In response to the COVID-19 pandemic, governments around the world have provided a massive fiscal and monetary stimulus. While this policy is welcome in the short run, it does not address the underlying problem in the medium and long run. The reason is that the pandemic has not given rise to a generalized shortfall in aggregate demand. Rather, it has generated a Great Economic Mismatch, characterized by deficient demand for things requiring close physical interactions among people and deficient supply of things compatible with social distancing, where appropriate. Expansive macroeconomic policy can stimulate aggregate demand, but when social distancing is enforced, it will not stimulate production and consumption whenever this demand is satisfied through physically interactive activities. To overcome the Great Economic Mismatch, “readaptation policies” are called for. In the medium run, these policies promote a redirection of resources to activities compatible with social distancing; in the long run, these policies make economies more resilient to unforeseen shocks that generate a Great Economic Mismatch. Once the pandemic is over, a more profound rethinking of decisionmaking—in public policy, business and civil society—is called for. First, decisionmakers will need to supplement the current focus on economic efficiency with greater emphasis on economic resilience. Second, economic policies and business strategies will need to focus less on incentives for selfish individuals and more on the mobilization of people’s prosocial motives. Finally, to encourage people around the world to cooperate globally in tackling global problems, policymakers at local, national and global levels will need to encourage people around the world to cooperate globally in tackling global problems, with the aid of two powerful tools that humans throughout history have used to coordinate their efforts: identity-shaping narratives and institutions of multi-level governance.

Challenge

Governments around the world have been caught off-guard by the COVID-19 pandemic. The rich countries have responded by seeking short-term protection of their citizens’ health and livelihoods. Whereas this response averted a major worldwide economic collapse, the medium- and long-term implications have not received much attention thus far, even though the longer term may be only weeks away. The nations of the world face grave dangers from the economic and social fallout that lies beyond our immediate planning horizon. It is not yet too late to avert these dangers, but time is running out fast.

This paper focuses on this medium- to long-term economic and social fallout. I will show that the current rich-country policy responses are helpful in the immediate short run, they are inadequate for the medium run. The reason is that the pandemic has given rise to what I shall call the “Great Economic Mismatch”: Vast swathes of the world economy have been closed down through the widespread social distancing regulations; at the same time, the demand for essentials, produced and consumed through physically distanced activities, has exploded. Thus, over the medium run many countries face the prospect of massive excess supply alongside massive excess demand: for example, large inventories of face masks and medical gowns in some production centers, while doctors and nurses elsewhere treat COVID-19 patients without adequate protection; food rotting in the fields, while some urban inhabitants go hungry. Unless this Great Economic Mismatch is tackled, the monetary and fiscal stimulus unleashed by the rich countries will turn out to be surprisingly ineffective. After all, the expansionary macroeconomic policies will give people access to the goods and services they need—medicine, food and lots more—only if these goods and services are produced. In the presence of the Great Economic Mismatch, more income does not guarantee more output. If output were not to rise adequately, then the macroeconomic stimulus would serve primarily to reduce the recession-driven downward pressure on prices. That would lead to economic and social disaster.

Furthermore, I will argue that free market forces by themselves are unlikely to surmount the Great Economic Mismatch in time—namely, by the time people spend their incomes to obtain products that have not yet been produced. On this account, “readaptation policies” will be called for. These are policies that induce people to readapt to the novel economic conditions created by the pandemic and that make economies more resilient to such shocks in the future. In the medium run, these policies promote a redirection of resources towards production and consumption processes that are compatible with widespread social distancing. In the long run, these policies comprise a new economic strategy that plays a role analogous to Keynesian automatic stabilizers. But whereas the latter stabilize business cycles in response to fluctuations in aggregate demand, the readaptation policies provide automatic incentives to recover economically from unforeseen shocks that cause a Great Economic Mismatch. The readaptation strategy also enables us to move from short-run crisis measures (such as the massive grants and loans in response to the pandemic) to a medium- to long-term policy framework in which the Mismatch automatically generates mismatch-reducing incentives.

In the long run, we will need to address fundamental problems that can be overcome only by rethinking some fundamental principles of economics, business, and public policy thinking. We will focus on three such fundamental problems. The first concerns the current emphasis on measuring performance in terms of efficiency, that is, choosing the most effective means to achieve predetermined ends under conditions of risk (unknown events with known probabilities). When we face radical uncertainty (unknown events with unknown probabilities)—such as from a new sort of pandemic—we cannot identify the most effective means for achieving predetermined ends and then we should strive for resilience. Thus economic and business performance needs to be assessed in terms of both efficiency and resilience.

A second fundamental problem is a widespread belief that we can overcome future pandemics—as well as other global shocks such as climate change—through prevailing policy and business models predicated on the assumption that people are selfish, lazy, materialistic, and rational. In the future, we will need to develop new models that we show us how to mobilize people’s prosocial motives.

A final fundamental problem is that the rising tide of nationalism is dramatically inappropriate for addressing pandemics and other global problems. In order to extend people’s willingness to cooperate across national borders, we will need to develop new identity-shaping narratives and institutions of multilevel governance. In doing so, we will need to reach beyond our current ideological toolboxes, covering the right-wing versus left-wing spectrum. The corresponding portfolio of policy approaches ranges from laisser-faire (individualistic free market activity) to centralized planning (top-down government intervention). These approaches are utterly inadequate for fighting pandemics, which require strong reliance both on public compliance and international coordination. The time has come to generate new political movements that are compatible with multilevel governance.

Proposal

Short-run policy

For policy design, it is useful to distinguish conceptually between three time periods:

(1) the short-run (primarily in the coming weeks), over which the supply of goods and services can be increased only by drawing down inventories, raising capacity utilization of existing capital equipment, hiring unemployed workers with existing skills in existing locations, and increasing the number of production shifts;

(2) the medium run (primarily over the following few months), when new production capacity can be created by adopting new production processes and reconfiguring our supply chains;

(3) the long run (over the following years), when new production capacity can be created through investment in physical capital (machines and factories), when our norms and values can be modified, thereby influencing our willingness to cooperate across national boundaries; and when new institutions for protecting ourselves against pandemics and other major global shocks (such as climate change) can be built.

Though the precise length of these periods will vary by sector, geographical region, and culture, for each particular case it is useful to divide the policy challenges into these three categories.

Currently, public policy around the world is focused squarely on the short run. Specifically, governments have unleashed a massive fiscal stimulus, in excess of 2 percent of world product, far larger than the one provided in response to the financial crisis of 2008-09. The G- 20 agreed to combined fiscal measures amounting to $5 trillion—a crisis response that is unprecedented in the history of macroeconomic policy. Central banks worldwide—led by the European Central Bank and the U.S. Federal Reserve—are promising to print all the money it takes to buy whatever debt their governments decide to issue. Interest rates are kept low in order to make government borrowing cheap.

In the rich world, governments are showering firms with cheap loans and grants in order to avoid defaults and dismissals. Some governments are paying most of the wage bills of people left unemployed through the crisis. In addition, households are frequently given relief on their mortgages, rent payments, and utility bills.

In the short run, this rich-country policy response is no doubt welcome, otherwise the pandemic, along with the social-distancing measures decreed in response to it, would have led to a tsunami of bankruptcies and layoffs. If the COVID-19 pandemic were a very transitory affair—lasting a matter of weeks—then these measures would be all that is needed to overcome this crisis. In that event, after a temporary lockdown of more than 2 billion people worldwide and a temporary shutdown of much production and retail trade, everyone could return to work and—with the exception of those who lost their loved ones—carry on with life before the pandemic.

Alas, the pandemic is not a transitory affair. We simply do not know how long it will last, but most experts expect it to last for many months, possibly followed by another pandemic wave towards the end of the year. On this account, it would be irresponsible for policymakers not to consider what might happen beyond the short run and to design policies addressing the oncoming dangers. This is particularly important because, under a continuation of the current policy approaches, the medium-run economic implications of the pandemic look very grim indeed.

Meanwhile, in the poor world, where government largess is impossible, many people will increasingly face the choice between dying of the coronavirus and dying of starvation. On the one hand, poor countries have a disproportionately large proportion of young people, in warm climates, doing rural work—and the coronavirus has relatively little effect on the young, spreads less readily under warm conditions, and can travel less readily in sparsely populated rural areas. On the other hand, the inhabitants of poor countries suffer disproportionately from malnutrition and disease and consequently have relatively weak immune systems. Moreover, hand washing is impossible in the absence of running water and social distancing is difficult in crowded city slums. The upshot of these considerations is that in the poor world the pandemic will spread—slowly in some places, quickly in others—but probably far, over a prolonged time.

Even if the inhabitants of rich countries were completely unconcerned with the fate of their poor counterparts, this prospect should be alarming. The reason is that unless the flow of people and goods between rich and poor countries is stopped completely (or at least quarantined, for which we do not have the physical capacity), it is impossible to prevent the spread of the coronavirus from poor to rich countries.

The problem with the current short-run policies is that they address the crisis merely by stimulating aggregate demand. This Keynesian pump-priming policy is appropriate in times of generalized economic recession, such as during the financial crisis of 2008, but it is woefully inadequate as a response to the pandemic.

To think constructively about appropriate policy responses to the pandemic, we must explore the economic policy implications social distancing. In what follows, I will use the term “social distancing” in its widest sense, to include not just the practice of keeping one’s physical distance from other people, but also identifying the infectious people (through testing) and isolating them (a targeted form of social distancing) and imposing travel restrictions. Social distancing is practiced in most countries in order to reduce the infection rate, which in turn helps reduce the likelihood that medical capacities become overwhelmed. However social distancing also has devastating consequences for our ability to produce and consume. The tradeoff between social distancing and economic activity has profound implications for economic policy.

The medium run: The Great Economic Mismatch

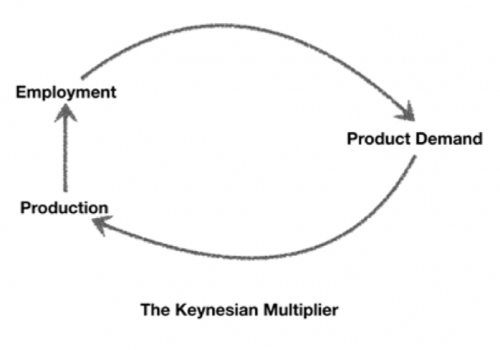

Keynesian pump priming relies on a strong reciprocal relationship between labor demand and product demand. The government stimulus to product demand induces businesses to produce more goods and services. To do so, they require hire more labor. The rise in employment leads to a rise in the incomes of the employees, who proceed

to consume more. The rise in consumption leads to a further rise in employment, and so on for all subsequent rounds of the Keynesian multiplier.

This mechanism works as long as the economy is in a generalized recession, with many people willing to work more at the prevailing wages and many businesses willing to sell more products at the prevailing prices. Under these circumstances, a rise in government expenditures leads automatically to a rise in production, necessitating a rise in employment, which generates the income for more product demand.

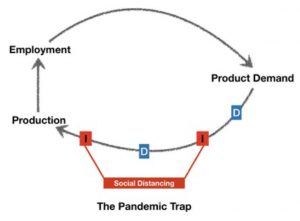

However, during a pandemic, when social distancing is prescribed, this mechanism doesn’t function. To see why, let us divide all production and consumption activities into “physically interactive activities” (I) and “physically distanced” (or disjoint) activities (D). The physically interactive activities require people to come into physical contact with one another (such as waiters and customers in restaurants), while the physically distanced activities permit market transactions to take place without such physical interactions (such as delivery services for food).

Most goods and services are produced through supply chains that contain complex sequences of physically interactive (I) and physically distanced (D) activities. For example, fruit is picked from trees, packed into boxes, transported to restaurants, where it is prepared in a kitchen and placed on tables as part of the meals. Fruit picking and transporting may be physically distanced, whereas packing, cooking and serving tend to be physically interactive (since there is limited factory space for packing, limited kitchen space for cooking, and serving requires immediate proximity to the customers).

When social distancing is practiced, the physically interactive parts of the supply chain collapse. Thus stimulus to product demand leads to far less production than in normal times. Taking our previous example, this means that fewer boxes of fruit are packed, because the factory can accommodate fewer packers, who are now packing at a greater distance from one another. And once the restaurant and its kitchen is shut, the production of meals may cease altogether in the context of the original logistical setup.

Under these circumstances, the Keynesian stimulus to product demand may lead to little increase in production, which in turn conveys little stimulus to employment. Since few additional people are employed and few people work more intensively in the old production chains, little additional income is generated and consumption does not rise much either. So, in the context of the original supply chains, the Keynesian multiplier has withered.

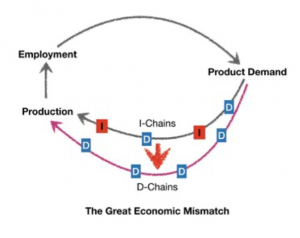

But that is not the end of the story, because goods and services differ in terms of the degree to which their production and consumption require physical interaction. Theaters, sports arenas, and restaurants are all reliant on physically interactive consumption. The associated I-activities cease to be available in times of pandemic. Other products can be produced and consumed in physically distanced ways, such as remote health diagnosis and data analysis. Many of the associated D-activities experience a rapid rise in demand during a pandemic.

Finally, some products can be produced and consumed more flexibly, requiring a reconfiguration of their supply chains in order for the move from ones containing I-activities to ones reliant predominantly on D-activities. Food that would have been eaten in restaurants might now be delivered at home. Some restaurants can make this transition promptly, while others (lacking the necessary vans and equipment) may do so only after a significant adjustment period if at all. Some conferences that took place physically could now take place remotely via conferencing apps. Many conference organizers are not set up to master this challenge. Films that would have been viewed in the cinemas can be watched online. There few if any cinema theaters able to make such a transition.

Let the supply chains that rely on both I- and D-activities be called “I-chains,” since they are reliant on I-activities, i.e., they collapse once the I-activities are no longer performed. Furthermore, let the supply chains that rely predominantly on D-activities be called “D-chains,” since they do not collapse when the I-activities become impossible.

In this framework of thought, the pandemic creates what may be called the Great Economic Mismatch. Many jobs associated with I-chains are lost, while the demand for jobs associated with many D-chains explode. The pandemic necessitates a redirection of economic activity from I-chains to D-chains. For example, the fruit-packing capacity under social distancing could be increased by building more packing factories or producing robots that can pack the fruit, and the fruit could be delivered directly to the doorsteps of the consumers. Thereby the supply chain—from fruit-picking to consumption—could be transformed into physically distanced activities.

But it is difficult for free-market economies to make such adjustment in the short run, since it is costly (for example, supermarkets may need more delivery vans and more drivers) and may call for new skills that are not readily available (for example, hospitals may need more nurses and pharmaceutical firms may need more microbiologists, who may need to be trained). Furthermore, the people operating the supply chains are bound not only by contractual relations, but also social relationships that establish the trust necessary for these supply chains to operate efficiently (namely, without the monitoring and enforcement of contracts). These social relationships take time to build up.

Nevertheless, the pandemic makes short-run adjustment imperative for essential goods and services. If food cannot be brought from the farms to the food consumers, then farmworkers will be laid off while people elsewhere go hungry. If medical supplies cannot be produced in time for patients in intensive care, then people will die. Once citizens realize that they cannot rely on their governments for food and health care, the social fabric is in danger of disintegration.

The implications for economic policy are profound. The first is that Keynesian demand- management policies are ineffective in the medium run. The second is that free markets cannot solve the problem; government intervention is required. And the third concerns the readaptation policies that can overcome the Great Economic Mismatch.

If significant adjustment from I-chains to D-chains cannot be made promptly, something would happen that no government currently expects: the rise in government expenditures and fall in taxes becomes disappointingly ineffective in preventing the precipitous drop in production and employment. It is worth spelling this out carefully: the large-scale fiscal packages to protect incomes—$2 trillion in the U.S. alone—could be largely wasted. People have been given the money to keep buying goods and services, but these goods and services may no longer be produced, due to the disruption in the supply chains. No amount of money could enable people to buy things that have not been produced.

When more money chases fewer goods and services, prices rise relative to what they would otherwise have been. Currently, there is sharp downward pressure on the prices of many products, on account of the sharp drop in aggregate demand. Giving people more money without changing production capacity merely means that this downward pressure on prices is mitigated. When the G-20 countries pledged $5 trillion in a united response to the coronavirus crisis on March 26, the G-20 policymakers expected at least $5 trillion of stimulus to world product and probably more in terms of private-sector response. They were surely not anticipating that, unless economies made a swift adjustment from I-chains to D-chains, the stimulus package would merely blunt the fall in prices.

Unless there is a shift from production and consumption activities that rely on I-chains to those that rely on D-chains, the Great Economic Mismatch will occur: people will demand products (food, medicines and many other goods and services) with their subsidized incomes, but these products will not be produced adequately. Food may rot in the fields while the potential harvesters, packers, drivers, retail personnel, logistic and financial support staff, accountants, and others remain unemployed at home. Patients will demand hospital and care services that are not provided, since the staff that could have been trained for this purpose remains idle, waiting for their old jobs to return.

Can free market enterprise overcome the Great Economic Mismatch?

In the medium run, therefore, policymakers face a straightforward problem, namely to ensure that the transformation of supply chains from I- to D-chains takes place fast enough so that the existing fiscal stimulus is not wasted and that the otherwise ensuing wholesale destruction of livelihoods does not happen. There is no reason to believe that free market enterprise on its own can tackle this problem adequately, let alone with the requisite speed.

After all, it takes time to acquire new skills, to invest in new physical capital, to relocate to where the newly created jobs are, to undertake organizational restructuring and to form new social groups. If the pandemic is prolonged, then free markets will create incentives to train, invest, relocate, reorganize and reaffiliate—but not enough to solve the mismatch problem. First, people do not know in advance how long the pandemic will last and this uncertainty leads to under-investment in physical, human and social capital. Second, pandemics occur too infrequently to enter appropriately into the time horizons over which these investment decisions are characteristically made. Third, the investment decisions are all associated with large positive externalities: one person’s investment raises the reward from another person’s investment. As is well-known, in the presence of such positive externalities, free market enterprise leads to under-investment, even in the long run, since the private return from the investment falls short of the social return.

In practice, free markets have not risen to the challenge of pandemics. Just last year the report of the Global Preparedness Monitoring Board, A World At Risk1 warned that “there is a very real threat of a rapidly moving, highly lethal pandemic of a respiratory pathogen killing 50 to 80 million people and wiping out nearly 5 percent of the world’s economy.” Just a month before the first cases of coronavirus were reported, the Center for Strategic and International Studies issued a report on Ending the Cycle of Crisis and Complacency in the U.S. Global Health Security,2 noted the rising threat of infectious diseases on account of population increase, intensive agriculture, climate change and, urban agglomeration. As the current health and economic crisis dramatically attests, free market enterprise has not responded adequately to these warnings.

In order to minimize the economically disastrous lockdown periods, it is necessary to build up medical capacity as well as supply chain flexibility, enabling a quick transition from I-chains to D-chains. While the former is essential for health security, the latter is just as essential for economic security. If the economies of the world manage to create such flexibility in the current crisis, it will need to be retained into the foreseeable future. Without it, every future pandemic could lead to a repeat of the current economic carnage. In this sense, supply chain flexibility is like a seatbelt. Most of the time seatbelts are not required, but wearing them while driving is always necessary, on account of the possibly disastrous consequences in case of accident. COVID-19 should prepare us for a new world in which versatility in switching between I- and D- chains is deemed permanently essential.

Against this backdrop, it is apparent that the current policy approach of lockdown plus pump- priming needs to be replaced by a new approach that addresses the Great Economic Mismatch directly, namely by readaptation policy, whereby people are given incentives automatically to “redirect resources from where they are idle to where they are in excess demand and thereby make the economy more resilient to unforeseen shocks.

In the labor market, the move from short run pump-priming to readaptation can be achieved through the benefit transfer program, which gives the currently unemployed people the opportunity to their current income support to provide hiring and training credits to firms that hire and train them.3 In short, the “benefits” that unemployed workers currently receive (for example, the current British government policy of paying up to 80 percent of the wages of furloughed workers, or the unemployment benefits that the U.S. government is paying to 6.6 million new American unemployment claimants) are “transferred” into incentives for activating unemployed people.

The benefit transfers are targeted to address precisely the looming danger of the Great Economic Mismatch. They induce people whose work has disappeared through the pandemic to redirect their efforts to the production of goods and services that are now in burgeoning demand. By matching unemployed labor with vacancies in the new I-chain activities, the benefit transfers create new revenues, which can be shared by employers and their employees. Consequently, employers find it cheaper to hire and train new employees, enabling them to offer their employees more income, relocation support and better training than the latter currently receive. In effect, the employees receive more than the firms pay, the difference being the unemployment benefits that are transferred into hiring and training credits.

The size of a worker’s hiring and training credits should rise with the duration of unemployment and fall with the duration of subsequent employment, phased out completely after two years. This makes sense in terms of benefit transfers, since the longer a person is unemployed, the lower are her chances of gaining employment and thus the greater the present value of her expected unemployment benefits. Thus, a policy that allows unemployment benefits to be transferred into hiring and training credits will have these credits rise with unemployment duration. Once the hiring and training credits have run out, many of the workers are likely to be retained, since they will have received valuable experience and skills related to the new I- chain activities. The benefit transfer program would be largely costless to the government, since the funds spent on hiring and training credits would have been spent on unemployment benefits anyway.

The two pitfalls of the benefit transfer program are “deadweight” (giving hiring and training credits to workers who would have found employment and training anyway) and “displacement” (the workers getting jobs with the hiring and training credits displace existing employees).4 Both of these potential problems are likely to be minor in the current crisis. Many of the people who can find employment and training anyway may be expected to do so reasonably promptly over the short run, so that those who remain unemployed in the medium run may be expected to be the ones that require the hiring and training credits in order to make the transition to the new I-chains. So deadweight is likely to be small. Furthermore, the I-chain production processes are currently experiencing soaring excess demand (as evidenced, for example, in stock outs and lengthy delivery times at Amazon). Under such circumstances, the new hires serve to satisfy the existing product demand, not displace existing employees.

These readaptation policies indicate a pathway out of the current crisis. The current lock-down should be restricted to I-chain activities. People engaged in D-chain work could carry permits to that effect, get lock-down waivers and be allowed back to work. Needless to say, D-chain work must be defined with respect to all aspects associated with one’s work, including the transport (where necessary) to and from the job.

Once implemented, the benefit transfers come with an exit strategy for policymakers, since the support declines gradually with the duration of employment. For those who remain unemployed, their entitlement to benefit transfers continues to rise with the duration of their unemployment, giving them progressively larger support to overcome their mismatch difficulties.

The readaptation policies will need to be supplemented by an appropriate foundation of job search and matching services from both the public and the private sectors. Online job labor exchanges (such as and job matching platforms such as LinkedIn, Monster, the jobnetwork, Jobr, and Totaljobs), job search engines (such as SimplyHired and Indeed), and advanced job matching platforms (such as workfountain, anthology, and elevated) will have an expanded role to play in identifying D-chain vacancies to be connected with the appropriate job searchers. Companies that certify D-chain activities are called for. Public sector employment services will be also be required, particularly to coordinate private-sector efforts and support search and matching for systemically sensitive jobs (related to national health and security, as well as complementary networks of jobs, for which the social return from job matching is significantly higher than the private return).

Readaptation of investment

Readaptation policies can also be implemented with respect to investment in physical capital, such as delivery vans for food producers, construction of new hospitals, and production of face masks. Currently, governments are providing loans to businesses to preserve current jobs and current business operations. The U.S. Federal Reserve and European Central Bank have both promised to buy short-term business debt. The U.S. government provides loans to small businesses that will be forgiven when workers are not laid off. This policy is welcome in the immediate run, but it is clearly appropriate beyond that. In the OECD, on average, about 8 percent of businesses fail per year and about 10 percent of employees lose their jobs. This natural turnover—essential for eliminating waste and resource misallocation in capitalist economies—is eliminated by the current policy measures.

When the benefit transfer program is applied to investment in physical capital, the “benefits” that businesses currently receive in terms of loans and grants are “transferred” into incentives for adopting D-chains to produce and consume products. These benefit transfers are targeted at the Great Economic Mismatch in the allocation of equipment and factory space. Under the current COVID-19 lockdown, many delivery vans for inoperable I-chain businesses now stand idle, while there is a large excess demand by D-chain retailers and medical suppliers. The investment benefit transfers give the former businesses much needed incentives to make their excess capacity available to the latter businesses. The benefit transfers also encourage the growth of digital platforms that promote this matching process across all relevant sectors of the economy. Thereby firms are induced to redirect their business from the development, production and marketing activities that have been laid low by the lockdown to the D-chain activities that are vital for keeping people healthy, fed, and secure. In this process, the benefit transfers create new sources of revenue, inducing businesses to undertake investments in equipment as well as manufacturing and service structures that they would not otherwise have considered. In this respect, the benefit transfers are analogous to investment tax credits applied to D-chain technologies and processes.

Readaptation in financial markets

The problem of “debt overhang”—the over-indebtedness of governments, businesses and individuals that makes it difficult for these entities to borrow more money, even in the presence of profitable investment opportunities—is a legacy of the last worldwide financial crisis. It is a problem that policymakers never managed to address sustainably. Instead, in the dozen years since this crisis, monetary policy has remained highly expansive, driving interest rates low enough to keep debt overhang from precipitating another wave of international financial instability. The Institute of International Finance calculated that the ratio of global debt to GDP reached a record level of 322 percent in the third quarter of 2019.5 Central banks have been engaged in asymmetric monetary policy, supporting markets in downturns but not withdrawing support equivalently in upturns. The resulting, persistently low interest rates have prevented financial markets from differentiating adequately between safe and risky investments, thereby delaying the day of reckoning for financially unsustainable businesses. The low interest rates inevitably led to excessive risk taking by financial institutions.

In contrast to the period leading up to the financial crisis of 2008, the current private debt is not primarily mortgage lending, but rather corporate loans. According to the OECD, the outstanding stock of non-financial corporate bonds reached a record high at the end of 2019, at $13.5 trillion, which in real terms is twice the level it attained in December 2008.6 This corporate debt is riskier than in previous credit cycles, the OECD report indicates, since the current stock of corporate bonds has lower credit quality, higher payback requirements, inferior covenant protection and longer maturities (making the bonds more sensitive to interest rate variations).

The problem of debt overhang that is about to get far, far worse. The reason is that much of the monetary and fiscal stimulus to firms has come in the form of loans. In the U.S. and Europe alone, more than $8 trillion of government loans, guarantees, and temporary subsidies have been promised to private businesses—an amount that corresponds to all their profits for the last two years. Governments have supplemented cheap business loans with bailouts to large firms that may be too big to fail. For example, the U.S. government has reserved $50 billion for airlines and businesses deemed vital to national security. It has also promised to buy unlimited amounts of agency mortgage-backed securities, if needed.

Once the current pandemic-related economic crisis is over, this highly indebted corporate sector will pose a grave risk to the stability of the international financial system. To mitigate this risk, two novel policy instruments could promote financial readaptation:

(1) Earnings-related, variable-rate bonds and loans: These are corporate bonds and loans whose interest rate is related to corporate earnings. The greater the earnings of a business, the greater is the business’s ability of repaying the loans and therefore also the greater its ability to pay a higher interest rate. When earnings fall beneath a specified threshold, the interest rate falls to zero and repayment of principal is postponed, for a specified period. These financing instruments receive preferential tax treatment only when devoted to D-chain activities.

(2) Non-voting, contingent convertible bonds and loans: These are corporate bonds and loans that automatically convert into equity when the capital adequacy ratio (the ratio of equity to risk-weighted assets) falls beneath a specified minimum level. Corporate bonds convert into non-voting stock, to ensure that governments do not get a say in the management of the businesses holding this financial instrument. Loans convert into a corporate income tax on future earnings. Again, preferential tax treatment is reserved for D-chain activities. When the business experiences financial distress, the conversion guards the business against debt-driven default, since the size of the swap would be sufficient to return the company’s capital adequacy ratio to the specified minimum.7

Both of these instruments would help ensure that the debt overhang does not precipitate a widespread financial crisis. The latter instrument would ensure that companies that are deemed “too big to fail” don’t fail, because as soon as their capital adequacy ratio is too low, enough debt would be converted into equity for capital adequacy to be restored. The taxpayer would no longer need to bail these institutions out, since the need for a bailout would not arise. In effect, the solvency guarantee of these companies would be financed by the shareholders, since the interest rate on the bonds would take account of the possibility that the value of the shares may become diluted if the debt-for-equity swap occurs.

Long-run paradigm change

In the new world that we are soon to enter, the reality of pandemics will have to be taken seriously, along with the likelihood that they will occur with increasing frequency. Testing, hospital and medical service capacity will need to be built up accordingly, in both the developed and developing worlds. As noted, this capacity will be needed not only in the medium run, to get people through the current crisis, but also in the long run. In rich countries this will require a greater role for finance and provision at state, regional and local levels, just as welfare services were expanded in the aftermath of the Second World War. Poor countries will need to receive support in building the requisite capacities.

Beyond that, the new post-pandemic world will bring new challenges that can be met only through new ways of thinking.

Efficiency versus resilience

Some particularly vicious policy errors arise because of the way many policymakers deal with ignorance concerning the evolution of the pandemic. The widespread temptation in fighting the pandemic is to reduce our ignorance of probabilities specified with respect to the “best” statistical model available and then, armed with these probabilities, to choose the most efficient policy means to achieve our ends. The public is shown diagrams of bell-shaped curves outlining the infection rate through time. This spurious precision is often meant to suggest policymaking competence. With monotonous regularity, for example, U.K. government officials have announced that they are doing “the right thing at the right time.”

This approach—combining estimated probabilities from a specified statistical model with efficient policy decisions—may be effective in allaying our anxieties, but it is not appropriate for fighting the pandemic. The reason is that this type of pandemic has never occurred before and thus we have no reliable way of assessing the probabilities future infection rates. Probabilities can be legitimately measured only when the future is just like the past. Then the frequency with which an event occurred before can inform you about the frequency of future occurrences. When something radically new happens, however, we simply don’t know.

The appropriate policy response to such uncertainty would be to admit ignorance and to stop seeking probability estimates from the “best” statistical model, since we have no reliable way of assessing which model is best. Instead, policymakers should (whenever they are not already doing so) encourage the formulation of a variety of models, each reflecting state-of-the-art research and then formulate policies that seek to be robust with regard to these models. Thereby policymakers put themselves into the best possible position to learn about what is currently unknown. The more reputable models that are available and the more divergent these models’ predictions, the greater are the opportunities for policy learning.

At the international level—for example, the European Union or preferably the G-20— policymakers should not encourage policy monocultures. Instead, they should allow different countries to pursue their different policies, while imposing stringent travel restrictions across national borders—namely, a rigorous two-week quarantine for everyone who crosses a border. Again, the greater the number of divergent country approaches, the more policymakers can learn from one another internationally. The G-20 together with the WHO has an important role to play in coordinating this learning process.

To maintain credibility in the eyes of the public, politicians should communicate that their aim is not to find the “best” policy in response to the “best” model, but rather to design policies that are robust with respect to the various state-of-the-art models available. Alas, this has not been the approach that most politicians appear to have chosen nationally or internationally.

Throughout history, people have repeatedly confronted new challenges and developed robust strategies to survive. The successful ones did not do so by seeking the best statistical model and then deriving the optimal policy response. Instead, they kept an open mind and experimented in their responses. The more experiments, the better. Societies then provide opportunities for different people to learn from one another. This process enables us to learn as much as possible about the new event. This is the lesson that government officials, eager to demonstrate their competence to their voters through clear predictions and instructions, tend to forget.

When something unprecedented happens, we need to learn as much as possible, not try to find the best response to what we currently consider to be our best guess. The evolutionary process works through variation, selection, and replication. When there is variation in our responses to an unknown event, it becomes possible to select the ones that promote survival and wellbeing and to replicate these winning responses. This is the way to build societies that are resilient in the presence of unforeseen shocks.

In many respects, resilience is the opposite of efficiency. Resilience requires you to try lots of things, make lots of mistakes, in the hope of finding something that works. Efficiency requires you to accept a given model of reality and then making the single best decision to reach your predetermined objectives. To policymakers focused on efficiency, resilience looks wasteful. It means having lots of spare hospital beds, research facilities, and testing centers to deal with the unknowables of the future. Nowadays, pursuing resilience is not the way to win elections, because most voters—like the politicians who lead them—are focused on finding efficient solutions to known problems. The pandemic will hopefully teach us the dangers of seeking efficiency in the face of uncertainty and the value of building resilience.

Mobilizing prosocial motives

Conventional economic analysis assumes that people are selfish, lazy, materialistic, and rational: selfish, in that they are concerned only with their own wellbeing, not the wellbeing of others; lazy, in that they prefer to work as little as possible; materialistic, in that their wellbeing derives primarily from their consumption of goods and services; and rational, in that they consistently choose the most efficient means to reach their stable, internally consistent ends. Consequently, conventional economics has generated a huge literature on how the behavior of such people may be influenced through external incentives, primarily monetary rewards and punishments, along with regulations. This is the basis for much economic policy advice as well as the principal-agent theories on how to run businesses.

What the pandemic shows us, in country after country around the world, is that this conception of human nature is seriously misguided. Not only have we seen widespread compliance with social distancing recommendations, even when there was no chance of enforcement, but the pandemic has generated countless acts of kindness, selfless assistance, and benevolence, even among strangers, as well as heroism among doctors, nurses and other medical staff. It has also given rise to an extraordinary outpouring of painstaking research by scientists worldwide. Without such prosociality, the death toll from the coronavirus would have been staggeringly higher.

The psychology, neuroscience, sociology, anthropology, and biology literatures have produced a wealth of empirical evidence indicating that people are not invariably selfish. They are capable of a wide range of motives, ranging from care8 and affiliation9 to achievement,10 as well as from status seeking and power11 to anger and fear.12 From these motives arise behavior patterns that range from cooperation to conflict. These motives can be influenced by the narratives, social contexts, and institutions within which people live.

On this account, politicians can influence the public by much more than merely monetary incentives and regulations. They can motivate their citizens to impressive acts of cooperation within and across national boundaries. They can mobilize the prosocial motives of their citizens through the narratives they espouse and the institutions they build.

COVID-19 highlights humanity’s deficient willingness to cooperate at a scale appropriate to the problem at hand. Populist nationalism encourages cooperation among citizens, while producing distrust, grievance, and antagonism with regard to foreigners. Such movements are utterly inappropriate for fighting the coronavirus pandemic, because the only way of defeating the pandemic sustainably in any country is to defeat it everywhere. The reason, naturally, is that we live in a highly integrated global economy, in which most goods are produced in multiple countries and people travel internationally in order to keep the global value chains functioning. Under these circumstances—particularly in view of the long dormancy and incubation periods for the coronavirus—containing the pandemic within any country in isolation would require the state to trace all infected people and moving objects and quarantining everything that crosses national boundaries. This is practically impossible and, even if it were possible, it would bring the global economy to its knees.

On this account, policymakers must recognize far more explicitly than they have done heretofore that their pandemic policies must rest on global cooperation. Their voters must recognize that populist nationalism endangers them both individually and nationally. Why is this lesson so hard to learn nowadays? Because people’s social affiliations are generally not sufficiently broad to make them willing to cooperate at this scale. Their largest-scale affiliations tend to be national. Thus, nations usually confront the pandemic nationally, often even restricting exports of medical supplies. The existing international governance systems are insufficient to promote global cooperation on a top-down basis.

To overcome the problem of deficient willingness to cooperate, we will require new frameworks of thought. This is certainly not the first time that humanity has risen to such a challenge. From the rise of religions in the Axial Age to the Enlightenment and beyond, humans have confronted trials of ever-larger dimensions, calling for ever-larger circles of cooperation. Cities emerged from villages and towns. Nations emerged from principalities. Multi-national companies emerged from nation-based firms. The international organizations arising in the aftermath of World War II were created in response to international conflict. In all these cases and many others, people managed to cooperate in ever larger numbers by creating two complementary edifices: (1) identity-shaping narratives to promote internal change (affecting the ways with think and feel) and (2) institutions of multilevel governance to promote external change.

The narratives assign social roles to people, giving them social identities and a sense of belonging to their social groups. These narratives widen our circle of affiliation, giving us a sense of purpose, norms, and values to sustain this purpose, and the conviction to act in accordance with this purpose.13

In order for the identity-shaping narratives to be accepted and sustaining, they must satisfy fundamental needs and purposes of their adherents. There is a vast literature about these basic constituents, transcending nations, religions, classes and cultures. In a recent paper, Lima de Miranda and Snower (2020) identify four such needs and purposes and measure them across time and countries:

- Solidarity (S), associated with the social motives of care (seeking to promote the wellbeing of others and to alleviate their suffering) and affiliation (seeking social belonging);

- Agency (A), associated with the need to be empowered to shape one’s environment, motivated by achievement (seeking to attain socially accepted goals), power (seeking social influence), and status (seeking social standing);

- Material gain (G), associated with the level and distribution of consumption across individuals in a social group; and

- Environmental sustainability (E), ensuring that human activities remain within planetary boundaries.

These four measures constitute a SAGE dashboard for assessing human wellbeing and thereby measure the potential success of the underlying identity-shaping narratives.

One of the major advantages of the readaptation policies described above is that they give people agency, by helping them to help themselves. They also give people the freedom to redirect their efforts in the context of their social groups, thereby strengthening their social solidarity. They promote the generation of income and output, thereby contributing to material gain. Finally, when the readaptation policies take environmental costs and benefits into account, they can also promote environmental sustainability.

To address global threats such as the pandemic effectively, we will need to develop identity- shaping narratives that enable people, in all their diversity, to satisfy such fundamental needs and purposes by cooperating globally. We all have multiple identities. People live effortlessly in their capacities as family members, friends, neighbors, colleagues, citizens, and so on. In thriving societies, these identities—at the local, regional and national levels—are in harmony with each other. The challenge that the coronavirus pandemic poses is whether we are able to develop identity-shaping narratives that give us a global identity—as human beings who are all in one boat—when we are fighting pandemics together. If we succeed, we will experience the internal change that will make us willing to look beyond our national borders in response to global threats.

But internal change is not enough. It needs to be reinforced by external change, through institutions of multilevel governance. In order for these institutions to be regarded as legitimate and effective in promoting cooperation, they need to satisfy some basic principles. Elinor Ostrom received the Nobel Prize for identifying such principles empirically.14 These principles are in accord with the fundamental needs and purposes identified above, and summarize institutional features of successful multilevel governance:

- Define clear group boundaries.

- Match rules to local conditions and needs.

- Ensure that those affected by the rules can participate in modifying the rules.

- Ensure that the rule-making rights of community members are respected by

outsiders. - Ensure that community members monitor each other’s behavior.

- Use graduated sanctions for violators.

- Provide accessible, low-cost dispute resolution mechanisms.

- Implement polycentric governance.

The first principle is necessary for solidarity (S); principles 2-4 are necessary for agency; and principles 5-8 specify the requisite institutional arrangements to promote compliance to common goals.

These foundations provide guidelines for how to achieve the global cooperation that is necessary for tackling the COVID-19 pandemic without much unnecessary loss of life and livelihood. At present the nations of the world are still far from following these guidelines. But the way ahead is clear. Whatever policies are implemented, they should build on our existing social groups, along with their norms and values. These norms and values should be expressed in identity-shaping narratives that lead to the satisfaction of fundamental human needs and purposes, motivating people to adopt these narratives. Everyone should be empowered to contribute towards the goal of overcoming the pandemic, in the context of local conditions and needs. Everyone should be included in the formulation of these contributions.

This sense of agency must be respected widely. The contributions should be monitored and violators should be subject to sanctions that become more stringent with each violation. Procedures for fair and fast conflict resolution must be developed. And finally, what holds for individuals in a group should also hold for groups within a meta-group.

This approach also has far-reaching implications for the interaction between policymaking and business. In order for business decisionmaking to complement the identity-shaping narratives and institutions of multilevel governance that permit cooperation at the appropriate scales, insightful thinkers have advocated changes in business evaluation and reporting, as well as changes in the existing institutional and legal frameworks, to induce companies to extend their objectives beyond the maximization of shareholder value.15 Proposals for maximizing stakeholder value, along lines that are compatible with the goals of multilevel public policy, however, lie beyond the scope of this paper.

This approach to the pandemic follows neither laissez-faire nor central planning.16 It extends beyond demand-side versus supply-side economic policy. It goes beyond right-wing versus left- wing politics. It points to a new approach to policymaking, to which we may aspire. May the severity of the current pandemic lead us to transcend our parochial perspectives and embrace a new chapter towards achieving such global cooperation.

References

- Akerlof, G., and D.J. Snower (2016), “Bread and Bullets,” Journal of Economic Behavior and Organization, 126, 58-71.

- Albul, B., D. Jaffee, A. Tchistyi (2012), “Contingent Convertible Bonds and Capital Structure Decisions,” mimeo, https://pdfs.semanticscholar.org/223f/bf7805ac98d6dad4de3f1ac43090458e4d33.pdf?_ ga=2.143652534.2058708375.1586107569-1307808775.1586107569

- Collier, P. (2019), The Future of Capitalism, London: Penguin Books.

- Fleurbaey, M., and G. Ponthiere (2020), “The stakeholder corporation and social welfare,” mimeo.

- Heckhausen, J. (2000), Evolutionary perspectives on humans motivation, American Behavioral Scientist, 43(6), 1015-1029.

- Heckhausen, J., and H. Heckhausen (2000), Motivation und Handeln, Berlin: Springer.

- Lima de Miranda, K., and D. J. Snower (2020), “Recoupling Economic and Social Prosperity,” Global Perspectives, 1(1), 1-34, https://doi.org/10.1525/001c.11867

- Kelly, C. (2019), “Repurposing our economies — and our businesses,” Policy Brief, G20 Insights, https://www.g20-insights.org/policy_briefs/repurposing-our-economies-and-our- businesses/

- Mayer, C. (2018), Prosperity, Oxford: Oxford University Press.

- McAdams, D.P. (1980), A thematic coding system for the intimacy motive, Journal of Research in Personality, 14(4), 413-432.

- OECD (2020), “Corporate Bond Debt Continues to Pile Up,” Feb. 18, https://www.oecd.org/corporate/corporate-bond-market-trends-emerging-risks-and-monetary- policy.htm and a summary: https://www.oecd.org/corporate/corporate-bond-debt-continues- to-pile-up.htm

- Orszag, M., and D. J. Snower (2003), “Designing Employment Subsidies,” Labor Economics, 10(5), 557-572.

- Ostrom, E. (1990), Governing the Commons: The Evolution of Institutions for Collective Action. Cambridge University Press, UK, 1990.

- Pang, J.S. (2010), The achievement motive: a review of theory and assessment, in O. Schultheiss and J. Brunstein (eds), Implicit Motives, 30-71, Oxford: Oxford University Press.

- Snower, Dennis J. (1994), “Converting Unemployment Benefits into Employment Subsidies,” American Economic Review, 84(2), 65-70.

- Tiftik, E., K. Mahmood, J. Poljak, R. Zhang (2020), “Global Debt Monitor: Sustainability Matters,” https://www.iif.com/Portals/0/Files/content/Global%20Debt%20Monitor_January2020_vf.p df

- Tuckett, D., and M. Nikolic (2017), “The Rolf of conviction and narrative in decision-mailing under radical uncertainty,” Theory and Psychology, 27(4), 501-523.

- Weinberger, J., T. Cooler, and D. Fish an (2010), The duality of Affiliation motivation, in O. Schultheiss and J. Brunstein (eds.), Implicit Motives, Oxford: Oxford University Press.

- Wilson, D.S., E. Ostrom and M.E. Cox (2013), “Generalizing the Core Design Principles for the Efficacy of Groups,” Journal of Economic Behavior and Organization, 90, S21-32.

- Wilson, D.S. (2019), This View of Life, New York: Pantheon Books.