling funds from the private sector into achieving the SDGs is constrained by a lack of adequate incentives, common definitions, standards, and impact measurements. Furthermore, reported sustainable investments are represented in both real and financial asset classes. To close the estimated investment gap of US$ 2.5 trillion per year, it is crucial that global economic policies and financial systems are aligned with the 2030 agenda. As multilateral development banks and development financial institutions struggle to close the gap, private sector interventions to source finance must be leveraged by innovative mechanisms backed by global forums such as the G20.

To ensure its sustainability, the private sector has specific interests in securing longterm production along commodity supply chains, while reducing their environmental and social impacts and mitigating risks. Private firms have already advanced in their risk assessments, increasingly accounting for the environmental, social, and governance aspects of projects, and fostering more realistic risk scenarios through wider stakeholder participation. The long-term economic impacts of funding projects that support the sustainability agenda are, thus, clearly understood. However, additional capital needs to flow into areas that address the risks appropriately. For example, much remains to be done to factor climate change as a risk variable into emerging markets that face the largest financing gap in achieving the SDGs. It is imperative that international regulators incorporate the risk of climate change into their models while focusing on mitigating these risks to avoid impediments in the financing of emerging markets.

The private sector can contribute widely, from policy-driven solutions to voluntary investments. The member countries of the G20, through their global reform initiatives, are critical in driving the transformation of the framework by encouraging private sector support for the SDG 2030 agenda. Consequently, multiple potential solutions have been tabled, but with limited success due, primarily, to these challenges. UNCTAD proposed a strategic framework for private investment in SDGs where public financing schemes could be used to attract additional private investment in sustainable development projects (UNCTAD 2014). Thus, governments are pivotal in providing localized leadership and strategic guidance in creating mutually beneficial market development partnerships with the private sector. For example, development organizations, such as Swisscontact, International Development Enterprises (iDE), and Water Aid, have encouraged market and skills development by the private sector in rural Bangladesh. Global governance systems, like the G20, must play an active role in initiating this kind of innovative approach by engaging the private sector in remote areas. Moreover, G20 leaders can initiate a framework to create sector specific partnerships between private entities. These can generate and mobilize resources for the lesser-focused social sectors of SDGs, using various financial instruments such as corporate bond issuances, securitization structures, covered bonds, and debt funds (World Bank 2015). Public–Private–Partnerships (PPPs) have also enhanced the accessibility and empowerment of women in many sectors. A PPP-based gender mainstreaming agricultural project in India increased women’s income, employment generation, access to markets and resources, and psychological empowerment (Ponnusamy, Bonny and Das 2017).

By offering mutually beneficial solutions with appropriate incentives, private sector assets, if channeled effectively, can mitigate the SDG gap to meet the specific goals by 2030. For example, Project Last Mile, a partnership between The Coca-Cola Company and its foundations, USAID, The Global Fund, and The Bill and Melinda Gates Foundation, facilitates knowledge transfer from Coca-Cola to ministries of health in Africa. This improves health outcomes by developing their capacity to create and sustain efficiencies. This is a definitive example of how private sector engagement and financing helped achieve SDG 7 and SDG 13 targets in Africa. Mobilizing the private sector unlocks financing options to achieve the specific target under SDG 8: Decent Work and Economic Growth. According to the IFC (2013), the private sector generates 90% of jobs in developing countries. The considerable interlinkages among the SDGs further reinforce the significant role of the private sector in their attainment.

The G20 Solution

The changing geo-political scenario and emergence of many competing infrastructure initiatives at the regional and global level poses significant challenges for G20 economies as they look to leverage the framework by incentivizing the private sector to support SDGs. G20 economies must simultaneously promote inclusivity and facilitate policy reforms that complement competing infrastructure initiatives. All measures need to be socially and economically beneficial for all stakeholders, and especially by increasing the participation, rights, and accessibility of women. Since the private sector is primarily guided by a profit motive, the G20 needs to drive and support the merits of their economic agenda. Studies have found that the empowerment of women in emerging markets increases organizational profitability (Vali 2019). Specific policy reforms to incentivize the private sector’s support of the SDG agenda 2030, as summarized in Figure 2 below, should thus be considered.

1. Economic modernization and inclusive business tax reform

The economic modernization theory of development refers to changes in societies that offer improved productivity, education, and welfare services (Reyes 2001). Inclusive business tax reforms foster inclusive growth and opportunity incorporating the needs of the poor and marginalized during economic development. Economic modernization, combined with local business tax reform, can provide businesses with a more attractive environment for growth, competition, and innovation. Global leaders should thus consider leveraging the G20 Inclusive Business Framework[1] that was formulated to explore the structural incentives that simultaneously advance a business and development agenda (G20 Development Working Group 2015). Globally, multilateral development banks have invested over US$ 15 billion in inclusive business approaches and private investors have raised US$ 6 billion in funds for businesses that are both commercially viable and expound explicit social objectives. Inclusive business frameworks tend to be most effective in those sectors that link poor populations with basic services supporting their livelihood and health, among others (G20 Development Working Group 2015). An example is M-PESA which, as an inclusive business, has revolutionized access to credit and financial services for 15 million people in Kenya. Similarly, Jain Irrigation Systems Limited has facilitated the economic empowerment of 30 million rural Indian farmers by training them on deep irrigation. At the fiscal level, supporting an inclusive tax reform agenda can trigger significant improvements in the income of rural and local suppliers. In the case of Mauritania, from 2010 to 2014, the government provided a minor tax rebate for businesses in the mining sector that purchased raw materials from official domestic suppliers (Akitoby et al. 2019). Encouraging interested developing countries to participate in the G20/OECD base erosion and profit shifting (BEPS) project and other international tax mechanisms can ensure the equitable deployment and utilization of resources by preventing tax avoidance by multinational enterprises (MNEs). This will further promote fair market competition in the international sphere.

2. Investment in R&D and market innovation

Focusing on “growth-friendly” fiscal consolidation by increasing public sector efficiencies, while incentivizing private sector to invest in R&D, can unlock unexplored markets. This can increase product diversification, leading to enhanced competitive advantage internationally. A 1% increase in public expenditure on R&D will lead to a corresponding increase of between 0.48% and 0.68% in private expenditure (Economic Insight 2015). Apart from public sector R&D, several countries have experimented using PPP modalities. The Netherlands, for example, enacted PPPs through its four leading technology institutes for innovation initiatives that have been evaluated as proven good practices (OECD 2004). Consequently, carefully designed, adequately funded, and politically backed mechanisms that stimulate demand for, and supply of, private R&D could generate the desired stimulus effects.

3. Promoting new development institutions focused on gender issues

Capital flows from bilateral donors and multilateral institutions are usually directed towards developing and underdeveloped economies. These capital flows, including grants, donations, or low-interest loans which are often backed by sovereign guarantees, reduce their risk profile compared to exclusively private sources of finance. The growth of new regional and multilateral development institutions contributes to increased fund portfolios. The introduction of the Asian Infrastructure Investment Bank (2015) and the New Development Bank (2016) expanded the available sources of finance within the global development portfolio by US$ 200 billion. Newly created bilateral donors such as the International Development Finance Corporation (USA), the National Investment and Infrastructure Fund (NIIF), and FinDev (Canada), contribute innovative governance and operational models capable of leveraging private investment.

While these development institutions enhance the reach of private sector investment, there is a need, opportunity, and scope for creating institutions that target financing focused on gender equality. Even though gender equality has a distinct goal under the SDGs, its impact is spread across all 16 SDGs, reinforcing its significance. G20 economies need to back initiatives that promote developmental institutions focusing on gender equality. This will help the private sector access capital with lower risk while enabling them to benefit from increased returns by eliminating gender biases and disparities. Consequently, the G20 community should specifically explore the feasibility of pro-poor PPP projects in developing countries that lead to inclusive and equitable development outcomes.

4. Leveraging innovative financing vehicles

Various innovative financing vehicles that address the development needs and interests of the private sector—such as blended and results-based financing—have gained prominence in recent times. Blended finance shares similarities with PPP models where the government shares the risk of the investment along with the private entity. Results-based financing links the financial returns of investors to agreed-upon and measurable development outcomes. These innovative financing models, however, demand an integrated approach by resolving inconsistencies across resources to finance sustainable development.

In Bangladesh, for instance, blended finance has helped microfinance institutions develop sanitation products and extend their reach to poorer households. This has been possible through the provision of an output-based aid subsidy by the World Bank and the Government of Bangladesh to microfinance institutions (World Bank 2016). In this context, the G20 community being mostly development partners, can advocate for blended financing in development projects and the mainstreaming of blended finance in the national planning processes of developing countries. An effective example of results-based financing mechanisms is the Development Impact Bond in India which increased the enrollment of girls and improved the learning outcomes of about 18,000 children in Rajasthan (Eldridge and TeKolste 2016). Blended finance, through concessional capital instruments, can catalyze greater participation and investment by the private sector in SDG-related investments in developing countries. However, such financial instruments, which are often complex, need to be structured and supported in ways that help the development sector, or public entities, get associated and ensure seamless and effective operation. The G20 must address issues facing innovative finance instruments, such as blended finance, within regional and multilateral institutional frameworks such as the OECD, World Bank, or Asian Development Bank (ADB). These include the development of effective measurement metrics for additionality, value for money, and leverage, while raising awareness and understanding among the donor community of the complexities of such instruments.

5. Maintaining sustainable public finances over the medium-term

There are few developing countries endowed with development finance institutions holding healthy balance sheets. These countries also lack sufficient fiscal strength to undertake massive public investments across energy, transport, or water infrastructure projects. Accordingly, instruments such as PPPs are increasingly seen as ideal solutions for building infrastructure in the developing world. Sustainable public financing can exert considerable leverage on private investment through its “crowding in” effect (Brown and Jacobs 2011).

In many cases, robust fiscal health is a precondition of undertaking robust and bold policies that might have the potential to generate long-term benefits at the cost of short-term profitability. While such policies usually favor socially desirable projects, they are not commercially lucrative as they may entail short-term losses. In such projects, public finance plays a key role in mobilizing private financing locally and abroad. A fitting example is the adoption of low carbon infrastructure alternatives. While this might discourage private investors by being less profitable compared to carbon intensive alternatives, the public sector can intervene to provide the private entities with adequate incentives to compensate for their forgone profits. This policy has been proven highly effective in the Southeast Asian region. While these policies serve business, they simultaneously assist in achieving specific SDG goals in a sustainable manner. The G20 community can advocate the incorporation of such innovative and proven policy options in the national planning framework of developing countries globally.

6. Streamline credit-rating systems for developing and underdeveloped economies

Credit-rating mechanisms that evaluate the ability of a debtor to repay their debt are inadequate in many developing and underdeveloped economies This creates impediments for foreign private financiers. While many such economies may have good business opportunities, the general perception of being business-unfriendly may discourage private financiers despite existing opportunities. Consequently, the G20 needs to extend their support in ensuring a transparent and reliable credit-rating framework for all countries, thereby providing the private sector security of investment in SDG-related activities. Financial institutions already provide pro bono advice to underdeveloped/developing countries on how to obtain or improve their ratings, which supports the standardization of SDG/ESG criteria. Such initiatives need to be supported by the G20 through a multilateral framework, so that they can be effectively scaled and streamlined to facilitate the appropriate collection of finances.

Conclusion

G20 countries, as global development partners of developing countries, must realize the urgency and scope of private capital mobilization for SDG implementation. While these policy recommendations have the potential to induce the private sector to invest in SDGs, the development outcome of these investments depends primarily on the macroeconomic stability and institutional environment of their economies. Given the diversity of context and stages of development, G20 communities should also realize there is no universal solution to the challenges facing developing countries. Rather, policy reforms need to be country-specific to mobilize private financing for SDGs in countries that are currently abandoned.

Disclaimer

This policy brief was developed and written by the authors and has undergone a peer review process. The views and opinions expressed in this policy brief are those of the authors and do not necessarily reflect the official policy or position of the authors’ organizations or the T20 Secretariat.

References

Akitoby, Bernardin, Jiro Honda, Hiroaki Miyamoto, Keyra Primus, and Mouhamadou

Sy. 2019. Case Studies in Tax Revenue Mobilization in Low-Income Countries. Washington,

D.C.: IMF Working Paper.

Brown, Jessica, and Michael Jacobs. 2011. Leveraging Private Investment: The Role of

Public Sector Climate Finance. London: Overseas Development Institute (ODI).

Economic Insight. 2015. What is the Relationship Between Public and Private Investment

in Science, Research and Innovation. London: Economic Insight Ltd.

Eldridge, Matthew, and Rebecca TeKolste. 2016. Results-Based Financing Approaches:

Observations for Pay for Success from International Experiences. Washington,

D.C.: Urban Institute.

G20 Development Working Group. 2015. G20 Inclusive Business Framework.

G20 Insights.

Gallagher, Kevin P., and William N Kring. 2017. Remapping Global Economic Governance:

Rising Powers and Global Development Finance. Boston: Boston University.

Gallagher, Kevin P., Leandro A. Serino, Danny Bradlow, and Jose Siaba Serrate. 2018.

Scaling Development Finance for Our Common Future. Buenos Aires: G20 Insights.

Guzman, Martin, Jose Antonio Ocampo, and Joseph E. Stiglitz. 2018. “Real Exchange

Rate Policies for Economic Development.” World development (World Development):

51–62.

Khan, Towfiqul Islam, and Kazi Golam Tashfiq. 2019. “An Enquiry into the Evolving

Landscape of Development Finance Flows.” Southern Voice Occasional Paper: 1–55.

Kring, William N., and Kevin P. Gallagher. 2017. “Remapping Global Economic Governance:

Rising Powers and Global Development Finance.” GEGI Policy Brief, October

01: 1–5.

Marx, Axel. 2019. “Public-Private Partnerships for Sustainable Development: Exploring

Their Design and its Impact on Effectiveness.” Sustainability 11: 1087.

OECD. 2019. Global Outlook on Financing for Sustainable Development 2019. Paris:

OECD Publishing.

OECD. 2019. Global Outlook on Financing for Sustainable Development 2019: Time to

Face the Challenges. Paris: Publishing.

OECD. 2004. “Public-Private Partnerships for Research and Innovation: An Evaluation

of the Dutch Experience.” https://www.oecd.org/netherlands/25717044.pdf

Ponnusamy, Kuppusamy, Binoo P. Bonny, and Manju Dutta Das. 2017. “Impact of

Public Private Partnership Model on Women Empowerment in Agriculture.” Indian

Journal of Agricultural Sciences: 613–617.

Reyes, Giovanni. 2001. “Four Main Theories of Development: Modernization, Dependency,

Word-System, And Globalization.” Revista Crítica de Ciencias Sociales y Jurídicas

4.

Rodin, Judith, and Saadia Madsbjerg. 2017. The Innovative Finance Revolution: Private

Capital for the Public Good. New York: The Rockefeller Foundation.

Singh, Kavaljit, and Stefano Prato. 2019. “Preventing the Next Financial Crisis while

Financing Sustainable Development: Three Propositions.” In Global Civil Society Report

Spotlight on Sustainable Development 2019: 61–73. Beirut: Social Watch.

Standard Chartered. 2020. “Opportunity 2030: The Standard Chartered SDG Investment

Map.” London: Standard Chartered. https://av.sc.com/corp-en/content/docs/Standard-Chartered-Opportunity-2030.pdf.

UN. 2014. “Improving ODA Allocation for a Post-2015 World”. New York: United Nations.

https://www.un.org/en/ecosoc/newfunct/pdf15/un_improving_oda_allocation_for_post-2015_world_policy_briefing.pdf.

UNCTAD. 2014. “Investing in the SDGs: An Action Plan for Promoting Private Sector

Contributions.” Geneva: UNCTAD. https://unctad.org/en/PublicationChapters/wir2014ch4_en.pdf.

Vali, Nazila. 2019. “Gender Equality: Closing the Gap in the Private Sector Around the

World.” The Guardian. https://www.theguardian.com/business-call-to-action-partnerzone/2019/apr/29/gender-equality-closing-the-gap-in-the-private-sectoraround-the-world.

World Bank. 2015. Capital Market Instruments to Mobilize Institutional Investors

to Infrastructure and SME Financing in Emerging Market Economies. Paris:OECD Publishing.

World Bank. 2016. Facilitating Access to Finance for Household Investment in Sanitation

in Bangladesh. Washington D.C.: World Bank.

Appendix

[1] . Inclusive businesses provide goods, services, and livelihoods on a commercially viable basis, either at scale or scalable, to people living at the base of the economic pyramid making them part of the value chain of companies’ core business as suppliers, distributors, retailers, or customers. Inclusive businesses should promote sustainable development in all dimensions–economic, social, and environmental.